https://www.afr.com/street-talk/back-to-the-drawing-board-for-bolton-as-magellan-wins-vote-reprieve-20231101-p5egt3 [Wednesday 1st October]

Back to the drawing board for Bolton as Magellan wins vote reprieve

Supreme Court ruling is a blow to the activist investor’s efforts to wind up the Global Fund.

Source: www.afr.com

Previously: https://www.afr.com/street-talk/magellan-plays-its-hand-but-bolton-isn-t-done-20231016-p5eck5 [16th-October]

Magellan plays its hand, but Bolton isn’t done

Street Talk understands the activist investor won’t be stepping back from his campaign despite Magellan’s announcement

Source: www.afr.com

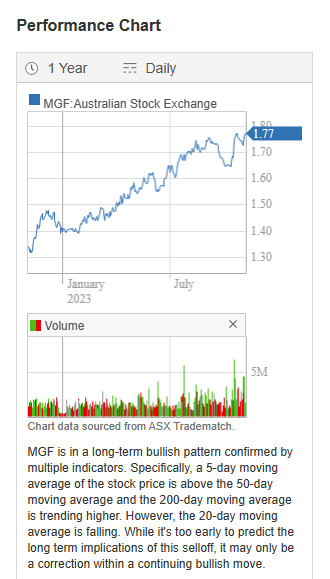

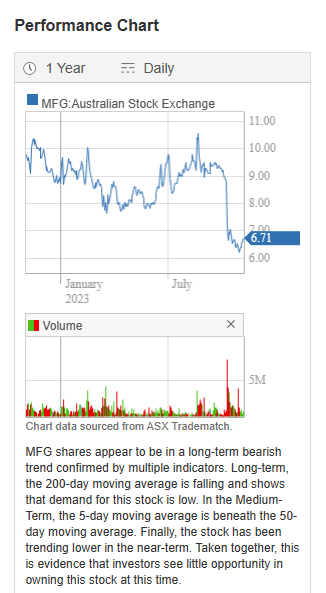

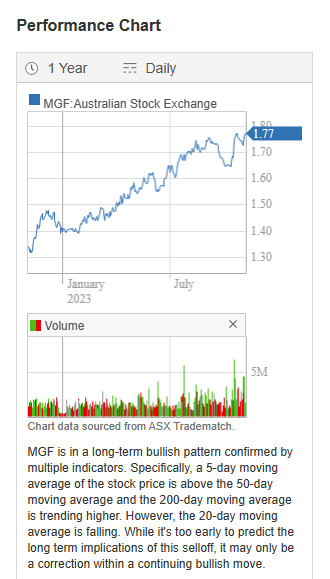

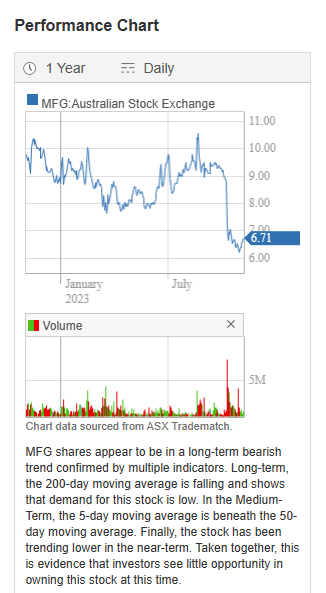

Market Reaction: [MGF = The Fund; MFG = the Manager of The Fund, i.e. MFG is the manager of MGF.]

Wednesday (1st Nov): MGF +2.5 cps (+1.44%) to close at $1.76. MFG +10 cps (+1.54%) to close at $6.59.

Thursday (2nd Nov): MGF +1 cent (+0.57%) to close at $1.77. MFG +12 cps (+1.82%) to close at $6.71.

MGF's NAV (Net Aset Value) as at Tuesday, 31 October 2023 was $1.9068.

Boys and girls, one of these things is not like the other:

And now, some perspective (their 5 year share price charts):

Disclosure: I do not hold any MFG (any more, sold the last of mine on 18th August @ $10.89/share, on the day they released their FY23 results and announced the special dividend and popped up as high as $11.04 during the day before closing at $10.42; they closed at $9.12 one week later, and they're now below $7) but I do hold some MGF (the global fund, closed class) in a small 2-stock portfolio I manage for our two children. There is also a small amount of MGFO (options) in there that are not worth selling - they were trading at 2.4 cps on Monday, but they're down to 2.1 cps today.

Unless Keybridge Capital's Nick Bolton (pictured above) can come up with a viable plan B those (MFGO) options will expire worthless on March 1st 2024 (in 4 months). Nick's Keybridge Capital is the largest holder of MFGO which he accumulated mostly at around 1 cent each or less. He's had success with his activism previously, with other companies, but he may have bitten off more than he can chew with Magellan on this occasion. Time will tell, and there's only 4 months of it left in this particular case, so not long to wait to see how this one plays out.