Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Thank you Anthony! You have a very Merry Christmas too!

Trading Update and Profit Guidance

Nick Scali Limited today wishes to issue the following trading update for the first half of FY26.

Following the Company’s trading update on 29 October 2025, first half revenue for Australia and New Zealand is expected to be 10% - 12% more than the previous year, higher than previous guidance of 7% - 9%.

As a result of the revenue growth in Australia and New Zealand, statutory net profit after tax for the group in the first half FY26 is expected to be in the range of $37m - $39m, compared to guidance of $33m - $35m.

Held IRL (10%), SM 25%

Anthony Scali’s trading update shows some very positive progress this quarter for the business. The sales in AU & NZ are expected to be up c. 8% in 1HFY26, the Nuck Scali branded stores in UK are outperforming Fabi branded stores by 10%, UK gross margins have lifted from 41% to 58.3% since acquisition of Fabi, and 1HFy26 NPAT is expected to lift 13% to $39-$40 (compared to $34 on pcp). If Nick Scali continues on this path for the rest of FY26 it should shoot past current analyst forecasts of $77 million NPAT for FY2026. It could be closer to $80 million?

Trading Update and Outlook

For trading across Australia and New Zealand for the first quarter of FY26, total written sales orders are up 11.6% on the prior year and same store written sales orders have increased 10.7%.

Sales Revenue in the first quarter increased 6% and we expect sales revenue for the first half FY26 to be 7-9% more than the previous year.

During FY26 in Australia and New Zealand, we are committed to opening 5 new stores, 3 x Nick Scali and 2 x Plush stores.

United Kingdom

In the UK as more store refurbishments are completed, written sales orders have begun to improve.

Nick Scali branded stores for the August and September period were up 10% on the same period when the stores traded as Fabb. During August and September there were 13 and 14 stores trading as Nick Scali respectively, with one to two stores closed for refurbishment.

With all stores opened and trading, as stated during our FY26 results presentation, our break-even revenue position will be circa A$53m. Despite two key stores closed for refurbishment and others not yet rebranded, August and September total written sales orders were an encouraging A$7.6m.

The UK gross margin in the first quarter was 58.3%, which compares to 41% on acquisition of the business and 47.1% for FY25.

We can now see a clear improvement in written sales which will transcend to better revenue results towards the end of the half.

Statutory Losses in the UK for the first half will likely be A$5m-$6m, including the impact of AASB16 (700k). The losses trend downwards in the second quarter when compared to the first quarter.

As a result of the anticipated revenue growth in ANZ, the ANZ statutory net profit after tax for the first half FY26 will be in the range of $39-40m, compared to $34m in the prior corresponding period.Statutory net profit after tax for the group in the first half FY26 is expected to be in the range of $33-35m, compared to $30m in the first half FY25.

Held IRL and SM

I'm starting to put this one on the watchlist and doing some more research as a bit of a macro play and would appreciate anyone's more recent thoughts. I've gone through the previous posts and really appreciate everyone's time and effort!

The basic thesis is:

- Cost of living pressures decreasing (at some point!) so greater disposable income to purchase or upgrade furniture

- Near zero inventory costs

- They own a lot of their properties so are largely immune to rental movements (enter discussion about opportunity cost here!)

- Expansion into the UK sounds interesting, but hopefully it doesn't go the same way as Masters...

- Consequence of the tariff wars being downward pressure on shipping costs perhaps? And possibly some spare capacity

$NCK announced their 1H FY25 results this morning.

Their Highlights

ANZ Group

- Revenue $222.5m, gross profit margin 64.4%.

- Underlying profit after tax $36.0m versus October 2024 AGM guidance $30-33m.

- Statutory profit after tax $34.1m.

UK

- Revenue $28.6m, gross profit margin 45.1%

- Underlying loss after tax $2.8m.

- Application of AASB16 to the acquired UK property leases increased the UK loss after tax by $1.2m for the period. The adoption of AASB16 has no cash impact.

- Statutory loss after tax $4.1m.

Group Balance Sheet

- Cash and bank deposits $87.6m at 31 December 2024.

- Interim dividend 30 cents per share fully franked.

Other Significant Points from the Presentation

As expected, the 1H ANZ sales were subdued, with the suply chain problems communicated earlier further eating into %GM. ANZ revenue was down on pcp, although undeyling profit came in well ahead of guidance.

UK is now into the transition, with the Fabb range being run down, and some sales disruption due to the conversion of stores from Fabb to Nick Scale.

The UK Nick Scali website is up and running (view it here: https://www.nickscali.co.uk/ )

Integration is proceeding, with $KCK processes and systems implemented, and $2m run rate of costs taken out.

UK performance was also ahead of guidance.

UK is still running the old distribution centre, which is on 3-month notice, pending identification of the new operation.

Despite the transition, the UK operation is already seeing an improved %GM off the old range, and $NCK are guiding to a %GM of 57%-59% for the NickScali range and stores. Bearing in mind Australia achieves 64%-65%, this is an encouraging start, as the %GM should increase over time as the store network grows and the business benefits from scale and supplt chain benefits.

Positively, there are early indications of a good product-market fit. The rebranded $NCK stores were the 3 top performing stores in January 2025 for written sales orders, only one of which had been in the Fabb top 5.

The target is to complete 8 further re-branded stores to Nick Scale by EOFY, with ongoing sales disruption due to store conversions.

Importantly, $NCK are already evaluating potential new store locations in the UK.

Outlook

There were a few questions on the surprising soft start to the year, with written sales orders down 8.5% in January 2025, although Anthony cautioned against reading much into this, pointing out that the sale week of the January Sale in Feruary was up 5%.

My Assessment

FY25 and 1H FY26 represent an important period of transition, during a time of sluggish sales in ANZ.

The early signs of a positive start to the UK are there, although there will be a drag on performance as the Fabb brand is transitioned out and stores closed for the $NCK uplift. There is also a change yet to come around identifying and implementing a new distribution centre, which brings some transition risk, and certainly some addition cost.

I retreated to the sidelines on the SP recovery before Xmas (considering the tranisition risks in the UK coming at the time of a slower ANZ period, added to news of supply chain problems). As it turns out, it would have done me no harm to have held on but that said, I don't see positive performance catalysts in 2H FY25.

This morning's SP response (SP up to $18.00 at time of writing!) indicates that the market is looking through the sluggish current period, and seeing the potential for what the UK can achieve for SP. That was always the risk of selling on relative strength ahead of the result. Never mind.

The $NCK SP tends to be reasonably volatile, and I'll be happy to get back onboard around $15.00-$15,50, should I be presented the opportunity. Otherwise, it is not a stock I have to own, so patience and discipline are required! I think FY26 and FY27 could be transformational, as UK starts to drive the group result, and monetary easing contributes to a better retail environment, so if I can get back on in the next 6-9 months at a reasonable price, then I will.

Overall, Anthony and team are doing a good job (and I am looking forward to my new armchair arriving in April .... I did my bit to help January written orders!)

Disc: Not Held

Updated Nov 2024

Revising down based on higher container and other costs plus lower than expected traction in the UK over next couple of years. Keeping growth at 15% p.a. with UK to contribute 5% + of the total within a couple of years.

Based on 90 cents EPS, PE of 10 and 15% growth rate for next 5 years

Why do I own it?

# The best run furniture retailer in Australia with a strong founder/owner

# Long term structural tailwinds as population grows and hopefully they can keep taking some additional market share too

# Outstanding ROE and ROC, margins, cash flow and earnings growth for many years

# Possibility of further complementary acquisitions and multiple expansion as time goes on

# Well thought out UK launch underway that offers significant EPS upside over 5 to 10 years

# Long term plan to expand combined Nick Scali / Plush store count to 180 stores in ANZ.

# They can deliver double digit revenue and earnings growth for 5 + years so the return should exceed our 15%p.a. + target

# The MOS is good at high single digit multiples which it trades at most years.

# Sharing some of their cost advantages through lower prices to maintain market share

What to watch

# Debt to equity and assets trend - want to see it steady or declining ideally as it has crept up recently after Plush acquisition

# UK expansion results - is progress, sales per sq meter, costs, gross margin etc all trending for this to be adding at least 5% p.a. to EPS within a couple of years

# Maintenance of current high margins - avoid discounting and margin compression

# Watch insider selling

# Succession planning for Anthony

Nick Scali said they might struggle to meet 1HFY25 guidance of $30 million - $33 million due to additional costs and delays as a result of one of their freight forwarders and customs agents going under administration. This isn’t a structural problem but the share price is likely to take a hit.

FREIGHT AND CUSTOMS AGENT OPERATIONAL ISSUES

Nick Scali Limited (the Company) advises that one of its freight forwarders and customs agents has experienced operational issues and is now under the administration of a liquidator. This has resulted in a significant number of the Company's containers being delayed at the ports causing challenges to the delivery of its products in Australia.

To resolve the issue the Company made an application to the Federal Court of Australia to seek orders for the shipping lines to release the Company's containers through the giving of certain undertakings. With the Court orders now granted, the Company is working to have these containers delivered to its Distribution Centres to allow delivery of the goods to its customers as soon as practicable.

Due to the delays, the Company now expects to incur unexpected additional storage and detention costs for the containers which cannot be quantified at this time.

These unexpected delays and costs are adding significant additional risks to the Company's ability to achieve its prior guidance of NPAT for Australia and New Zealand in the first half FY25 (a range of $30-33 million).

As further details of the financial impact of these events are known, additional guidance on the financial impacts will be provided.

In todays AFR: Nick Scali wants to conquer Britain. Does it stand a chance?

It's quite a lengthy piece and for those outside the paywall ...

Nick Scali wants to conquer Britain. Does it stand a chance?

The ASX-listed furniture retailer has made a big bet on the United Kingdom, where plenty of big Australian companies have come unstuck.

The Fabb Furniture outlet in Croydon, South London, is a pretty unassuming place: it has modest frontage in a retail park dominated by Britain’s biggest branch of Ikea. The Swedish behemoth lords it over the landscape, and seems to have a tractor beam hoovering up visitors as they emerge from their cars.

Inside Fabb’s narrow, warehouse-like building there’s a selection of perfectly decent sofas and beds. Although the slogan plastered over the walls is “Fill your home for less”, the prices aren’t a screaming bargain. Fortunately, customers are also offered five years’ interest-free credit.

Fabb has 21 stores, scattered across England in edge-of-town retail parks like this one. It’s fair to say that this chain, a former co-operative founded in 1979, isn’t one of the titans of the UK furniture market. So it might seem an unlikely launching pad for Nick Scali’s big assault on Britain.

The Australian company’s chief executive, Anthony Scali, admits as much. “It is a very poorly presented store network, with very average-looking furniture,” he told The Australian Financial Review after Nick Scali’s recent annual result.

But he has grand plans. It’s his first attempt to bust out of Australia and New Zealand, and he isn’t planning just to stick a few “Nick Scali” signs over the top of the Fabb ones. He’s ready to take some risks.

The 70-odd staff will stay put but the stores will be given a makeover and eventually restocked with Nick Scali products, ranging from modern swivel armchairs to mid-century modular sofas.

Fabb’s board has been cleared out – a cull that appears, from regulatory filings, to have spared nobody bar Fabb’s finance director Tracey Jackson and veteran managing director Matt Hesketh.

But Hesketh is now referred to as “commercial director”. Nick Scali just named former Best & Less boss Rodney Orrick as its British chief executive – ready to fly over from Australia, run the relaunch, then go for growth.

For Anthony Scali, the growth opportunity lies simply in the sheer scale of the UK market: 67 million people is just a lot more than Australia’s 26 million.

“You have got a big population,” he says. “Of the 60 million-odd people, there are going to be at least 20 million of those that are reasonably affluent, that will be our customers.

“All the UK retailers do double sales per store than we did in Australia, and we also think there’s less competition.

“The business we bought is located in the retail parks next to the likes of the DFS and Furniture Village, where their stores are doing £7 million ($13.7 million) a year to £9 million, which is a lot.”

But wait. If Scali’s lodestar is DFS, which has 118 stores across the UK and Ireland, there’s a klaxon warning. And it comes from the rival company itself.

At its most recent trading update in mid-June, DFS cut its full-year profit forecast in half. The company cited shipping delays on the Red Sea, which had driven up freight costs and delayed sales. It also said consumer demand was at “record lows”.

The economic stats back this up. Britain has at last emerged from a spell of soaring energy costs, double-digit inflation and rising interest rates. But in the big-ticket parts of the retail market, cost-of-living-conscious consumers are still feeling cautious.

The UK Office of National Statistics’ most recent data, from July, shows sales in the “furniture and lighting” sector slumping 12.4 per cent since the start of the year. The index for this category is at a three-year low.

Fabb itself has been struggling. As a private company, it doesn’t report as frequently as the likes of DFS. Its most recent accounts are for the 12 months to the end of June last year when margins topped 50 per cent. But Fabb was sober about the outlook.

“The retail sector continues to trade through difficult circumstances, with consumers demonstrating lower levels of disposable income,” its report said.

The company also noted hefty upward pressure on wages and on costs in its supply chain, but was hopeful these could be contained and would pass.

It’s not exactly a rosy picture, but the local industry expects it will eventually brighten as the economy – and particularly the housing market – revives and consumers regain confidence. And Scali reckons his company is well-placed.

“The key objective is to get to profitability within 18 months,” he says. “We’ve got this business that we’re starting with – a real low-cost space. So we think we should be able to get to profitability quickly, even with the tough landscape.”

His assessment is that the British furniture retail sector isn’t that competitive, which has left the gate swinging open for someone like Nick Scali.

“I’ve been in the UK often. I’m very close to the retailers. I see what they’re selling. In my view, it’s a very similar market [to Australia],” he says.

“They all look more or less alike over there. We will be a new entrant, and we think we can offer something different.”

Within the industry, this rings a bit of a bell. In 2016, Wesfarmers spent $705 million buying the struggling hardware chain Homebase and tried to transform it into Bunnings.

Like Nick Scali, they cleared out the board and management, brought in managers from Australia and revamped the brand at pace. The big assumption was that the Bunnings model would transfer readily to the British market and that the locals would welcome the Australian upstart.

But it all went wrong. Bunnings lost the existing Homebase customers and identity, and struggled to pitch the new concept. Even though Brits and Australians speak the same language and watch the same TV shows, their consumer habits and marketing cultures are less similar than anyone imagined.

“Just because you’ve got a great concept and you think the world’s heard of it, that doesn’t necessarily mean that resonates to people walking through the doors in a different country,” says one veteran of the UK retail scene.

“There are very, very few examples of successful retailers globally. Ikea is one, but it just doesn’t translate well unless you’ve got a completely distinct proposition. If all you’re doing is selling what everybody else is selling but with a concept that worked in a different country, well, why is that going to work?”

Within two years, Wesfarmers was forced to admit defeat and headed for the exit. The question for Nick Scali is, how can they rewrite that script?

Some industry observers say that furniture doesn’t involve committing as much stock into the stores, so Nick Scali will be able to experiment and adapt in Britain more easily than Bunnings could.

Still, Barrenjoey analyst Peter Marks warns that Nick Scali will need to educate British consumers and get the store refurbishments right.

“Shoppers want to trust the brand. You want to know the brand,” he says. “Homes are smaller and the wrap-around lounges that are popular here will not work in smaller homes in the UK.”

The online revolution

Scali hasn’t yet put any meat on the bones of his strategy, at least in public. It’s not yet clear how he plans to differentiate his stores from DFS or Furniture Village – or, more importantly, from online sellers like Amazon and Argos.

British consumers have long been at the vanguard of buying online, and by some counts almost one-third of retail sales are now made this way, compared with about one-fifth in Australia.

Furniture is not like shoes or fast fashion, where people routinely order items and send back the ones they don’t like or that don’t fit. But one retail consultant suggests the online revolution won’t leave this sector unscathed.

“Millennial consumers are now starting to buy houses, do stuff up, and digital for them is the only way,” the consultant says. “They’re saying, ‘why would I get my car, which I probably don’t have, and drive out of town to look at it? It’s a waste of time. Just order it and get it.’ So we’re right in the middle of this fundamental transition.”

Fabb has an easy-to-use website, allowing customers to order online. But the brand’s real strength, if the TrustPilot ratings are anything to go by – 79 per cent five-star – is customer service in the stores themselves.

The lower ratings tend to be from customers whose orders have been caught up in the freight and shipping delays – something Nick Scali will have to watch closely. The disruption on the Red Sea has eased but it isn’t going away.

Against the Bunnings experience, other Australian retailers have found their niche in Britain: jewellery chain Lovisa and stationery and gift seller Smiggle. Harvey Norman has established a beachhead in Ireland and will open its first English store in October.

All these brands, though, have chosen to enter the British market organically rather than by acquisition. But one executive from one of these companies told the Financial Review that Nick Scali might have made the right choice in its own sector, where well-positioned shop frontages aren’t always easy to come by. “If I were in their shoes, that’s how I’d have done it,” the executive said.

Barrenjoey’s Marks also gives Nick Scali a thumbs-up, calling the Fabb purchase “a logical, sensible way to enter the UK market”. The company could even buy a few more stores, he reckons, because Britain’s long leases mean vacant sites aren’t thick on the ground.

“He’s not betting the farm. He’s got an excellent track record creating value for shareholders, particularly with the Plush acquisition,” Marks says.

“If the UK works, it means the growth runway is a lot longer. If it doesn’t work, the balance sheet is in such a strong position that it’s not going to be a big deal.”

Anthony Scali has rolled the dice. But he’s not getting carried away.

“We are different, we have product differentiation. I think there’s an opening there. I see a segment that we can capture,” he says.

“I could be wrong. But time will tell.”

$NCK get us warmed up for earnings season as usual, as one of the early reporters.

Some quick comments ahead of the Investor Call at 10am

The results are complicated by the UK acquisition, which we won't be able to judge for a good couple of years, so I focus my remarks on the ANZ business and the underlying report.

ANZ written sales orders of $4447.4m up 2,4% Y/Y is a reasonable result in the current environment. On a LFL basis, sales expanded 1.0%. Of course this is less than inflation, so depending on the level of discounting volumes were fairly flat, possibly a slight decline. However, in the context of the current macro-economy and impact on discretionary spend, not a bad result.

Encouragingly, Gross Margins continued to expand strongly, up 2.5% to 66% on the PCP.

Expense control is not bad, all things considered. Total Operating Expenses (including D&A) increased 6% - which includes the UK expenses and acquisition costs. Stripping out D&A and $1.5m acquisition costs, expense growth is +4.9%, so, pretty good actually when you consider the inflationary environment.

The Y-o-Y revenue decline is explained in terms of things that happen in FY2023 around the FY22/FY23 transition. Need to understand this further, as I don't recall it having been called out as exceptional before - but I need to check.

Online continues to grow reasonably for the Nick Scali brand - written orders of $34.8m vs $29.5m in the pcp.

On outlook in ANZ, June and July are down -1.2% vs PCP - discretionary continues to be under pressure. No surprise there.

Balance sheet is strong, given the capital raising with Cash+Equivalents+Term Deposits at $111m up from $89m, and with $20m of long term debt having been paid down, which will reduce interests. LT Debt now $69m.

EPS seeing the drag of lower NPAT as well as increased share count following the capital raise.

Store expansion plans broadly in line with strategy. UK exapansion plans yet to be decided (need to uplift the acquired properties first).

Good news - a UK CEO has been appointed. Rodne Orrock, ex-CEO Best & Less. Interested to hear if any StrawPeople have views on him, as I don't know him.

Initial thoughts

An OK result - $NCK continues to navigate the challenging discretionary retail environment, maintaining a strong balance sheet (supported by the capital raising).

Will see if there is anything else to report after the call.

Some of the numbers look a smidge under consensus, but I am not sure hot much to put into that, given the muddying of waters due to the UK acquisition. Happy long term holder.

Disc: Held in RL only

See the full story in the AFR this morning (12/07/2024): Shipping crises ‘spanner in works’ for inflation fight

Continuing threat of attacks on commercial ships by Yemen’s Houthi militants off the Horn of Africa has forced vessels to reroute around the southern tip of the continent, increasing journeys by two weeks, and adding to fuel costs for shipping companies while the logjam in Singapore is creating delays of more than a month for Australian consumers.

Anthony Scali, chief executive of Australian furniture retailer Nick Scali, said freight rates had increased dramatically while the company was also dealing with reduced shipping capacity for its imported goods.

“The big issue is the shipping lines just don’t honour contracts and hence the rates have more than doubled compared to your contract rates,” Mr Scali said. “Clearly this will cause importers and retailers to have to increase prices. Very inflationary.”

I picked this up from @Jimmy’s regular News Summary DJ Australian Equities Roundup (10/07/2024). I thought I’d move it here for future reference.

“Nick Scali keeps its bull at Macquarie, where analysts say Australian spending on home furniture remained resilient at the end of fiscal 2024 despite pressure on consumer spending. They tell clients in a note that the proportion of June consumer spending dedicated to furniture was largely in line with the year-earlier period. Foot traffic to Nick Scali's furniture stores in fiscal 2H also looks broadly in line with a year earlier, they say. Macquarie keeps an outperform rating and A$16.10 target price on the stock, which is up 0.7% at A$13.27. ([email protected])”

15-June-2024: My PT for Nick Scali is $15.70 over the next 2 years. Their SP closed yesterday @ $13.80, however they recently very briefly tagged $16/share after announcing that UK expansion).

Further Reading: NCK - SPP @ $13.25 (strawman.com)

And here: NCK - Trading Halt and Capital Raise (strawman.com)

And here: NCK - NCK valuation (strawman.com)

And here: NCK - Nick Scali Limited - Strawman: ASX share price, valuation, research and discussion

Top notch management team, they run it like business owners, great business model, high margins, should be replicable in the UK, so just starting out on what could well be a good few years of further decent growth.

Can look expensive based on historical metrics - like PE and other ratios, but has a management premium in the share price which is well deserved and there's growth ahead of them, so there are gains there to be made for the patient, IMO. FWIW.

Good company to buy more of on decent pullbacks, which they seem to have fairly regularly due to the no-bullsh!t style of Anthony Scali when he outlines headwinds that the company faces - or could possibly face in the near to mid-term more than he seems to highlight positives. He's not one to try to put any positive spin on anything and that style can see over-reactions to the downside at times, which does present the odd opportunity to those of us who know how good this company is.

This isn't one of those pullbacks - when they do pullback, it can often be a decent pullback:

From over $8/share to under $4/share in 2020, from $16 down to below $8 in FY22, and from over $14 to almost $8 in the first half of last year, so 40% to 50% share price drops are not uncommon with this company if you're patient.

That said, if you pick almost any spot to buy them other than the two times they've tagged $16 - and the few months around those times that they've been over $12, you'd be in the green today and have received some generous dividends to boot - depending on when you bought them - they're good dividend payers:

Note: Dividend amounts have been rounded to the nearest full cent.

Chart data sourced from Commsec. Dividend data sourced from the ASX and Intelligent Investor: Nick Scali Limited (ASX:NCK) - Dividends - Intelligent Investor.

So decent income and growth as well. I hold NCK in my largest real money portfolio and we did participate in their recent CR (the SPP part). Not held here, but you can't hold everything everywhere.

NCK ASX: Nick Scali mounts UK push with Anglia Home Furnishings buy, US or Canada could be next (afr.com) [24-April-2024]

Excerpt from the bottom end of that AFR article:

Competitor struggles

Wilsons analyst Tom Camilleri said his channel checks suggested the UK furniture market was under immense pressure, which “makes for ideal timing for a new entrant to take advantage of competitor struggles”.

Mr Scali called the Australian consumer outlook stable, noting trading to date had been consistent with the update provided at its half-year result with positive momentum in January, a slowdown in orders in February due to fewer promotions, and an uptick in March.

Written sales orders grew 1.2 per cent to $326.2 million in the nine months to March 31.

Mr Scali said amid tougher domestic conditions, retail competition consolidated, allowing Nick Scali to gain share.

“On the negative side I thought there’d be more talk about interest rate reductions and inflation coming off, so the US spooked people,” he said. “On the positive side is tax cuts.”

--- end of excerpt ---

Go Anthony!

Result of the SPP are out:

From the release:

As the total value of applications received exceeded the SPP offer size of A$10 million, the Company has undertaken a scale-back of applications consistent with the terms of the SPP3 . The scale-back principles were structured with consideration to shareholder fairness as follows:

• applications for A$1,000 of New Shares (being the minimum application amount) received from eligible shareholders were not subject to any scale-back and will receive A$1,000 of New Shares, rounded down to reflect a whole number of shares; and

• applications received from eligible shareholders for more than A$1,000 of New Shares were scaled back on a pro rata basis based on the shareholdings of those eligible shareholders as at the Record Date.

Approximately 97% of eligible shareholders who submitted valid applications will receive an amount of shares that exceeds their percentage holding in Nick Scali as at the Record Date.

Well done to all who helped in the lobbying. It sounds like our voices were heard!

08-May-2024: NCK-Change-of-Director's-Interest-Notice-Carole-Molyneux.PDF

Wow! We sometimes look at director buying and wonder whether it's a case of directors seeing value or just trying to signal to the market that the shares are cheap.

Carole Molyneux bought 25,000 NCK shares for $367,327.11 (average price of just over $14.69 each) yesterday (7th May). That is a decent purchase!

Interestingly, Ms Molyneux, pictured below, who has been a Nick Scali director since June 2014 (so almost 10 years) owned zero NCK shares prior to this purchase.

With this on-market purchase she has gone from zero to 25,000, so more than Bill Koeck and Kathy Parsons, and only behind Anthony Scali and John Ingram (Nick Scali's Chairman).

It's got to suck to be the only director who could NOT take part in this SPP (@ $13.25) because she held zero shares on the record date. I guess she's decided not to be caught out like that again.

Source: https://www.linkedin.com/in/carole-molyneux-richards-41276a/?originalSubdomain=au

---

Just changing the subject for a minute - I've only ever seen Anthony Scali, the CEO & MD of NCK like this:

And I thought I'd found an earlier photo of Anthony today:

However that is Nicky Scali, Anthony Scali's brother, who was Director of Sales and Marketing @ Nick Scali Furniture from Nov 1991 - Apr 2016 (24.5 years) according to this: (25) Nicky Scali | LinkedIn.

I found the image here: https://rocketreach.co/nicky-scali-email_36690771

No word on what Nicky is doing with himself these days. It was in 2016 (around the time that Nicky left NCK) that siblings Nicky and Yvonne sold their 33% stake in NCK to Institutional Investors and to their brother Anthony Scali at a price of $3.80/share, or an implied total of $111 million. At the time (as a result of those purchases) Anthony increased his own stake from 16.7% to 27%. Nicky and Yvonne apparently held zero NCK shares after that sell out in 2016.

See here: Anthony Scali's siblings dust $75 million selling down (afr.com) [15-Feb-2017]

Less than 2 years later, in March 2018, Anthony Scali reduced his stake in Nick Scali to 13.63% after selling half of what he held to Chinese supplier, Jason Furniture (KUKA) @ $7.00/share, for a total of $77.2 million. See here: Scali sells half stake in $77 million deal (insideretail.com.au) [27-March-2018]

In September of the following year (2019), KUKA sold their 11 million NCK shares at $6.85/share ($75m) through broker UBS, so slightly less than what they paid for them. See here: Nick Scali's largest shareholder sells stake for $75m (afr.com) [3-Sep-2019]

Anthony Scali held 7.95% of NCK prior to this current CR, worth around $103 million, and he has purchased an additional $4m worth of NCK @ $13.25 as part of this CR, so he still has significant skin in the game, despite taking profits along the journey.

He's no dummy this fella.

Nick Scali's SPP is now open, from today. I've downloaded my application form from the email they sent to me and will apply for the full $30K at $13.25 each. Eligible shareholders can apply for a minimum of $1K and a max of $30K as per the application form details. See here: Announcement-and-Share-Purchase-Plan-Booklet.PDF

NCK has been trading at over $15 before yesterday's sell off and they're still over $14.50/share. I expect this one to be scaled back significantly because it will be heavily oversubscribed - they're only targeting a $10m raise through the SPP after raising $46m via the Insto Placement and issuing $4m of new shares to Anthony Scali, Nick's MD, all at the same price of $13.25/share - so $50m raised already, plus this additional $10m via the SPP. They may accept oversubscriptions and raise that $10m cap, but I wouldn't expect them to, they are usually fairly disciplined with these sort of things and will likely just raise the $10m as indicated, which will require a scale back if they receive more than $10m worth of valid aplications, which they will.

Because I expect a scale back, I am applying for more new NCK shares through the SPP than what I actually want, and if my application is not scaled back and I do actually receive the full $30K worth of new NCK shares, I can sell some on-market. I already trimmed my real-money portfolio position a little on April 26th (Friday) by selling into the closing single price auction (CSPA) at 4:01pm Sydney time, so I got $15.85/share for those (NCK's final closing price on the day). I'm not holding NCK in my Strawman portfolio.

I'd be wary of selling down too much of a NCK position now however, because recently I have noticed a strong trend with SPP scale backs of various companies scaling back SPPs on a pro rata basis - based on each shareholder's existing holding at the end of the SPP offer period, so the idea is it rewards those with larger positions at the expense of those with smaller positions. Often, those who hold less than a "minimum marketable parcel of shares" (currently regarded as $500 worth) get zero shares in scaled back SPPs and have their application money refunded to them in full. Not always, but often enough to take notice of this trend I think. This was in part a reaction to some people holding 1 share or a very small amount of shares in a bunch of different companies for the purpose of giving them access to SPPs if and when those companies announced them - and then the game plan with those people was usually to buy the max shares at a discount and then sell them on-market for more fairly soon after receiving them - so arbitrage (Arb) plays. These Arb players with tiny shareholdings are NOT loved by companies because (a) shareholders with very small positions cost the company money in terms of administration expenses - as share registries charge fees based on numbers of shareholders and may have to send out annual reports and other hard copy stuff to them from time to time, which all costs money, and (b) these arbitrage plays put additional selling pressure on the company's shares directly after the new shares are issued because of these people trying to close out their trades, which can lower the share price to levels below where it would otherwise have been trading - and makes the company look weaker than they should when they want their share price to remain strong to keep all their serious shareholders happy.

There is often some churn in shares after an SPP (and sometimes after placements) as people get comfortable around how many shares they now hold (so trims or top-ups to get to their required weighting) but companies would prefer not to have these Arb players dumping their shares at the same time and putting further downward pressure on the share price.

So it has become commonplace for SPP scale backs to now be based on how many shares each applicant already held - often on the closing date of the SPP - which means the more of your current position you sell down prior to the SPP closing, the less shares you MIGHT receive in the SPP. For this reason I have kept most of my original NCK position and will sell-down AFTER the SPP shares are allocated if I think my new weighting to NCK (with the SPP shares included, after they are issued) within that portfolio is too high.

Assumed three growth scenarios ranging from revenue growth ranging from 10% to 5% over next 5 years. Share Count growing after capital raise and 1% Margin for each year giving roughly 90m shares on issue. Net Margins 17% based on past performance and PE ranging 25 Bullish - 15 Bearish. Resulting in discounted valuation of $14.10 when 3 scenarios are combined.

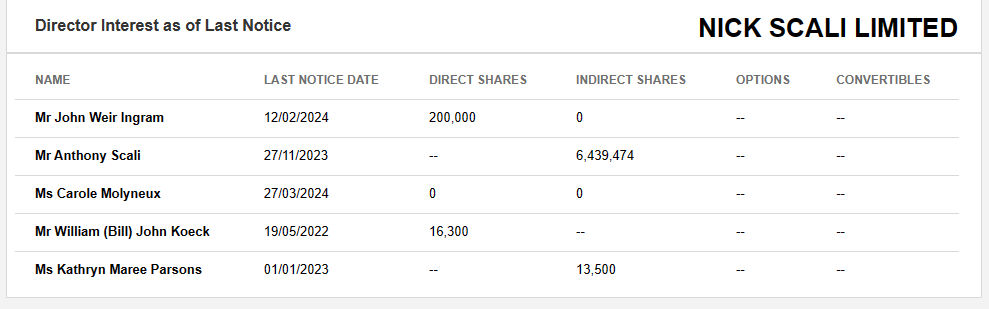

Inside Ownership Ordinary Shares % NCK Issued Net Value at $15.83

Anthony Scali 6,439,474 7.95% $101.936m

John Ingram 200,000 0.25% $3.166m

Carole Molyneux 0 0 0

William (Bill) Koeck 16,300 0.02% $258,029

Kathy Parsons 13,500 0.02% $213,705

Total 6,669,274 8.23% $105.574m

*Note figure pre capital raise April 2024, Note have not included Anthony Scali A$4.0m conditional placement. https://announcements.asx.com.au/asxpdf/20240424/pdf/062tmqwhyzb0sq.pdf

Board Selling

Carole Molyneux

27 March 2024

· Sells 25,000 shares at average $15.26 per share ($381,500)

John Ingram

8-12 February 2024

· Sells 156,551 shares at average $14.88 per share ($2,330,201)

Anthony Scali

27 November 2023

· Sells 4,600,000 shares at average $11.00 per share ($50,600,000)

https://announcements.asx.com.au/asxpdf/20231123/pdf/05xptg4rl0fbjz.pdf

Bio Board of Directors

John Ingram – Independent Non-Executive Chair

John was appointed to the Board as non-executive Chair in April 2004, and was formerly Managing Director of Crane Group Limited.

Carole Molyneux – Independent Non-Executive Director

Carole was appointed to the Board in June 2014. Carole has extensive experience in retail and was the Chief Executive Officer of Suzanne Grae, (part of the Sussan Retail Group), for eighteen years until 2013.

William (Bill) Koeck - Independent Non-Executive Director

Bill was appointed to the Board in August 2020. Bill is an experienced legal adviser with over 40 years of experience in mergers and acquisitions, equity capital markets, private equity, restructuring and corporate governance. For over 20 years, Bill has been a part time lecturer in corporate and securities law in the Masters of Law course at the University of Sydney. Bill is a Member of the Federal Governments Takeovers Panel.

Kathy Parsons – Independent Non-Executive Director

Kathy was appointed to the Board on 1 January 2023 and brings a wealth of experience in accounting, finance, governance and risk management. Formerly she was an assurance partner at Ernst & Young with deep international experience working in Australia, the USA and the UK in a broad range of industries including retail and real estate. She was also part of the Oceania assurance leadership team responsible for quality assurance and risk management. Kathy was the signing partner on the audit of Nick Scali Limited from 2012 to 2018.

Anthony Scali – Managing Director

Anthony is Managing Director of Nick Scali Limited. Anthony joined the Company in 1982 after completing a Bachelor of Commerce degree at the University of New South Wales and has almost 40 years’ experience in furniture retailing.

Unsurprisingly, the institutional placement was fully taken up.

And Anthony has said that investing shareholders who bid up will be allocated their pro rata share, despite new institutional investors also showing up.

The market has liked the announcement with SP up 11% at time of writing, making the SPP off of $13.25 looking very attractive.

Good to see such a great reception for the move.

$NCK has just gone into a halt pending an announcement about a capital raise.

Is this the long hinted at UK acquisition coming to fruition?

I can’t think what else, given that it’s so cash generative.

Tristan Harrison from The Motley Fool shared some upgraded broker price targets in his commentary on Nick Scali today. The average price target from the three brokers mentioned below comes in at $14.72. https://www.fool.com.au/2024/02/07/this-asx-all-ords-stock-is-surging-6-amid-multiple-broker-upgrades/

“According to reporting by The Australian, the ASX retail share has seen three brokers increase their ratings on the ASX All Ords stock.

Broker Jarden Securities raised its rating to overweight (which is positive) and increased the price target to $13.87. A price target is where the broker thinks the share price will be in 12 months.

Macquarie analysts have raised their price target on the company to $14.90, which is slightly higher than where the Nick Scali share price is currently trading.

Wilsons increased its rating to overweight on Nick Scali shares and bumped up the price target by 36% to $15.40.”

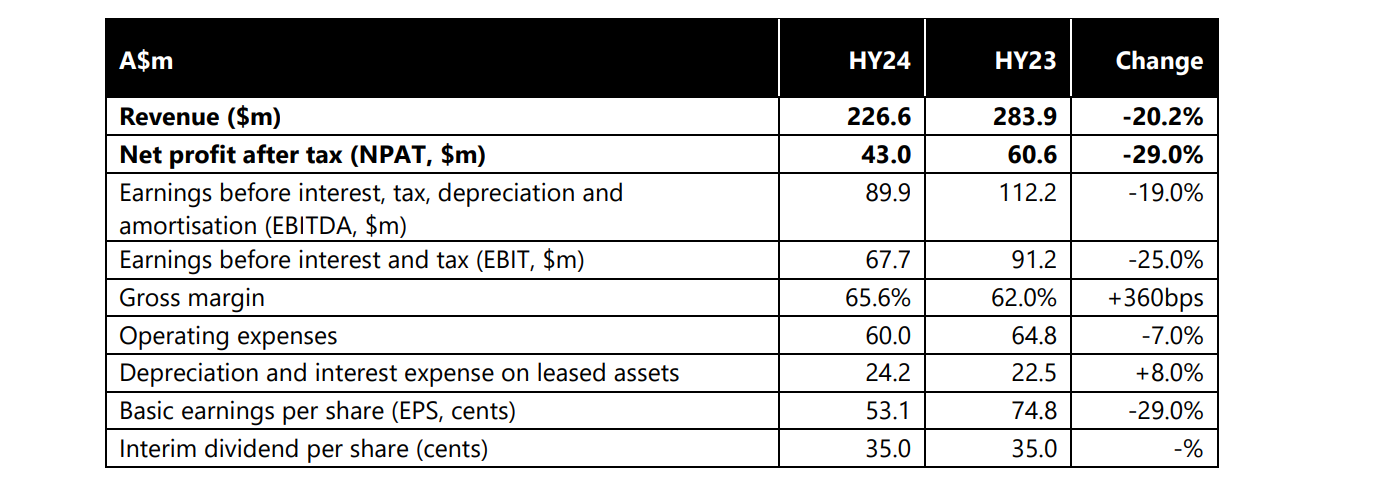

$NCK announced their HY results this morning....always fast out of the blocks in reporting.

My Analysis

A slight beat on NPAT guidance of $40-42m ($41m consensus).

Revenues were down 20.2% cycling a very strong pcp half, and negative operating leverage pulled NPAT down 29%.

Online sales are doing well, up 22.5% - on a small base.

Improved GM%, up 360 bps and operating expenses were well-controlled.

On the cash side, operating CF of $66.79m is up 16% on the PCP, a strong result and a further $20m of debt was paid down, reducing LT debt from $89m to $69m. Not bad to be achieving that at or close to the bottom of the retail cycle, while still investing $14m in expansion and store upgrade.

Overall, a very good result in the context of the toughening environment for discretionary retail.

The store build-out program and rationalisation continued in line with strategy. There are now 64 Ncik Scali stores and 44 PLush stores, against the target of 86 (NCK) and 90-100 (Plush), which indicates ANZ store count growth remaining of 63-72%.

Looking to the FY, January written sales are up 3.6% over pcp (2.6% LFL) ... which I put down to strong promotions over the summer period, [judging by the number of 20-50% sale emails I received over the last 4-6 weeks. Whatever they have been doing on promotions hasn't hit %GM, so it will be interesting to see if this holds up in H2.]

While there's no forward guidance this morning, with consensus for FY NPAT at $74m, there is some room for a weaker send half of $31m to still meet FY consensus. The H2 FY24 number will be cycling $40.5m in H2 FY23.

The combination of the slide earnings beat and good news for January might see FY consensus tick up a few points.

My Key Takeaway

$NCK continues to weather the storm well.

$NCK SP rallied quite hard in December off the back of the strong November retail number, but has wound back somewhat in recent weaks, again due to the weaker picture on retail.

I'm not expecting a significant market reaction to today's result. The next 6 months could still be tough, particularly if the RBA doesn't cut rates until the second half, as this will be the first 6 month period with the lion's share of the mortgage fixed rate cliff run-off is largely played out, reflecting a lot of discretionary spending capacity out of the market. That said, with house prices and jobs market holding up, immigration still strong, and inflation moderating, consumer confidence can be expected to improve, aided by the redistribution of stage 3 tax cuts as this comes closer.

I'm still hoping to increase my holding of $NCK, but I don't think the market is going to offer me the opportunity this week. (I'd prefer to top up below $11.00)

So, I'm a HOLD for now.

Disc: Held in RL and SM

In todays AFR:

Nick Scali founder cashes out $50m via UBS

Expect only the finest in Christmas presents this year from Anthony Scali, the founder and CEO of ASX-listed furniture retailer Nick Scali

Street Talk understands UBS has underwritten a sale of $50 million worth of shares on Scali’s behalf, in his first selldown in nearly five years

The parcel of 4.6 million shares represented 5.7 per cent of issued capital. The trade was underwritten at $11 – or a 5.3 per cent discount to last close

Scali last sold shares in the company in 2018 at $7 apiece. He would be still its largest investor with 8 per cent ownership

It comes after the company posted record revenue – $507.7 million, up 15.1 per cent – as well as after-tax profits – $101.1 million, up 34.9 per cent – for the 2023 financial year. Its shares have risen 24 per cent over the past 12 months, and the latest trading update showed a slowdown in orders but was better than consensus expectations

It listed at $1 a share for an $81 million market capitalisation in April 2004. The company was capitalised at $948 million on the ASX as of Wednesday’s close

DISC: Held in SM & RL

$NCK gave a Q1 trading update today as part of the AGM address.

1Q sales were down 5.4% on the pcp and 6.7% on a LFL basis.

Store traffic was down 10-15% so the sales numbers are reported as showing a higher conversion due to "our better value products from both brands."

1H NPAT is forecast to be in the range $40-42m, which would compare with $60.5m for 1H FY23, reinforcing the negative operating leverage of retailers.

My Analysis

When FY23 was reported in August, it was noted that July was down 8.1% over PCP. So, to be down 5.4% for the quarter indicates that the decline moderated through the quarter. (Hence, the positive SP move on a down day?)

1H FY23 NPAT was 60% of the FY result. If $NCK comes in at $41m and if that turns out to be 60% of the FY result, that would indicate a FY result of $68m, vs. consensus of $71m. So, broadly in-line with the broker views.

That's a lot of "ifs" and dangerous to extrapolate given that we still expect a softening retail environment through FY24.

Overall, $NCK appears to be weathering the storm, and at the time of writing, is one of the few points of "green" on my screen this morning.

In RL, I am still only at 50% of my intended allocation to this small but quality retailer. However, I intend to see how the macro pans out and may wait until 1H or other opportunistic "event".

Disc: Held RL only

Thank you @DrPete for your kind words and your views on the future for Nick Scali.

After reading your straw I am starting to think that perhaps I have been too bullish with my valuation? Perhaps assuming a 5 year ROE of 40% might be a little too high?

Retail is definitely not out of the woods yet and I agree Nick Scali is in for a lower NPAT in FY24. I think in the short term putting a valuation on Nick Scali is a bit like gazing into a crystal ball. We’ve got to make some assumptions about the economy, interest rates, consumer sentiment, the housing cycle etc etc.

Post results, the brokers are starting to adjust their earnings forecasts and the 12 month price targets are starting to come through.

Taking a look at the 12 month price targets on Simply Wall Street the consensus for 7 analysts is $12.44. However, there is not much agreement here with the most bearish at $9.70 and the most bullish at $15.84. That puts my valuation of $16 in the bullish camp!

Source: Simply Wall Street (14/08/23)

The consensus earnings forecast for FY24 from six analysts is $69.3M, climbing up to $88M in FY26. Both significantly less than the $101M just announced for FY23.

Source: Simply Wall Street (14/08/23)

There is a large variance in earnings per share forecasts between analysts. Looking at forecasts from 5 analysts for FY25, the average is 98cps. However the highest is $1.18 per share and the lowest is 85cps.

This is how the variance looks graphically.

So this tells me there are probably too many variables for anyone to forecast Nick Scali’s earnings over the next few years with any degree of certainty.

I think the share price could vary wildly over the next 2 to 3 years depending on sentiment towards discretionary retail. I think there is likely to be trading opportunities for Nick Scali shares over the next few years. However, five years down the track I don’t think I want to be short on Nick Scali shares.

There has been some discussion on Strawman lately about when to Sell a stock. I think we currently have too much Nick Scali in our IRL portfolio (over 10%). For us, the higher the share price goes the higher the risk of holding it becomes. There is a risk of seeing potential profits evaporate! So if the stock approaches $15 to $16 per share I will most likely lighten off some shares and balance out our portfolio (unless there is some unforeseen good news about the economy and the housing cycle which Nick Scali will benefit from).

Similar to @DrPete, our cost base is $9.93 per share, so we could take some profits now. So you could say I am both a seller and a buyer of Nick Scali, a long term BULL and in the short term I’m CAUTIOUS. However, I can’t think of a better stock to get caught holding with a 5 to 10 year time horizon.

So we are holding too much Nick Scali in our portfolio at the moment and we have an opportunity to balance it out and take some profits now. But look at the chart!

I don’t claim to be an expert chartists, but I know enough to know this is not the time to lighten off. I will most likely hold until the MACD heads in a negative direction, then lighten off some of our holdings.

@mikebrisy, I wish I found selling a simple process. For me it is very hard, especially with a wonderful business like Nick Scali! :)

I'm solid but a little less optimistic than some of our SM colleagues, sitting at a Hold for Nick Scali (I hold IRL and SM). Here are my scenarios:

- Bull (20% probability): 7% dip in rev for FY24, jumping back 15% FY25, with 5 yr CAGR of 9%. FY28 financials: rev $784m, 18% NPAT, 70% payout ratio, 3.5% div yield, PE of 20, no dilution, discounting 10%, current valuation $21.63, 5 yr ROI of 27%

- Base (50% prob): 12% dip in rev for FY24, 12% lift in FY25, then around 10% growth ongoing: FY28 financials: rev $666m, 15% NPAT, 70% payout ratio, 4.4% div yield, PE of 16, no dilution, discounting 10%, current valuation of $12.26, 5 yr ROI of 15%

- Bear (30% prob): 17% dip in rev in FY24, returning to 10% but then slow decline in growth with 5 yr CAGR of 4%. FY28 financials: rev $612m, 12% NPAT, 60% payout ratio, 5.0% div yield, PE of 12, no dilution, discounting 10%, current valuation $6.75, 5 yr ROI of 3%

Weighted average across these three gives $12.48 current valuation, with 5 yr ROI of 15% including dividends.

Here are my notes from Nick Scali's FY23 results. Thought these might be useful given I'm positive (hold IRL and SM) but less positive than recent vibe on SM. I've done well given I bought in avg price of $9.92, prompted by @Rick's past SM posts (thanks Rick for your advocacy and insights!), but with recent share price increase it's now in my Hold range.

- Mgmt quality is unquestionably exceptional with recent ROE > 50%, with Scali family owning 14%.

- Company is in great health, with essentially zero net debt.

- FY23 rev is extremely unlikely to be repeated in FY24. It cam off a Covid high, with massive Covid demand combined with supply chain delays that pushed a lot of order fulfilment into FY23. Compared to FY23 rev of $508m, new sales orders over last year were $437m. For me, this is the base case revenue for FY24 given the economic headwinds.

- It's likely that FY24 will break the long history of increasing dividends, unless payout ratio nears 100%. Assuming FY revenue of $440m, gross margin of 60%, operating expenses of $180m, we get a NPAT around $60m, far lower than the $101m in FY23. Even with a 100% payout ratio, that's only around 75c dividend, same as FY23.

- I have concerns about growth. FY23 sales orders were 14% lower than FY23 revenue, because of the Covid backlog of sales that fulfilled in FY23. With economic headwinds, I'm not confident there will be much or any growth from this "underlying" revenue in FY24. Also, store growth was just 3 stores from 104 to 107 in FY23. Another 4 are planned for H1FY24. Not bad, but not awesome. Historical growth prior to covid as about 13% pa. My base case is 5 yr CAGR of 6% (dip in FY24 then returning to around 10% with small ongoing decline).

- Perhaps it's the nature of the large heavy goods they sell, but Nick Scali hasn't cracked online sales. They are tiny at $26m, down from $29m in FY22.

- Despite my muted optimism, the sky isn't falling. Even with my scenario above of 14% decline in rev for FY24, assuming current operating expenses and steady gross margin, NPAT will still be around $60m, which would be 4.3% fully franked yield based on 70% payout and current share price of $12.12, growing around 10% pa.

$NCK report their FY23 results today and, overall, they are pretty decent! Before getting excited, remember that FY23 includes a full year of the Plush acquisition.

EPS of 124.8cps is a small beat on concensus of 122cps.

What's encouraging is to see that Gross Margin has increased due to acquisition synergies and easing supply chains offsetting other factors driving the increased CODB.

The darkest point is as follows:

"The second half written sales orders for FY23 were down 16.2% on the prior period. Trading was very volatile over the half although improved in June 2023 where written sales orders totalled $51.5m, up 4.5% on the prior year. Nick Scali brand online written sales orders 2H FY23 of $14.5m were up 14.5% on 2H FY22 with enhancements in the user experience driving growth. Nick Scali brand online written sales orders 1H FY23 of $12.0m were down 27.7% cycling off 1H FY22 where online benefited from temporary store closures due to Covid 19 lockdowns.

The outlook of a soft July 2023 vs July 2022 is to be expeccted. -8.1% is not bad given the broader macro conditions in discretionary good, particuarly household equipment. While we may be at or towards the peak of the interest rate cycle, for many households we are just at the start of maximum pain as a big chunk of retail spending capacity goes towards higher mortgage bills.

The growth program is on track overall.

Balance sheet is strong, with another chunk of the debt from Plush acquisition being paid down. So cash and deposits of $89m completely offsets long term debt of $89m,

They are maintaining a reasonably conservative stance on dividend payout at 60%, with the final dividend flat cf. last year. It is however an increase of 7.1% at FY. The full year dividend yield is 7% (before franking credits), which is pretty good for a company which continues to be positioned for growth.

Notwithstanding the challenging retail environment, $NCK looks to be in rude health and well positioned to emerge strong through the downturn, as it continues to grow and drives internal efficiency.

At yesterday's closing price of $10.70, $NCK is on a p/e of 8.6 - historically well into its bottom quartile over the last 5 years.

Investor call at 10:00am

$NCK is towards the very bottom of my valuation range, and I am currently underweight. It is on my shortlist to add to, and provided everything is OK on the call, I'll be adding when I can. I know that there may be further to fall in the retail cycle, but I don't mind getting in a bit early with this quality.

Disc: Held in RL (1%) and SM

I haven’t heard the term ‘time horizon arbitrage’ coined before, but it makes perfect sense. Tim Carleton, Auscap Asset Management CIO talks about their approach to investing on ‘The Rules of Investing’ (Episode 170, 28th July, 2023).

Tim talks about looking past the 6 month horizon the market tends to focus on, and viewing businesses with a much longer time horizon.

In response to the final question, ‘Which stock would you own if the market closed today and didn’t open again for 5 years’, Tim’s choice was Nick Scali. He backed his conviction with the following reasons:

- A founder run business

- A long track record of high ROE, an average of c. 50%

- Mostly ungeared, holding net cash 9 years out of 10

- A very long runway of organic growth, with opportunity to double the store network over the next decade.

- Recently acquired Plush where they have been improving the product, lowering costs to the consumer, while improving their own margins

- Valuation is very attractive on a 5 year horizon. Tim said the biggest driver for furniture sales is housing turnover which is currently the lowest it has been in 20years

It’s an interesting podcast. He also talks about JBH, MIN, PLS, REH and REA, including some of their investing mistakes - both missed opportunities and acquired businesses going wrong.

He says they are long term investors, but talks about the reasons why they would sell a stock, with some real life examples.

Disc: Held IRL (8%), SM (15.6%)

FNArena's All-Year Round Australian Corporate Results Monitor - Macquarie reduced to Hold, Price Target $13.57

Disc: Held IRL (8.5%), SM (20%)

Here is a terrific summary of Why profits are up but share price is down at Nick Scali by Chris Bachelor for ‘Money Magazine’ published on 8 Feb 2023, copied below:

“Furniture importer and retailer Nick Scali (ASX:NCK) receives a Quality score of 99/100 based on Stockopedia's Quality ranking system. This means it is in the top 1% of all companies listed on the ASX based on a combination of quality metrics.

Nick Scali was established more than 50 years ago by the Scali family and listed in 2004. They raised $40 million in the IPO and have never raised any equity capital since.

During its listed life, earnings per share (EPS) has grown from 9c to $0.93, an annual growth rate of 14% over 18 years. The share price has increased from $1.00 to $10.33 today and they have paid out $4.275 in dividends. $10,000 invested into the IPO and held, would have yielded almost $140,000 in profits or an annual compounded return of 17.1% per annum.

This demonstrates how investors can accumulate large amounts of wealth by investing in high quality companies, and then remaining patient despite the gyrations caused by pandemics, property cycles, exchange rates and share market sentiment.

In the 2021 financial year Nick Scali, like many retailers, saw revenue grow at record rates as people were restricted regarding travel and going out, so they diverted their spending to sprucing up their homes. But unlike many other retailers, Nick Scali's revenue growth continued into 2022 and further growth is forecast for 2023 following a record first half.

However, a direct comparison is not entirely fair as Nick Scali's revenue growth was not all organic. It includes revenue from Plush-Think Sofas which they acquired in November 2021. Plush added another 45 furniture stores to the 62 under the Nick Scali brand. The acquisition was funded through debt and existing cash. The purchase price of $103 million represented an Earnings before interest tax, depreciation and amortisation (EBITDA) multiple of 3.8 which was not expensive.

Unlike many acquisitions this one is looking like it will add significant value to Nick Scali shareholders. They have already managed to strip out $20 million in running costs, benefits that go straight to the bottom line, as well as paying off $17 million in debt.

On Monday Nick Scali released their 2023 financial year half-year results. Revenue hit a record at $284 million for the half. Net profit was also up 70% to $61 million. Only two months of income from Plush were included in the previous period, versus the full six months this half year. The first half of last year also included extended periods of lockdowns in the eastern states.

Nevertheless, it is still a very strong result. Gross profit margins also rebounded to 62% helped by reductions in freight costs that had skyrocketed during the height of the pandemic. They have also seen big improvements in the gross margins at Plush as processes have become much more efficient.

Typically Nick Scali earns a little over 50% of its revenue in the first half, although the last few years have not been typical. If this held true, they could expect to earn about $560 million in 2023. Market analysts were forecasting full-year revenue of $537 million prior to the release of the results, so there is room for some upside to these expectations. Since the results announcement, some analysts have already started making small upgrades to their EPS forecasts.

Despite this seemingly strong result, the share price fell 13% on announcement day and a further 4% the following day. Which begs the question, why?

Admittedly the market as a whole also fell, but not nearly as much. It would appear that the declines were driven by a shift in sentiment regarding the outlook for the remainder of this financial year. Management expressed concern that rising interest rates may start to dampen demand, but so far they were not witnessing it.

Some of the commentary from the presentation of the results included that Nick Scali brand sales orders declined 3.0% but this is in comparison to the boom times of 2021. Further, written sales orders for January were 12.1% below January 2022. This includes prices reductions of 5% to 10% in January. Management expects price reductions across the industry. In part, this reflects the capacity to pass on some price reductions due to the benefits of the appreciating AUD, but the market probably also interpreted it as a sign that demand is softening. They also declined to give full-year guidance, citing uncertainty about the coming months.

There is no doubt that some pressure is building as interest rates rise and property prices fall, however, Nick Scali has ridden through many cycles in its history and has demonstrated it can come out the other side in good shape.

From a valuation perspective, some of the metrics are starting to look attractive following the price retraction. The forward PE ratio is only 9.2 which compares with a five-year average of about 13. The dividend yield is 7.6% fully franked.

The short-term risks for Nick Scali are heightened as the uncertainties around inflation, interest rates, the property market and the economy remain. However, the company is conservatively managed and has an outstanding track record of steady growth over the long term. The value proposition for the shares is much like that of Nick Scali's lounges. A quality product at a reasonable price.”

Disc: Held IRL (8%) and Accumulating. SM (20%). The writer of this article, Chis Batchelor, owns shares.

James Mickleboro shared another broker view in an article he wrote for The Motley Fool on Tuesday:

“Investors have been selling this furniture retailer’s shares since the release of its half year results. Macquarie has also responded to its results by downgrading its shares to a neutral rating with an $11.30 price target. The broker appears concerned by the headwinds the company is facing from higher interest rates and a cooling housing market.”

The price has dipped even lower today, down as low as $10.10. I’m loving it, and it will be better still if it falls to $8 to $9. Bring it on!

Is the Scali family reducing their 13.6% holding this week? Not that I’ve seen. They are too focused on opening new stores and improving the margins at Plush. Will there be a recession? Possibly. Will Nick Scali have a few tough years? Possibly. While I’m waiting for the economy to turn around hopefully the grossed up dividend will remain around 9%-10% (ie. including franking credits. This year should be closer to 11.4% grossed up yield). I’m happy with that for the foreseeable future, even if the price continues to fall. The recession won’t last forever (hopefully)!

Disc: Accumulating IRL. SM, reached my limit until it goes lower!

I think NCK is a great business - one of those founder-led businesses often talked about. Very high ROE which has been maintained over many years - has been above 40% since 2016. It's managed very well over many years - with good products and thick margins. They sell quality products and I like the deposit model, which reduces working cap requirements and increases cash flow. Debt is low and they own some of their properties, which does provide a great buffer in troubled times, which may be coming given the discretionary nature of the product. Having said the outlook is bleak, I took the opportunity yesterday to top up my IRL holding, not many times you can get a business like this on close to 8% yield (noting the forward outlook is unclear), longer term I think this will pay off for me.

Thanks for your trading updates @Invmum and @Seasoning. Were you as stunned as I was with the market reaction to the 1H23 result, share price down 13%! Fair enough there was no full year guidance but 13% down after beating guidance and the business continues to improve…Go figure??

Nick Scali increased 1H23 NPAT by a whopping 70% over 1H22, beating profit guidance two months ago of a 57% to 66% improvement.This huge boost was partly due to delayed deliveries in 2H22 and a full half year of Plush sales. Cost of doing business fell and Gross Margins improved by 2.5% from 59.5% to 62%. Plush acquisition cost saving synergies realised $20 million. The Plush business is also continuing to improve monthly as they upgrade stock and store layouts.

While this was once again a cracker half year result, written sales orders grew very slowly at 3.4% for the half and January written orders were down 12% PCP. However, this was better than Nick Scali was expecting being up 22.9% on pre-COVID levels.

I think Nick Scali will surprise to the upside for FY23. Analyst forecasts (S&P Global data on Simply Wall Street) average $93 million NPAT for FY23. Given Nick Scali has already landed $60.3 million of this in the first half, I think they’ll romp this in. The analysts also have Nick Scali’s FY24. earnings falling to c. $75 million, a mere $15 million more than 1H23 earnings.

I think the analysts and the market are underestimating Nick Scali…AGAIN! For me yesterday was a buying opportunity and I topped up IRL, and I’m now looking forward to the 3.7% fully franked dividend (for the half year!) just over a month away. Apparently investors and analysts were expecting a higher dividend announcement? The market is getting pretty hard to please IMO! For me, this incredible business is a screaming buy at 9x FY23 earnings, while it returns investors 40%+ on their equity in the business. I am happy to buy and hold this high ROE, well managed, founder owned business for a VERY, VERY long time…perhaps forever?

Disc: IRL 6% and adding. SM…I can’t add more than 20% of my portfolio apparently (otherwise I would have!).

I’ll take a closer look when I have more time. However, the bottom line is Nick Scali had a cracker first half with NPAT guidance up 57% to 66% on the PCP.

“Group written sales orders for the four months were $148 million, 55% above the prior year, with the strongest trading months being July and October. Nick Scali brand written orders were 21.7% above the first four months of the prior year and 35% above the pre Covid 19 FY20 year.

Final net profit after tax for the first half will depend on actual deliveries achieved before the end of December, including the risk of any future unknown external impacts affecting our distribution operations. Based on current delivery levels we expect net profit after tax for the first half of FY23 to be in the range of $56 to $59 million, 57% to 66% above the first half FY22 of $35.6 million.

Trading to date this year has been robust, though uncertainty on future near term levels of demand remain in the current economic environment. Therefore, we are unable to provide additional guidance for the full FY23 financial year.

Disc: Held IRL and SM

Bad Habits

Once a popular darling, Nick has developed some bad habits that no one wants:

- Chases Retail

- Very Discretionary in nature

- Loves your home

- Makes you wait for your lounge

Other wee issues

- Interest rate

- Inflation

- Transport

- Higher wages

- COVID and Lockdowns (at home, China and Vietnam).

Nobody wants Nick

It’s not just Nick, it’s the entire discretionary retail sector.

But wait…This could be Nick’s BEST YEAR EVER!

”Given the scale of the outstanding sales order bank and deliveries in Q3 FY22, the Group entered the final quarter of FY22 in a strong position to deliver revenue and profit growth on the prior year.

This is despite lockdowns impacting sales orders during the first half of FY22 and temporary impacts to margin a result of unforeseen increases to freight costs following the Vietnam lockdown

The Group’s result will continue to benefit from the inclusion of Plush which will contribute positively to profit this financial year”

Heaps of orders…but there could be a wee problem with delivery!

“With current lockdowns in sourcing locations and ongoing delays in shipping as a result, the extent to which revenue and ultimately profit will be recognised this financial year cannot be accurately forecast at the current time (Macquarie Presentation, 4/05/22).

Nick gets the jump on FY23 too!

“Regardless of the level of deliveries that are completed by 30 June 2022, the Group expects to enter FY23 with an elevated order bank, and this will provide a solid platform for revenue delivery in Q1 FY23”

Tough times ahead? Nick has a good model

Note: NOT a Nick Scali lounge

My wife and I ordered a Nick Scali leather lounge at the end of January 2020, just before the full impact of COVID. We shopped around at a number of other retailers before eventually settling on the lounge at Nick Scali. Why? We liked the modern styling and quality of Nick Scali lounges. We fell in love with the lounge!

I tried to bargain, with no success (it’s not part of Nick Scali’s model). I also questioned the minimum upfront 30% deposit, but that wasn’t negotiable either. We put down the deposit of $1870 expecting an 8-12 week delivery. Of course with COVID the delivery got blown out to 4 June 2020, 4 months later. Before delivery we paid in full for the lounge (Total $6170). We also paid extra for a care package (conditioning treatment) and additional warranty (5years).

I asked the delivery driver (contractors) how business was going with COVID. He said they were run off their feet and couldn’t keep up with deliveries. I bought shares in Nick the following day. They were cheap at the time (around $5) because the market was worried about the impact of COVID. How did that turn out? Best year ever!

So why is this a good model? When Nick takes the order they bank 30% of the retail price and before the customer receives their lounge they are paid in full, plus any add on extras. The lounge is not handled by Nick Scali, it is delivered directly to the customer. Factory, Ship, Warf, Transport, and Customer. Nick Scali’s job is to arrange the logistics and collect the profit. The delivery is done by contractors.

The only stock they own is the display stock which they sell at a slight discount when they discontinue a line.

There are 3 models for retail:

- Just in case - warehousing stock ready for sale (done to avoid delays in delivery, risky, costly, double handling, risk of outdated stock, cash tied up in inventory)

- Just in time - careful inventory management, minimal stock held, less cash tied up in inventory. JB Hi-Fi does this well.

- Order/Deliver after payment (This is the Nick Scali model- Less risk, less handling, lowest cost, no old stock when they discontinue a style)

‘The time to buy retail stocks is when no one wants them’

I think it was last year when retailers were just starting to come off the boil I heard Jun Bei Liu say something like, ‘the time to buy retail stocks is when no one wants them.’ If there was ever a time when no one wants retail stocks it would have to be now.

I think Nick Scali will have a decent FY22. Next year could be a bit tougher, but I think this is a quality business that should ‘pay you to play’ while you wait for them economy to improve.

Disc: Held and accumulating

In today's AFR story “Smashed Small Caps that can turn into portfolio treasures” Paul Biddle, portfolio manager for Celeste Funds Management said “The time to put money to work is when everyone is running for the fire exits.”

He also said “At times like these, few people want to own small-cap industrials. That’s when they get oversold”.

“In a weakening market, our preference is small caps that can reliably deliver a 4-6 per cent yield, before franking,” says Biddle. “That’s not a bad outcome if the sharemarket is flat this year. We liken an attractive yield to being ‘paid to play’ while we wait for market conditions to improve – and for our industrial small-cap portfolio stocks to re-rate higher.”

I whole heartedly agree with Paul Biddle’s comments above, particularly this one, “being ‘paid to play’ while we wait for market conditions to improve”. Thats how I’ve been reshaping our SMSF portfolio this year. As a retiree, CASH FLOW in your SMSF is just as important as it is for a company you might hold in your portfolio. It’s ALL about CASH FLOW for retirees when you are in pension phase. You are required to withdraw a minimum amount each year (reduced to 2% for us this year) so if you are mostly invested (like we are) you must have dividends, or you’ll need to sell some shares! Not a good outcome in a bear market. Now back to the AFR story.

Coincidently, I also go along with some of Paul Biddle’s stock picks:

Biddle said “Housing-related stocks have challenges as rising interest rates reduce demand for new furniture and other discretionary items. Nick Scali has fallen 44 per cent from its 52-week high.”

“Biddle likes Nick Scali’s expected yield of about 7 per cent, the strength of its forward order book and its recent results.”

”We don’t doubt that some people will be less inclined to buy a new couch as interest rates rise,” says Biddle. “But Nick Scali delivered yet another strong quarterly update and has a lot of cash locked in through its forward-order book. They have used excess cash through COVID-19 to acquire Plush (a rival sofa retailer), which will significantly grow Nick Scali’s medium-term earnings.”

Not all fund managers agree with Paul Biddle about housing related stocks though:

“Richard Ivers, portfolio manager of the Prime Value Emerging Opportunities Fund, is wary of housing-related stocks. “We’re avoiding any small caps that rely on the housing cycle or consumer discretionary spending, unless it offers compelling value. With interest rates just starting to rise, there’s too much earnings uncertainty.”

I guess this is where the risk lies with businesses like Nick Scali especially if the Aussie economy goes into a recession. Personally I think our economy will be much stronger than most countries over coming years, with the backing of mining and agriculture.

Other small caps Biddle likes are Smart Group (SIQ) and HT&T. I like SmartGroup, but personally I wouldn’t include HT&T because of it’s historical low ROE of 3.5%. I prefer businesses with ROE greater than 15%. Nick Scali has a consistent historical ROE of 50% over several years. Smart Group has an historical ROE of 20% to 30%.

Read the full AFR story for small cap picks from other fund managers.

Disc: Shares held in Nick Scali and Smart Group.

Last week (10 & 11 May) the Nick Scali Chairman, John Weir Ingram, bought 25,000 shares on-market averaging $9.42 per share coming to a grand total of $231,000. That’s $31,000 more than his annual board remuneration of $200K. ASX Announcement

If the Chairman thought it was a good time to buy shares in the company last week, today looks even better, down 4.5% to $8.80 during the day.

Disc: Adding today IRL

After gleaning the Macquarie Conference Investor Presentation it looks like Nick Scali is on track for another record year (FY22). The only thing that might prevent full sales being realised in this financial year is the current lockdowns in sourcing locations and ongoing delays in shipping.

Macquarie Conference Investor Presentation

Trading Update: