What do they do?

Ausco develop software and hardware relating to healthcare communications systems, primarily nurse call and real time patient tracking systems, as well as re-sell and market complimentary systems.

They are also Systems integrators (nurse call and PTS installation contractors), through acquisitions, giving them sales channels into various geographic markets. It has achieved this primarily through acquisition, and is part of a strategy to enhance their direct sales channels in Australia, where systems integrators tend to have the customer relationships.

Financials

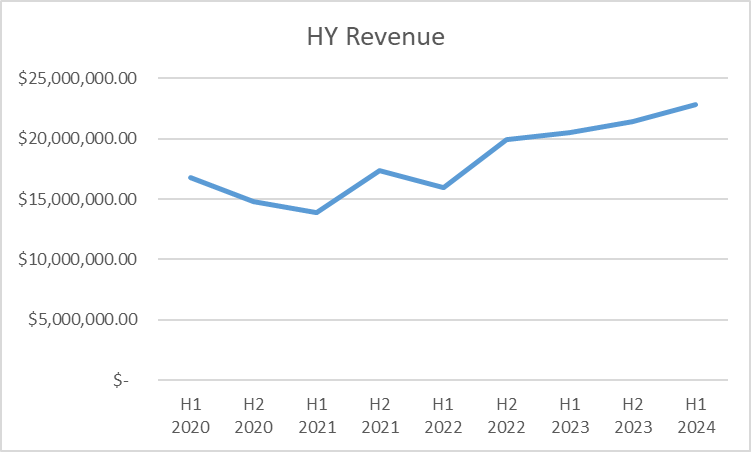

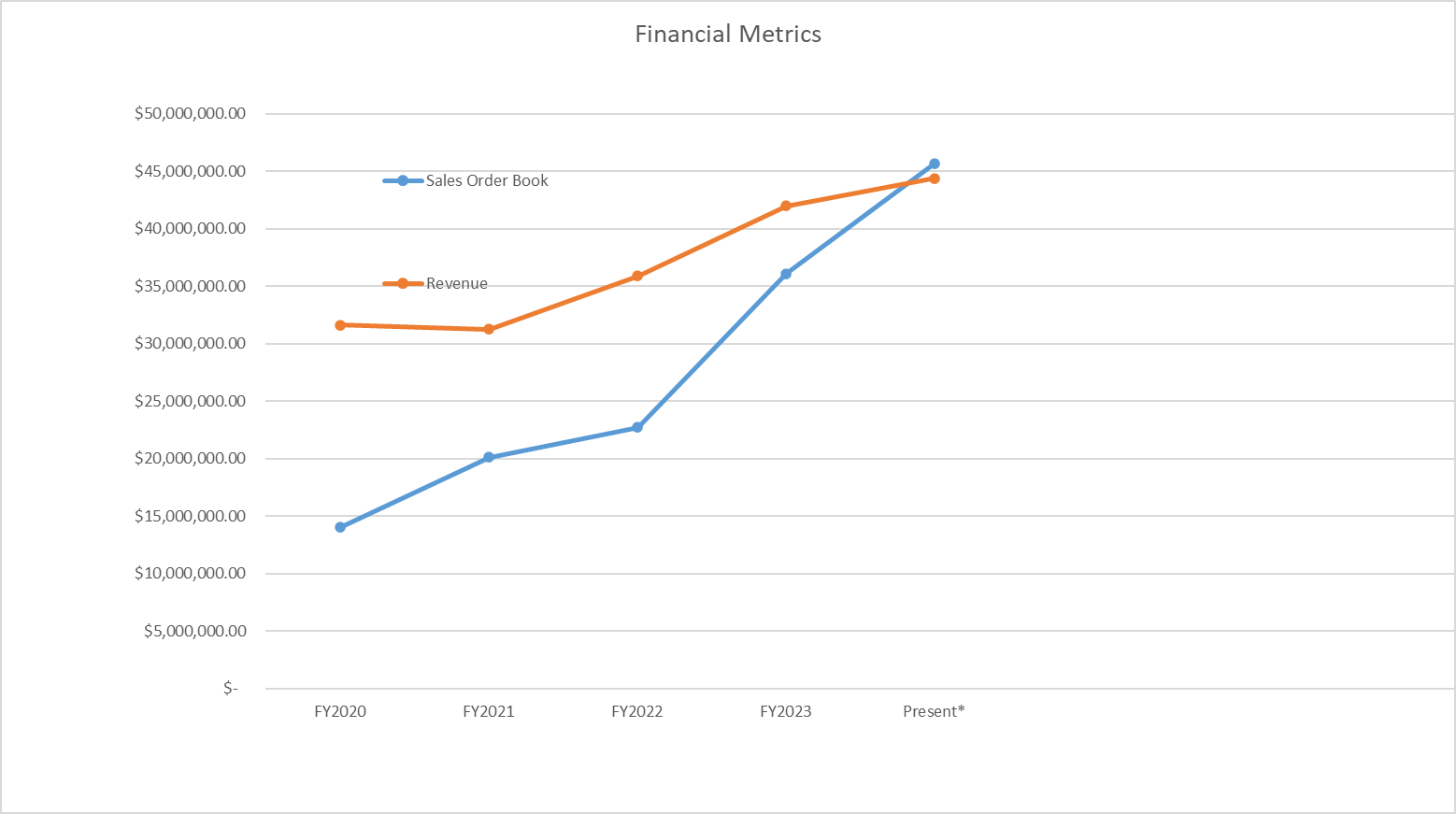

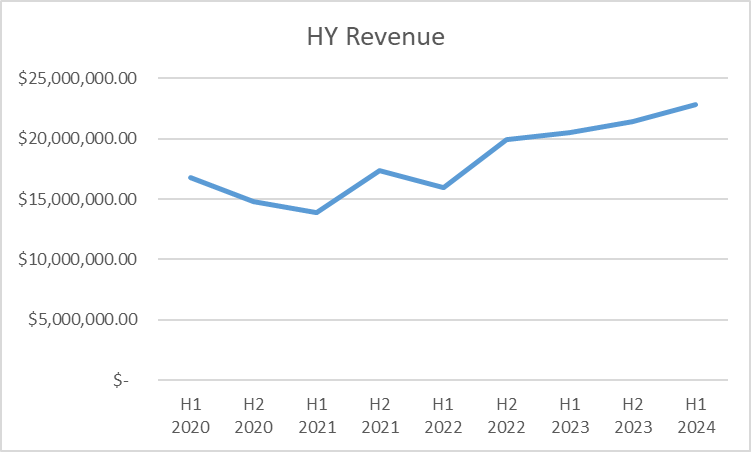

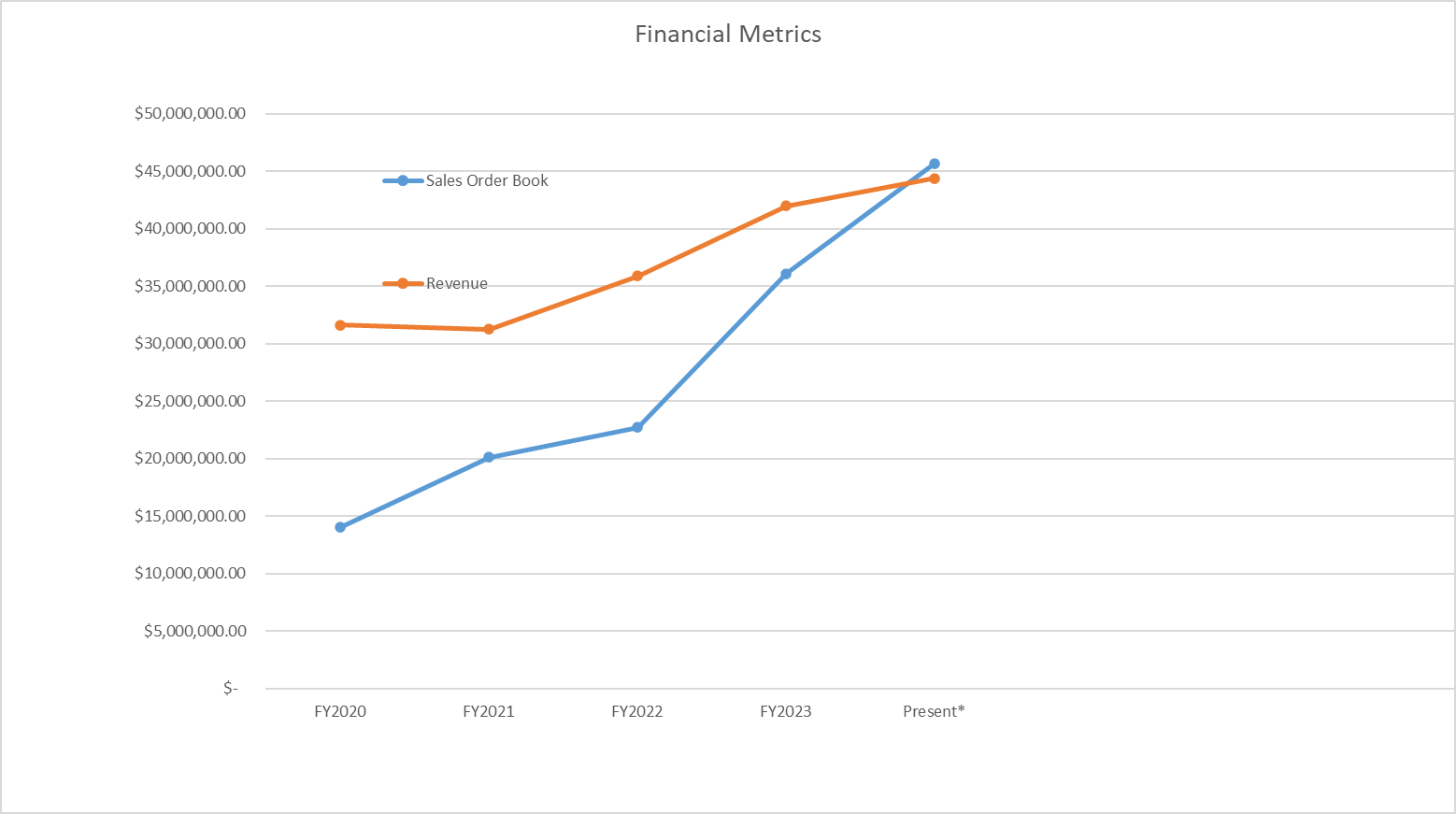

The business experienced significant disruption throughout FY 2021 due to COVID-19. Since then, revenue CAGR is 18%

Gross margins have remained relatively flat over the past 3 years at around 52%.

Profit margins have been in the range of 2-7%, noting the business has been profitable over the past 3 years.

Since H1 2022, software and software services revenue CAGR is 28% over the past 2 years, and is now 21% of total revenue. AHC has been developing its Nurse call and clinical comms platform Tacera,

Sales Pipeline: Sales pipeline has more than doubled to $44.4 million over the past 12 months, leading into H2. AHC revenue streams are seasonal, with H2 traditionally being the stronger half. The sales pipeline has benefited from the following recent acquisitions:

- Acquired Amentco (Integrator) for $10.6M (3.5 x 2023 EBITDA) - Feb. 2024

- Acquired Tecknocorp acquisition for $2.6M plus earnout (3.5 x EBITDA) - Sep. 2023.

- Present revenue value is annualising H1 revenue.

Share Price Performance

Share price has been in an upward trend since early 2019.

Valuation

Austco Healthcare Ltd is trading on a trailing PER of 24.5. However, given the strong pipeline into a seasonally stronger H2, I would estimate the forward PER is around 20, which appears to be reasonable value, assuming it can continue to grow at around 10-15% pa.

Ownership

The largest owners are:

- Former CEO / Founder: Robert Grey (19.2%)

- Aust. Ethical Investments (17.8%)

- Asia Pacific Holdings (18.1%)

The board is a lean one, with just 4 members

MD, Clayton Astles owns 1.1% of the company, and Brendan Maher (CFO) 0.85% . Other directors holdings of around $100-200k each.

AHC has some solid institutional investors, with reasonable inside ownership

Management Incentives

Short term incentives are based on pre-defined profitability, gross margins, and revenue financial targets. Non-financial are product development, process improvements, and Leadership and team contribution.

Summary

AHC strategy of rolling up integrators and re-sellers in Australia at about 3.5x EBITDA will juice revenue and hopefully profits over the next few years. The call option is it the re-sellers / integrators enable AHC to get their sticky Tacera platform on sites around the country. Once these systems are in, they are difficult to replace.

Presently, sales orders are exceeding the H1 2024 revenue run rate, indicating a strong H2 is ahead of us.

DISC - HELD