$TNE announced their FY23 results today. It is my largest RL holding, so I attended the call, and here will bring out a few points.

Their Highlights

• Profit Before Tax of $129.9m, up 16%, beating guidance of 10%-15% growth

• Profit After Tax of $102.9m, up 16%, beating guidance of 10%-15% growth

• Total Annual Recurring Revenue (ARR) of $392.9m, up 23%

• On track to surpass $500m ARR by FY25

• Net Revenue Retention (NRR) of 119%. Above our long-term target of 115%

• Total Revenue of $441.4m, up 19%

• Revenue from our SaaS and Recurring Business of $390.7m, up 22%

• Expenses of $311.5m, up 21%

• Cash Flow Generation of $104.6m, up 36%

• Cash and Investments of $223.3m, up 27%

• Total Dividend of 19.52 cps, including a special dividend of 3.0 cps, up 15%

• R&D investment of $112.0m before capitalisation, up 21%, which is 26% of revenue

My Analysis

The results are impressive, and the highlights above speak for themselves.

Yet the market had run up in anticipation of the results - both expecting a good result given the strong 1H and as part of the wider macro pick-up in recent weeks. So, $TNE closed the day down 2%, as those who play with a shorter-term horizon took some profits. This is often the pattern with this stock.

The presentation held some interesting insights, which continue to support my thesis to continue to hold $TNE long term.

Cash generation was particularly strong, reportedly due to good performance by the collections team, with Cash Flow Generation (a number they use which is close to FCF) was 102% of NPAT – something CEO Edward Chung claimed was a year earlier than expected.

$TNE upgraded their target to hit $500m ARR by 2026 pulling it forward to 2025 – again, this was widely expected.

Net Revenue Retention was a very strong 119%, aided by pricing increases in an inflationary environment. However, even excluding the inflation effect, Edward said the result was very close to their ongoing goal of having NRR of 115%. This "target" allows the company to double revenue every 5 years, from existing customers.

Churn remains low at 1%, which was also positive. As $TNE gets to the end of the transition to a 100% cloud SaaS company, this was expected to lead to the loss of some customers on legacy platforms.

Although profit growth beat consensus, it was weaker than indicated by the strong ARR growth because costs have increased, driven by increased spending in R&D to drive development of the SaaS+ platform, and building out their full One Education offering.

Two case studies presented on Slide 25 showed where they are winning full government department ERP and whole of university ERP deals (student management, finance, HR and payroll). So, it has taken a lot of development investment to get to this point.

Consequently, PBT margins have fallen back to 30% from FY21’s high of 31%, however, Edward said that this will now gradually ramp up towards 35% over the coming years. Given the prospect of strong, ongoing revenue growth, this should turbocharge earnings growth over the next 3-5 years.

Long Term Prospects

My thesis for long-term sustained growth rests on two pillars: 1) continued strong growth from existing customers and 2) UK as a material future growth horizon. I’ll update briefly on both.

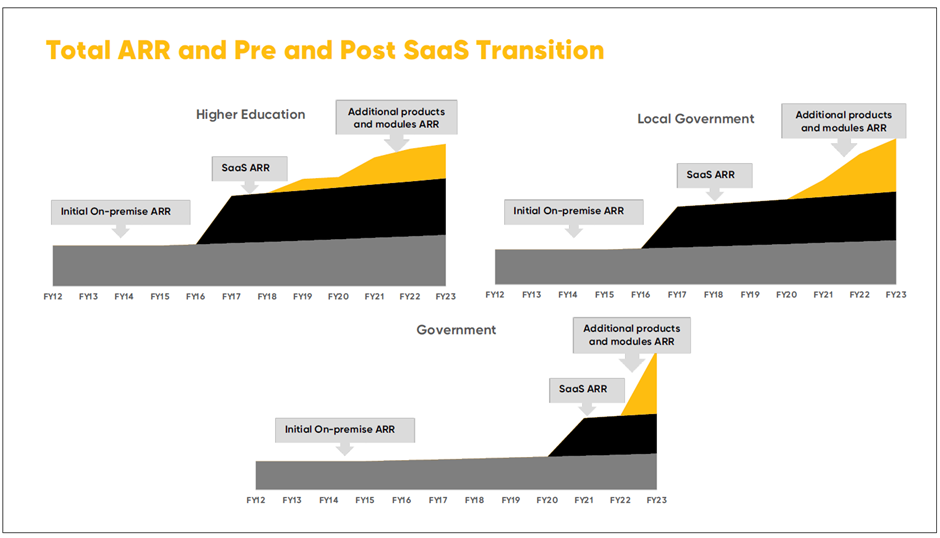

1) Growing Existing Customer with SaaS+ the next phase

A lot of rubbish gets written about $TNE by analysts who talk about the company’s growth slowing as they run out of room in ANZ, and today’s presentation addressed this head on.

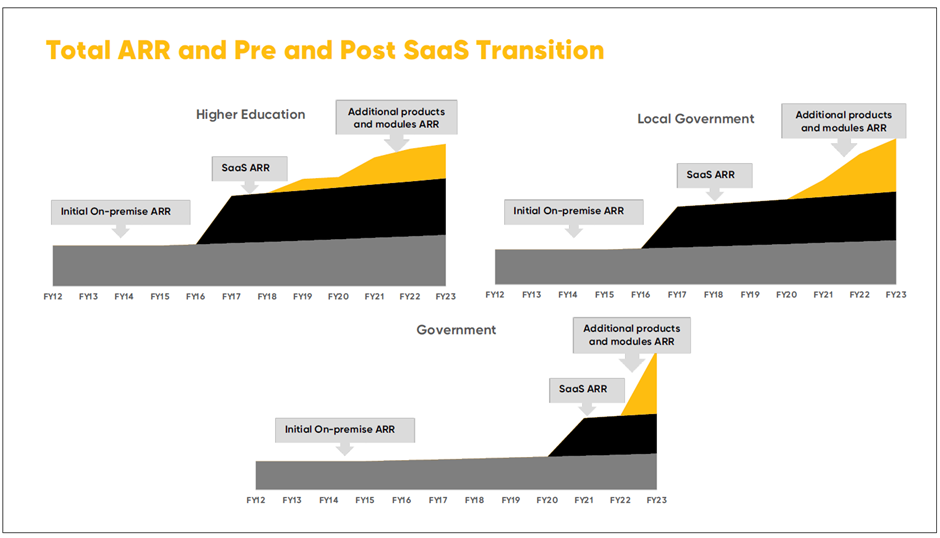

Without going through the detail of the product suit that makes this possible(but they now have 16 products and over 400 modules), I include on chart from the presentation below that shows how $TNE’s innovation allows it to grow revenue strongly from existing customers.

Presentation Slide 29: Case Study of Existing Customer Growth

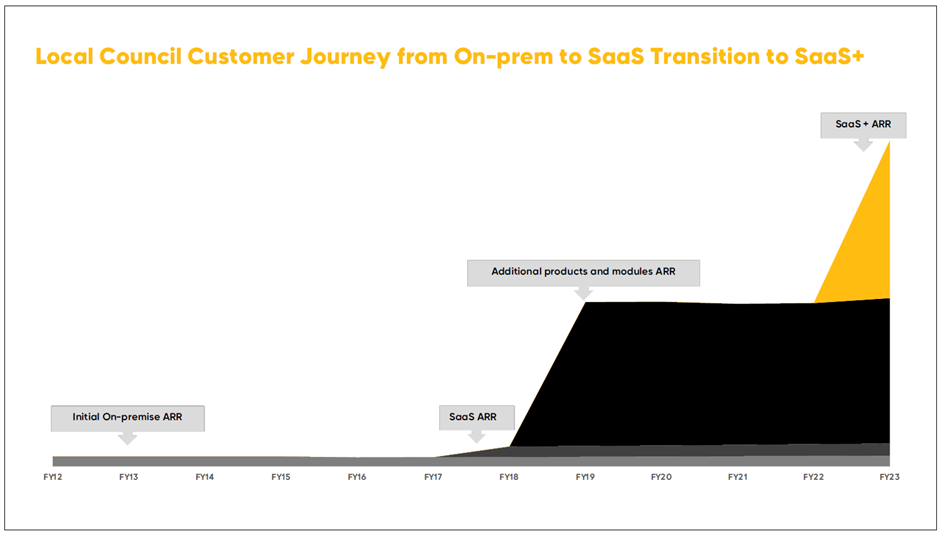

The slide shows selected case studies indicating how the transition to SaaS from the on-premises legacy drove the initial step-up in ARR, to which over time they have added new modules. Nothing new here, it’s the classic SaaS modular land and expand model.

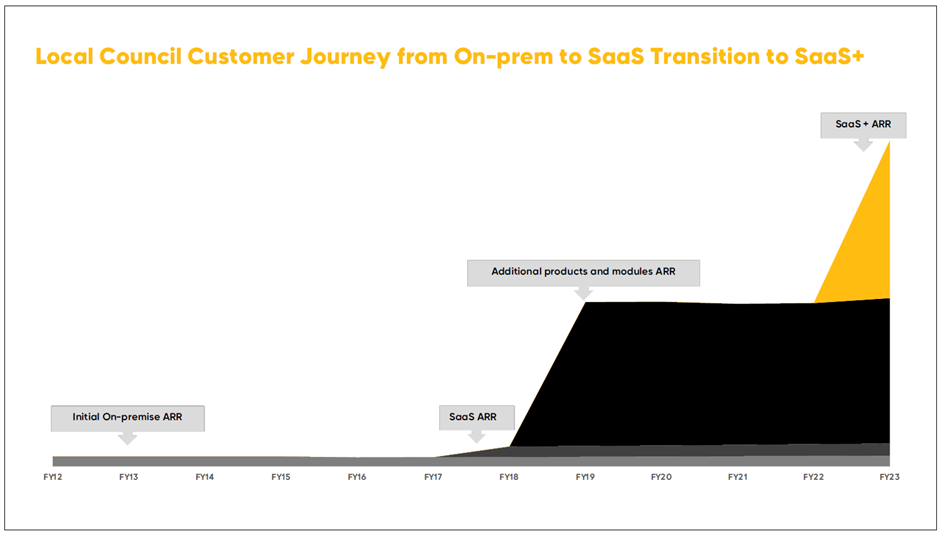

What’s exciting is the new SaaS+ model, which is an enhanced SaaS ERP service including support for implementation and training and other services bundled around it. The offering has been developed to enable customer to adopt the service without having to use system integrators to manage the implementation. Slide 30 shows how this added value creates a new horizon of growth – one that is not yet material at the portfolio level, but which drive growth over the coming years.

Slide 30: Impact of SaaS+ (Case Example)

Edward was at pains to point out that while their competition in education and local government (including SAP) have now moved their offerings to the cloud, unlike $TNE these systems have not been designed as SaaS, cloud native products. Edward stated that $TNE have rebuilt their entire tech stack 4 times over 36 years. He claimed that no other ERP player has even ever done it once. So, they have a massive advantage against competitors in having very low technical debt. Importantly, the architecture is design for ease of implementation, as well as modular expansion.

Customers of competitors, on the other hand, generally continue to face the historical implementation challenges, including hefty consulting bills. As evidence, Edwards showed that $TNE consulting revenues actually fell 11%, which was celebrated as a good thing, demonstrating the ease clients face in implementation.

SaaS+ is proving an early hit with clients. 2023 was the first year of implementation, and they had targeted 10 deals. They delivered 34.

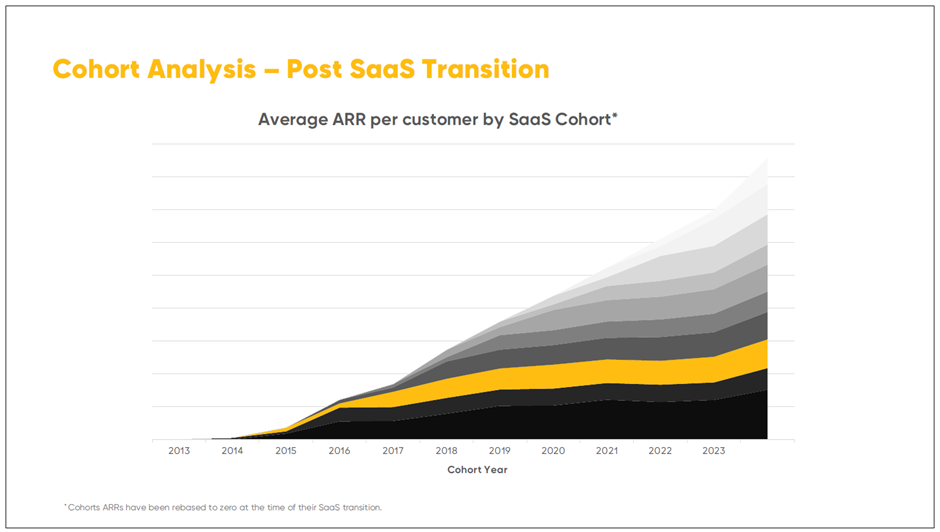

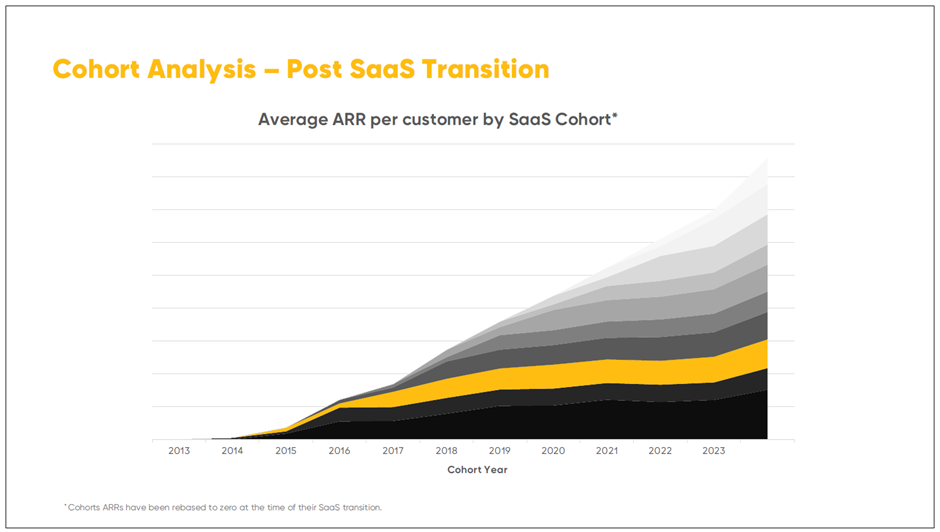

To show the enduring nature of the growth from existing customers, they included a cohort chart (which looks very much like what you see from $ALU and $WTC).

Slide 28 – Cohort Analysis

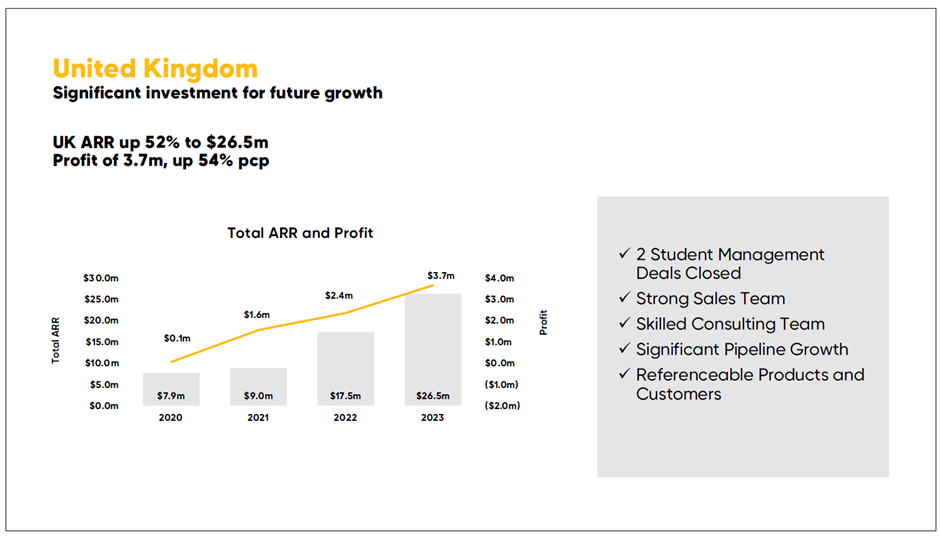

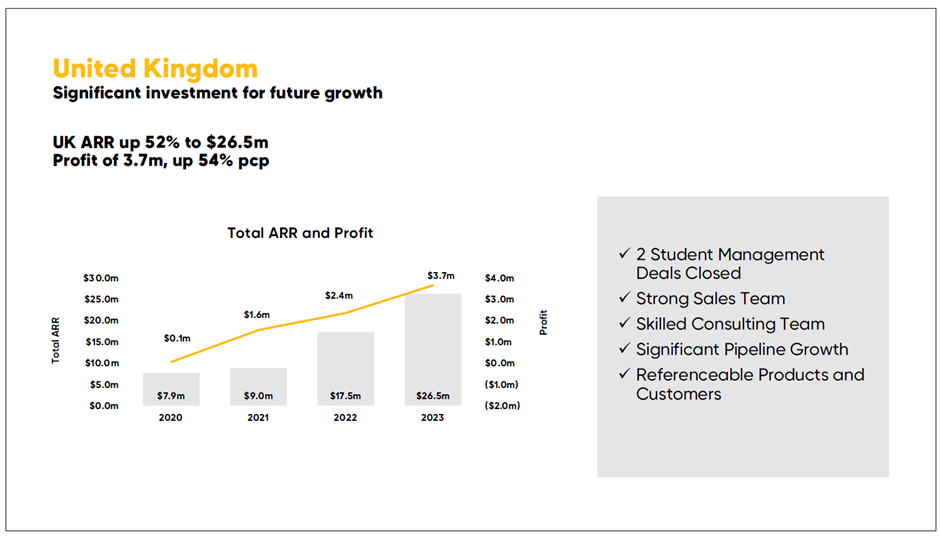

2) UK is making progress

The UK is the second part of my long term growth thesis.

$TNE started operations in the UK just before the pandemic, turning a profit in the first year, 2020. (Just think about that in the context of some of our other SaaS favourites here on SM that have spent 2-3 years around the inflection point!)

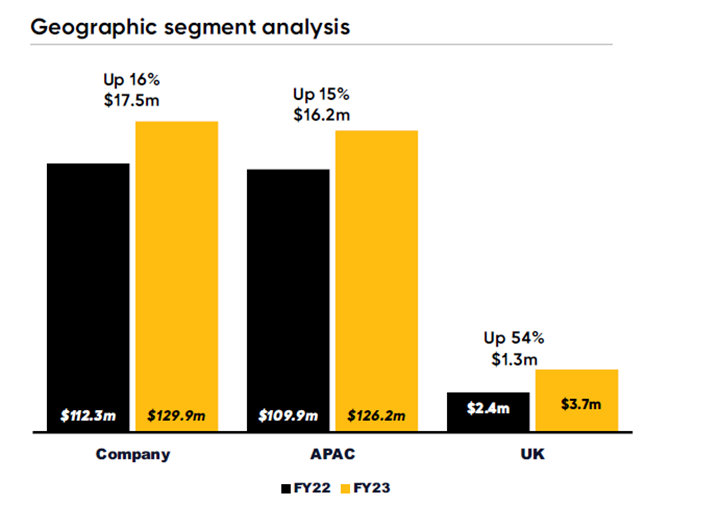

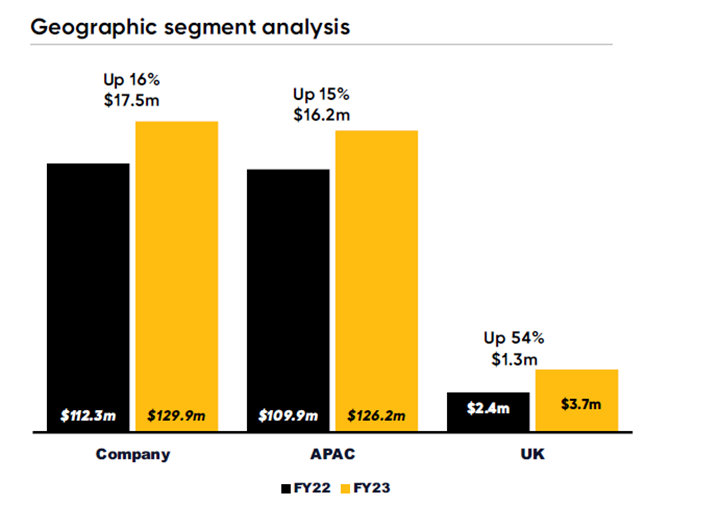

In FY23, ARR was $26.5m (up 52%) and profit of $3.7m was up 54%. It is still not a material part of the business, but it is intereesting nonetheless.

See the following two charts for an overview. (They have been just a bit naughty, in that the first chart is not to a consistent scale!)

One question mark in my thesis is whether $TNE can replicate their ANZ success in the UK. Or, are they late to the party in the UK, and up against established competitors who are all now also in the cloud. (Perhaps like we’ve seen with $XRO in its international expansion, where the international business is facing slowing growth, and represents objectively a lower quality business.)

While it is still early days, the signs are promising, and the management team expressed confidence that they are going to continue the trajectory established.

The reason for the confidence is the innovation their have built into their products which beats the competitor ERP offerings in the core verticals of education and local government. In fact, examples were presented where clients using competitor on-premises products, rather than risk a painful transition to the cloud used that transition decision as the opportunity to switch to $TNE. If $TNE develops an industry reputation as offering the best customer experience for on-prem to cloud transition, then perhaps they are just in the right place at the right time.

Progress in the UK is one I am watching closely. It’s not material at the moment, but looking out over 5-10 years, it could be a very important part of the long term growth story.

Valuation

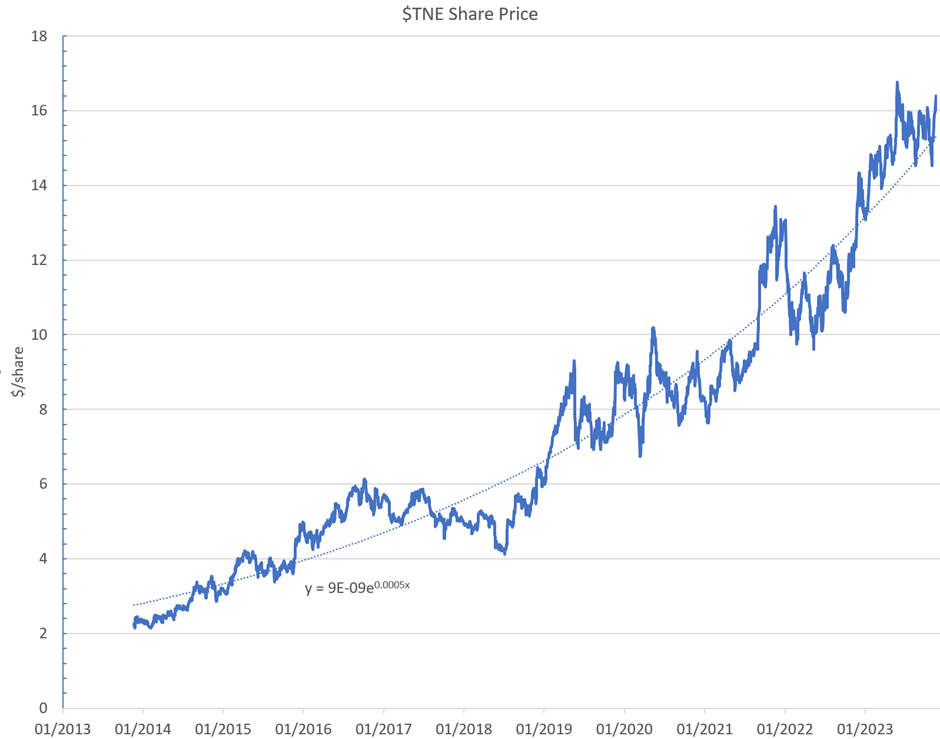

$TNE is not cheap (understatement). Based on today’s result and closing price, the p/e is 51. That’s well into the upper half of its p/e range over the last 5 years (p/e range c. 35-60).

In my basic DCF models, I get valuations ranging from $13.50 – $22.00. With a stable margin structure, it really comes down to how long and how hard you believe it can continue to grow.

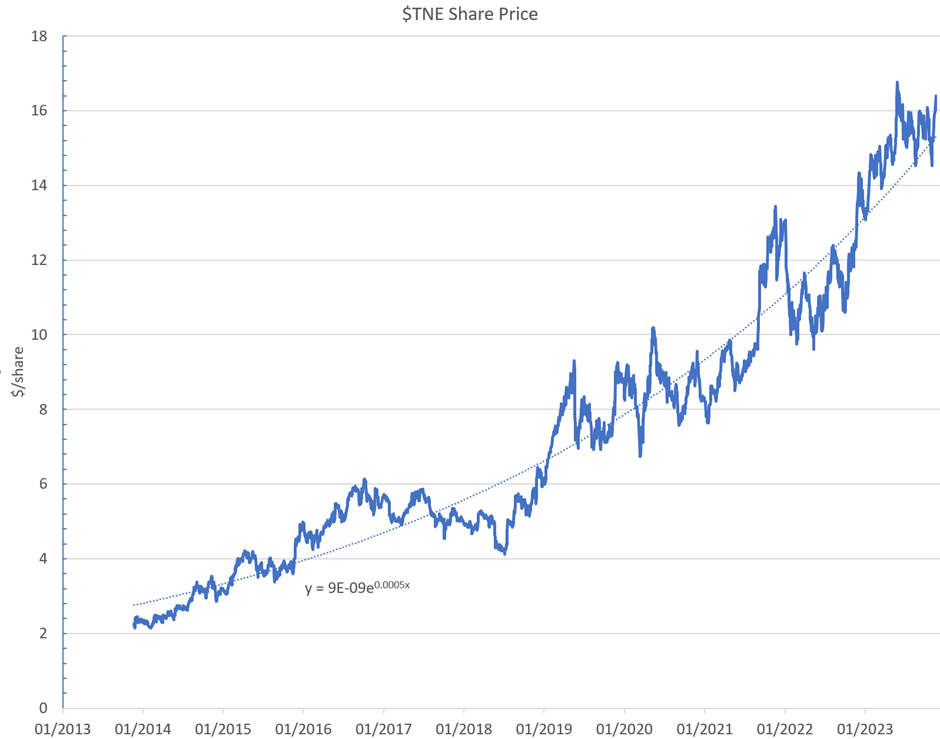

I’ve plotted the last 10 years SP below, with an exponential best-fit curve overlaid. If that curve is a good approximation to fair value, then pretty much every year you can get an opportunity to buy $TNE at a 10-20% discount to fair value. That is in fact when I last topped up in early 2022. But today, I’m not a buyer.

I’m certainly also not a seller, as I have a high conviction that with continued good management, this journey can carry on for the next 5-10 years. $TNE is my largest ASX holding in RL, and second only in conviction to $WTC.

My Key Takeaways

The FY23 was good on all fronts. There is really nothing to be critical about.

This is a high-quality business, and it appears to have a good runway ahead. In truth, it is hard to know just how good the market runway ahead of it is in ANZ. They claim to be no more than 15% penetrated in any of their verticals. I am happy to judge them year-by-year on delivery. The interest for me is the early progress in the UK – a market 2-3x ANZ. They’ve started well, and if the trajectory can be sustained, then even buying at today’s price will look like a great decision in 5 years’ time.

Disc: Held in RL (7.5%) not held on SM