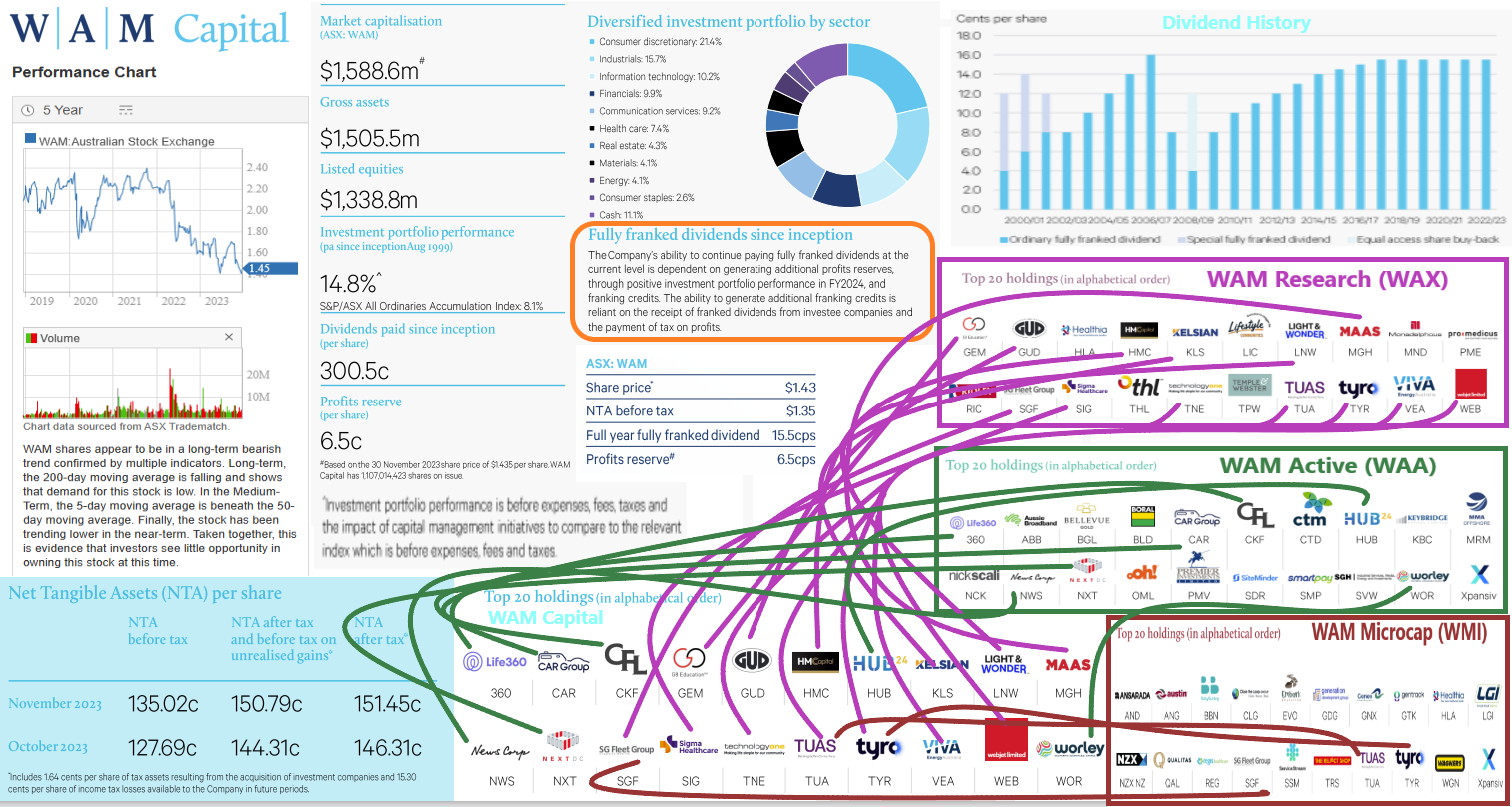

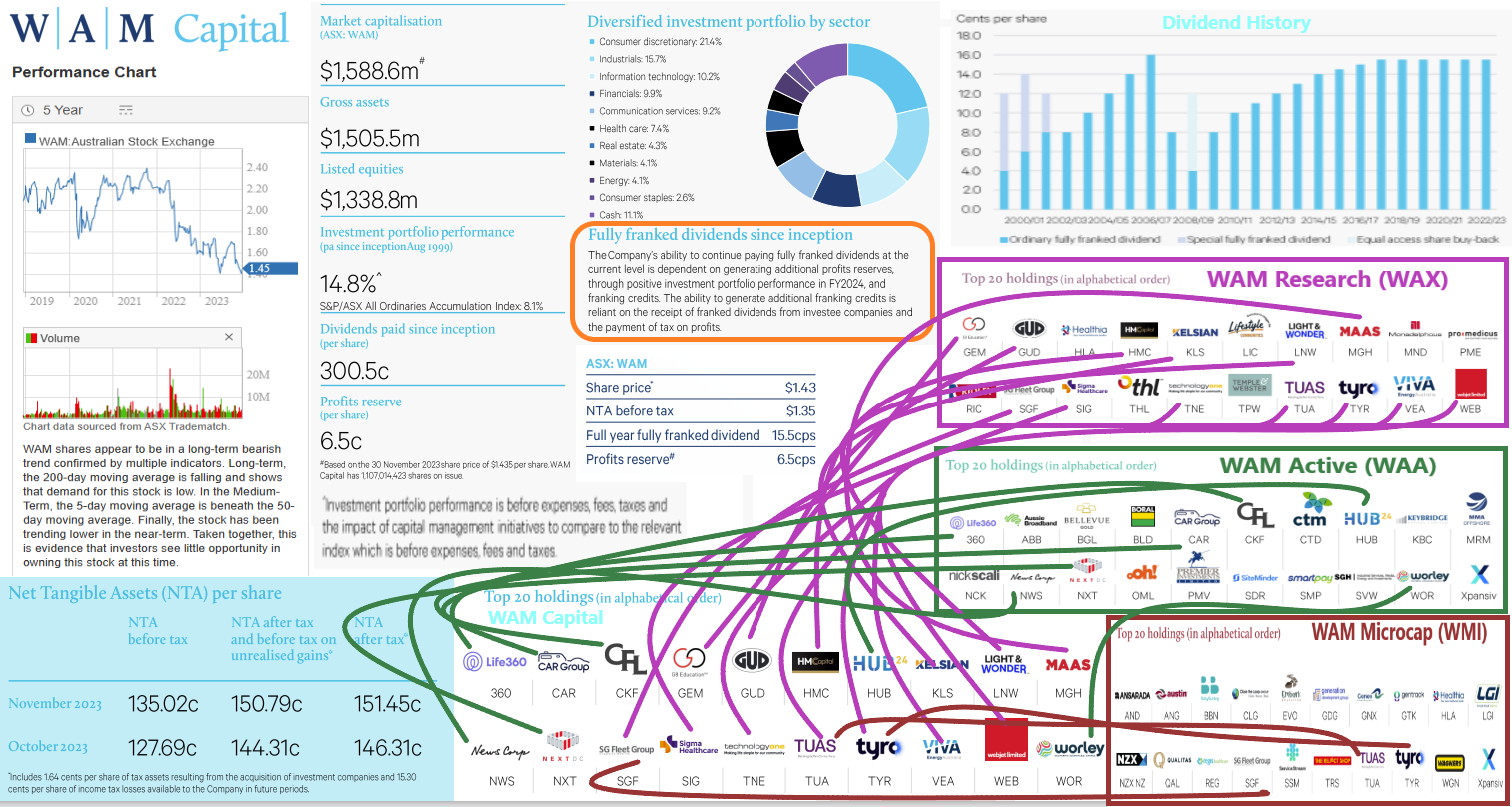

16-Dec-2023: They have a very low profit reserve, they haven't raised their dividends in 5 years (since 2018), and they can't continue to maintain their current 15.5 cps/annum in dividends unless they top up their profit reserve and also generate more franking credits - via trading profits, so above and beyond what they get from their investee companies with the dividends they receive from those companies. Despite their previously massive premium to NTA now just being a large premium to NTA (it's shrunk, or narrowed substantially), it's STILL too big - this LIC does not deserve to be trading at a premium at all. There are far better LICs that are outperforming WAM Capital and growing their dividends - yet they trade at discounts to their NTA - and one of them is also managed by Wilson Asset Management - it's WAM Global (WGB) - you can read more about the various LICs that they manage here: https://strawman.com/forums/topic/7044

But WAM Capital (WAM.asx) is one of the worst LICs in their stable of eight, despite it being their "flagship fund" - or it used to be - it was the OG of the 8 anyway, but it's been all downhill lately, as that five year share price graph (top left above) shows.

So, flat dividends, not a "Growing Stream" of fully franked dividends as promised - the fund's stated aim and purpose is to provide a growing stream of fully franked dividends to their shareholders, and they have done that if you leave out the word "growing" for the past five years.

And little prospect of increasing dividends, as they have bugger all in their profit reserve, which is where their dividends are paid from, and every chance of a reduced dividend if they can't turn things around, like, yesterday or earlier.

And they disclose the fund's performance BEFORE expenses, fees (both base fees and performance fees) and taxes, which according to Geoff a few years ago is poor behaviour from a fund manager.

And every stock held in WAM Capital is held in at least one of their other funds. As shown there by the purple, green and brown spaghetti, 7 of WAM's top 20 positions are also held in WAA, and the other 13 are held in WAX, with 3 of those 13 also being held in WMI - their Microcap fund. I wouldn't recommend WAA and their "Active" (mostly arbitrage) strategies, but WAX is a far better option than WAM in terms of their healthy profit reserve, their good portfolio performance and their excellent record of growing their dividends every year - although WAX has just run out of franking credits and is trading at an even bigger premium to NTA than WAM is.

My point being - WAM Capital (WAM.asx) just holds companies that are held in their (WAM Funds') other LICs, but it has none of the positives that those funds have, like 3 or 4 years worth of dividends in their respective profit reserves, dividends that are rising every year, etc. When they finally either suspend or reduce the WAM Capital dividend, I expect carnage. And I do believe that is inevitable unless they can get VERY creative and work out some other way of funding the dividend - instead of from their profit reserve - so against what they have been telling us since the inception of the fund - which is what I've highlighted in orange above - that the dividends are funded from the income received from their investee companies and profits they make from trading - which is all stored in their profit reserve and the balance of that profit reserve is reported each month (in their monthly reports) in cents per share. At the end of November, WAM Capital's profit reserve contained just 6.5 cps.

At this point, WAM Capital has less in their profit reserve than the last half yearly dividend they paid - which was 7.75 cps, same as the previous 10 dividend payments before that. And they have an interim dividend coming up for the 6 months that ends at the end of this month (December 2023). They have been just scraping through so far, but I have a feeling that's just from selling stuff they don't really want to sell, just to lock in enough profit to fund the dividends, hence the poor performance, as shown by a declining NTA and a declining share price.

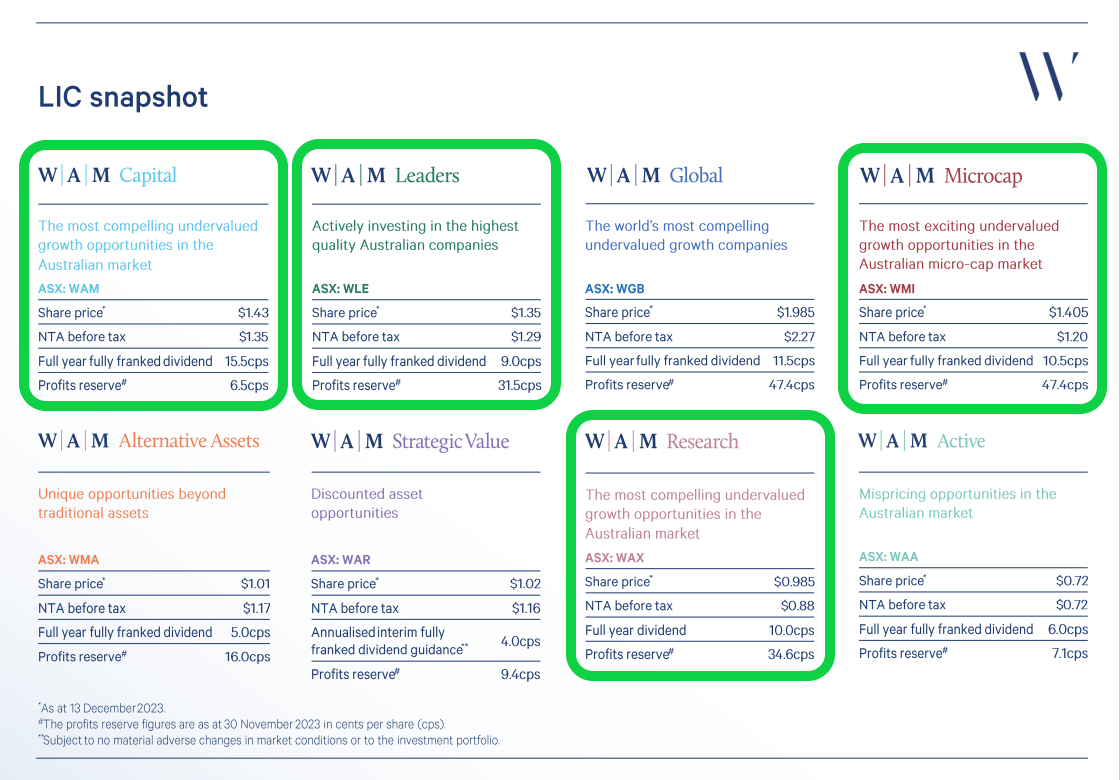

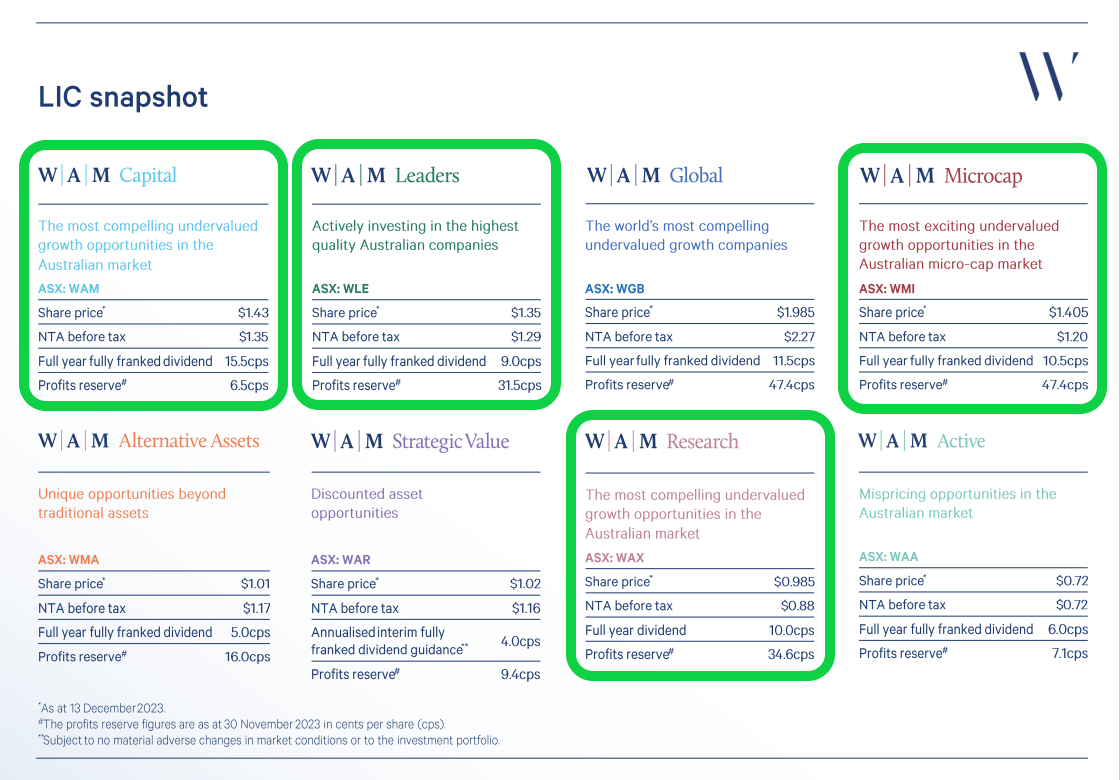

Compare the Eight:

The ones trading at premiums to their NTA are highlighted in green.

I have held WAM, WAX, WMI, WGB, WLE, WMA and even WAA at various times over the years, but not WAR (which is the most recent one), but I hold no LICs, LITs or any other managed funds at this point in time, having recently exited the last of them (SNC, in October) - I haven't held any WAM Funds for a few years now, and I have no plans to jump back in. I'm steering clear of LICs and other managed funds for a while, just managing my own funds.

In terms of how I rate each of those 8 funds, I would say that WGB and WLE are clear standouts in terms of consistent performance and quality portfolio managers, plus rising fully franked dividends, then WMA has its place for those who want that exposure (to "Alternative Assets" like water rights, debt, private equity funds, some property and agricultral assets, infrastructure, etc.), and WAX and WMI are OK if you can close your eyes and ignore the premiums to NTA they trade at, but I don't rate WAM, WAA or WAR as being too flash - I'd give those three a wide berth. They might be individually good for a trade now and then if that's what you're into, but their performance over recent years has been very sub-par. There are some good LICs in there (in those 8) - with high fees but good total shareholder returns [TSRs] after fees, but WAM isn't one of them - not any more, in my opinion.