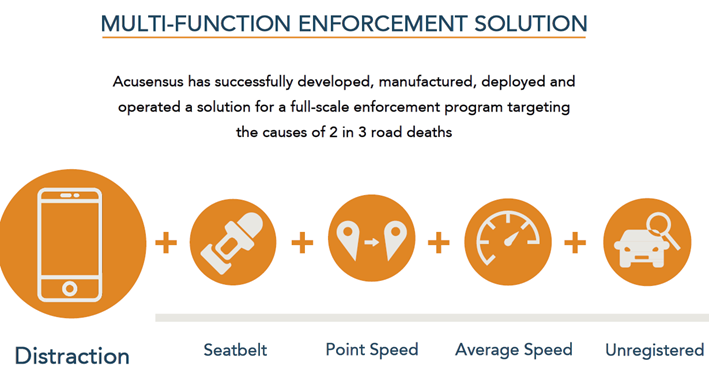

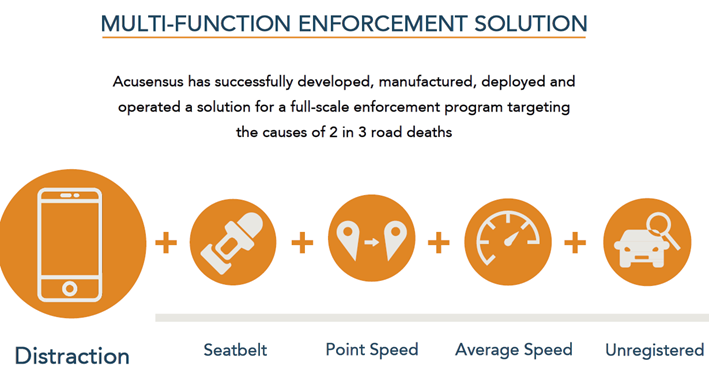

Acusensus (ACE) is a tech co that provides automated traffic enforcement solutions with a specific focus on distracted driving/mobile phone use. ACE’s solutions are fixed camera or portable trailer based cameras which can detect a range of traffic offenses with the company’s IP in their Algos and knowhow of optimal detection set ups. Whilst ACE’s tech has been predominately used for mobile phone detection, it has been deployed for speeding, seatbelt and more recently, tailgating awareness in QLD.

ACE was founded and is lead by Alexander Jannink who owns ~13% of the company. Alex founded the business off the back of a friend who was killed by a distracted driver and whilst this as good a driver as any, Alex was formerly responsible for research and development as the Head of Future Product Group for Redflex Traffic Systems Limited (previously ASX:RDF). RDF was an Australian based traffic enforcement business which was ultimately taken over by Vera Mobility in 2021. I also note the board and management own/control ~30% of the business with the Chairman controlling ~16% via Ador Powertron Ltd.

Distracted driving is increasingly presenting as a major cause of serious collisions and deaths on the road and is becoming a new focus area globally for authorities in reducing road trauma. Use of a mobile phone whilst driving is of most concern and the key distraction type that is being legislated with the TAC stating that “drivers are 10 times more at risk of crashing if they are texting, browsing or emailing on their mobile phone” and “Taking your eyes off the road for two seconds or more doubles your crash risk. At 50kmh you will travel 28m in 2 seconds, that’s about the length of a cricket pitch”.

To date, enforcement has been challenging and considered resource intensive from a policing perspective and as such, has required technology advancements, such as that from ACE, for widespread enforcement to be possible. Technology providers like ACE not only enable broader enforcement, but they have also been used to better understand the extent of the problem through data collection programs.

ACE’s solutions come in 3 versions with:

-The flagship being Heads Up which is the fully automated captures system which can identify drivers speeding, using phones, not wearing seatbelts etc… and comes as either fix cameras or trailer based mobile units.

-Heads Up Real Time which is a trailer version which flags an infringing motorist to a police car down the road who enacts the enforcement. This solution is focused on the US market where automated enforcements can be tricky politically.

-Harmony is a basic version of the core system that offers a lower price point for speed capture solutions.

The revenue model is simple. The company wins contracts from government authorities and is paid for providing the requested enforcement solutions of the tender charging a fixed monthly fee per deployment. The contracts are akin to a MSA which means variations and ongoing expansions of enforcement coverage can occur without retendering. Tenders are typical 3-5yrs with options to extend. As they are service contracts, ACEs own all gear, IP/data and the contracting party only tells them where to put cameras. ACE is not paid for rate of offences captured.

Since being first to go commercial with their camera technology in 2019, ACE has won multiple contracts for mobile phone enforcement in Australia as well as a speed contract in NSW. In addition, ACE has established a presence in the UK and US with regular deployments of their technology being used to collect data and test pilot the efficacy of the solution. ACE was awarded its first contract in the US in June 2023 in North Carolina and although it is a small contract, it is a stepping stone to accelerating adoption across further US states.

I believe ACE has and retains a global first mover advantage against the competition with Jenoptik winning in VIC (head to head) and Sensys Gatso winning in TAS (extension of a speeding contract), with the underlying tech for both from a small start-up called Onetask AI. Other technologies have been tested in the UK and Europe however there have been no broad enforcement contracts conducted to date in these regions. Whilst others have been used, I note that in the UK, ACE’s tech appears to be the most used and tested solution with the company having 5+ trailers on rotation across 15+ constabularies. However, ACE’s competition are larger and more established traffic enforcement solution companies thus one can’t discount their ability to close the competitive gap.

ACE IPO’d in Jan 2023 raising $20m ($24m total cash post IPO) to provide funding for long term growth and currently has ~$25m cash on hand to fund future growth whilst on a pre-capex basis, the company has lived within in means spending only the incremental growth. This provides a long runway for ACE to maintain its growth potential and see that growth compound and reflect in the share price.

As for growth, I think ACE is capable of delivering revenue of $50m+ in FY24 whilst in FY25, revenue could be close to $60m with a high case potential closer $75-80m which the high case being driven by a significant European contract win expected to be awarded in the second half of FY24. This growth will be profitable growth as well but how much flows through to the bottom line depends on how much incremental investment management decide to put into the business (i.e. major success offshore likely precipitates large investment).

I have a base case target price of $1.40/sh based on 15x (current multiple) EBITDA on FY25 ($1.97/sh on the higher case), on a fully diluted share count of ~136m. Another way to consider valuation is what is a “cash cow” which is if the company abandoned growth spend and maintained existing contracts. Based on FY24 revenue and reducing opex by ~$6m and using a 10x multiple, this gives a target price of $1.16/sh.

Between the global thematic tailwinds and the near term prospects of the company, I think the risk/reward is skewed to the upside from here.

Catalysts

· South Australian tender award 1H CY24

· Further NSW contract variation award 1H CY24

· European tender award 1H CY24

· Western Australian tender award CY24

Risks

· Competition catching up tech wise and outcompeting in tenders which; reduces overall growth potential, and; can create pricing pressure and reduces margins

· Contract cancellation (noting a gov can cancel a contract with 30 days notice)

· US market risk on economic funding model beyond existing infra spending funding pool.