Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Hi, up 10% today cant necessarily find any news that correlates to change ,though in my opinion undervalued

XRF Valuation update based on the company's September 2025 Quarterly Trading Report.

Revenue was $15.3m for the September 2025 Quarter which is up 16 % compared to $13.1m for the September 2024 Quarter.

Profit before tax was $3.4m for the September 2025 Quarter which is up 7 % compared to $3.2m for the September 2024 Quarter.

The September 2025 quarter was a positive period, with all divisions contributing to the result. International sales were strong, with our offices in Canada, Belgium and Germany delivering a robust performance.

Consumable sales were $4.4m for the quarter compared to $4.6m in the Previous Corresponding Period (PCP). Sample analysis activity across mining production and exploration continued to drive sales. Domestic sales remain steady, with international sales expected to be the main driver of growth in FY26. Conditions for consumable sales have been positive for the first part of October.

Sales of capital equipment products were $5.0m compared to $4.3m in the PCP. Demand for Orbis crushers remained strong, with growth occurring in Australia and internationally. Orbis continued to gain market share, with crusher sales of $1.4m during the quarter, compared to $0.7m in the PCP. Incoming orders for other core products such as xrFuse improved during the quarter, compared to the run rate achieved in 2H25. In September they launched the next generation versions of their xrFuse 1 and xrFuse 2 fusion machines, which are scheduled for production in the December 2025 quarter. Additional new machines are currently under development, with further releases expected in FY26.

Precious metals product sales were $5.9m for the quarter compared to $4.3m in the PCP. The recurring revenue base continues to grow, as additional fusion machine installations result in demand for platinum labware recycling. Platinum prices increased, which had an effect on revenue and costs, causing products to be sold at higher prices through the quarter. The increased platinum cost is passed through to customers, with the dollar profit per unit sold remaining steady.

XRF expect the December 2025 quarter to be positive for all divisions. During this period the company's key focus areas are international sales growth, new product developments and M&A opportunities.

Vance Stazzonelli adds ~ $12.5k on-market.

Small purchase, but historically a good sign.

Another steady as she goes Quarterly report:

Had a re-look at my previous XRF valuation from 20 Sep 2025 following really good feedback. Changes are in red text.

- Doing the Pessimistic scenario is a much better approach than a "Highly Optmistic" but also highly unrealistic, scenario

- if XRF grew only 10%, and that is a distinct possibility, I could absolutely see the market throwing a bit of a hissy fit down to about ~$1.48.

- Adjusted the Forecast PE of the Optimistic scenario to 27 from the previous 30, which at 10x premium, did feel overcooked

- Need to bake in the dilution impact in future iterations.

- The process of doing a realistic Base Case, then Optimistic, then Pessimistic Case, then weight in that order, seems to work well for me - it tempers the optimism and makes it more real, I think.

Final revised valuation is: $2.11 ($1.48 to $2.47). This feels more reasonable.

Any feedback would be most appreciated!

22-Sep-2025

Updated following the FY25 results.

$1.76 ($1.45 - $2.12)

Method:

Extrapolate financials to FY29 and discount back.

Common Parameters

- Discount rate: 10%

- Tax rate: 30%

- Growth in SOI are 1.2% p.a. (based on last 4 years)

20-Aug-2024

Update on Quick Valuation following FY24 Results

Assumptions to FY29:

- Revenue CGAR 12%

- Expenses CAGR 12%

- FY29 %GM expand to 48% with scale

- Tax rate 30%

- SOI grow to 145m

- FY29 NPAT = $19.44m = 13.41cps

- P/E = 20

- Value/share = $1.59 discounted back to FY24 at 10%

Non-Executive Director David Brown sold 1m shares, 10.84% of his 9.2m share holdings in XRF between 2 and 8 Sept 2025. This reduces his ownership in XRF by 0.71% from 6.56% to 5.85%

- Sale for financial diversification as the vast majority of his investments are in XRF shares

- Does not currently have a plan to conduct any further share sales

No huge concern for me. Caused a dip in the XRF price after the recent post-earnings rise, but these dips are fairly normal for XRF.

Mr David Brown (non-executive director)

David has over 40 years of experience in the research, development and manufacturing of X-ray flux chemicals. He pioneered the commercial development of X-ray fluxes in Australia and was responsible for the commercialisation of current formulae now used by most Australian X-ray flux users. David was previously Chief Chemist for the Swan Brewery Co. Ltd, where he carried out research involving the separation of proteins by gel electrophoresis, a technique that has subsequently progressed to the modern techniques of DNA separation and profiling. David holds B.Sc. and B.Ec degrees from the University of Western Australia and has held the position of Chairman of the Scientific Industries Council of WA.

Discl: Held IRL and in SM

XRF have released their results for the 24/25 FY as follows

XRF Scientific Ltd (“XRF” or “The Company”) today announced its results for the June 2025 full-year

: Key Highlights

• Revenue $59.5m

• Net Profit After Tax up 17% to $10.4m from $8.9m

• June Q4 Profit Before Tax of $4.3m and Revenue of $16.8m

• Net cash inflow from operating activities $10.1m

• Final fully franked dividend of 4.5 cents per share

Which is quite a good result

So in regards to a valuation,

With a NPAT of $10.4 Million

So $10.4 Million / 143.6 Million shares = $0.0724CPS earnings

Valuation as an exceptional growth stock which I believe it is $0.0724 x 20PE = $1.45 per share

With EPS and DPS growing at around 15% XRF seems to going quite well

But with an actual PE of around 30 I think that XRF may be a bit over priced at the moment,

But I hold this stock and have no intention of selling at the moment

Current Market Cap at $2.23 is $313.3m

Management Bio's

Mr Fred Grimwade (non-executive Chairman)

Mr Grimwade is a Non-Executive Director of Australian United Investment Company Ltd and is a Principal and Executive Director of Fawkner Capital Management Pty Ltd, a specialist corporate advisory and investment firm. He was formerly the Chairman of CPT Global Ltd, and a Director of AWB Limited and Select Harvests Ltd. He has also held general management positions at Colonial Agricultural Company, the Colonial Group, Western Mining Corporation and Goldman, Sachs & Co. He has a broad range of experience in strategic management, mining, finance, corporate governance and law.

Mr Vance Stazzonelli (Managing Director)

Vance joined XRF Scientific Ltd as Chief Financial Officer in October 2009. He was subsequently appointed to Chief Operating Officer in January 2011 and then Chief Executive Officer in August 2012. On 22 February 2018, he was appointed as Managing Director.

Mr David Kiggins (non-executive director)

Mr Kiggins is a Chartered Accountant and Chartered Secretary, and currently Chief Financial Officer of Sadleirs. He has previously held senior finance positions at Arthur Andersen, Automotive Holdings Group Ltd, Global Construction Services Ltd, Heliwest and Stealth Global Holdings Ltd. He is experienced in finance, mergers, acquisitions, corporate governance and consulting. He has worked in mining, resources, automotive retail, construction services, telecommunications and general industrial companies.

Mr David Brown (non-executive director)

David has over 40 years of experience in the research, development and manufacturing of X-ray flux chemicals. He pioneered the commercial development of X-ray fluxes in Australia and was responsible for the commercialisation of current formulae now used by most Australian X-ray flux users. David was previously Chief Chemist for the Swan Brewery Co. Ltd, where he carried out research involving the separation of proteins by gel electrophoresis, a technique that has subsequently progressed to the modern techniques of DNA separation and profiling. David holds B.Sc. and B.Ec degrees from the University of Western Australia and has held the position of Chairman of the Scientific Industries Council of WA.

Looks like order has been restored with the XRF price, following the FY25 results 2 days ago!

- XRF made a new all-time high today of $2.28, closing at $2.26

- Following the previous high on 21 Feb 2025, the price retraced to around 60% with the low of $1.44 on 7 Apr 2025 - textbook retracement, really

- It then went sideways around the 50% retracement line at ~$1.54-ish, before forming today's high

The XRF chart is one that tracks its results very nicely ...

As I am, unfortunately, very price anchored from my entry at lower levels, I am now seriously contemplating signing up to the XRF Dividend Reinvestment Plan, which has a 2.5% discount, as the only way I to get over this price anchoring and very slowly increase my exposure ...

Discl: Held IRL and in SM

XRF Scientific reported revenue of $59.5 million, down slightly from $60.1 million in FY24 (a 1.1% decrease). Despite this, the company achieved a record Net Profit After Tax, up 17% year-on-year, driven by strong divisional performance and margin improvements.

Reasons for Slight Revenue Decline

- Capital Equipment: Sales of xrFuse fusion machines normalized after prior years of strong growth, leading to fewer new orders.

- Precious Metals: Fewer large new metal orders compared to FY24, though recurring orders remained strong.

- Consumables: Record product volumes were offset by falling lithium input prices, which lowered selling prices and slightly reduced top-line revenue.

Divisional Highlights

- Consumables: Achieved a record profit before tax of \$7.2 million.

- Precious Metals: Delivered \$21.5 million in revenue and \$3.6 million in profit before tax.

- Capital Equipment: Generated \$21.8 million in revenue and \$4.6 million in profit before tax.

- Orbis Mining: Contributed \$5.8 million in revenue and \$1.7 million in profit before tax, with full ownership acquired post-year-end[1].

Balance Sheet & Financial Position

- Cash Position: Ended FY25 with \$8.13 million in cash, down from \$12.05 million in FY24[2].

- Borrowings: Total debt reduced slightly to \$4.57 million from \$4.69 million in FY24. Financing costs declined due to reduced borrowings[3].

- Net Cash: Net cash position decreased to \$3.56 million, down from \$7.35 million in FY24.

- Major Cash Outflows: Included the \$2 million purchase of the remaining Orbis shares and a \$4.1 million dividend payment during the year.

Shareholder Returns

- Declared a final fully franked dividend of 4.5 cents per share, up 15% from the previous year

@RogueTrader posted this Rask podcast on small caps which talked about XRF.

https://www.youtube.com/watch?v=Kg8RQKG72xQ&ab_channel=Rask

The one point I picked up was that the Seneca boys use the lab mining sample volumes from the big Labs SGS, ALQ, as a leading indicator for XRF consumable volumes and revenue.

Quite an interesting chart from the ALQ FY25 Annual Report of 27 May 2025 in terms of the noticeable sample volume spike in 2025 through to 16 May 2025, implying the flow through to XRF consumables volume.

When a business with XRF's quality falls 28% in SP within a couple of months I think it warrants a look.

The March quarter trading update (pasted below) revealed a 9% drop in revenue but a 5% increase in profit before tax compared with the PCP.

I suppose the other plausible trigger for the slump in SP is concerns over the effects on mining services secondary to pain in China from tariffs.

In any case I see a PE of 22 as undemanding for a business with long term growth potential, quality management and a strong balance sheet. Looking to add to holdings... (Held IRL)

Good call with Vance as always! There is zero fluff - he calls it as he sees it in his completely unassuming style. I took away the following key points from the call:

- XRF is increasingly wanting to do more in analysis-type equipment, diversifying from the traditional base of sample preparation products.

- Like to sell all capital products for a profit - do not like to use capital sales as a loss leader, believe should make good gross margins on capital sales which leads to good follow-up consumable sales

- Vance sees after sale technical and chemistry support which customers rely heavily on, over and above the world-class products, as a key XRF differentiation, not just the quality of the products and price - he made this point repeatedly in the session - I understood “technical support” but “chemistry support” was an interesting added perspective

- In acquisitions, want to always be able to add value rather than buy a business simply to add scale - how to take good products to the next level by adding XRF resources, capabilities and after care technical & chemistry support into the mix

- Currently, no impact on US tariffs other than reciprocal tariffs potentially, largest competitor is based in Canada, the US has no domestic manufacturing of X-Ray Flux, cheaper alternatives are in China (also subject to tariffs), US is less than 10% of revenue

- No need for capex in the $m in the coming years as capacity upgrades across Consumables, Precious Metals and Capital Equipment have already been undertaken - only small capex tweaks in the $’000k range is likely to be needed

- No key man risk - Vance not going anywhere soon - great place to work, good management team, best experts in the world in the product line

- Management is laser focused on the profit line, not revenue and COGS, which will fluctuate with movements in Li and platinum prices - pricing is based on spot price + margin

XRF is the sort of company that the Future Made in Australia policy must be aiming to produce - world class leading technology and expertise, products manufactured domestically which are globally superior and thus competitive, punching above its weight globally ...

Discl: Held IRL and in SM

Further to @Noddy74's question about exploration and capex in gold in today's meeting:

Here's a paper from late last year showing how gold mining activities haven't yet responded to the price signal (well for exploration anyway). I haven't found one for development capex yet, although I assume that must be up? With Au price having hit US$3,000 last week surely 2025 will see an uptick?

I've also added at the bottom (Figure 1) the 15 year trend of annual gold production from mines. Pretty flat over the last 7-8 years, which would indicate development capex is just at the sustaining level. I've also included a table (Figure 2) from various sources of the R/P (reserve to production) ratio, indictating reserve life. I understand that the R/P ratio for gold has been stable for many years, which means that new reserves are being booked pretty much to keep pace with mining output.

I'm no gold expert, so a question to @Bear77 is at what point does the high gold price start to send an activity signal that the industry acts on?

Brining that back to $XRF, this says that the major driver in the gold segment for $XRF is greater market penetration, and/or extending the product range, and/or having products that add more value to customers.

-------------------

Here is the S&P article summary courtesy of my BA.

Conclusion:

Despite record-high gold prices, exploration budgets fell in 2024 due to risk-averse strategies, funding challenges for junior miners, and industry consolidation. Future investment in gold exploration will depend on capital market conditions and continued price strength.

Key Findings:

- Gold exploration budgets declined by 7% in 2024, totaling $5.55 billion, despite record-high gold prices.

- Gold accounted for 45% of global exploration spending, the lowest share in a decade.

- The number of gold explorers dropped by 8% to 1,235, driven by industry consolidation and fewer junior explorers.

- Investors prioritized cost efficiency, leading to reduced allocations for grassroots projects and a shift towards safer investments in existing mines.

- Funding challenges in the junior sector resulted in a 21% decline in their budgets, while major companies increased their share of total gold exploration budgets to 55% ($3 billion+), a record high.

Major Trends and Challenges:

- Mergers & Acquisitions (M&A) played a role in reducing overall exploration budgets as companies focused on cost savings.

- Example: Newmont's acquisition of Newcrest Mining led to a $93M budget cut.

- Exception: Alamos Gold increased its budget after acquiring Argonaut Gold and Orford Mining.

- Shift towards mine-site work:

- Grassroots exploration budgets declined by 16% to $1.08 billion, hitting a record low share of 19%.

- Investment in near-mine exploration rose to 45%, while late-stage exploration dropped to 35%.

- Three major companies surpassed $300M in exploration budgets for the first time in 12 years:

- AngloGold Ashanti: $328M (focused on Nevada’s Silicon project).

- Barrick Gold: $322M (+37% YoY, heavy investment in Nevada).

- Agnico Eagle Mines: $302M (Canadian Malartic focus).

Regional Insights:

- Canada remained the top destination with a $1.3B budget (-9%), driven by late-stage projects.

- Latin America saw an 8% decline, though Mexico, Argentina, Chile, and Brazil each received $100M+.

- Australia’s gold budget fell 14% to $913M, ending a three-year streak of $1B+ allocations.

- Juniors’ spending dropped sharply (-$116M), while majors saw only a slight increase ($7M).

Future Outlook:

- Gold prices exceeded $2,700/oz in Q4 2024, with expectations for further increases.

- A positive market response to high gold prices could drive renewed exploration investment in 2025, especially if interest rates ease.

Figure 1 Gold Production from Mines

Figure 2: Resource:Production (R/P) Ratios for Selected Resources.

(Note: range of sources, so data might not be strictly comparable)

@Strawman Vince Stazzonelli was last on with us in October 2023. Do you think it would be possible to get him along for another chat?

Mining analytic equipment supplier $XRF posted their 1H FY25 results today.

Their Highlights

- Revenue of $28.7m

- Profit Before Tax up 13% to $7.0m from $6.1m

- Net Profit After Tax up 12% to $5.0m from $4.5m

- Operating Cash Inflow up 105% to $4.4m from $2.2m

- Record quarterly Profit Before Tax of $3.8m in December Q2

References to profit above are net of profit attributable to non-controlling interests.

Key Points from the Report

Although precious metals and capital equipment had relatively subdued sales, the stand out for the result was the strong consumables performance, where although sales revenue was flat to the PCP, PBT increased by 26%, which carried the result for the group.

Overall PBT advanced 9.4% on a reported basis, or 13% adjusting for the accounting impact of the non-controlling interest due to the acquisition of the outstanding 50% of Orbis.

Orbis contributed $697k to PBT vs. $369k in 1H24. And the German office returned to profitability and is expected to remain there.

Overall, while it was an unexciting result for the half year, I note that this is perhaps unsurprising, as globally FY24 was a less-than-stellar year for global mining (critical minerals and gold notwithstanding!)

Today’s result shows the resilience of $XRF’s installed, durable equipment base and the ability of this to drive robust consumable sales throughout the cycle, without changing the underlying cost base.

Overall, the balance sheet is in very good shape, with borrowings having been further reduced, resulting in declining financing costs.

It was a weaker period for overall cashflow, with the purchase of the remaining Orbis shares costing almost $2m and the annual dividend payment of $4.1m coming out in the half. The cash position should strengthen in the current half, even with a payment of $1.16m expected for Labfit, assuming completion this month, as planned.

At the time of writing, the market has taken the result in its stride with a modest uptick in SP on moderate volumes (which are low for this business at the best of times.)

Results in Context

In the chart below I’ve updated the quarterly revenue and PBT results. Revenue growth continues just below the trend, with profit growth just on trend.

My Key Takeaways

$XRF continues to have all the indications of a quiet, steady compounder.

It remains a long-term hold for me and has quietly grown to become a 5% position in my RL portfolio.

Looking like another wincourtesy of the Strawman Community … several of the usual suspects!

Disc: Held in RL and SM

Another small and sensible XRF acquisition to add to XRF’s portfolio of capital equipment for $1.16m upfront and $0.3m earnout.

With $12.0m of cash at 30 June 24 and $8.1m positive operating cashflow in FY24, this cash + 15% of consideration in XRF shares deal will barely cause any financial dent.

This is more of XRF’s sensible, incremental-step approach to acquisitions. I like how this expands products to XRF’s existing markets as well as expand into newer, non-traditional mining sectors.

Discl: Held IRL and in SM

-----------------

XRF has entered into a binding but conditional to acquire 100% of the shares in Labfit Pty Ltd ("Labfit").

Labfit is a manufacturer of Carbon Sulphur Analysers, pH Analysers and laboratory weighing systems. Carbon Sulphur Analysers perform elemental analysis of Carbon and Sulphur in samples for mining and industrial production applications. pH Analysers are used to determine how acidic, neutral or alkaline samples are. They can be used to test samples such as drinking water or soils for agriculture, for productivity, quality control or safety purposes

For FY23 and FY24 Labfit produced average unaudited revenue of $1.5m and profit before tax of $0.2m. The business currently has a blue‐chip customer base of commercial laboratories, miners and industrial producers.

$XRF reported their 1Q FY25 trading performance this morning.

- Revenue of $13.1m, down 3% compared with pcp

- PBT of $3.2m, up 15% compared with pcp

- Consumables of $4.6m compared with $4.4m, driven by volume increases, with selling prices reduced due to lower lithium prices being passed on to customer, but unit profits remaining steady

- Capital sales of $4.3m compared with $5.1m in pcp, with $0.8m of sales referred to Q2,

- Precious metals sales of $4,3m were up from $4,0m in pcp, with the much vexed German office reportedly "improved".

My Analysis

As shown below in the trend chart this was by any measure a soft quarter, with both revenue and PBT falling below growth trend lines. Given everything that's happened in bulk metals and lithium in the quarter, a pullback - focused on capital sales - from the overall trend is perhaps not surprising. Even so, the market has reacted negatively with shares down around 5% at time of writing. This is probably because of expectations of improved capital sales from the new products being introduced this year. Even with the delayed sales, these would be flat.

Looking at SP progression over the last year, the SP has advanced very significantly (up some 45% YTD at the open), and arguably well ahead of might be justified on fundamentals. So, today's pullback has to be understood in that context.

Today's results aren't great, but with this quality microcap, I can't moditfy my generally positive view off one report. Let's see how the rest of the year unfolds. Capital sales in 2Q will be of particular interest.

Disc: Held in RL (4.2%) and SM

Scroll down - latest updates are the end...

23-July-2021: I do not follow this one closely enough to add much value here unfortunately. They're in my Strawman.com virtual portfolio, but I've been selling down and taking profits there. The wind has come out of the sails a little in the past couple of weeks, and I think they need to have a ripper of a report next month to get them to resume that upward trajectory once again. My gut feel is that 40 cps is reasonable knowing what we know now, and anything above that is probably pricing in future growth that is not guaranteed to happen, but well might. In that light, they do look a little overbought above 45 cps, and if they have a poor report or even an ordinary report, I can see further downside. That said, I'm obviously wishing they do shoot the lights out, for the sake of all of the XRF shareholder we have here on Strawman.com.

25-Oct-2021: Update: ...And they did shoot the lights out, great report, and here they are testing all-time highs once again around 66 to 68 cps. Wish I still held them in real life. Not only has their share price been flying, they've also upped their dividend every 6 months since 2017, including through Covid.

At least I still have some XRF in my SM portfolio...

Upgrading my PT to 77cps.

03-Nov-2022: Update: Raising my Price Target (PT) from 77 cents to 90 cents because the company is now trading at 80c, i.e. above my previous 77c/share PT. The company continues to perform well and surprise the doubters, however I think it will take a fair bit to push through $1, so they might hang around 90c/share or thereabouts for a while before having a few goes at $1 and beyond.

I'm not going to talk about the company's fundamentals because it's not a company I follow closely now, and not one I currently hold IRL (although I have previously, and I did follow them a lot more closely then). They're in my Strawman.com virtual portfolio however, and they've performed well for me, albeit it's a relatively small position, as many of my positions here are. I was just looking through and noticed that this "valuation" was stale, so thought I'd "refresh" it. So I did.

10-Sep-2023: Updating this one again: Once again, I have to move my price target (not a valuation, just a price target) up, because the SP has overtaken my old one yet again and the business has outperformed even my lofty expectations.

I'll target $1.48 this time, and I know that's not particularly brave, since XRF closed at $1.41 on August 1st this year and were as high as $1.435 in intraday trading back then, however I'm happy to keep raising the bar and watch them sail over it again with apparent ease. There's not much of a negative nature you can say about XRF. They have good management, a good business model, they have products and services that companies and organisations need, they are very well positioned within their industry, and they keep moving in the right direction.

Occasionally they look over-valued by the market, i.e. not cheap, but then they never seem to put a foot wrong, and they don't take too much time to grow into those lofty valuations. Quality company. Quality products and services. One of the few companies who are able to increase their ROE as they grow:

Source (above bar graphs): Commsec.

Below sourced from FNArena.com:

While FNArena is showing some NPM decline over the past two years, their Net Profit Margin is still higher than it was FY18, FY19 and FY20, and still above 10%, which is a good NPM for a business of their type. Everything else (Book Value/share, Cashflow, Sales Revenue, Earnings, Dividends/share, ROE and EPS) are all continuing to rise at a good clip.

They weren't always heading northeast at a good clip, but they have been since 2018 (so for the past 5 years), and the company has never looked stronger.

Disclosure: I do hold XRF here in my SM virtual portfolio and I have held them on and off in real life also. Currently not holding IRL, but wishing I was. This is one of those companies that is high enough quality that I should just hold them through and not try to sell in and out and time them so much.

14-May-2023: Update: Marked as stale. No Change. $1.48 still good. XRF kissed my $1.48 price target at the end of April (2 weeks ago) - well, they got up to $1.46 intraday before closing at $1.44 on 30th April. Close enough. Let's see what their results in August does for their graph. Still holding both here and in my largest real money portfolio. I think I did mention here somewhere that I'd bought some XRF, paid just under $1.11 ($1.1073 average price) on Feb 26th this year. Very happy with that entry point. I also topped up here on SM shortly after that.

21-Aug-2024: Update: Post-FY24 Full Year Results. All good. Pity I sold in June. Raising my price target from $1.48 to $1.65. XRF just keep on performing. This is one I would absolutely hold in my SMSF if they were in the ASX300 index (a precondition for inclusion - fund rules) - and I plan to add them back into my larger portfolio outside of super after I harvest some dividends from a few companies that pay a much higher dividend yield than XRF do - but XRF isn't an income stock, they're a growth stock, or a really good TSR stock, so Total Shareholder Returns (Capital gains plus dividends). The only thing I am vaguely worried about is bad M&A, like making a big acquisition and overpaying, but I think that is unlikely - they've been very measured and sensible so far - very good good capital allocation record to date, including their modest payout ratio around the 60% mark, so reinvesting a decent chunk of their profits back into the business as well as sharing it with their shareholders.

Their balance sheet is solid, a negligible amount of debt, which it looks like they'll pay off this calendar year, or roll over into another facility, but under $2m total debt ($1.6m) with $12m in cash, being +$1.6m higher than their $10.4m cash balance a year ago. Plenty of net cash. Very solid balance sheet. They're not going to go broke.

Growing Revenue, Growing Earnings, Growing Margins (Revenue up 9% to $60.1m, NPAT up 16% to $8.9m), Growing Dividends, Solid Balance Sheet, Net Cash (No Net Debt), with a realistic and achievable growth strategy for FY25:

- Ramp-up sales strategy on xrTGA;

- Grow Orbis laboratory crusher sales;

- Continue with geographical expansion initiatives;

- New product releases from all divisions;

- Continue to pursue M&A opportunities. "Our targets are complementary manufacturing companies, in the laboratory supply or precious metals sectors"; and

- Work to improve their scale/market cap and their share price [which I'm assuming means get into the All Ords index and then aim for the ASX300 Index (I'd like that!)]

Yeah, plenty to like.

There aren't many companies where you can look at their EBIT, their EPS, their Dividends, their Share Price, and their Market Cap, and every single one of those five metrics has increased every single year for the past 5 years. Not a single one of them has failed to increase in ANY of those years - see table above.

This company BELONGS in my super, and since I can't hold it there, I'm going to make room for it in my other portfolio again.

Another high quality company who impressed me with their results was ARB Corporation (ARB) today (Tuesday 20th August) - however I want to buy them back when they're a little cheaper. XRF are fine @ anything under $1.60 in my view.

Further Reading:

XRF-announces-record-full-year-result.PDF

XRF-August 2024 Investor Presentation.PDF

If you want to view that Presentation without the ASX "ersonal use only" watermark up the left edge of every page, then go here: https://www.xrfscientific.com/asx/# and then scroll down a little to their ASX announcements list and click on "Download Link" to the right of the presentation title (which is "August 2024 Investor Presentation") - they've done something clever so that I can't copy that link and paste it here (or anywhere else) - it can only be used from their own website. If you click on the title of the document (on the left) instead, it opens up there within their own website - but I find it's easier to read if you use the download link on the right of the document title (and it will open up as a PDF doc).

And if that doesn't work, there's always this option: https://www.asx.com.au/markets/company/xrf

And XRF Scientific's website is: https://www.xrfscientific.com/

Disclosure: Was a holder, Not currently - except here - and will be holding again in a real-money portfolio again soon.

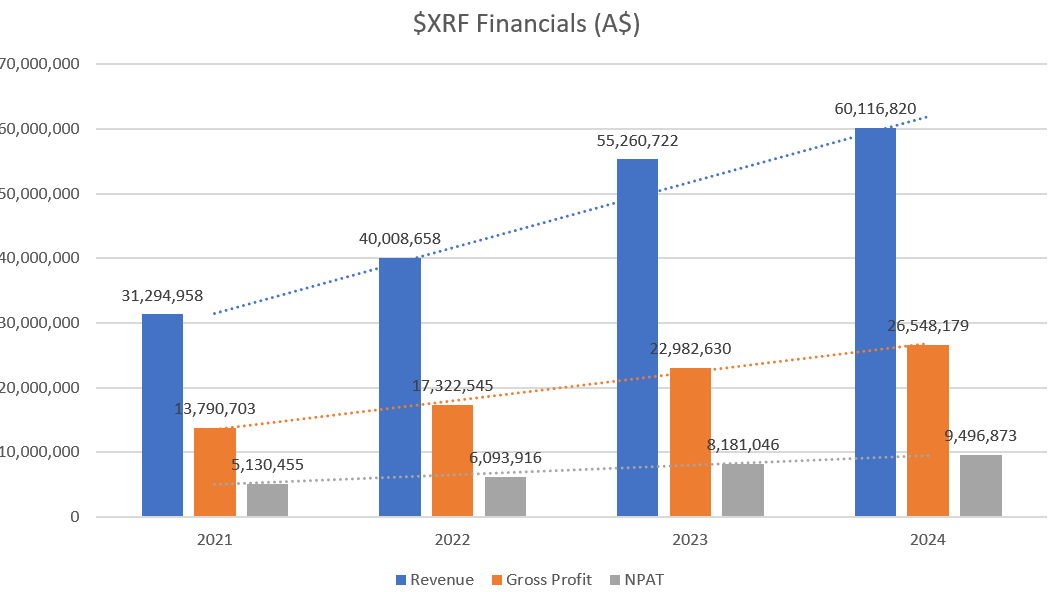

Mining analytical equipment manufacturer $XRF released its FY24 results today.

Their Highlights

- Revenue up 9% to $60.1m from $55.3m

- Net Profit After Tax up 16% to $8.9m from $7.7m

- June Q4 Profit Before Tax of $3.3m and Sales Revenue of $16.2m

- June Q4 Profit Before Tax and Non-Controlling Interests (Orbis) of $3.9m

- Final fully franked dividend of 3.9 cents per share

My Analysis

$XRF provides quarterly revenue and PBT updates, so there was little room for any overall surprises.

In July 2024, the acquisition of the outstanding 50% in Orbis became effective. Without the previous NCI, PBT for Q4 was $3.3m. Including the NCI, PBT rises to $3.9m. Future periods will now enjoy the full contribution of Orbis.

The main driver of the result was %GM expansion from 41.6% to 44.2%, leading to gross margin increasing by 15.5% on revenue up 8.8%.

Performance was primarily driven by capital Capital Sales, up 16% with an NPBT margin of 21% up from 18% in FY24. With the initial sales of xrTGA (thermogravimetric analysis) equipment, capital sales are expected to continue to grow strongly into FY25. Management noted "Sales growing in numerous markets worldwide". Capital sales are also expect to benefit in FY25 as the company launches new products that have been in development.

Consumables revenue was up 11%, albeit with PBT margin compressing slightly to 30% from 31% in FY24. Falling Lithium prices were called out as impacting both selling prices and production costs, and will lower working capital requirements into FY25.

Precious metals was the only underperformer, with revenue down 1% on PCP. The problematic German Office was called out as reducing profit from FY23 by $0.8m "due to economic conditions. This is expected to improve in FY25.

The final fully franked dividend of 3.9 cps represents a +18% increase on last year, and a grossed up yield of 3.8%,... not so impressive in this high interest rate environment, but this is primarily a capital growth play.

Free cash flow was $5.7, down from $7.1m in the PCP due to investment in manfuacturing facilities, however, cash on the balance sheet increased to $12.0m from $10.4m.

My Key Takeaways

The results represent good - if unremarkable - progress.

NPAT growth of 16% was strong albeit bringing the 3-year CAGR down to 23%.

Strong capital sales helped cover a weak performance in precious metals.

$XRF continues to be a steady performer.

Disc: Held in RL and SM

$3.91m for the 50% shares in Orbis

XRF Scientific Ltd (“XRF” or “The Company”) is pleased to advise that it has exercised a Call Option to acquire the remaining 50% of Orbis Mining Pty Ltd (“Orbis”).

Resources generally trade lower at the moment.

XRF Return (inc div) 1yr: 20.42% 3yr: 45.31% pa 5yr: 53.52% pa

So XRF keeps on track.

ROA up

Net profit margin: 14.9%

Debt / Equity low - sustainable

Dividend pay out ratio ~ 50% very sustainable ( Telstra pays out 100% dividend !!!)

XRF is on track for ~$9m NPAT in FY24, with mid-teens earnings growth able to continue into FY25 aided by the acquisition of the remaining Orbis share which I suspect XRF will execute as soon as possible post 1 July this year. Sticking with a 15x multiple on the midpoint of $10-10.5m FY25 NPAT is $1.15.

Last valuation was 4 years ago for XRF! I reasoned it was undervalued then, and bought in at 26c. Being the genius that I am I started selling out a year later between 50 and 67c (I kept a small amount irl, but was completely out here on SM)

Anyway, not going to lament it too much (although it's annoying i seem to have to re-learn this lesson over and over again) -- time to correct the error.

Revenue growth has really accelerated in recent years, with a CAGR of >20%. And profit has grown at a greater rate 35%pa

The business wont see as much in FY24, although it will be another record. I'm guessing something like ~$60m in revenue, which would be ~9% growth. But with better margins NPAT could be 15-20% higher at around

For the sake of the exercise i'll say FY24 NPAT is $9m. And I'll grow that at 10%pa for 3 years to get $12m, or 8.7cps.

Whack on a PE of 20 and discount back by 10%pa to get a rough valuation of $1.30.

Pretty much the current price. Factor in another 3.5% or so in gross up dividends, as well as the quality of the business, and it's close enough for me to hold.

A good company at a fair price.

$XRF issued their 3Q trading update.

Keeping it brief, all segments contributed with a positive outlook for the final quarter. Reference made to strong gold prices driving demand, as well as low Lithium price driving lower selling prices and production costs.

One new product was launched - the next generation of weighing device - xrWeigh-S-FL, with other new products on track for FY25.

In short, nothing of note that I can see in the release.

Looking to the numbers, in the context of history, both PBT and Revenue are a whisker below the 2-3 year growth trend, but certainly well within the q-on-q variation to not be a significant departure from steady growth.

No real market reaction - low volumes on either side of the trade.

Disc: Held in RL and SM

Figure 1: XRF Quarterly Revenue and PBT ($m)

Looks like Westferry is no longer in the top 20.

The overhang that is causing the downtrend is starting to make sense

2022 Annual Report

2023 Annual Report

However, Westferry still counts XRF as one of the top holdings

As Westferry is not a substantial holder, we don't know when the sale occurred or how much they have keft

Capital IQ Pro reckons it is zero but from above I think that could be wrong.

Might be a good but pointy question to ask?

[held]

A Coffee Microcaps Interview of Peter Johns, Portfolio Manager at The Westferry Fund talking about XRF

The discussion goes for a bit over 15 minutes from about 16 minutes into this Youtube video (NB: direct link to the start of the XRF discussion)

https://www.youtube.com/watch?v=LxBsYdVndgE&t=955s

DISC: Held in RL & SM

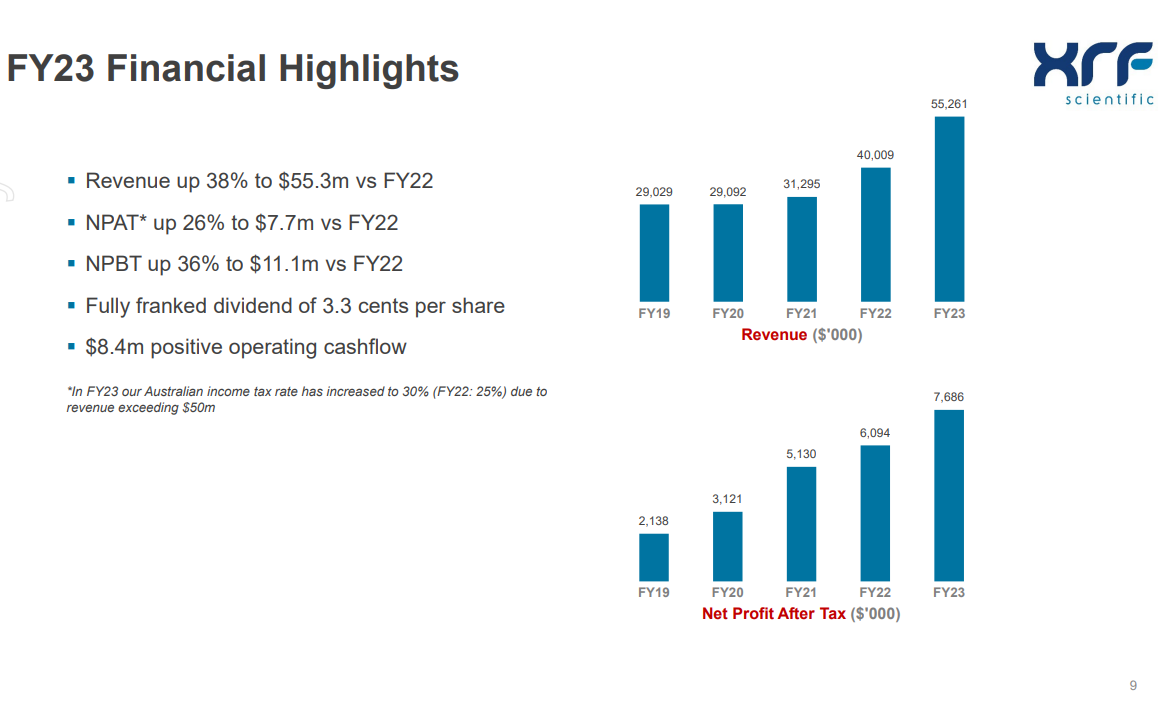

Record revenue and profit

Very strong demand from mining and industrial customers

Strong demand for capital equipment products, currently at record order levels

Launch of new product line: xrTGA thermogravimetric analyser

Continued R&D investment in new products across all divisions

Outlook: We expect the December 2023 quarter to be a positive period, with a focus on machine lead times, xrTGA sales, new product developments and international sales growth

Return (inc div) 1yr: 22.99% 3yr: 52.81% pa 5yr: 48.26% pa

Market Cap; $132M

*limited analyst coverage along with low trading liquidity holds XRF back. Reduction in mining industry generally

Combined my notes on the 30 Sep 2023 Quarterly Update and today's meeting with Vince Stazzonelli.

Discl: Held IRL and in SM, looking to top up IRL if the price falls closer to $0.90.

Built this simple revenue xls to get a better perspective of the 1QFY24 results against FY23, will add in subsequent quarters

- Solid result with PBT growing much more than Revenue

- Consumables was up 15.8%, Capital Equipment was up 27.5% but Precious Metals was down 14.9% over the PCP

- Revenue is 5.9% lower than the average FY23 quarterly revenue (average is annual revenue divided by 4)

- Not a concern given the large forward orders held for Precious Metals, but puts the 1Q result in better context, taking cue from concerns previously about the rate of growth from H-to-H

- All segments appear to be firing, with the order book for capital equipment at record levels, and production for some products is now being scheduled for the June 2024 quarter

TAKEAWAYS FROM VINCE MEETING

Industry Tests to test quality of a product which XRF Supports

- XRef Analysis - using X-Ray Fluorescence analytical technique to determine the major components of a sample

- ICP Analysis - ICP (Inductively Coupled Plasma) Spectroscopy is an analytical technique used to measure and identify elements within a sample matrix based on the ionization of the elements within the sample.

- Gold - FireAssay and PhotonAssay (C79’s technology)

- Platinum Labware - this is used in the sampling process. XRF manufactures Platinum Labware for all machines, not only XRF-specific machines

How the XRF Equipment Comes Into Play

- Orbis Mining Crushers - breaks down (crushes) big rocks to provide powder samples, which are then used as inputs to the various tests

- XRTGA Thermogravimetric Analyser - a high-temperature furnace, heats up the sample to run tests at different temperature points

- Market is dominated by key competitor: Leco

- XRF’s benefits over Leco units:

- 30 samples at a time vs 18

- Has heating and cooling cycles to speed up the process

- User friendly Touch Screen vs separate computer console

- Reputation of building reputable products

- Provides complementary data for XRF analysis

- XrTGA opens up access to new markets for XRF - Pharmaceuticals, Food, Agri-Products, Plastics etc

- Capital equipment should have at least 7-8 years of life through to 15 years

- Drives other products - spare parts, labware rework, consumables

Manufacturing Capacity

- Solved factory capacity issue for Capital Equipment this past quarter

- Can ramp up production across all 3 segments by adding more shifts - no further major spend to boost capacity is anticipated

International Expansion

- Already have presence in Europe (Germany and Belgium), North America (Montreal), Australia and parts of Asia

- Direct sales are fulfilled in Australia

- Large network of Distributors which are required to provide on-the-ground customer support

- Not in a position to open offices in many countries - driven by product line and the individual needs of the countries

Cost Pressures

- Cost pressures of the last 12-18M have eased in the last 3-6M - lead time blow outs

- Able to pass on price increases to customers who mostly pay based on the metal spot price at the time of invoice

- Employees were given good pay increases to retain them

Customer Demand

- Exploration activity mostly focused on Rare Earths, Lithium

- Exploration spend did not fall in Australia - Gold spend did fall, but Base Metals, Iron Ore continued to perform well

- Have not seen anything impacted by a slowing of Chinese demand

Capex Management Approach

- Dividend payout ratio is around 60% - this level of dividends is able to provide required capital for R&D, Inventory and Working Capital

- On the lookout for bolt on acquisitions - generally like to issue script to fund these acquisitions to incentivise vendors

- Ideal targets are (1) lab products which have business synergies with XRF’s products (2) used by existing customers (3) are under-developed in market potential

- Not interested in building business scale as XRF is at “about the right size” - focus is on value adding acquisitions

Key Investor Misunderstanding on XRF

- Investors misunderstand where XRF sits in the laboratory process

- High quality products

- Strong IP

- Essential in providing data to mines, industrials

- Critical to customers processes

Well it appears that my days as a valued member of Capital IQ pro are numbered

I've been blocked from looking at the most recent estimates

But I still managed to find that XRF had received a downgrade from an unknown broker. My guess it is Euroz

Revenue downgrade of 9%

Sentiment changed to hold

Price target maintained at 1.22

Since Aug 2023, XRF has dropped more than 9%

[held]

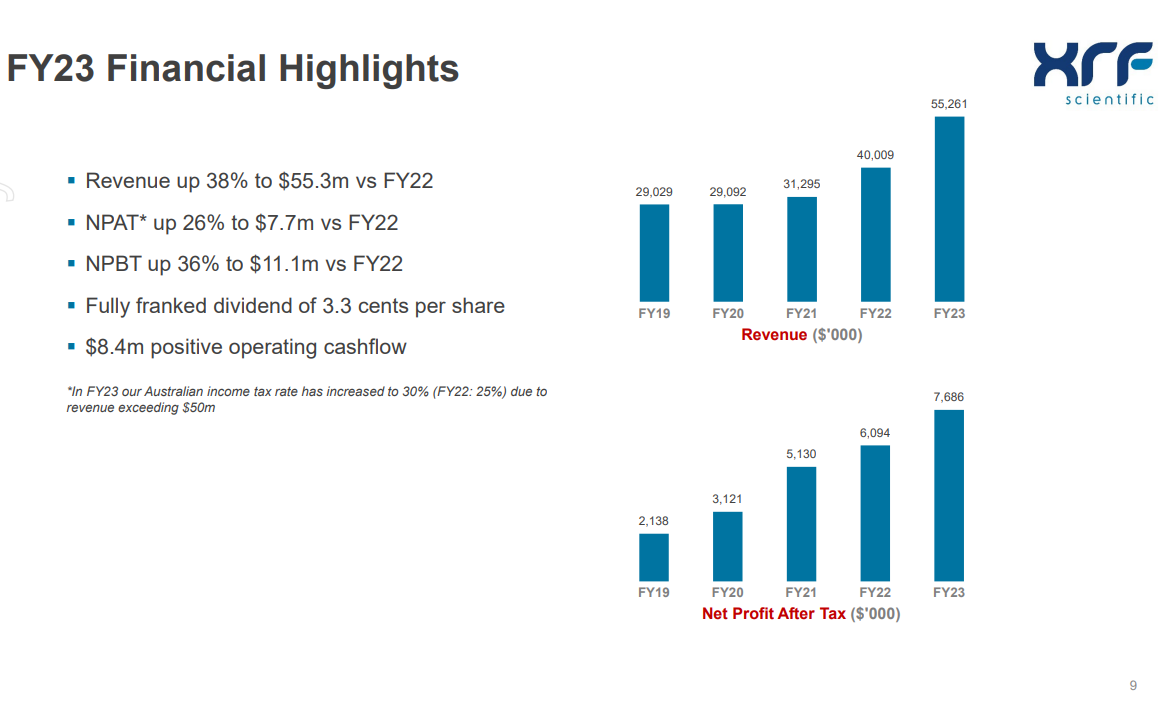

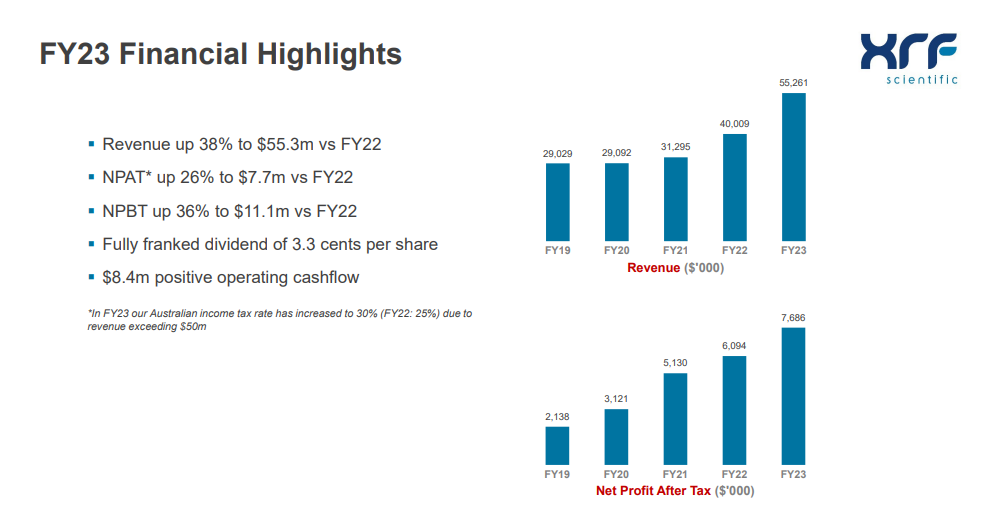

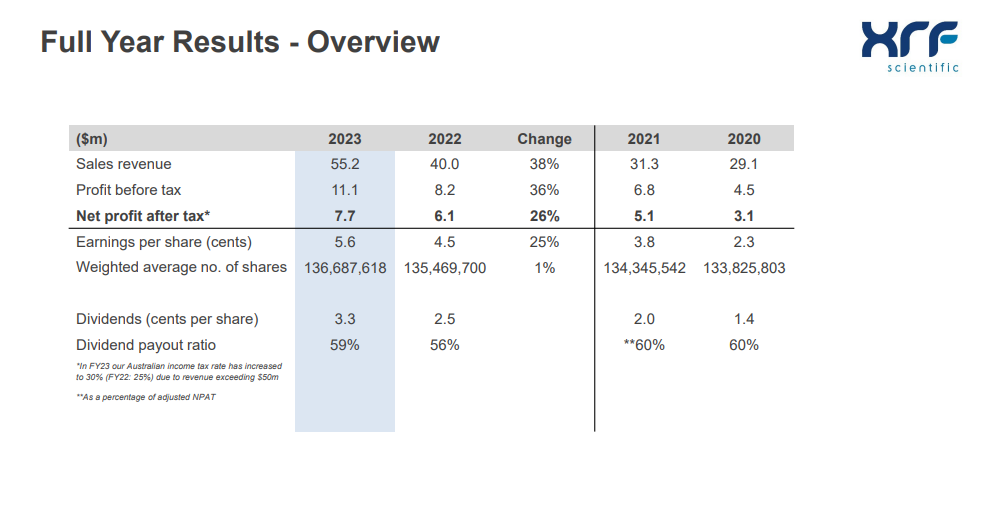

- Summary: August 2023 Investor Presentation

3 x Segments Below:

Return (inc div) 1yr: 98.03% 3yr: 67.98% pa 5yr: 52.85% pa

Shares in Value have just emailed their thoughts on XRF, here they are:

Our high-conviction pick for this month is XRF Scientific (ASX: XRF), a significant player in the mining industry, providing essential gas and electric fusion equipment for mineral sample preparation, a prerequisite for X-ray fluorescence analysis. This indispensable process plays a pivotal role in shaping the strategies of industry heavyweights like BHP, Glencore, Vale, South 32, and Alcoa, who depend on it for assessing the grade, reducing waste rock, and formulating drilling plans. The role of sample preparation cannot be understated—it serves as the vital initial step in deciphering a sample's chemical purity and composition.

We recommended XRF to our members in January at $0.84, and it has grown 58% in the last 6 months to a princely $1.33 (effective 27 July 2023).

So why do we remain so bullish on XRF?

XRF's unique non-cyclical attribute offers uncommon stability in the volatile mining industry. Further, the company follows a Gillette-style business model, providing high-margin chemical agents essential for each sample preparation.

Over the years, the company has been undervalued as a mining services supplier rather than being recognised for its inherent value as a premium international equipment provider, a reputation reinforced by 28% and 19% revenues and profits growth in 2022. It also maintained a 60% dividend payout ratio, delivering a yield of over 3%, a beneficial attribute for those pursuing dividend returns. The company's record-breaking order book indicates there is potential for further growth.

With the increasing demand for low-emission technologies driving commodity growth, XRF, central to mining activities, stands to benefit. Looking forward, XRF's ambitious 2023 expansion plan is noteworthy. With strategies targeting geographical diversification, new product launches, and a particular emphasis on precious metals, XRF offers a blend of steady cash flows with a balance of growth and dividends.

A substantial amount of credit for XRF's success is due to the tenacious leadership of CEO Vance Stazzonelli. He embodies the ideal qualities that we at Shares in Value believe are crucial in an effective leader: honesty, accuracy, and a refreshing lack of pretentious adjustments in the financial results. His straight-shooting approach, especially in the small caps realm, sets him apart.

Under Vance's steady helm, XRF continues to deliver exceptional results. Despite the considerable recent surge in its share price, we are confident in our recommendation of XRF, believing in its long-term potential.

Competitive Advantages: Large sample carousel with 30 positions for greater throughput Higher maximum temperature range up to 1100°C Highly automated and user-friendly interface Fast heating and cooling cycle times Fully integrated PC without the need for an external unit

Had a mighty run -up Return (inc div) 1yr: 104.89% 3yr: 72.11% pa 5yr: 53.00% pa

20/5/2023: A look at NPAT.

Below from the Feb 2023 Report:

2023 shares on Issue: 135,8

June 2022 NPAT actual reported: $6,084Mill

Forecast June 2023: NPAT $7,909Mill = 6,084 x 1.3 ( say NPAT growth is 30%pa )

Find EPS for June 2023: 5.82cps = 7,909 / 135,8

so Valuation Range $1 to $1.35

1st Guess Pe ratio 23% = 135cps / 5.82cps ( Bull )

Vs

2nd Guess Pe ratio 17.18% = 100cps / 5.82cps ( Bear )

Market cap:$88Mill

ROE: growth has been good

ROE future: some pundants thinking lower in 2023.

EPS growth likely to tail off in 2023 Free cash flow ok

Free cash flow: current 3.25c out -look 4.47cp

PE ratio 18% then future pe taper off to 15 times earnings

Revenue stream or silo's of cash from Australia , Canada, Europe.

A solid performance will the buyers get excited again..

Return (inc div) 1yr: 38.08% 3yr: 55.22% pa 5yr: 35.49% pa

David Brown: Consideration $60,180

Securities b) 3,059,163 Securities held after the change b) 3,110,163

Good 1yr Price trend here

I’ve been watching XRF but still don’t own it unfortunately. Congratulations to those who jumped on board.

@Winiwas spot on in forecasting the incremental growth rate in ROE. Generally other analysts didn’t see this coming so I should have taken more notice of Wini’s forecast!

Assuming FY23 NPAT of c. $11 million and current equity of $49 million, that puts XRF on FY23 ROE of over 24% (even higher than Wini’s forecast of 22.5%). The ROE chart is likely to look something like this for FY23. That’s a significant jump and supports Wini’s view that XRF is a capital light business.

@edgescape put forward a valuation of $1.58 based on historical PE ratios x forecast FY23 earnings. If I use McNiven’s Formula assuming a forward ROE of 24% and a 10% required return on investment I get a similar valuation to Edgescape. If you were requiring a higher return on your investment, say 12%, the current valuation would be $1.20 or about the current share price. If the incremental growth in ROE continues into the future this will push the valuations higher still. Wini might have a view on what the future looks like from here.

My guess is that share price will now be influenced more by share price trends and the chartists in the short term, so I wouldn’t be surprised if the share price reached $1.80 or higher. If I owned XRF I wouldn’t be selling it in a hurry while the green candles continue and MACD sits in positive territory.

However, ignoring the charts and considering a ROE based valuation with a required return on investment of 15%, I won’t be buying at the current share price of $1.20 either. Good luck to those who are holding.

Not held

See my straw added 15 April 23.

Sales of capital equipment products have been robust at $3.9m compared to $2.8m in the PCP. The demand is being driven globally by both the mining and industrial sectors. Geographical growth is adding to revenue, and certain markets have been reactivated post COVID‐19 impacts. For some core products our order book remains at record levels, with production now being scheduled into the December 2023 quarter. We are working to reduce our lead times through the addition of new labour and inventory resources.

- Summary:Summary: March 2023 Quarterly Trading Report

- Price Sensitive: Yes

21/2/23 Appendix 4D - Half-Year Report

Another fantastic result from XRF, it says a lot that I almost expect it from them at this point.

It's a well covered stock now on Strawman so I will let others break down the headline numbers, but one thing I have been focused on for some time with XRF is how the business is far more capital light than headline numbers suggest.

A simple calculation for XRF shows roughly 22.5% return on equity (rolling 12 months profit before tax of $10.17m on equity of $44.89m). However within that the incremental return on equity is far stronger at 76% for this current half:

$5.67m 1H23 profit before tax minus $4.5m 2H22 profit before tax is $1.17m incremental PBT on $1.54m incremental equity ($44.89m 1H23 - $43.35m 2H22).

Ultimately it is the incremental return on equity that drives share prices rather than the absolute level.

Really excellent growth in EPS the last 5 years, if it were continue at a similar growth pattern (which I think could be very likely), say 13% with a PE ratio of 20, price is closer to $1.03 once discounted back.

Leaving a little bit of margin for say 9-10% growth gives my current valuation of $0.87. If growth slows to 5%, price would be closer to $0.72.

Would be interested in adding to RL portfolio under $0.80, however will add a little now to SM portfolio.

27-Aug-2021: Click here to watch Luke "Wini" Winchester from Merewether Capital talking on Ausbiz on Friday (27-Aug-2021) about the recent (24th Aug) full year results from XRF Scientific (from the 3:30 mark of the video), Kip McGrath Education and Austco Healthcare. Wini was the Emerging Companies Portfolio Manager at Oracle Investment Management (and might still be according to his LinkedIn profile), and is now the CIO of Newcastle-based Merewether Capital, which ARC have just bought 40% of. Luke discloses that he owns all three of those companies (XRF, KME and AHC) and he's bullish on them clearly, and when Wini is bullish on a company it's worth noting!

Disclosure: I do not hold any of those companies in RL, but XRF is in my SM portfolio (and ARC is on my watchlist).

05-Mar-2021: CCZ Equities Research: XRF Scientific (XRF): Stronger testing volumes expected in the 2nd half

Analyst: Daniel Ireland, [email protected], +61 2 9238 8239

- Recommendation: BUY

- Target Price: 37cps (down from 39cps)

- Market Capitalization: $37.5m

- Index: None

- Share Price: 28cps (29.5cps on 12-Mar-2021)

- Sector: Industrials

Stronger testing volumes expected in the 2nd half

- Performance weighted to 2 nd half: XRF reported HY21 revenue of $14.9M ($15.7M pcp, -5.3%%) and -12.8% below CCZ forecasts whilst PBT was $2.2M adjusted for JobKeeper (-5% vs pcp). Growth was slower than anticipated due to COVID19 shutdowns in Europe and Canada whilst reordering patterns for flux materials, a critical component in base metals testing and a significant contributor to profit, is expected to be weighted to the 3 rd and 4th quarters. The company continues to develop new machines, with the release of such products expected shortly and a natural extension of the companies long standing diversification strategy away from resources.

- Platinum Division continues diversification: The company has not provided guidance for FY21, however testing materials will inevitably increase in conjunction with a strong mining and minerals market. It is expected that laboratories will require x-ray flux materials driven by a surge in mining refit capex. The German office experienced a positive result for the half, profitable for 4 months - achieved via careful cost management and increased service and product margins. With a strong presence in platinum products, the success of this office provides a significant opportunity to diversify the company toward industrial customers with an immediate addressable market of €100M.

- Forecast marginally changed: FY21E revenue expectations have been increased to $31.3M from $30.6M, Fy21E EBITDA expectations have increased from $6.6M to $6.7M and Fy21 EPS has been maintained at 2.8cps. Based on the HY21 results we have adjusted revenue for Consumables to $9.5M (7% growth vs Fy20), Precious metals to $13.6M (+7% growth vs Fy20) and Capital Equipment to $8.2M (10% growth vs Fy20). Expectations are for XRF to pay a full year dividend of 1.8cps (+28.5% vs pcp) fully franked, largely due to an improvement in operating cashflow and a large franking credit balance.

- Investment thesis - Unchanged: We have reduced our valuation to $0.37 per share. With moderate growth expected from all divisions, XRF is positioned to benefit from the capex refresh cycle taking place in the mining industry. As budgets increase in the industry, XRF is well positioned with new product developments close to commercialisation, a growing customer base and a shift toward industrials customers in cement, aerospace and high-end manufacturing industries.

--- click on the link at the top for the full CCZ report on XRF ---

[I have held XRF shares previously, and they are still on my Strawman.com scorecard.]

XRF saw flat revenue for FY20, coming in at $29.1m compared to $29m in FY19.

Net profit after tax, however, jumped 47% to $3.1m. Thanks to improved product mix and reduced costs.

Net cash improved to $2.7m with 10% growth in operating cash flows and repayment of debt.

Consumables again steal the show, with 11% more sales and an 18% lift in profit. Precious Metals saw a big margin improvement that saw its profit rise 50%.

Capital equipment sales and profit was down 113% and 7% respectively.

Overall, a good result and in line with expectations. Great to see past investment paying off and there appears to be good momentum going into FY21.

Results detail here

I think it is very hard for anyone to accurately predict on a macro level how long the current downturn lasts for and the long term effects of it. What we can and should do though is look at individual businesses and assess the impacts to them from the coronavirus, positive or negative.

For XRF I recently spoke with the CEO Vance Stazzonelli who said they have yet to see any impact from the coronavirus with business remaining as usual. XRF's main clients are in mining and construction which have been deemed essential industries even in countries with full shutdowns. The company's offices in Canada and Germany are sales offices with employees able to work from home and sales closed over phone and email. This is assisted by the fact majority of sales are from existing clients.

Vance sees the big short term risk to the business being a forced closure of their Melbourne factory. If the Victorian Government did implement Stage 4 restrictions Vance hoped they could claim an exemption given their products are critical to the mining industry which would be deemed essential.

The other point Vance stressed was how conservative the company's balance sheet was, net cash and the small debt on the balance sheet backed by the company's Melbourne land and factory. On top of this, the $9m of inventory is roughly six months worth of operations in case supply chains are disrupted with a big chunk of that being pure platinum. With no changes to business operations Vance said the company would release their planned third quarter update in mid-April and saw no need for a specific corona virus update.