Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Click anywhere on that image (or here) to watch this interview of Jake Klein by Peter Ker. Jake was the founder of EVN and its Executive Chairman until earlier this year when he transitioned to being the company's non-executive Chairman.

Always worth listening to what Jake has to say if you're interested in gold mining, and/or the rise of China - particularly as it relates to mining and resources in general.

Disclosure: I hold EVN (4.5% weighting).

29th October 2025: The latest MoM podcast is a deep dive by JD into the history of Evolution Mining and how Jake Klein created the company through opportunistic M&A at the start and grew it to become Australia's second largest gold miner, behind NST.

Click anywhere on those images above (or here) to go to their home page and access any of those podcasts.

To go straight to today's one about EVN, click on the image below.

Source: https://www.youtube.com/watch?v=Smoli3gxry0

Disclosure: I hold EVN. 5.3% weighting.

13th August 2025: Not so unlucky for EVN - Pretty Good Numbers, Eh!?!

Source: EVN-Record-FY25-Financial-Performance-and-Final-Dividend.PDF [above and below]

Bear77 Comment: This is what a large Australian gold producer with good management can achieve when the gold price is high and they make excellent capital allocation decisions; mostly through NOT making any acquisitions at high gold prices. One of the best things that Jake and Lawrie did in FY25 was nothing - in terms of M&A - they just made a LOT of hay while the sun was shining - and they didn't spend money except on further exploration of their own tenements and expansions of their own mills.

Jake Klein in August 2018 (7 years ago):

Klein told delegates at Diggers & Dealers that Evolution's modus operandi was building a business that would profit during the good times and the bad times.

"This means a strong focus and discipline on upgrading the asset base by selling lower quality assets in the upturn and acquiring higher quality assets in the downturn," he said.

"It also requires having the courage to swim against the tide - when things are at their darkest for the sector is when you should be growing and when everything seems too good to be true, then maybe it's time to sell assets."

Source: https://www.miningnews.net/precious-metals/news/1344129/gold-companies-scalable-klein

---

In other words, be smart, and engage in counter-cyclical M&A - if you engage in it at all.

---

This year (Feb 2025):

Good deals don’t come along often, particularly in resources. More often, pro-cyclical M&A results in value destruction as peak-cycle commodity prices revert. Cyclicality is an absolute certainty in commodity pricing, and acquired assets are often the subject of massive impairments as soon as the cycle turns – for example Rio Tinto and Alcan.

General exceptions to the rule have been:

- The purchase of Tier-1 assets from motivated sellers requiring urgent balance sheet repair - for example Evolution’s purchase of Ernest Henry from Glencore. To quote Evolution’s Jake Klein, “if you are looking to be successful in M&A don’t find assets, find sellers.”

- The opportunistic purchase of unwanted smaller assets from major producers. Particularly those who have recently completed a major acquisition (e.g. Newmont / Newcrest). Historically, buying assets off major mining companies has been a great strategy for juniors, particularly when assets shake loose as part of a broader consolidation.

Source: https://www.livewiremarkets.com/wires/gold-deal-of-the-decade [Matthew Fist of Firetrail Investments on the opportunity with Greatland Gold, now Greatland Resources, ASX: GGP)

I have also heard Jake asked in interviews this year about M&A and he said the time to buy things is when there are motivated sellers and he doesn't see too many of those around at these gold prices; so the thing to do currently is print cash and bank profits, and reward shareholders.

Jake has taken a step back now from Executive Chair to Non-Executive Chairman of EVN (from July 1st), however Laurie and Jake have always sung from the same hymn sheet, so I don't expect any radical departures from EVN in terms of strategy, especially M&A strategy.

See also: FY25 Full Year Results Presentation

See also: D&D 2025 | Evolution Mining - Lawrie Conway, Managing Director & Chief Executive Officer [Presentation, August 2025]

The market likes EVN's results today (why wouldn't they?!) - however there are some goldies who are up even more than EVN are:

Disclosure: Of the goldies on that list above, I currently hold just two - EVN & GMD - but I also hold others who are not on that list (which is just the top quarter of my Aussie Gold Sector Watchlist in order of share price performance today).

Show Notes:

Our special guest is one of Australia’s most influential mining leaders, Jake Klein, Executive Chair of Evolution Mining.

In this jam packed Finding the Front 50thepisode Jake provides valuable lessons and observations in gold, China and importantly, the future of Australia's mining sector.

A seriously insightful discussion, Jake opens up on his:

- early days in Cape Town and arriving in Australia with $1,000 in his pocket, the major influence of his first job at Macquarie Group,

- views on early China and leading the largest foreign gold miner in China Sino Gold to a $2.2B exit,

- insights into the founding of Lynas Rare Earths Ltd where he was a long term Non-Exec Director,

- his journey over 15 years and the steps to build Evolution into a gold powerhouse - M&A, gold assets (inc. Mt Rawdon, its mine life to now becoming a Pumped Hydro Project for Qld energy), costs, people, gold price and

- the challenges facing the future of the Australian mining sector including the major influence of China.

For those who love mining or are involved in the industry, opportunities like this don’t come along often.

--- end of show notes ---

Source: https://www.youtube.com/watch?v=WYloLJZimJE

Disc: I hold EVN in my SMSF.

03-April-2025: Mungari-Expansion-Project-Commences-Commissioning.PDF

Excerpt:

3 April 2025: Mungari Expansion Project commences commissioning

Evolution Mining Limited (ASX: EVN) is pleased to advise that commissioning of the expanded Mungari mill has commenced, with the project team handing over to the operations team. Commissioning is set to continue through the June quarter.

The project expands the Mungari process plant capacity from 2 million tonnes per annum to 4.2 million tonnes per annum. The mill expansion project has been delivered nine months ahead of the original schedule with the current estimated final cost of $228 million, now 9% under the original $250 million budget. This is an outstanding achievement by the project team.

Completion of the project enables the extension of Mungari’s mine life to at least 2038 and supports the operation’s anticipated transition to an average annual production rate of ~200,000 ounces in the coming years. This represents a 50% increase on current production rates of approximately 135,000 ounces.

Onsite commemorations of the successful completion of construction and start of commissioning are being held onsite today which secures the long-term future of Mungari Operations in the Goldfields regions, Western Australia.

Managing Director and Chief Executive Officer, Lawrie Conway said:

“Today we celebrate the operational handover of a construction project that has been executed safely, efficiently, ahead of the original schedule and under the original budget. This incredible achievement would not have been possible without the collective efforts of our employees, contracting partners including GR Engineering Services Limited (ASX: GNG), NRW Holdings Limited (ASX: NWH), MLG Oz Limited (ASX: MLG) and local stakeholders, for which I am very thankful. It’s a proud moment for all of us and an important milestone for the Mungari Operation, which will now transition back to a major cash contributor for Evolution.

“I am delighted that the Hon. David Michael MLA, Minister for Mines and Petroleum and Goldfields-Esperance, and Ms Ali Kent MLA, Member for Kalgoorlie are both able to join us today to celebrate this significant achievement.”

--- end of excerpt ---

Disclosure: I hold EVN in my SMSF, and I hold GNG and NWH both here on SM and also in my real life portfolios (NWH in both my RL portfolios, and GNG only in the larger one outside of my SMSF because GNG is an ex-ASX300 company and I can only hold ASX300 companies in my SMSF).

It is a real credit to GNG, who were awarded the $153 million contract to expand the Mungari Mill back in late September 2023 (see here: https://www.gres.com.au/news/article/29092023-120/epc-contract-mungari-future-growth-project-process-plant.aspx), and have now completed the project and handed it back to EVN for commissioning approx. 9% UNDER the original budget and 9 MONTHS ahead of the original schedule. Another feather in their cap.

GNG remain the "go to" company for gold mills here in Australia, both greenfields builds (new mills) and brownfields expansions (as in this case, expanding the existing mill from 2 mtpa to 4.2 mtpa). Outside of Australia, fellow Perth-HQ'd engineering company Lycopodium (LYL, who I also hold) win most of those contracts, particularly work in West Africa and other higher risk areas of the world, however GNG are still winning most of the local contracts for this sort of stuff.

Combining the two (GNG + LYL) into a single company would make heaps of sense, but each of them has very high insider ownership - around one third of each company is owned by their management, board members, company founders and their families - so I see that as a high hurdle to get over, as neither company's management would likely be too keen on giving up control of their company to the other company's management team. It could happen, but it would be a tricky deal to negotiate I reckon.

In the meantime both GNG and LYL are doing well by themselves, and I hold both, including here where LYL is my largest position. LYL is also by far my largest position IRL. I do often load up on GNG, but currently I only have about $50K in GNG (over $200K in LYL) because GNG look like they are close to fully valued to me up at $2.90 to $3/share, until they land some more large contracts, whereas LYL look significantly undervalued at below $11/share. They're both going to keep growing and performing well IMO, especially if the gold price stays up around these high levels or rises further, but LYL has greater near and mid term upside from here based on their current share price, IMO.

Both are very good at what they do.

And EVN is a decent company to consider if you want some copper exposure along with your gold exposure. Leaving aside their copper (and they produce quite a bit of copper, particularly from Northparkes and Ernest Henry), their gold production alone makes Evolution Mining (EVN) the second largest Australian gold producer, behind NST.

Below are some images of EVN's Mangari mill:

Further Reading: https://www.abc.net.au/news/2023-06-05/evolution-mining-approves-250-million-expansion-of-mungari-mill/102440912 [05-June-2023]

04-March-2025: EVN released an update concerning their best asset (by a country mile) Cowal in rural NSW on Friday arvo:

28/02/2025: 2:04 pm: Final-regulatory-approval-received-to-extend-Cowal-Operation-to-2042.PDF

Excerpt:

Cowal Gold Operations (Cowal) Open Pit Continuation (OPC) has received Federal Government approval pursuant to the Environment Protection and Biodiversity Conservation Act 1999 (‘EPBC Act’).

This approval marks the final regulatory step required for the continuation of open pit mining following the previously granted NSW State Development Consent in December 2024. It allows for the expansion of open pit mining at Cowal, including the mining of three adjacent ore bodies. The approval is valid to 28 February 2050, reinforcing long-term operational stability.

As all regulatory approvals for the OPC have now been received, approval from the Evolution Board is expected to be sought during the June 2025 quarter.

Managing Director and Chief Executive Officer, Lawrie Conway said: “It is extremely pleasing to receive the final regulatory approval to continue open pit operations at our Cowal Gold Operations. This project has been subject to a robust approvals process, at both a State and Federal level, and we acknowledge the constructive engagement and rigorous input across government to reach this positive outcome. Cowal possesses a significant mineral endowment that will sustain our operations for decades to come and provide lasting benefits for our stakeholders and continue the significant returns generated to date for our shareholders.”

--- end of excerpt ---

Good news for Cowal and EVN.

Disc: Holding, in my SMSF.

Map Source: https://evolutionmining.com.au/cowal/

https://evolutionmining.com.au/storage/2025/01/FY24-Fact-sheet-Cowal.pdf

Water management is key to this one, otherwise it's a gold mine, literally.

Lake Cowal pictured in flood, with the Cowal gold mine next to it, in the NSW Central West. (Supplied: Brad Shephard)

Lake Cowal gold mine expansion approved by federal government

https://www.abc.net.au/news/2025-02-28/lake-cowal-gold-mine-expansion-approved-by-federal-government/104995690 [28-Feb-2025]

In short:

The federal government has approved the Cowal Gold Mine's expansion project in the NSW Central West.

The plans include expanding the mine's main open cut pit, digging three new pits, and extending the lifespan to 2042.

What's next?

Evolution Mining will make a final decision on the project at its board meeting later this year.

ABC Story [28-Feb-2025, link above]:

One of New South Wales' largest gold mines has been given federal approval to expand further into the state's biggest inland lake in the Central West.

Evolution Mining sought approval to extend its main open cut pit further into Lake Cowal, dig three new pits, and lengthen its life span until 2042.

The company estimated the expansion would inject more than $900 million into the state's economy over its lifetime, and produce about 1.6 million ounces of gold, and 1.5 million ounces of silver.

The NSW government signed off on the project in December.

The state government estimated the three new open cut pits would result in an additional $56 million in royalties, and employ a further 64 full-time-equivalent roles during construction.

Evolution Mining's managing director and CEO Lawrie Conway said in a statement that securing federal consent was "extremely pleasing".

"This approval reinforces our original vision for Cowal as a long-life asset that can continue for decades to come," he said.

"This project has been through a robust approvals process … and we acknowledge the constructive engagement and rigorous input across government, together with all our stakeholders, to reach this positive outcome."

A local environmental group has previously raised concerns that the expansion could threaten the lake's bird breeding seasons.

Lake Cowal is a known breeding ground for waterbirds such as the straw-necked ibis. (Supplied Mal Carnegie)

Part of the mine currently covers 132 hectares of the lake's 13,500-hectare size.

The approval means that would expand the mine's operations to about 500 hectares of the lake's footprint.

The disturbance area includes land classified as key fish habitat, and important habitat for migratory bird species.

The company also proposed to extend a protective wall that separates the mine and the lake to more than 6 kilometres in length.

Lake Cowal operations general manager Joe Mammen said in a statement the company would address all environmental requirements attached to the consent.

"We are committed to meeting all approval conditions, including biodiversity protection measures, environmental offsets, and ongoing compliance reporting," he said.

"We look forward to seeing the strong socio-economic benefits it will bring to the Central West region."

A spokesperson for the federal Department of Climate Change, Energy, the Environment and Water said it approved the extension with "strict" conditions to protect important habitats for threatened and migratory species.

The company will make a final decision on the expansion project at its board meeting later this year.

--- ends ---

Bear77 comment: This final approval for Evolution's Cowal gold mine extension is interesting because Cowal is west of Newmont's Cadia gold mine, which is just a hop, skip and a jump away from Regis Resources' (RRL's) McPhillamys Gold Project (see map, below left), which had received "final" development approval before the project got scuttled by Tanya Plibersek, the Federal Minister for the Environment and Water, who made a controversial decision last year that the planned McPhillamys TSF (tailings storage facility, a.k.a. tailings dam) could not be built in the location it had been planned to be built, due to indigenous cultural heritage concerns. According to Regis, the TSF could not be relocated so that decision by Plibersek effectively blocked McPhillamys from proceeding - I understand Regis are in the process of challenging that decision through the courts.

Source: Slide 18 of Cowal site visit presentation 20 June 2024

Here's that Map a bit larger:

My take on this is that it is becoming increasingly hard to get greenfields (new) projects going in eastern Australia, or in NSW more specifically, but much easier to get approvals to expand existing operations.

If you like both gold and copper at this point in time, EVN mine both through a bunch of mines, with two of those (Northparkes and Ernest Henry) producing more copper than gold (in dollar value terms). Cowal is their best gold mine in terms of ounces of gold produced p.a. and lowest costs without using copper byproduct credits.

EVN is the second largest gold producing company on the ASX that is headquartered here in Australia with the ASX as their primary listing, behind Northern Star Resources (NST). So I'm not counting Newmont (NEM.asx) because Newmont is a US company who bought Australia's largest gold miner (at the time), Newcrest Mining, a couple of years back, and while NEM can be traded here on the ASX, those are CDIs for their US shares; Newmont's primary listing is on the New York stock exchange. So I do not include Newmont as an Australian gold mining company, because they aren't.

Just for clarity, EVN do produce a lot of copper, however even if you ignored all of their copper and ONLY looked at their gold production, they would STILL be Australia's second largest gold producer, behind NST.

Disclosure: Holding both EVN & NST (in my SMSF). [and NST here also]

EVN are within spitting distance of their all-time high SP of $6.43 which was set within the past fortnight (on Feb 20th). Below, right, is their 10 year chart:

12-Feb-2025: EVN-Record-H1-FY25-Financial-Performance.PDF

Plus: FY25 Half Year Results Presentation.PDF

Plus: Appendix 4D and FY25 Half Year Financial Report.PDF

Plus: Evolution-Mining-Executive-Leadership-Update.PDF

Two months ago, I highlighted here that EVN were in a solid uptrend:

Well, that has certainly continued, and today's report hasn't done that uptrend any harm at all:

Disclosure: I hold EVN in my SMSF, having bought back in last year. I had previously gone cold on the company because of the increased exposure to copper through their production of more copper than gold (by value) at two of their mines (Ernest Henry and Northparkes), however I'm now more comfortable with that dual exposure - to both copper and gold.

Here's some of today's highlights:

I note they are using a gold price there (in note 5 above) of A$3,300/oz and the gold price today was over A$4,600/oz, so EVN are being conservative here, and there is clearly plenty of further upside potential in this guidance.

And here (below) are some of the more important slides from their presentation today:

Above: The only metric that was below the previous half was gearing, i.e. they have reduced their debt, so every single metric improved.

I love the way they break down their costs by minesite (below). Ernest Henry and Northparkes had NEGATIVE AISC (All In Sustaining Costs per ounce of gold produced) due to copper byproducts, which, as I have previously stated here, distorts their Group AISC number (which is $1,475 to $1,575 per ounce - all amounts are in Australian dollars) and makes them look like low cost gold producers when the reality is that 3 out of 6 of their mines (being Mungari, Red Lake and Mt Rawdon, the bottom three below) have high costs, and in Mt Rawdon's case, VERY high costs ($3,000 to $3,500/ounce).

Cowal is EVN's BEST gold mine by a country mile, and they have reasonable costs of $1,700 to $1,770/ounce, but EVN's overall group cost guidance for all the gold they expect to produce in FY25 is even LOWER than Cowal, even though their other three gold mines (Mungari, Red Lake and Mt Rawdon) have HIGHER costs. The group AISC (costs) are distorted by those negative AISC (costs) at their two copper/gold mines where they use all of the profits from those mines' copper production to offset the gold production costs from those two mines and end up with negative costs because they make more profit from that copper than it costs them to produce the gold from those two mines.

Below is something I'd like to see ALL gold producers (and other miners) do, break down their costs in percentage terms so analysts and us mug punters can see how much underlying price movements in these inputs (electricity, labout, diesel, reagents, etc) might affect EVN's costs. They also show there (below, right) how copper and gold price movements - and volumes produced - affect their cash flows and their costs.

It's a pretty comprehensive report in terms of both what they've achieved and their guidance.

Disc: Holding.

10 December 2024: Regulatory approval granted to extend Cowal Operations to 2042

Evolution Mining Limited (ASX: EVN) (Evolution) has been advised that the NSW Department of Planning, Housing and Infrastructure has reached a determination on the Cowal Gold Operations (Cowal) Open Pit Continuation (OPC) with approval received and Development Consent granted.

This Development Consent is for the continuation of open pit mining with extension of the E42 pit and subsequent development of three new open pits, and continuation of ore processing at a rate of up to 9.8 Mtpa. The mining lease extends to 2045.

Managing Director and Chief Executive Officer, Lawrie Conway, said, “The approval received today is an important milestone for Cowal and our stakeholders. Since acquiring Cowal in 2015, the operation has been a cornerstone asset for Evolution delivering material cash flows and high rates of returns, which will now enable its continuation to at least 2042.

“The extension of operations allows continued contributions to the local and national economies through employment, community advancement, payment of taxes and royalties.

“We acknowledge and thank the NSW Government for their continued support of Evolution and the thorough and rigorous approval process undertaken.”

--- end of excerpt ---

Market Like!

Disclosure: I hold EVN in my SMSF where it is currently my largest position.

I was planning to sell half after Trump won the US presidential election recently based on my bullishness for copper waning in terms of 2025 at least, however I had a change of mind after NST made the $5 Billion bid for De Grey (DEG), as I think EVN could garner more interest from prospective investors and traders in light of that M&A, even though Jake has recently said (on an MoM poddy) that Evolution is not looking to be buying anything at current levels and is focused on making profits right now.

Leaving aside all of the copper EVN produce from Northparkes and Ernest Henry, EVN are still Australia's second largest gold producer, behind Northern Star (NST). And Cowal is by far their best gold mining operation - it's the gift that keeps on giving - now permitted through to 2045 with this announcement claiming they have enough ore to keep it running through until at least 2042, so for at least another 17 years.

And Cowal is here in Australia, in NSW, just a stone's throw from Regis' McPhillamys gold project, which got the rug pulled out from under them in August this year (2024) when Federal Environment and Water Minister Tanya Plibersek made a declaration of protection over part of the approved McPhillamys gold project site to protect a significant Aboriginal heritage site near Blayney, in central west NSW, from being destroyed to build a tailings dam for the gold project.

This came only days after the NSW Supreme Court of Appeal upheld an appeal against the development approval for the Bowdens silver mine project near Mudgee a little north of Cowal and McPhillamys on the basis that the the state's Independent Planning Commission (NSW IPC) failed to consider the impacts of a transmission line when it granted the approval in 2023.

The locals were more concerned with the lead that Bowdens would produce as a byproduct of silver production, so were protesting against the "Bowdens Lead Mine" even though the mine would have been a signifcant silver mine that also produced some lead.

While it might be true that getting approval to build new mines in NSW is a damn sight harder than it used to be, getting approval to expand an existing mine that is already producing seems to be a lot more straightforward.

Below, EVN's Cowal gold mine, now set to keep producing gold until at least 2042:

17-Jan-2024: I hold EVN in my SMSF, but nowhere else, so not here on Strawman.com. I wasn't planning to take part in their SPP, which formed part of the CR for their recent acquisition of 80% of the Northparkes Copper-Gold Mine from CMOC Group Limited, but a few things have changed now. [I'm still not planning to participate despite those changes]

[03-Sep-2024: Note: Not holding EVN now, anywhere]

Firstly - there's this: Extension-of-Share-Purchase-Plan.PDF released on Thursday 11th Jan (last Thursday) which advises that the closing date for the SPP that was announced on 5 December 2023 will be extended from its original closing date of 16 January 2024 (yesterday) to 5.00pm on Tuesday 30 January 2024.

Eligible shareholders participating in the SPP will be able to purchase shares at the lower of:

- A$3.80 per Share, being the same price paid by institutional investors under the Placement announced on 5 December 2023; and

- a 2.5% discount to the 5-day volume-weighted average price of Shares traded on the ASX up to, and including, the revised SPP Closing Date (30 January 2024) (rounded to the nearest cent).

Which is a good thing for EVN shareholders participating in the SPP because they're now likely to be paying a good deal less than $3.80 for those shares now due to today's announcements:

Wednesday 17 January 2024:

Firstly: December-2023-Quarterly-Report-EVN.PDF

Secondly: Exploration-Success-Continues-at-Cowal-and-Ernest-Henry.PDF

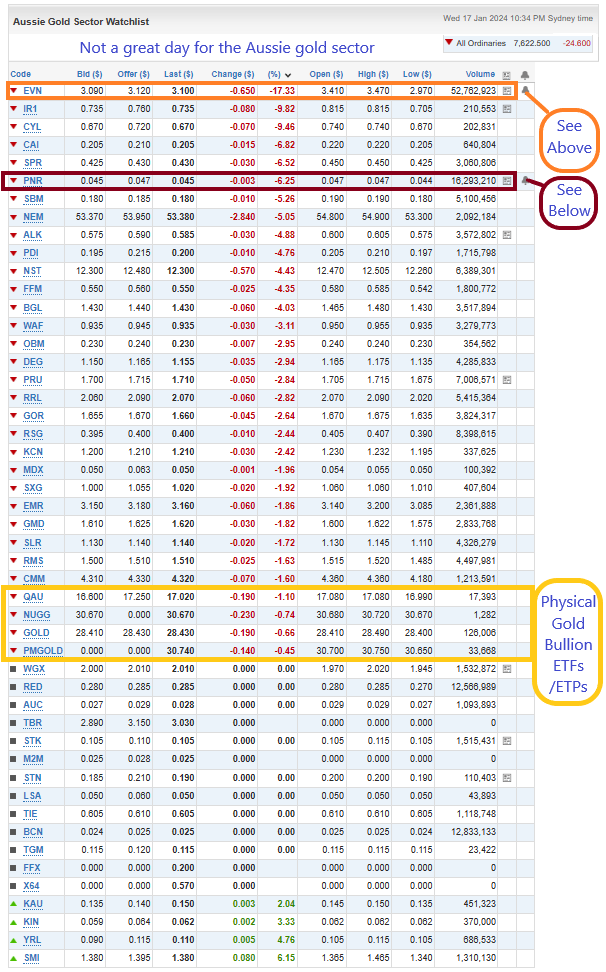

The first one did the damage. EVN closed down -65 cps at $3.10, so down -17.33% today.

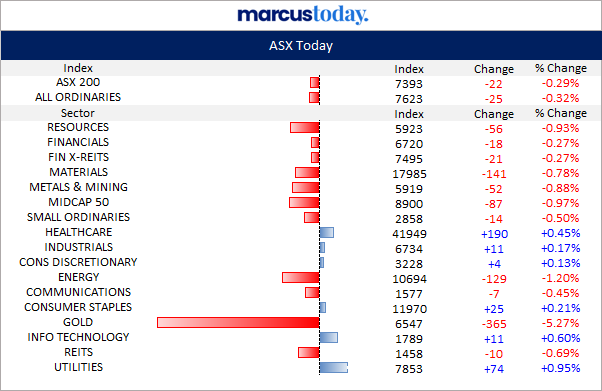

The market was in no mood for bad news - here's the sector movements today:

Gold sector down -5.27% - that's a BIG move. EVN's selloff would have contributed to that for sure because they are the third largest constituent of that gold sector. They should be the second largest after NST, but the sector still has NEM in it, Newmont Corporation, even though they are listed in the USA and are not an Australian company. Because Newcrest (formerly NCM) WERE Australia's largest gold producer, and Newcrest shareholders were paid in Newmont (NEM) shares when Newmont acquired Newcrest last year, they've (S&P have) decided to keep those NEM CDIs in the Australian gold index.

EVN was the worst of a bad bunch today...

The fact that the majority of our goldies closed substantially lower than the four physical gold ETFs (see above) is a clear sign of seriously negative sentiment across the sector today.

Pantoro (PNR) released the following update last week (on the 8th): December-2023-Quarter-Production-Update-PNR.PDF

And their SP fell -7.55% on the day and then another -6.12% the following day.

Today they released this at 9:33am: Underground-Development-to-Commence-at-Scotia.PDF

And their SP fell another -6.25%. Those that follow PNR (and that would be a small group, because they're a small goldie) were clearly expecting or at least hoping for better, or more, and dumped them when they didn't get what they wanted from those updates. Pantoro finished CY 2023 @ 5.7 cps and they're now (in the middle of January) some -21% lower at 4.5 cps. I have held them in one of my real money portfolios previously and do occasionally have a small trade in them with some loose change here - because of the lack of brokerage fees.

After the market closed, at 4:54pm, they lodged this: Addendum---Underground-Development-to-Commence-at-Scotia.PDF

Meanwhile Evolution Mining (EVN), one of our gold majors, closed at $4.14/share on December 4th, the day before they announced the Northparkes transaction and capital raising, and today they closed at $3.10, which is -25% lower.

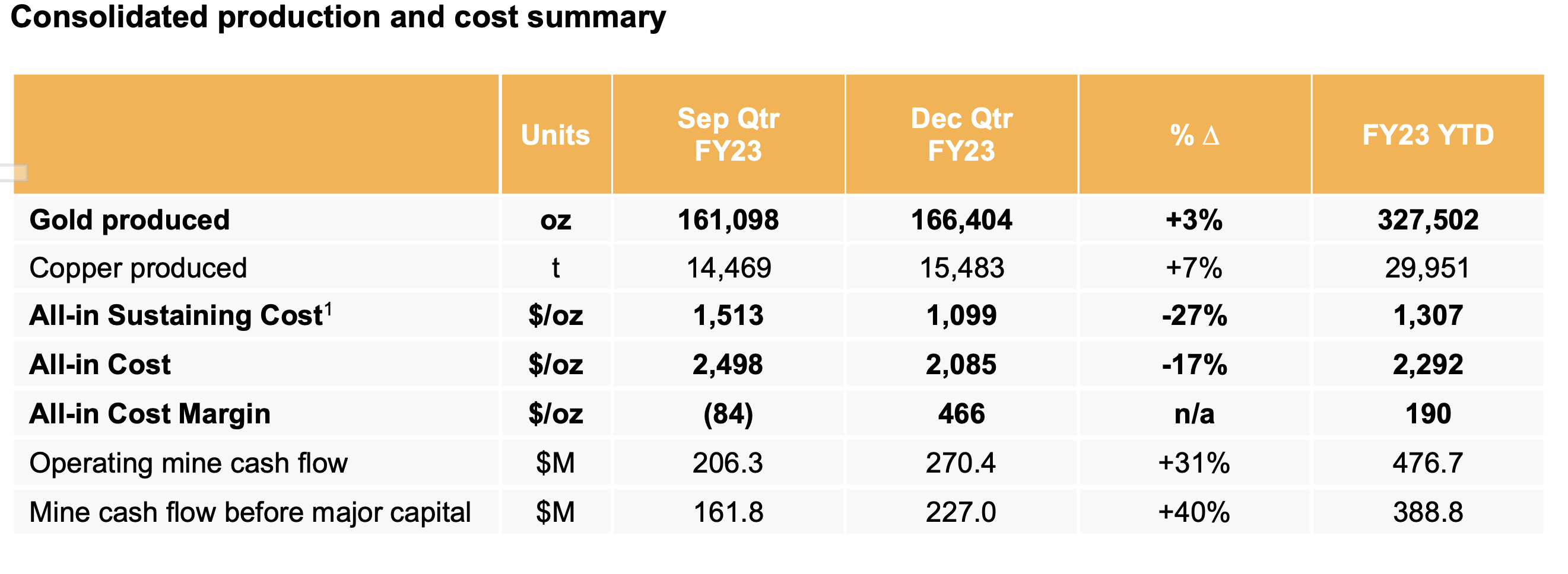

Some details from today's update:

- Evolution’s Chief Operating Officer (COO), Bob Fulker has decided to leave the Company to pursue other opportunities. Mr Fulker will finish at the end of March. A search to identify an appropriate replacement is underway.

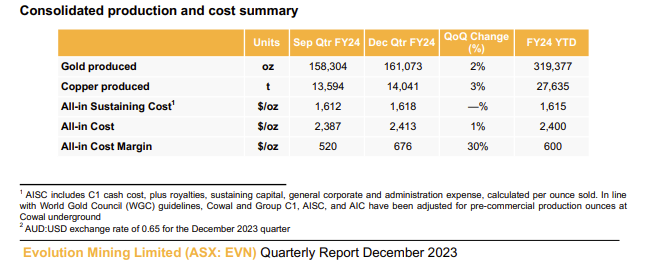

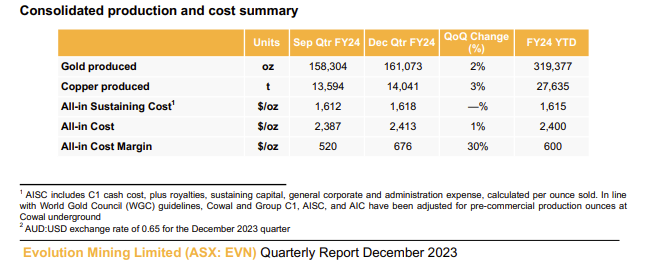

- Gold production for the quarter was 161,073 ounces at an All-in Sustaining Cost (AISC) of $1,618 per ounce (US$1,052/oz) compared to the previous quarter which was very similar:

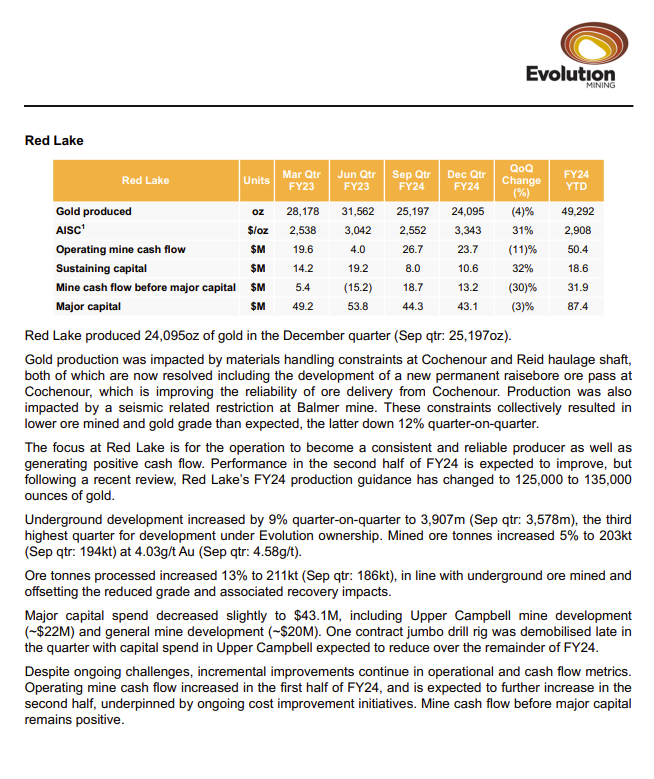

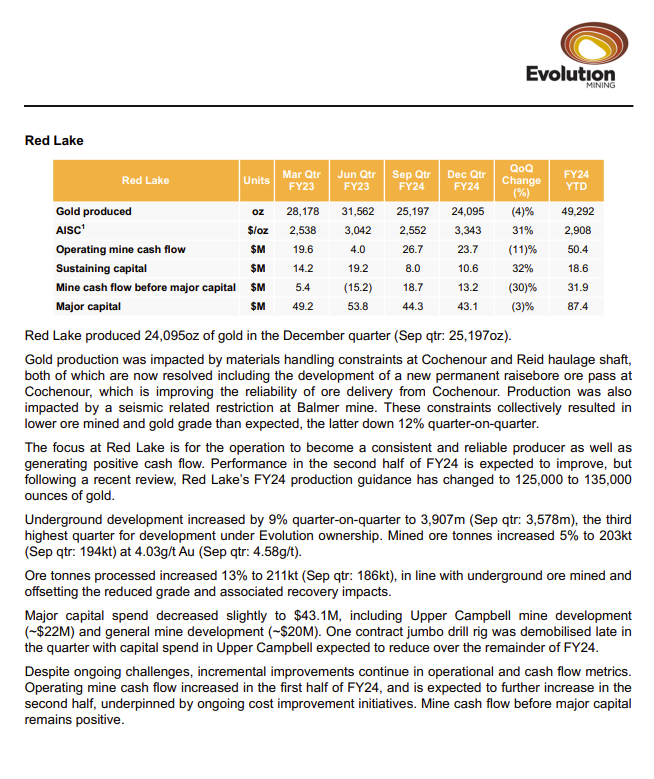

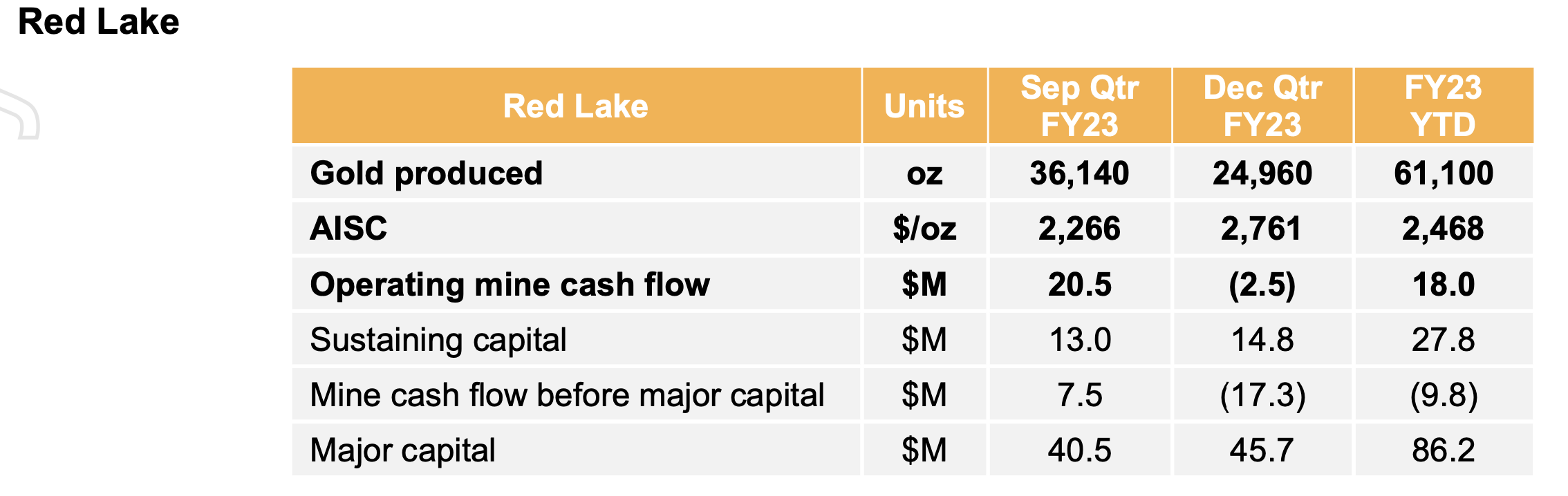

- Despite some positives elsewhere, the market is probably focusing more on the continuing basket case that is Red Lake:

- Evolution Mining's Red Lake underground gold mine in north-western Ontario (Canada) is their only gold mine located outside of Australia (they have 4 gold or copper/gold mines here in Australia - Cowal, Ernest Henry, Mungari and Mt Rawdon, plus their 80% of Northparkes in NSW as well), and Red Lake is certainly their problem child. The update (see above) shows that for the December quarter, their production at Red Lake (gold produced) fell by -4%, their AISC (costs) rose by +31% from A$2,552 to A$3,343/ounce (above the gold price, so Red Lake is losing money), cashflow decreased by -11%, and sustaining capital (which is included in that AISC) increased by +32%. I've included the whole page (above) on Red Lake from today's quarterly report, for some context. That is one acquisition that Jake Klein made that has NOT worked out as planned. Not yet anyway.

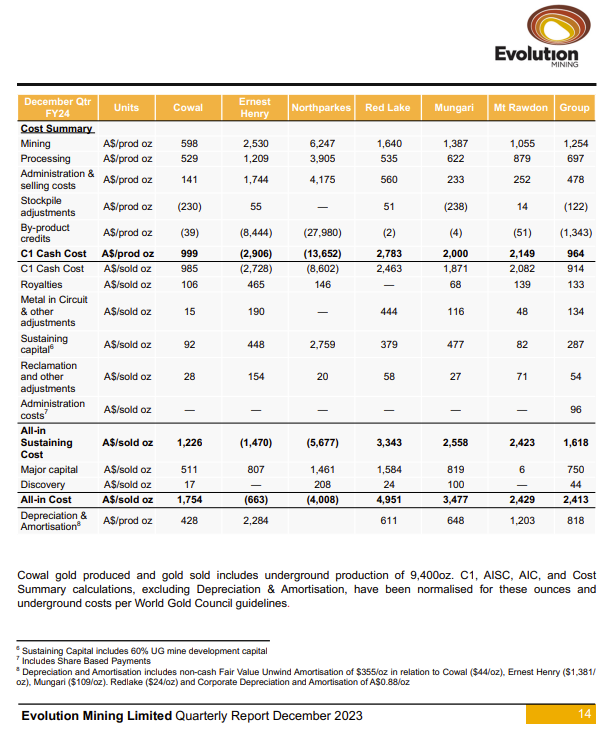

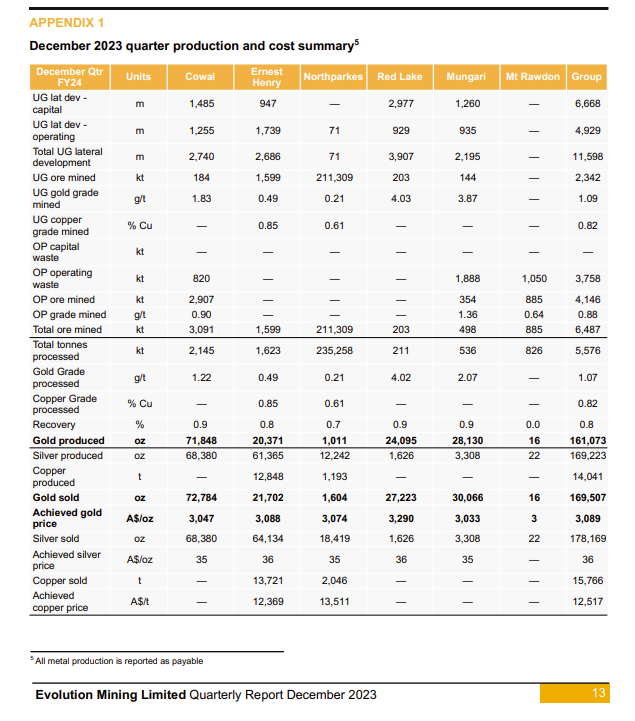

Appendix 1 contains their December 2023 quarter and their FYTD (financial-year-to-date) production and cost summaries. Below is page 14, which is the second page of Appendix 1. Page 13 was the production breakdown. Page 14 (below) is the cost breakdown for the December quarter:

The full report can be read here: December-2023-Quarterly-Report-EVN.PDF

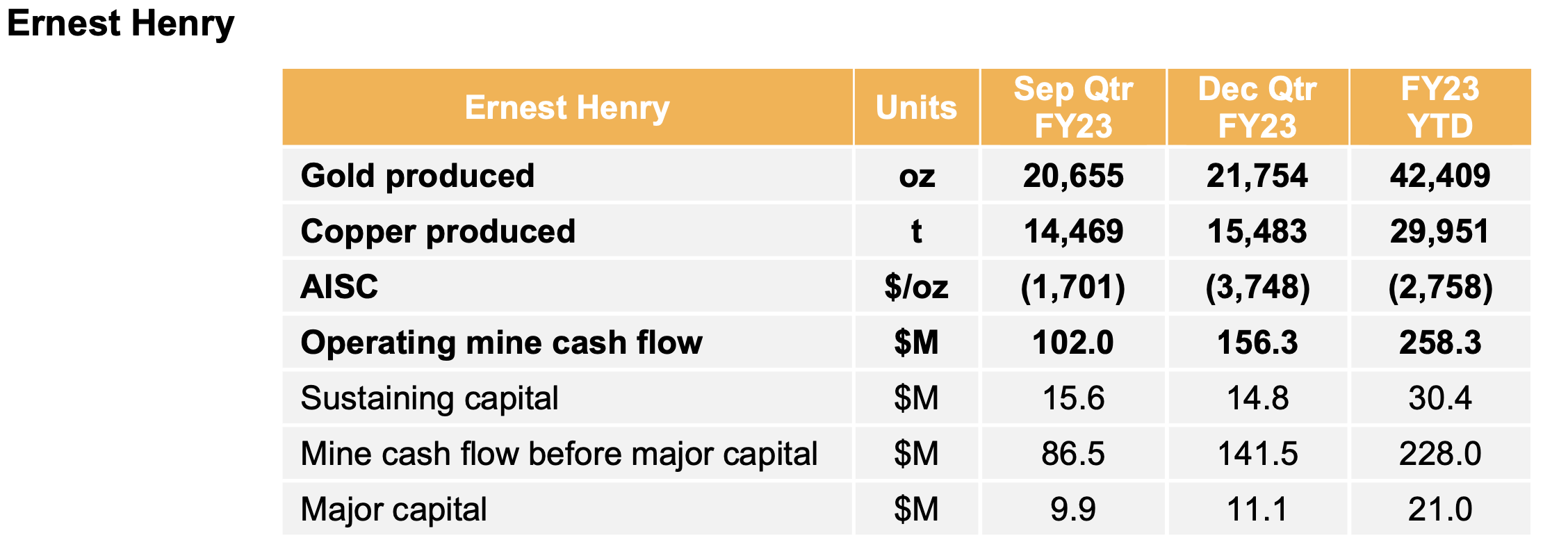

You can see there how wide the range is across their minesites for their costs - both AISC and AIC. Their AISC ranges from negative (A$5,677)/ounce at Northparkes up to positive A$3,343/ounce at Red Lake. It is only because of those byproduct credits for copper from Ernest Henry and Northparkes, which both produce far more copper than gold, that EVN manages to get their Group AISC down to A$1,618/ounce. All of their mines also produce Silver, but the silver production is not particularly material, as shown on page 13 (reproduced below).

Cowal, EVN's flagship copper/silver mine in NSW which produces around 45% of all of EVN's annual gold production, is clearly their best asset. Cowal has an AISC of just $1,226/oz after silver byproduct credits and it's a high quality gold mine for sure. And I'm sure Ernest Henry and Northparkes are great copper mines too, that also produce some gold. But looking across the suite of mines that EVN operate, the quality varies greatly, as do the costs.

Source: https://evolutionmining.com.au/cowal/

Cowal is an excellent mine that is expanding with heaps more gold there at good grades, but I believe the market isn't entirely comfortable with how some of EVN's other assets are travelling.

I'm not adding to the EVN position in my super or selling any - it's a long term holding in what was Australia's third largest gold producer when I bought that position a few years ago (@ $2.83/share) - they are now Australia's second largest goldie after Newcrest got taken out by Newmont last year.

But I don't intend to buy any EVN in any of my other portfolios, including the virtual one I have here. Other goldies like NST and GMD look heaps better to me at this point.

------------------

03-Sep-2024: Update: I sold out of EVN earlier this year after deciding I wanted more pure gold exposure rather than gold/copper which you get with EVN with Ernest Henry and Northparkes both being copper mines that also produce gold but being regarded by EVN as gold mines that have a negative ASIC because of the copper "byproduct credits" reducing the cost of gold production to a negative number. When you have your cost of gold being negative because of copper production, i.e. it cost you LESS than nothing to mine the gold, then clearly those are copper mines that also produce gold and should not be regarded as gold mines that also produce copper, but it's legal, and they're doing it. I just find it very misleading in terms of trying to make cost comparisons across the gold industry and including EVN, so I tend to exclude EVN from my gold sector universe now because it's just too hard.

The main problem for me is that if you REMOVE the copper production entirely, EVN is NOT a low cost gold producer. They are ONLY a low cost gold producer because they use their copper sales to reduce their gold production costs.

That said, for people who want exposure to gold AND copper, EVN would likely be a good option to consider. I just don't want that copper exposure right now - I may later, but not now.

EVN's latest report was apparently very good, and the market liked it, especially their bullish outlook, but I'm not interested in them now, so I haven't looked at it in any detail. Their SP closed at $3.81 on the day before they reported (August 13th) and they've traded as high as $4.40 and closed as high as $4.36 during the following fortnight, but they closed at $4.11 yesterday. So a bit of a reality check perhaps.

Their share price may well be driven as much by copper prices and sentiment than gold prices and sentiment now.

[not held]

05-Dec-2023: Trading-Halt.PDF

Evolution Mining are doing a CR - a placement and an SPP. I imagine they're buying something - don't know what yet.

Disclosure: I hold EVN shares.

10-August-2023: Today: Jake Klein joins us to Share the Evolution of the $8b Gold Major - YouTube

Their Show Notes:

"We’re at the end of 3 big days at Diggers, and we’ve got a great interview to share. Please bear with our lower-than-usual production standards because the value of this one is phenomenal."

"Jake Klein, the executive chair of Evolution Mining (EVN), one of Australia’s largest gold miners, came on Money of Mine to share his thoughts with us. We had a great chat about gold, copper, M&A, previous acquisitions, and a bunch more."

"We hope the Money Miners enjoy the discussion!"

Source: https://www.youtube.com/@Moneyofmine

CHAPTERS

0:00 Preview

0:29 Introduction

2:26 Interview with Jake Klein

24:09 Wrap-up

You can click on the time stamp to the left of the "Chapter" title above to go straight to that point.

DISCLAIMER

All Money of Mine episodes are for informational purposes only and may contain forward-looking statements that may not eventuate. The co-hosts are not financial advisers and any views expressed are their opinion only. Please do your own research before making any investment decision or alternatively seek advice from a registered financial professional.

---

I hold EVN shares. They are Australia's third largest ASX-listed gold miner, and after NCM is delisted from the ASX later this year (after the completion of US-based-Newmont's acquisition of Newcrest) - Evolution (EVN) will become Australia's SECOND largest ASX-listed gold miner. Jake Klein is one of the highest profile "thought leaders" in the Aussie gold sector, and is always worth listening to - I feel the same about Bill Beament but Bill is out of gold now and into mining services, although I believe Bill's new company (DVP) will end up owning some mines themselves as well, a business model that could end up being similar to MinRes' (MIN's) business model. I don't think Jake Klein is going anywhere - he's definitely still a gold-bug!

In this interview with the MoM podcast boys at "Diggers" (or D&D) in Kalgoorlie today, Jake discusses Evolution (of course) but also why he's bullish on gold and the gold price from here. This interview was recorded after Jake's D&D Presentation, which by all acoounts was very well received.

05-June-2023: No less than 5 (five) announcements from EVN today, three of which have been marked price sensitive. You can access all of them from here: Investors - Evolution Mining

EVN is one of the few goldies that is actually in the green today - most of them have lost ground after a couple of very good days to start June last week.

Disclosure: I hold EVN both here and in my SMSF.

EVN also released its Quarterly yesterday.

the headline results are fine:

Production is up a bit (both for gold and copper) and cash flow has improved

Brilliantly, AISC reduced massively. But....

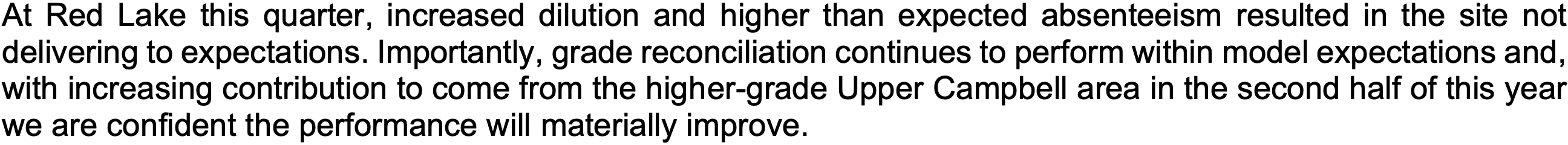

The future of EVN rests on Red Lake, and things there are continuing to go from bad to worse. The only reason the headline figures are any good is because of this:

The AISC from Ernest Henry has created a weirdo -$3748.

I think in a previous post @Bear77 explained the reasoning behind this which has to do with the contract with Glencore for copper sold, when EVN bought the mine. Anyhoo, it is a big masking agent for Red Lake which is not going to plan.

In the report though, there are good reasons why it isn't going to plan just now, but will improve shortly:

And even though this is apparently, entirely normal, expected and nothing to see here:

So, heads have rolled. There have been many quarters of disappointment regarding Red Lake

I have now lost faith in EVN. I think that "the great white hope" of Red Oak is not going to eventuate and will be selling out completely tomorrow.

Bit sad, after nearly 20 years or so of holding EVN from a penny stock.

But..never fall in love with a stock, and always re-assess in the light of new evidence.

FY22 production guidance lowered from 650K to 640K

AISC guidance increased from 1,190/oz to 1,250

Reasons include higher number of people sick from Covid after WA border reopenings and Cowal being impacted by wet weather.

Down 20%+

The negative report also impacted other gold miners including NST (down 12% which is a big smackdown on my real life holding!!!)

Not a good period to invest in gold miners.

Jake Kleins philosophy – It's much better to produce less gold at higher margins and make lots of money. Their margin for this qrt was $1470 oz.

The quarterly was a positive long term story with some problems in the short term. Full year production was downgraded to 650K ounces (vs 700-760K previously) so a big miss but understandable in the context of Red Lake being behind on production and weather and Covid impacts at Mt Rawdon and Cowal. Plenty of positive signs and good commentary around each of their mines. Group AISC was $990 oz for the qrt and full year guidance is $1135-$1195. Good to see that inflation, wage increases are being contained and managed well. Evolution reminds me of the duck on water, looks like its doing nothing but underneath its kicking away and forward momentum is coming. I am satisfied the downgrade is mainly due to timing and one off things, so no biggie.

The positives-

Buying Ernest Henry from Glencore is already paying itself off, in this qrt alone the mine generated 17% of the purchase price. Mainly due to increased copper production, tripled to 13332 T (4-6K previous qrts). This gave an AISC for this mine of -$2001 oz.. I like the increased exposure to copper that this mine provides. Original FY guidance for EVN copper production was 23Kt, full ownership of this mine gave them 13KT in this qrt alone. The commentary is that they are excited about this assest – excited about the geology, mine life extensions and the cash generation. Can’t argue with that in a gold mine!

Red Lake – I was getting a bit nervous about this acquisition over the last 2 qrts where production was only 19-23K oz/qrt, (75K oz YTD vs original FY guidance of 165K) but this update and the associated commentary relieved some of my concerns and does show the potential of the mine and that it is moving in the right direction. They acknowledge that they are 12 months behind where they wanted to be in this transformation but are guiding for >40K oz per quarter going forward. The commentary around this mine that they knew it was undercapitalized when they bought it and it’s a process of removing the bottlenecks, improving the ore grade and building the confidence at the mine site so it can consistently deliver at high rates. They mentioned how they want to maintain steady state production (40K/qrt base) with step ups over time rather than trying to push it hard to make up for lost production, hence the downgrade. Seems like a sensible approach to me. Good honest commentary around how they overestimated their ability and the time it would take to turn it around, but they are confident it is a quality long life mine and it is moving in the right direction. This includes even simple things like improving haulage logistics -- replacing the existing slow electric locomotives with diesel that has enabled a 47% increase in ore haulage.

Existing guidance is for 200K oz for Red lake in FY23, but commentary suggests this will probably be revised down – my guess is it will probably be 160-180K oz given that they want 40K oz per qrt to be there new base target for red lake. AISC are still high ($2394 oz) but I expect these will reduce as grade improves and production ramps up. They are making progress on all of their revised milestones/timelines and they still have a mill onsite that is unused so plenty of scope for production increases.

Mungari – Good commentary around the ‘One Mungari’ and the cost improvements created by the assimilation of the Kundana and East Kundana and the shared equipment /workforce.

Cowal – Impacted by weather and COVID

Mt Rawdon – Feasibility study for converting mine to pumped hydro when mine life due end of FY23. Sounds like a good option to reuse the pit. Production affected by weather this quarter and instability in the north wall and resulted in lower grades being processed.

Overall, I am happy to sit back and collect the dividends while the mine improvements happen and am expecting this one will re-rate strongly when Red Lake starts to deliver. I also don't give a high probability to the gold price declining below $US1800 oz and see it more likely to be above $2000 over the next few years.

05-Sep-2021: This is really a reply to Barney's Business Model/Strategy Straw for EVN. If you like Minelab, they are owned by Codan (CDA) - have a look at their share price graph. I own Codan shares and Evolution Mining Shares. I also own a few other gold stocks, and some gold ETFs, so you could say I'm bullish on gold longer term. However, you have to realise that gold producers are a leveraged play on gold. When the gold price is rising, most quality listed gold producer's share prices will rise by MORE than the gold price rises, and when the gold price falls, particularly if it is in a downtrend, the share prices of most gold producers will fall FURTHER than the gold price in percentage terms. When you invest in a gold producing company, you are investing in what they own (which is primarily gold, albeit most still underground or in pits or in ore stockpiles) and the company's ability to deliver shareholder returns in the form of profits, dividends, and share price increases. Gold companies are generally valued with a good discount off the gold that they own that is still underground, because there is risk associated with them being able to efficiently extract that gold (including getting it to their plant and processing it through their plant) and then sell it while the gold price remains accomodative.

Also, with a lower gold price, lower grades of gold - in terms of ounces per tonne of ore (dirt/rock/whatever it's in) - may not be economic to dig up and process - the cost might be higher than what they will get when they sell the gold - but a higher gold price means that lower grades become worth processing, even though they are going to be costlier to process. For example a company might have an AISC (all-in sustaining cost) for their gold production of $1,200/ounce, however if the gold price rises to A$2,800 (Perth Mint gold price is currently around A$2,450/ounce), the same company might be able to mine additional lower grade ore that might cost $1,500 or $1,800/ounce to process and still make heaps of money. A higher gold price can means that a company can include more of their ore as minable gold. They use a cut-off grade for calculating what they've got, and the higher the gold price, generally the lower the cut-off grade can be.

So what that means is that without anything else happening other than the gold price rising, a gold producing company can get a double positive, in that the gold they were going to mine anyway becomes worth more, and they may also be able to mine and process additional gold that they already know they have but that was previously not economical (cost-effective) to mine.

The same effect works in reverse when the gold price falls substantially. They may have to raise the cut-off grade to remain profitable which may mean they now have less minable gold - i.e. less gold that is cost-effective to mine.

All that said, Evolution Mining is the third largest ASX-listed gold producer (behind Newcrest and Northern Star), and they currently have the best portfolio of mines I think, certainly the cheapest AISC (costs) of the three. Also there have been two star performers in terms of superstar gold company managers in Australia in the past 10 years and Jake Klein at Evolution is one of those. The other is Bill Beament who used to run Northern Star (NST) but has now left to run Venturex (VXR) who are currently focussed on base metals (not precious metals like gold). Jake and Bill have excellent track records of very smart dealmaking, mostly buying quality yet underperforming assets during the gold-price-lows, then turning those assets around and working them hard and smart, and also offloading assets when the gold price is high and prices of gold mines are even higher. With Bill stepping away from the gold industry for the time being, that leaves Jake (at EVN) as the #1 smartest gold mine manager in Australia - in the opinion of most industry participants I would imagine.

If you're going to buy a gold producer, buy them when the share price is at the lower end of their range - and EVN is back to near March 2020 (COVID-19 crash) lows. Also buy a quality gold producer that makes money and has very smart management - and EVN ticks those boxes also.

On page 12 of their recent FY21 Full Year Results presentation, they stated that they have low leverage at less than 0.5x and modest gearing at 15% (net debt to equity ratio) plus no material debt repayments until 2026, followed by some material repayments due in 2029 and 2032. Their average debt maturity is 7 years. I'm not worried about their debt. They also have a lot of cash and a lot of cashflow.

But Barney, if you want to go look for gold yourself, you can't beat a Minelab gold detector, they are the best in the world!

Share price has faded over 10% in the two trading days since the Quarterly Meeting announcement of a projected 4-6cps 2021 final dividend, down from 9cps FY2020. The Canadian Red Lake mine acquisition is proving a hard pill to swallow, running at a A$21.9m loss while upgrading and has an AISC of A$2233/oz, cf group ASIC of A$1215 and current gold price of A$2450. By 2023, Red Lake is expected to double output with 30% decrease in AISC and blue skies by 2026 with projected 330,000oz annual production, bringing Group output to 90% of the magical Mega oz mark. Group cost base is 53% on labour, something to watch with reported mine personnel shortages and inflation on the horizon.

https://www.australianmining.com.au/features/is-a-miningskills-shortage-looming/

True believers can hearten themselves by remembering the gold price doubling after governments spent their way out of the 2008/9 crash.

(disclosure: I've held EVN since 2017)

10-Dec-2020: Evolution Acquires 100% of Crush Creek

Evolution Mining Limited (ASX:EVN) is pleased to advise of the acquisition of a 100% interest in the Crush Creek project located 30km southeast of the Mt Carlton Operation in Queensland.

In September 2019 Evolution entered into an earn-in agreement with Basin Gold Pty Ltd (“Basin Gold”) over the Crush Creek project. Evolution has now achieved the requirement of sole funding A$7.0 million of exploration expenditure to earn a 70% interest in the project. In addition, Evolution has exercised an option to acquire the remaining 30% of the project from Basin Gold for a cash payment of A$4.5 million. Basin Gold retains a 10% Net Profit Interest on any gold production in excess of 100,000 ounces.

Crush Creek hosts low sulphidation epithermal gold mineralisation which has significant potential to provide mine life extensions at Mt Carlton. Drilling under Evolution management of the project has focused on understanding and expanding the mineralisation at BV7 along with testing the Delta area for a new discovery. Encouraging results have been received from BV7 as well as from the Delta, The Kink and Gamma prospects. Drilling continues at these prospects during the December quarter focusing on the high-grade plunge to the north of BV7, as well as follow up drilling at The Kink and Gamma prospects.

Commenting on the earn-in, Glen Masterman, Vice President Discovery and Business Development said: “Drilling at Crush Creek has returned promising results and reinforces our belief that mineralisation we are delineating has the potential to extend mine life at Mt Carlton.”

--- click on the link at the top for the full announcement with a map showing Crush Creek's proximity to EVN's Mt Carlton gold operation ---

[I hold EVN shares.]

About Evolution Mining: Evolution Mining is a leading, growth-focused Australian gold miner. Evolution operates five wholly-owned mines – Cowal in New South Wales, Mt Rawdon and Mt Carlton in Queensland, Mungari in Western Australia, and Red Lake in Ontario, Canada. In addition, Evolution holds an economic interest in the Ernest Henry copper-gold mine in Queensland. FY21 Group gold production is forecast to be between 670,000 – 730,000 ounces at an AISC of A$1,240 – A$1,300 per ounce.

[EVN are one of the lowest cost gold producers on the ASX, and they are also the third largest (after NCM & NST).]

04-Apr-19: Evolution Mining, Australia's 3rd largest listed gold miner (miners where gold is their primary focus) has today organised a site tour of their Cowal gold mine in NSW. See here for the presentation that their Cowal GM Craig Fawcett is giving to those who attend. It gives a decent overview of EVN, but focuses primarily on Cowal, which is the jewel in the Evolution crown, their flagship mine. They are currently mining gold at 6 sites which are all within Australia, and only one of them (Mungari) is in WA, near Kalgoorlie. The others are all in NSW and Queensland, including Ernest Henry (EH) which is located near Cloncurry (in Qld) which Evolution owns 30% of. They own 100% of all of their other gold mines.

EH is owned and operated by Glencore and EVN paid $880 million for a 30% stake in the operation in 2016 when Glencore were undertaking debt reduction activities which involved selling some of their assets and reducing their stake in others. EVN are entitled to 100% of the mine’s gold, and 30% of its copper and silver production. EVN pay ongoing monthly cash contributions equal to 30 per cent of production and capital costs associated with copper concentrates.

Further reading on EH (the Ernest Henry mine):

http://www.australianmining.com.au/news/evolution-mining-buys-glencores-ernest-henry-mine/

http://www.i-q.net.au/main/evolution-buys-into-ernest-henry-mine

http://evolutionmining.com.au/ernest-henry/

http://www.ernesthenrymining.com.au/en/Pages/home.aspx

Jake Klein is an excellent deal maker, and is similar to his rival over at NST, Bill Beament, who also runs his gold company as a business first, and as a miner second. They both like buying distressed assets or good assets from forced sellers, when they see great opportunity to make money out of the asset. They don't buy at the top of the market. They tend to sell their weaker mines when the gold price is high, and buy assets when the gold price is low. I hold both EVN and NST in my super, and I also hold NST in my main trading portfolio (and on my Strawman scorecard). I rate Jake Klein and Bill Beament both very highly as managers and deal makers, and I'm happy to retain exposure to their companies through the cycle. However, the time for buying these companies is not when their share prices are on a tear but rather on a serious pullback - which is usually associated with a falling gold price. Load up when everybody is selling out of gold companies, and sit back and enjoy the gains when gold is rising.

One of the issues with the Strawman scorecard system is that we can't nominate buy or sell prices - we have to accept end-of-day prices. A bigger issue is that we can't nominate position sizes. We can hold a company more than once on our scorecard but that's more of a "double or nothing" scenario. In reality, position sizing is a lot more subtle than that, and very important to returns. Ideally, you want to hold much smaller positions in higher risk and more speculative companies especially project developers, and turnaround stories (which often don't succesfully turn around), and you would buy much larger slabs of highly profitable companies like EVN and NST when they're a lot cheaper than where they are today. EVN was 30% cheaper six months ago, and NST was around 40% cheaper 12 months ago. I loaded up on both around those times - in my super. If Strawman had a better position sizing aspect to it, I think the scorecard returns could look a lot different for many of us.

05-Oct-2020: Update: Obviously Strawman.com now DOES have position sizing - they did not have that option when I wrote the above straw. It is no coincidence that my returns here on Strawman.com were very pedestrian up until that change, which coincided with the "pandemic pullback" (or crash) that the market experienced in March, and have improved a fair bit since then when I have had the ability to get my Strawman.com scorecard positions as I would like them to be - with regard to risk versus reward.

While it might seem like I have a high risk tolerance, because I dabble in mining stocks for one, and also because I don't mind the odd base metals or precious metals explorer who is still burning through cash and doesn't generate ANY revenue let alone profits... I make up for that apparent reckless attitude with position sizing and diversification. That means that my high risk (and potentially high reward) positions tend to be very small, and my safer ("heads I win, tails I don't lose much") companies tend to be my larger positions. And I hold a LOT of companies relative to most other community members here. That means that I have the ability to outperform in a falling market, as you can see from my scorecard chart, but it also means I will never shoot the lights out like a single-stock-portfolio (or a very concentrated portfolio) can. My approach is much more about risk management, particularly around capital preservation. I still want to make profits, but I would rather NOT lose money (meaning permanent capital losses).

It's not all about the results. It's also about the process. If you get the process right, the results tend to look after themselves - eventually.

And good exposure to quality gold miners is certainly an important part of my approach.

13-Aug-2020: FY20 Financial Results and Final Dividend and FY20 Financial Results Presentation and Appendix 4E and FY20 Annual Financial Report

Also: 13-Aug-2020: Red Lake 11 Million Ounce Mineral Resource and 12-Aug-2020: Red Lake Update

[I hold EVN shares]

04-June-2020: Agreement to divest Cracow Gold Mine for up to A$125M

Evolution Mining Limited (ASX:EVN) has entered into a binding agreement with Aeris Resources Limited (ASX:AIS) to sell the Cracow gold mine in Queensland for a total consideration of up to A$125 million. The total consideration consists of:

- A$60 million cash payable upon completion;

- A$15 million cash payable on 30 June 2022; and

- up to A$50 million contingent consideration payable in the form of a 10% net value royalty, based on gross revenues less C1 direct cash costs in relation to any gold produced at Cracow in the five-year period from 1 July 2022 to 30 June 2027.

Evolution has consistently stated that a key objective of its corporate strategy is to continuously seek to upgrade the quality of its portfolio and hold six to eight assets with an average mine life of at least ten years. The sale of Cracow is consistent with this strategy and reflects the completion of the Red Lake acquisition in April 2020 and the Company’s view that Cracow has more value in the hands of Aeris than in Evolution’s portfolio.

Commenting on the transaction, Evolution Executive Chairman, Jake Klein said:

“Cracow was acquired in 2011 as part of the formation of Evolution and has been a reliable asset within the portfolio. We thank everyone at Cracow for their contribution to Evolution. One of our sustainability commitments is to leave a lasting positive legacy in the communities in which we operate and we are confident that our relationships within the broader community around Cracow, including the traditional custodians of the land, the Wulli Wulli People, reflect this. We also believe that Aeris will prove to be a great partner for the community going forward.”

The sale is expected to close around the end of June 2020. Evolution is committed to assisting Aeris to ensure a healthy, safe, smooth and orderly transition of ownership at the Cracow operations.

--- click on link to the full announcement at the top of this straw for more ---

Disclosure: I hold EVN shares.

13-Feb-2019: EVN's H1FY19 Results: Four page summary - see here.

Full Results (including Appendix 4D, 42 pages) - see here.

Results Presentation (22 pages) - see here.

Dividend maintained at 3.5 cents, fully franked, same as at this time last year. Trailing dividend yield is a shade under 2% fully franked, which is not too bad for a mining company. The yield has come down due to EVN's share price increasing from around $2.80 one year ago to $3.80 now.

Market Reaction: Muted. EVN closed down 4 cents at $3.80 (-1%).

29-Jan-2020: December 2019 Quarterly Report

QUARTERLY REPORT – For the period ending 31 December 2019

HIGHLIGHTS

Sustained strong cash flow and debt free

- Mine operating cash flow of A$233.1 million (FY20 year-to-date (YTD): A$511.8 million)

- Net mine cash flow of A$144.4 million (FY20 YTD: A$351.8 million)

- Group free cash flow of A$83.8 million (FY20 YTD: A$242.4 million)

- Outstanding debt of A$275.0 million repaid. Net cash position increased by A$78.6 million to A$170.3 million

Operations

- Group gold production of 170,890 ounces at an All-in Sustaining Cost (AISC) of A$1,069 per ounce (US$730/oz)

- FY20 YTD production of 362,857 ounces at an AISC of A$1,041 per ounce (US$713/oz)

- Significant progress made at Cowal in reducing the operation’s reliance on surface fresh water

Value accretive growth through M&A

- Acquisition of high grade, long life Red Lake gold complex in Ontario, Canada, expected to complete at end of March 2020

Continued exploration success driving organic growth

- Cowal’s GRE46 and Dalwhinnie ore bodies continue to return exceptional drilling results which is expected to inform an upgrade in size and classification of the current underground Mineral Resource of 1.4Moz. The Board has approved the commencement of a Pre-Feasibility Mine Design Study for an underground mine

- Extensional drilling highlights from the Cowal underground complex include: 38m (30.4m etw) grading 6.64g/t Au and 7m (5.6m etw) grading 124.72g/t Au

- Mungari’s Boomer prospect continued to return narrow laminated vein intercepts containing visible gold with a best intersection of 0.78m (0.58m etw) grading 96.71g/t Au

- Ernest Henry drilling commenced below the 1200mRL with 10 holes completed for 4,400m. Assay results are expected in the March 2020 quarter. Drilling to continue in CY2020 with over 18,000m planned

FY20 Group guidance

As per ASX release on 10 January 2020 Group FY20 gold production is expected to be around 725,000 ounces. AISC guidance of A$940 – A$990 per ounce remains unchanged.

----------------------------------------------

Disclosure: I hold EVN shares. They are our (Australia's) 3rd largest gold miner (behind NCM & NST) and they look like they're going to once again have the lowest costs, with AISC guidance of below A$1,000/oz. Not bad at all when the A$ gold price is over $2,300/oz.

10-May-2019 WA Gold Sector Update from MiningNews.Net (Kristie Batten, 7-May-19), Straw #1 (of 2)

Evolution (EVN) gets a mention near the end (which will be in Straw #2) due to the dubious distinction of having a mine with reported March quarter AISC of over A$1,500 per ounce (Mungari, A$1,521/oz) - Newcrest's Telfer mine was even worse (A$1,594/oz). This article clearly explains why not all of WA's gold miners have been good investments over the past year or two. Some have certainly been big winners. Others, not so much. The larger companies with multiple gold mines, like NCM, EVN & NST, have some very low cost mines in their stable, which in NCM's case offsets Telfer, and in EVN's case offsets Mungari. I hold NST, EVN, SBM, DCN & IGO (and AMI up until recently) and I also own a couple of mining contractors who work in the gold sector (MAH, NWH) and engineering and construction contractors who specialise in the gold sector (GNG, LYL), so I'm bullish on gold, but you have to choose your companies carefully, and be prepared to bail out and move on when necessary.

Things aren't all that glittering in WA gold

THEY say it’s never been a better time to be an Australian gold producer – which is true if you’re Newcrest, Northern Star, St Barbara, Evolution or Saracen. But look a tier down and it’s a very different story.

The Australian gold sector has been praised globally over the past couple of years for its staggering success, outperforming its global peers.

Strong management teams, a razor focus on costs and high Australian dollar have made the Australian mid-tier the "rock stars" of the local mining sector, and the darlings of the global gold industry.

But several events over the past year have led to board upheaval, destroyed shareholder value and dented the reputation of the Western Australian gold sector - and is likely continuing to weigh on the rest of the pack.

One of the biggest blights on the WA gold sector was the saga of Eastern Goldfields.

The Mike Fotios-founded company faced protests at Diggers & Dealers 2017 for unpaid bills, with the fledgling Davyhurst producer then put into liquidation by a creditor.

The company's shares were suspended from trading between August 2017 and April 2018, when it re-emerged after completing a A$30.6 million capital raising, cornerstoned by Hawke's Point Holdings.

Davyhurst continued to underperform, producing just 8087 ounces of gold in the June 2018 half against an original forecast of 35,284oz, and the decision was made to put the operation on care and maintenance in the September quarter.

In late November 2018, Eastern Goldfields collapsed. A proposed recap is now underway, with the rebadged Ora Banda Mining seeking to raise $30-40 million in an offer lead managed by Hartleys.

Early last year, Diggers & Dealers' 2017 Emerging Company Award-winner Kin Mining, farewelled its managing director Don Harper just a week before construction of the Leonora gold project was due to kick off.

Amid board tensions, construction was abruptly halted in April 2018 as the definitive feasibility study estimates were called into question, and subsequent investigations revealed capital costs would be much higher than the $35 million first envisaged.

In the fallout, Kin faced another board spill and was forced to repay the initial US$5 million drawn down under a $35 million Sprott project funding facility.

Kin shares were trading at 25c before construction was halted. The company raised A$8.9 million at 11c last year and over $9 million at 8c early this year. Its shares now sit at just over 7c.

It is targeting a fresh final investment decision for Leonora in December.

Bronzewing redeveloper Echo Resources released the bankable feasibility study for its Yandal project during Diggers & Dealers in August 2018, with the 3.75-year mine life disappointing the market in the process.

Shares in the Northern Star-backed company lost around half of their value in five weeks, culminating in the departure of finance director Gary Lethridge and managing director Simon Coxhell.

The company raised $4 million at 11c in December (against its pre-BFS price of 22c) and bolstered its board, including the appointment of former Barminco exec Victor Rajasooriar as MD.

A revised BFS followed last month, which only marginally increased the life to four years, but Echo resolved last week to raise $15 million at 13c to fund an aggressive exploration program to find more ounces and extend mine life.

Continued in Straw #2...