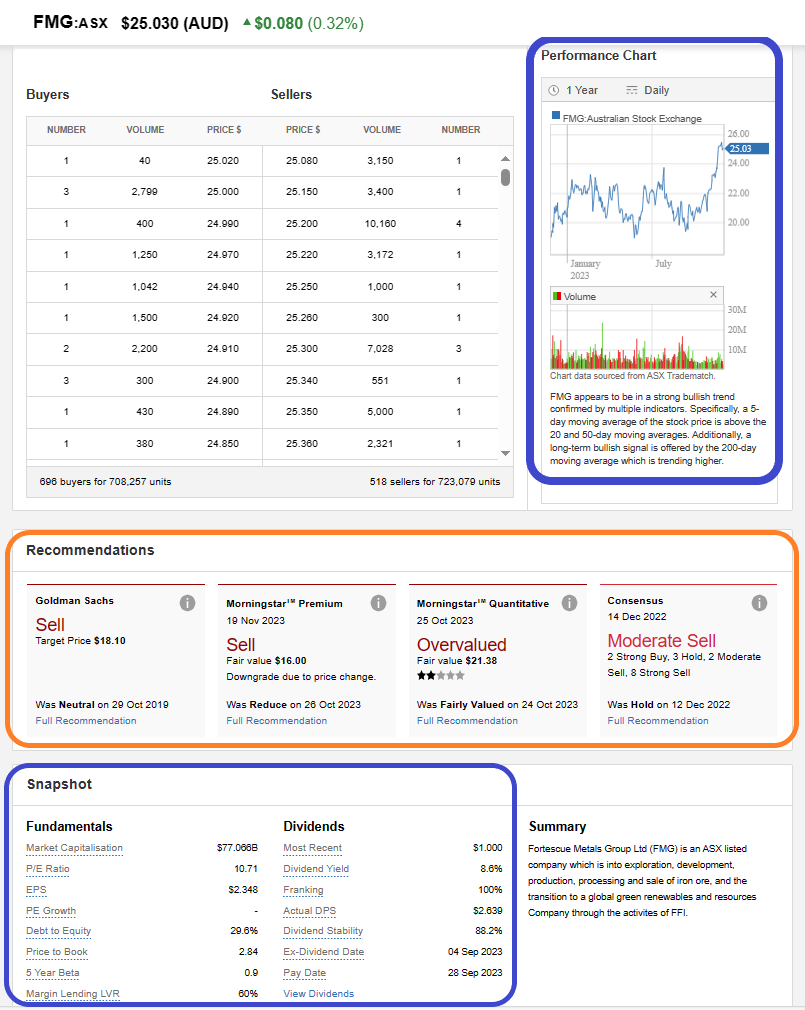

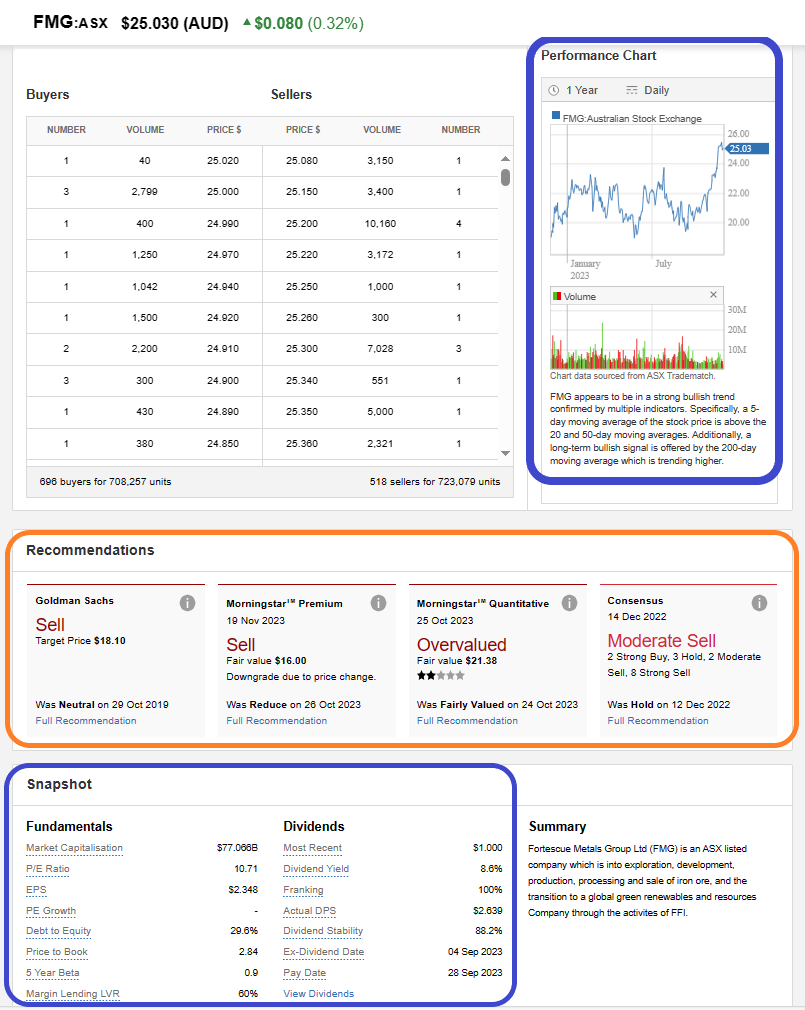

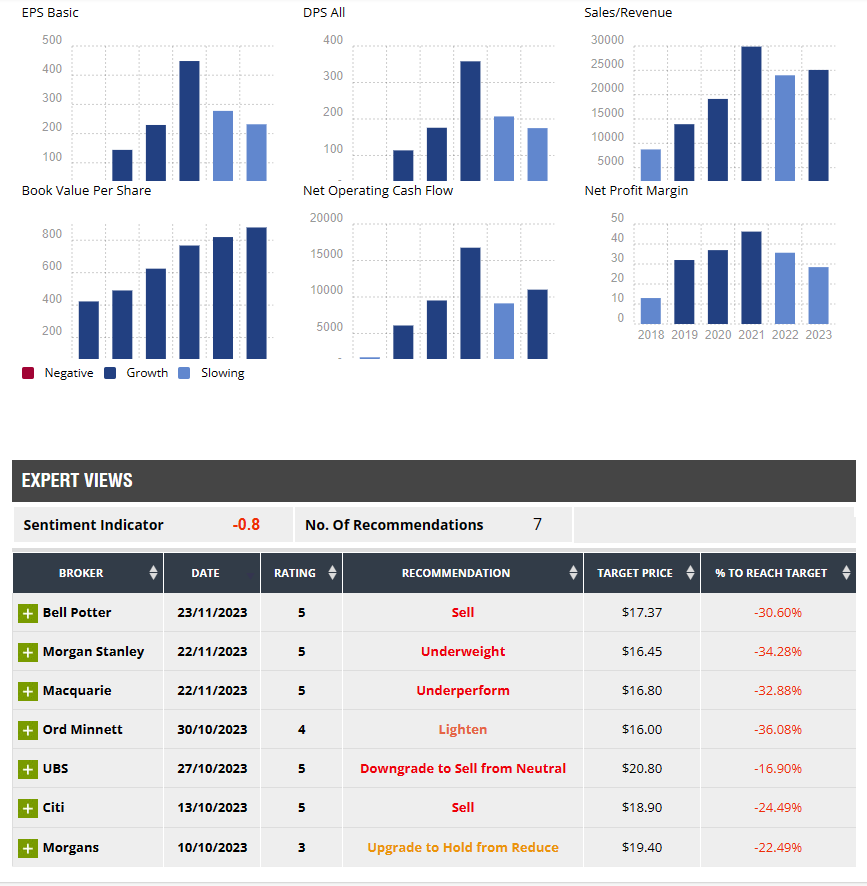

Couldn't agree more @edgescape - Here's a snapshot of FMG from Commsec today:

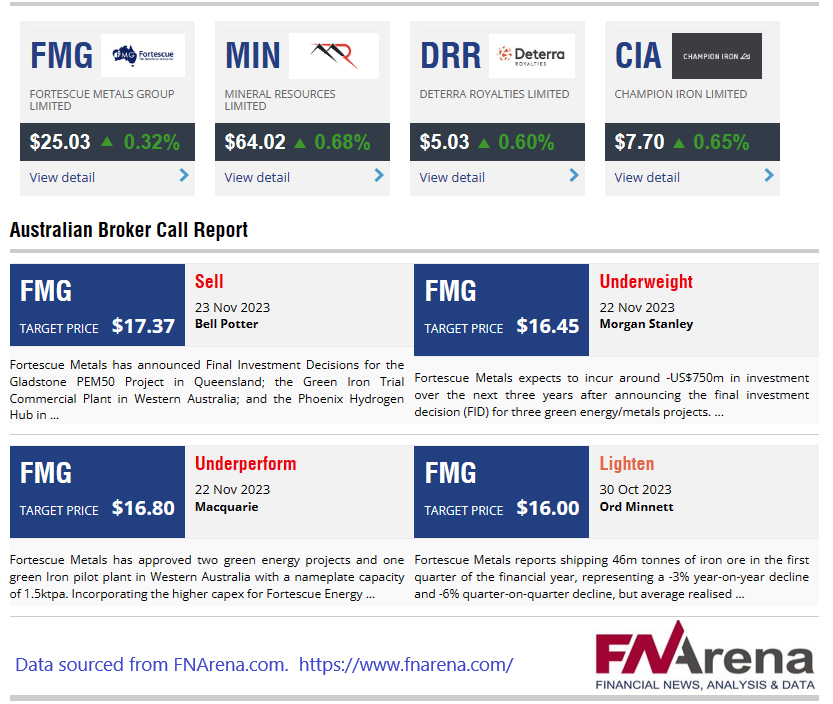

Now you could say that the BEARISH view from analysts and brokers might be down to the high share price - back over $25/share again Friday and they've been trading at over $25 for the majority of the past fortnight. However the PE remains low, the Debt is manageable, their market cap now starts with my favourite number - i.e. $77 billion, and they have new avenues of growth beyond iron ore now. Delving a little deeper into what's been driving these broker downgrades, let's start with a snapshot of FMG from FNArena:

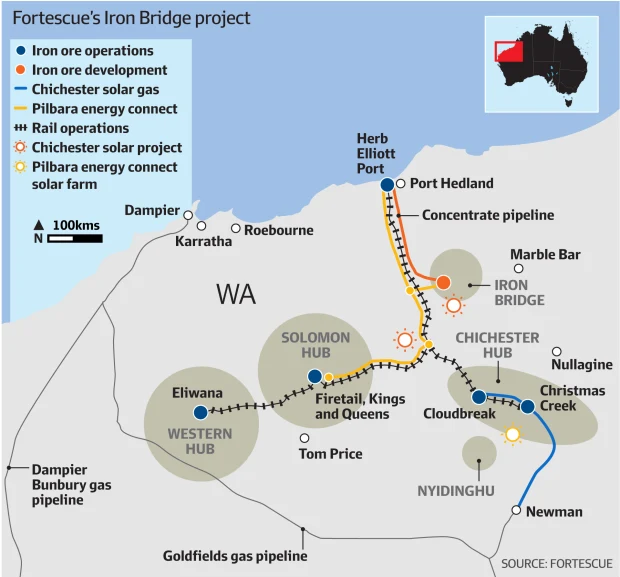

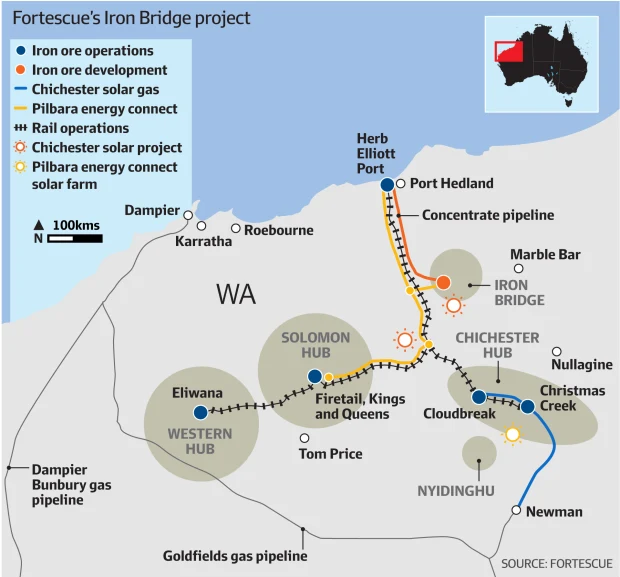

They seem more concerned with big spending in the coming years and declining iron ore production. They don't seem to think Iron Bridge is much of a gamechanger with it's higher grade magnetite, however they are correct that the majority of FMG's iron ore production will remain the lower grade Pilbara hematite, despite Iron Bridge now being in production with their higher grade magnetite. And the costs of building Iron Bridge did blow out, a LOT. See here: https://www.afr.com/companies/mining/why-magnetite-matters-more-to-fortescue-in-the-green-iron-era-20230506-p5d6ah

When it does hit full capacity, Iron Bridge magnetite (>68% Fe) will make up about 10 per cent of Fortescue’s iron ore exports. The Fortescue hematite mining delivers a product that typically contains between 56 per cent and 59 per cent iron. FMG says Iron Bridge could be just the first in a series of magnetite mines in the Fortescue portfolio, with the company also looking to mine a high-grade hematite deposit in Gabon.

Andrew Forrest and Fortescue Metals chief executive Fiona Hick at the Iron Bridge magnetite project in the Pilbara. Peter Milne

Fiona Hicks left FMG in August, one of a number of high profile upper management departures that I discussed in my recent Valuation Update.

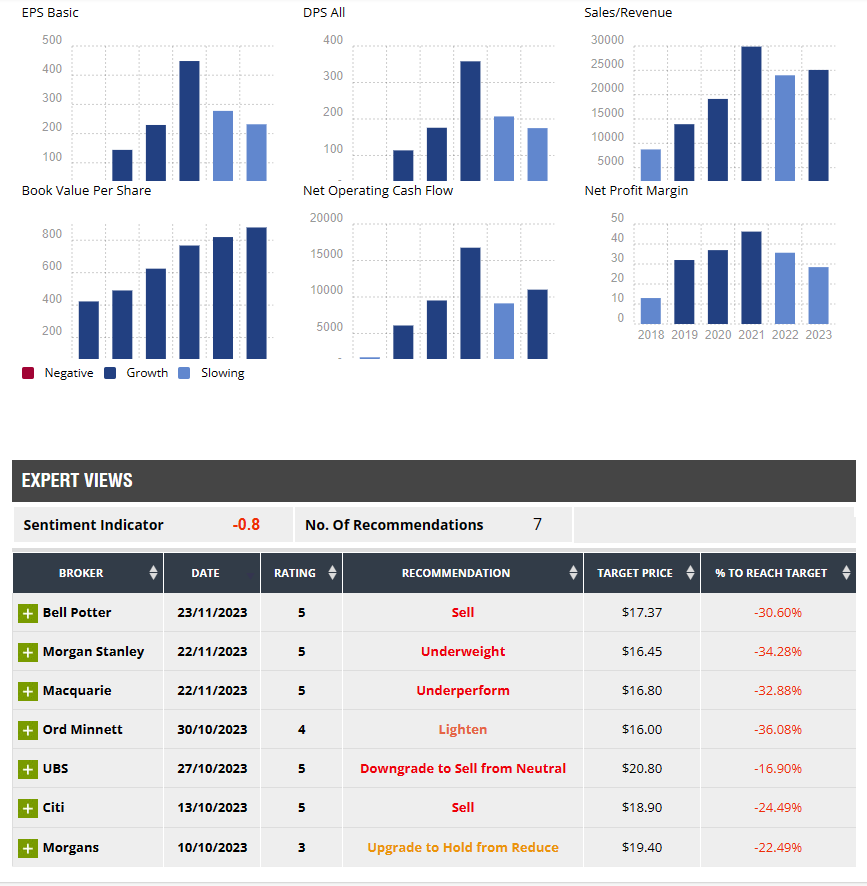

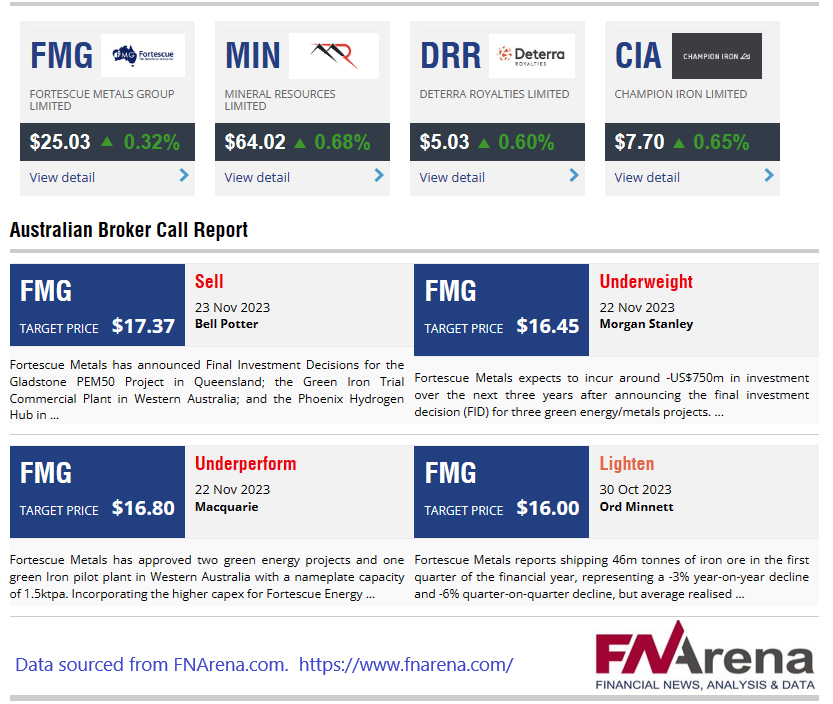

Here's some more detail on broker views from FNArena:

So, more detail in terms of the latest calls from ALL of the brokers who FNArena monitor (and cover) who also cover FMG. FNArena cover either 7 or 8 brokers so that's either all of them or else all but 1 that cover FMG. FMG is a top 20 ASX-listed company (they're in the S&P/ASX20 Index) after all, so they are hard to ignore.

Other issue that the brokers have include the declining EPS, Dividends, NOCF (net operating cash flow) and NPM (net profit margin) over the past two years, as shown in the graphs above, however you have to remember that this is a commodities company that has little control over the price they receive for their ore. Those metrics rise and fall with the iron ore price, and FMG management's job is to control that which is within their control, and they are doing an excellent job with that. One example is the increasing book value despite the lower revenue in the past two years compared to the peak revenue of 2021. Another is their focus on reducing ongoing costs. Another is their willingness to invest in the infrastructure required for higher grade production - such as magnetite/Iron Bridge. Another is their development of the higher-grade hematite deposits they own in Gabon. Another is their Fortescue Energy division which will create new revenue over time that will NOT be reliant on the iron ore price.

Lots of negativity there from the brokers, but the market seem to be ignoring them all so far. Morgans is the only one to have upgraded FMG in recent months, and they only upgraded them from a "Reduce" to a "Hold" and their target price (TP) is $19.40, some -22.5% below the current share price. The average TP across all 7 of those brokers is $17.96 for FMG, being -28.25% below their current share price of $25.03, so either the FMG SP comes down from here, or the brokers continue to play "catch up" and keep raising their TPs, or the brokers remain wrong, unable to properly grasp and appropriately value the more complex business that Fortescue Limited, as it will be know from this week, has become.

Another concern that brokers have is the unknown capex spend and other investment by FMG over the coming years on/in their new Fortescue Energy division, formerly known as FFI or Fortescue Future Industries. This is what Macquarie had to say on October 27th:

- Fortescue Metals' Sep Q iron ore production was stronger than expected, while sales, realised prices and costs were in line with Macquarie's estimates. FY24 volume, costs and capex guidance are unchanged, however the broker notes Iron Bridge shipments were downgraded at the recent site tour. With Fortescue trading on free cash flow yields of only 6-8%, and with uncertainty over the capital commitment to Fortescue Future Industries, the broker retains Underperform. Target rises to $16.80 from $16.60.

--- end of excerpt --- Source: FNArena.com

The most recent update was from Bell Potter on November 23rd (Thursday, last week):

- Fortescue Metals has announced Final Investment Decisions for the Gladstone PEM50 Project in Queensland; the Green Iron Trial Commercial Plant in Western Australia; and the Phoenix Hydrogen Hub in Arizona in the US.

- The company advises three green energy projects (hydrogen) will be also accelerated: Holmaneset in Norway; Project Chui in Kenya; and Pecem in Brazil.

- Bell Potter advises the total investment in the FID-approved projects is -US$750m, the largest being the Phoenix Hydrogen Hub in the US at a cost of -US$550m (first production is pegged for 2026).

- The broker reads the update as a positive given it improves transparency and quantifies investment. Bell Potter also considers the capital expenditure commitments to be relievingly modest, leaving money for dividend distributions.

- On the downside, commercial and operating parameters are still unknown so the projects have a way to go before being de-risked.

- EPS forecasts rise 13% in FY24; 5% in FY25 and 5% in FY26, to reflect rising iron ore prices.

- Sell rating retained. Target price rises to $17.37 from $16.21.

--- end of summary --- Source: FNArena.com

Again - there is a focus there on spending, particularly spending on Fortescue Energy's various Green Hydrogen projects. None of the major brokers want to stick their neck out and go against the consensus that FMG has been overbought and is trading at higher levels than they deserve to. There may be some more bullish calls from some of the smaller brokers who FNArena do not cover, but I haven't come across any lately. The market, as I have said, continue to make up their own mind.

You can bet against a billionaire who has passion, drive, determination, control of one of Australia's largest companies (and Australia's third largest tax payer; FMG paid $3.5 billion in tax in FY22), and is putting his own money where his mouth is, but I'd rather back the guy myself. In fact, if Australia ever breaks ties with the Monarchy, I reckon Twiggy would make a decent Australian President.

Just saying...

And in their own words...

Source: FMG 2023 AGM Presentation [21-Nov-2023]

Twiggy is driving this company where he believes it needs to go, and he doesn't care much for people who want to stand in his way, and he's not just doing it because he thinks it's the RIGHT thing to do, but also because it makes commercial sense as well - there's money to be made in new green energy solutions, and he wants that first mover advantage.

Manage the company really well, and the share price will take care of itself. As it has recently.