I agree that the risk of ABB becoming a direct distributor is a negative and would impact the IPD group business model significantly.

I think investors are using Mosanto as an example when the distribution agreement with Nufarm got terminated and decided to go direct. And therefore IPD Group is overlooked as it would also have this risk despite the solid financials and shareholder alignment with directors buying after the IPO (and which also got my attention too).

But diving deeper, I think that thesis doesn't hold water for IPD Group as it does with Nufarm.

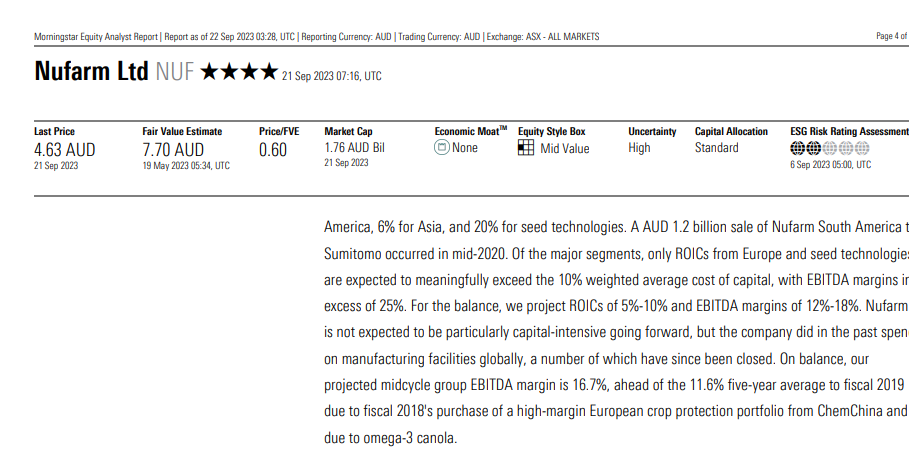

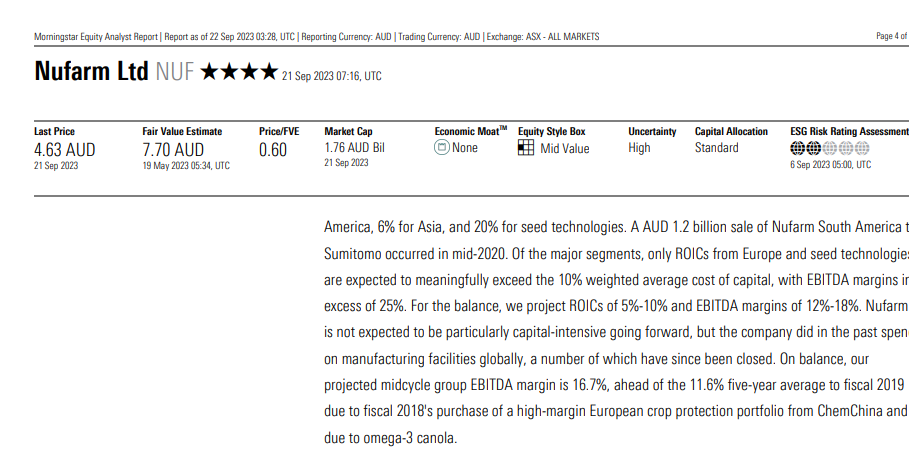

The products in Nufarm's distribution agreements are mainly crop protection. I don't think it should be too hard to sell these products and probably requires little training. Hence low barriers of entry. From Morningstar

On the other hand, most of the products being distributed by IPD requires some level of specialised expertise and experience one being trade certifications. Hence I would conclude that that sourcing and training talent to sell and implement ABB products will be difficult even for ABB.

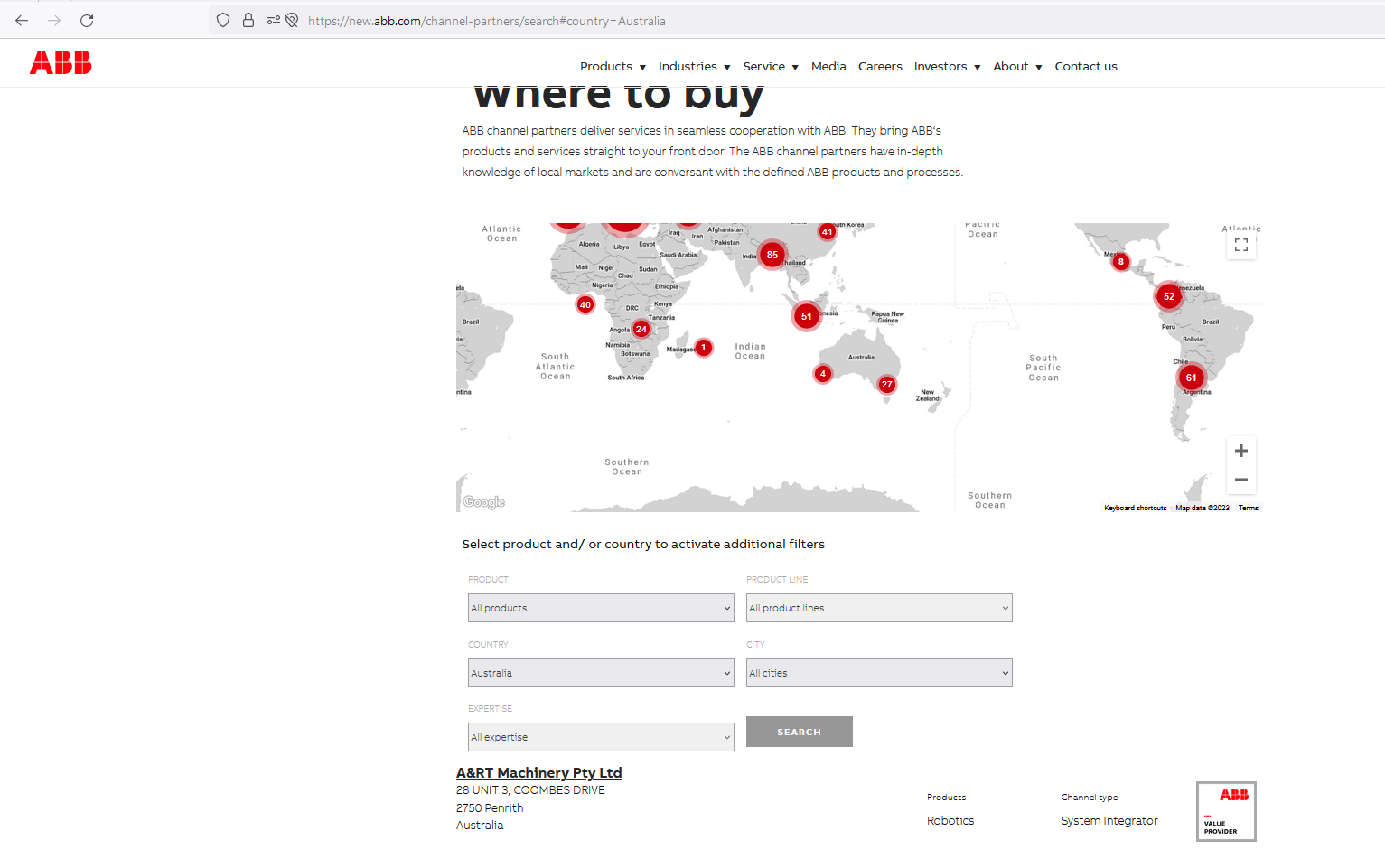

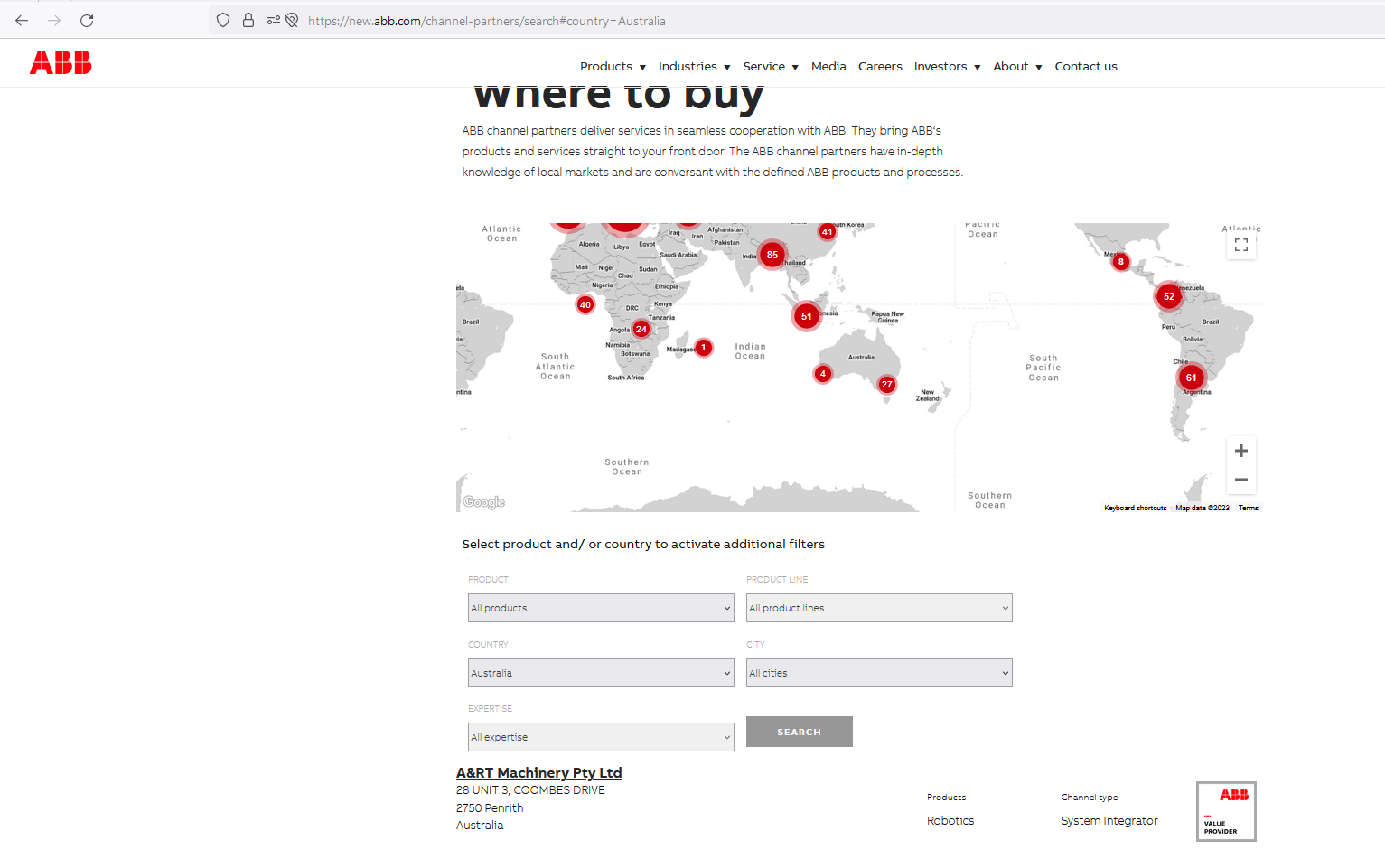

Looking at the ABB website I can't see how ABB will become a direct distributor. There appears to be many in Australia and around the world when you check the link below

https://new.abb.com/channel-partners/search#country=Australia

Obviously I'm talking my own book since I hold as well! Thus I'm happy to be proved wrong.

Also the CMI acquisition looks good on paper and could offer more diversification for IPD Group. Seems like Excelsior Capital got a good deal out of this.