Good points @PortfolioPlus - I agree with what @Rick has said also - and I would add that in regard to the sovereign risk, there have been a lot of "events" that have occurred across West Africa in particular in the past few years that have had major impacts on gold miners - as there have also been in other risky locations such as Thailand, the Philippines, Indonesia, it's a long list. However LYL have worked through that period in and around those countries and they haven't booked any material impairments as a result of those issues that occurred, so they have become very adept at both insulating themselves from the frontline work where possible (much of their work is done from Australia) and also having clear in-country exit strategies and crisis mitigation processes. One of the reasons why they have such high ROE is that they can charge premium prices for their work when they are doing it in relation to a project deemed to be in a risky location. Those people willing to work in Africa know that they can charge more, and they all do. In relation to their risk management, I rely a fair bit on their track record to date, which is very good.

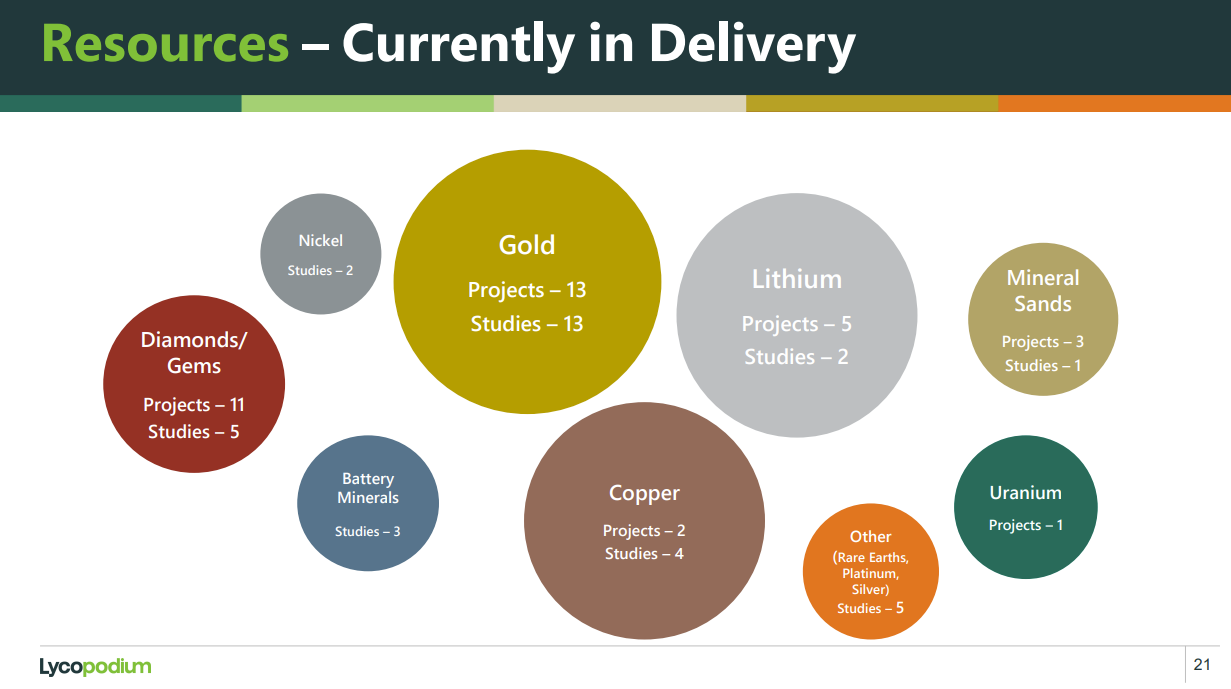

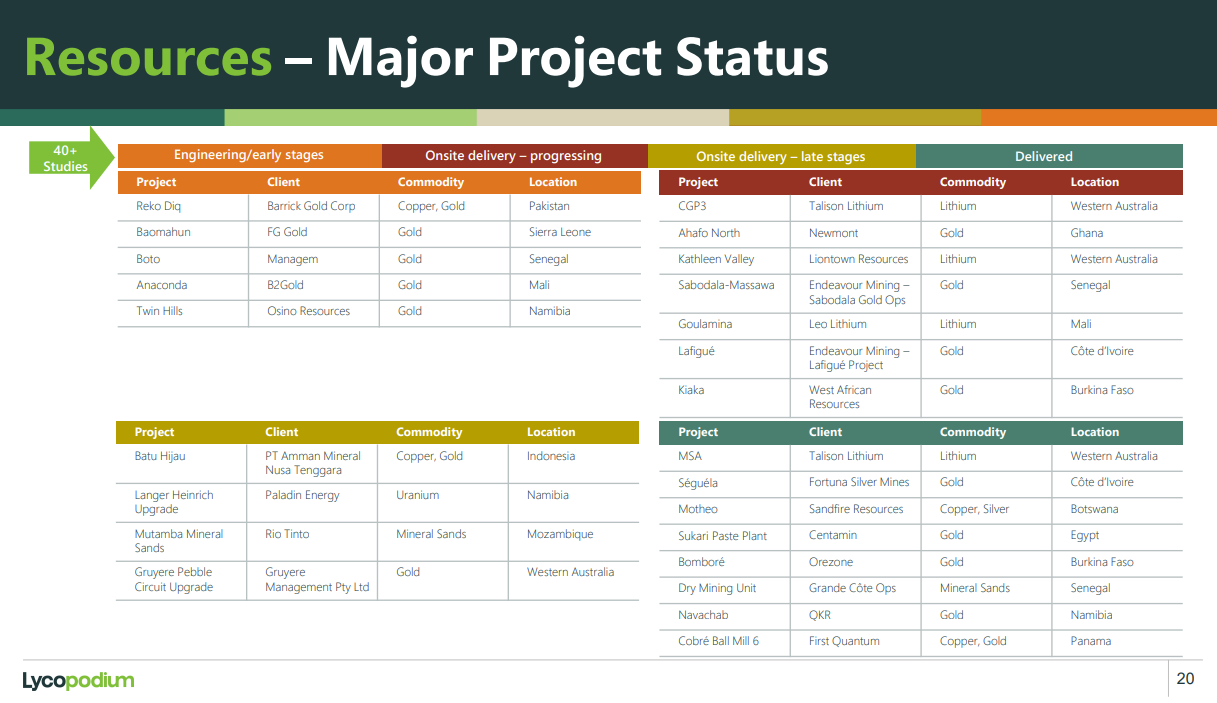

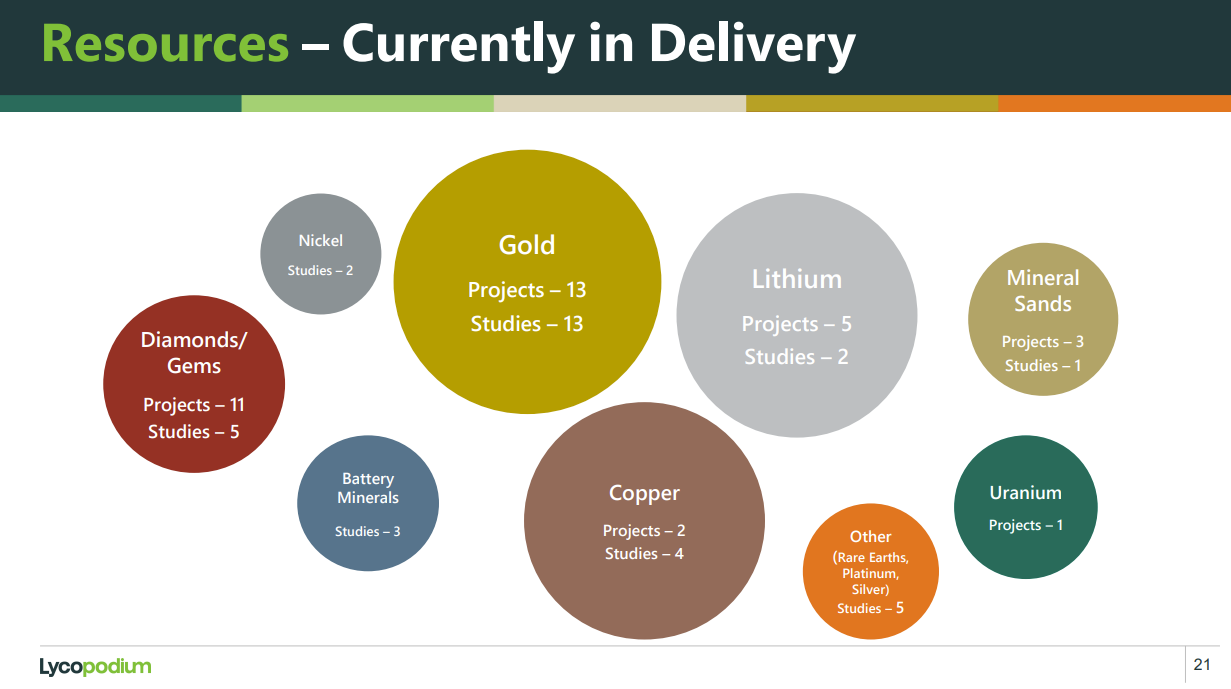

Another point is that your African dictator full of booze, drugs and power, is likely to only be in charge or in control of one country, and LYL work in many, so if they did find themselves adversely affected due to the behaviour and decisions of said dictator, it would likely only affect one or two projects (the ones they are doing in that country), and they are currently working on 35 studies and on another 35 projects (see slide below) and at least 4 of those major projects are here in Australia, with the rest spread across the globe, most in Africa, but not all of those are in West Africa - see maps below.

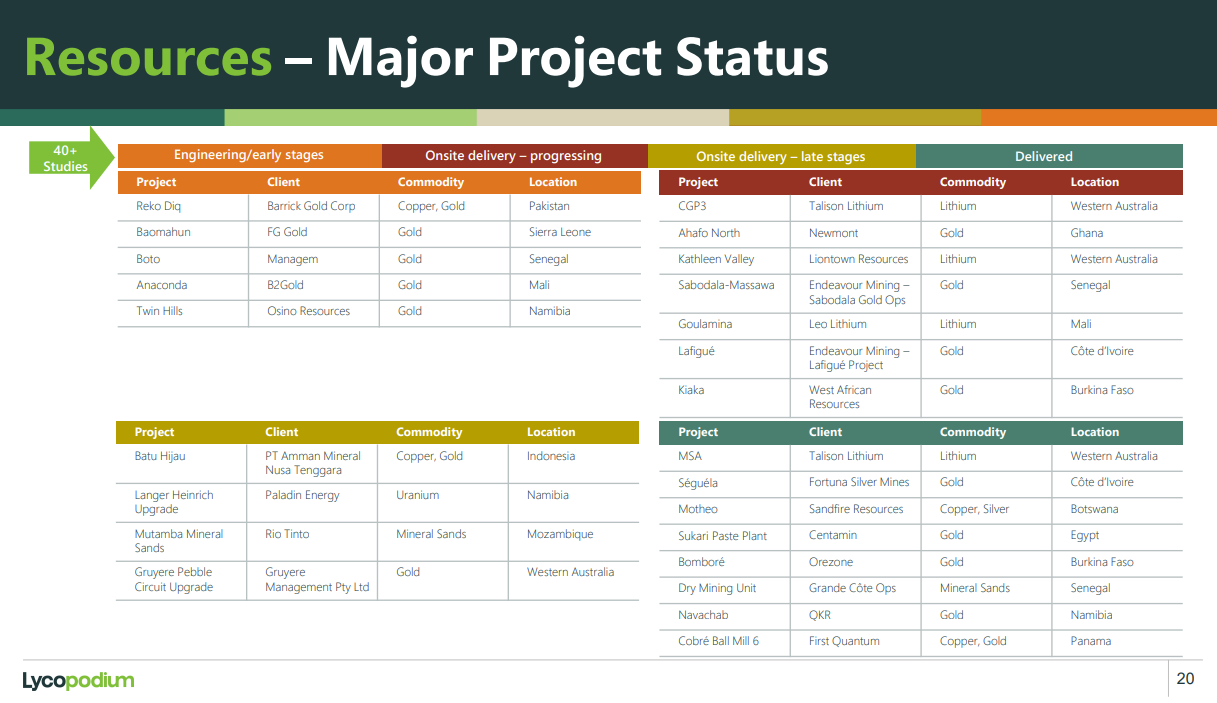

They have recently delivered 8 major projects (bottom right, above, dark green section) and are involved in another 16 major projects - from Engineering/Early Stages (orange section), Onsite delivery/Progressing (dark red section) through to Onsite delivery/late stages (light/tan brown section above) and those 16 are comprised of 9 Gold projects, plus 2 Copper/Gold projects, 3 Lithium projects, 1 Uranium and 1 Mineral Sands project. Those 16 are spread across West Africa - specifically Sierra Leone, Senegal (2), Mali (2), Ghana, Côte d'Ivoire and Burkina Faso - plus Southern Africa - being in Namibia (2) & Mozambique - plus Western Australia (3), Pakistan and Indonesia. (details above, maps below)

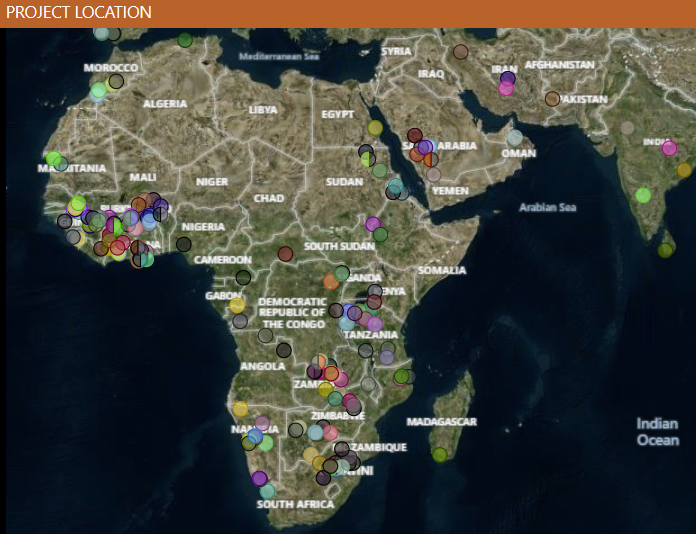

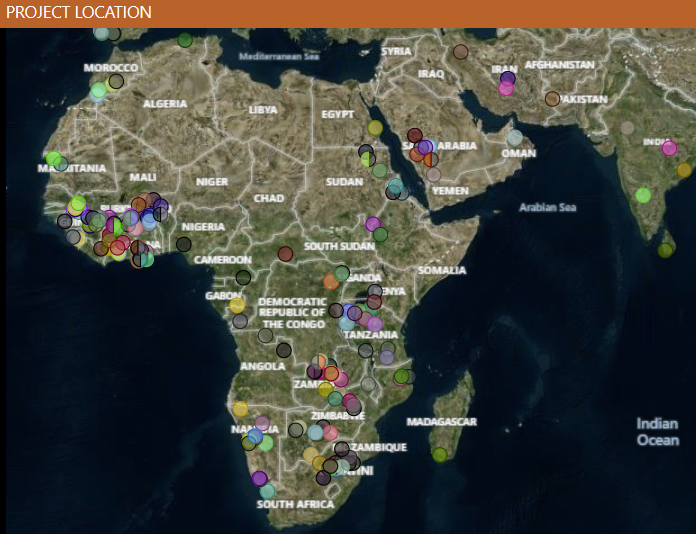

That's from the OMC website (Orway Mineral Consultants, a division of Lycopodium) and all of the dots are locations of studies and projects that have been completed by OMC during their 40 year history. Below is West Africa, a little larger.

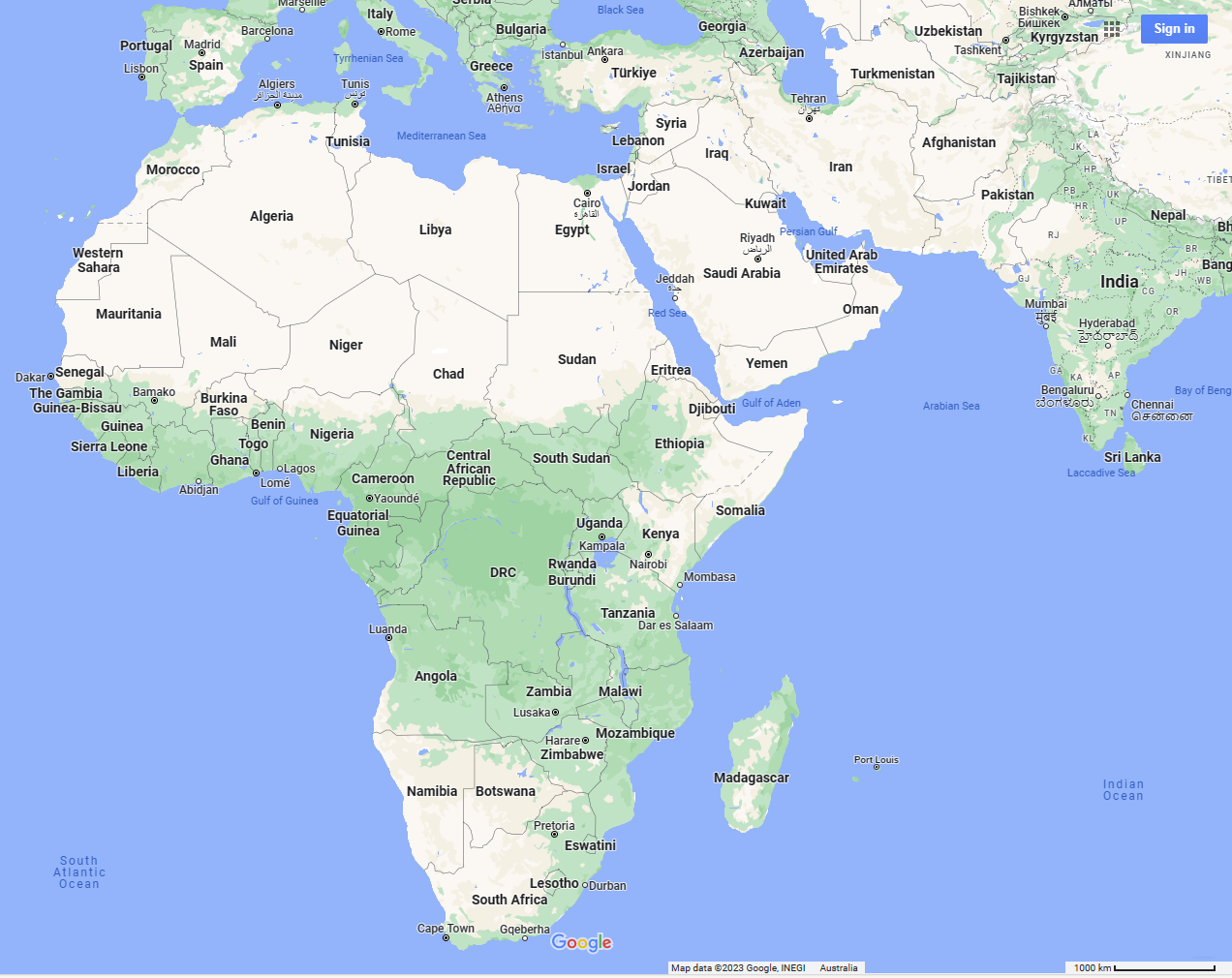

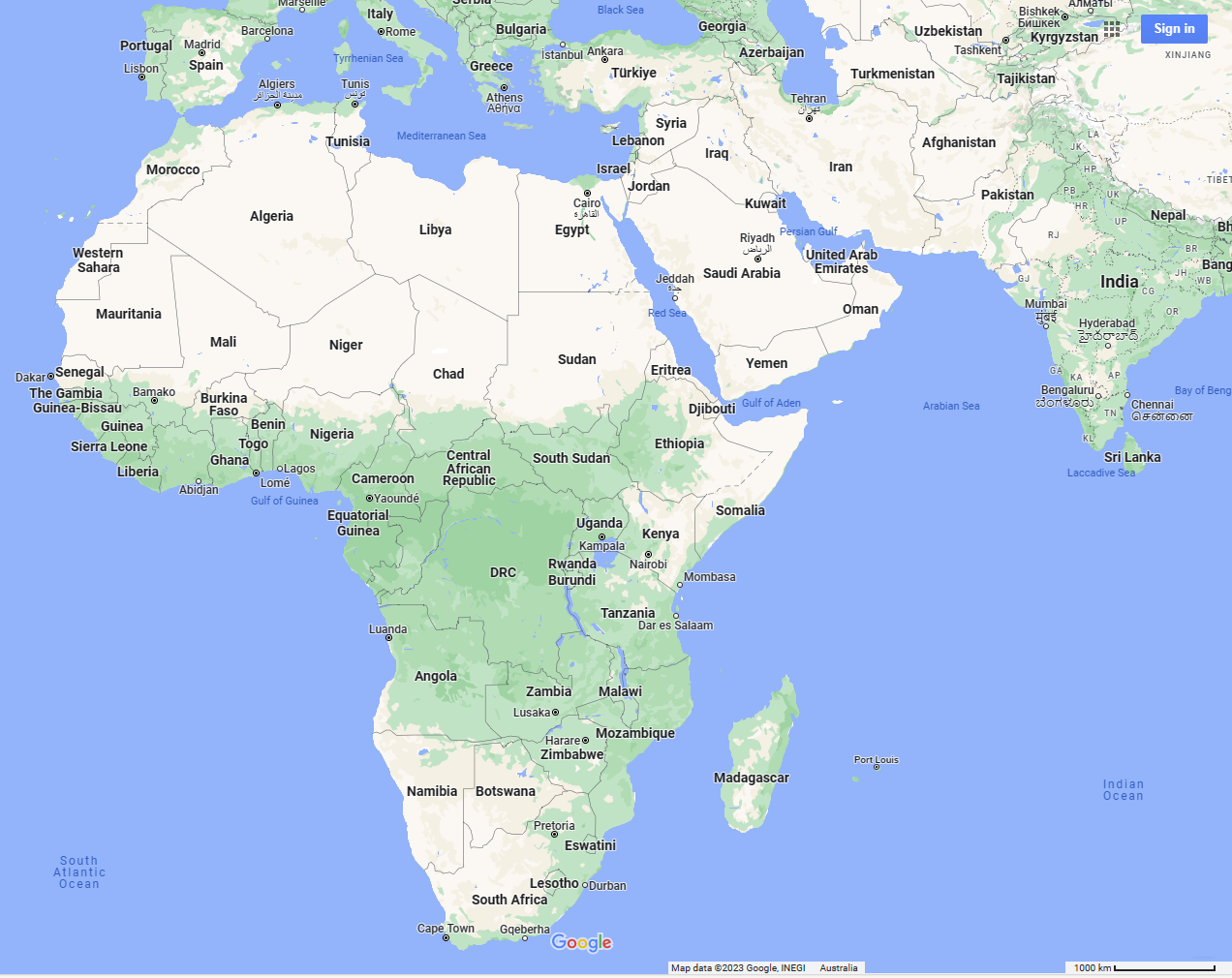

I have added Côte d'Ivoire (the Ivory Coast) because it is not labelled on OMC's map, and I have also labelled Ghana and Guinea as they weren't clear. Ivory Coast, officially the Republic of Côte d'Ivoire, also known as Côte d'Ivoire, is on the southern coast of West Africa between Liberia and Ghana. Its capital is Yamoussoukro, in the centre of the country, while its largest city and economic centre is the port city of Abidjan. Interestingly, Google Maps also does not show Côte d'Ivoire or their capital city (Yamoussoukro); they only show Abidjan (their largest city):

But according to Encyclopedia Britannica, Côte d'Ivoire is definitely there:

Not sure why Google Maps don't want to label the country at all - perhaps some issue with which one is their "correct" name? (there are 3: Ivory Coast, Republic of Côte d'Ivoire, and just Côte d'Ivoire)...

Anyway, in terms of major African exposure, Lycopodium is currently contracted to deliver services on major projects in Mali, Senegal, Côte d'Ivoire, Ghana, Sierra Leone and Burkina Faso, which are all West African countries, plus services on major projects in Mozambique and Namibia, those two being located in southern Africa and both sharing a border with South Africa, as shown above (2nd map up). So LYL's current African Exposure is to Southern and Western Africa.

And then they have current exposure to WA (3 major projects), Pakistan (1) and Indonesia (1). All according to their FY2023-AGM-Presentation.PDF yesterday.

So, yeah, there's sovereign risk, no argument, but I remain confident that it's not going to wipe them out or even hit them hard, because of their experience and procedures and controls. And their diversification across countries.

They also use project insurance which does cover them for a number of things but not everything. Like GNG, LYL do Fixed Price Lump Sum Contracts for Turn-Key Processing Plants, so there's plenty of risks associated with cost blowouts if they did occur, for any reason, anywhere. Not all of their contracts are structured that way, but it is an option that they offer. They tend to mention the type of contract when they announce major contract awards, so that level of detail is appreciated.

I agree that their ROE will not keep going up in a straight line, it will bounce around, but they will remain very profitable and either debt free or virtually debt free.

For what it's worth I have NOT been buying LYL above $10.20, and more recently have been buying below $9.70. I would probably pay up to $11 for them if I couldn't get them any cheaper, but I'm reasonably confident that the share price will keep spiking up and down a fair bit, as it always has, due to the high insider ownership (36%) and insto ownership reducing the free float, so low liquiidty. I have them as a top 5 real life position now, so I'm happy with current weightings and not looking to add any more, unless they get down to below $8 again - in which case I'd have to reconsider.

But yeah, there are risks, as there are with any company; I just reckon LYL management handle those risks a lot better than most.