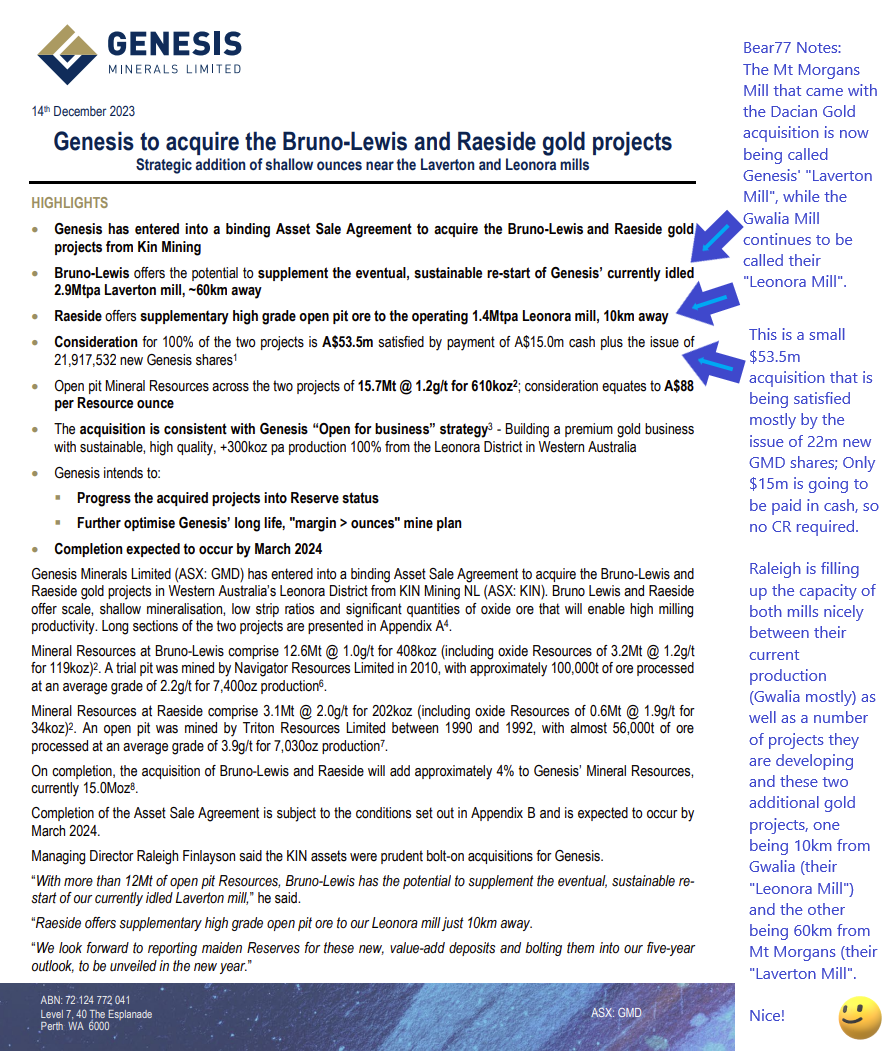

14-Dec-2023: Genesis (GMD.asx) has just agreed to buy a couple more gold projects, this time from Kin Mining (KIN.asx).

GMD-to-acquire-the-Bruno-Lewis-and-Raeside-gold-projects.PDF

GMD-Reporting-on-select-Kin-Mining-gold-projects.PDF

Kin-Receives-$535m-from-Sale-of-Gold-Deposits-to-Genesis.PDF

That's $53.5m, not $535m as the KIN announcement file name suggests - can't have dots in the middle of file names - I wish companies would stop doing that, as it can give an entirely wrong impression until people open the announcement and read it properly.

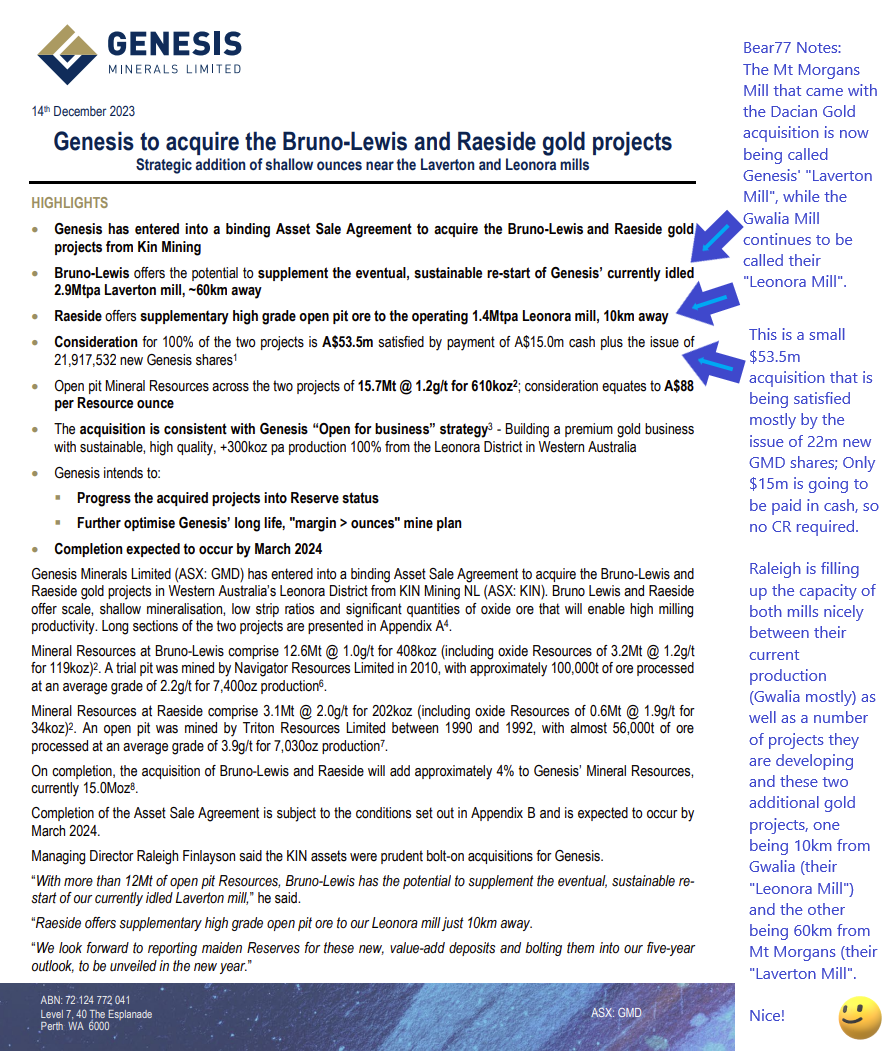

Below is the first Page of GMD's first announcement, with some notes from me on the right:

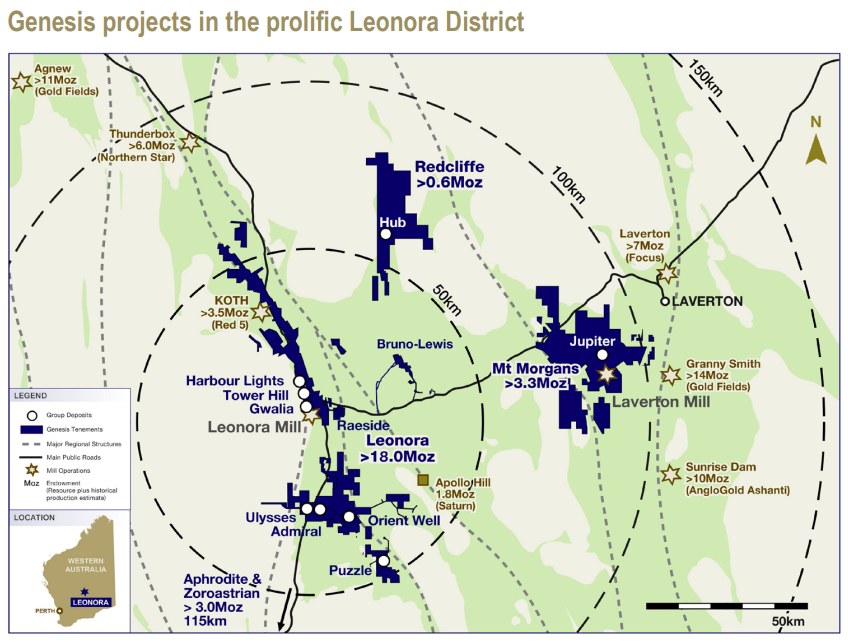

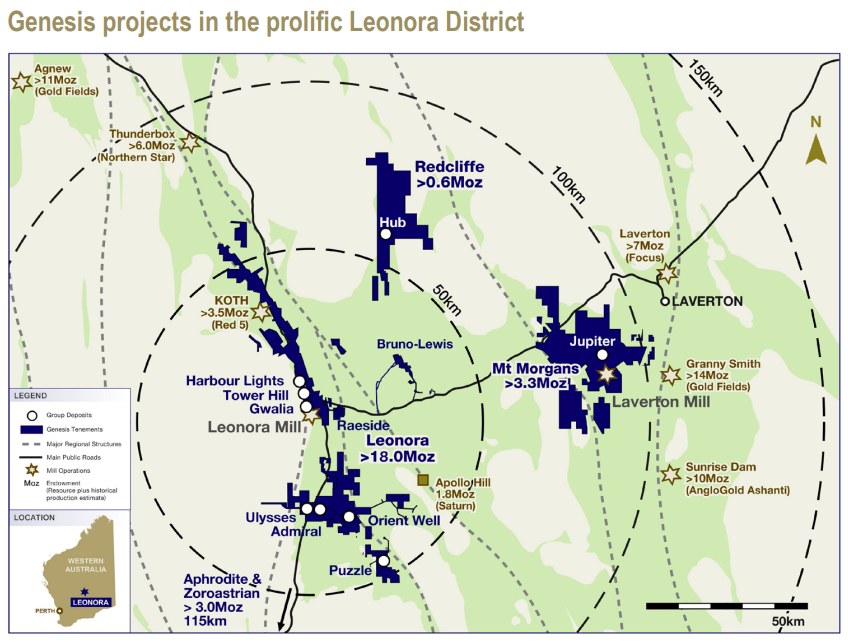

Map from page 2 of that same announcement:

As I write this, GMD's SP is up +8% at $1.80 (closed at $1.665 yesterday), however they spiked up to as high as $1.90 this morning which was +14.1% above yesterday's close. They got down to below $1/share in mid March, so they're up over +80% from there.

KIN is up +10%, but were up +16.7% earlier at 7 cps (closed at 6 cps yesterday, currently trading at 6.6 cps).

The rise in the GMD share price today might seem a bit overdone for such a small acquisition, but it's more about the fact that the market may be coming around to my way of thinking in terms of Raleigh being less likely to be bidding for RED (Red 5) now. My argument is that RED has now become too expensive, and their mill is no longer needed by GMD now or in the near term, AND that SLR have a blocking stake in RED that they would almost certainly use to frustrate any takeover of RED that GMD might attempt. It would be a negative if Raleigh tried to go after RED at current levels because he would almost certainly be overpaying, however with every small acquisition like this the likelihood of GMD making a near-term bid for RED reduces in the eyes of the market.

In short - the roll-up (growth via acquisition) model remains intact without Genesis clearly overpaying for any assets that they are acquiring - so all good, thesis remains on track. The market is liking the progress to date.

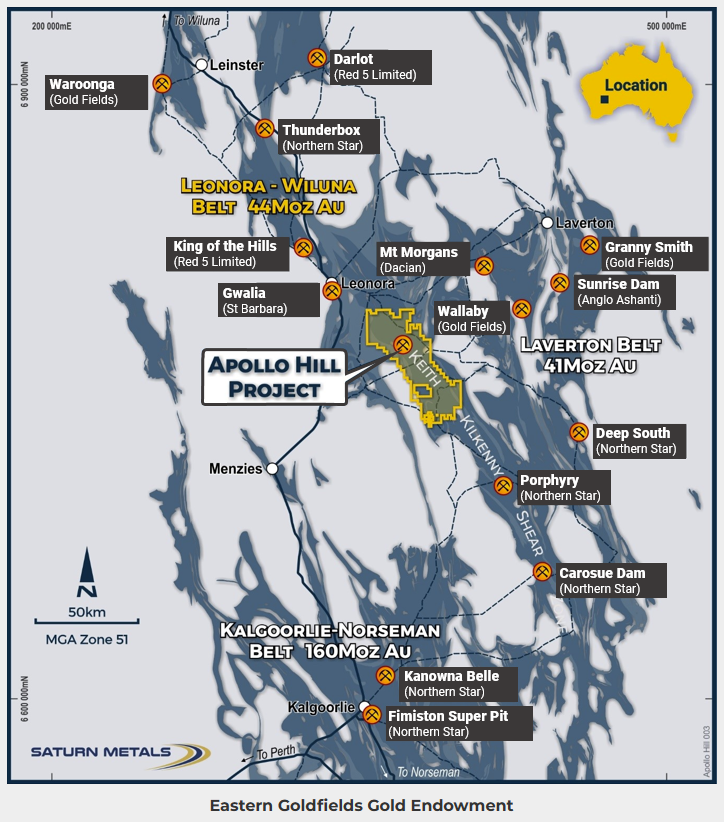

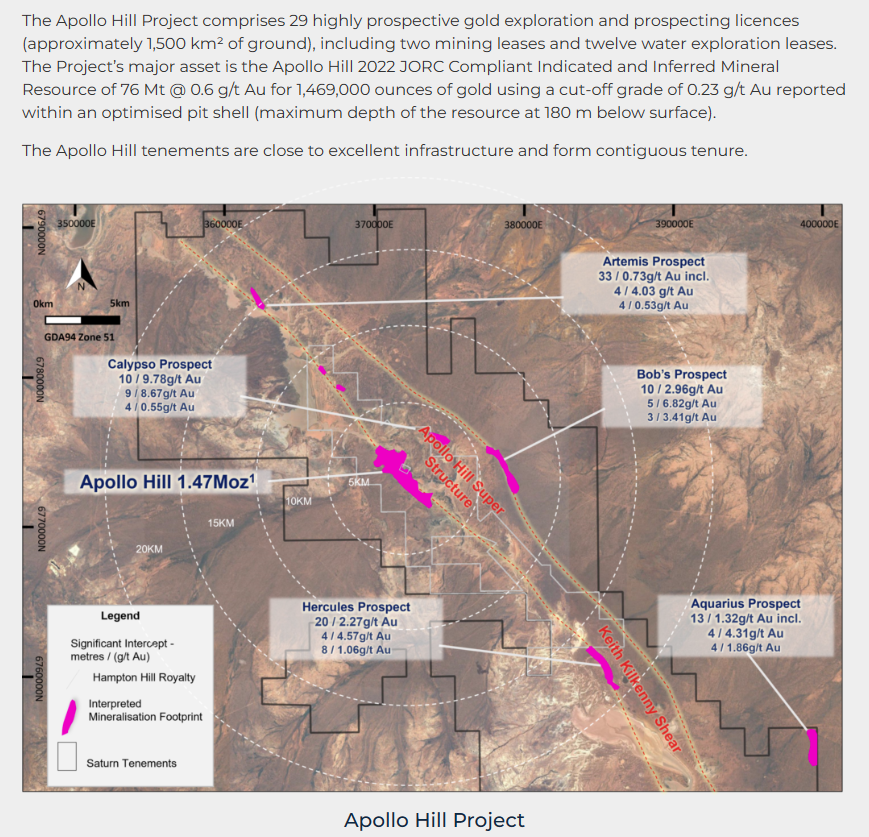

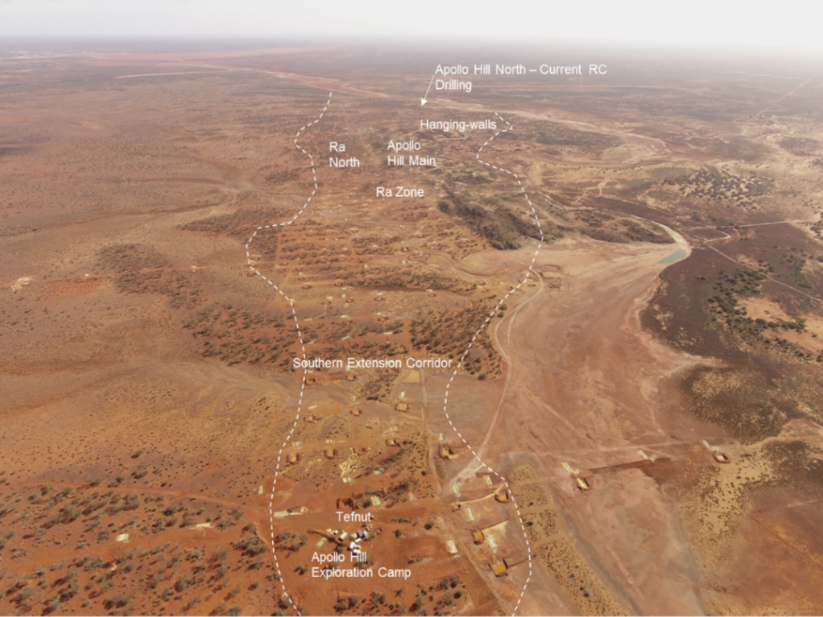

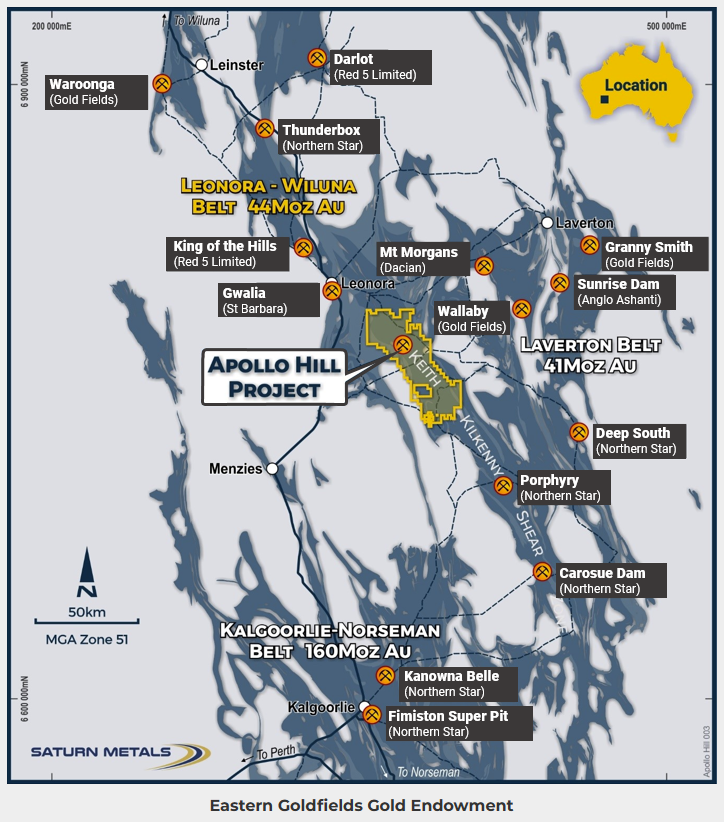

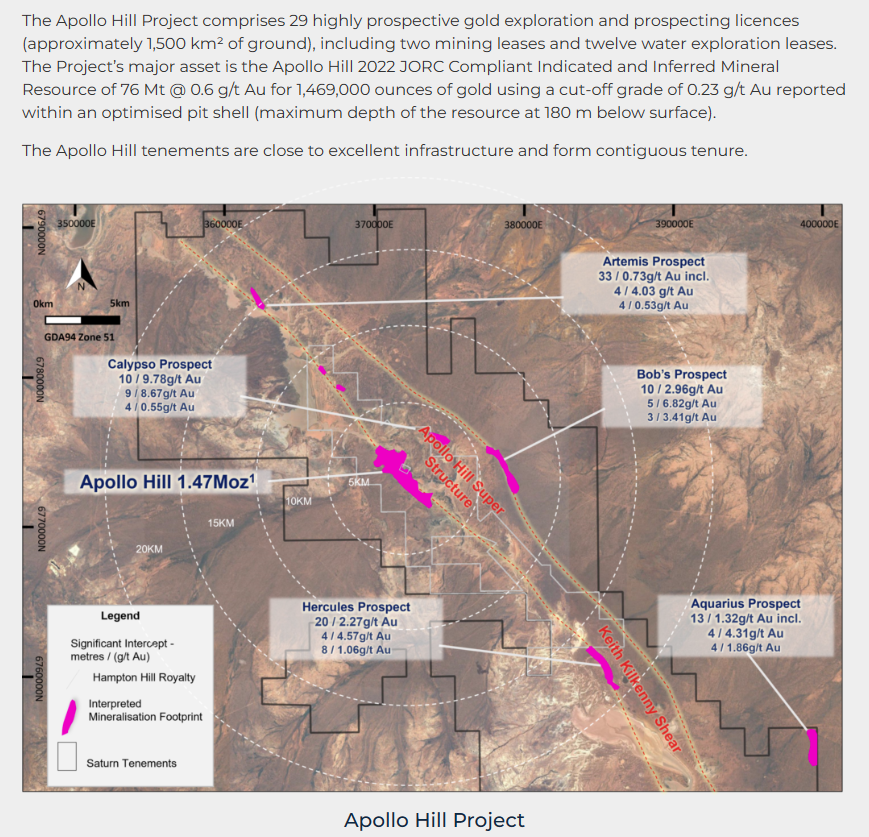

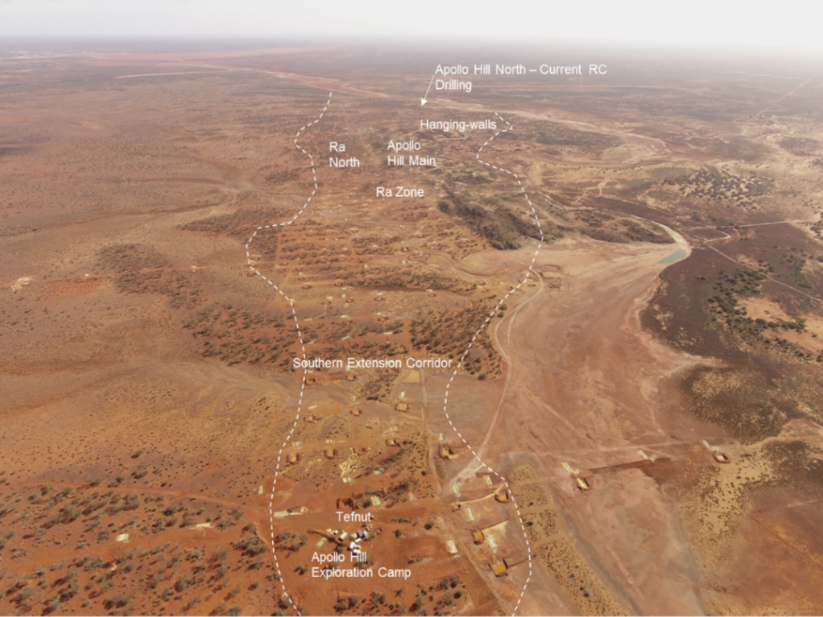

Sidenote: Saturn Metals' (STN's) Apollo Hill gold project is absolutely in the firing line for Genesis Minerals. Apollo Hill is around 40km south east of the Gwalia (Leonora) Mill. RED's KOTH (King of the Hills) mine and mill are around the same distance north west of Gwalia/Leonora (see map above). RED's market cap is $1.17 Billion. STN's m/cap is less than $40 million - currently $33.46m according to the ASX website. Genesis could buy all of Saturn (STN) for less than $100m, or just Apollo Hill, although the price difference wouldn't be much considering Apollo Hill is STN's main asset. They bought it off Peel Mining (PEX) in mid-2017.

That's from the Saturn Metals website: https://saturnmetals.com.au/projects/apollo-hill/

...which needs to be updated - as it shows Gwalia as still being owned by SBM and Mt Morgans still being owned by Dacian (which is now 100% owned by Genesis) - plus it shows Apollo Hill as having 1.47 Moz (million ounces of gold) in the ground (see below) but the up-to-date map from today's GMD announcement (scroll up for that - towards the top of this straw) shows Apollo Hill as having 1.8Moz. Not particularly high grade, but close to Leonora. Raleigh would have an eye on that one for sure.

Disclosure: I hold GMD shares, and I have STN on a watchlist now.

That's a better buy than RED is at current levels - for sure. The major differences are that RED are in production, have WAY more gold, at higher grades, and a very decent mill as well, but they're priced for all that at over $1 billion. So STN is high risk for sure, and RED is expensive but de-risked. If I was to invest in STN, it would be an appropriately small punt rather than an investment, because they don't make any money, and they could go broke if they're not taken over by somebody like Genesis. High risk means I would put way less money at risk, but I'm not pulling the trigger on them yet - just on a watchlist for now.