Found the answer to the share price weakness.

Hidden somewhere near the back of the prospectus and it was quite hard to find.

I admit I missed this when I went through the doc a month ago.

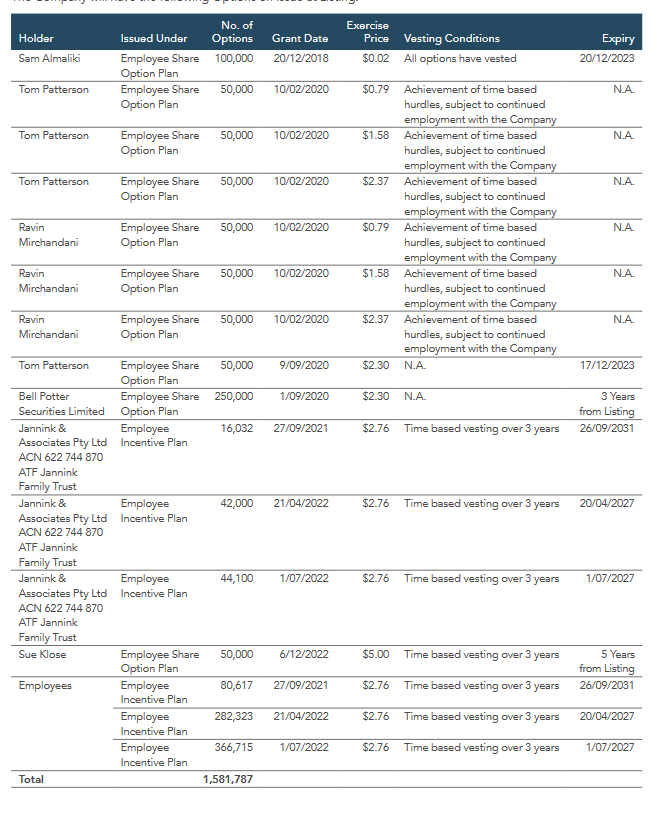

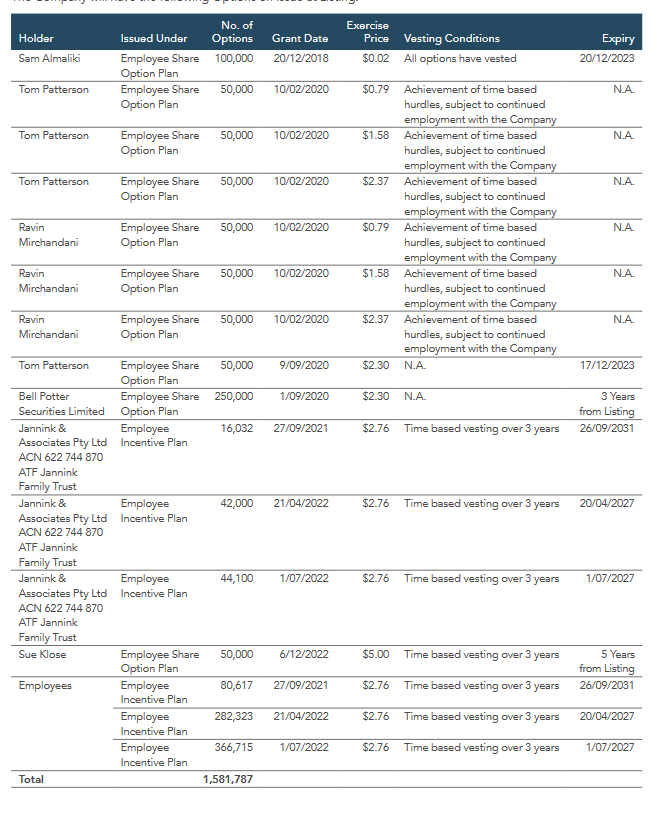

Below gives an insight into how funds were raised before the IPO and prices the seed investors paid before the IPO that would not be on this list.

On average seed investors must have have paid around $2.00 per share pre split before the IPO when Acusensus was still private.

Also the aggregate summary value of all these options was not on the FRONT of the prospectus which helps the investor find out if the IPO is good value or not. However I'm not sure if it is compulsory to put that value in but all the ones I've seen have done that.

Taking a step back, I think most of the selling below $3 happened in February. So maybe it is over?

At least the subs in the above haven't sold ... yet. Only the employees, Bell potter and others not listed above.

On that note, if business momentum is maintained then maybe the selling will stop.

[held]