19 April 2022

March 2022 Quarterly Trading Report

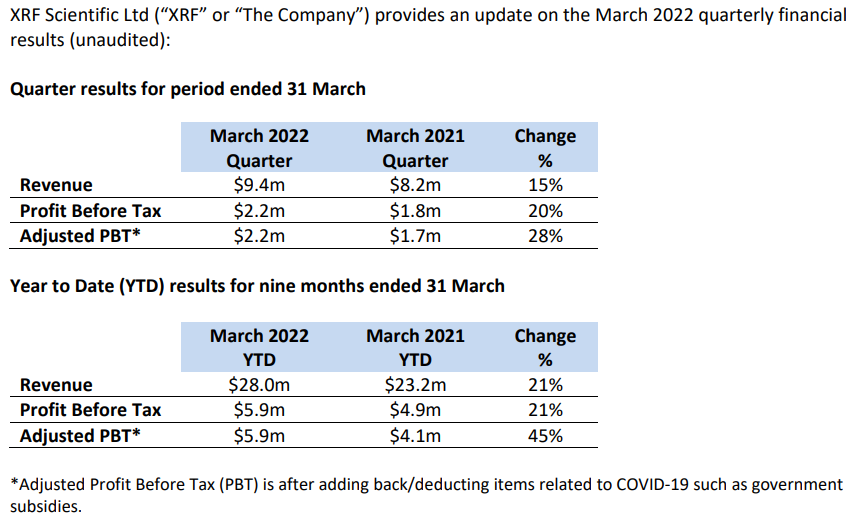

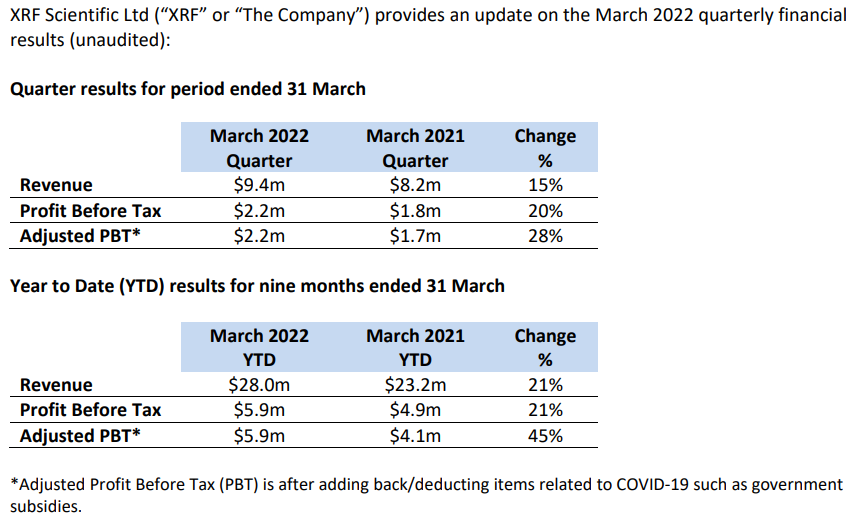

The March 2022 quarter was very positive, with all divisions making a strong contribution to the result. The

results were driven by mining production, high levels of sample testing in mining exploration and industrial

markets internationally.

Consumable sales have continued to strengthen and were $2.9m during the quarter compared to $2.7m in

the Previous Corresponding Period (PCP). Both the mining and exploration sectors continue to drive large

volumes of sample testing, with long lead times for results being reported by commercial laboratories. As

expected, rising lithium prices have increased our consumable production inventories, and no impact has

been experienced on margins.

Sales of capital equipment products have been strong at $2.8m compared to $2.0m in the PCP, with orders

at record levels through the quarter. Demand has been particularly robust from the mining industry, which

has generated sales for new and replacement machines. Our order book remains at high levels, with a full

production book for the June 2022 quarter.

As part of capital equipment sales, Orbis Mining laboratory crushers delivered revenue of $1.06m during the

quarter. The forward order book is robust and growing, with production booked out for the June quarter.

The OM100 laboratory crusher is developing a significant reputation for its unique ability to take drill core

samples of 110mm down to 2mm in a single pass. The Orbis product line has been integrated into XRF’s

existing sales network, which has started to contribute to sales.

Precious Metals sales have been performing well and were $3.7m during the quarter compared to $3.5m in

the PCP. We are seeing a high level of platinum labware remanufacturing orders, as well as new product

sales related to expansion in the mining sector. Our market share in the industrial platinum markets

continues to grow, with new customers being added on a regular basis. New customers recently added

included platinum components for manufacturers of bioactive medical glass and quartz glass.

We expect the June 2022 quarter to be a strong trading period across all divisions. During this period our

key focus areas are new product developments, international sales growth, and M&A opportunities.

Please direct any inquiries to:

Vance Stazzonelli

Managing Director

[email protected]

+61 8 9244 0600