Nanosonics provided a trading update for 1H24

- Revenue for 1H24 will reduce ~4% compared to PCP ( to $79.6m )

- Nanosonics revenue comprises 2 components (Capital sales and Consumables)

- Consumable would have increased by definition because of more installed base ( no figures provided)

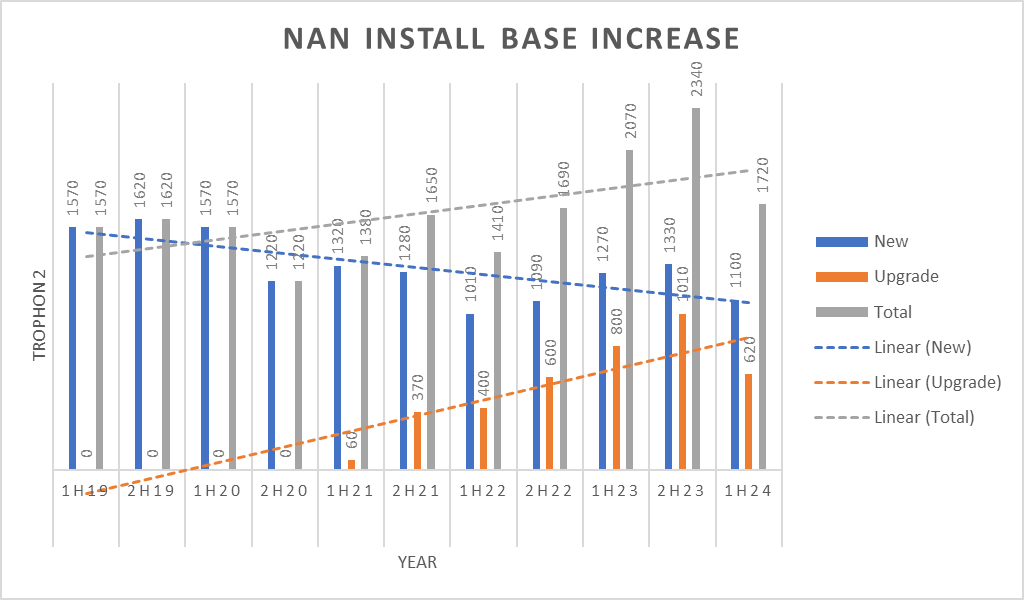

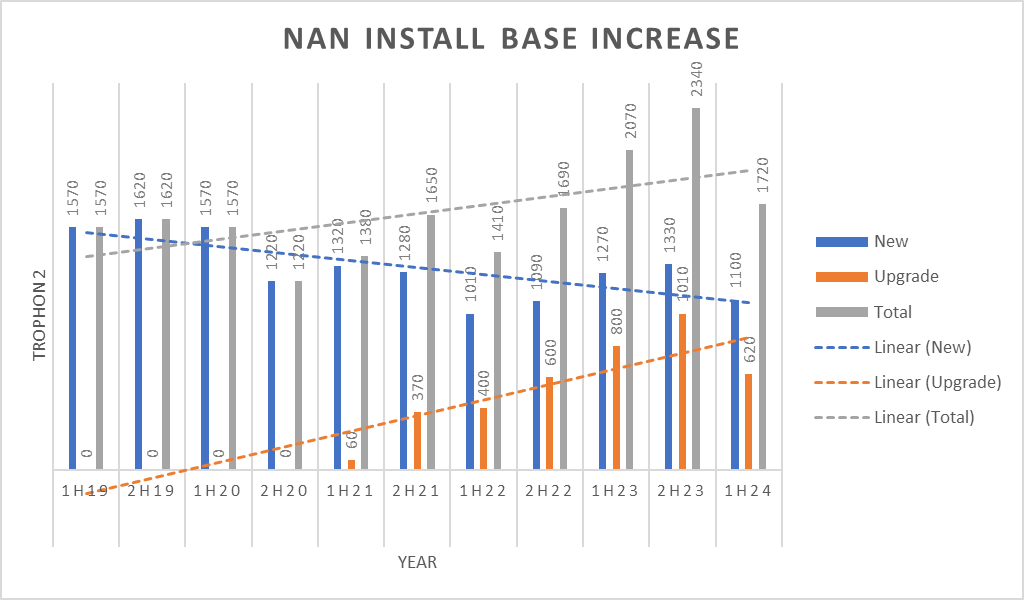

- In this half, Nanosonics only sold 1720 units ( 1100 new and 620 upgraded) compared to the 1H23 figure of 2070 (1270 new and 800 upgrades)

- Management is saying that the revenue miss is because of lower-than-expected capital sales ( I think management would have factored in around 2250 capital sales in this half i.e ~10% growth over pcp) so they are short of 530 units this half - reason given in the announcement is "Hospital capital budget pressure"

- The following chart shows historic capital sales for the last 5 years and trends.

Now the question for investors is, is this a structural issue, or Market penetration issue, or an economic cycle issue? More information will be provided in half year result at 26th feb.

One thing is for sure that I was wrong in expecting 25% growth this year - Market has slapped 35% of its market cap in a day and to be frank market is right in doing so - Nanosonics was ( and is) on high multiple and it can not afford to not grow and miss the guidance. So hopefully, I learn and grow from this experience ( like i did with EML and KME and others)