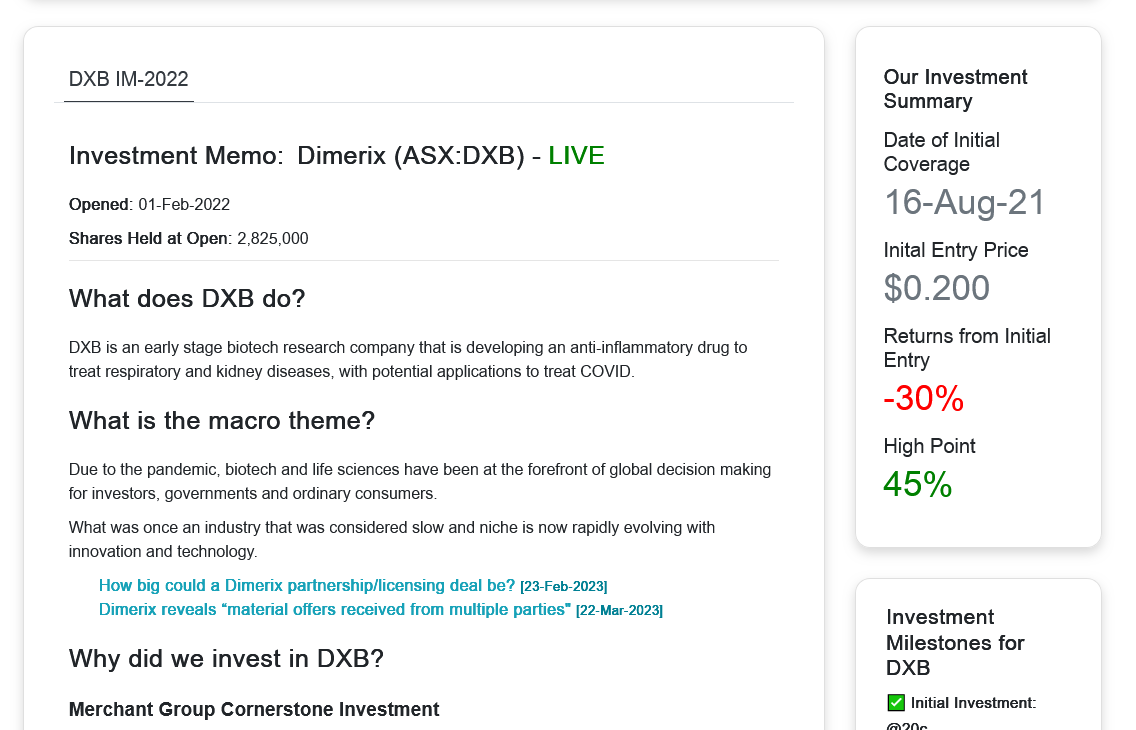

Pinned straw:

Presentation by Dr Nina Webster around FSGS and DMX-200.

She touches on Phase III trial progress, potential market size & pricing, plus the benefits of orphan drug designation (possibility for accelerated approval in some markets based on second interim analysis outcomes).

Also touched on the Advanz Pharma partnership and what they are looking for in partners for other regions.

https://youtu.be/diDMtiYZYCA?si=dfGmz0HEL3Lr6cpP

Might be a bit light on detail for those fully across this business but a good introduction for newbies like me.

Dr Webster didn’t go as far a calling DXB the next Neuren, but there was an NEU price chart in her presentation ;)

My understanding of where the company is at according to recent studies.

Phase 2 (for diabetic kidney disease): https://investors.dimerix.com/DownloadFile.axd?file=/Report/ComNews/20200914/02280306.pdf

- 45 patients with diabetic chronic kidney disease: no statistically significant difference for the full cohort. However it was seen as statistically significant in those with higher levels of proteinuria (using 24 hour measurement which is gold standard). Simplistically this is an anti-inflammatory of the kidneys so in my mind makes sense the worse the proteinuria the greater percentage improvement.

Phase 2a (for focal segmental glomerular nephrosis) no current treatment and the what the current phase 3 study and Advanz deal is run off: https://investors.dimerix.com/DownloadFile.axd?file=/Report/ComNews/20200729/02259666.pdf

- 7 patient randomised control trial for focal segmental glomerular nephrosis which showed a statistically significant reduction in proteinuria. 6/7 got a >29 % reduction and 2/7 got a >40% reduction.

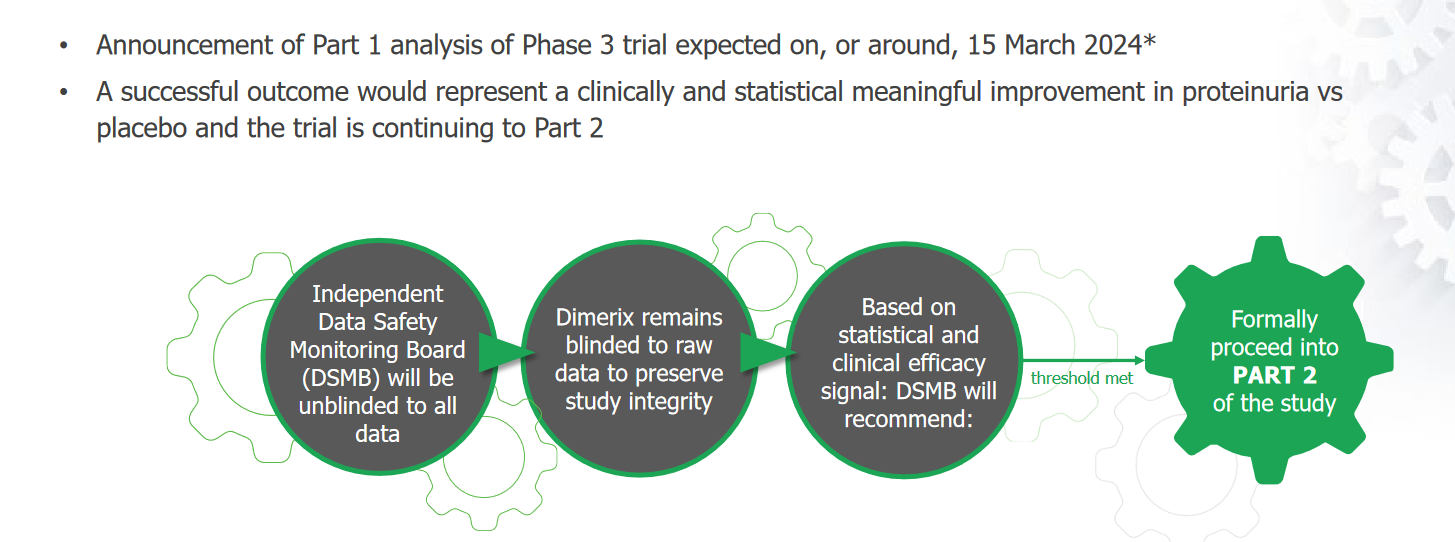

Phase 3: https://classic.clinicaltrials.gov/ct2/show/NCT05183646

The primary outcomes to be measured and reported in 3 parts are: (reference above)

- Evaluate the efficacy of DMX-200 in terms of urine PCR in patients with FSGS who are receiving an ARB. [ Time Frame: Baseline to Week 35 ] Percent change in urine PCR (based on 24-hour urine collection)

- Evaluate the efficacy of DMX-200 in terms of eGFR slope in patients with FSGS who are receiving an ARB (Analysis at week 35 and Week 104). [ Time Frame: Baseline to Week 104 ] Slope of eGFR

- OLE - Assess the long-term safety and tolerability of open-label treatment with DMX-200 in patients with FSGS who are receiving an ARB. [ Time Frame: Double-blind baseline to Week 216 ]Incidence and severity of treatment-related AEs and any AESIs and SAEs following long-term treatment with DMX-200

Thoughts:

- I’d be willing to bet on the first part of phase 3 trial due in March being a positive. This is based on 6/7 patients with FSGS in the phase 2a trial having a reduction in proteinuria. (I think this was only 9 patients) I would not be willing to bet yet that eGFR would improve based around this surrogate measure (proteinuria) at this stage. So for me jury is still out on that. I’ll need to have a deeper dive before I feel like I can stomach the risk/reward of holding through the 2nd part of the primary outcome. This will depend however on how the US reacts…

- US may be able to take it to market just on proteinuria alone. Whereas other countries may be slightly more strict wanting eGFR. (Keep in mind though that high proteinuria is a prognostic factor for worsening disease in FSGS). The Advanz deal is just for Europe, Canada, Australia and New Zealand. Dimerix retains all other rights so a US deal may be on the cards post March.

- Who knows what the other 132 million pounds in milestones are… I would say if the next bit is positive there will be a small upgrade.

I am going to buy in at some stage, The question for me is where is the market cap where a positive result is priced in?? Who knows. I see the 26 cents as hype and it’s slowly coming back down now before a little rally prior or after March. Who knows what its base will be but dare say it will be treading water until march unless they look at a deal with he US prior. I’ll likely play it for the short term until after march and reassess then.