Apparently Infratil acquired 80% of Console Connect from HKT in July 2023. So my above post about PCCW/HKT is out of date.

I should really be posting under IFT but there are more views on the MP1 threads..

From below as mentioned, this is much smaller than Megaport. This seems like a "cheap" stake when compared to Megaport. Only difference is Console Connect owns and maintains some infrastructure including fibre and subsea cables.

EBITDA forecast of 40-50m - good to see some financials but the Infratil financial updates don't show much detail on Console connect.

https://infratil.com/news/strategic-investment-in-console-connect/

Console Connect owns its global IP network which has been developed over many years and has been a top 10 Tier 1 network globally for the last 5 years, serving ~17% of all internet traffic and reaching over 150 countries. Integration with an owned Tier 1 IP network, as well as long-term integrated access to a global backbone network, provides a clear point of differentiation for Console Connect given its extensive network coverage and superior unit economics.

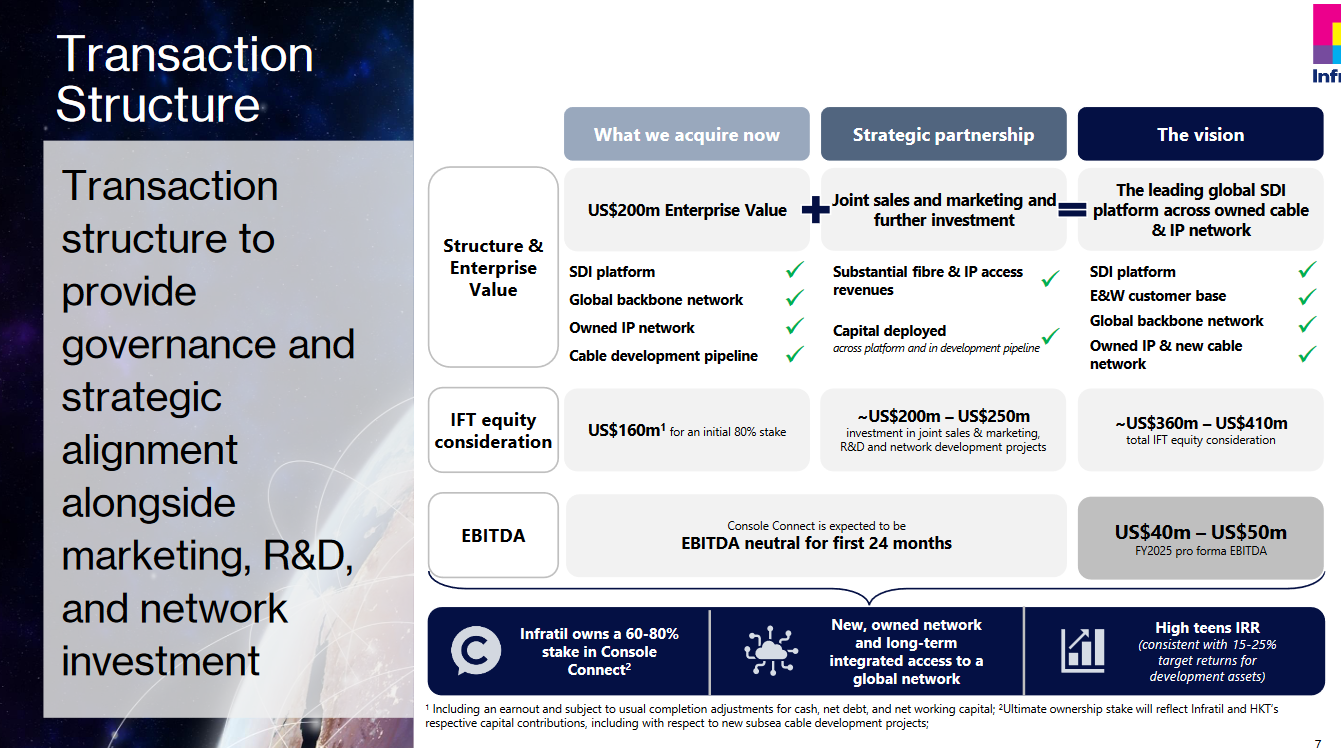

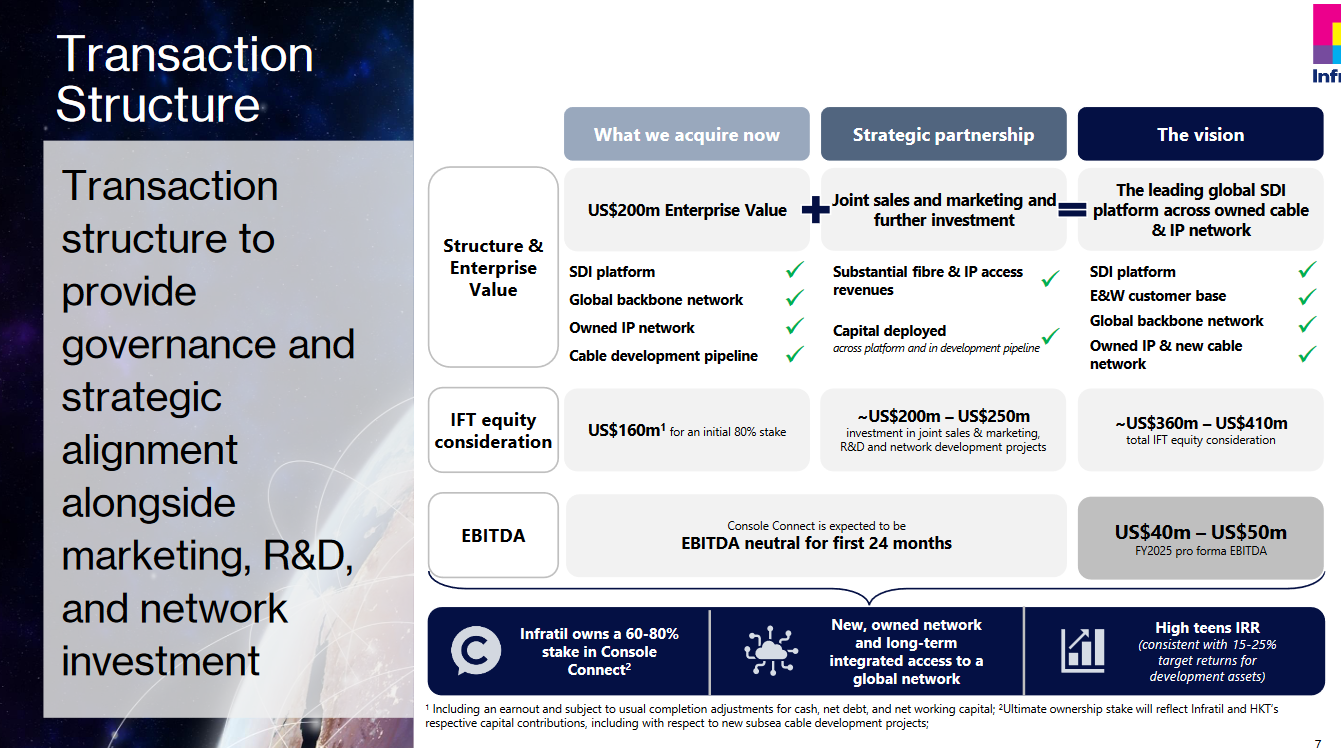

Infratil will initially acquire an 80% stake in Console Connect from HKT for US$160 million. Infratil will also enter into a strategic partnership with HKT, with both jointly investing up to US$295 million over a 2-year period following completion of the acquisition to accelerate Console Connect’s growth through:

- Joint sales and marketing via an HKT-supported approach to offer critical fibre infrastructure and IP access to its existing and new enterprise & wholesale customers.

- Investment in new subsea cable systems and network development to increase Console Connect’s network capacity, resiliency, and reach.

- Continued investment in research and development (‘R&D’) of Console Connect’s technology platform to expand and enhance its product offerings.

Following this initial period of growth investment, Infratil will own between 60-80% of Console Connect, with HKT holding the remainder. Ultimate ownership stakes will reflect the relative equity contributions of each party over this initial 2-year period. As the majority investor, Infratil will have governance rights consistent with its interest and, working alongside HKT, will continue to drive the development and growth of the business.

Infratil’s initial investment implies a 3.4x EV / FY2022A revenue multiple for Console Connect, with target returns of 15 – 25% over 10 years. The purchase price includes an earnout and is subject to usual completion adjustments for cash, net debt, and net working capital.