@Rocket6 your post is timely from my perspective because I have recently been asking myself "What do I have to believe about Coris to buy $NAN on a pullback?"

I can't see any value at this SP, and probably wouldn't be a buyer above $3.00, even if CORIS is approved. (It looks pretty impressive tech from the recent presentations).

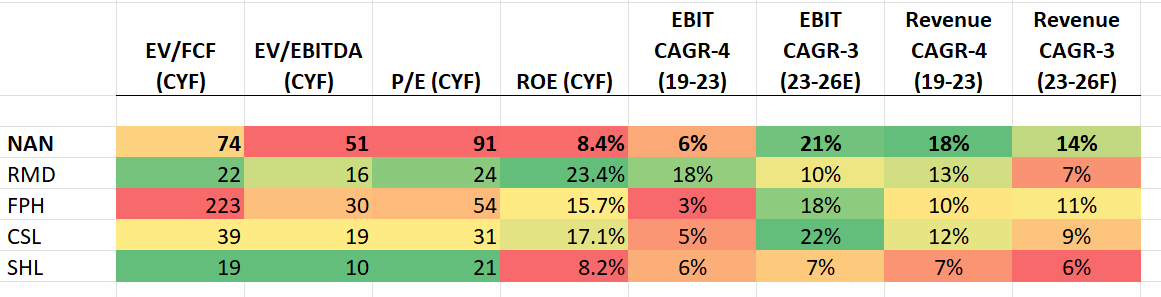

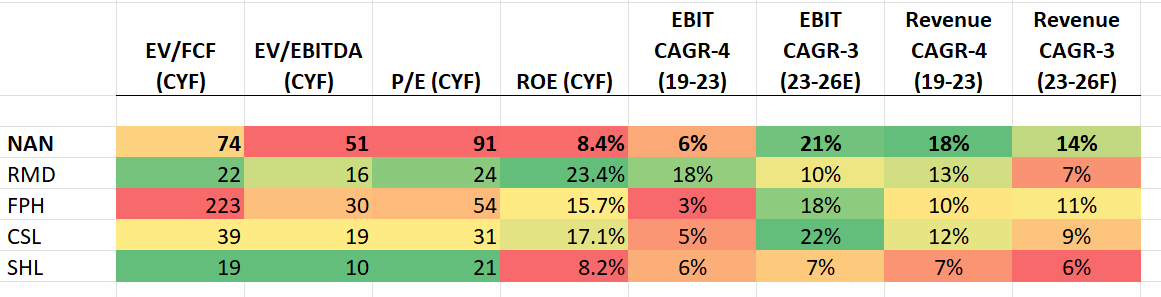

I've put some healthcare comparables in the chart below, looking at FY24(F) valuation multiples (EV/FCF, EV/EBITDA and P/E), ROE, and then historical (4-yr) and broker consensus forecasts (3-yr) for EBIT and Revenue.

If I ignore $SHL, then the average 3-yr forecast EBIT CAGR for $CSL, $FPH and $RMD is c. 17% vs. 18% for $NAN, even though $NAN is forecast to achieve much stronger Revenue CAGR at 14% vs. 9% for the other 3.

So, buying $NAN at today's prices, you are paying 2-3x on an EV/EBITDA and P/E basis to gain exposure to marginally superior earnings growth and a 50% stronger revenue trajectory.

Some notes: I'm kinda ignoring EV/FCF as $FPH delivers a dumb result because of the peak investment in their supply base. I also believe that $RMD will deliver a much stronger revenue CAGR to 2026, and accordindingly a much higher EBIT CAGR. Although $CSL, $FPH, and $RMD are much bigger and more mature companies, I believe all have the prospects for quality, long term growth into truly material, global markets.

Conclusions:

In terms of places to allocate capital, I continue to prefer $RMD, $CSL and $FPH (in descending order of preference) over $NAN at current prices. One key argument in favour of taking on the risk in investing in a small cap is they often don't have the valuation mulitples associated with their more established and larger peers. Over time, as they grow strongly into their markets, exceptional returns can be achieved as they build a track record of stable earnings growth that allows them to be valued more consistently. My view of $NAN for some time has been that its premium valuation has run away ahead of the numbers, and the growth isn't exactly spectacular,

So in answer to your question, my opinion is that not only does $NAN have the usual "quality healthcare premium" it actually has a significant valuation premium to the healthcare sector. So I think you have to be VERY bullish about Coris to justify the SP at current levels.

Disc: I hold $CSL, $FPH and $RMD in RL. I have previously held $NAN (exited in 1-April-2021 and on watchlist ever since.)

Source: marketscreener.com