I had my paralegal draft this memo on the legal proceedings brought by Redflex, the recent ruling dismissing Redflex’s application to strike out evidence that $ACE is seeking to rely on and the impact of the outcome of the legal proceedings on the $ACE valuation.

Disc - Held IRL and in SM

⸻

Investment Memo

Company: Acusensus Ltd (ASX: ACE)

Issue: Legal proceedings – Redflex Traffic Systems Pty Ltd

Date: December 2025

⸻

Executive Summary

Acusensus is defending Federal Court proceedings brought by Redflex Traffic Systems alleging intellectual property infringement. A recent procedural ruling on 15 December 2025 was incrementally favourable to Acusensus, with the Court dismissing Redflex’s application to strike out evidence that Acusensus intends to rely upon in its defence.

The matter remains ongoing, with a substantive trial scheduled for April 2026. While legal risk persists, the recent ruling reduces downside asymmetry and supports the view that resolution will likely occur only after full evidentiary consideration or later-stage settlement.

⸻

Background

• Proceedings commenced by Redflex in June 2025 in the Federal Court of Australia.

• Claims relate to alleged ownership and infringement of intellectual property arising from events dating back approximately eight years.

• Acusensus denies the allegations and has stated it will defend the proceedings vigorously.

⸻

Recent Legal Development

• 15 December 2025: The Federal Court refused Redflex’s application to strike out certain evidence Acusensus seeks to rely upon.

• Acusensus is therefore permitted to include and rely on that evidence through discovery and at trial.

• The ruling is procedural and does not determine liability or remedies.

Significance:

Strike-out applications are commonly used to narrow or weaken an opposing party’s case at an early stage. The Court’s refusal indicates that Acusensus’s evidence is at least arguable and relevant, preserving its ability to run a full factual defence.

⸻

Current Status & Timetable

• Proceedings ongoing in the Federal Court of Australia

• Discovery completion: 20 February 2026

• Trial: Scheduled for April 2026

⸻

Strategic Implications

For Acusensus

• Strengthened defensive posture and litigation leverage

• Reduced risk of early adverse procedural outcomes

• Supports management’s view that the dispute will turn on technical and factual matters rather than procedural elimination

For Redflex

• Unsuccessful attempt to constrain Acusensus’s evidentiary case

• Increased reliance on success at full trial rather than early procedural resolution

⸻

Valuation Impact – Scenario Analysis

Base Assumptions

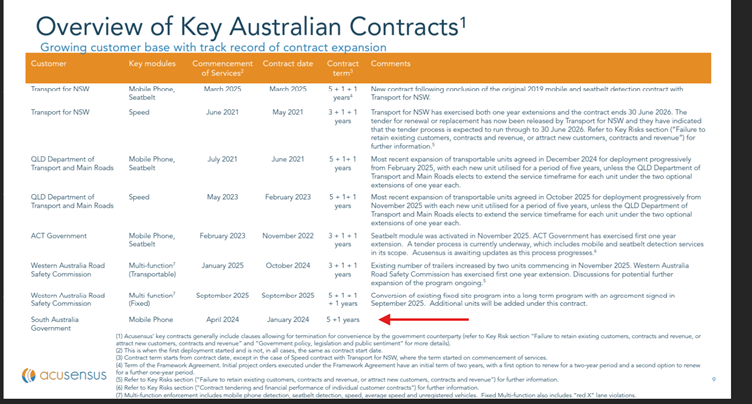

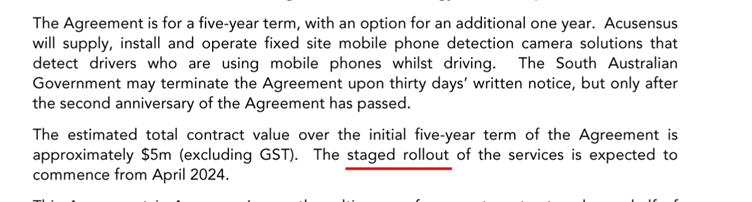

• Core growth thesis (global automated road safety enforcement) remains intact

• No interruption to existing customer contracts

• Valuation based on forward multiples discounted for execution and legal risk

⸻

???? Bull Case – Defence Success / Immaterial Settlement

Probability (illustrative): 30%

Assumptions

• Acusensus prevails at trial or settles on immaterial financial terms

• No injunctions, licensing obligations, or operational restrictions

Valuation Impact

• Removal of legal risk discount (estimated 10–15%)

• Multiple expansion toward peer upper quartile

• Upside: +15–25%

⸻

???? Base Case – Protracted Litigation / Neutral Settlement

Probability (illustrative): 45%

Assumptions

• Case proceeds through trial or resolves late

• One-off settlement and legal costs absorbed without structural impact

Valuation Impact

• Limited long-term cash flow impact

• Valuation impact: −5% to +5% (largely neutral)

⸻

???? Bear Case – Adverse Judgment

Probability (illustrative): 25%

Assumptions

• Redflex succeeds on core IP claims

• Damages, licensing fees, or constraints on certain technology

Valuation Impact

• Margin pressure and potential contract risk

• Downside: −25–40%

⸻

Expected Value View

On a probability-weighted basis:

• Risk-weighted valuation impact: approximately −5% to +10%, skewed modestly positive

• The 15 December 2025 ruling improves expected value by reducing the probability of early procedural loss and increasing Redflex’s trial and settlement risk.

⸻

Key Watch Items

• Discovery outcomes by 20 February 2026

• Any interim rulings affecting admissibility or scope of evidence

• Indications of settlement discussions ahead of trial

• Legal cost disclosures versus guidance

⸻

IC Conclusion

The Redflex proceedings remain a live risk into FY26; however, the recent Federal Court ruling reduces downside asymmetry and supports continued inclusion of Acusensus within a high-risk, high-growth allocation. The dispute now appears more likely to be resolved through full evidentiary trial or later-stage settlement rather than early procedural defeat.