$NCK announced their HY results this morning....always fast out of the blocks in reporting.

ASX Announcement

My Analysis

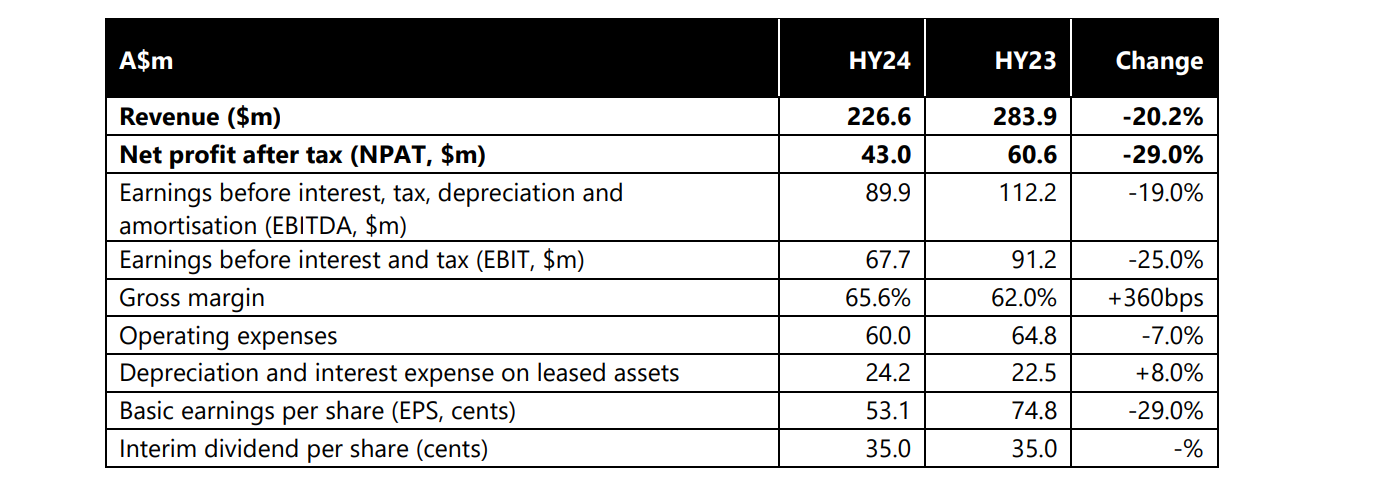

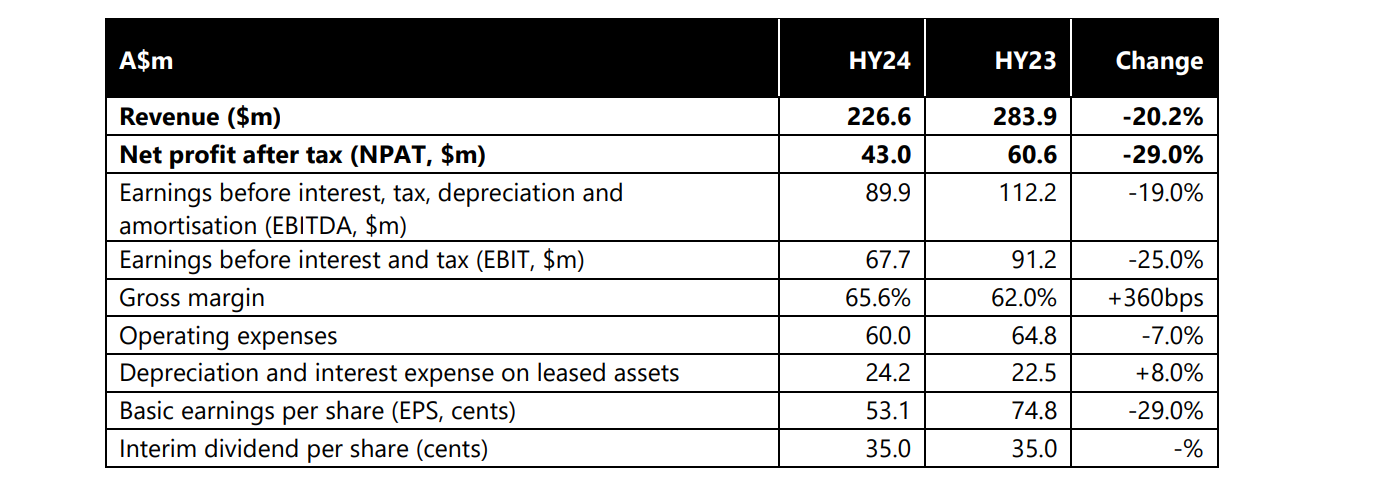

A slight beat on NPAT guidance of $40-42m ($41m consensus).

Revenues were down 20.2% cycling a very strong pcp half, and negative operating leverage pulled NPAT down 29%.

Online sales are doing well, up 22.5% - on a small base.

Improved GM%, up 360 bps and operating expenses were well-controlled.

On the cash side, operating CF of $66.79m is up 16% on the PCP, a strong result and a further $20m of debt was paid down, reducing LT debt from $89m to $69m. Not bad to be achieving that at or close to the bottom of the retail cycle, while still investing $14m in expansion and store upgrade.

Overall, a very good result in the context of the toughening environment for discretionary retail.

The store build-out program and rationalisation continued in line with strategy. There are now 64 Ncik Scali stores and 44 PLush stores, against the target of 86 (NCK) and 90-100 (Plush), which indicates ANZ store count growth remaining of 63-72%.

Looking to the FY, January written sales are up 3.6% over pcp (2.6% LFL) ... which I put down to strong promotions over the summer period, [judging by the number of 20-50% sale emails I received over the last 4-6 weeks. Whatever they have been doing on promotions hasn't hit %GM, so it will be interesting to see if this holds up in H2.]

While there's no forward guidance this morning, with consensus for FY NPAT at $74m, there is some room for a weaker send half of $31m to still meet FY consensus. The H2 FY24 number will be cycling $40.5m in H2 FY23.

The combination of the slide earnings beat and good news for January might see FY consensus tick up a few points.

My Key Takeaway

$NCK continues to weather the storm well.

$NCK SP rallied quite hard in December off the back of the strong November retail number, but has wound back somewhat in recent weaks, again due to the weaker picture on retail.

I'm not expecting a significant market reaction to today's result. The next 6 months could still be tough, particularly if the RBA doesn't cut rates until the second half, as this will be the first 6 month period with the lion's share of the mortgage fixed rate cliff run-off is largely played out, reflecting a lot of discretionary spending capacity out of the market. That said, with house prices and jobs market holding up, immigration still strong, and inflation moderating, consumer confidence can be expected to improve, aided by the redistribution of stage 3 tax cuts as this comes closer.

I'm still hoping to increase my holding of $NCK, but I don't think the market is going to offer me the opportunity this week. (I'd prefer to top up below $11.00)

So, I'm a HOLD for now.

Disc: Held in RL and SM