$XRO announced their 1H FY24 results this morning. These are the first results where we can see the full impact of CEO Sukhinder Cassidy's refocusing the business towards a strategy of profitable growth.

Their Highlights

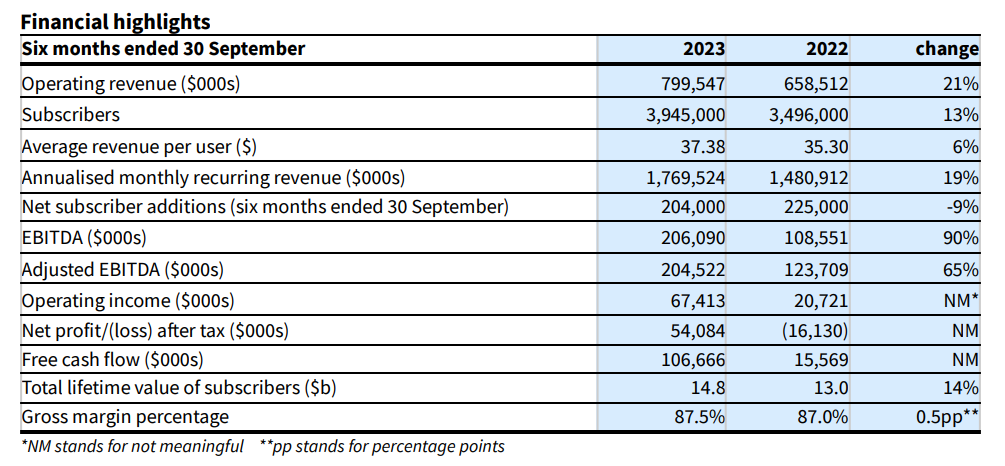

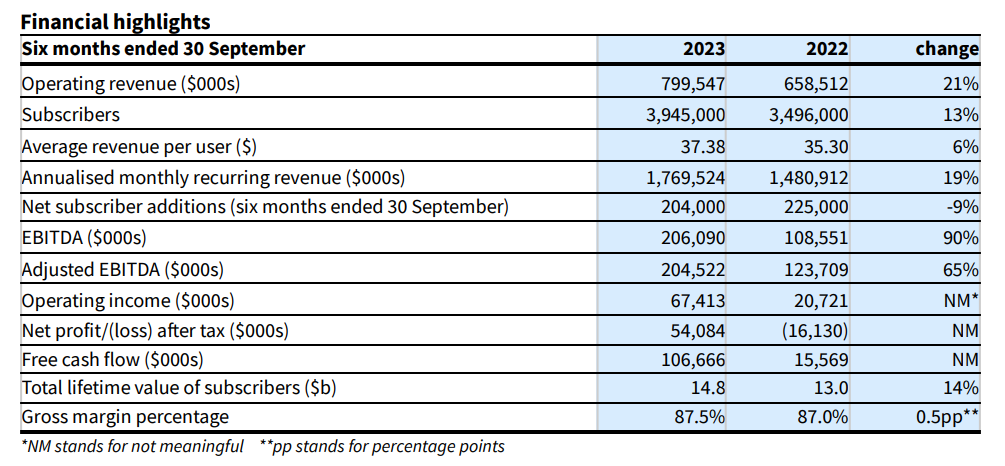

Xero delivered strong operating results with operating revenue up 21% (20% in constant currency (CC)) to $799.5 million. This, along with disciplined cost management and restructuring outcomes, supported a 90% increase in EBITDA compared to H1 FY23, to $206.1 million. This reflected Xero’s ongoing focus on balancing growth and profitability, and resulted in free cash flow increasing to $106.7 million, representing a free cash flow margin of 13.3% compared to 2.4% in the prior period. This focus was also reflected in Xero’s net profit, which increased to $54.1 million compared to a net loss of $16.1 million in H1 FY23.

CEO Sukhinder Singh Cassidy said: “We’ve demonstrated good momentum this half. As we look forward, we’re sharpening our focus on Xero’s key levers of growth as we aspire to become a higher performing SaaS company. We will continue to balance growth and profitability, while delivering more value to our customers.”

My Analysis

The bottom line improvements (EBITDA +90%, Operating Income +225% and an NPAT result of $54m) are impressive, and they follow logically from the refocusing on to profit.

Interestingly, if I look across the consensus results (as reported a few days ago by GS):

- Revenue growth $800m (+21%) vs consensus of $814m

- Gross Profit $700m vs consensus of $710m

- EBITDA $206m (+90%)vs consensus of $211m

- EBIT of $79.5 vs consensus of $94m

- Subscribers 3.945m vs consensus of 3.964m

So on all metrics, expectations were high, and the result - while impressive, came in a little short.

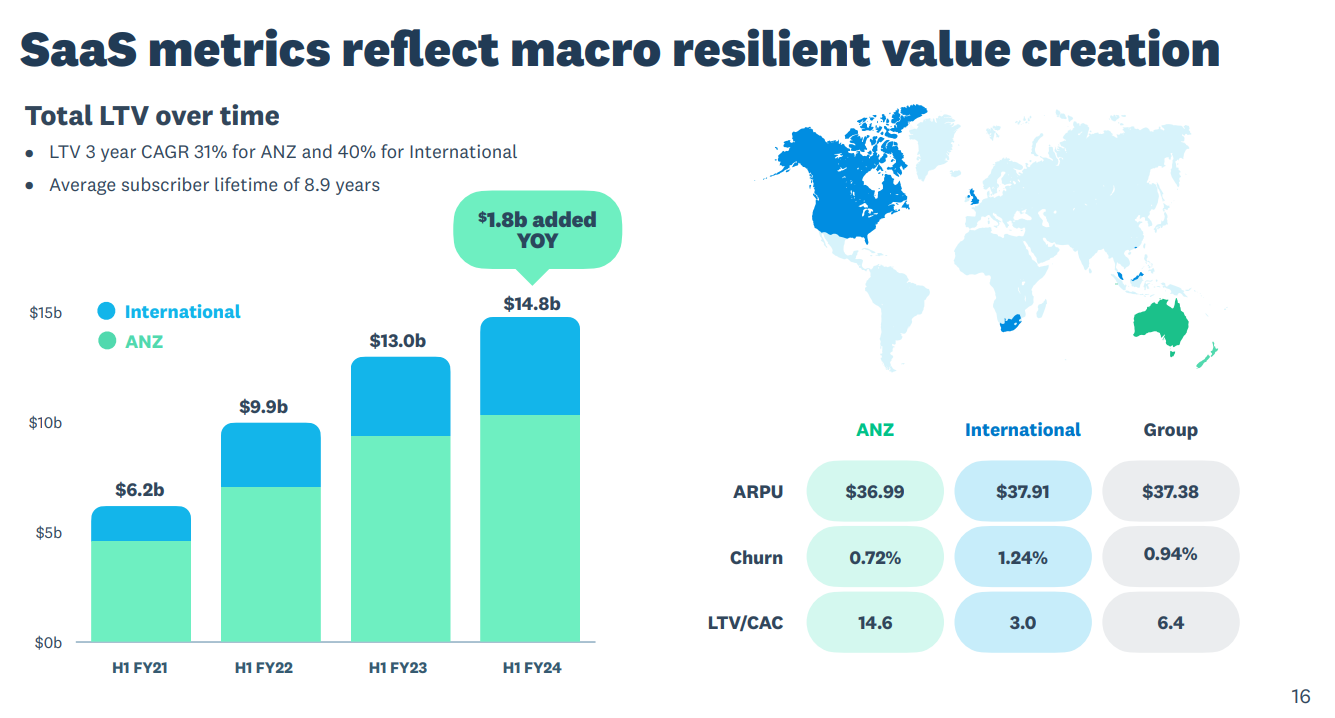

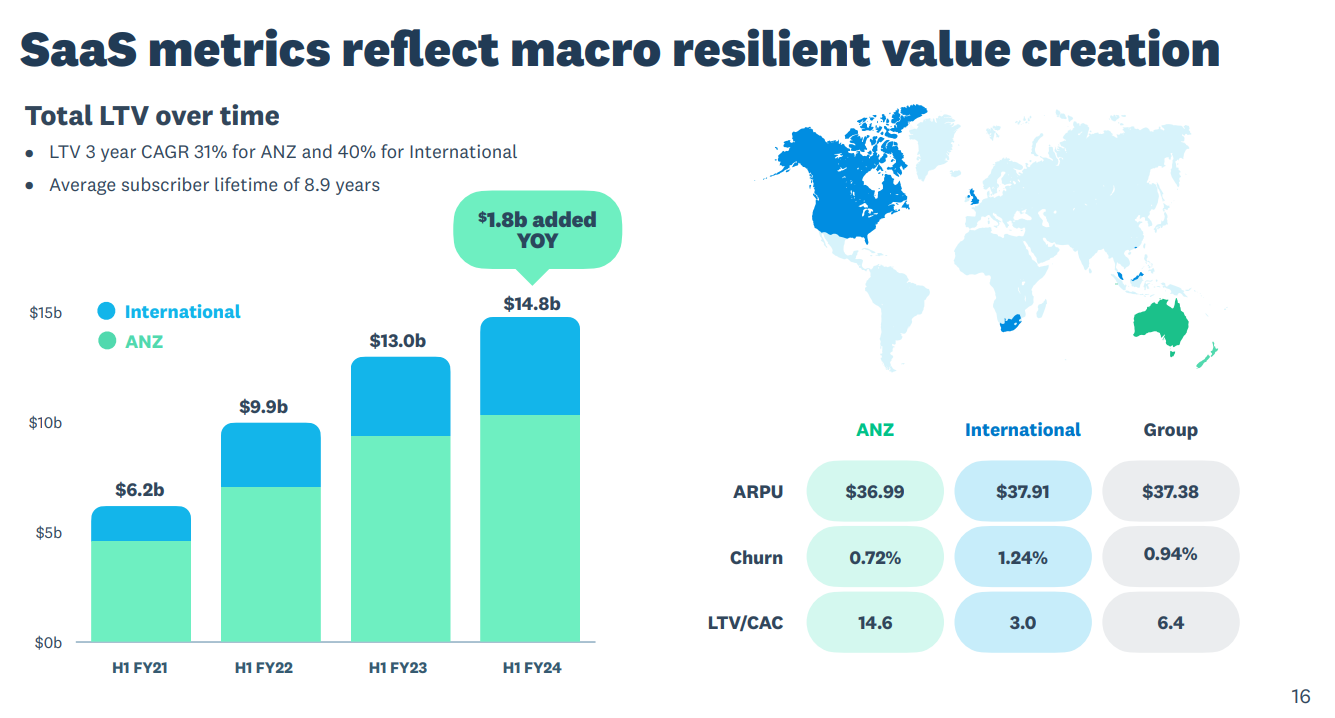

$XRO has been pulling the pricing lever this year, adding $1.8bn on LTV by growing ARPU from $34.61 to $37.38 with additional assistance from FX and product mix.

Despite the price increases, churn has stayed comfortably low with monthly churn only nudging up from 0.90% to 0.94%.

Rather than go into lots of detail, I want to focus on a few important points.

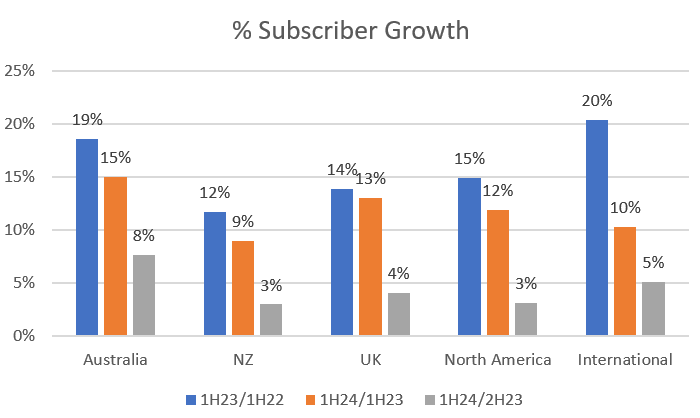

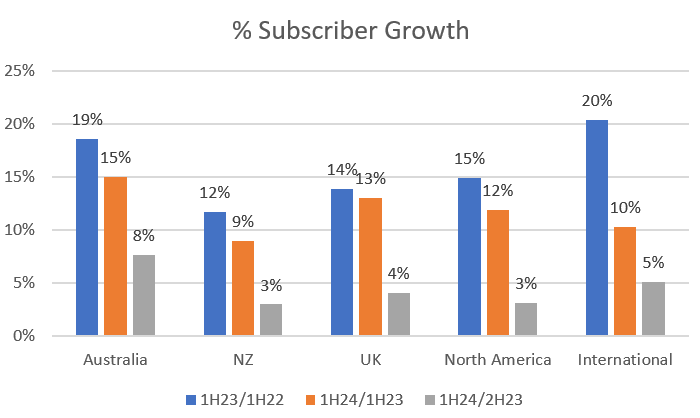

Subscriber growth is moderating. In the graph below I have compared the 1H %y-o-y additions by region (blue and orange) and I've also added the 1HFY24 h-o-h comparison to FY23 (grey bar).

Its an interesting story.

Figure 1: % Subscriber Growth (1H y-o-y for FY24 and FY23 and 1H h-o-h for FY24)

Looking first at the Y-o-Y comparisons

The powerhouses in ANZ are holding up well, although growth is moderating.

The UK is maintaining solid subscriber growth, despite the depressed economic environment in that country.

North America is also slowing - with the growth rate trending down to the ANZ average, however, $XRO has only achieved a subscriber base in this market of 396k (vs. 584k in NZ!), and while 42k were added for the year, only 12k were added in the last half (NZ added 17k in the last half!).

International, once a hypergrowth segment as $XRO entered markets such as South Africa and Singapore, is cooling significantly.

Now look at H-o-H comparison (1H24/ FY23)

The grey bar shows a very mixed story.

Australia is holding up well. 8% h-o-h is actually 17% annualised!

However, NZ, UK and North America have slowed significantly, with international holding steady at 5%, which is 10% annualised.

The slowdown should not be suprising for three reasons:

- The macro-environment has continued to cool, with businesses tighening their belts and tighter credit conditions likely a brake on new SME starts

- Price increases over the last year have been significant. Although we are not seeing churn for existing customers, perhaps there is some price elasticity for new customers?

- Competition: $INTU has declared Australia, Canada and UK as its priorty markets for international expansion. But there are multiple competing offerings, all on SaaS, in all markets.

This story is supported by the chart below from $XRO's presentation. On the key SaaS value metrics, the international business is of much lower quality with a LTV/CAC of 3.0 compared with the stunning 14.6 in Australia and NZ.

$XRO has clearly broken through into positve earnings territory - a major milestone. The focus on profitable growth and control of costs is turning this into a cash gusher, with $107m FCF and a FCF of 13%....there'll be more to come.

With guidance on operating expenses, $XRO should continue to grow strongly both with cash generation and earnings growth as all three levers contribute: price, subscriber growth and cost control.

Valuation

However, $XRO is still priced as a high growth stock, with a forecast P/E going into this mornings result of 124x and EV/Revenue of 11x.

My Key Takeaways

Directionally, today's result was always going to happen given the strategy shift. We are staring to see the economic power in this business and that is going to drive earnings and cash for some time to come. But in the details, it is a softer result. How the market responds to a soft result and slowing subscriber growth remains to be seen.

Embedded in the presentation are further details of Sukhinder's strategic review of North America. Its simply about focus and discipline in execution. We were given a heads-up at the AGM, which triggered my exist from $XRO in RL and SM. While it makes perfect sense, its not enough. $INTU has a strong incumber position, and there are other alternatives.

$XRO is a quality business, with a great product. Its leadership in ANZ appears unstoppable.

But that's not enough to justify the valuation. The fact is that there are other offerings for SaaS accounting in the material target markets of UK and USA. While the UK is still progressing well, it is apparent that success in the US will be a long haul.

$XRO has started pulling the pricing lever to drive revenues earlier and harder than my thesis to account for moderating subscriber growth. That could have a negative feedback loop on growth and create further opportunity for competition.

So farewell from me for now, and thank you for being one of my best investments ever on the ASX in the last 7years. But investing for me is about numbers and not sentiment. For me, the numbers don't stack up.

Disc: No longer held in RL and SM