EVN also released its Quarterly yesterday.

full announcement here

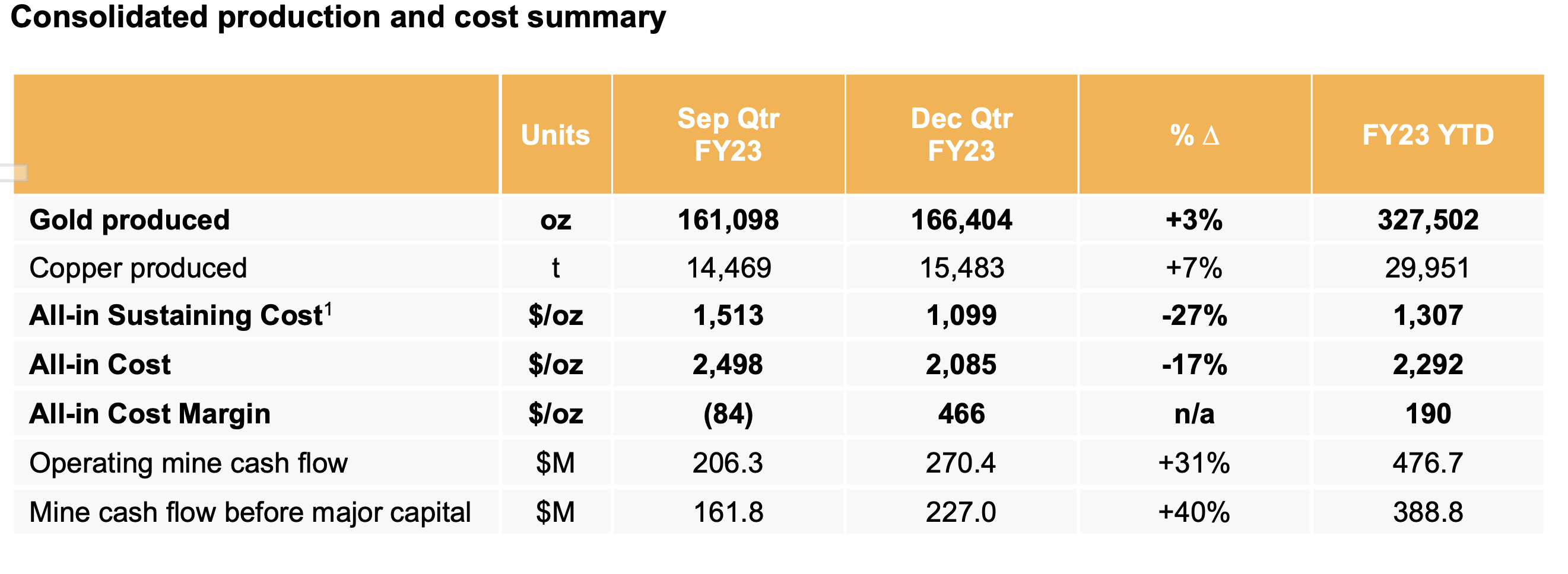

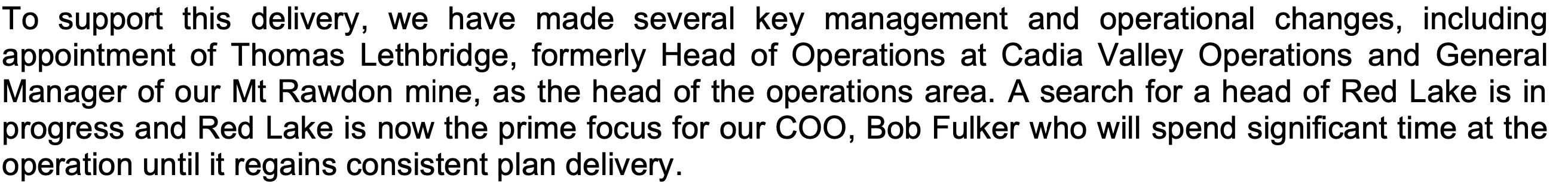

the headline results are fine:

Production is up a bit (both for gold and copper) and cash flow has improved

Brilliantly, AISC reduced massively. But....

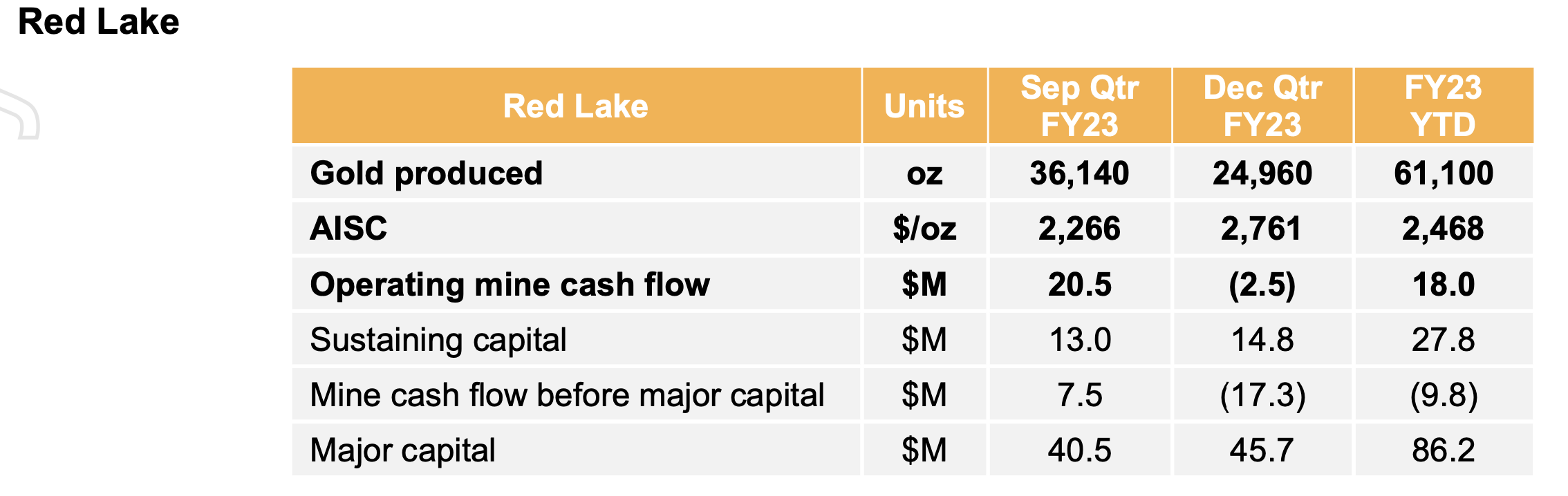

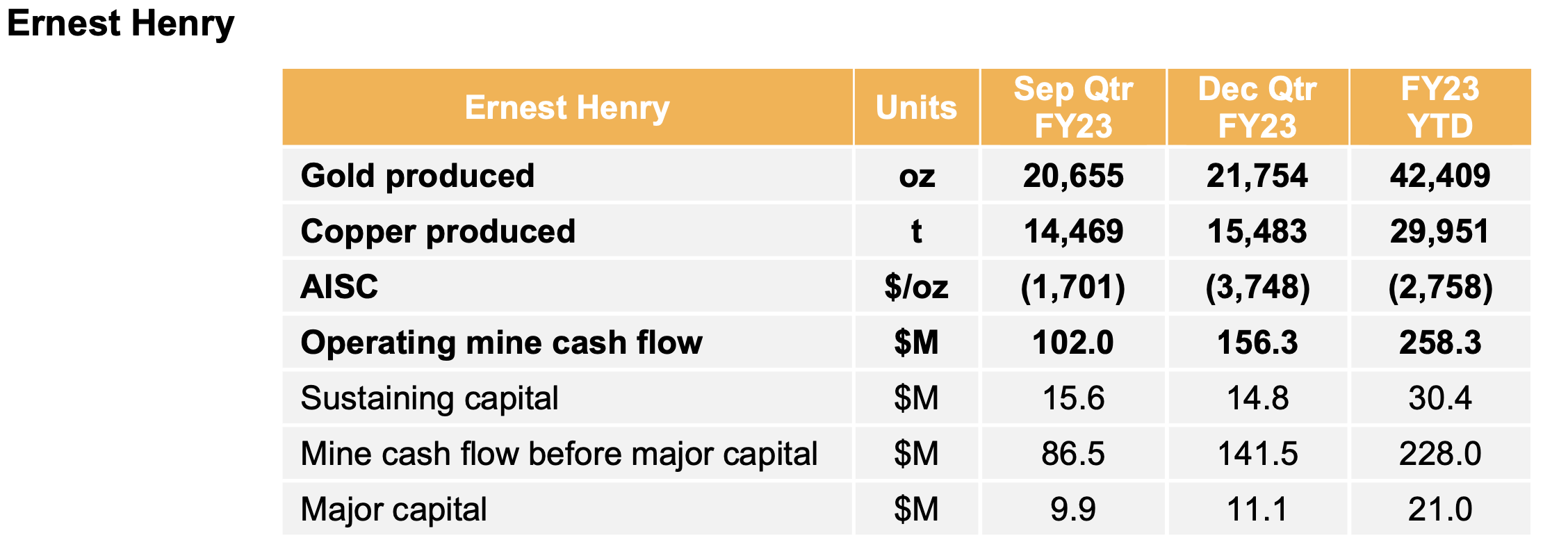

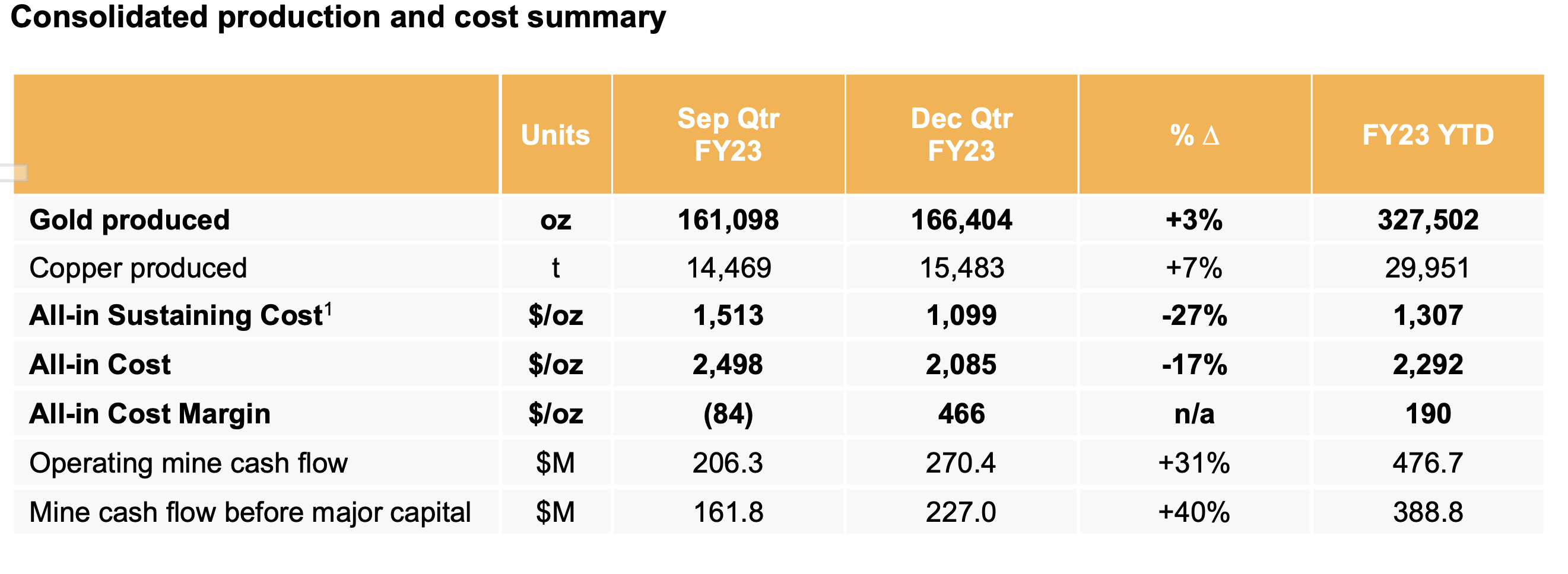

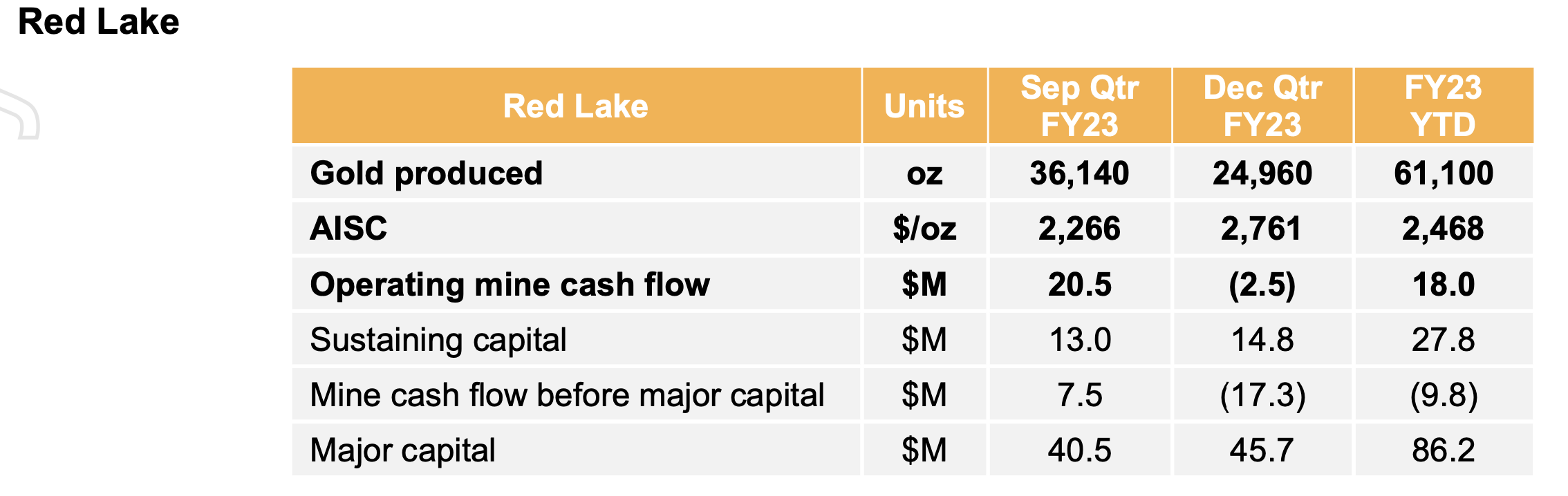

The future of EVN rests on Red Lake, and things there are continuing to go from bad to worse. The only reason the headline figures are any good is because of this:

The AISC from Ernest Henry has created a weirdo -$3748.

I think in a previous post @Bear77 explained the reasoning behind this which has to do with the contract with Glencore for copper sold, when EVN bought the mine. Anyhoo, it is a big masking agent for Red Lake which is not going to plan.

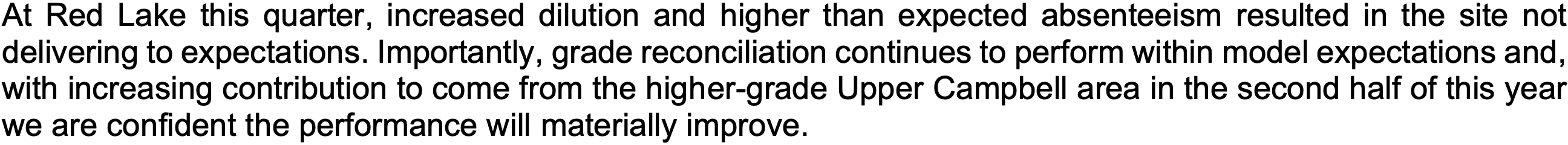

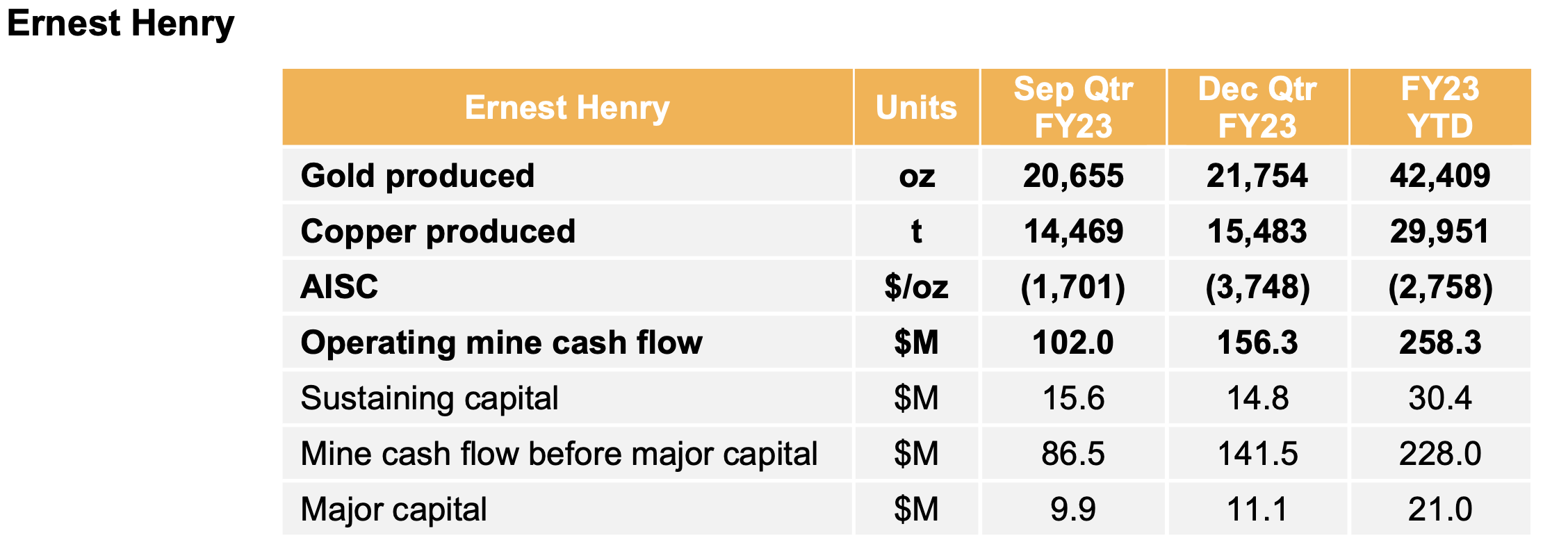

In the report though, there are good reasons why it isn't going to plan just now, but will improve shortly:

And even though this is apparently, entirely normal, expected and nothing to see here:

So, heads have rolled. There have been many quarters of disappointment regarding Red Lake

I have now lost faith in EVN. I think that "the great white hope" of Red Oak is not going to eventuate and will be selling out completely tomorrow.

Bit sad, after nearly 20 years or so of holding EVN from a penny stock.

But..never fall in love with a stock, and always re-assess in the light of new evidence.