You beat me to it @Bear77 -- agree the update is generally positive, and while we need a solid second half for the company to land in its targeted revenue range ($36-45m), they seem to be suggesting that is very much in play with a "substantively stronger" second half. In Mal's words:

They'll need second half revenue of $22m to hit the lower end of their target range.

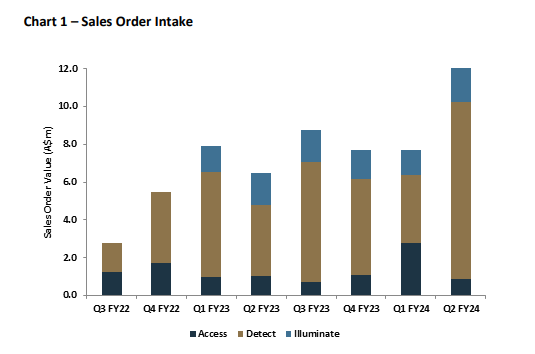

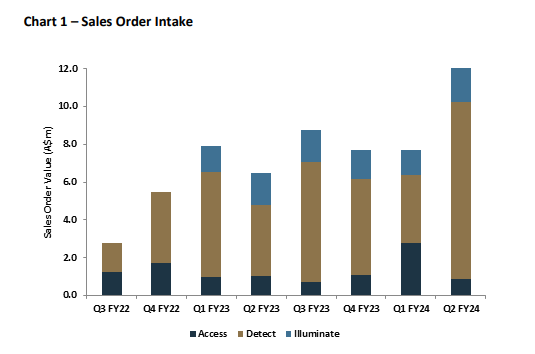

In the first half they have secured just shy of $20m in new sales orders (37% growth), with the second quarter representing 61% of the first half total and representing yoy growth of 39%. There's $8.9m in backlog to be fulfilled this calendar year, most of which is project delivery work -- this compares to a $5.2m backlog at the end of FY23.

This suggests (i think) that most of the sales order intake is converted to revenue relatively quickly (ie they added $19.7m in new sales orders in the 6 months to Dec 31, but the order backlog only increased by $3.7m. (someone please sanity check this assertion!).

Still, the reality is that H1 revenue is only 10% higher than H1 FY23, and is at the very bottom of the guidance they issued in October ($14.2-15.2m). The access segment had a great half but this was helped by stocking orders from their channel partners -- we'll need to see some good end-customer sales before we really know how their new Cobalt locks are being received by the market. And Illuminate was flat, albeit with a good improvement between the first and second quarters.

For me, the main game is with Access and Aura Ai-X, which has accounted for roughly 2/3rds of new sales orders. And they really do seem to be seeing some good sales traction there. Group targets aside, even if they 'only' get $18m in H2 revenue, that'll still be annual growth of 15% at the top line. (the previous second half did $15m in revenue, so I dont think that's too much of a stretch target)

Holding gross margins and fixed costs steady -- which is what management have essentially said to expect -- under that scenario you should still get an EBITDA figure that is more than double what we saw in FY23 (from cont. operations) and an operating margin expansion from 7% to ~12%.

The market obviously remains somewhat sceptical (if it wasn't the share price should be easily above 20c imo). But for me I consider the thesis still on track and shares good value. The next 6 months will be telling.