Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Austco Healthcare Limited (ASX: AHC) Valuation based on Trading Update – First Quarter FY26 provided on 29th October 2025

Austco Healthcare achieved 51% revenue growth and a higher EBITDA margin in the start of FY26

Financial Highlights

• Revenue of $23.2 million, up 51% on the prior corresponding period (pcp), which included both organic and inorganic growth.

• EBITDA of $4.2 million, representing 18.1% EBITDA margin, up from 16.0% at FY25 year-end

• Unfilled Contracted Revenue (UCR) of $54.6 million at 23 October 2025, providing a strong foundation for continued revenue momentum.

The improvement in profitability reflected strong organic growth, positive contributions from recent acquisitions, and the benefits of disciplined operating leverage as integration and efficiency gains continue to flow through earnings.

Operationally, Austco continues to benefit from strong demand for its integrated nurse call, RTLS, and workflow solutions. The Company’s sales pipeline remains robust across its core healthcare markets, supported by increasing interest in its innovative, integrated product suite.

Outlook

With strong demand, integrated solutions, and continued efficiency gains supporting earnings growth, Austco is positioned to sustain profitable growth through FY26 and beyond. The Company continues to target 10–14% organic revenue growth for the financial year.

Chief Executive Officer Clayton Astles commented: “Our acquisitions are contributing positively, and we continue to realise the benefits of operating leverage, reflected in the further expansion of our EBITDA margin this quarter. The strong start to FY26 gives us confidence in delivering continued growth and disciplined execution through the year.”

1Q26 trading update at the AGM with $23.2m revenue and $4.2m EBITDA. Historically there has been a ~45/55 revenue and ~40/60 EBITDA split between 1H/2H putting them on track for ~$105-110m revenue and $19-20m EBITDA.

~$4m D&A and normalised tax rates means $11-12m NPAT or ~3.3c. 50c price target would be 15x earnings, a fair multiple for the growth on offer.

Some pretty impressive headline numbers from AHC's 1Q26 trading update at the AGM this morning.

Revenue of $23.2m up 51% and a record EBITDA margin of 18.1% (compared to 17.8% in 2H25). It's tough to pin down exactly where organic growth is landing, but management have provided a full year target of 10-14% and the EBITDA margin expansion provides confidence that acquisitions aren't just providing empty calories.

There were a couple of questions at the AGM about board shareholdings and the potential to pay a dividend again, but compared to some other recent AGM's it's fair to say AHC shareholders are content with how things are travelling right now. After being forced to survive through Covid (which larger peer HIL couldn't achieve), AHC is thriving now.

Austco released a trading update today to coincide with their AGM later this morning. Overall impression is it was what you would want to see, which is to say, solid. They didn't break down the organic/inorganic split, which would have been nice, but did reconfirm targeted 10-14% organic growth for FY26. Highlights included:

• Revenue of $23.2 million, up 51% on the pcp, which includes both organic and inorganic growth.

• EBITDA of $4.2 million, representing 18.1% EBITDA margin, up from 16.0% at FY25 year-end.

• Order book of $54.6 million at 23 October 2025.

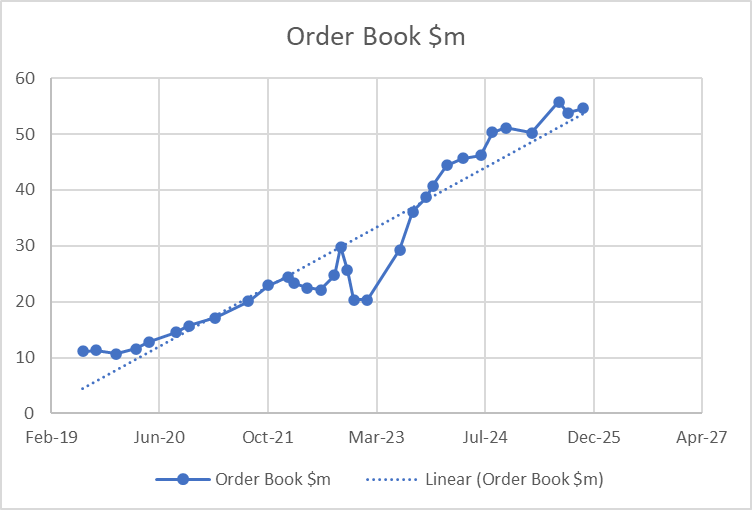

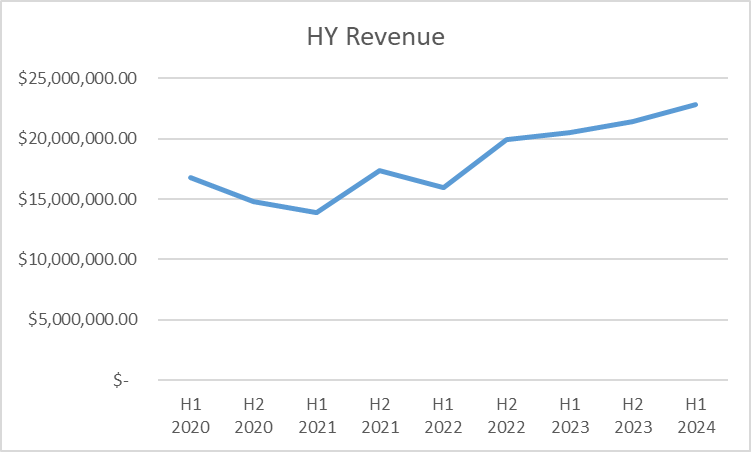

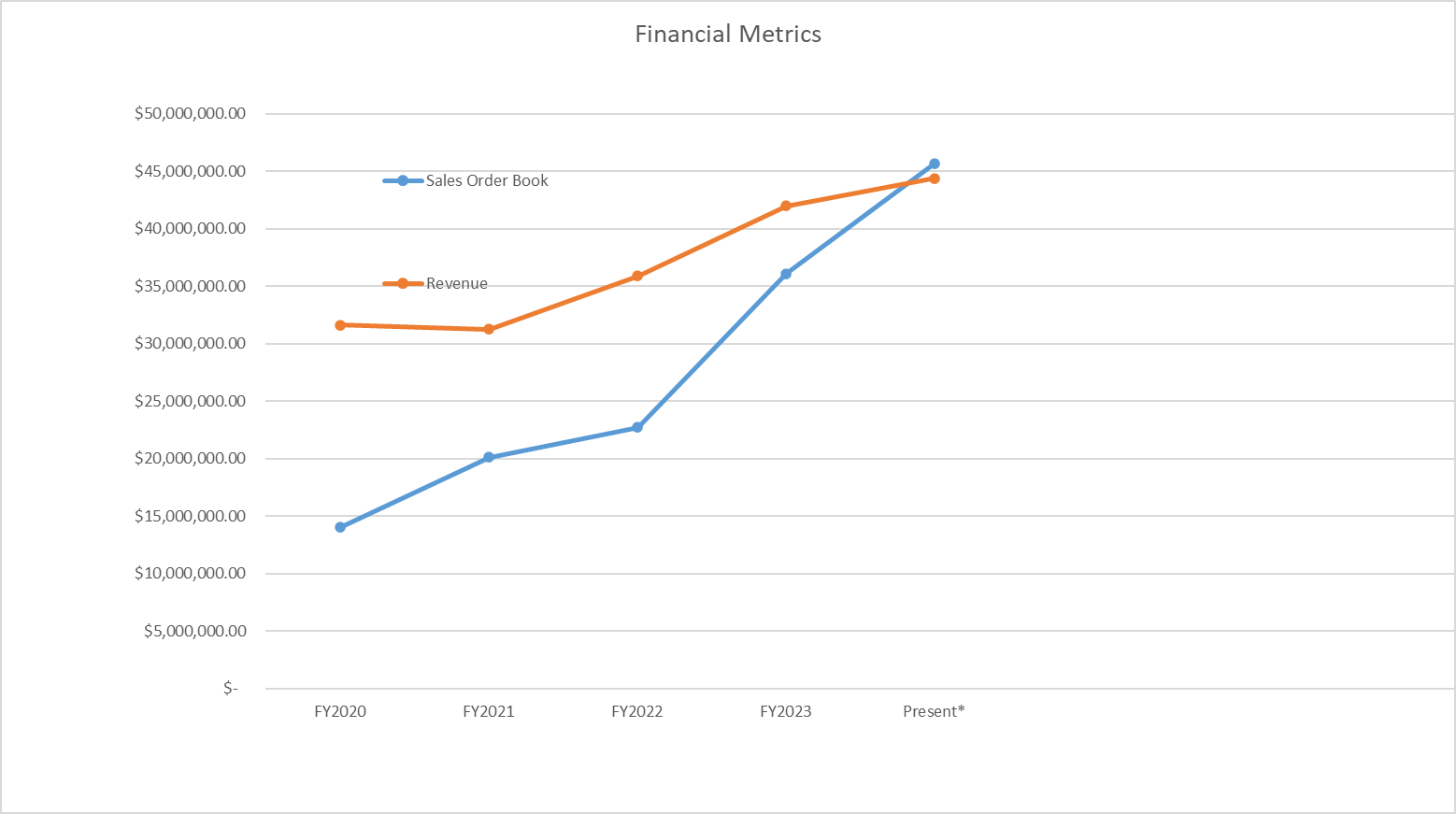

Here's how the order book has tracked over the past six years:

Overall it continues to deliver at or above what I need it to in order to justify continuing to hold. I've been lightening some positions that have gotten a bit frothy in recent months but Austco is not one of them.

[Held]

Great trading update by Austco, continues to perform

Good to see some actual Performance Rights with Hurdles. Not common in the shares I hold down in this part of the market cap world.

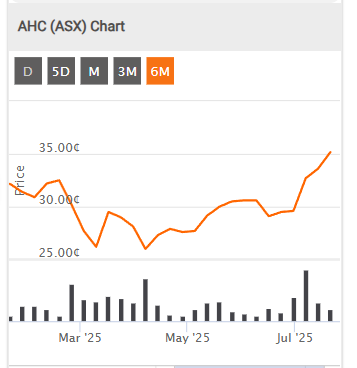

AHC closed 2.5c up on Friday to break through 40c and close at 41c. It had been threatening to do so for a while. Might this indicate a positive update will be released very soon?

Sure, it's a growth-by-acquisition story, but at least they are acquiring into an industry with structural growth tailwinds.

Net Profit After Tax lower: $5,933Mill (16.2%)

Net Debt/ Equity is ok so has liquidity here .. We looking for the these acquisitions to be integrated, sustainable.

https://hotcopper.com.au/threads/ann-appendix-4e-fy25-financial-statements.8731195/

Unfilled Contracted Revenue Recent large contract wins in North America and growth in most other regions across the group have contributed to the continued growth of Austco’s Unfilled Contracted Revenue (UCR). Our UCR book now stands at $53.8 million at 13 August 2025. This includes a net $6.3 million from the recently acquired G&S, being their UCR less orders they had open with Austco NZ.

Cash and Working Capital Position Cash on hand was $14.5m at 30 June 2025, up from $13.6 million at June 2024. Cash generated from operating activities of $13.48 million reflected underlying profitability and allowed for the investment into further businesses (G&S acquired in May 2025) without the need for debt or raising capital. Despite working capital increasing as a result of acquiring G&S, the Group is well placed to fund future contingent consideration obligations without the need for liquidity events, if it chooses to do so.

AHC closed lower while the XJO 8,395 -0.40% also lower

Return (inc div) 1yr: 71.43% 3yr: 50.53% pa 5yr: 38.36% pa

Updated calculation 12th Aug. 2025

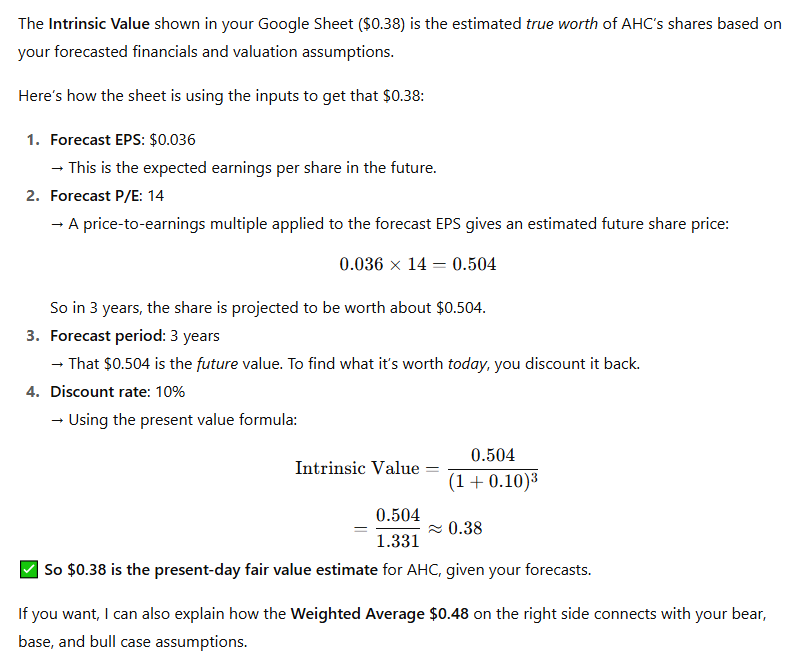

My valuation Calculation from 3 weeks ago Just to clarify the projected Share Price $0.504 ( say an eps growth 12% pa)

The Intrinsic Value shown in your Google Sheet ($0.38) is the estimated true worth of AHC’s shares based on your forecasted financials and valuation assumptions.

https://hotcopper.com.au/threads/ann-austco-healthcare-trading-update-and-guidance-upgrade.8677109/

think, AHC should be able to scale up the model: support for over 5,000 healthcare facilities worldwide.

Unfilled Contracted Revenue Unfilled contracted revenue currently stands at $55.8 million, up from $50.2 million reported in February 2025. The increase reflects the addition of G&S Technologies to the Group since the last update, as well as continued strong operational performance, including a record revenue delivery of $13.2 million (unaudited) in June 2025. Amentco Earn-Out Adjustment The earn-out period for the acquisition of Amentco concluded on 30 June 2025.

Based on the strong performance of Amentco, Austco now expects a final earn-out payment of approximately $8.4 million, exceeding the previously accrued amount of $5.9 million. Under accounting standards, the incremental $2.5 million must be expensed through the income statement rather than adjusted through goodwill. While this will reduce statutory net profit as at 30 June 2025, it has no impact on EBITDA.

Austco retains the option to settle up to 50% of the $8.4 million earn-out in Austco shares, with the balance in cash. A decision on the option to settle is expected following on or around the release of the audited Full Year Results.

CEO Commentary Commenting on the performance, Clayton Astles, CEO of Austco, said: “FY25 was a transformative year for Austco. We delivered strong double-digit growth, successfully integrated acquisitions, and executed our strategy with discipline. Our ability to fund acquisitions through operating cashflow while maintaining a strong balance sheet reflects the resilience and scalability of our business model. With robust contracted revenue and momentum across key markets, we enter FY26 with confidence.”

The Company expects to release its audited Full Year Results and Appendix 4E on 26 August 2025. Authorised for release by the Board of Austco Healthcare Limited.

Austco Healthcare Limited (AHC) is an international provider of healthcare communication solutions, including nurse call systems, mobile communications, and clinical workflow management. Founded in Australia, the company has expanded its presence globally, with subsidiaries in six countries and support for over 5,000 healthcare facilities worldwide. Austco's competitive advantage lies in its advanced IP-based nurse call systems,

Chart shows a great trend here:

Return (inc div) 1yr: 81.40% 3yr: 54.60% pa 5yr: 40.97% pa

Can AHC announcements be found at https://hotcopper.com.au/asx/ahc/?keywords=AHC ? 1/ For example 14th May 2025 - Toronto Western Hostpital

Yes — HotCopper does list AHC’s ASX announcements, including the one from 14 May 2025 regarding the Toronto Western Hospital contract.

Example: AHC — Toronto Western Hospital (14 May 2025)

- On HotCopper, the thread titled “AHC Ann: Secures $2.1M contract at Toronto Western Hospital” reflects the official ASX announcement posted on that date HotCopper.

- In addition, the Announcements page under AHC on HotCopper compiles the company’s recent ASX disclosures, including that same contract announcement, along with many others like acquisitions, results, and trading updates HotCopper+1.

Summary

Yes, you can find AHC company announcements on the HotCopper site — including the 14 May 2025 announcement about the Toronto Western Hospital contract. It’s a convenient repository that mirrors, in near real-time, the ASX releases.

The CHAT GPT missed - the announcements so I conclude Chat GPT is has limited asx knowledge here:

The likely outlook for AHC - no company-issued forward guidance!

I couldn’t find any company-issued, forward-looking guidance for FY 2026 from Austco Healthcare (ASX: AHC)—no specific projections for EPS growth, revenue targets, or contract estimates are disclosed publicly at this time.

FY 2025 Guidance (Latest Available)

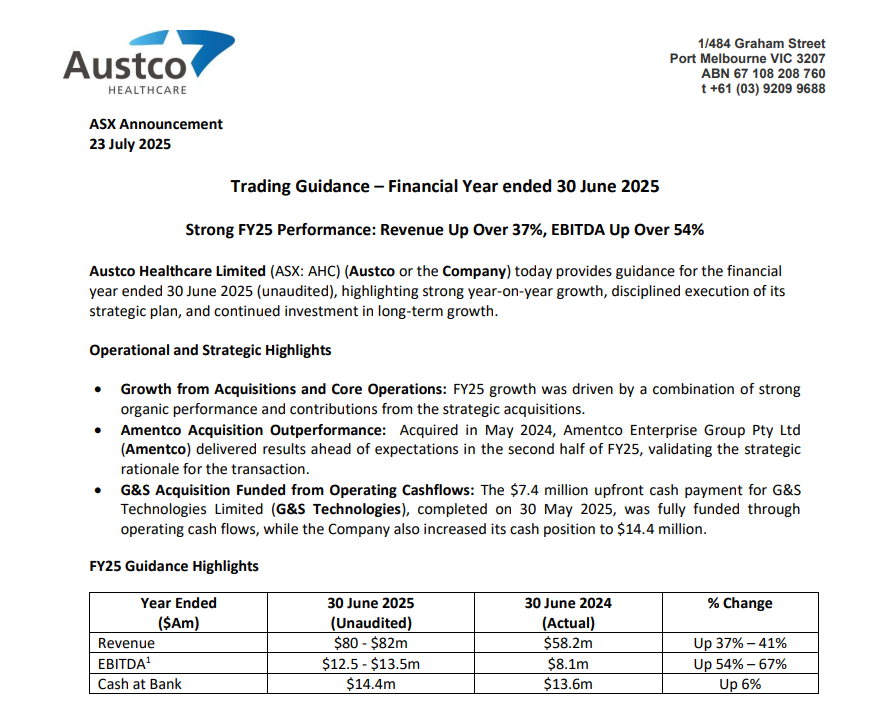

Austco has provided detailed FY 2025 guidance in its ASX announcement dated 23 July 2025:

- Revenue: forecasted at AUD 80–82 million, up 37–41% from FY 2024’s AUD 58.2 million investorpa.comaustcohealthcare.com.

- EBITDA: projected between AUD 12.5–13.5 million, marking a 54–67% increase over FY 2024’s AUD 8.1 million investorpa.comaustcohealthcare.com.

- Contracted (unfulfilled) revenue pipeline: currently stands at AUD 55.8 million, up from AUD 50.2 million in early 2025 investorpa.comaustcohealthcare.com.

These figures provide insight into Austco’s near-term expectations but stop short of detailing FY 2026.

What About FY 2026?

- There is no published or analyst-provided guidance on EPS, revenue, or contracts specifically for FY 2026.

- Analyst forecasts, such as those from Simply Wall St, offer general multi-year growth projections, but they reflect aggregated expectations—not company-issued forward guidance:

- EPS growth: ~18.85% per annum

- Earnings growth: ~21.4% per annum

- Revenue growth: ~14.3% per annum Simply Wall St

Summary

YearEPS GrowthRevenue GrowthContracts (Pipeline)FY 2025Not disclosedGuided: +37–41% (AUD 80–82 m)Pipeline: AUD 55.8 mFY 2026———Analyst Avg.~18.9% p.a.~14.3% p.a. (multi-year)—

Next Steps

If you're seeking FY 2026 guidance, you may want to monitor these channels:

- Upcoming Annual Results (Full Year FY 25) due 26 August 2025, when Austco may release fresh guidance or commentary austcohealthcare.com.

- Investor presentations or ASX releases later this year—especially the FY 2025 results—often include forward commentary on the next fiscal year.

@Bear77 , @DrPete I hope this answers some questions

I've just posted a valuation for Austco. Overall it looks strong. But I'm relatively new to this company. So I have a few questions for the Austco old-timers and wise folks.

Since June 2024 the Return on equity is: 20.28%, Net profit margin: 12%, :

1/ Why did revenue start to grow in 22/23 after many years of stagnating?

2/ Who are Austco's main competitors?

3/ Who is John Bennetts and why does he own 16%?

4/ Who is Robert Grey and why has he been aggressively offloading shares?

5/ Is there a reason Austco uses the language "revenue from customers" rather than just "revenue"?

6/ How comfortable are you with the strategy of acquiring resellers, given the resellers aren't entirely

7/ focused on reselling just Austco but also have other unaligned sources of revenue and profit?

8/ is the 'Net profit Margin' at 12% because of a contract win?

1. Why did revenue start to grow in FY22–23 after years of stagnation?

Austco’s revenue took off thanks to two main factors:

- Organic growth—especially in North America and Asia—grew revenue by about 17% or ~AUD 7 million.

- Acquisitions—Teknocorp (Nov 2023) added AUD 6.5 million and Amentco (May 2024) added AUD 2.7 million. Combined, that delivered a 39% jump in "revenue from customers" over FY23 to FY24.austcohealthcare.com+1Listcorp

2. Who are Austco’s main competitors?

Sources list a range of competitors depending on perspective:

- Craft.co: Ascott Sales Integration, Rethink Medical, MOMI Brands, and RudolfCraft.co

- CB Insights: 9Solutions, Schweighofer Fiber, MatchMD, West-Com Nurse Call Systems, plus othersCB Insights

- Tracxn: Names athenahealth, CareCloud, and Notable among the top rivalsTracxn+1

- For global scale, Austco’s market share in healthcare comms is relatively small—under 1%, compared to giants like Cerner, McKesson, and athenahealthEnlyft+1

3. Who is John Bennetts and why does he own ~16%?

According to MarketScreener, John Bennetts holds ~15.63% of Austco’s shares, making him the largest individual shareholderMarketScreener. I couldn’t find more detail on his background or motivations for his stake.

4. Who is Robert Grey and why has he been offloading shares?

Robert Edward Grey is Austco’s long-time founder (founded in 1986) and has held executive and board roles. As of a 2024 update, he owns ~14.51% and is no longer in an executive roleMarketScreenerMarketScreener UAE EmiratesTracxn. The share reductions may reflect typical founder portfolio diversification or liquidity needs, though no explicit rationale was found.

5. Why does Austco use “revenue from customers” rather than just “revenue”?

This phrasing likely distinguishes recognized sales from existing contracts still to be fulfilled (“unfilled contracted orders”)—which stood at a record AUD 50 million as of FY24austcohealthcare.com+1. It clarifies actual billing versus future revenue potential.

6. What about the strategy of acquiring resellers who also sell other products?

Austco’s strategy appears to intentionally target resellers with established regional reach. Acquisitions like Teknocorp and Amentco not only added revenue but also embedded Austco’s offerings deeper in their networks—allowing revenue synergies while maintaining reseller autonomyListcorp+1austcohealthcare.com. While reseller loyalty might not be exclusive, Austco seems focused on aligning them through integration and software upsell opportunities.

7. Is the 12% net profit margin due to a specific contract win?

The net profit margin of roughly 12% in FY24 was up from ~5.4% in FY23—reflecting a strong combination of organic growth, M&A gains, operating leverage, and tax benefits from recognizing previously unrecognized tax lossesYahoo Financeaustcohealthcare.comListcorp. There’s no clear indication it hinges on a single contract.

Summary Table

QuestionSummary1. Revenue growthOrganic markets + two acquisitions2. CompetitorsIdentified across Craft, CB Insights, Tracxn; includes both med-tech startups & large EMR players3. John BennettsLargest shareholder (~15.6%), little else publicly known4. Robert GreyFounder, former director; now holds ~14.5%, likely managing personal stake5. “Revenue from customers” termDifferentiates recognized income from future contract pipeline6. Reseller acquisition strategyExtends reach and integration without demanding exclusivity7. Margin improvementDriven by scale gains, deal integration, and tax accounting — not a single contract win

Disc: S.M

I've just posted a valuation for Austco. Overall it looks strong. But I'm relatively new to this company. So I have a few questions for the Austco old-timers and wise folks like @Wini, @Noddy74, @raymon68, @lyndonator, etc.

- Why did revenue start to grow in 22/23 after many years of stagnating?

- Who are Austco's main competitors?

- Who is John Bennetts and why does he own 16%?

- Who is Robert Grey and why has he been aggressively offloading shares?

- Is there a reason Austco uses the language "revenue from customers" rather than just "revenue"?

- How comfortable are you with the strategy of acquiring resellers, given the resellers aren't entirely focused on reselling just Austco but also have other unaligned sources of revenue and profit?

Valuation 11/8/25: a "Buy" with current price of $0.37, a fair price of $0.70, and buy price at $0.56

TLDR

- Austco had a solid recent update and guidance. FY25 results look like they will be strong, on the back of both organic and acquisition growth.

- However the quality and long-term impact of the recent acquisition binge of 3 resellers is yet to be determined. Investors need to monitor closely whether they become a drag on growth.

- If recent success is maintained, Austco could easily 4x in the next 5 years. But there is also a bear case where the share price halves.

- Weighing across bull, bear and base cases, at current price of $0.37 I estimate a 25% pa ROI over the next 5 years, a current fair price of $0.70, and a buy price around $0.56 to achieve a 15% required rate of return.

Bull case

- Revenue has grown substantially in the last 5 years, accelerating in the last 3 years, with a 5-year revenue CAGR of 20% pa.

- Unfilled contracted revenue has also grown, from $20m in Feb ’23 to currently around $56m, providing confidence that revenue growth will continue.

- Growth is coming roughly evenly from both organic growth and acquisitions.

- The company is profitable, with EBITDA about 16%, and roughly half of that flowing through to cash flow and NPAT.

- Gross margin is about 50%, providing the opportunity for leverage with scale.

- Negligible debt and interest expense, with current assets exceeding total liabilities.

- Key personnel have moderate skin in the game, with the CEO Clayton Astles owning about 1% of shares worth about $1.5m, the CFO Brendan Maher owning about 0.8% worth about $1.1m, and the Board also owning a total of about 0.8% of shares worth $1.1m.

- It appears that recent acquisitions have performed well based on larger than expected performance-based earnout payments. The 3.5x EBITDA paid for acquisitions suggests sound capital allocation.

- A healthy 7% of revenue is spent on R&D of products and software, with about half if it capitalised, half expensed.

- The recent improvement in share price has lagged the sharply accelerating revenue and profit growth.

- Valuation:

- The last 3 years have seen >30% pa revenue growth. If we take a bullish view and assume this drops to a still strong 23% CAGR over the next 5 years, we get a FY30 revenue around $230m.

- With scale, NPAT could grow to around 13% giving $30m in FY30.

- If Austco is able to maintain 20% growth, a PE of 40 could be possible, giving FY30 market cap around $1.2b. Allowing for 40% dilution (see reasons for such a large dilution in bear case below), that would be a FY30 share price around $2.30.

- Using a discount rate of 10%, a fair current price would be around $1.40.

Bear case

- Recent acquisitions, that have helped goose revenue growth, are of Austco resellers. Hence the increased revenue is coming from services (sales commissions, installation and maintenance), not product. These business had lower gross margins at time of purchase, and have had a small negative impact on Austco gross margin.

- The acquisitions are not a clean fit for Austco. Although the companies are Austco resellers, they also sell, install and maintain products of other suppliers who are either competitors or in unaligned services (eg the recently acquired G&S Technologies does ICT auditing, infrastructure for education facilities, general commercial ICT upgrades, surveillance systems). This leaves Austco with the undesirable choice between continuing to support a now wider range of products and services, or dropping revenue and margin from acquired companies if these unaligned offerings are not maintained. It is also possible that by purchasing resellers, Austco may offside other resellers who subsequently reduce their sales of Austco products.

- Annualised contract revenue, from software and support, is low at around 12%. The bulk of revenue comes from one-off equipment and installation sales.

- There has been substantial dilution of outstanding shares for many years, almost doubling outstanding shares in the last 10 years. Shares outstanding have grown from 193m in FY15 to 262m in FY20 (6% 5-yr CAGR; revenue declined 1% pa during this time) to 364m at end of FY25 (7% 5-yr CAGR; revenue grew 20% pa during this time).

- The CEO’s salary, approaching $1m, is high for a company with market cap of $137m. Less than 6% of total salary comes in the form of performance rights which are contingent upon EPS and TSR targets. The rest of the salary comes from a fixed component and an arbitrary cash bonus determined by the Board.

- Valuation:

- If revenue growth drops to 10% pa we’ll see around $130m revenue in FY30.

- Let’s say NPAT drops from currently around 7% to about 5%, giving around $7m in FY30.

- With a PE of 18 we get a market cap around $120m. Allowing for 40% dilution, that will be a share price around $0.23.

- Using a discount rate of 10%, a fair current price is around $0.14.

Base case

- My base case sits between the bull and bear cases above.

- Recent revenue and profit growth have been strong, although it is unclear what level of growth is sustainable. The quality of recent acquisitions is currently unclear and their impact needs to be monitored closely.

- I’ll assume FY25 revenue around guidance of $81m, with 5-year CAGR of 16% to around $170m in FY30.

- With net margin of 9% (slightly higher than current 7%, allowing for scale benefits), PE of 30, and dilution of 40%, I get an FY30 market cap around $460m and share price of $0.90.

- If I weigh roughly evenly across bull, bear and base cases, I get an expected ROI of 25% pa over the next 5 years.

- Applying a 10% discount rate, I get a current fair price around $0.70.

- If I apply a 15% required rate of return, I get a buy price around $0.56.

at 23rd July 2025 good results.

todays Price Share Price $0.38 + 14.9%

Noted; Net Profit is double digits and growing positively.

*1 year Valuation Intrinsic $0.31 you pay w' average $0.37

Valuation before the 23rd July announcement:

Valuation after the 23rd July 2025 announcement:

If the EPS grows at 12%pa ( as per previous year)

Then 3 years: EPS growth 12%pa guess 2028 Intrinsic value ~ $0.38

The AHC share could be North of this at $0.48

Holder: RL

Austco today announcing the acquisition of NZ-based call system solutions provider and Austco reseller, G&S Technologies. I don't know about others but I find it very difficult to play armchair quarterback on acquisitions. There are just too many factors, like working capital pegs and balance sheet health, that are completely unknown unless you're in the tent. However, what we can say based on what's available to us:

- 3.5 times EBITDA - tick. It's in line with other acquisitions they've done, which have so far proven successful. They're maintaining price discipline.

- The EBITDA conversion % is roughly in line with the existing Austco business - tick. On that measure at least seems to be of reasonable quality.

- Strengthens direct sales capacity - tick. They've been doing this across multiple regions and it's been working so far.

- Up to 75% funded by scrip, at Austco's discretion - tick. Give them skin in the game and preserve cash. Yes, it's somewhat dilutive but there's always going to be a trade off.

- It's a meaningful addition - tick. It roughly represents half of Austco's business from 12 months ago. They've grown considerably since so probably represents about a quarter of FY25 business but still significant.

Only slight quibble is that they didn't take the opportunity to update on the order book but I'm nit picking.

[Held]

06/09/2024

So, updating based on their FY24 results:

Assume that 2025 revenue from Amentco and Technocorp was the same as the pre-purchase estimates for 2024 ($13m and $9m respectively) and the underlying business grows at 10%

=> 2025 Revenue: $76m

assume a GP margin of 53% and Opex of $30m (increasing 20% YoY)

=> 2025 EBT: $10m

360m Shares and a 12X P/EBT

=> 2025 Share price: $0.33

A much simpler valuation than I usually do, but why complicate things if you don't have to. This is still pretty conservative so Austco share seems very reasonable to me and I have be buying steadily.

Previous

Using similar approach but allowing for the increase in share count from the recent capital raise

Assuming 2024 revenue is 4/3 Q1-Q3 = $48m

Growing revenue at 9% to => 2029 Revenue: $74m

Assuming a 6% CAGR in Opex,

and a 55% gross margin => 2029 EBT: $12m

Starting with 360m shares (around a 20% increase from the recent cap raise),

and growing them 1% per year => 2029 share count: 374m

P/EBT of 12 => 2029 share price: 0.37

Discount at 10% => 2024 share price: 0.23

So no change to valuation.

Note: I have not really increased revenue projections due to the purchase of Amentco (basically assumed this was essential for the 9% growth) and have probably downplayed the contributions from Teknocorp (as Q1-Q3 only had 4 months of revenue from them). So I'd suggest this is very conservative.

Maybe I am anchoring too much to it's current share price but I'd like to see a few more quarters, maybe another year, of execution from them before I get more bullish on my valuation.

Assuming 2023 revenue is 2 x 20231H = $41m

I'm going to assume Austco delivers (at least partially) on their potential and will grow revenues 9% a year to 2027 =>

2027 Revenue: $58m

Assuming a 6% CAGR in Opex, and a 55% gross margin =>

2027 EBT: $9m

Using a 12 EBT multiple, and assuming 310m shares in 2027 =>

2027 share price: 0.34

discounted at 10% =>

2023 share price: 0.23

Provided AustCo get it done I think this is a pretty conservative valuation with plenty of upside to both their growth potential and market multiple.

I will be adding further to my position in Austco - and monitoring their execution.

DISC: Held

Austco released its full year results announcing Revenue of 58.2m, NPAT of 7.1m (tax offset by the last of its loses) and an order back log of 50m.

Is a re-rating on the cards?

https://austcohealthcare.com/wp-content/uploads/2024/08/29AUG24_media-release.pdf

Austco puts out out their hand for a capital raise

Bell Potter are the underwriters.

Bell Potter also did the raise for Clarity Pharmaceuticals and only 33% took the offer.

I think this could head the same way. Extra 15m shares for retail OR Bell Potter has to buy up to 10m shares (going by the 33% using Clarity and an example) if retail do not take the offer.

I know comparing Clarity Pharmaceuticals and Austco is not an apples to apples comparison but I'm making the point that that retail right now doesn't have the stomach to tip money into the begging bowl unless there is very clear upside and synergies.

Sold on the pop on the morning

[not held].

Found a bear case while scrolling through my feed

Tauranga Investments - Feb 2024 update

It is a bit old as it was published before the Q3 update but does highlight the challenges faced by AHC one being less cash as a result of acquisitions, revenue growth versus software costs and now the trading halt pending capital raise.

[held]

@LifeCapital and @BendigoInvesto covered this, so I won't back over what they've written. Except to say that I was scratching my head at this result. The numbers just looked too good, and I couldn't get them anywhere near to adding up until I re-read almost to the bottom of their trading update:

Talk about burying the lead - a 5.6% increase in GM is huge! Much higher than anything they've done for at least 10 years. What is that? Is that Technocorp? I'd thought of Technocorp as strategically important, but of lower quality than the existing business. That isn't borne out by the numbers though:

So Teknocorp appears to be holding its own and then some. But the underlying business appears to have had a standout quarter as well. While I thought the 1H numbers were fair-to-good, I had expected a lot more given the growth in order book and commentary around impacts of COVID impacts easing. Q3 appears to have made up for that.

It's just as dangerous to extrapolate a good quarter as it is a bad one, but I'll do it anyway cause I'm a slow learner. Although they disclose NPAT, I'll focus on EBITDA because their tax is all over the shop. They are run-rating at almost $10 million EBITDA, which is an EV/EBITDA ratio under 6. Add a record order book and I'm a happy holder.

Nice, company continues to deliver.

Further acquistion should add to bottom line if costs can remain low.

All important for small caps.

Share count @ June 2020: 284 188 951

Share count @ December 2023: 290 790 167

Share count growth: 0.8% pa.

What do they do?

Ausco develop software and hardware relating to healthcare communications systems, primarily nurse call and real time patient tracking systems, as well as re-sell and market complimentary systems.

They are also Systems integrators (nurse call and PTS installation contractors), through acquisitions, giving them sales channels into various geographic markets. It has achieved this primarily through acquisition, and is part of a strategy to enhance their direct sales channels in Australia, where systems integrators tend to have the customer relationships.

Financials

The business experienced significant disruption throughout FY 2021 due to COVID-19. Since then, revenue CAGR is 18%

Gross margins have remained relatively flat over the past 3 years at around 52%.

Profit margins have been in the range of 2-7%, noting the business has been profitable over the past 3 years.

Since H1 2022, software and software services revenue CAGR is 28% over the past 2 years, and is now 21% of total revenue. AHC has been developing its Nurse call and clinical comms platform Tacera,

Sales Pipeline: Sales pipeline has more than doubled to $44.4 million over the past 12 months, leading into H2. AHC revenue streams are seasonal, with H2 traditionally being the stronger half. The sales pipeline has benefited from the following recent acquisitions:

- Acquired Amentco (Integrator) for $10.6M (3.5 x 2023 EBITDA) - Feb. 2024

- Acquired Tecknocorp acquisition for $2.6M plus earnout (3.5 x EBITDA) - Sep. 2023.

- Present revenue value is annualising H1 revenue.

Share Price Performance

Share price has been in an upward trend since early 2019.

Valuation

Austco Healthcare Ltd is trading on a trailing PER of 24.5. However, given the strong pipeline into a seasonally stronger H2, I would estimate the forward PER is around 20, which appears to be reasonable value, assuming it can continue to grow at around 10-15% pa.

Ownership

The largest owners are:

- Former CEO / Founder: Robert Grey (19.2%)

- Aust. Ethical Investments (17.8%)

- Asia Pacific Holdings (18.1%)

The board is a lean one, with just 4 members

MD, Clayton Astles owns 1.1% of the company, and Brendan Maher (CFO) 0.85% . Other directors holdings of around $100-200k each.

AHC has some solid institutional investors, with reasonable inside ownership

Management Incentives

Short term incentives are based on pre-defined profitability, gross margins, and revenue financial targets. Non-financial are product development, process improvements, and Leadership and team contribution.

Summary

AHC strategy of rolling up integrators and re-sellers in Australia at about 3.5x EBITDA will juice revenue and hopefully profits over the next few years. The call option is it the re-sellers / integrators enable AHC to get their sticky Tacera platform on sites around the country. Once these systems are in, they are difficult to replace.

Presently, sales orders are exceeding the H1 2024 revenue run rate, indicating a strong H2 is ahead of us.

DISC - HELD

Austco has announced a $3.8 million contract win across two hospitals in Singapore.

They have also announced this has taken their order book to $40.7 million, up from the $38.7 million announced at the AGM last month. They've been on a bit of tear this year having more than doubled the order book since February this year.

Zooming out a bit the order book has been steadily rising since late 2019, apart from some COVID and supply chain impacts through 2022 and early 2023.

Nice to see at least one of my holdings kicking ass and taking names. I still think it flies under the radar a bit considering its history of profitable, non-dilutive growth. @Strawman have we spoken with Clayton?

Austco has come out with a roadshow presentation today, with lots of funky graphs and "buy me" arguments. Not a lot new, although they did disclose sales orders were up again from last month's record high to $37.2m - so they're filling the funnel faster than they can drain it. (Ignore the 'Revenue from customers' tag - revenue it ain't).

Austco is one of my more comfortable holdings. They disclose often enough to make you feel wanted, without getting all over-promotional. When they make investments in product or people they set realistic expectations about how long it will take to get a payback from the investment. They certainly appear to be in that zone of getting a return of previous investment right now though.

If I were being hyper-critical I'd say the CEO is very well compensated for a company of this size. However, Clayton appears to be getting the job done so I'll not quibble while that remains the case. It's arguably not a screaming bargain but if they keep growing at the rate they are it will look cheap soon enough. Happy to hold.

Bull Case:

- $7m in cash and no debt

- Strong product offering: They seem to know their market, so have a good level of optionalty while also not trying to be "all things to all people" and as such watering down their core competency.

- Strong sales momentum coming out of Covid and catching up on the backlog of sales orders

- Great gross margins (for software plus hardware business) of 50+%

Things to watch:

- Continued sales momentum - increasing revenue and sales orders

- Software and SMA revenues as a % of revenue - ideally I'd like this to increase, but ultimately as long as the gross margins stay high it is not that important. It would be nice if they started reporting on actual recurring revenue as well.

Pop in share price after AGM update

Would have been good if they had a slide that tracks their progress against competitors. Otherwise lots of content to take away and digest.

Still have watch position

[held]

Maybe I'm a bit picky but biggest concern is the lack of shares traded on AHC. Trading of shares seems very illiquid and is difficult to get a sense of what the market thinks about this company.

Another concern is there are other bigger players competing for the same pie including Phillips.

Despite this, I took a small starter after reading some of the previous straws by Noddy74 and Wini (must have taken weeks to finally get some shares), but then bumped my partial fill back down a bit while I do more research into the competitive landscape. Not keen on making a full position yet.

[held]

Austco snuck in a price sensitive investor presentation this morning, which was an interesting decision given they released results less than two weeks ago (sans presentation). It came two days after a competitor, Hills Limited (HIL.ASX) announced they had been successful in bidding for the New Footscray Hospital tender in Melbourne. I'm not saying it was because of that. I'll leave that to others.

Largely it replicated what they they had already released with some swanky graphics added. It did give a little more detail about the growth investment being made in each region. One nice little new tidbit it shared was an increase in the order book to a record $24.7m. That's $2m higher than they had disclosed at the end of August and is probably what justified it being price sensitive.

[Held]

Essentially what you have here is a profitable, dividend-paying, growing, tech company in the Healthcare sector - they just need lithium and they've won Buzzword Bingo. All of that comes for bargain basement price of just $33m market cap.

Revenues are growing in the mid-teens but their margins have been under pressure - like every one else - from higher product costs and supply availability issues. However, they have largely offset the impact with more software revenue (higher margin) and sale of higher margin products.

It will be interesting what FY23 will bring with several offsetting impacts to weigh up. The company has flagged an investment in sales in FY22, but call out long sales cycles means the benefit of this won't be realized until FY24 onwards. Additionally we'll need to back out COVID assistance grants over the past two years.

Offsetting this is a strong order book and improved hospital access post normalization of COVID (get well soon Chagsy), which is being reflected in growing revenues. Normally we'd like to see order books growing over time but I think at this stage of COVID recovery it's a bullish signal that the order book appears to have peaked as it suggests normalization of access is real. This, plus the fact their revenue is growing much faster than the run off of the book, means it doesn't unduly concern me the order book may now be reverting to a more normal setting before it starts to grow again (it has grown to $22.7m since year end).

One thing I like about this company is they seem pretty straight forward and conservative. They call out issues they're seeing even if they may not be apparent from the numbers as there are offsetting 'good guys' or are yet to be reflected in the financials. They keep adjustments to a minimum and where they do use them it's to back out the impact of one-off grants and gains, rather than back out costs.

They raised capital in 2019 to invest in sales capacity and growth. What was pleasing is when COVID hit they didn't deploy it for this use or any other. They just sat on it. Now they're coming out the other side they can invest for growth at a time when a lot of other companies are bunkering down and trying to strip costs out.

Their future opportunity is to move into patient monitoring, including post-discharge, and patient engagement, including entertainment and food. This may require acquisitions with competition already heavily invested in this tech.

The declaration of a dividend is a moderately bullish signal for me. I'm not sure the last time they paid one but I don't think they have for at least 6-7 years.

Overall, I expect them to continue to steadily grow the top line with this accelerating in FY24 and beyond as growth initiatives being spent today bear fruit. It may be difficult to grow the bottom line at the same rate in the short term with ongoing margin pressures and investment in sales capacity. However, that operating leverage will come in time.

Based off a fairly conservative DCF.

[Held here and IRL - both underwater, which puts them in plenty of good company]

Just realised I have had this report on private for 3 months. Think it still holds, will review the result in coming weeks and update.

_____________________________________

Simple valuation approx A$60m, or 20cps

Overall I think Austco represents good value at 10cps. Risk to the downside is mostly temporary market sentiment in my mind. Their position in a defensive, slow moving industry and strong balance sheet should see them through any market sentiment or supply chain disruption issues. If growth can be achieved - and there are some signs with good contract wins and pipeline and increasing software revenue - then there is good upside potential and likely eventually become a dividend payer.

What I like:

High NTA (5.5cps about half cash have inventory/assets) offers downside protection for a profitable company (ie. no cash burn)

No debt - downside protection in event of extended market or economic downturn

Growth plan with shift to software, investment in sales and potentially investment, global footprint in growing & defensive industry (healthcare)

What I don't like:

Low ownership from board and CEO. No longer founder led although he still holds a bunch of shares.

No recent, proven track record of executing on growth strategy.

Could they be out-competed by a larger organisation who spend a lot of money on comms tech and stumble into the hospital industry.

Model assumptions for valuation @ A$60m:

limited revenue growth and margins in 22/23 - conservative assumption due to supply chain issues

starting to grow thereafter and doubling revenue by 2030 as hospitals invest more in systems and software - more bullish assumption as they have had minimal growth last 5 years

NPAT margins of about 10%, supported by transition to software weighting, limited by requirements to re-invest over time in technology - they're a little under this presently after removing govt grants

Discount rate 10%

The latest investor preso (see here) warns shareholders of supply chain issues -- increased raw materials and transport costs, semiconductor shortages -- and says that management expect these pressure to last for the remainder of FY22, and possibly beyond.

This will impact margins, and has prompted the company to build up inventory. The business will also be investing in added sales resources. With $7m in cash, they are also on the lookout for acquisitions, particularly in Europe and the US.

Will be interesting to see how sustained these supply chain issues are, and whether there is much capacity to increases prices (i suspect not)

I think there's good scope for sales growth as they prosecute their record order book, but with ongoing investment and added costs it'll make profit growth more difficult.

Not a great deal of insight provided in terms of FY22 trading or outlook. Main takeaways for me were:

- increase in open order book to $22.9m (from $20.1m at Jun 2021)

- Biggest risk being supply change shortages, particularly semi-conductors

Austco copped a first strike against their remuneration report in FY20 but this was passed comfortably this time around. The re-election of director Brett Burns was the most contentious with 22.69% voting against. Claude Walker chipped in with a question to Brett Burns to detail one opportunity and one risk to the business. To his credit he did answer it, although I wouldn't say I was left any more enlightened about Austco after doing so. Given the stage the business is at and the stated strategic direction of the business I think an acquisition in FY22 is probable.

[Held]

Austco has won a $3.3m contract to supply its Tacera Nurse call platform to Khoo Teck Puat Hospital -- a 795 bed hospital in Singapore (as a side note, Singapore has one of the worlds leading healthcare systems. Certainly in the top 5 globally).

ASX announcement here

The deal is a significant one, representing ~10% of last years total revenue.

Further, the hospital belongs to the Yishun Health Network -- and it is Yishun that the contract is with. This network encompases many other healthcrae institutions in Singapore, so although it wasnt mentioned, I assume there's potential for the contract to be extended to other facilities if all goes well.