Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

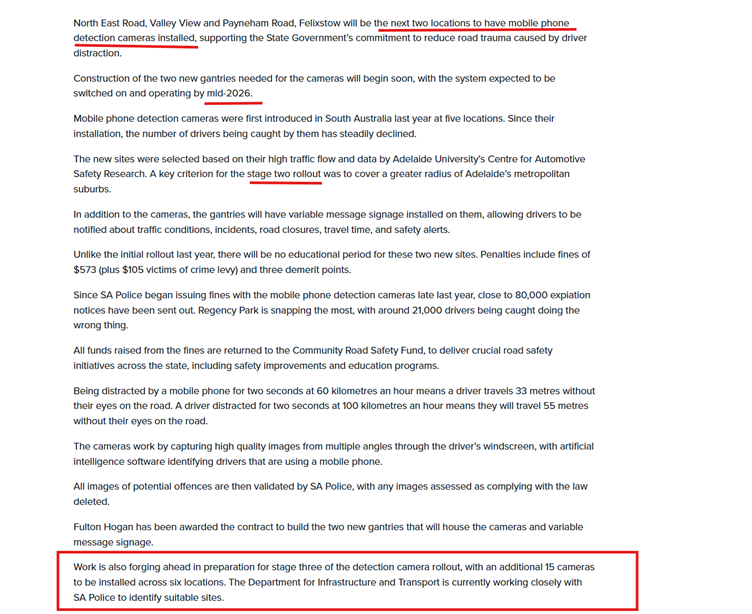

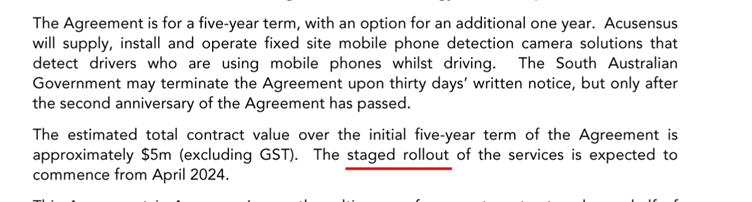

A bit late to the party, but in early Dec the SA Government announced information about the rollout of new MPDC across South Australia.

I have highlighted a few key items below which may be pertinent to Acusensus.

There is no mention of Acusensus in the release, or this lates round of cameras in the latest capital raise information released by Acusensus (see excerpt below)

Why do I think that these new cameras are likely to be awarded to Acusensus in the future?

- Governments would typically need to announce a market process when they are purchasing new materials. After a quick search of the SA government Forward Procurement Plan and tenders page, I can only see that they are out to market to replace 15 Jenoptik speed/red light cameras. It would be unlikely that a new market process could be run between now and the required delivery timeframe.

- Initially, SA went out to market with a proposal to buy 7 Mobile Phone Detection Cameras. They then expanded this by another 10 cameras at a later date. From my count, 13 cameras have already been deployed across SA across 5 locations, with 4 cameras to still be rolled out in the future.

- The 8 Jan 2024 announcement from Acusensus confirming the contract award mentioned that there will be a staged rollout in South Australia (see excerpt below)

- It would be very bizarre if the remaining four cameras funded under this budget announcement aren’t operated by Acusensus.

If Acusensus is the likely operator of the new cameras in SA, why has nothing been announced to date?

- As the remaining cameras are being built on new gantries, DIT would have had to complete due diligence investigations and design processes before confirming any potential camera locations for Stage 2.

- While there has been a formal announcement by the SA Government, it is my take that Acusensus have not officially disclosed anything to the market, as they have not signed any contractual/variation to officially increase the number of cameras they operate in SA.

- My gut feel is that something like that will likely come out early next year (especially if they are to make the mid 2026 rollout date)

If awarded to Acusensus, I would expect that ongoing revenue from SA will increase to around $1m per annum in July, and further increase to around $1.4-1.6m per annum once phase 3 is rolled. Not huge in comparison to the NZ deal, but would still help them to nudge closer to generating a positive NPAT.

This is by no way a guarantee that any new cameras in SA will be awarded to Acusensus, as my hypothesis is based on publicly available information to date.

DISL: one of my largest holdings IRL and on SM.

I had my paralegal draft this memo on the legal proceedings brought by Redflex, the recent ruling dismissing Redflex’s application to strike out evidence that $ACE is seeking to rely on and the impact of the outcome of the legal proceedings on the $ACE valuation.

Disc - Held IRL and in SM

⸻

Investment Memo

Company: Acusensus Ltd (ASX: ACE)

Issue: Legal proceedings – Redflex Traffic Systems Pty Ltd

Date: December 2025

⸻

Executive Summary

Acusensus is defending Federal Court proceedings brought by Redflex Traffic Systems alleging intellectual property infringement. A recent procedural ruling on 15 December 2025 was incrementally favourable to Acusensus, with the Court dismissing Redflex’s application to strike out evidence that Acusensus intends to rely upon in its defence.

The matter remains ongoing, with a substantive trial scheduled for April 2026. While legal risk persists, the recent ruling reduces downside asymmetry and supports the view that resolution will likely occur only after full evidentiary consideration or later-stage settlement.

⸻

Background

• Proceedings commenced by Redflex in June 2025 in the Federal Court of Australia.

• Claims relate to alleged ownership and infringement of intellectual property arising from events dating back approximately eight years.

• Acusensus denies the allegations and has stated it will defend the proceedings vigorously.

⸻

Recent Legal Development

• 15 December 2025: The Federal Court refused Redflex’s application to strike out certain evidence Acusensus seeks to rely upon.

• Acusensus is therefore permitted to include and rely on that evidence through discovery and at trial.

• The ruling is procedural and does not determine liability or remedies.

Significance:

Strike-out applications are commonly used to narrow or weaken an opposing party’s case at an early stage. The Court’s refusal indicates that Acusensus’s evidence is at least arguable and relevant, preserving its ability to run a full factual defence.

⸻

Current Status & Timetable

• Proceedings ongoing in the Federal Court of Australia

• Discovery completion: 20 February 2026

• Trial: Scheduled for April 2026

⸻

Strategic Implications

For Acusensus

• Strengthened defensive posture and litigation leverage

• Reduced risk of early adverse procedural outcomes

• Supports management’s view that the dispute will turn on technical and factual matters rather than procedural elimination

For Redflex

• Unsuccessful attempt to constrain Acusensus’s evidentiary case

• Increased reliance on success at full trial rather than early procedural resolution

⸻

Valuation Impact – Scenario Analysis

Base Assumptions

• Core growth thesis (global automated road safety enforcement) remains intact

• No interruption to existing customer contracts

• Valuation based on forward multiples discounted for execution and legal risk

⸻

???? Bull Case – Defence Success / Immaterial Settlement

Probability (illustrative): 30%

Assumptions

• Acusensus prevails at trial or settles on immaterial financial terms

• No injunctions, licensing obligations, or operational restrictions

Valuation Impact

• Removal of legal risk discount (estimated 10–15%)

• Multiple expansion toward peer upper quartile

• Upside: +15–25%

⸻

???? Base Case – Protracted Litigation / Neutral Settlement

Probability (illustrative): 45%

Assumptions

• Case proceeds through trial or resolves late

• One-off settlement and legal costs absorbed without structural impact

Valuation Impact

• Limited long-term cash flow impact

• Valuation impact: −5% to +5% (largely neutral)

⸻

???? Bear Case – Adverse Judgment

Probability (illustrative): 25%

Assumptions

• Redflex succeeds on core IP claims

• Damages, licensing fees, or constraints on certain technology

Valuation Impact

• Margin pressure and potential contract risk

• Downside: −25–40%

⸻

Expected Value View

On a probability-weighted basis:

• Risk-weighted valuation impact: approximately −5% to +10%, skewed modestly positive

• The 15 December 2025 ruling improves expected value by reducing the probability of early procedural loss and increasing Redflex’s trial and settlement risk.

⸻

Key Watch Items

• Discovery outcomes by 20 February 2026

• Any interim rulings affecting admissibility or scope of evidence

• Indications of settlement discussions ahead of trial

• Legal cost disclosures versus guidance

⸻

IC Conclusion

The Redflex proceedings remain a live risk into FY26; however, the recent Federal Court ruling reduces downside asymmetry and supports continued inclusion of Acusensus within a high-risk, high-growth allocation. The dispute now appears more likely to be resolved through full evidentiary trial or later-stage settlement rather than early procedural defeat.

Trading Halt pending a material capital raise.

Disc Hold IRL

This recent deck from $ACE provides a nice visual representation of the progress the company is making in penetrating the US market. Having said that the percentage of revenue coming from international markets is still quite small but it is increasing.

Disc - Held IRL and in SM

Whilst the new US deal is good and widens the long term growth potential at the top end of the range and whilst I haven't updated my model yet, noting my val probably lifts a lot closer to $2m, the chart is parabolic short term so I have punched a few shares out to manage that risk.

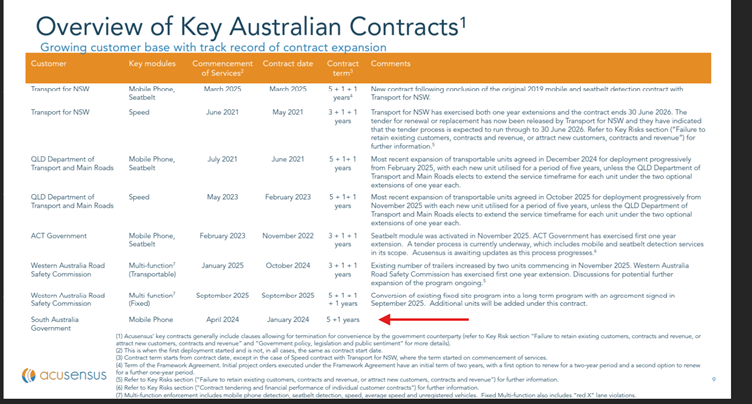

Nice 5 year deal from Acusensus with an additional 3 year option to extend in yearly increments.

Disc Hold IRL & SM

Update - August 2025

See https://strawman.com/forums/topic/11720#post-37628 for my recent update and background on this one.

2027 forecasted NPAT: $15-20m range

EPS: Approx. 11.5 to 15c per share

P/E: 12-15x to account for the growth opportunities and cyclical nature of procurement businesses

Est Price: $1.45 to $1.8 (while the current growth opportunity would typically lend itself to the higher end, I am reducing slightly given the legal proceedings and to factor in a 10% discount rate applied on the 2027 NPAT)

---------------------------------------------------------------------------

Original Post - Feb 2025

Its been a while in the making, however I have finally have been able to do a writeup about them as I no longer work in the industry. I also wish I could have put my capital into the business when they were at 50c.

Why I like the business

- A great business who are well regarded by their customers in Australia

- They provide a solution to reduce the prevalence of driver distraction

- A company who have a strong focus on innovation (they moved out of Redflex to push a heavier innovation agenda in a new company.

- State Governments (typically in Aus) are reliable customers and pay promptly.

- A supply on demand model, with camera equipment manufactured on order once contracts have been executed and inventory managed accordingly.

- Acusensus have established their system to integrate with all of their customers, and any new contracts will not need the technical resourcing to roll out new devices in the future.

- Have now achieved their ISO 9001and 27001 compliance, which will help put them in good stead to win future contracts

- A non loop based business which does not have the outage issues from roadworks, or extensive costs to integrate into existing infrastructure.

- No debt and good cash reserves at hand after latest round of capital raising (hopefully the last)

- Contracts are starting to be in place for up to 7 years, with the camera assets being depreciated over 5 years or 3 for fixed devices. Cameras can probably continue to operate long into the future after this date, and its more about whether the technology is still cutting edge and value adding. The longer cameras are operational the more NPAT they will contribute if assets have already been heavily depreciated and that's before any price increases for CPI are considered. Refer Link for extract below

Risks

- $4.50m of NSW revenue to drop off in Dec 2025 if they can’t secure a contract. Other contracts

- Other camera providers become further advanced and steal market share from Acusensus

- Lengthy legal battle over patent infringement

- Increased maintenance costs over time as cameras start to age

- NZ does not materialize to the full $90m value.

- Material or employee shortages, supply chain issues or other delivery constraints (i.e governments bureaucracy) impact the ability to roll out new contracts in time with announced delivery dates.

Opportunities

- Increased revenue in some jurisdictions to switch on seatbelt enforcement solution without significant cost outputs

- Acusensus appear to be one of the leaders in the mobile point to point field (with a contract with WA) and will likely capitalize on this opportunity once AustRoads provide their guidance on MP2P solutions (and may put them in with a shot for the 3 P2P cameras in South Australia announced for 2025-26)

- I would be keen to understand the opportunity to recycle some of the trailer components in the future when rolling out new devices when Alex is interviewed on Strawman.

Acusensus and other camera providers deliver strong revenue generation for Jurisdictions, who have been accustomed (maybe even addicted) to the revenue they bring in and will have a huge budgetary hole to fill if they don’t extend contracts. From this reason alone, and the signal from TNSW’s contract extension (who typically try to only have 1-2 year contract/extension terms), I believe that contracts will continue to be extended to keep the gravy train running and extend the useful life of cameras to 7-10 years.

From my limited knowledge, the fleet of Owner Operator camera solutions continue to be in operation up to and well past their useful life for this reason. For example, South Australia went to market in 2022 (see SA tenders) to replace their ageing devices, however still have not announced a provider nearly 3 years later. The devices have continued to generate revenue even though they are past their useful life.

Valuation

If you strip out the staff and supplier costs for new builds and operations for the next 2-3 years (which are mainly front loaded for development), there will be contracts hopefully generating around $70-80m+ in revenue once NZ, SA, WA are all online. This isnt too far a stretch when you consider their latest update in the cap raise documents

After accounting for Research, OPEX, Plant and Equipment, Wages, IP, Leases, high depreciation and taxation, I am expecting NPAT to be at least in the $15-20m range. If Acusensus win more customers this will impact the 2027 NPAT but would provide better long term value. Taking this into consideration, my calculations are as follows:

2027 forecasted NPAT: $15-20m range

EPS: Approx. 11.8c per share

P/E: 12-15x to account for the growth opportunities and cyclical nature of procurement businesses

Est Price: $1.45 to $1.8 (leaning more towards the middle range after discounting)

I am leaning more towards the higher range given their track record of revenue growth over the past few years.

Disc: Held on SM and in RL.

Quick update.

Revenue of $59.4m was mid of range ($58-61m), a smidge under me and consensus in line. EBITDA of $5.7m was above top of range a bit but likely a timing around NZ ramp up.

Guidance for FY26 is key. $79-$84m is an upgrade to consensus which is about $79m. Strong growth. Key will be ongoing wins to supper sustained growth in FY27.

Interesting is this report is the first time they disclosed Oz bis unit EBITA, which is $19.5m This is a EV/EBTDA multiple of ~5.8x at $0.91/sh. This is ex several things like road worker and R&D. Adding that back then underlying is more like $15m for a multiple of 7.3x. Still cheap if oz biz can growth low 10% without any significant new contract wins/expansions.

A lot to like here but key risks are sustaining larger contract wins to maintain higher growth rates beyond FY26 and litgiation from Redflex for which I have no idea about given what little is disclosed.

NEW: Rolling over to FY26 as per below, subject to change post when I update my model properly.

OLD4: As per yesterday straw and today's addendum, a modest lift in valuation to $1.34/sh for FY25. FY26 lifts to $1.73.

OLD3: $1.29/sh. Updated post NZ contract win. Raise mostly offsets the revenue gain from the contract in FY25 given timing of deployment but is accretive in FY26 where its has lifted more materially going from $1.47/sh to $1.66/sh.

OLD2: $1.26/sh. Updated for post FY24. Tempered revenue expectations and applied multiples based on peers and more moderate growth trajectory. Not using EBITDA multiple given the co has guided to flat or negative EBITDA growth as it continues to resource growth (note cheap on this metric on Oz div standalone.

OLD1: $1.40/sh Fd basis on FY25

Redflex Commences Legal Proceedings Against Acusensus and CEO Alexander Jannink

Today it was announced that Redflex Traffic Systems has initiated Federal Court proceedings against Acusensus IP Pty Ltd (a subsidiary of Acusensus), Acusensus Limited, and Managing Director Alexander Jannink.

https://announcements.asx.com.au/asxpdf/20250618/pdf/06kw6d5h4h2ckm.pdf

This legal action relates to alleged intellectual property infringement. Notably, Acusensus disclosed this issue in its 2022 IPO prospectus as a risk factor:

Section 4.1.6 – Intellectual Property Infringement Claim

“In December 2020, a competitor alleged that the Company and/or Mr Alexander Jannink may have infringed copyright in certain code. The competitor also alleged that Mr Jannink may have breached obligations owed to the competitor under his previous employment.

The Company engaged legal advisers, responded to the allegations, and received no further communication after March 2021. The Board considers the allegations to be without merit and did not disclose them to any customers or potential customers.”

Alexander Jannink’s Background

Before founding Acusensus in 2018, Alexander Jannink spent over a decade at Redflex Traffic Systems:

· Joined as a Software Engineer around 2006

· Progressed to Product Engineer and Development Team Leader

· From 2015 to 2017, served as Head of Future Product Group, leading R&D efforts across Australia and the U.S.

About Redflex

Redflex, founded in 1997 and based in Melbourne, was a major provider of road safety and traffic enforcement systems. It was previously listed on the ASX before being acquired by U.S.-based Verra Mobility in 2021 and delisted. In 2011, it was the target of a failed $300 million takeover bid by Macquarie and Carlyle Group. The company has operated extensively in Australia and the U.S., though it has faced legal controversies in the past, including bribery investigations tied to U.S. contracts.

Today the co released that the MSC (Mobile Seatbelt Contract) contract for NSW has been renewed after it was retendered. The term is longer at 5+1+1yrs under the main framework agreement.

The initial project orders (PO) are $8.94m (ex-GST) and operate under a 2+1+1yr term. Tbh, I’m not sure why this would be contracted differently but from the prior option pick up under the prior contract, its seems to be a way business is done.

LfL the initial orders would be the equiv of ~$49m over 5 years versus the prior contract being ~$42m over 5 years noting the main difference is that the $42m did not include switching on seatbelt as that was done 5mths before the end of the prior contract. ACE did not specify a value in the release but I think on a latter call it was determined that it would be ~10-20% revenue uplift on an annualised basis. Multifunction has higher GM so it was a backsolve in extra revenue to take GMs form 40s into 50s so from the perspective of adding on a function later, ACE flicks a "switch" to turn it on so the GM on the incremental revenue is effectively 100%.

As such, this implies under the prior deal, the annualised revenue rate was potentially ~$8.5-8.6m (ex-GST) thus implying the new PO of $8.94m (ex-GST) is largely a rollover + minor scope changes/inflation. The image below shows some working out of this.

The release today ;eft many Qs open and the contract hasn't been published yet. It could take a day or two or weeks so this is an exercise in thinking and testing numbers until confirmation can be sought.

Given the term of the new framework agreement is longer than the initial project orders, I suspect NSW is working on broadening deployment and maybe use ACE for things like average speed (note ACE will do this with the same trailers in WA). Below is from the roadmap 2026 doc and a recent ministerial release which I think I linked in my update on the speed contract.

This doesn't change my valuation as I had a figure for this included. 1H25 also hasn't changed much either.

In ACE’s qtr report they noted the option for the NSW speed deal was picked up, extending the contract to June 2026. This link is to the page on Tender NSW for the contract which provides key headline info including the value of the contract.

I noticed the same with the WA contract as the value was higher than what ACE put in its own release (and latter mentioned in ACE’s qtr report). For this I note ACE’s release said it was ~$3.13m p.a. with the tender page implying it can be up to $4.16m p.a.

Back to NSW Speed. The original contract was for a period of 3 years with a total value of ~$77.1m (incl GST) or ~$23.3m p.a. (ex-GST). Post the option pick up, the page details a period of 5 years with a total value of ~$149.8m (incl-GST) or ~$26.7m p.a. Subtracting the initial 3yrs from the 5yr total, gives a total value of ~$72.8m (incl GST) for the extra 2 years for ~$31.5m p.a. (ex-GST). This suggests revenue from this contract will increase by ~$8.1m p.a. I note that speed contracts sit in the low to mid 30% GM range.

The other group doing mobile speed in NSW is Redflex (formerly listed on the ASX) and their contract has gone up as well with their option pick up. I note that the proportion towards ACE has increased under the option pick up thus I guess one can infer it has “won market share”.

The images below show the breakdowns for both ACE and Redflex for NSW speed and the back solving of contract value after the option pick up.

I will note that I haven’t been able to clarify with the company as there is likely some nuance to understand. In a release from the gov in January, they indicate that they will materially increase the number of sites where mobile speed cameras can be located (predominately expanding in country regions), however, there wouldn’t be an increase in total enforcement hours. This suggest that existing (and/or additional) cameras will be moved around more regularly and wider across NSW which may explain the uplift in contract values i.e. being paid more to manage a higher turnover deployment schedule.

The impact is that growth in Oz is likely to increase further and adding this to my model would see FY25 and FY26 valuations increase to $1.38/sh and $1.75/sh from $1.29/sh and $1.66/sh respectively. I will reserve formerly updating my valuation until I can verify.

Aw Nuuu Bro, I have to update the model.

ACE announced it won a nationwide tender for mobile speed in NZ and alongside that it is raising up to $12m at $0.90 (tight). Not so good is a $3m sell down by the chair and MD.

The contract is estimated to be worth NZD92m (AUD83m) over 5yrs of which NZD5.2m (AUD4.7m) is recognised in FY25 with full deployment to be achieved in FY26 which is revenue of NZD17.2m (AUD15.6m). Margins unclear but noting their speed contract in NSW, it is typically lower at low 40s or high 30s.

Good win overall and dries a big step change in revenue and profit growth. I note ACE was the tech used to pilot mobile phone and given that is a big issue over the ditch, this is likely the first for further contracts for ACE in country. It will help as for ACE, it is a as easy as flicking a switch on the software to implement thus they have the advantage of lower cost and time to add on services.

See the valuation section for the impact of this contract on my valuation.

Apologies for this being a bit light on specifics as I didn't bring my model with me to vietnam.

ACE update with the AGM is good. Revenue on track for mid to high $50ms ($57m) and depending on the timing for when WA comes on, there is scope to upgrade closer to $60m (and with it my valuation). GMs were also strong in the 47% range and I think is higher than I model. So unless they're about to load up some more costs, they may actually grow EBITDA with the guide being flat to down potentially. Reiterated doubling of international revenue which based on today and recent disclosure is supported but customer contracts.

So overall the business is tracking well, growing well with positive operating leverage with the potential to surprise a little to the upside.

Finally around to updating post FY24 results and getting a chat in with the co. Key points:

- US and UK to grow at least 100% each. Both back by contracts which commenced around the end of FY24 so largely bankable. US is Georgina and Arkansas whilst UK is Devon & Cromwell.

- Oz to growth ~10% without any major new contract wins. Comprises of QLD speed variation going live early FY25, Full yr uplift from additional mobile/seatbelt trailers that went live Dec 23, + BAM stuff on tailgating. Full year of SA + extra installs. NSW seatbelt switch on July 24 that could lift revs by 10-20%p.a. (Say ~$1.5m).

- Immediate major contract awards ahead is WA. Expected award this month. Initial 6 Trailers (see my straw on that preso) which based on ACE average of $380k/yr/unit ($49m rev on ~130units)(likely higher given multi-function) equates to a contract value of $2m+.

- Other incremental is ACT and SA flagging desire to switch on seatbelts too. US trials have led to funding request is upside to bolt on more deployments. QLD has more speed to outsource as well.

- Revenue growth is higher margin deployments so expect GMs to tick up however this is offset but additional cost-in which would increase as they win more major work. Full run-rate of FY24 cost in would add ~$2m to run-rate cost base. Hence why Rev and GP better tools for progress and valuation.

- Whilst UK traction is accelerating, unclear when it leads to Oz style deployments and tenders. US will be smaller piecemeal contracts without changes to automated enforcement.

Putting thing all together in updated numbers as per below:

Broad based build up demonstrating the ACE capability in the UK. What I can tell, few other systems trialled in competition. With ongoing and more consistent trial deployments this year I would like to think is building towards formal tenders and fuller roll outs next year.

Summary Contracts Announced Since IPO

· January 2024 South Australia Government, Estimated $5m , five plus year contract for provision of fixed mobile phone detection camera installations using Acusensus “Heads-Up” solutions. https://announcements.asx.com.au/asxpdf/20240108/pdf/05z7gbm7k4rt04.pdf

· November 2023 Transport for New South Wales, (in addition to previously contracted) from this contract variation is expected to total approximately $4.5m The initial term of the agreement was two years from 1 Dec 2019. Extension of existing Mobile Phone Detection Camera Agreement until November 2024. https://announcements.asx.com.au/asxpdf/20231129/pdf/05xy2jjl8smps0.pdf

· August 2023 Queensland Department of Transport and Mainroads, variation of existing contract. Revenue from contract variation to total approximately $19.2m over a five year period. Extension to its existing Mobile Phone & Seatbelt Safety Technology Enforcement framework. https://announcements.asx.com.au/asxpdf/20230815/pdf/05smmz6v5zzx57.pdf

· July 2023 Queensland Department of Transport and Mainroads, excess of $700,000 three month trail. For the provision of phone awareness monitoring and tailgating monitoring services. https://announcements.asx.com.au/asxpdf/20230726/pdf/05ryvl2t363q99.pdf

· June 2023 North Carolina Department of Public Safety US$0.5m, the agreement has a one year term, with an option for it to be renewed for two further one year period. Agreement marks the launch of the first ongoing camera supported program in the United States to enforce mobile phone and seatbelts use. https://announcements.asx.com.au/asxpdf/20230601/pdf/05q7sb0hd3bf0r.pdf

· February 2023 Queensland Department of Transport and Mainroads, Estimated total contract value over the initial five year term of approx $11.7m. For the provision of trailer-based road safety speed camera services using the Acusensus Harmony solution https://announcements.asx.com.au/asxpdf/20230206/pdf/45l9rp34y3y37v.pdf

Board

Inside Ownership Ordinary Shares %ACE Issued Net Value at $0.63

Ravin Mirchandani 88,752 0.07% $56K

Alexander Jannink 3,350,000 2.65% $2.11m

Sue Klose 25,000 0.02% $15K

Mike Giuffrida 0 0 0

Total 3,463,752 2.74% $2.182m

Management Bio

Ravin Mirchandani -Chairman

Ravin is the co-founder and Chairman of Acusensus. He is also the Executive Chairman of Ador Powertron, a company incorporated in India that is a major shareholder of Acusensus. He is a non-executive director on the board of Ador Welding Ltd, a company listed on the Bombay Stock Exchange and is part of the Audit Committee and Chair of the Shareholders Grievances Committee. He was previously also part of the Remuneration Committee. Ravin has extensive commercial experience across a range of sectors including defence, energy, gas, manufacturing, power electronics and traffic enforcement.Ravin is a member of the Road Safety Partnership Panel for the World Economic Forum Global Road Safety Initiative and Chairman of the West India Chapter of the Indo Australian Chamber of Commerce.

Qualifications: MBA International Business from the Queensland University of Technology, B. Commerce (Accounting & International Business) from the University of Pune, India.

Alexander Jannink -Managing Director

Alexander is a founder of Acusensus and has pioneered the design, development and deployment of traffic enforcement technologies in multiple applications, markets and geographies across the globe. Prior to founding Acusensus, Alexander was responsible for research and development as the Head of Future Product Group for Redflex Traffic Systems Limited (previously ASX: RDF), leading a team of professional staff spanning Australia and the USA.

Qualifications: MBA(Exec) from RMIT University, BE(Hons) in Mechatronics from the University of Melbourne, BCS from the University of Melbourne.

Sue Klose- Non-executive Director

Sue Klose is an experienced non-executive director, with a diverse background in digital business growth and operations, corporate development, strategy and marketing. Sue is currently a Non-executive Director of Envirosuite (ASX: EVS), a global leader in environmental data and intelligence, Halo Foods (ASX: HLF), a provider of nutritional and wellness products, Honan Insurance Pty Ltd, and Stride, one of Australia’s largest mental health care providers. She was previously on the Boards of Nearmap (ASX: NEA) and Pureprofile (ASX: PPL). Previously the Head of Digital and CMO of GraysOnline, she was responsible for digital product strategy, brand strategy and marketing operations. In prior roles in digital and media companies including 12WBT and News Ltd, Sue led strategic planning and development and is passionate about helping businesses continually seek new opportunities for growth and innovation. As Director of Digital Corporate Development for News Ltd, Sue screened hundreds of potential investments, leading multiple acquisitions, establishing the CareerOne and Carsguide joint ventures, and holding multiple board roles in high-growth digital and SaaS business. Prior to her move to Australia, Sue held various digital media management and strategy roles in the United States, primarily with Tribune Publishing and as a consultant with Marakon Associates. Sue has an MBA in Finance, Strategy and Marketing from the JL Kellogg School of Management at Northwestern University, and a Bachelor of Science in Economics from the Wharton School of the University of Pennsylvania.

Qualifications: MBA (Finance, Strategy and Marketing) from Northwestern University, B. Science (Economics) from the University of Pennsylvania.

Mike Giuffrida -Non-executive Director

Mike is an entrepreneur with over 25 years of experience, having co-founded and been the CEO of a human resource technology company, Acendre Pty Ltd (now Hire Road Inc.) in 1997. Acendre pioneered using the internet as a means of delivering enterprise ‘software-as-a-service’ to organisations with the release of the first online resume builder and first online applicant tracking system software to the Australian market, before evolving into a full online talent management space. Under Mike’s leadership, Acendre subsequently established a presence in the US, including in the US Federal Government market, before leading a process to identify a majority growth investment partner for Acendre and subsequent acquisition of a US-based HR technology company. At the end of 2019, Mike led a successful transition to a US-based CEO to head up Acendre’s next phase of growth, which enabled Mike to return to Australia full-time with his family. Since his exit from Acendre, Mike has been supporting Australian technology companies in various capacities including Non-Executive Director, Operating Partner and Executive capacities.

Qualifications: Bachelor of Engineering from Swinburne University of Technology.

ACE takes One task to court

Shares rally 10%

Now we know why they were silent on One Task

Getting the popcorn out...

[Held]

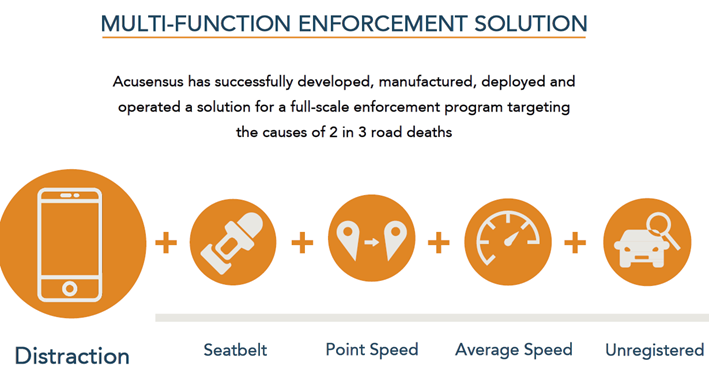

Acusensus (ACE) is a tech co that provides automated traffic enforcement solutions with a specific focus on distracted driving/mobile phone use. ACE’s solutions are fixed camera or portable trailer based cameras which can detect a range of traffic offenses with the company’s IP in their Algos and knowhow of optimal detection set ups. Whilst ACE’s tech has been predominately used for mobile phone detection, it has been deployed for speeding, seatbelt and more recently, tailgating awareness in QLD.

ACE was founded and is lead by Alexander Jannink who owns ~13% of the company. Alex founded the business off the back of a friend who was killed by a distracted driver and whilst this as good a driver as any, Alex was formerly responsible for research and development as the Head of Future Product Group for Redflex Traffic Systems Limited (previously ASX:RDF). RDF was an Australian based traffic enforcement business which was ultimately taken over by Vera Mobility in 2021. I also note the board and management own/control ~30% of the business with the Chairman controlling ~16% via Ador Powertron Ltd.

Distracted driving is increasingly presenting as a major cause of serious collisions and deaths on the road and is becoming a new focus area globally for authorities in reducing road trauma. Use of a mobile phone whilst driving is of most concern and the key distraction type that is being legislated with the TAC stating that “drivers are 10 times more at risk of crashing if they are texting, browsing or emailing on their mobile phone” and “Taking your eyes off the road for two seconds or more doubles your crash risk. At 50kmh you will travel 28m in 2 seconds, that’s about the length of a cricket pitch”.

To date, enforcement has been challenging and considered resource intensive from a policing perspective and as such, has required technology advancements, such as that from ACE, for widespread enforcement to be possible. Technology providers like ACE not only enable broader enforcement, but they have also been used to better understand the extent of the problem through data collection programs.

ACE’s solutions come in 3 versions with:

-The flagship being Heads Up which is the fully automated captures system which can identify drivers speeding, using phones, not wearing seatbelts etc… and comes as either fix cameras or trailer based mobile units.

-Heads Up Real Time which is a trailer version which flags an infringing motorist to a police car down the road who enacts the enforcement. This solution is focused on the US market where automated enforcements can be tricky politically.

-Harmony is a basic version of the core system that offers a lower price point for speed capture solutions.

The revenue model is simple. The company wins contracts from government authorities and is paid for providing the requested enforcement solutions of the tender charging a fixed monthly fee per deployment. The contracts are akin to a MSA which means variations and ongoing expansions of enforcement coverage can occur without retendering. Tenders are typical 3-5yrs with options to extend. As they are service contracts, ACEs own all gear, IP/data and the contracting party only tells them where to put cameras. ACE is not paid for rate of offences captured.

Since being first to go commercial with their camera technology in 2019, ACE has won multiple contracts for mobile phone enforcement in Australia as well as a speed contract in NSW. In addition, ACE has established a presence in the UK and US with regular deployments of their technology being used to collect data and test pilot the efficacy of the solution. ACE was awarded its first contract in the US in June 2023 in North Carolina and although it is a small contract, it is a stepping stone to accelerating adoption across further US states.

I believe ACE has and retains a global first mover advantage against the competition with Jenoptik winning in VIC (head to head) and Sensys Gatso winning in TAS (extension of a speeding contract), with the underlying tech for both from a small start-up called Onetask AI. Other technologies have been tested in the UK and Europe however there have been no broad enforcement contracts conducted to date in these regions. Whilst others have been used, I note that in the UK, ACE’s tech appears to be the most used and tested solution with the company having 5+ trailers on rotation across 15+ constabularies. However, ACE’s competition are larger and more established traffic enforcement solution companies thus one can’t discount their ability to close the competitive gap.

ACE IPO’d in Jan 2023 raising $20m ($24m total cash post IPO) to provide funding for long term growth and currently has ~$25m cash on hand to fund future growth whilst on a pre-capex basis, the company has lived within in means spending only the incremental growth. This provides a long runway for ACE to maintain its growth potential and see that growth compound and reflect in the share price.

As for growth, I think ACE is capable of delivering revenue of $50m+ in FY24 whilst in FY25, revenue could be close to $60m with a high case potential closer $75-80m which the high case being driven by a significant European contract win expected to be awarded in the second half of FY24. This growth will be profitable growth as well but how much flows through to the bottom line depends on how much incremental investment management decide to put into the business (i.e. major success offshore likely precipitates large investment).

I have a base case target price of $1.40/sh based on 15x (current multiple) EBITDA on FY25 ($1.97/sh on the higher case), on a fully diluted share count of ~136m. Another way to consider valuation is what is a “cash cow” which is if the company abandoned growth spend and maintained existing contracts. Based on FY24 revenue and reducing opex by ~$6m and using a 10x multiple, this gives a target price of $1.16/sh.

Between the global thematic tailwinds and the near term prospects of the company, I think the risk/reward is skewed to the upside from here.

Catalysts

· South Australian tender award 1H CY24

· Further NSW contract variation award 1H CY24

· European tender award 1H CY24

· Western Australian tender award CY24

Risks

· Competition catching up tech wise and outcompeting in tenders which; reduces overall growth potential, and; can create pricing pressure and reduces margins

· Contract cancellation (noting a gov can cancel a contract with 30 days notice)

· US market risk on economic funding model beyond existing infra spending funding pool.

@edgescape I found this recently which you may be interested in. Have had a very brief look at them - didnt find a reason for the stock split and not sure why you would split to make the share price under $1. Any ideas?

Acusensus broker report OCt 2023.pdf

On a side note I believe I did see the results of their work - a mate of mine was pinged in Qld 3 times in quick succession for having his phone on his leg and not in the console of his car!

Nessy

Found the answer to the share price weakness.

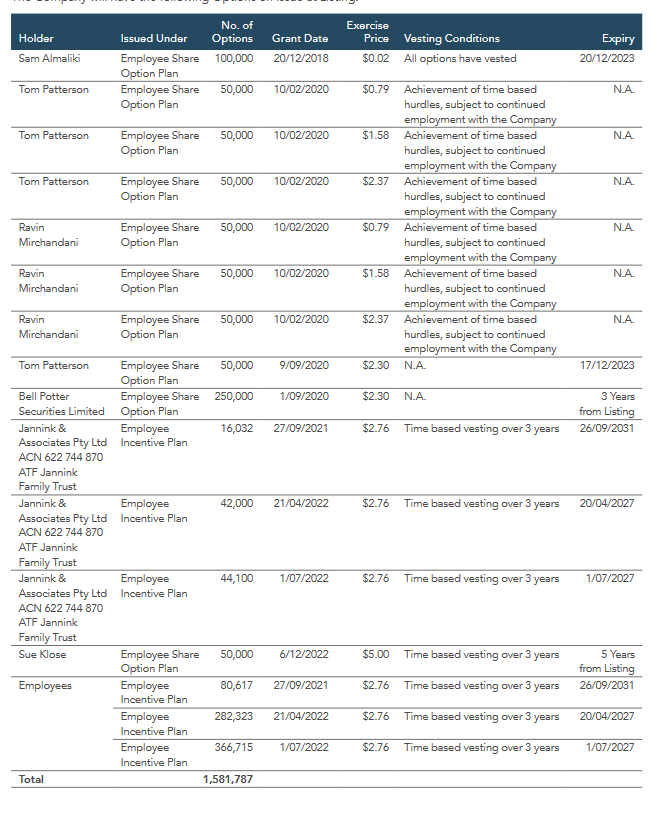

Hidden somewhere near the back of the prospectus and it was quite hard to find.

I admit I missed this when I went through the doc a month ago.

Below gives an insight into how funds were raised before the IPO and prices the seed investors paid before the IPO that would not be on this list.

On average seed investors must have have paid around $2.00 per share pre split before the IPO when Acusensus was still private.

Also the aggregate summary value of all these options was not on the FRONT of the prospectus which helps the investor find out if the IPO is good value or not. However I'm not sure if it is compulsory to put that value in but all the ones I've seen have done that.

Taking a step back, I think most of the selling below $3 happened in February. So maybe it is over?

At least the subs in the above haven't sold ... yet. Only the employees, Bell potter and others not listed above.

On that note, if business momentum is maintained then maybe the selling will stop.

[held]

Talking about IPOs again and this is one where retail were the losers.

There are a few red flags I could see in the prospectus. One obvious one is Pre IPO equity vastly outnumber the equity available to retail.

The few positives about the company is the business (traffic safety camera monitoring), upward revised guidance and low market cap.

With more shares coming out of escrow in the next few months, I think it can head lower even with the revised guidance and business momentum.

Seems like the Pre-IPO holders aren't showing much conviction in the business as in February 23 the share price dived to $3 on release of the HY23 results. I'm assuming it was the Pre IPO holders since shares were removed from escrow after the release of the HY results.

There is also an upcoming stock split (5 for 1) in the next month.