Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

The price of Iron ore has surprised the market with it’s resilience by staying above US$100, I have been less surprised but recognise plenty of downside risk. The lower quality grade produced by Fortescue provides a sale price in the mid US$80’s but this remains a healthy distance from the US$18 C1 cost.

The thesis behind FMG was that as a very low-cost producer it was going to profitable throughout the commodity price cycle and there to take advantage of higher prices when they occur. This may not be enough in the future with the Chinese involvement with the Simandou mining which is ramping up.

As we have seen in the Lithium space, the motives of Chinese producers are different to most commercial producers in terms of operating profitably. A willingness to operate at a loss for periods far beyond those a commercial operation would accept or be capable of are normal in order to gain control of a market or for geopolitical strategic reasons.

We have not seen this yet, likely many years off, but for me with this factor the future outlook for FMG is now very uncertain and the risk has increased. Current yields of 4.6% FF dividends and a PE of 14 are ok for low risk, but not for moderate risk in the commodity space from my point of view.

Upside from here is also capped, even without a price war, global capacity to deliver Iron Ore has increased notably, all but eliminating any possibility of seeing price spikes like we have over the last couple of decades.

The inflation hedge that commodities offered during a period of high inflation and with inflation uncertainty going forward mostly remains, but compared to the threat of an irrational competitor in Simandou it’s not enough. We could see a bifurcation of international trade between China and US aligned trading blocks, which would reset any of these assumptions – but that is a wild call with an outcome no one can guess at.

Hence, I have exited what was left of a position I have held for a few years now because the anker it provided the rest of the portfolio is rusting fast… no new information today, just a steady build of factors and I am only now getting around to reviewing FMG and the price is very good currently.

https://www.afr.com/interactive-freeview/2025/african-iron-ore/

That's a link to a recent AFR piece that does not appear to be behind a paywall that is very interesting for anybody directly exposed to WA Iron Ore (FMG, MIN, etc. and of course BHP & RIO).

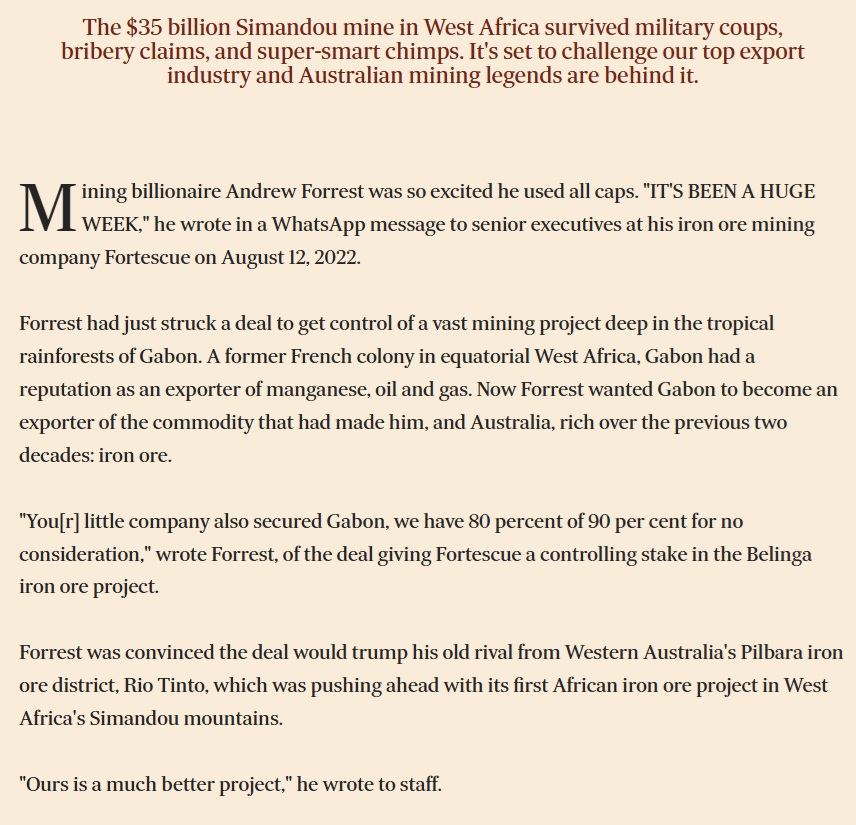

Three years on from Forrest's ebullient message, Rio is having the last laugh in the African iron ore war. Rio will start loading a boat with ore from Guinea's Simandou mountains in November. Unlike the single batch of Gabonese ore that Fortescue shipped in 2023, Rio's is expected to be the first of many, heralding the birth of a major new iron ore province.

When the first Simandou tonnes set sail from the port at Morebaya, it will be the culmination of a multi-decade journey that was buffeted by military coups, bribery allegations, project redesigns, commodity price gyrations, lawsuits that read like movie scripts and a campaign to save some super-intelligent chimpanzees.

The mines, railways and ports that will carry Simandou's ore to market will ultimately cost more than $35.5 billion. This is the world's biggest mining project under construction today, and it serves as a bellwether for the rise of Africa's long-stalled iron ore industry.

Export volumes from Africa are tipped to rise by 60 per cent between 2024 and 2027, and that's just the start of a trend that is as much about geopolitics as geology.

The wave of new mines is fresh competition for Australia's most lucrative export industry, adding substantial new supply at a time when Chinese iron ore import volumes are forecast to decline by 4 per cent.

Iron ore prices are tipped to fall by between 12 per cent and 30 per cent in the next five years, depending on which analyst you listen to. It's a trend that will punch a hole in Australian government tax receipts and GDP.

And in a perverse twist, many of those driving Africa's iron ore boom are the legends of the Australian industry.

Click here or on the video above to watch the drone flyover footage.

Two rival consortiums – one led by Rio and the other led by Singaporean shipping company Winning International – are collectively spending $US23.2 billion ($35.5 billion) on the mines, railways, bridges and ports that will make the Simandou project a reality.

That sort of spend makes waves anywhere, but particularly in Guinea, which had gross domestic product of just $US15.4 billion last year according to World Bank data.

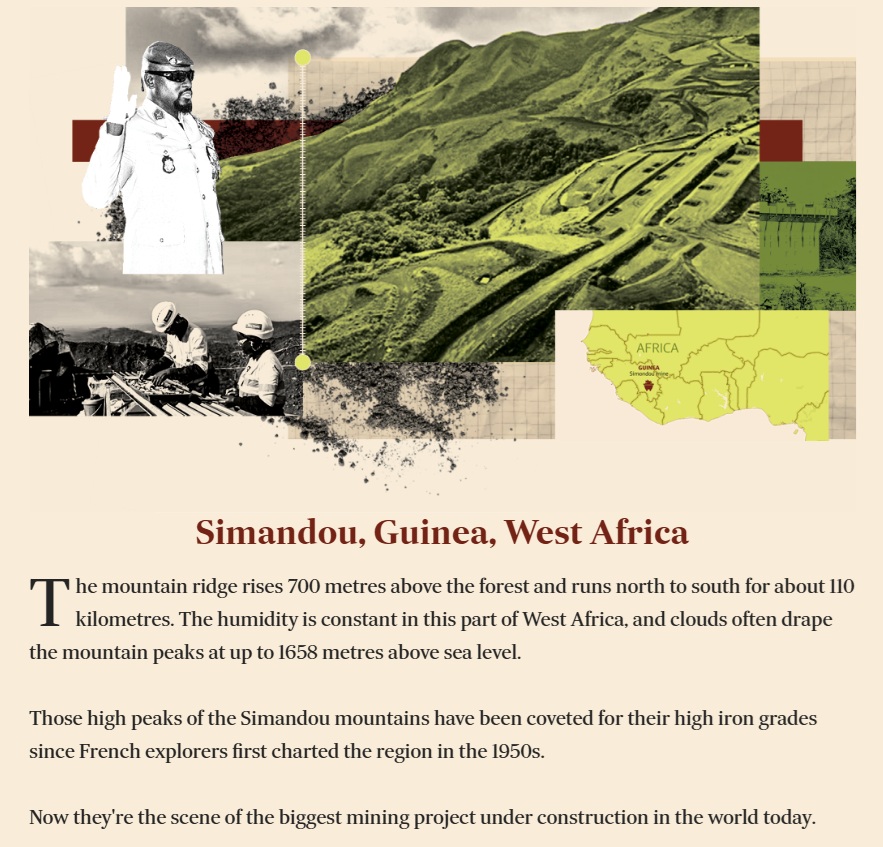

The tops of the mountains contain ore with between 64 per cent and 67 per cent iron; well above the grades shipped from Western Australia, where the ore typically contains between 55 per cent and 62 per cent iron.

But Simandou's superb quality ore could hardly be located in a more remote location, and building the railways, bridges and ports to carry the iron ore to customers abroad has always been hard and expensive. That's why Simandou was the mining industry's great white whale for decades.

"Iron ore is mostly about logistics, it always has been," says Perth-based Bronwyn Barnes, whose company Ivanhoe Atlantic is trying to develop a similar iron ore project about 200 kilometres away from Simandou.

Most of Simandou's $US23.2 billion is being spent on a 536-kilometre, transnational railway line that will connect the town of Kerouane in Guinea's south-east to a new port at Morebaya on the nation's west coast.

For the Guinean government, the transnational railway is hoped to become a "nation building" logistics corridor, that can stimulate development of other industries.

The two Simandou consortia are building rival mines that are about 100 kilometres apart.

Both consortiums will use a 536 kilometre long transnational railway line to the port at Morebaya.

For the Rio mine, a railway spur of 78 kilometres will be required to connect to the transnational railway.

The easiest and most direct route for that spur would run along the western side of the mountain ridge.

But the Rio team spent hundreds of millions of dollars going through a much more difficult route. Why? Well, in short.. Because of some clever chimps.

The forest on the western side of the ridge is home to a community of Western Chimpanzees, a species ranked "critically endangered" by the International Union for Conservation of Nature. The chimps are exceptionally smart and are among the few primates that use tools to help themselves eat and drink.

Rio chief technical officer Mark Davies says expensive design changes were made to the spur railway to protect both the chimp habitat and Rio's reputation.

"When we designed the mine, the easiest thing to do was bring the rail straight into the western side and drive up and down the western side, but clearly that would be detrimental to that forest," he says.

The solution was to dig a 908-metre-long tunnel through the mountain range, so the railway could approach the mine on the eastern side of the ridge.

"That has cost us hundreds of millions, if not billions of dollars to address, but we have committed to those standards, and we have to live up to those standards," he says.

Click here or on the image above to watch the Chimp video.

Rio's Simandou mine will ramp up to produce 60 million tonnes a year within about 33 months, meaning it will be operating at full speed by about 2028 or 2029.

The neighbouring mine under development by the Winning consortium will also produce 60 million tonnes a year once ramped up, meaning the Morebaya port complex is forecast to export a combined total of 120 million tonnes per year by the end of this decade.

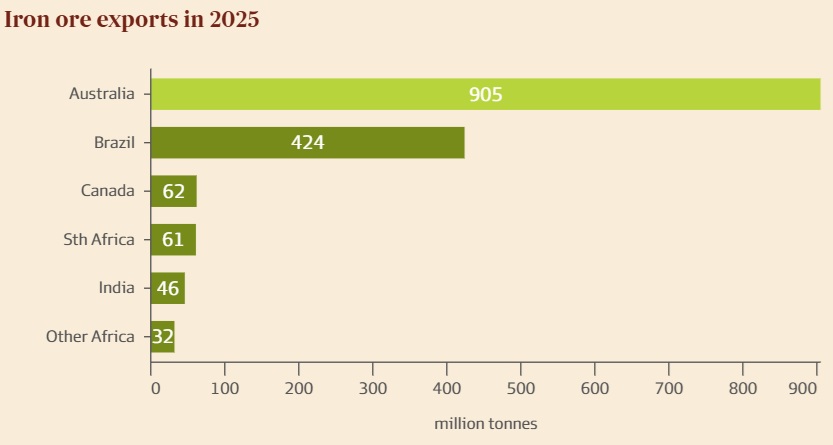

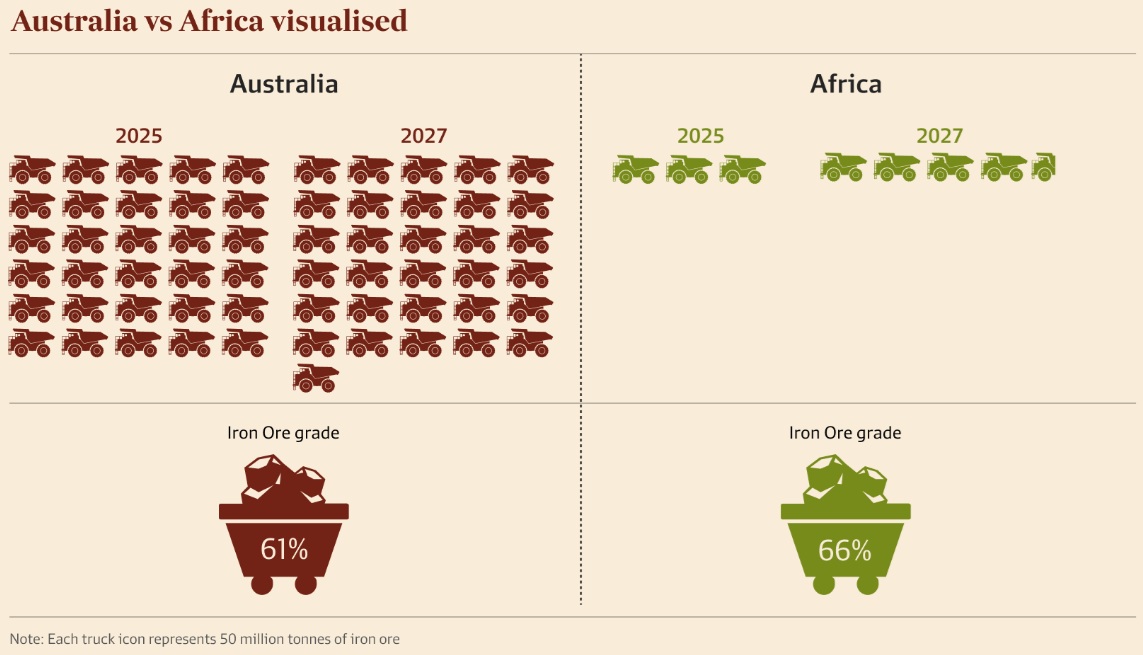

To put that in context, Australia is expected to ship about 905 million tonnes in 2025, making it easily the world's biggest exporter. Brazil will claim second place with about 424 million tonnes, while African miners will ship about 93 million tonnes.

Australian miners have traditionally feared that if railways and ports were ever connected to the Simandou mountains, the province could be rapidly expanded and challenge the Pilbara's stranglehold on global supply. Previous plans for the province talked of producing 170 million tonnes per year.

But most analysts are sceptical about the potential for Simandou to reach the modern-day target of 120 million tonnes a year, let alone be expanded further. CRU Group iron ore analyst Liz Gao says a long and complex supply chain and extreme weather patterns will cap output.

"Once fully ramped up, Simandou is likely to deliver just over 100 million tonnes per year," she says.

Compared to previous plans to develop Simandou, the size of the railway equipment adopted this time is much smaller and cheaper.

Axle loads on Rio's Simandou spur railway will be 25 tonnes; well below the 42 tonne axle loads on some of the trains that carry Australian iron ore to port.

Lower axle loads will limit the Simandou partners' ability to expand production in future.

The same is true at the port.

Rather than a deep-water port on the coast, Morebaya port is built on a narrow, estuarine river.

A trans-shipping operation like Morebaya is cheaper to build than a big deepwater port like Port Hedland in Western Australia, where conveyor belts stand on the wharf and pour a continuous stream of ore into the bellies of big "capesize" vessels.

But trans-shipping is less efficient once operations begin because every tonne of ore needs to be double-handled. It is also less scalable because there is a limit on the amount of ore that can be barged down a narrow river.

"The trans-shipping becomes the bottleneck," says Macquarie analyst Rob Stein, when asked about the potential for Simandou volumes to be expanded.

"We think that Simandou will hit 110 million tonnes per year by 2030, with creep to 115 million tonnes taking a few extra years."

The Simandou infrastructure has been built quickly by international standards, with Chinese engineering and construction firms winning plaudits for their cookie-cutter approach to building bridges and other items.

Rio chief Simon Trott describes it as "catalogue engineering" and a big change from the way Rio has traditionally built things in Australia.

"There's 30 or 40 river crossings. We would go to each one of those river crossings traditionally and design the perfect bridge, get the configuration right. They've got a long bridge, a short one and a medium one, and it is just rolling it out and replicating," he told investors in London in October.

The trade-off for the speed and efficiency of the Chinese engineering might be safety. Reuters reported earlier this year that 13 people had been killed on the construction project between 2023 and early 2025.

When Guinean president Alpha Condé was overthrown by a military coup in September 2021, it presented an ethical dilemma for Rio and the other western companies that work in the country.

Click here to watch the video.

Could it meet the governance standards of their first world stakeholders if they continued to work under an administration that was governed by an unelected dictator brandishing a gun?

The answer Rio found on its subsequent visits to Washington and Westminster was yes; Western governments were eager for Rio to persist in Guinea to ensure the project's infrastructure did not become entirely Chinese-controlled.

That sort of statecraft is commonplace in Africa nowadays, with the US government pumping money into projects like the Lobito Corridor, which will provide critical minerals producers in the Democratic Republic of Congo and Zambia with a rail connection to the port of Lobito in Angola.

Dubbed the "Liberty Corridor", it would be shorter than Simandou's transnational railway at about 300 kilometres, and would carry iron ore to port from Ivanhoe's proposed Kon Kweni mine in Guinea.

"We are trying to pull together a consortium that would fund the Liberty Corridor and that is a large part of the discussion we are having with the US," says Barnes.

‘This is the US response to China's Belt and Road. Now they've worked out the importance of being involved in infrastructure corridors in Africa, I think there is a real appetite for them to step up their involvement.’

"It is not just iron ore that sits within trucking distance of that Liberty Corridor, there are also other critical minerals."

Ivanhoe hopes to initially produce 2 million tonnes of ore each year at Kon Kweni, before ramping up to 5 million tonnes per year. The resource is big enough to sustain a 30 million tonnes a year mine, should market conditions warrant it.

Ivanhoe's iron ore won't be the first to leave Liberia; multinational steel giant ArcelorMittal started mining at Tokadeh in 2011 and has spent close to $US3 billion expanding the mine to an annual capacity of 20 million tonnes.

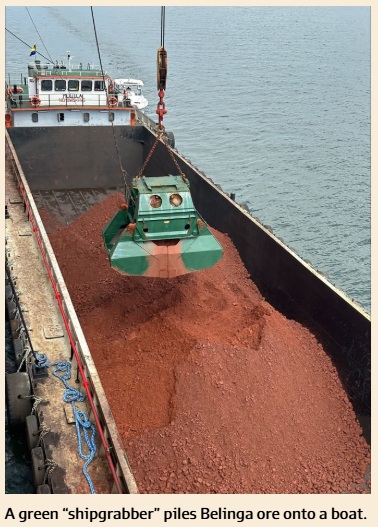

It was certainly a far cry from the giant shiploaders that pour a continuous stream of Fortescue's Australian ore deep into the bellies of the much bigger ships that dock at Port Hedland.

Click on the image above to see the 20 second video/GIF of iron ore loading at Port Hedland.

But for Fortescue Mining chief executive Dino Otranto, this was a revolutionary moment. The ore had come from the Belinga iron ore deposit; a mountain range located 550 kilometres away in one of Gabon's tall canopy forests.

Like Simandou, Belinga's high-grade ore had for decades been stranded because of the high cost of building railways and ports to get the ore to market.

But in typical style, Fortescue sought to crash through those impediments by sending a small batch of ore to port on the back of a truck, barely 11 months after striking a mining convention with the Gabonese government.

Otranto was at Owendo as the big claw piled 11,000 tonnes of ore onto Mouila; about 23 times less ore than gets piled onto the big capesize vessels at Port Hedland.

Despite the small volumes, Otranto insisted the shipment was big on symbolism.

"This project has the potential to revolutionise our portfolio and ultimately create a product that will be the envy of our peers. It will also open growth opportunities for Fortescue throughout Africa," Otranto claimed on December 5, 2023.

But three months later, Otranto confirmed the first shipment of Belinga ore was mostly for show.

"The shipment, I wouldn't read too much into that," he told analysts on an earnings call on February 22, 2024.

"That was very, very early days and the concept was to prove the logistics process and also to demonstrate to our stakeholders here … how serious are we as a partner.

"This orebody has been around since the 1960s and no one's been able to get any ore out, and we did it in about six months. However, we won't be ramping up that particular supply chain through the road network here."

Since then, mining has ceased at Belinga.

Click on the image above to watch the 9 second zoom out.

In October 2024, Fortescue terminated the five-year, $US150 million, Belinga mining services contract it had issued to Capital Limited just 16 months earlier.

Fortescue has spent the past year doing little more than exploration drilling at the site and working on a feasibility study.

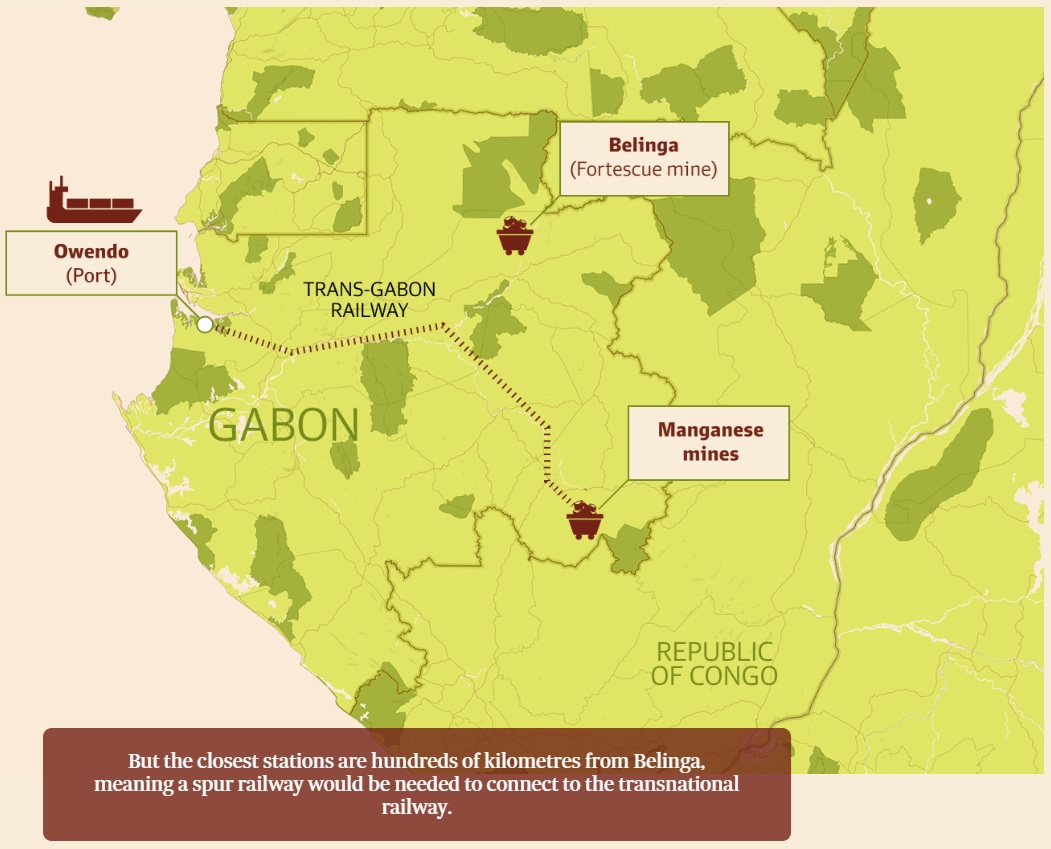

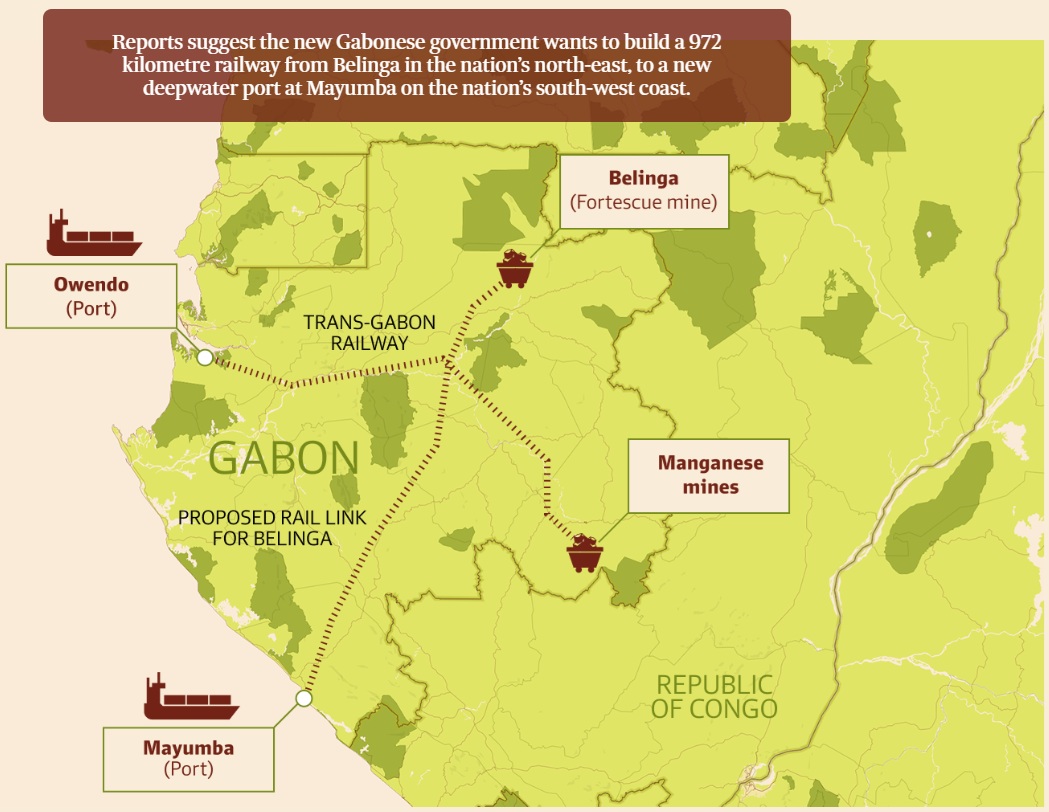

Otranto says work on a feasibility study for Belinga will continue until December 2026. Just as it was for Simandou, the biggest issue for the Belinga feasibility study will be railways and ports.

Gabon already has a 669 kilometre transnational railway that carries manganese ore and other commodities to Owendo port.

The cost of the project has been touted at close to $US10 billion, and it's unclear who would pay for it.

JP Morgan doesn't give Fortescue much chance of building a mine at Belinga: the investment bank values Fortescue's stake in Belinga at zero.

At the current rates, Fortescue's former chief operating officer Greg Lilleyman might be shipping Gabonese iron ore before his former employer ships the second batch from Belinga.

Lilleyman is chairman of Genmin; a small ASX-listed company with an $18 million market capitalisation that hopes to develop the Baniaka iron ore deposit in Gabon's south.

Baniaka has ore with 63 per cent to 64 per cent iron, which can be trucked a relatively short distance to reach Gabon's transnational railway.

At a cost of $US200 million, Genmin hopes to build a mine producing 5 million tonnes a year and the resource is large enough to host a mine producing 20 million tonnes a year.

At those small initial volumes, Genmin can more easily fit in with the limited capacity on the transnational railway.

"There is existing power, rail to port solution within a 50-kilometre distance from our deposits," he says.

If Genmin can get Baniaka into production, the winners will include Mineral Resources managing director Chris Ellison, who is a shareholder in Genmin in his private capacity.

The many risks of mining in Africa

A series of coups d'etat have rocked Australian miners working in Africa in recent years. Madagascar became the latest example on October 14, when a section of the military seized power of an island that is home to some Rio Tinto mineral sands mines.

Leaders in Gabon and Guinea have also been overthrown by armed but peaceful militia in the past four years.

In the past five years Australian companies like AVZ Minerals, Equatorial Resources and Sundance Resources lost control of lithium and iron ore projects in either the Republic of Congo or the Democratic Republic of Congo in circumstances that were murky. Arbitration via World Bank tribunals have followed.

Perth-based gold miner West African Resources got a shock in late August when the Burkina Faso government declared it was suddenly taking an extra 35 per cent stake in WAF's Kiaka gold mine.

Click on image above to watch the 7-second video grab.

Things have been even murkier in Mali, where ASX-listed Resolute Gold had its chief executive Terry Holohan and other employees detained in November 2024 over a tax dispute.

"There is still a heightened level of sovereign risk in African nations, no doubt," says Lilleyman.

"Africa isn't one country. There are numerous countries with different levels of sovereign risk."

Former Atlas Iron chief executive David Flanagan saw the difficult side of African mining this year, when media reports in Guinea declared his new vehicle Arrow Minerals had two of its tenements cancelled.

One of the tenements is named "Simandou North", and is hoped to produce iron ore that gets put on the same trains that carry ore from the Rio and Winning mines nearby.

Arrow shares have been suspended for the past five months, as Flanagan and the Arrow team have tried to clarify the status of their tenements with the Guinean government.

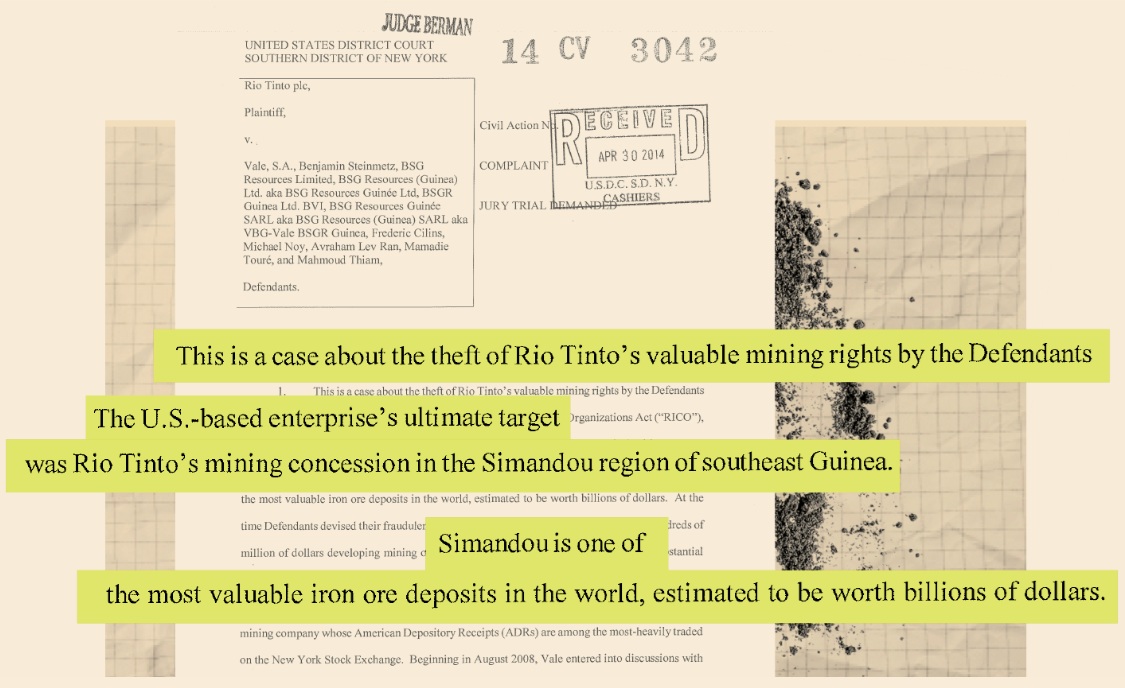

There has been no shortage of sovereign risk for Rio at Simandou over the years.

The company originally controlled all four mining tenements in the Simandou mountains, but the Guinean government confiscated half of the acreage in December 2008 and awarded it to Israeli diamond magnate Beny Steinmetz.

A Swiss court would later convict Steinmetz of bribing foreign officials to obtain the Simandou acreage.

In 2014, Rio filed a spectacular lawsuit in a US court, which accused the world's biggest iron ore miner - Brazilian giant Vale - of conspiring with Steinmetz to strip Rio of the Simandou leases.

Rio and Vale spent much of 2008 in secret talks over a deal that would have seen Rio sell a portion of its four Simandou tenements to Vale.

In documents filed to the US District Court for the Southern District of New York, Rio accused Vale of entering those talks with fraudulent intent.

With its claims of racketeering, theft, conspiracy and corruption, Rio's lawsuit read like a movie script. But by November 2015 it had been dismissed because the alleged events had occurred beyond the statute of limitations.

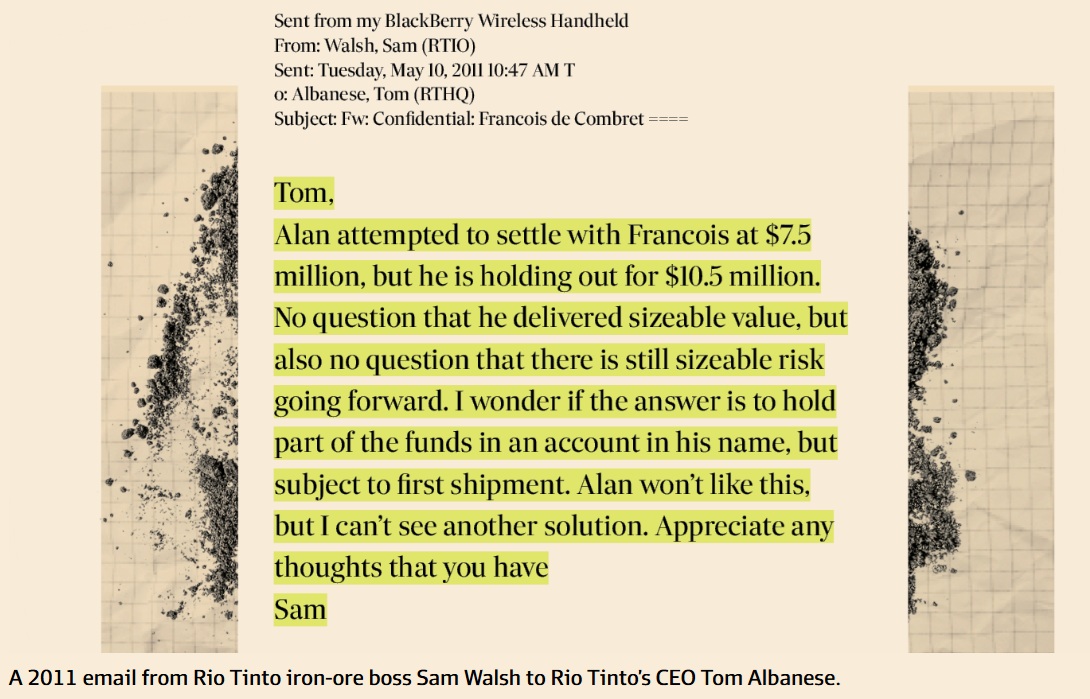

The following year in 2016, the spotlight would turn to Rio's dealings in Guinea, when a series of leaked emails sparked a reputational crisis for Rio.

The leaked emails were from 2011, and showed Rio executives discussing a $US10.5 million payment to a political consultant named Francois Polge de Combret, whose close relationship with then Guinean President Conde helped ensure Rio kept possession of half the Simandou tenements.

The leaked emails triggered the termination of three Rio executives and corruption investigations in the US, UK and Australia.

To this day, the Australian Federal Police have a live investigation underway into the 2011 payments. De Combret will never see the result of the AFP investigation; he died on October 8.

Will African iron ore break Australia's stranglehold?

Australia will ship about 905 million tonnes of ore this year, well above the 93 million tonnes that are expected to leave Africa.

But by 2027, the Department of Industry expects African iron ore exports to rise to 140 million tonnes.

The volume growth will come from a list of nations that includes Guinea, Liberia, Mauritania, Sierra Leone, Morocco, Algeria and Kenya. The department expects those nations to grow exports to 87 million tonnes in 2027, up from 27 million tonnes in 2024.

For comparison, Australian miners are tipped to grow volumes by 30 million tonnes between 2024 and 2027.

Extra supply always weighs on commodity prices, and the downward pressure could be doubly strong if demand from steelmakers fades at the same time as African miners ramp up volumes.

British investment bank Panmure Liberum believes global demand for finished steel will peak this year at 1.9 billion tonnes then fall in each of the next four years to reach 1.788 billion tonnes by 2029.

Panmure Liberum believes iron ore prices will slide to average between $US68 and $US71 a tonne (including the cost of shipping to China) in each of the next five years.

That's well below the $US107 a tonne seen in October, and Panmure's forecast would push some marginal Australian mines into mothballs.

Every $US10 fall in the average iron ore price for the year ahead will put a $500 million hole in federal tax receipts and decrease Australia's nominal gross domestic product (GDP) by $2.5 billion.

The new African mines will have one clear advantage over their Australian rivals; they will generally produce ore with higher iron content, which fetches higher prices.

Most ore shipped from WA contains between 55 per cent and 61 per cent iron.

But GenMin's Gabonese ore will contain between 63 and 66 per cent iron, Simandou ore will contain about 65 per cent iron, while Ivanhoe Atlantic's initial volumes will be ore with a staggering 67.5 per cent iron.

When Panmure Liberum forecast an iron ore price of $US68 a tonne later this decade, it was referring to ore with 62 per cent iron.

Higher prices will be paid for ore with more than 62 per cent iron and that gives Ivanhoe chief Barnes confidence her $US120 million Kon Kweni mine can be viable even if "benchmark" prices slide.

"We are very comfortable that the iron ore price will hold particularly for the high grade," she says.

CRU Group's Gao doesn't expect African mines to cut Australia's lunch; by 2030 she expects Africa will have 10 per cent market share.

"There are lots of projects in Africa, but we think it will be challenging to bring them all to the market. High transportation and infrastructure costs, geopolitical uncertainty, and restricted power supply will remain key constraints in bringing African iron ore to the seaborne market," she says.

"The cash costs of operations like Simandou are likely to sit in the third quartile of the [cost] curve, while the Australian majors will continue to dominate the first and second quartiles."

Gao says Simandou will largely replace retiring mines and result in only a "small net addition to the seaborne iron ore market".

Even if the wave of new supply from Africa drove iron ore prices down to $US68 a tonne, the Australian mines of Rio, BHP and Fortescue would still be profitable.

The cost of shipping ore from West Africa to China is expected to be three times the cost of shipping from the Pilbara to China.

"The one fact of life that cannot be changed in the iron ore business globally is you can't move Brazil nor West Africa closer to China. Australia will have the same shipping advantage over African miners as it has had over Brazilian miners," says Clinton Dines, who served as BHP's China president between 1998 and 2009.

Dines is now a director of London-listed Zanaga Iron Ore, which hopes to develop a $US1.94 billion mine in the Republic of Congo. Zanaga's investors include former Anglo American chief Mark Cutifani, former Xstrata boss Mick Davis and Rio's former head of business development and strategy, Phil Mitchell.

Dines reckons the rise of the African iron ore industry is not something Australia "needs to panic about", even if it drives down prices for the commodity.

"BHP and Rio are going to be profitably selling Australian iron ore for a very, very long time," he says.

Source: https://www.afr.com/interactive-freeview/2025/african-iron-ore/

Bear77 disclosure: Not holding FMG, MIN, BHP or RIO currently. I do have a position in RHI (Red Hill Minerals, in my speccy stock portfolio only) who have some iron ore and gold projects and interests, mostly in WA's Pilbara region, as well as a few royalties including one royalty that covers all of the iron ore that MinRes (MIN) mine at their Onslow Iron Ore project.

I am interested to see how Simandou and other potential iron ore supply out of West Africa pans out over the next decade, but I'm not particularly bullish on iron ore in general, so I have very limited exposure to it.

Friday 8th August 2025:

The Unbelievable Story of How Fortescue Beat the Odds [Money of Mine podcast 8/8/2025]

https://www.youtube.com/watch?v=M9mGIKuqyWY

Aug 8, 2025 Money of Mine Podcast

Show notes:

Today’s episode is an exploration into the story behind one of Australia’s greatest business success stories, Fortescue.

The company has paid over $42B in dividends in its brief history, which began at Andrew Forrest’s kitchen table just 22 years ago. Within a few years it was one of the largest companies in the nation as it smashed through records while creating its foundation at Cloud Break.

We focus in on the first 5 years, looking to relive the highs and lows, while attempting to understand the attributes that separated FMG from the pack.

CHAPTER TIMESTAMPS

00:00 The Rise of Fortescue: A Story of Wealth Creation

00:36 The Early Years: Controversies and Challenges

02:23 Twiggy's Pre-Fortescue Ventures

09:13 The Birth of Fortescue

16:40 Building the Dream Team

18:16 Aggressive Expansion and Exploration

30:17 Infrastructure Ambitions and Market Dynamics

36:50 Cracking the Geological Code

38:22 Discovering Cloud Break: A Game-Changer

40:21 The Metallurgical Breakthrough

42:14 Strategic Moves and Market Reactions

53:07 The China Financing Debacle

01:00:22 Land Access Negotiations and Controversies

01:03:05 Innovative Mining Techniques

01:06:11 Rail and Infrastructure Developments

01:07:34 Financial Challenges and Strategic Partnerships

01:08:57 Legal Battles and Regulatory Scrutiny

01:12:06 Securing EPCM Contracts and Major Deals

01:16:36 Equity Investment and Loan Details

01:16:49 Fortescue's Financial Manoeuvring

01:19:17 The Clock is Ticking: Securing Funds

01:22:20 Bond Rating Drama

01:27:01 Construction Challenges and Triumphs

01:33:12 Cyclone George and Its Aftermath

01:36:01 Fortescue's Meteoric Rise

01:39:52 Reflections on Fortescue's Journey

01:40:19 The Entrepreneurial Spirit

01:41:09 Lessons from the Past

01:42:22 Innovative Approaches and Cultural Impact

01:46:01 The Role of China and Market Dynamics

01:49:59 Twiggy's Unique Leadership

01:53:04 Final Thoughts and Legacy

-------------------------------------------------------

DISCLAIMER

All information in this podcast is for education and entertainment purposes only and is of general nature only. The hosts of Money of Mine are not financial professionals. Money of Mine and our contributors are not aware of your personal financial circumstances. Before making any investment decision, you should consult a licensed financial, legal or tax professional. Money of Mine doesn’t operate under an Australian financial services licence and relies on the exemption available under the Corporations Act 2001 (Cth) in respect of any information or advice given. MoM strive to ensure the accuracy of the information contained in this podcast but we don’t make any representation or warranty that it’s accurate or up to date. Any views expressed by the hosts of Money of Mine are their opinions only and may contain forward-looking statements that may not eventuate. Please read the full Disclaimer here: https://www.moneyofmine.com/c/privacy...

------------------------------------------------------------------------------------------

Source: https://www.youtube.com/watch?v=M9mGIKuqyWY

Disc: Not holding since I went bearish on iron ore last year.

Scroll down - latest update is at the bottom...

28-Dec-2021: Their 12-month share price graph suggests to me that the FMG SP has been trying to push through $25 and has failed to do so on a number of occasions in CY2021. Every time it gets there a sell-down has followed, and the biggest of those was down to sub-$15 in Oct/Nov. FMG looks to be heading NE again now, however I don't know how many times it will take for them to break through $25 with conviction. My guess is that we'll know it when we see it because they'll go on to at least $30 in a relatively short space of time when it happens.

I'm not a huge iron ore bull, not by any stretch, however I very much like the new direction that Twiggy is taking this company, particularly the Clean & Green Hydrogen, and his carbon neutral target - by 2030 - see here: Climate Change and Energy | Fortescue Metals Group Ltd (fmgl.com.au)

I think that Andrew ("Twiggy") Forrest has the billions and the willpower and passion to make this happen. He has always set the bar high, with difficult targets to achieve, but he's achieved them all so far, and I'm backing him to continue to do so. He's a man who wants to leave a positive legacy behind and be remembered as somebody who did the right thing and did what he could to improve the world for future generations. It's a powerful combination, having lots of money and lots of passion, and the willpower and determination to achieve things that matter. He also has a wife that is 100% behind him, or rather alongside him - they both want to create a lasting positive legacy and they're doing a pretty damn good job so far.

I understand of course that people doing good things partly or mostly via their control of a public company isn't always going to also provide the best investment option for ordinary retail investors. However, in this case, the vast majority of Twiggy's own wealth is via ownership of FMG shares (he owns nearly 37% [36.74%] of FMG through his family company, Minderoo, and FMG is a now a $59 billion company, so Twiggy's FMG shares are worth over $21 billion) and I therefore conclude that it's in his own best interests for him to keep the FMG share price as buoyant as he can.

A decent FMG share price underpins Twiggy's ability to do all of the stuff that he does outside of FMG with his extensive philanthropy and other business ventures. I doubt that he would do anything to sink the company's share price, certainly not intentionally. I expect him to continue to promote FMG as a positive investment at every opportunity, as he always has, and to always seek to add value at FMG rather than lead them down a path that ultimately results in lower profitability and lower total shareholder returns.

Those reasons also underpin my belief that FMG is likely to continue to provide a very good source of fully franked dividend income, as they have over the past year. This is also needed by Twiggy for his philanthropy and other business ventures, because he funds them primarily from his FMG dividend-derived income.

Regarding iron ore specifically, because let's not kid ourselves, iron ore prices will continue to have a huge impact on investor sentiment and therefore the share prices of iron ore producing companies: I am happy that FMG now have got their C1 cost/wmt (wet metric tonne of iron ore) all the way down to around US$15 to $15.50.

That's their latest guidance, given at their AGM in November, and it's also interesting to note that they have now provided FFI (Fortescue Future Industries) expenditure guidance as well. There have been some commentators suggesting that FFI (which includes the foray into Green Hydrogen power) was going to drain all of the iron ore profits out of FMG leaving shareholders with very little in the way of income or capital growth. Clearly with a targeted FY22 capital expenditure (capex) of US$400 to $600 MILLION for FFI, compared to their iron-ore-related FY22 capex target of US$2.8 to $3.2 BILLION, that is not going to be the case. They are not throwing the farm at this. They are moving into clean and green in a sensible and measured way. In other words, it is going to happen, but it won't happen overnight.

Most people here would be familiar with the flywheel analogy, and here's how FMG see it applying to them:

Additionally, they use a similar method to explain their plans for FFI:

I do not usually take much notice of broker consensus calls and expectations, or their price targets, but I often get interested when most brokers are neutral or negative on a company whose share price is rising, particularly when I personally believe the company has some strong tailwinds, great industry position, and excellent management. Here are the most recent broker calls on FMG according to FNArena.com:

As you can see, we have 4 hold/neutral calls, 2 sell/underweight calls, and only one buy/outperform, which is from Macquarie. That is of course just the 7 brokers that FNArena.com covers. Here's the broker/analyst sentiment according to Commsec:

So Commsec (or their data provider at least) believe there are only 3 positive views on FMG from the 17 brokers that that cover FMG (that are covered by Commsec's data provider).

Not exactly a market darling. Yet the share price has been rising since early November. My personal view is that the brokers and analysts are seeing better shorter-term opportunities elsewhere, and are not really looking at FMG as a 5-year-plus investment. Over 5 to 10 years I think I'll do very well in FMG, in terms of total shareholder returns (capital growth plus dividends), so I bought FMG in two of my real life portfolios during the first half of December at prices ranging from $17.22 to $19 per share. I was buying them at $17.22 on December 3rd, bought more at $18.01 on the 10th, and bought more on the 20th at $19/share. Averaging up for a change, instead of averaging down.

I think broker views and broker calls will likely continue to mostly be behind the curve with FMG, and they will try to play catch up, but may rarely get ahead of what the share price is doing. It seems to me that most people who hold FMG are not doing it based on broker calls, but are instead doing it because they personally believe in the man, his vision, and the company that he has built, and its future prospects.

Not all, but most. And I could be wrong, but that's the impression I get.

OK, from a fundamental POV, have a look at their key metrics, particularly profitability:

Sources: Above: FNArena.com, Below: Commsec (https://www2.commsec.com.au/)

They are HIGHLY profitable!

While there is always commodity-exposure-risk with any miner, especially a miner that only mines a single commodity at this stage, this company has zero net debt. Gearing (ND/E) = negative, i.e. No net debt. Cash on hand of US$6.9 billion and net cash of US$2.7 billion at 30 June 2021. $2.7 billion is a handy net cash buffer to have, especially when your costs are so low, and your margins are so high. To put that into some perspective, FMG could easily survive a prolonged period of unprofitability if that was to occur (something that would drive most smaller companies to the wall), however for FMG to NOT be profitable, the iron ore price would have to half, and then halve again, and then halve again, and then drop a bit further (i.e. reduce by over 90%) and even then they would likely be at around breakeven if not barely profitable.

As long as iron ore prices stay above US$20/tonne I think we're good.

Here's how FMG currently view iron ore demand:

Obviously, Vale's issued (in Brazil) have a fair bit to do with the supply constraints they mention there, and I've been expecting Vale to get on top of those issues for a while now (like, over a year) and they really haven't. But they will, sooner or later. However, I'm not getting too caught up in the big (macro) picture here, I'm looking at FMG as an investment regardless of the commodity that they are involved in. And I'm not trying to predict the supply/demand outlook too much. They are VERY profitable, are spitting off a LOT of cash, much of which is being returned to shareholders, they have a VERY solid balance sheet, and exciting plans for the future.

They will remain highly profitable at MUCH lower iron ore prices. That's the main point that sets them apart from a lot of other miners.

Check out their latest (November AGM) presso here: fortescue-agm-presentation-2021.pdf (fmgl.com.au)

And their plans for establishing a Green Energy manufacturing hub at/near Gladstone in Queensland here: 2279422.pdf (fmgl.com.au)

And their CEO transition announcement here: fortescue---transition-and-leadership-change.pdf (fmgl.com.au)

That is regarding their CEO position, which is not a thesis breaker IMHO, because Andrew Forrest will continue to be the main driving force behind the company and he is remaining in his Chairman role. He is listed as being a Non-Executive Chairman, but make no mistake, as the man who founded the company, built it up to what it is today, and still owns almost 37% of it, he isn't just along for the ride, he is steering this ship.

Twiggy is now Dr Andrew Forrest, due to his PhD in marine science – see here: The doctor is in: 'Twiggy' Forrest gets PhD in marine science (smh.com.au)

He has been passionate about cleaning up the world’s oceans and protecting marine life since he was a child (see story linked to above).

Further Reading: Australia's Fortescue sets sights on becoming world's first supplier of green iron ore | Reuters

Fortescue Future Industries (ffi.com.au)

Presentations and Webcasts | Fortescue Metals Group Ltd (fmgl.com.au)

FMG’s Solomon Hub in Western Australia

FMG’s Iron Bridge Magnetite project in Western Australia

One of FMG’s trains hauling iron ore to Port Hedland for shipping to China

One of FMG’s iron ore haulage vessels (ships)

“Back at the Ranch”: When Dr Andrew (“Twiggy”) Forrest AO made his mining fortune, he bought back his family’s farm. He has since become one of the largest landholders in Western Australia.

Disclosure: I hold FMG shares in real life.

26-March-2023: Update: Another one marked as stale...

The investment thesis in a nutshell is that Twiggy has turned FMG into one of the world's lowest cost producers (3rd lowest cost in the world I believe, behind only BHP & Rio, and ahead of Vale, although I haven't checked on that recently), and at current iron ore prices, FMG are VERY profitable. The Iron Ore price would have to fall a very long way to put FMG's profitability under serious threat.

The fact that the company is churning out good profits and returning a good chunk of that cash to shareholders in the form of dividends is enough on it's own to form a decent investment case for FMG, but the thing that interests me most about the company is FFI - Fortescue Future Industries, and the push to develop green hydrogen and other alternative green energy sources and to turn FMG into the world's first carbon neutral iron ore miner. FFI will burn cash for years until they achieve some commercial success with these new technologies, and that's the risk, however the upside potential of being at the forefront of this should not be overlooked. To date, Twiggy shows no signs of wanting to burn up all of FMG's iron ore profits by going too hard into green hydrogen and the rest of it. He's being quite measured in the way he is going about it, in my view, as underlined by these generous dividends we keep receiving, despite the FFI expenditure.

So, $30/share as a price target (PT, a.k.a. TP: Target Price) might seem a little high, but if you look at how FMG has trended in prior years, it wouldn't take much for them to get there. Just better sentiment around iron ore, the iron ore price, and FMG in particular. It might not happen this year, or next year, but they're going to $30 and beyond at some point. This is a very well run company, and Twiggy Forrest is no mug, he's a very smart and passionate operator. Never underestimate a billionaire with heaps of passion who's prepared to put his own money where his mouth is.

Disclosure: I hold FMG in two of my main real life portfolios as one of the largest positions - it's currently the second largest position in both portfolios, which includes my SMSF (where NST is the larger position). In the other portfolio, Codan (CDA) is the larger position. FMG is also my third largest position here in my Strawman virtual portfolio. (CDA and NST are the larger positions)... So, yeah, I'm a fan.

Thursday 23-Nov-2023: Update: Marked as stale once again - and no change to my $30 price target once again, and they're closer now than they've been since 2021:

Just above $25/share does seem like a strong resistance level that they can't seem to break through - so far they have not remained above $25 for long - they dropped back below $25 again today after closing above $25 for the previous 6 trading days.

Not a bad 5-year return, eh?! Compared to the XJO in particular which many fundies use as their benchmark index - the S&P/ASX200 Total Return Index - which includes all dividends and distributions reinvested back into the underlying companies; the FMG return there does NOT include dividends, and in recent years there have been some nice dividends(!) which would add significantly to the +578.31% return shown there for FMG for the past 5 years. Note - those returns are not per annum, they are the total return over the 5 year period.

But yeah, I'm guessing they'll punch through that resistance level and go on with it at some point - so happy to keep a $30 PT for now.

There have been some orange flags lately (not red ones), including Twiggy and Nicola announcing that they've separated - and that there will be no change to the way they manage FMG, their private family investment group, Tattarang, or their Minderoo Foundation, and that they have no immediate or current plans to sell any of their FMG shares. There is also the number of KMP at FMG who have left in recent months - their CEO (Fiona Hicks), their CFO (Christine Morris), Fortescue Future Industries Director, Guy Debelle, and Laura Woodall, the long-term right-hand woman to successive chief executives.

There have been rumours that Andrew "Twiggy" Forrest is a difficult man to work for and that he doesn't like to be argued with, especially by his own employees. Speaking to 9News on 30 August, Dr Forrest shed some light on the shock departure of Ms Hick, less than six months into the CEO role and a mere 48 hours after the company’s 20-year anniversary celebration at a Pilbara mine site. Dr Forrest was asked whether Ms Hick left of her own accord or if she was pushed out. “Fiona was given a choice to make and she chose, so I’d say she wasn’t pushed,” Dr Forrest told 9News. At that point the company hadn't yet announced who would be replacing those people.

Source: https://miningmagazine.com.au/fortescue-mass-exodus-continues/

A few days later, in early September, Andrew O’Dowd, FMG’s GM of Operations Planning handing in his notice. He was the fifth exit of a key senior lieutenant at Fortescue within a week.

That article lists 17 people who have left FMG, Tattarang, Minderoo or Wyloo (controlled by Tatarang) since 2021, however those entities together employ thousands, including maybe one hundred or more executives, with perhaps 40 or 50 of those being KMP/senior executives, and some of those 17 (mentioned in that "West Australian" newspaper article) were not particularly high up (not senior management/KMP). Also, many of the moves may have been due simply to better job offers or new opportunities/challenges elsewhere.

Still, the terms "revolving door" and "exodus" were being used in relation to FMG quite a bit in August and September - particularly by the media - and it's not a good look. And I would call it an orange flag.

But not red flags. And the market has sold them down on each negative news item - and then bought them right back up again. I've trimmed my FMG positions in recent weeks but they remain large positions in my real life portfolios. FMG has become a smaller position here in my SM virtual PF but only because I've sold most of them to buy some MIN and DVP which I believe are likely to have more near/mid-term upside from current levels. But I remain adequately exposed to FMG in real life. They've been an excellent performer in terms of total shareholder returns (TSRs) - more on that a little later...

And then there's the iron ore price:

Source: https://tradingeconomics.com/commodity/ironore62

On the rise, yes, but not looking like we're going to see a 2023 peak of over US$150/tonne like we did in 2022 or prices over US$200/tonne that we saw in 2021.

It looks like US$130 - around where it is now, is the year high - to date, and if it put on another US$10 or $20, that would be a nice Chrissy Present.

Of course, FMG has some of the lowest costs now of all of the majors, way down at US$17.54/wmt (wet metric tonne) in FY23 (US$15.91/wmt in FY22). Their average realised price received for their iron ore was US$94.74/dmt (dry metric tonne) in FY23 (US$99.80/dmt in FY22).

Their FY24 Production Guidance is for 192 - 197mt, including approximately 7mt from Iron Bridge (100% basis) at a C1 cost for Pilbara hematite of US$18.00 to US$19.00/wmt and a C1 cost for Iron Bridge high grade magnetite concentrate of US$45/wmt (Iron Bridge production will sell for higher prices because it will be up to 67% Fe; their Pilbara hematite has traditionally been below 62%).

Perhaps you can see from those numbers why I say that FMG can not only survive but indeed continue to thrive with substantially lower iron prices than what we have now, and if the iron ore price instead goes up, happy days!

Source: https://fortescue.com/investors/results-and-operational-performance/fy23-full-year-results

And: https://www.syfe.com/au/learn/fortescue-metals-group-the-story-so-far-in-2023/ [27-July-2023]

Brazil's Vale claimed in 2021 to be the World’s most efficient iron ore producer with long-term C1 costs estimated at $15/tonne (although closer to $30/tonne when adding transportation costs to Asia’s main ports according to ratings agency S&P) however it is my understanding that Vale was hit particularly hard by the Covid pandemic in Brazil and their costs have increased.

Just on costs:

- C1 cost represents the ‘direct’ production costs of iron ore and is a commonly quoted figure. However, it does not represent the full cost of production;

- Delivered cost includes the C1 cost, plus shipping, royalties and overhead costs; and

- All-In cash cost is the delivered cost, plus interest and sustaining capital expenditure.

And on Wet vs Dry Ore (wmt vs dmt):

- Production is usually quoted in terms of wet metric tonnes (wmt), and the iron ore price is based on dry metric tonnes (dmt)

- To adjust from wet to dry tonnes, an 8% reduction is applied to the wet tonnes to adjust for moisture content

And I should point out that the iron ore price chart above shows the Platts 62% Benchmark price and FMG have been paid anywhere from 70% (in 2021) to 86% of those prices (in 2022). This is because they have been producing iron ore below the 62% grade, however they have spent billions developing and commissioning their Iron Bridge Project, which is designed to deliver magnetite of up to 67% grade, and Iron Bridge achieved first concentrate loaded on ship in July (2023).

The updated life of mine C1 cost attributable to Fortescue for Iron Bridge is estimated at US$45/wet metric tonne, with C1 cost guidance for all of their other iron ore production in FY24 to be between US$18.00 - US$19.00/wmt.

Still low cost, and there's also more to FMG now that just iron ore too.

Fortescue Energy

- Fortescue formalised the structure for Fortescue Energy in late FY23, comprising the following integrated segments:

- Fortescue Future Industries: Green energy project development and production

- Fortescue WAE: Battery and fleet technology development and manufacturing

- Fortescue Hydrogen Systems: Electrolyser and hydrogen production systems development and manufacturing.

- Fortescue Energy has prioritised and progressed its global portfolio of green energy projects, with a target of five Final Investment Decisions by the end of calendar year 2023.

- Ongoing focus on priority projects in Australia, United States, Norway, Brazil and Kenya.

- Advanced offtake discussions underway with Australian, European, American, and Asian customers for green hydrogen and derivatives.

- Completed construction works on the 2GW Gladstone electrolyser manufacturing facility.

- Commenced manual assembly of in-house designed proton exchange membrane (PEM) electrolyser stacks, with automated assembly line due for delivery and installation in FY24.

- Advanced development of technology and Intellectual Property to underpin decarbonisation of Fortescue Metals, including testing of green haul trucks and fast charger.

- Expanded WAE’s battery and electric power train production operations in the United Kingdom to focus on zero emission products for the off-road sector.

- Continued research and development into green iron and green steel including agreements with China Baowu Steel Group and Primetals and Voestalpine.

- Positive momentum in global policy environment, including Inflation Reduction Act in the United States, Green Deal Industrial Plan in Europe, and Hydrogen Headstart program in Australia.

Source: https://fortescue.com/investors/results-and-operational-performance/fy23-full-year-results

Latest News:

21-Nov-2023: 2023 Presentation – Annual General Meeting

21-Nov-2023: Green-Energy-and-Green-Metals-Projects-Approved.PDF

17-Nov-2023: Fortescue-to-Establish-a-Major-US-Manufacturing-Facility.PDF

16-Nov-2023: Launch-of-Fortescue-Capital.PDF

26-Oct-2023: September-2023-Quarterly-Production-Report.PDF

20-Oct-2023: Climate Transition Plan

12-Oct-2023: Pilbara Operations Site Tour Presentation October 2023

Plenty Happening!

And then there's this, from their AGM Presso on 21st November (this week):

Hard to argue with that! Click Here to check out the rest of the slides in their 2023 AGM Presentation - there's some really interesting ones.

Disclosure: Yep, I sure do!

--- --- ---

31-May-2024: Update:

Happy with the price target - they've tagged it a couple of times in the past year and then retraced, but I'm confident they're going back up to $30 again, and eventually beyond that level. This one was marked "stale" so I'm refreshing it and updating it. I haven't changed anything I've written above - that will be good to look back on in future years to see what I got right and what I got wrong - but Fortescue is going OK at this point in time, and all remains on track.

Their latest update was on May 14th at the BofA (Bank of America) Global Metals, Mining and Steel Conference in Miami, Florida:

The following are some of the key slides (but not all of them):

That last one is reassuring in terms of FMG continuing to pay out very decent dividends (50% to 80% of underlying NPAT dividend policy) while continuing to grow the business, including the energy division.

Source: BOFA-Conference-Presentation.PDF

If you're interested in iron ore, here are links to the presentations given by some other large players across the industry at the same conference:

BHP: Bank of America Securities 2024 Global Metals, Mining and Steel Conference (bhp.com) [Note BHP were using the opportunity to talk up their bid to merge with or acquire Anglo American at that time, which they (BHP) have sinced walked away from after some serious pushback from Anglo American and a few of their (BHP's) own larger institutional shareholders]

RIO: Bank of America Global Metals, Mining & Steel Conference 2024 (riotinto.com)

There were a few other miners presenting as well, including a few that are not involved in iron ore or steel:

Ivanhoe Mines: BofA Securities 2024 Global Metals, Mining and Steel Conference – Ivanhoe Mines

IGO: BoA-Global-Metals-Mining-and-Steel-Conference-Presentation.pdf (igo.com.au)

Alcoa: Alcoa Corporation - Bank of America Global Metals, Mining & Steel Conference

Anyway, still holding FMG, and still happy with the company and its management.

28-Aug-2024: Nah, not so much now. Update:

No longer holding FMG - sold the last of them in June. I'm wary of iron ore exposure right now - I think that all iron ore miners can go lower if the iron ore price goes lower, and there's every chance that it can. FMG is one of the world's lowest cost iron ore producers - from their main Pilbara operations, not so much from Iron Bridge - so they're not going broke, just lower - most likely.

I have plenty of respect for Andrew ("Twiggy") Forrest and what he has achieved with FMG, an Australian top 20 company, and one that has been paying some of the best dividends as well as providing capital growth up until a few months ago when the iron ore price started falling and he backed away from that "Green Hydrogen or nothing!" mantra of his. There's plenty to be concerned about with FMG at this point actually, and most of it has been discussed here already, so I won't go over it again. I'm sure I'll be back in at some point - FMG is my preferred exposure to iron ore, it's just that I don't want ANY direct exposure to iron ore right now.

They reported today and the market wasn't overly impressed (FMG -1%) but the market was down today so not too bad in that context, however they cut their final div to 89 cents (from $1 last year, and the $1.08 interim div this year) and I expected that - lower profits on lower prices, with a bleak near-term outlook, what do you expect? That is one of the reasons I jumped off the FMG train a couple of months ago.

The iron ore miners are attempting to put a positive spin on the situation (the declining global demand for iron ore at this point, mainly driven by China significantly reducing steel production) but the numbers don't lie. As I said, FMG have very low costs, so they're NOT going to become unprofitable, they'll be one of the last iron ore producers standing if iron ore really goes down the dunny, but they're also unlikely to provide me with my best short term returns from here at this point in time, in my opinion, so I'm out.

For people with an investment time horizon of over 5 years, and especially around 10 years or longer, FMG is probably a good pick-up at below $20/share for a super fund or other set-and-forget type portfolio, but that's not where I'm at right now.

26-Feb-2025: Update: Lowering PT to just above $15 downside resistance level:

I'm not bullish on FMG at all now, and I've explained why in a lengthy straw today, titled "How Low can they go?", which I'll make public in a minute.

Disc: Not Held - sold out last year.

24-July-2025: Update: Raising PT to just below $20 (from $15.20):

I'm not holding FMG and I remain neutral to bearish on iron ore in the medium term, no idea about the short term, and longer term is tricky because of all the new supply that is going to come online progressively over the next decade and whether demand will exceed that extra supply over that period, so I'm personally staying away from iron ore companies at this point.

However, I like a couple of things about the FMG-June-2025-Quarterly-Production-Report.PDF that they released today, and so does the share market with FMG up over +4% (although we still have a few minutes left in the trading day) while BHP is down and RIO is flat.

In a nutshell, FMG are keeping their costs low, which is a good thing for them as their iron ore tends to be of a lower quality (lower percentage of Fe) compared to BHP and RIO, except for FMG's higher grade Iron Bridge Concentrate - of which they produced 2.4Mt in the quarter for a total of 7.1Mt in FY25. It's worth noting however that Iron Bridge is still struggling to ramp up with today's reports saying:

- Update on the staged ramp up of Iron Bridge, with nameplate capacity of 22Mt per annum anticipated to be achieved in FY28 amidst further process optimisation.

But back to their costs. The vast majority of their production is Hematite ore, and their C1 cost for Hematite was US$16.29/wet metric tonne (wmt) in Q4 FY25 and US$17.99/wmt for the full year (FY25). That was 1% lower than FY24 and is their first annual cost decline since FY20. That's positive.

To give you an idea of the discounts FMG have to accept for their lower quality Hematite, their Hematite average revenue of US$82/dry metric tonne (dmt) for the quarter, was 84% of the average Platts 62% CFR Index.

FMG's average revenue of US$85/dmt in FY25 represents both that Hematite production and their Iron Bridge Concentrate revenue of US$108/dmt for the quarter (100% of the average Platts 65% CFR Index and 111% of the average Platts 62% CFR Index).

It's clear why they badly want to get Iron Bridge up to nameplate capacity! Much better prices for that concentrate compared to their Hematite DSO which represents the vast majority of their production.

Here's a snapshot of Page 4 of their quarterly today:

The Good:

- Exploration continues in Australia, Gabon, Argentina and Peru;

- They are starting to kill off some of their ambitious Hydrogen projects, and the two that this report names as having been axed are the Arizona Hydrogen Project and the PEM50 Project in Gladstone, Australia. To be clear, I'm all for progressing clean energy and renewables, alternative energy solutions, etc., but Twiggy has been far too much, "My way or the Highway; and I'm building this stuff whether it makes financial sense or not!!", hence his revolving door at FMG's C-suite, however he is clearly starting to accept some economic reality now and agreeing that there are more ways than just green hydrogen to skin that particular cat;

- Their FY26 expenditure guidance of US$300 mill in Capex and $400 mill of Opex for their "Energy" division (which is everything except for iron ore production, i.e. "Energy" is all of their clean & green projects) is much lower than many brokers and analysts had feared. Compare that with their FY26 expenditure guidance of US$3.3 to $4 Billion in capex for their Metals division and you can see that FMG is prioritising their core iron ore business and reducing expenditure on everything else, which is what most analysts want to hear; and

- Their C1 cost guidance (in FY26) of between US$17.50 and $18.50 per wmt (wet metric tonne) of Hematite iron ore is excellent - costs below US$20/tonne are world leading; Where FMG lose ground is with their lower realised prices due to their lower grades (as I've already discussed). But their costs are very low.

The Bad:

- Flagging pre-tax write-downs of circa $150 million relating to their Energy division projects that they've just axed isn't great, but it could certainly be worse. The problem is that it may well get worse over future years;

- While having $4.3 billion (US$) in the bank is a good look, they also have $5.4 billion in gross debt (all in US$) giving them a net debt position of $1.1 billion. The good news about that is that debt has halved over the quarter; they had $2.1 Billion of net debt at 31st March 2025. But they still have debt. Lucky they're making money, eh!?! They could be debt free (in terms of Net Debt) in either 3 or 6 months' time, so that is a good thing, but for now they have over a Bill in net debt;

- FY25 Capex was US$3.9 Billion and their FY26 Capex guidance for their Metals division is for between US$3.3 and US$4.0 Billion, so they are NOT flagging reduced expenditure there; at the top end of guidance (US$4 B) it would exceed FY25 Capex. Out of that, they are planning to spend between US$900 million and US$1.2 Billion on "Decarbonisation", so I suspect that some of that reduced "Energy" division capex has been reallocated to "Metals" because it is expected to directly impact their Iron Ore ("Metals") business. This could be seen as an orange flag by some analysts.

In summary, mostly good, but a tough sector, and they can only control their costs and their expenditure; they have bugger-all control over the prices they receive for their iron ore, and I'm not bullish on iron ore because of increasing supply and future demand being less than clear.

But the market liked it. FMG closed up +4.34% (or +79 cents) @ $19.00 today. BHP down a little, RIO up a tiny bit (+0.33%), so FMG was getting the love in the sector today on the back of their quarterly.

I am still on the sidelines with FMG, with no intentions of buying back in any time soon, however I'll add a couple of dollars to my price target for FMG anyway because of their cost control, debt reduction and renewed focus on their profitable iron ore division (meaning the cancellation of two of their green hydrogen projects).

Not enough clear upside for me to jump back onboard, but they are probably going a little higher from here, just not back to their previous highs any time soon.

26-Feb-2025: Today, FMG announced they'd increased their ownership of Red Hawk Mining Limited (RHK) from 91.57% to 95.04%, however that is immaterial since they can proceed with compulsory acquisition of the remainder of RHK (that they do not already own) once they reach 90% and they had already reached over 90% prior to this notice (Change-in-substantial-holding-from-FMG.PDF).

What has likely moved their share price today (they were down by another -6.23% today to close at $16.86/share) was their BMO Global Metals, Mining & Critical Minerals Conference Presentation yesterday (24th Feb, so presented on Monday) that they uploaded to the ASX announcements platform at 8:07am yesterday morning (25th Feb). Their SP closed down -52 cps (-2.81%) yesterday, but they were down another -$1.12/share today (-6.23%) as analysts processed their presentation and updated their models with the latest cost and capex/opex numbers.

Brokers, analysts and investors would also be factoring in additional iron ore supply that is coming and is higher grade than FMG's iron ore, more on that in a minute.

FMG still have super-low costs, however their iron ore is of lesser quality than RIO's and BHP's, so FMG don't get the full Platts Iron Ore Index (IODEX) price which is based on a standard specification of iron ore fines that contains 62% iron, 2.25% alumina, 4% silica, and 0.09% phosphorus, a standard which FMG can't meet with their lower grade ore.

Fortescue's iron ore has historically been a mix of grades, but the company has been working to increase the percentage of ore with an iron grade above 60%. They have not gotten up to that 62% standard yet, and seem a fair way off that mark TBH.

The dominant iron ore mined in Australia since the 1960s, hematite is red and typically contains more than 55% iron. This is the main iron ore type that FMG mine. Below is slide 3 from the BMO Conference deck (link above):

As you can see there, they have sub-US$20/wet metric tonne C1 costs (good!), however they have only been receiving an average price of US$85/dry metric tonne (through H1 of FY2025, so the half ending December 31st, 2024). That's obviously less than what BHP and RIO get for their own higher grade ore.

My understanding is that the numbers in the following slide are feeding into analysts downgrades:

Higher capex and opex than expected, plus, also (and not mentioned in this slide deck) more supply to come online through RIO's Simandou in Guinea (Africa’s largest mining and related infrastructure project) and the unlocking of RIO's Rhodes Ridge in WA this week with Japanese giant Mitsui making the biggest investment in its 78-year history paying $US5.34 billion (A$8.4 billion) for a stake in the Rhodes Ridge iron ore project in a bid to secure guaranteed reserves of the resource to make steel and counter the rise of China.

As Canberra and Tokyo forge close defence ties to combat the growing threat of China in the Pacific, Japanese corporations have refocused their capital on Western Australia’s Pilbara, buying $10 billion worth of coal and iron ore mines in the past six months.

That's good, right? Yes, for RIO it is, and possibly Mitsui longer term, and Japanese companies do tend to take longer term views on their investments, which is why they can pay up (higher prices than others are prepared to pay), not get into a bidding war, and have clean and quick acquisitions. It is only with a longer term view that you can justify the sort of prices that the Japanese do pay for such assets; sometimes the Japanese view is multi-generational, something that is fairly unique to Japan in my experience.

Not so good for FMG and MinRes, because it just means that another very large higher grade iron ore deposit is going to be developed sooner rather than later, creating even further supply in a market where demand isn't growing at the same rate as supply is going to.

Iron ore hunger drove Japan’s monumental $8.4b Pilbara buy

by Peter Ker, Mark Wembridge and Jessica Sier, AFR, Feb 20, 2025 – 7.48pm:

Japanese giant Mitsui has made the biggest investment in its 78-year history paying $US5.34 billion ($8.4 billion) for a stake in the Rhodes Ridge iron ore project in a bid to secure guaranteed reserves of the resource to make steel and counter the rise of China.

As Canberra and Tokyo forge close defence ties to combat the growing threat of China in the Pacific, Japanese corporations have refocused their capital on Western Australia’s Pilbara, buying $10 billion worth of coal and iron ore mines in the past six months.

Western Range will allow Rio Tinto to maintain iron ore production from WA as other reserves deplete. Krystle Wright

“This deal fits geopolitically with what Japan and Australia are trying to do in the region,” said Ian Williams, a long-time M&A lawyer between Japanese and Australian companies who now consults to Herbert Smith Freehills.

“When you’re talking about energy security and resource security, you’re really talking about security in the wider sense. And securing supply chains is all part of this diplomatic push.”

The descendants of legendary West Australian explorer Peter Wright will receive $8.4 billion for their 40 per cent stake in Rhodes Ridge, a Rio Tinto-led project that Mitsui president Kenichi Hori described as “the last remaining crown jewel in the Pilbara”.

Former Rio chief executive Sam Walsh, now a director of Mitsui, described the Rhodes Ridge deal as a “win-win for all parties involved”.

“It reflects well on the Australia and Japan relationship and certainly a great result in terms of moving the project forward,” Mr Walsh said.

Mitsui director Sam Walsh, the former boss of Rio Tinto. Jason Alden

Mitsui will need to wait five years and spend billions of dollars on construction before Rhodes Ridge produces its first ore in 2030. Rio, meanwhile, is months away from delivering its first iron ore from two joint ventures with Chinese state-owned steelmaker Baowu at the Western Range mine in WA and Africa’s Simandou mine.

The Rhodes Ridge deal is the latest Japanese investment in Australian assets. Two Japanese firms – Nippon Steel and JFE Steel – spent $1.6 billion buying stakes in Whitehaven Coal’s Blackwater mine in August, and Japanese energy utilities bought $3.5 billion worth of LNG assets last year. Australian tech darling Altium was bought by Japanese semi-conductor company Renesas Electronics for $9.1 billion a year ago.

Iron ore is Australia’s most lucrative export industry and Asian steelmakers are expected to buy close to $108 billion worth of the commodity this year.

Most analysts, including BHP and the federal Industry department, believe Chinese demand for the commodity has peaked and prices may fall as supply from new mines ramps up.

The Industry department has forecast a 17 per cent slide in iron ore prices to $US76 a tonne – excluding shipping costs – by 2026, while Treasurer Jim Chalmers has based the federal budget on an iron ore price of $US60 a tonne.

But Hori said Mitsui did not think iron ore markets would be flooded with supply.

“Strong growth in steel production is expected in India and South East Asia, leading to expectations for a continued long-term increase in global crude steel production,” Hori said on Wednesday.

“There is expected to be an iron ore supply shortage, as some production from existing mines declines, and supply from both existing mines and new developments with a high probability of completion alone will not be sufficient to meet the growing demand.”

Rio Tinto chief executive Jakob Stausholm said the valuation put on Rhodes Ridge by Mitsui should make investors upgrade their assumptions about the longevity of the Pilbara industry.

“It just tells you the Pilbara has got many, many great – not years – but decades ahead,” he said.

Japanese trading firms such as Mitsui and Mitsubishi are famous in the Australian resources sector for their “patient capital”, typically buying minority stakes in some of the nation’s biggest and best mines.

Mitsui’s deal with Wright family descendants Leonie Baldock and Alexandra Burt, who were advised by Macquarie, was conceived two decades ago.

“We have been building a relationship with the owner families since the 2000s,” said Hori. “Now, after 20 years of efforts, we have reached an agreement to acquire an interest in this incredibly scarce asset.”

At 6.8 billion tonnes, Rhodes Ridge is a giant iron ore deposit with attractive metallurgical features such as low phosphorus levels and iron grades above 61 per cent.

For context, Fortescue has shipped a cumulative total of 2 billion tonnes of Australian iron ore in the past 17 years, and it typically sells ore with less than 60 per cent iron.

The mine is slated to run for 25 years according to the approvals documents lodged with WA regulators, but Rhodes Ridge contains enough iron ore to sustain the mine for 170 years at its initial production rate of 40 million tonnes per year.

Fortescue’s mining chief, Dino Otranto, said the deal was “fantastic” for the Pilbara industry.

“It is quite a large number, which reinforces the value of the Pilbara region. It’s great to see you’ve got the Japanese taking long-term positions in the Pilbara to sustain steel demand for the next generation,” he said.

--- ends ---

Reclusive iron ore magnates $8b richer after selling to Japan’s Mitsui

by Primrose Riordan and Peter Ker, AFR, Feb 19, 2025 – 3.21pm:

Perth’s Bennett and Wright families are $8 billion wealthier after agreeing to sell the majority of their stakes in the giant Rhodes Ridge iron ore project in Western Australia to Japanese conglomerate Mitsui & Co.

The families are the heirs to the fortune made by Peter Wright, the business partner of mining magnate Lang Hancock. While Hancock’s daughter, Gina Rinehart, oversees a massive iron ore empire, the Bennett and Wright families struck a long-term partnership with Rio Tinto.

On Wednesday, Mitsui and Rio announced the Japanese giant would acquire a large proportion of the Bennett and Wright families’ stake in the partnership. The Bennett family will keep a 10 per cent stake.

Both families are already on the Financial Review Rich List. Last year, Angela Bennett, Peter’s 79-year-old daughter, had an estimated fortune of $5 billion. Two of her brother Michael’s children, Leonie Baldock and Alexandra Burt, were worth $4.13 billion.

The Bennett and Wright family tree. The deal will benefit Angela, Angela’s children and Michael’s daughters Alexandra Burt and Leonie Baldock. AFR

“[Baldock and Burt’s company VOC] does not have a strategic ambition to directly participate in the development of a project of this scale, however it wishes to see Rhodes Ridge ultimately become a production asset as part of its ongoing family legacy in the Pilbara region,” the two daughters said in a statement.

Once the transaction completes, the families will have an estimate fortune of $8 billion each, which would place them above poker machine billionaire Len Ainsworth, trucking magnate Lindsay Fox and James Packer.

More than 1200 kilometres from Perth, the Rhodes Ridge project has an estimated 6.8 billion tonnes of high-grade ore, which could make it the largest and richest undeveloped iron ore operation on earth.

The sale is a vote of confidence in the future of the iron ore industry by one of Japan’s biggest conglomerates, just one day after BHP predicted demand for the commodity had peaked and prices were likely to decline.

Rhodes Ridge will not start production until 2030 and approvals documents filed to WA regulators suggest the mine will run for 25 years.

Simon Trott, Rio Tinto’s iron ore chief executive, in a supplied photo at the Rhodes Ridge deposit.

In reality, it contains enough ore to run for more than double that period, suggesting Mitsui expects the Pilbara iron ore district to have a major role to play in global supply for many decades to come.

Mitsui published an investor briefing detailing the acquisition on Wednesday with bullish projections for iron ore demand and prices. The company expects global crude steel production to rise by 14 per cent between 2030 and 2050. It believes the ore from Rhodes Ridge will be compatible with low carbon steelmaking technologies.

The Japanese firm said it expects to make ¥100 billion per year ($1.03 billion) of cash flow from its stake in the first stage of the mine, where Mitsui will have rights to 16 million of the 40 million tonnes of iron ore produced.

The ¥100 billion disclosure suggests Mitsui expects to make about $US41 of free cash flow on every tonne sold from Rhodes Ridge. After adding the cost of mining the ore, royalty payments to governments and native title custodians and the infrastructure fees that Rhodes Ridge will pay to Rio for use of the rail and port, Mitsui appears to be banking on iron ore prices averaging between $US80 and $US100 per tonne between now and 2055.

“A pre-feasibility study to progress the development of Rhodes Ridge is expected to be completed this year,” Rio said. “The development would use Rio Tinto’s rail, port and power infrastructure.” Mitsui told the Tokyo Stock Exchange that the deal was subject to due diligence and government approvals after which the parties would enter a final agreement.

--- ends ---

The real reason for Mitsui Japan’s $8.4b iron ore grab

The trading house aims to secure its future steel supplies to South-East Asia to counter China’s influence.

by Jessica Sier, AFR North Asia correspondent [Feb 20, 2025 – 4.02pm]:

Tokyo | Japan Inc never just does business deals to make money.

Japanese trading house Mitsui’s decision this week to buy a mammoth $US5.34 billion ($8.4 billion) stake in a giant West Australia iron ore project has a lot to do with a battle with China for influence across the region.

Mitsui bought two stakes in Rhodes Ridge from VOC Group and AMB Holdings.

The acquisition of a 40 per cent stake in Rio Tinto’s untapped Rhodes Ridge project is Mitsui’s largest investment ever. Mitsui president Kenichi Hori hailed it as a “crown jewel asset” in the metals-rich Pilbara region, and came just one day after BHP predicted demand for the commodity had peaked and prices were likely to decline.

“After years of relationship-building spanning across generations, we were able to negotiate for this agreement,” Hori said in Tokyo.

The deal is part of a pattern of Japanese firms deepening their investments in resource projects in Australia partly so they can strengthen supply of steel, energy and other resources to growing Asian nations and outmanoeuvre China.

“This deal fits geopolitically with what Japan and Australia are trying to do in the region,” Ian Williams, a long-time M&A lawyer between Japanese and Australian companies, said.

“When you’re talking about energy security and resource security, you’re really talking about security in the wider sense. And securing supply chains is all part of this diplomatic push.”

According to industry sources close to the deal, Mitsui’s investment aims to enhance future supplies to South-East Asia, where construction booms in Vietnam and Thailand are driving a demand for steel and energy.

One of the world’s largest undeveloped iron ore deposits, Rhodes Ridge contains about 6.8 billion metric tonnes of mineral resources. Production is expected to begin in 2030, with Mitsui’s share initially projected at 16 million tonnes annually, eventually rising to more than 40 million tonnes.