A bit late to the party, but in early Dec the SA Government announced information about the rollout of new MPDC across South Australia.

https://www.dit.sa.gov.au/news/articles/2025/december/more-detection-cameras-to-catch-drivers-red-handed

I have highlighted a few key items below which may be pertinent to Acusensus.

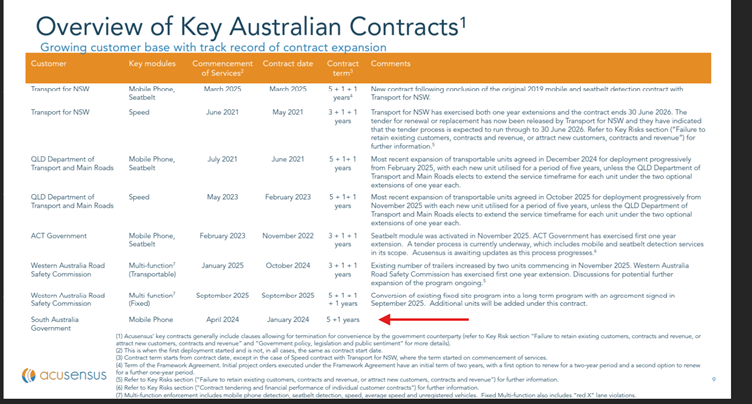

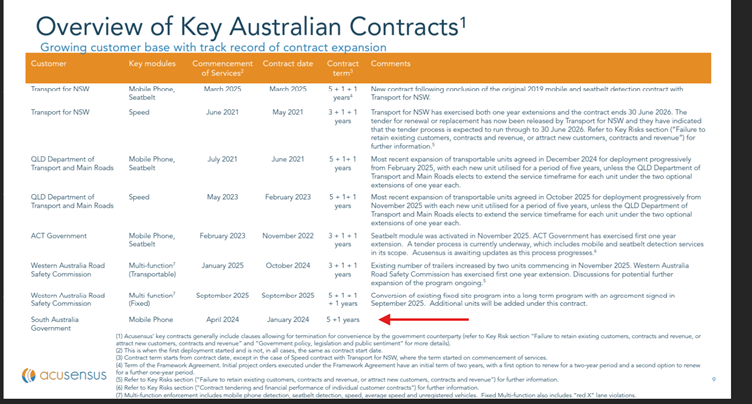

There is no mention of Acusensus in the release, or this lates round of cameras in the latest capital raise information released by Acusensus (see excerpt below)

Why do I think that these new cameras are likely to be awarded to Acusensus in the future?

- Governments would typically need to announce a market process when they are purchasing new materials. After a quick search of the SA government Forward Procurement Plan and tenders page, I can only see that they are out to market to replace 15 Jenoptik speed/red light cameras. It would be unlikely that a new market process could be run between now and the required delivery timeframe.

- Initially, SA went out to market with a proposal to buy 7 Mobile Phone Detection Cameras. They then expanded this by another 10 cameras at a later date. From my count, 13 cameras have already been deployed across SA across 5 locations, with 4 cameras to still be rolled out in the future.

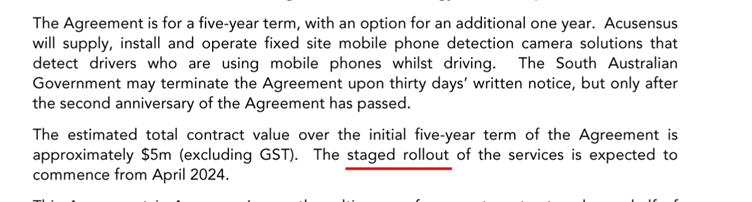

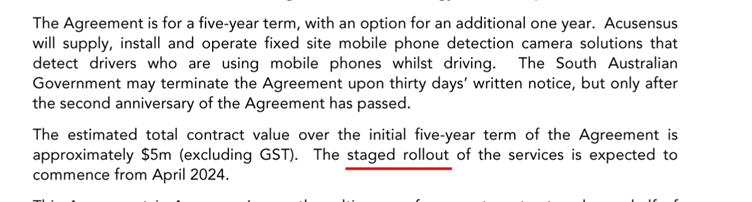

- The 8 Jan 2024 announcement from Acusensus confirming the contract award mentioned that there will be a staged rollout in South Australia (see excerpt below)

- It would be very bizarre if the remaining four cameras funded under this budget announcement aren’t operated by Acusensus.

If Acusensus is the likely operator of the new cameras in SA, why has nothing been announced to date?

- As the remaining cameras are being built on new gantries, DIT would have had to complete due diligence investigations and design processes before confirming any potential camera locations for Stage 2.

- While there has been a formal announcement by the SA Government, it is my take that Acusensus have not officially disclosed anything to the market, as they have not signed any contractual/variation to officially increase the number of cameras they operate in SA.

- My gut feel is that something like that will likely come out early next year (especially if they are to make the mid 2026 rollout date)

If awarded to Acusensus, I would expect that ongoing revenue from SA will increase to around $1m per annum in July, and further increase to around $1.4-1.6m per annum once phase 3 is rolled. Not huge in comparison to the NZ deal, but would still help them to nudge closer to generating a positive NPAT.

This is by no way a guarantee that any new cameras in SA will be awarded to Acusensus, as my hypothesis is based on publicly available information to date.

DISL: one of my largest holdings IRL and on SM.