17-Jan-2024: I hold EVN in my SMSF, but nowhere else, so not here on Strawman.com. I wasn't planning to take part in their SPP, which formed part of the CR for their recent acquisition of 80% of the Northparkes Copper-Gold Mine from CMOC Group Limited, but a few things have changed now. [I'm still not planning to participate despite those changes]

[03-Sep-2024: Note: Not holding EVN now, anywhere]

Firstly - there's this: Extension-of-Share-Purchase-Plan.PDF released on Thursday 11th Jan (last Thursday) which advises that the closing date for the SPP that was announced on 5 December 2023 will be extended from its original closing date of 16 January 2024 (yesterday) to 5.00pm on Tuesday 30 January 2024.

Eligible shareholders participating in the SPP will be able to purchase shares at the lower of:

- A$3.80 per Share, being the same price paid by institutional investors under the Placement announced on 5 December 2023; and

- a 2.5% discount to the 5-day volume-weighted average price of Shares traded on the ASX up to, and including, the revised SPP Closing Date (30 January 2024) (rounded to the nearest cent).

Which is a good thing for EVN shareholders participating in the SPP because they're now likely to be paying a good deal less than $3.80 for those shares now due to today's announcements:

Wednesday 17 January 2024:

Firstly: December-2023-Quarterly-Report-EVN.PDF

Secondly: Exploration-Success-Continues-at-Cowal-and-Ernest-Henry.PDF

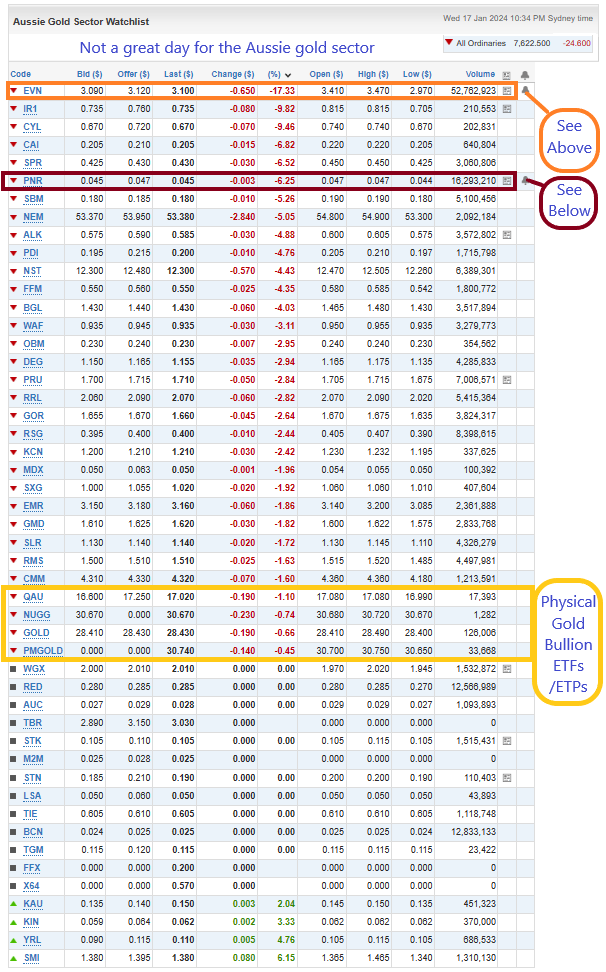

The first one did the damage. EVN closed down -65 cps at $3.10, so down -17.33% today.

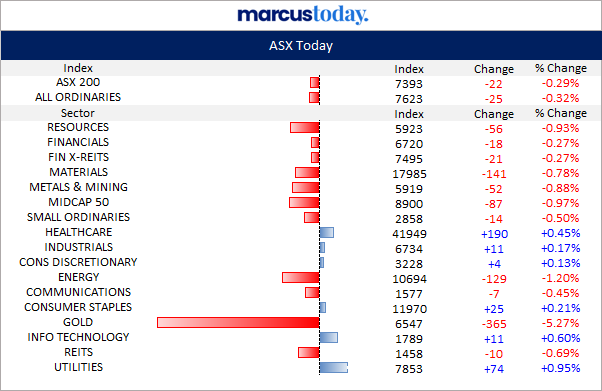

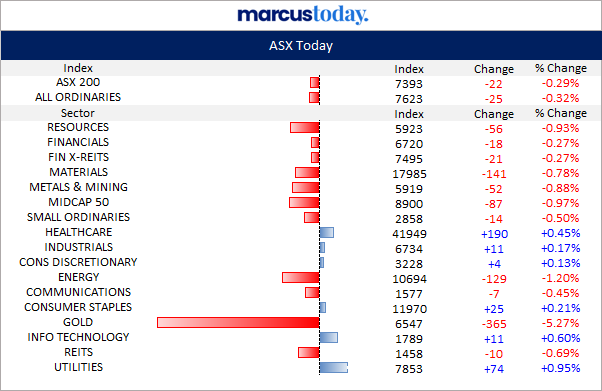

The market was in no mood for bad news - here's the sector movements today:

Gold sector down -5.27% - that's a BIG move. EVN's selloff would have contributed to that for sure because they are the third largest constituent of that gold sector. They should be the second largest after NST, but the sector still has NEM in it, Newmont Corporation, even though they are listed in the USA and are not an Australian company. Because Newcrest (formerly NCM) WERE Australia's largest gold producer, and Newcrest shareholders were paid in Newmont (NEM) shares when Newmont acquired Newcrest last year, they've (S&P have) decided to keep those NEM CDIs in the Australian gold index.

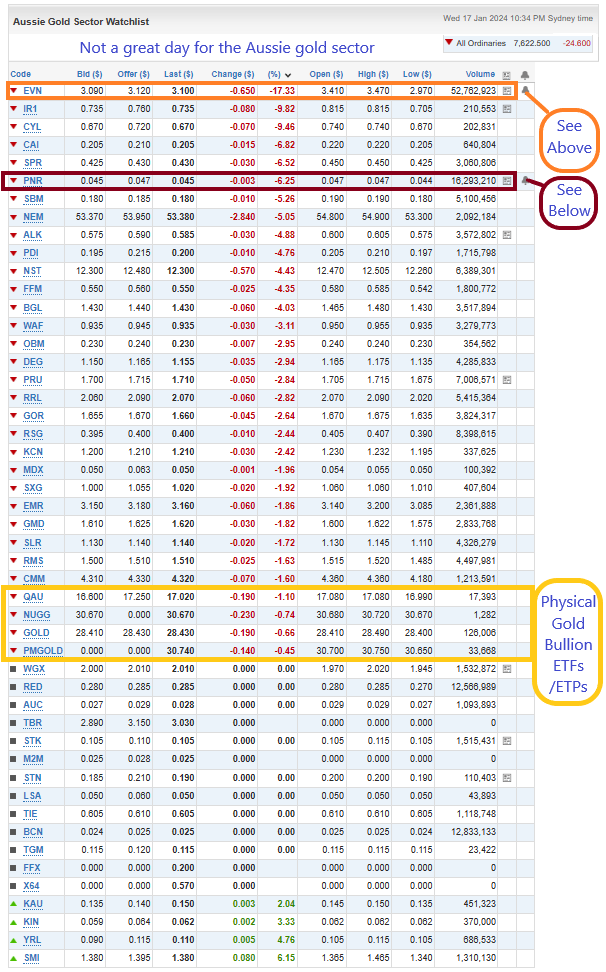

EVN was the worst of a bad bunch today...

The fact that the majority of our goldies closed substantially lower than the four physical gold ETFs (see above) is a clear sign of seriously negative sentiment across the sector today.

Pantoro (PNR) released the following update last week (on the 8th): December-2023-Quarter-Production-Update-PNR.PDF

And their SP fell -7.55% on the day and then another -6.12% the following day.

Today they released this at 9:33am: Underground-Development-to-Commence-at-Scotia.PDF

And their SP fell another -6.25%. Those that follow PNR (and that would be a small group, because they're a small goldie) were clearly expecting or at least hoping for better, or more, and dumped them when they didn't get what they wanted from those updates. Pantoro finished CY 2023 @ 5.7 cps and they're now (in the middle of January) some -21% lower at 4.5 cps. I have held them in one of my real money portfolios previously and do occasionally have a small trade in them with some loose change here - because of the lack of brokerage fees.

After the market closed, at 4:54pm, they lodged this: Addendum---Underground-Development-to-Commence-at-Scotia.PDF

Meanwhile Evolution Mining (EVN), one of our gold majors, closed at $4.14/share on December 4th, the day before they announced the Northparkes transaction and capital raising, and today they closed at $3.10, which is -25% lower.

Some details from today's update:

- Evolution’s Chief Operating Officer (COO), Bob Fulker has decided to leave the Company to pursue other opportunities. Mr Fulker will finish at the end of March. A search to identify an appropriate replacement is underway.

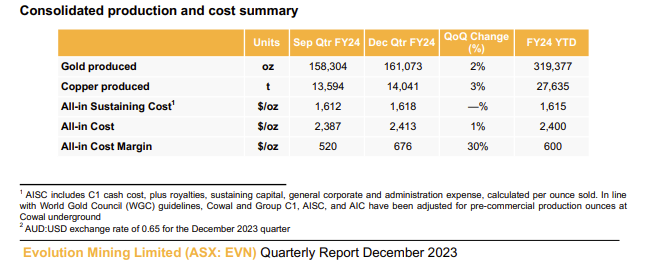

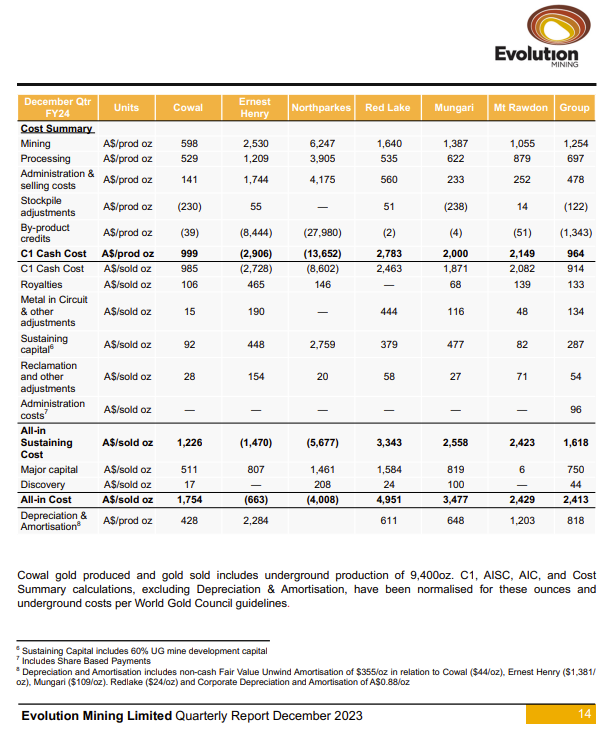

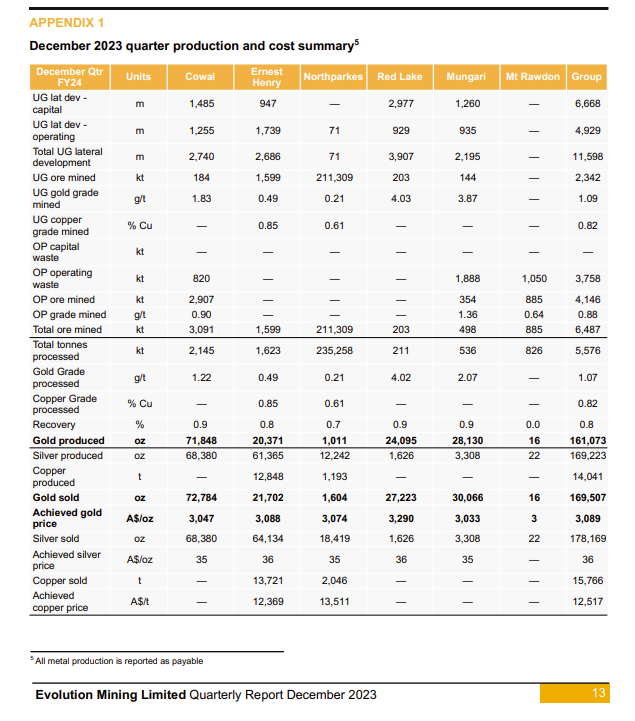

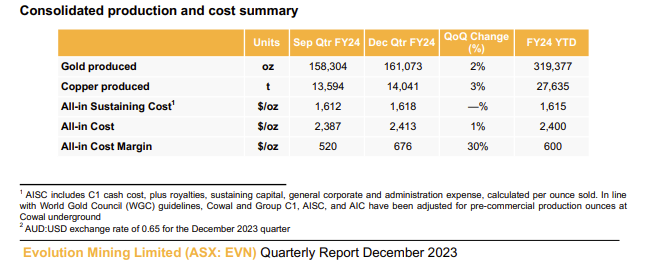

- Gold production for the quarter was 161,073 ounces at an All-in Sustaining Cost (AISC) of $1,618 per ounce (US$1,052/oz) compared to the previous quarter which was very similar:

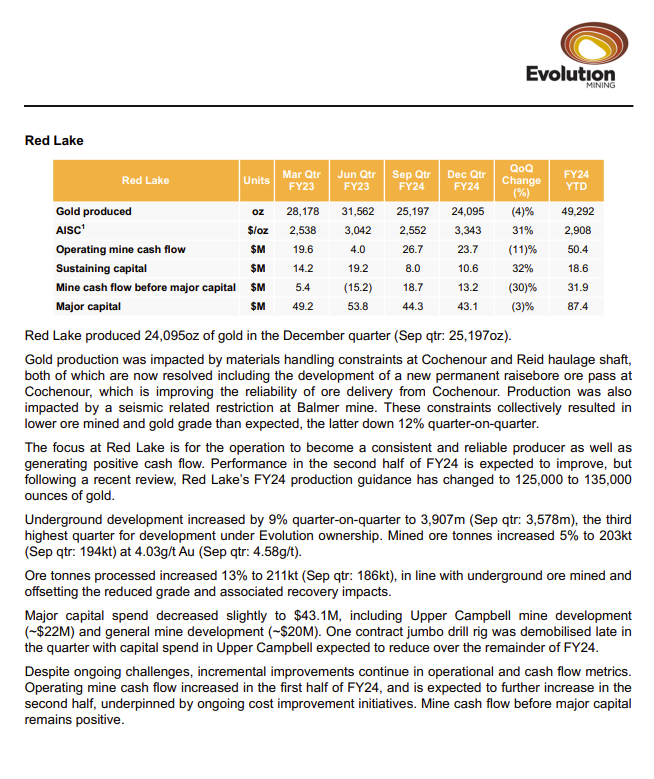

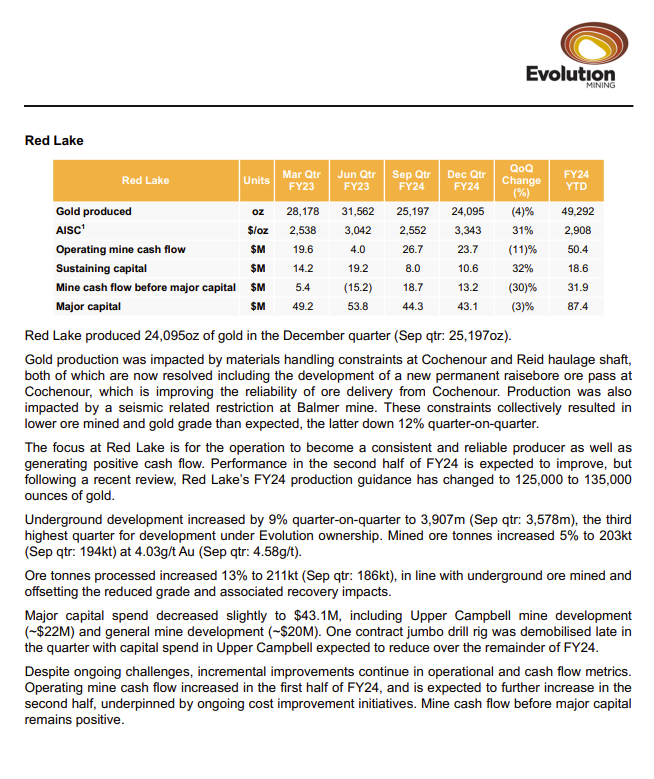

- Despite some positives elsewhere, the market is probably focusing more on the continuing basket case that is Red Lake:

- Evolution Mining's Red Lake underground gold mine in north-western Ontario (Canada) is their only gold mine located outside of Australia (they have 4 gold or copper/gold mines here in Australia - Cowal, Ernest Henry, Mungari and Mt Rawdon, plus their 80% of Northparkes in NSW as well), and Red Lake is certainly their problem child. The update (see above) shows that for the December quarter, their production at Red Lake (gold produced) fell by -4%, their AISC (costs) rose by +31% from A$2,552 to A$3,343/ounce (above the gold price, so Red Lake is losing money), cashflow decreased by -11%, and sustaining capital (which is included in that AISC) increased by +32%. I've included the whole page (above) on Red Lake from today's quarterly report, for some context. That is one acquisition that Jake Klein made that has NOT worked out as planned. Not yet anyway.

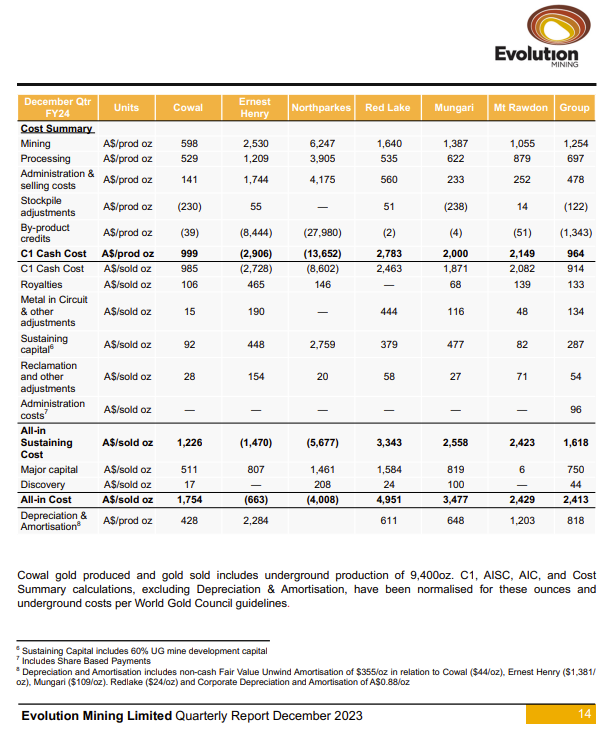

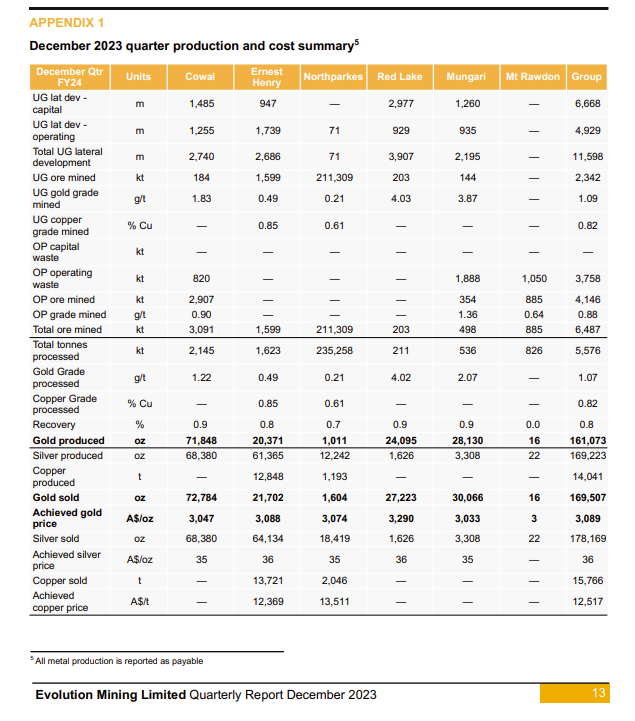

Appendix 1 contains their December 2023 quarter and their FYTD (financial-year-to-date) production and cost summaries. Below is page 14, which is the second page of Appendix 1. Page 13 was the production breakdown. Page 14 (below) is the cost breakdown for the December quarter:

The full report can be read here: December-2023-Quarterly-Report-EVN.PDF

You can see there how wide the range is across their minesites for their costs - both AISC and AIC. Their AISC ranges from negative (A$5,677)/ounce at Northparkes up to positive A$3,343/ounce at Red Lake. It is only because of those byproduct credits for copper from Ernest Henry and Northparkes, which both produce far more copper than gold, that EVN manages to get their Group AISC down to A$1,618/ounce. All of their mines also produce Silver, but the silver production is not particularly material, as shown on page 13 (reproduced below).

Cowal, EVN's flagship copper/silver mine in NSW which produces around 45% of all of EVN's annual gold production, is clearly their best asset. Cowal has an AISC of just $1,226/oz after silver byproduct credits and it's a high quality gold mine for sure. And I'm sure Ernest Henry and Northparkes are great copper mines too, that also produce some gold. But looking across the suite of mines that EVN operate, the quality varies greatly, as do the costs.

Cowal-fact-sheet-FY23F.pdf

Source: https://evolutionmining.com.au/cowal/

Cowal is an excellent mine that is expanding with heaps more gold there at good grades, but I believe the market isn't entirely comfortable with how some of EVN's other assets are travelling.

I'm not adding to the EVN position in my super or selling any - it's a long term holding in what was Australia's third largest gold producer when I bought that position a few years ago (@ $2.83/share) - they are now Australia's second largest goldie after Newcrest got taken out by Newmont last year.

But I don't intend to buy any EVN in any of my other portfolios, including the virtual one I have here. Other goldies like NST and GMD look heaps better to me at this point.

------------------

03-Sep-2024: Update: I sold out of EVN earlier this year after deciding I wanted more pure gold exposure rather than gold/copper which you get with EVN with Ernest Henry and Northparkes both being copper mines that also produce gold but being regarded by EVN as gold mines that have a negative ASIC because of the copper "byproduct credits" reducing the cost of gold production to a negative number. When you have your cost of gold being negative because of copper production, i.e. it cost you LESS than nothing to mine the gold, then clearly those are copper mines that also produce gold and should not be regarded as gold mines that also produce copper, but it's legal, and they're doing it. I just find it very misleading in terms of trying to make cost comparisons across the gold industry and including EVN, so I tend to exclude EVN from my gold sector universe now because it's just too hard.

The main problem for me is that if you REMOVE the copper production entirely, EVN is NOT a low cost gold producer. They are ONLY a low cost gold producer because they use their copper sales to reduce their gold production costs.

That said, for people who want exposure to gold AND copper, EVN would likely be a good option to consider. I just don't want that copper exposure right now - I may later, but not now.

EVN's latest report was apparently very good, and the market liked it, especially their bullish outlook, but I'm not interested in them now, so I haven't looked at it in any detail. Their SP closed at $3.81 on the day before they reported (August 13th) and they've traded as high as $4.40 and closed as high as $4.36 during the following fortnight, but they closed at $4.11 yesterday. So a bit of a reality check perhaps.

Their share price may well be driven as much by copper prices and sentiment than gold prices and sentiment now.

[not held]