In an ASX announcement this morning Dusk were quick to advise “it has not been approached by any prospective buyer or advisor in relation to a privatisation or takeover. Dusk said Ord Minnett are acting on their own initiative and do not have a mandate or arrangement with dusk in relation to this matter. We have not seen or contributed to the content of any document purported to have been prepared by Ord Minnett.”

The ASX announcement was in response to an AFR Street Talk story published yesterday (and copied below). I haven’t come across this approach before (ie. an instruction booklet on how to takeover over a company) but it probably happens all the time? I’m curious to see if anything develops from here.

Project Dawn: A flyer, a banker and a candlestick maker

“Dusk’s bombed-out share price is attracting attention.

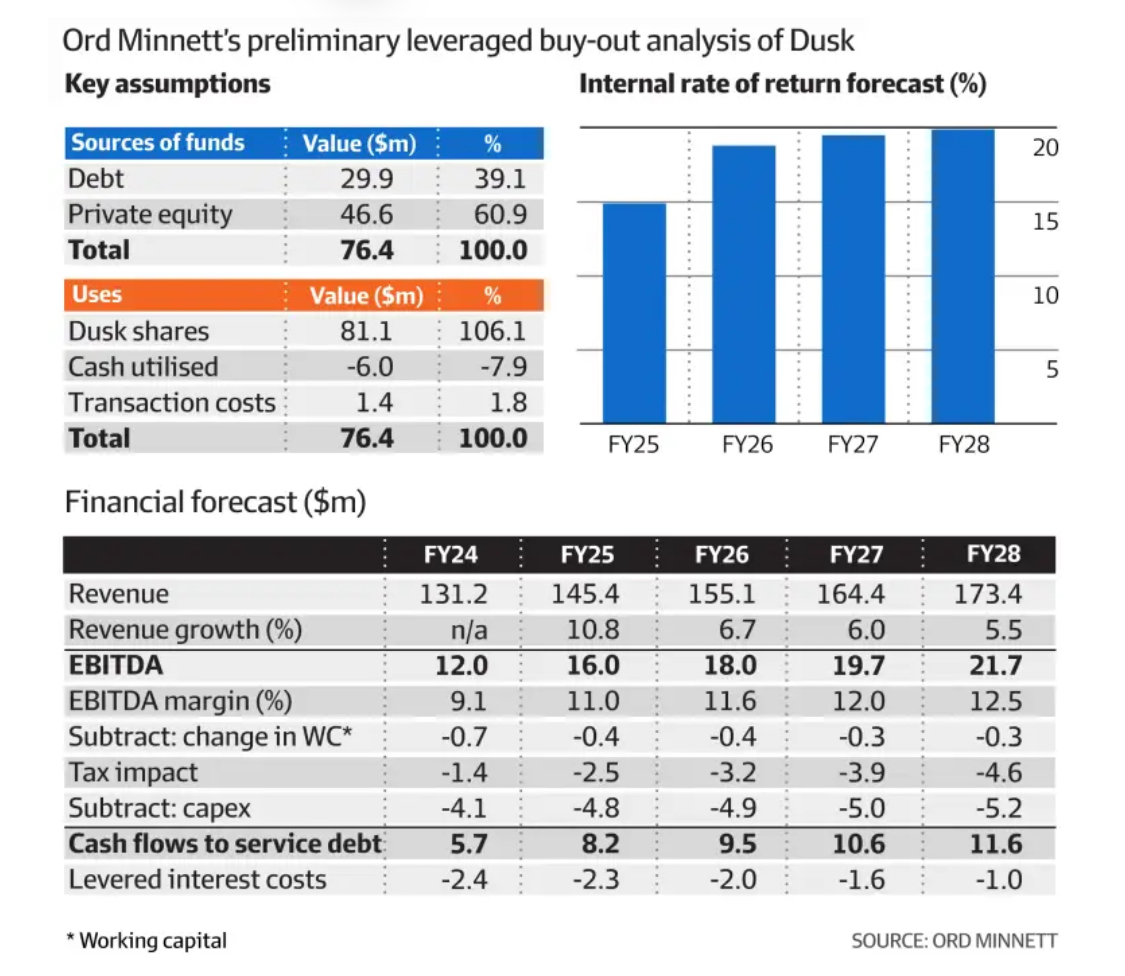

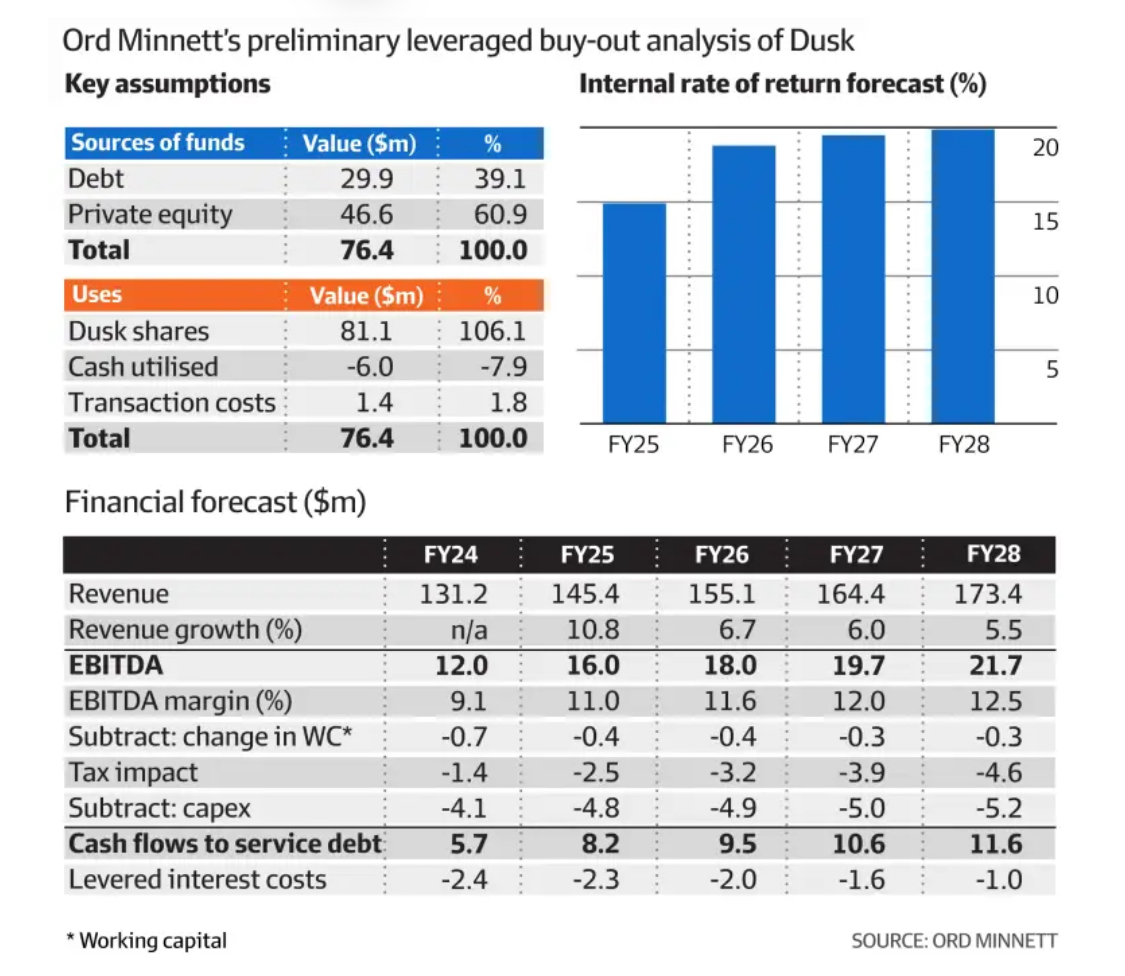

Street Talk understands stockbroker Ord Minnett is shopping around the ASX-listed candle and diffuser retailer, putting an investment opportunity flyer in front of potential acquirers.

The 43-page deck, dubbed “Project Dawn”, outlines the business’ financial performance, its abysmal trading performance since December 2021, the make-up of its register and how best to mount a takeover.

Ords recommends a scheme of arrangement via a full cash offer, which it calls a “friendly approach”, because of the strong representation of the board and management on the register.

“Early engagement with board and management who together own around 9.6 per cent of Rusk will be critical,” Ords argues.

“Board and management have a modest but important combined stake and may be influential on top institutional shareholders’ views. We believe the remaining major institutional shareholders may be open to an initial approach, and suggest early engagement to ensure alignment of interests with key shareholders.”

Ords’ friendly approach recipe aptly starts with a “fireside chat” with Dusk chairman John Joyce, followed by a formal written and verbal approach. The aim is to secure an agreed solution and receive a board recommendation.

Its alternative approach is securing a prebid stake from Dusk shareholders, including early engagement with its largest intuitional shareholder, Regal, which has a near 5 per cent stake, which it says would be considered “quasi-aggressive”. Then, it would put forward a scheme of arrangement or an off-market takeover.

It’s not surprising to see a document like this circulating. This is what bankers such as Ords’ Steve Boggiano and Sam Robinson do for a crust – try to get people to buy something and make a fat fee off the back of it. Whether it results in a transaction is another question altogether.

Still, Ords corporate finance team knows its target better than most, having advised Dusk on its $124 million initial public offering in October 2020. The company listed at $2 per share and has been trending down since December 2021, last trading at 94¢. Ords points out this means a reasonable cash offer would “likely gain board and shareholder attention”.

Dusk has 145 stores across Australia and New Zealand, selling candles, perfumes, oils and new lines such as personal fragrance ranges. Sales are under pressure given a broader slowdown in consumption as interest rates rise, but the company finished last financial year with $19.7 million EBITDA and an $11.6 million net profit.

To ward off any interlopers, Ords recommends getting on the front foot, doing “early engagement with the target and key shareholders”.

ENDS

Disc: Held IRL and SM