$VHT reported their 1H FY24 results this morning.

Their Highlights

- Revenue from customers up 17.5% to NZ$19.8M

- Core subscription revenue up 26.5% to $14.9M

- Subscription revenue up 19.0% to NZ$19.3M

- Net loss for the period after tax improved 16.6% to NZ$4.4M

- Second consecutive free cash flow positive half-year

- Normalised non-GAAP EBITDA4 improved 67.9% to −NZ$1.4M

- Revenue guidance maintained at NZ$40.0M–NZ$42.0M for the full year

- EBITDA guidance maintained at +NZ$0.5M to -NZ$2.0M for the full year

My Analysis

With the final 4C out several weeks ago there were no surprises. Revenue growth is broadly on track to achieve guidance for the year, which is maintained. 2H revenue tends to be stronger than 1H, so holding to guidance appears reasonable.

EBITDA continued to make progress, with $VHT's normalised non-GAAP measure improving 68%to -NZ$1.4m. EBITDA guidance also on track. I note GAAP EBITDA is -NZ$2.186m, a more modest improvements from -NZ$2.780 min the pcp.

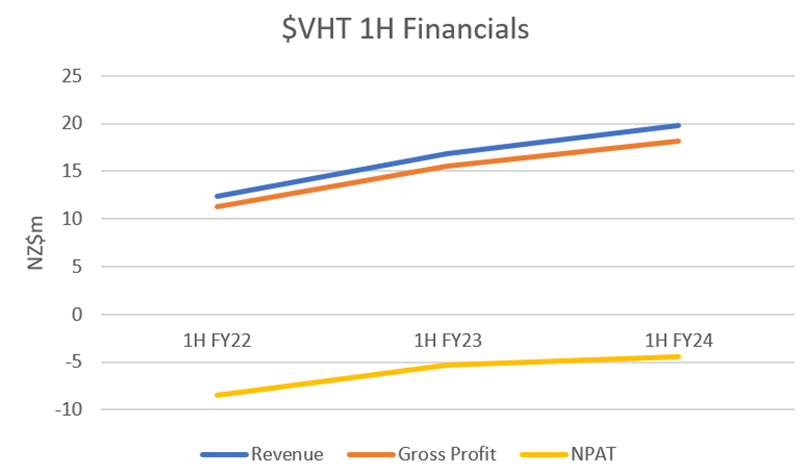

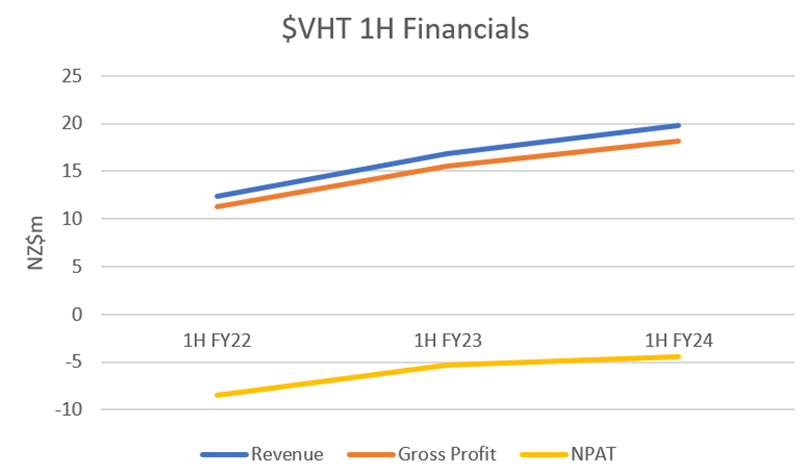

I have plotted some of the key financial trends for the 1H y-o-y comparisons. Its now about 18 months since Teri Thomas came onboard as CEO, bringing a much-needed cost discipline and a sales focus on larger customers (“elephants”). As a result, I am only showing a shorter time series on the financials, as it serves little purpose going further back in time.

Figure 1: 1H y-o-y Key Financials

The figure above shows the impact of the softer revenue growth this FY is having on the trajectory towards positive earnings. In short, while the trend is still up, its looking like hard work to get there.

Revenue

Softer revenue growth of 17% to pcp during the half is due to only one large customer going live, although the three core products of Analytics, Patient Hub and Risk Pathways achieved constant currency growth of 23%,

Revenue is only recognised once a customer contract goes live. Separately, CFO Craig Hadfield commented that $VHT are not making the progress they have aimed to in closing the gap between CARR US$28.4m and ARR US22.5m (the difference between the two being due to contracts that are closed but not yet implemented). To help close the gap, they will be adding a few headcount to accelerate implementations. Reading between the lines, it sounds like the recent cost control focus has meant that they have been running resourcing very tight in this area, adding some drag to having new customers going live.

Looking to H2, Craig noted that 4 customers with CARR of >US$250k are planned to give live. One has already gone live, with 3 more expected before end of March. Craig indicated that because of the strong second half, they remain confident of meeting guidance for the FY.

Other key metrics continue to be strong, with Net Revenue Retention at 112% (up 7% y-o-y) and APRA of $US40.4k up 25% y-o-y.

So the scene is set for a strong finish to the year.

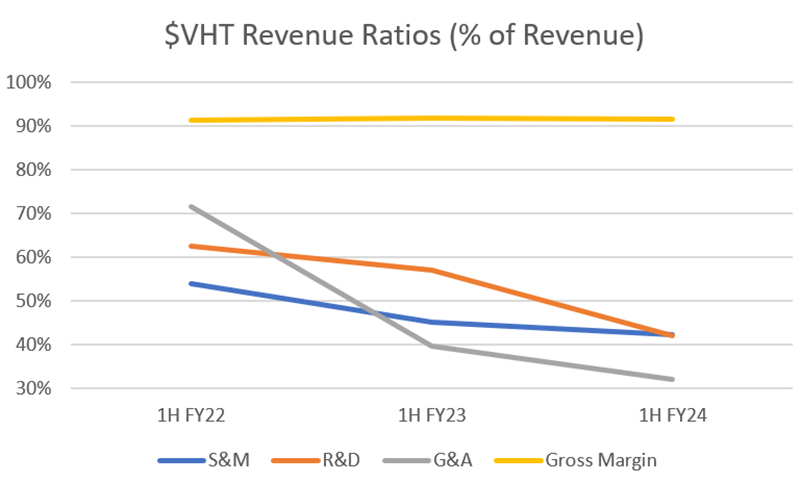

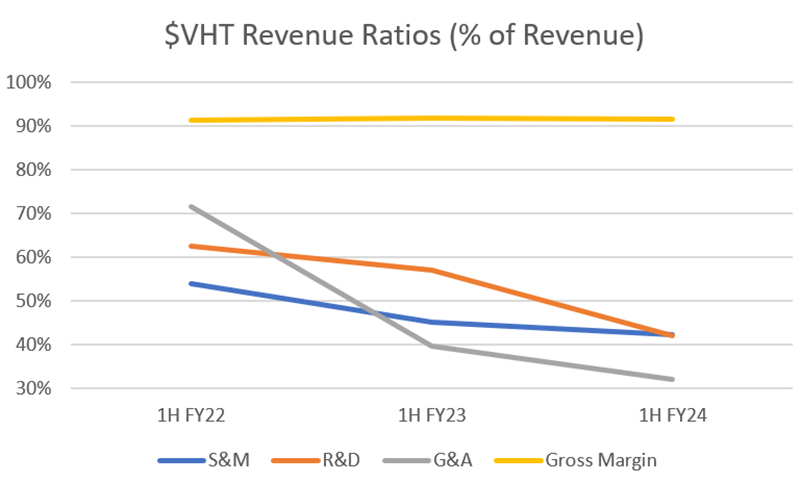

Costs

Figure 2 below shows that expense control continues to be $VHT’s saving grace, with R&D, S&M, and G&A all declining as a % of Revenue. In fact, Opex of NZ$23.055m is an actual reduction of 4% from NZ$23.952m, which is a great achievement given that revenue growth has been maintained, contracts have been expanded, new contracts signed, all in an inflationary environment.

Gross Margin is holding steady just under 92%, having held in the 91%-92% for several periods.

Having the cost base under control, $VHT are going to make targeted headcount increases, with a Sales Director in Europe (on which Terri sounded a bit more optimistic after having spent a month there over the summer), and adding clinically experienced people in the US who can help with customer success as well as sales (something she has learned from Epic days, and has mentioned previously that she is keen to push harder at $VHT).

Figure 2 1H y-o-y Margin and Expenses (% of Revenue)

Cash Flow

Net Operating Cashflow was NZ$1.3m compared with -NZ$6.0m in 1H23, demonstrating that positive impact of controlling costs while maintaining growth in receipts.

Overall, Free Cash Flow by my calculation was +NZ$0.443m (incl. lease payments), helped by the divestment of interest in Precision Medical Ventures.

My Key Takeaway

Overall, today’s result was solid if unexciting.

1H tends to be softer for revenue, as the key months of June to August include the summer in the US, which tends to be slower for the new customer “go-lives” that drive revenue.

I’ll not repeat ground covered in previous write-ups on $VHT, other than to say that I remain interested and the thesis requires a strong finished to maintain revenue growth in the realm of 20% p.a.

Disc: Held in RL and SM