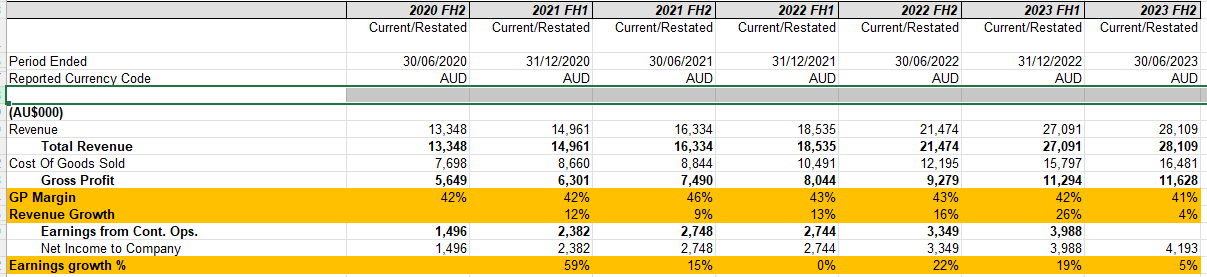

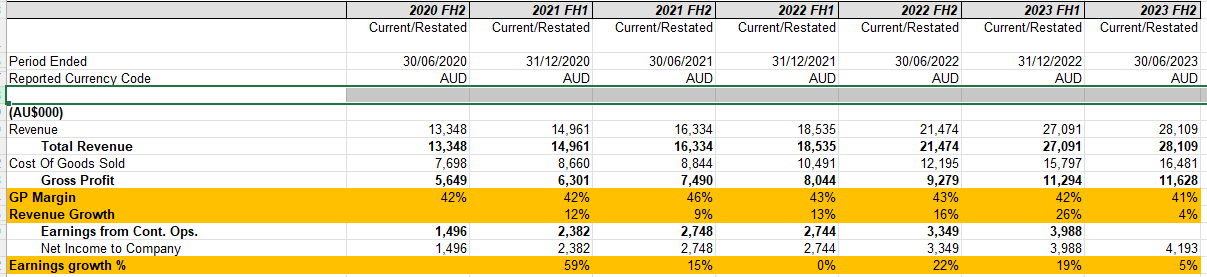

Adding further info to my comment on why the share price fell. I won't worry about drawing the graph as the numbers show the trend well enough.

My last comment mentioned margins fell, but it was only minor about 2% 2H2022 versus 2H2023

However of most concern is the revenue growth. It was only 4% from end of 1H2023 to 2H2023 versus 16% from end of 1H2022 to 2H2022.

Also earnings between 1H2023 and 2H2023 was only 5% growth versus 22% growth between 1H2022 to 2H2022

In summary it seems both revenue and growth stalled from the beginning of the 1st half to the end of June 2023 down to single digits.

The market reacted as expected, even though the numbers looked good,because the growth from previous period was not as much as opposed to the corresponding period. I think market wanted consistent double digit growth but unless I did something wrong above, it looks like growth is becoming marginal.

[held]