Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I have sold my MGF units IRL and Strawman. The discount to NTA has significantly closed to within 2% of NTA compared to some of my purchases of units at 20%+ discount.

While conversion to open units is likely which will mean effectively nil discount to NTA. For simplicity I have decided to sell out now prior to this occurring. Besides the hassles with conversion and potential lock up of funds for a couple weeks during conversion. The main reason for not converting is I don't believe Magellan will outperform the benchmark ongoing, though to be fair it has met its absolute return goal of 9%+ since inception. Simply, Magellan isn't the Magellan it used to be in my view. The culture must have changed with what has gone on at a corporate level over the last few years. I see the MOAT and QLTY ETFs as a more attractive investment (especially given MGF's high fees) which is where I will be redirecting some of my funds from the sale of MGF.

When I started out investing, I was very interested in LIC's at a discount to NTA, looking to pick up $1 for 70c. However, I didn't realise I need to ask how this discount was going to change? MGF is an example where this has worked but as I have learnt over time this isn't normally the case, things trade at a discount for a reason. For discounts to NTA to close, there must be a catalyst, in this case it was the aggressive share buyback of units then the announcement to convert to open class units. This only occurred because of the manager was willing to lower their profits in the interest of unitholders which is hard to do for any manager. If Magellan weren't willing to convert to open units, MGF unit holders could still be sitting at significant discount to NTA in my opinion.

MGF have made the offer to buy back 500m worth of options (expiring march 2024) at a price of $0.10c. It’s the highest they have traded at….ever.

But it’s a discount to their value so large and depressing I actually don’t want to calculate it. The options give the holder the ability to convert it into a share of MGF at a 7.5% discount to NAV. Problem being is that the shares trade at roughly this anyway.

Magellan have stated they are doing this to cover their balance sheet exposure to this, as they fund the discount.

@Bear77 I'm particularly interested in your thoughts.

I feel like they are trying to reduce the risk of them having to fund that at the current share price, or even worse for them whilst better for us. The actual NAV.

I guess the real question is what do we think the chances of a better payoff later are? I think it’s a 50/50 gamble at best.

Wednesday 01-Nov-2023: Court-orders-Meeting-Request-is-invalid-and-ineffective.PDF

https://www.afr.com/street-talk/back-to-the-drawing-board-for-bolton-as-magellan-wins-vote-reprieve-20231101-p5egt3 [Wednesday 1st October]

Back to the drawing board for Bolton as Magellan wins vote reprieve

Supreme Court ruling is a blow to the activist investor’s efforts to wind up the Global Fund.

Source: www.afr.com

Previously: https://www.afr.com/street-talk/magellan-plays-its-hand-but-bolton-isn-t-done-20231016-p5eck5 [16th-October]

Magellan plays its hand, but Bolton isn’t done

Street Talk understands the activist investor won’t be stepping back from his campaign despite Magellan’s announcement

Source: www.afr.com

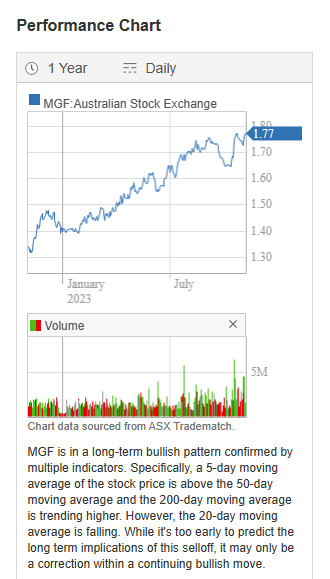

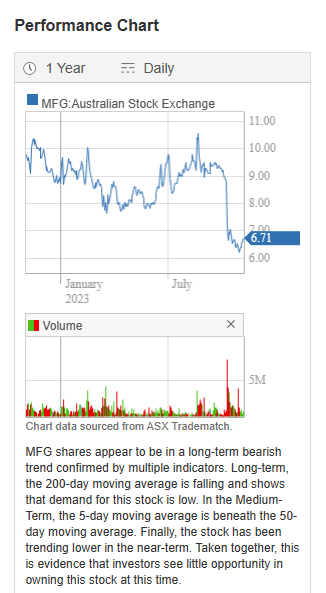

Market Reaction: [MGF = The Fund; MFG = the Manager of The Fund, i.e. MFG is the manager of MGF.]

Wednesday (1st Nov): MGF +2.5 cps (+1.44%) to close at $1.76. MFG +10 cps (+1.54%) to close at $6.59.

Thursday (2nd Nov): MGF +1 cent (+0.57%) to close at $1.77. MFG +12 cps (+1.82%) to close at $6.71.

MGF's NAV (Net Aset Value) as at Tuesday, 31 October 2023 was $1.9068.

Boys and girls, one of these things is not like the other:

And now, some perspective (their 5 year share price charts):

Disclosure: I do not hold any MFG (any more, sold the last of mine on 18th August @ $10.89/share, on the day they released their FY23 results and announced the special dividend and popped up as high as $11.04 during the day before closing at $10.42; they closed at $9.12 one week later, and they're now below $7) but I do hold some MGF (the global fund, closed class) in a small 2-stock portfolio I manage for our two children. There is also a small amount of MGFO (options) in there that are not worth selling - they were trading at 2.4 cps on Monday, but they're down to 2.1 cps today.

Unless Keybridge Capital's Nick Bolton (pictured above) can come up with a viable plan B those (MFGO) options will expire worthless on March 1st 2024 (in 4 months). Nick's Keybridge Capital is the largest holder of MFGO which he accumulated mostly at around 1 cent each or less. He's had success with his activism previously, with other companies, but he may have bitten off more than he can chew with Magellan on this occasion. Time will tell, and there's only 4 months of it left in this particular case, so not long to wait to see how this one plays out.

I would say that based on the below they have no intention of engaging in this and will be trying to avoid any activism based on realizing the value in any of the options to exercise shares at discount to NAV. I think I read somewhere that I’d this happens they are on the hook for circa 140m.

This from the board today following other closed unit trusts in the process of converting to open class units.

If it went through it would see a rise of about 20% to unit holders pre announcement.

There are also a significant amount of options listed (MGOF) which allows holders the option to convert that option into an MGF unit at 7.5% discount to NAV. So I await to hope that this does go through.

21-July-2022: Full Portfolio Disclosure: Two days ago, on July 19th, MGF disclosed the entire portfolio including weightings as at June 30th, 2022:

Quarterly-Portfolio-Disclosure---30-June-2022.PDF

If that's too small, either click on the link above it to view the file, or click on the image to make it larger.

21-July-2022: Today they also released this Investor-Letter.PDF to shareholders from their new MD/CEO, David George. Worth a read!

19-July-2023: Update: I'm expecting their disclosure for 30-June-2023 during the next week, but in the meantime, here's how their portfolio looked at the end of March 2023:

Source: Quarterly-Portfolio-Disclosure---31-March-2023.PDF

I note Meta Platforms (formerly known as Facebook) is NOT held by MGF now; Meta were not in the portfolio at the end of March anyway.

Disclosure: I hold MGF in a very small 2-stock portfolio I manage for our son and daughter. I also do currently hold shares in MGF's manager, MFG. Neither are held here on SM, only IRL.

19-July-2023: Just looking at MGF because I've been waiting for their FY23 tax statement (for their two distributions in FY23) and was wondering if I could download it from their share registry or website (no, it ain't ready yet), and noticed that they've actually been in a fairly steady uptrend for the better part of nine months now...

I had a feeling they'd stopped falling, but I didn't know they'd recovered that much. I only hold MGF in a small two-stock portfolio that I "manage" on behalf of our son and daughter. Unfortunately, the other company in that portfolio is FGX, the Future Generation Fund (the Australian Shares fund, not the Global Fund - FGG), and FGX has been in a steady downtrend for about the same period.

I do hold a larger position in MGF's (the fund's) manager, MFG (Magellan Financial Group) and I follow MFG a lot more closely than I follow their flagship global shares fund, MGF.

On Monday (17th), MGF (the fund) announced that their NAV per unit (of Closed Class Units in the Magellan Global Fund) as at Friday, 14 July 2023 was $1.9096. MGF closed on Friday at $1.64, and at $1.66 on Monday, so they're still trading at around a 14% discount to their NAV, so the gap has narrowed a little from what it got out to last year, but there's still value there, or reason for the traded price to keep rising towards their NAV. Their NAV has also been rising, which helps.

There wasn't much to be happy about last year. They started 2022 with a NAV of $2.07/unit, then reported a NAV of just under $1.70/unit for both June 30th and December 31st 2022. That NAV (net asset value) is now back up to $1.91/unit (last Friday). So not as good as 2021, but better than 2022.

That one year MGF unit price graph looks OK. It looks a lot better than their 3 and 5 year graphs do anyway. Onwards and upwards, I sincerely hope!

Might be the catalyst to force the wind up sooner rather than later.

AFR Article - ASX MGF: Nick Bolton seeks like-minded activists for Magellan battle (afr.com)

Activist investor Nick Bolton has acquired more than 100 million options tied to Magellan’s ASX-traded global share fund as he dials up a campaign to force a possible wind up of the $2.9 billion trust, and bank a quick profit.

....

Mr Bolton’s Keybridge Capital was revealed by The Australian Financial Review to have become a large option holder of Magellan Global Fund, which trades under the ticker MGF.

The relevant options, originally gifted to investors who can on-sell them, allow holders to buy into the fund at a 7.5 per cent discount to its net asset value. At present, they are out of the money.

While public disclosures reveal Mr Bolton’s Keybridge owned 32 million options as of June 30, 2022, sources close to the activist said he has bought a further 100 million. There are just over 1 billion options outstanding.

Not sure if this is a case of a broken clock being right once a day, or hopefully more a case of the new management team delivering to us long suffering holders.

At the very least it reverses a long downward trend of underperformance. Hoping this is a new dawn under the new team

“You only lose if you sell”. A quote by Hamish Douglass during his embattled ending at Magellan.

I am just chuckling to myself noting that Facebook, one of the largest Magellan holdings around 18 months or so ago, is up approx 180% since he left. I remember reading as part of the handover process that Nikki Thomas at Magellan who took over part of funds management saying “we like companies that report earnings that start with 10b”, but apparently not enough to keep it in their largest holdings.

Whats that other saying from a famous investor? “Be greedy when others are fearful”?

Oh well. Despite all this it has been nice to finally see some improved performance and uptick in the share price of late :)

April 23

Update: Valuation still 5% discount to the NTA. NTA was $1.85 as of 19/4/23.

May 22

I have applied a 5% discount to the current NTA of $1.74 to get a valuation of $1.65. I have applied the 5% discount due to recent underperformance and the current options that allow unitholders to purchase units at 7.5% discount to NTA. In my view this will limit unit price on the market from reaching NTA until the options expire. However, this valuation is still well above current trading price.

I am hoping that @Bear77 might tear apart the annual report?

The only moat that exists on this stock is the persistent moat between its NAV and share price. Always at a discount.

I don’t know why, but I just continue to not be able to bring myself to sell the mongrel, telling myself that at some stage the benefit of having a money manager will protect me on the downside. I know it’s foolish to just keep holding it, but surely at some stage that moat has to close?

Or maybe I need the scrutiny and collective criticism of this forum to tell me it’s never going to happen

Read on Magellan management thoughts - Magellan on LIC discounts and fund changes (firstlinks.com.au)

Looks like no conversion to an active ETF to close discount until the options expire (if at all but that's the current excuse).

Looking at that - option expiry is 1 March 2024.

The MGF fund buy backs have now reached 17.2% of units (or $349.5 million worth) since inception (November 2020) according to the latest fund update. A positive sign as a holder that the manager is willing to give up such a substantial portion of locked up capital to try an improve performance. However, performance is still below the set benchmarks of the fund. The fund continues to trade at more than a 20% discount to NTA. Given the buybacks have occurred while the discount has been significant this should leverage returns of the fund on a per unit basis if performance returns. I am still happy to hold as I still can't bet against the major holdings beating the S&P 500 over the longer term, especially if I can buy a basket of them at a 20%+ discount to the market price.

Major holdings as of 31/10/22:

Disclosure: Hold IRL and Strawman, looking to add to position.

iNav is currently $1.76. Going to apply a 5% discount as Magellan is just a toxic name currently for financial advisers so they and clients are selling no matter the price. Gives a price of $1.67.

A 17% discount seems a bit much given the ongoing on-market buybacks and quality companies they hold - even if you assume they just match the MSCI. The management fee needs to come down to be in line with industry norms though - it is priced way out of the market.

15-July-2022: I currently hold MGF (Magellan Global Fund) [closed class] units, as well as shares in the fund's manager, MFG (Magellan Financial Group). I also hold shares in GVF, the ASX-listed Global Value Fund LIC (listed investment company) run by Miles Staude out of London. GVF have a highly credentialed Board that includes Geoff Wilson of WAM Funds and Chris Cuffe, both legends of the Australian investment management industry. You can read more about Chris here: https://www.australianphilanthropicservices.com.au/board/chris-cuffe/

After building up Colonial First State and then Challenger Financial Services, Chris is now focused on philanthropy and education, having started the free e-newsletter, CuffeLinks, now called FirstLinks, and being on either the board or investment committee of a number of listed companies (GVF, ARG, HM1) and other organisations (UniSuper, Paul Ramsay Foundation, Third Link Growth Fund). Miles Staude himself is also on the GVF Board; Miles is effectively the MD (managing director) of GVF although for some reason he's listed as a non-executive director (NED).

Here's the GVF report for June 2022: GVF-Investment-Update-and-NTA-Value-as-at-30-June-2022.PDF

And here's a screenshot of page 3 and the top of page 4 from that report, which shows that MGF (the Magellan Global Fund) are now one of the top 10 positions in the GVF portfolio.

[click on the images above to make them larger. Source: GVF-Investment-Update-and-NTA-Value-as-at-30-June-2022.PDF]

Note 8, highlighted above, explains that not ALL of GVF's positions will necessarily be listed in these newsletters, so while listed 4th and being a 4.9% position in the GVF portfolio, MGF is not necessarily GVF's 4th largest position, but it's certainly safe to assume that MGF are a significant position for GVF, i.e. a top 10 position (and likely a top 5 position).

Because GVF are a $200 million fund, and MGF are a $2 billion fund (i.e. 10 x larger than GVF), GVF do not show up as being a sub (substantial shareholder) for MGF. A sub owns 5% or more, which in MGF's case is a minimum of $100 million worth of MGF shares. That would be half of GVF's entire market capitalisation, so clearly their exposure to MGF is more modest than that. It's actually around $10m (4.9% of $200m is $9.8m and GVF is currently trading a little below their actual NTA so you can add a little more onto that $9.8m).

Why is this significant in any way? I don't hear you ask. Well, I'm glad that thought didn't cross your mind. I'll attempt to answer it regardless...

For those unfamiliar with the Global Value Fund (GVF), it is similar to WAM Strategic Value (WAR) which is Geoff Wilson's latest LIC. Only GVF has a better share price graph than WAR does, and a better track record of shareholder returns as well; In WAR's defence, they've only been listed for 1 year (since late June last year) while GVF have been going since mid-2014, so for 8 years. Also WAR's hunting ground is Australia (and mostly ASX-listed funds and companies) while GVF has the whole world to choose from, so they have far more options from which to pick and choose.

Interestingly, WAR also count MGF as one of their top 10 positions.

Geoff lists those top 10 positions (bottom right corner of the image above) in alphabetical order, not portfolio weighting order, so we don't know how big that MGF position is within the WAR portfolio. WAR is currently a $180m fund trading at an 8% to 13% discount to their before-tax NTA (their before-tax NTA at June 30 was $1.11 per share as shown above and they closed today at $1.015 and at $0.97 on June 30), so reasonably similar in size to GVF, just a tad smaller at this point. I don't think that WAR holding MGF is nearly so significant as GVF holding MGF is, because pretty much all of WAR's holdings are ASX-listed LICs, whereas GVF often don't have much or any major ASX exposure.

WAR also hold Chris Mackay's MFF (as well as running MFF, Chris is also now back helping to run MFG, the manager of MGF, having started MFG alongside Hamish Douglass back in 2006 [16 years ago] and then transitioning to just running MFG's former flagship fund MFF [which originally stood for the Magellan Flagship Fund] before returning to help run MFG in February this year after Hamish took a Medical leave of absence).

WAR even hold WGB, the WAM Global Fund, one of Geoff Wilson's other LICs, also managed by his management company, WAM Funds. Originally it was envisioned that WAR would be an activist fund, similar to GVF, that would be actively executing on strategies to unlock value and close the gaps between the share prices and the NTAs of the LICs that they took positions in. In fact, that was one of the selling points during the lead up to the WAR IPO, with Geoff and his marketing team pointing to a raft of examples of where Geoff had either taken over the management of underperforming LICs or else had a significant positive impact on the share price performance of those non-WAM-Funds LICs that he chose to become in involved in - in prior years.

To an extent, that has and will continue to play out, with SOME of those positions that WAR hold, but clearly not all of them. For example, he's very unlikely to agitate for change with the management of WGB, which WAR holds a position in, because WGB (WAM Global) is already a fund managed by Geoff Wilson's WAM Funds, and he's the Chairman of the WGB Board. Geoff Wilson is the Chairman of the Boards of 7 out of the 8 LICs that WAM Funds manage. The only one of his LIC Boards that has a different Chairman is WMA - WAM Alternative Assets, where Michael Cottier is still the Chairman, as he was back when it was managed by Blue Sky Alternative Investments and was called the Blue Sky Alternatives Access Fund (BAF).

Anyway, back to MGF. And GVF. GVF has a serious track record of activism to unlock value in their underlying portfolio holdings, with an obvious example being the Blue Sky Alternatives Access Fund (BAF) where GVF did become substantial shareholders and Miles got himself onto the BAF board and was instrumental in making sure that shareholders' rights were protected as the manager (Blue Sky) imploded after a sustained short-seller attack and a severe loss of market confidence in the manager and their internal valuations of their assets, lack of external oversight (including sufficient external third-party valuations of Blue Sky's assets), and their (Blue Sky's) rights to management fees that seemed excessive compared to their returns generated from AUM (assets under management). One of Miles' and the rest of the BAF Board's biggest challenges was fighting off Howard Marks' Vulture Fund, Oaktree Capital, which took control of the Blue Sky Alternative Investments (BLA; the management company) and begun carving up and selling off its assets, with the intention of doing the same to the assets managed by BAF - see here: https://www.businessnewsaustralia.com/articles/oaktree-takes-hold-of-blue-sky-s-water-assets.html Further Viewing (video): The Vulture of Wall Street: Billionaire Investor Howard Marks

Miles and the rest of the BAF Board (along with other outspoken BAF shareholders) were ultimately successful in having the management contract with BLA (the former manager of BAF) terminated on mutually acceptable grounds and with agreed conditions, and having Wilson Asset Management (WAM Funds) appointed as the new managers of the fund.

Once WAM Funds took over the management of BAF - and the fund's name was changed to WAM Alternative Assets (WMA), Miles Staude resigned from the BAF/WMA Board and GVF sold their position in WMA (formerly BAF) at a good profit. The discount to NTA with BAF's SP (share price) had blown out to over 40% at one point before the manager change (which is likely when GVF was buying most of their BAF shares) and once WAM Funds took over the management that discount reduced to single figures for a time. I don't think the WMA SP ever moved to a premium-to-NTA because of the alternative nature of the assets - which always seem to trade at various discounts to NTA. It's now blown back out to 17.2% discount (as at June 30 when the WMA SP was $1.035 and their NTA was $1.25), however I daresay most current shareholders who have been in there since the BAF days are happy enough with the new management compared to what it looked like was going to happen in a wind-up scenario under Oaktree Capital control of the former manager (BLA).

Source: https://www.globalvaluefund.com.au/press-research/

In that link above, Miles talks to the Private Wealth Network here in Australia about himself, GVF, and BAF as a case study of his value capture strategy, a type of value investing where he scours the world for underpriced assets that meet his investment criteria and then invests in many of those opportunities once they (GVF) have identified a credible pathway to achieving a positive market re-rating of that asset that will allow them to exit the investment at a suitable profit. GVF MOSTLY invests in CEFs or Closed End Funds, with the most obvious Australian examples being LICs (listed investment companies). However, most of the CEFs that GVF invests in are based out of the UK, Europe or the USA and they are not called LICs over there.

The important distinction between a closed end fund and an open ended fund is that open ended funds will simply issue more units on demand or redeem and cancel units when people want to sell out so their total units on issue usually changes on a daily basis. Most Managed Investment Funds that are NOT ASX-listed are open-ended, and so are ETFs.

From https://www.vanguard.com.au/adviser/en/etf-knowledge-basics/what-are-etfs-tab -

"Although they trade like individual securities, ETFs – like managed funds – are open-ended investments. That means new units can be created and existing units redeemed daily, based on investor demand. Closed-end funds and individual securities, on the other hand, generally issue a fixed number of units."

This is an important distinction. Open ended funds tend to trade at levels that are very close to their NAV (net asset value). ETFs are a good example of this. ETFs use "market makers" who provide liquidity for buyers and sellers and ensure that the unit price (market price) does not stray too far from the actual net asset value (NAV) or net tangible assets (NTA) of the fund. LICs and other closed-end funds, who generally have a set number of shares or units on issue, are subject to far more supply and demand imbalances. While a LIC can issue more shares due to a placement, an SPP (shareholder purchase plan), a Rights Issue (RI), a DRP (dividend/distribution reinvestment plan) or a bonus issue to existing shareholders/unitholders, or can reduce the number of shares/units on issue by means of a share/unit buyback (where shares or units are bought back by the fund and then cancelled, usually done when the market price is significantly below the NAV/NTA of the fund), the number of units or shares on issue otherwise generally stay the same on a day-to-day basis. This means that with a CEF such as a LIC, when people want to buy shares or units, they need to buy those off people who already hold them, and similarly when they want to sell, they need to sell to people who wish to buy them at prices that they are prepared to pay.

This often results in a supply/demand imbalance that may result in those units or shares (in closed-end funds such as LICs) trading at significant discounts or premiums to their respective NTAs/NAVs. We have often seen this with some of the more popular Wilson (WAM Funds) LICs, such as WAM and WAX, which often traded at 20% to 40% premiums when they were in demand, and Karl Siegling's Cadence Capital LIC (CDM) which a few years ago regularly traded at circa 30% premiums to their NTA when they were flying and consistently paying an above-market dividend yield. A recent period of underperformance changed all that for them.

The terms NTA and NAV are usually interchangeable and LICs usually refer to their own NTA, but their NTA is also their NAV. Other funds usually just use the term NAV (net asset value) rather than NTA (net tangible assets) but they mean the same thing, being their underlying asset value in terms of real tangible assets that can be readily sold or redeemed for cash. Another way of thinking about it is that it is the break-up value of the company or fund in terms of what you could sell it off for if you owned all of it (in $/share terms). For that reason LICs will often provide three different NTAs, (1) their before-tax NTA, (2) their NTA after tax but before tax on unrealised gains (which is usually the most applicable with funds that generally hold their investments for multi-year periods), and (3) their after-tax NTA including tax on unrealised gains (which is their break-up or wind-up value).

Some of the main reasons for LICs and other CEFs trading at big premiums to their NTA or NAV are:

- The hunt for yield, and the fact that not only do LICs often provide above-average fully franked dividend yields, LICs usually also use Profit Reserves or Dividend Reserves to enable them to smooth their dividends, which means that as long as they have occasional periods of strong outperformance, they can hold back some (or most) of the profits from those bumper years to enable them to continue to maintain or increase their stream of dividends year after year even when their performance is poor or even negative. As a quick example, one of WAM Funds longest running and most successful LICs, WAM Research (WAX) had, at June 30th, a Profits Reserve of 38.7 cps (cents per share), and they paid out 9.95 cps in dividends during the past 12 months, so allowing for the fact that they have increased their annual dividends every single year for the past 10 years, they still have enough in their Profit Reserve for another 3+ years of dividends, even if they make 0% (i.e. no) profit for the next 3 years. However they would be unlikely to have such dismal returns considering their per annum average investment portfolio performance since July 2010 (past 12 years) has been +13.5%, outperforming the All Ords Accumulation Index (+8.1% p.a.) by +5.4% p.a. Understandably, their shares remain in high demand with more people on the buyers side (prepared to pay more) and less on the sellers side (not prepared to sell cheap) most of the time. At June 30, 2022, WAX closed at $1.295/share and their before-tax NTA was $0.9292 (or 92.92 cps), meaning they were trading at a +39% premium to their before-tax NTA, or a +31.8% premium to their NTA after tax (but before tax on unrealised gains) of 98.26 cps, or a +29.2% premium to their NTA after all tax (including tax on unrealised gains) of $1.0025/share.

- A recent period of consistent outperformance, such as WAX has demonstrated in the example above (+13.5% p.a. average investment portfolio performance, before fees, for the past 12 years), with the share price tending to follow that same north east NTA trajectory over time, despite periods of share price volatility. Although we are constantly warned that past performance is not a reliable indicator of future performance, most investors will extrapolate past performance into the future as a likely outcome, so they assume that a fund that has outperformed their benchmark for the past decade or more will more likely than not continue to outperform their benchmark, which is a reasonable enough assumption even if it is not always correct. When you combine consistent outperformance with a growing above-market dividend yield, and a decent amount of positive marketing by the manager of the fund, you will sometimes end up with a double digit premium to NTA in the share price.

- The underlying assets of the fund are in a sector that is popular / in demand. Such as a microcap fund when microcaps are seriously outperforming large caps, or a technology fund when tech stocks are flying.

Some reasons for LICs and other CEFs to trade at significant discounts to their NTA/NAV are:

- They have recently underperformed, so the market is expecting them to continue to underperform, so there is little demand to own them.

- They pay a low dividend or their dividends have been decreasing recently. This is often a factor when combined with recent portfolio underperformance. In the case of LICs, a very low Profit Reserve (or Dividend Reserve) combined with recent underperformance is also often a reason for investors to worry that recent dividends may not be sustainable going forwards and to want to move on to something else with brighter prospects.

- They are in a sector that is underperforming (such as tech) or they are unloved for another reason connected to the types of assets that they hold (i.e. a microcap fund when microcaps are seriously underperforming).

- They are in a sector where price discovery is more difficult, so there is generally less comfort around their valuations. An example of this is alternative asset funds such as WMA which may hold water rights or shares in unlisted private equity funds, or a myriad of other unlisted assets that are much harder to get accurate current valuations for at any given time compared to listed companies with live trading prices that are readily available to anyone with internet access.

- They are simply invested in companies or assets that are not ASX-listed and they usually trade at a discount just because of that, and because of the history of fund managers struggling to outperform their respective benchmarks in that asset class. The best example of this is ASX-listed funds that specialise in overseas listed assets. Even though these overseas companies (that these LICs, LITs or managed funds invest in) trade on the open market and we can check their current market value any time we want to, these funds USUALLY trade at discounts to their NTA or NAV even when other funds managed by the same fund manager that are invested in ASX-listed companies may be trading at a significant premium to NTA. If you look across ASX-listed LICs, LITs (listed investment trusts, such as MGF) and other CEFs that invest in companies listed on exchanges outside the ASX, pretty much all of them are currently and are usually trading at discounts to their respective NTA or NAV. For example, WAM Global (WGB) is a well managed LIC that has performed reasonably well (positive p.a. returns and an increasing stream of dividends) and they finished June at $1.69, an -18.4% discount to their pre-tax NTA of $2.07, and a -20.1% discount to their after-tax (but before tax on unrealised gains) NTA of $2.115 and a -22.4% discount to their after all tax (including tax on unrealised gains) NTA of $2.177/share. Meanwhile, their sister fund, WAM Research (WAX) (which is invested only in ASX-listed companies, but uses similar or identical research-driven investment strategies) finished June at $1.295/share, being a +39% premium to their before-tax NTA of 92.92 cps, a +31.8% premium to their NTA after tax (but before tax on unrealised gains) of 98.26 cps, and a +29.2% premium to their NTA after all tax (including tax on unrealised gains) of $1.0025/share. In summary, it appears that there is far less demand from Australian investors for managed funds that invest in overseas listed companies, and where there is some demand it would seem that most investors are preferring to get their exposure via ETFs who generally charge lower fees, so those investors are happy to gain exposure via passive investment rather than through actively managed funds. Based on recent performance, and current NTA/NAV-discounts indicating lack of demand, it looks like there is far less value placed on active management of investments in overseas listed companies, compared to active management of investments in ASX-listed companies. This is likely because most of these global-companies-focused LICs/LITs/funds (including WGB and MGF) have struggled in recent years to outperform the MSCI World index (the most common global shares index) or the MSCI ex-Australia World index (the same index excluding all ASX-listed companies) which most of these funds use as their own benchmark index. They usually use the accumulation version that includes reinvested dividends and distributions, known as the MSCI World [ex-Australia] NTR (net total return) index. So based on the recent performance of most of these globally-focused funds, even when their actual returns after fees have remained positive, investors would still have been better off in a global-index-tracking ETF where the fees would have been lower and the returns would have been higher. If the active funds manager isn't adding value above and beyond returns available from ETFs, then the demand for their services is much lower, and the Globally-focused closed-end funds that they manage will tend to trade at a discount due to that lack of demand.

This is ONE reason why MGF trades at a significant discount to NTA: Underperformance in recent years. Another is the various issues that their manager (MFG) has had, mostly around their co-founder, superstar portfolio manager and chief investment officer (CIO), Hamish Douglass, stepping back from the business for a time, after a number of internal and personal issues that included his marriage breakdown, his CEO quitting without a good publicly-disclosed reason, and MFG lost their largest institutional mandate (SJP: St James Place in the UK) which alone was a $23 billion hit to their FUM and started a run on their FUM (funds under management). See here: MFG-SJP-mandate-loss-plus-Funds-Under-Management---December-2021.PDF

So those issues are related to the manager, MFG, not to MGF (the fund), but when the manager is on the nose, so too are their funds in many cases (including this one). Obviously too, that FUM outflow is money coming out of the various funds managed by MFG, so that makes MFG forced sellers at times when they have to free up cash to cover those fund redemptions - with their open ended funds. Oftentimes that means selling at times when the prices they are going to get for those assets are far from ideal, so it feeds into further underperformance (realised losses) which feeds into further FUM outflows. It sort of feeds on itself or is a self-fulfilling prophesy, at least for a time. However, this too shall pass.

So MGF is a closed-end fund (CEF) of the type I have been discussing, although they are a LIT (listed investment Trust) not a LIC (listed investment Company). The main difference is that LITs have units and LICs have shares. Also trusts usually have to distribute ALL of their profits to their unitholders every year, however Magellan have come up with novel ways to get around this and make their LITs work in a similar way to LICs where they have managed to smooth their dividends to a degree, which is partly because much of what they do is often subsidised by the management company (MFG),so they have a target distribution yield and if they don't make enough profit to fund that distribution they either sell assets to cover it and/or it is partly paid for by the management company. That's another negative for MFG holders, but a positive for MGF holders. [I am both, so swings and roundabouts, or snakes and ladders, whatever floats your boat.]

MGF units closed June 30 at $1.34 per unit, and their NAV was $1.6954 (see here: MGF-Monthly-NAV---June-2022.PDF)

That $1.6954 NAV was "cum distribution" so included a distribution of 3.66 cents per unit payable on 21 July 2022 (next Thursday).

MGF therefore closed June at a 21% discount (or 20.96% discount to be more precise) to their NAV. Yesterday, Thursday 14th July 2022, MGF closed at $1.395 and according to their website their estimated NAV at close of trade yesterday was $1.70. So their $1.395/unit closing price yesterday was a 17.9% discount to their NAV on the day. That's ex-distribution now of course because the record date for the distribution was 1st July.

My thoughts are that MGF (being a $2 billion fund) is just too big for $200m GVF and $180m WAR to be prodding with a stick. Well, they could try, but I doubt that MGF's management (MFG) would take much notice of them, and they wouldn't need to.

However, I believe that these discount-capture specialist funds (GVF, WAR) are there to make a profit out of (a) the gap between the SP and the NAV closing, which we are already starting to see (21% gap on June 30th, 17.9% gap 2 weeks later on July 14th, and they are now trading ex-distribution as well when the share price often falls but it has actually gone up instead since June 30), as well as (2) a rebound in performance from the underlying portfolio of global companies held by the fund, which should also drag the SP higher if and when it happens.

Because I consider that MFG (the manager of MGF) are already making all the right moves to turn this underperformance and negative sentiment around, I do NOT believe that they (GVF, WAR), or we, need to do anything for that to occur, except to wait. I.e. no activism required, in this case.

MGF released their June report today - MGF-Fund-Update---June-2022.PDF

They are due for some outperformance in my opinion, based on that performance chart, their low base that they are working from, and the moves that Chris Mackay, Nikki Thomas and Arvid Streimann have made, and their portfolio holdings. Have a look at the companies they hold, Microsoft, Visa, Alphabet (Google), Mastercard, McDonald's, Yum! Brands (includes KFC), Novartis, Reckitt Benckiser, Intercontinental Exchange and Nestle are their top 10 positions and represented 49.1% of their portfolio at June 30.

I'm happy to see that Netflix is not there any more. Nor is Ten Cent or Alibaba. There is no longer a Chinese or Hong Kong-based company in their top 10. China has not been a happy hunting ground for Magellan in the last 18 months to 2 years, and I note they don't break out China exposure separately on their "Geographical Exposure by Source of Revenue" wagon wheel chart now; China is now simply included in "Emerging Markets". That change was one of a few changes that were made back in February when Chris Mackay was brought back into the fold as the effective CIO (chief investment officer) of MFG and Nikki Thomas was brought back in as one of the lead portfolio managers for MGF and many of their other funds as well. Along with selling out of some losing positions. They have also exited Guzman y Gomez, their share in the Australian roll out of the Mexican-style fast food store chain, at a good profit too, and are clearly concentrating their efforts more on where they had their greatest success in prior years, being large (mostly USA-HQ'd) global market-leading companies with huge and growing moats (competitive advantages) and strong tailwinds.

I think people are better off chasing Australian exposure to Chinese companies (if they want it) via Platinum Asset Management who have a specialist Asian fund, PAI (Platinum Asia Investments) or other specialist ASX-listed Asian funds like EAI (Ellerston Asian Investments). The very reasons that Hamish Douglass gave around 8 or 9 years ago for why they were NOT invested in Asia (at that time), which included the unpredictable operating environment there due to strong government control and government policies that could change without notice, plus a lack of transparency regarding the accounts and business dealings/practices of listed companies (and their true ownership structures at times), turned out to be quite prophetic in that those were some of the very things that tripped him up after he later changed his mind and invested heavily in Alibaba and Ten Cent before the Chinese Central Government stopped the Ant Financial Group IPO (Ant was to be spun out of Alibaba) and clamped down on a number of their tech billionaires like Alibaba founder and largest shareholder, Jack Ma, and the companies that those Chinese tech billionaires controlled, sending the share prices of those companies into strong downtrends. This was all sparked by a speech that Ma gave in which he appeared to criticise one or two of the government's policies. And to channel Julia Roberts in "Pretty Woman", that was clearly a BIG mistake. Huge!!

Yet it was not something that was easy to see coming - from over here, and certainly not something that would have had the same effect if it was BHP's Mike Henry criticising an Australian mining tax, or CBA's Matt Comyn saying he thought the RBA was going a bit too hard with interest rate rises, or Meta's Mark Zuckerberg complaining that US laws around anti-competitive company behaviour was having a detrimental effect on consolidation efforts (M&A) within the US tech sector. Freedom of speech, vs no freedom of speech. BIG difference. Huge!!

The Chinese Central Government may face far fewer headwinds when implementing their own policies compared to the US or Australian governments, and so are able to regularly set targets (such as growth targets) and then achieve them, one way or the other, but China still remains a high-risk country to invest in, particularly for outsiders, and that's something that I believe Chris Mackay has always understood, and Nikki Thomas agrees with also. For now, and hopefully for some time to come, they're out of China, or at least they have no major exposure to China within the MGF portfolio, except via expansion into or within China by US or European companies such as Yum! Brands, McDonalds, Microsoft, Alphabet (Google), Nestle, etc.

So, I think there's value there in MGF. They're down now below where they were back at the end of November, 2020, as shown on that graph above, and they've underperformed their main benchmark index, the MSCI World NTR (Net Total Return) Index, over that period, and they're trading at a significant discount to their NAV, however I think there's plenty of opportunity for that underperformance to reverse from here. Remember that while profits generated by the management company (MFG) do hinge a fair bit on FUM either increasing or being stable (not further FUM outflows), that ONLY relates to the manager and their ability to earn base management fees plus performance fees from that FUM. FUM flows have very little affect on the individual funds, such as MGF, unless there's a major outflow that results in forced selling at low prices, and even then, that mostly affects their open-ended funds, not their closed-end funds like MGF.

It would appear that GVF (and WAR) also see similar value here.

Disclosure: I hold MGF units in a small portfolio I manage on behalf of our two children, alongside FGX shares for ASX exposure. I also hold MFG shares (in the manager of MGF) here and in two of my larger real life portfolios. I also hold GVF shares here and in an income portfolio. Because of the nature of their assets and their discount capture strategy, GVF's investment returns are often not very correlated with the wider share market indices, so they often have positive returns or less of a drawdown in negative months for the ASX. They tend to underperform in a galloping bull market, but they can be good value to hold when things turn a bit pear-shaped as they have done recently. I do not hold WAR shares.

Magellan Global Fund Closed Class (ASX: MGF) - Magellan Financial Group (magellangroup.com.au)

Now trading at a 22% discount to NAV!?

Magellan Global Fund (MGF) continues to underperform the index benchmark of MSCI World Net Total Return index (AUD) over the shorter term. Using the open class units (due to the much longer history of this structure) performance Magellan does still beat the index over the longer periods even with the recent poor performance. To note is that Magellan targets a 9% absolute return for these funds and continues to meet this benchmark over the longer term.

The MGF (closed unit) fund is currently trading at a discount to NTA of 15% (and has been trading in this range for a while). The fund released a notice this week notifying that the buy backs of units since 19/10/21 totaled around 10-12% of the units on issue. This is a significant buyback at a large discount which gives unit holders instant value creation buying $1 worth of assets for 85c. This should also result in better returns for closed unit holders in the future, IF Magellan can return to the previous high-performance manager they were.

Is it time to give up on the fund given the poor performance? There are two main reasons I have not done so and these reasons continue to hold true from my point of view:

- Investors who invest in managed funds tend to underperform the performance of those funds because they invest when the fund is doing well and then exit when it is doing poorly. Ie buying high and selling low. You should be in a fund of the strategy not because of the performance.

- Would I bet against the portfolio of shares within the fund not making a 9% return compound over 5+ years (including after MGF large fee)? The answer is certainly not! MGF holds some of the world's largest high-quality companies. The image below contains the most recent portfolio update and weightings.

From the MGF interim report (for the 6 month period ending 31-Dec-2021) released to the market on 28-Feb-2022:

MAM = Magellan Asset Management.

And here is a full list of the positions held by MGF as at 31-Dec-2021:

And the following is the list of holdings in MFG's (Magellan Financial Group's) MGE (Magellan Global Equities Fund) and MGG (Magellan Global Trust) funds (which are both funds held by MGF, see above - 2nd top row (after Microsoft) and 4th last row (between Safran and Alphabet Class A):

When you put that all together, you'll see that there is a fair exposure there to Microsoft (8.7% of MGF), Alphabet (Google, 6.3% via both class A and class C shares) and Netflix (5.3% of MGF). I note that they now own more Alibaba than they did at 30-June-2021 but that the entire Alibaba position is still worth less than it was then, and that they have sold all of their Tencent Holdings shares, which was a reasonably large position (a top 10 position) at 30-June-2021.

In terms of NEW positions (since June 30, 2021), MGF now hold Amazon, Amadeus IT Group and Safran shares. Amadeus is a travel technology company, so similar to (but a lot bigger than) ASX-listed Serko (SKO). Safran is an aircraft, aerospace and defense engineering company that is quite innovative and is focused on environmentally friendly solutions that will contribute to an industry goal of carbon-neutral aviation by 2050 - see here: Areas of innovation | Safran (safran-group.com)

I assume we all know what Amazon does, but it should be noted that while Amazon is dominant in global online retail, it is their AWS (Amazon Web Services) business that is their most valuable strength and their main revenue generator - and AWS is still growing at a faster rate than their other divisions - AWS represented 74.5% of Amazon's total operating income in 2021, compared to 59.1% during the same period in 2020.

See here: Amazon sales, Amazon revenue and Amazon annual profits (digitalcommerce360.com)

Disclosure: I hold MGF shares in a small portfolio I manage for our son and daughter, and I recently bought back into MFG (the management company) with a smaller starting tranche (to be added to later) after watching their Global Equity Strategy Update presentation on 11-Feb-2022:

06-Feb-2021: Just to clarify, the Partnership Offer that MGF is currently extending to their unitholders is a 1:4 offer ($1 for every $4 already held) and is priced at an issue price that is equal to the NAV (net asset value, per Closed Class Unit) of MGF on Friday, February 26th, being three days after the offer closes, and being one business day before the allotment of the new units (on Monday 01-Mar-2021).

While there is no discount to NAV in the offer price, additional Closed Class Units worth 7.5% of what you subscribe for will also be allocated to you, as well as one MGF Option for each Closed Class Unit allocated under the offer. Each of those MGF Options will be excercisable into one Closed Class Unit with the exercise price set at a 7.5% discount to the estimated NAV per Closed Class Unit at the time of the exercise. The bonus units and the option discount will be funded by Magellan Group (MFG, i.e. the manager, not MGF - the fund).

I hold MGF units and have subscribed for my full allocation under the partnership offer. MFG are setting the bar high by funding these discounts and additional units themselves, which means their is no NAV-dilution to MGF (the fund). The continuing generosity of MFG (the manager) to the unitholders in their various funds is a great thing in my opinion, although it isn't necessarily immediately earnings-accretive for shareholders in MFG (the manager). Great for the funds they manage. Probably not as great for shareholders of the management company unless those shareholders take a longer term view, as Hamish Douglass (the driving force behind MFG) clearly is.

I hold MGF and MHH, in a portfolio I manage for my two kids, but I do not hold MFG at this point.