08-May-2024: NCK-Change-of-Director's-Interest-Notice-Carole-Molyneux.PDF

Wow! We sometimes look at director buying and wonder whether it's a case of directors seeing value or just trying to signal to the market that the shares are cheap.

Carole Molyneux bought 25,000 NCK shares for $367,327.11 (average price of just over $14.69 each) yesterday (7th May). That is a decent purchase!

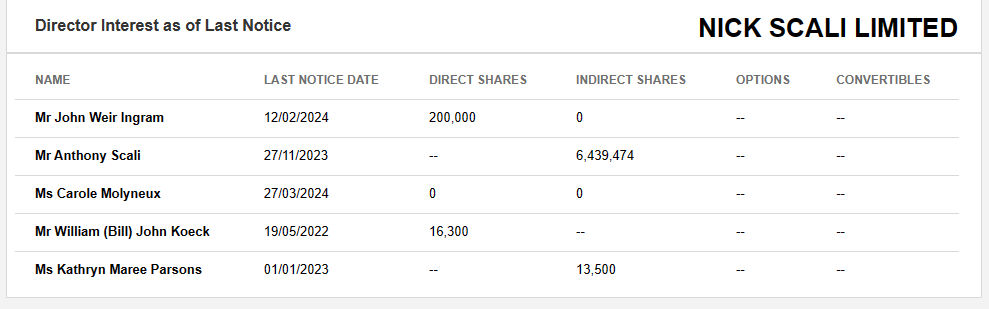

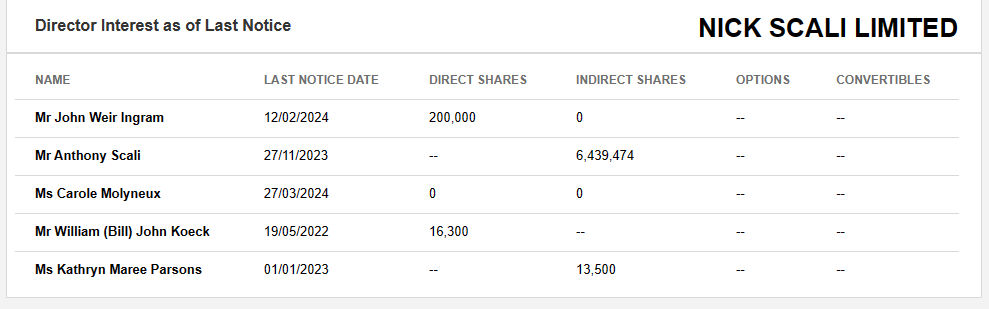

Interestingly, Ms Molyneux, pictured below, who has been a Nick Scali director since June 2014 (so almost 10 years) owned zero NCK shares prior to this purchase.

With this on-market purchase she has gone from zero to 25,000, so more than Bill Koeck and Kathy Parsons, and only behind Anthony Scali and John Ingram (Nick Scali's Chairman).

It's got to suck to be the only director who could NOT take part in this SPP (@ $13.25) because she held zero shares on the record date. I guess she's decided not to be caught out like that again.

Source: https://www.linkedin.com/in/carole-molyneux-richards-41276a/?originalSubdomain=au

---

Just changing the subject for a minute - I've only ever seen Anthony Scali, the CEO & MD of NCK like this:

And I thought I'd found an earlier photo of Anthony today:

However that is Nicky Scali, Anthony Scali's brother, who was Director of Sales and Marketing @ Nick Scali Furniture from Nov 1991 - Apr 2016 (24.5 years) according to this: (25) Nicky Scali | LinkedIn.

I found the image here: https://rocketreach.co/nicky-scali-email_36690771

No word on what Nicky is doing with himself these days. It was in 2016 (around the time that Nicky left NCK) that siblings Nicky and Yvonne sold their 33% stake in NCK to Institutional Investors and to their brother Anthony Scali at a price of $3.80/share, or an implied total of $111 million. At the time (as a result of those purchases) Anthony increased his own stake from 16.7% to 27%. Nicky and Yvonne apparently held zero NCK shares after that sell out in 2016.

See here: Anthony Scali's siblings dust $75 million selling down (afr.com) [15-Feb-2017]

Less than 2 years later, in March 2018, Anthony Scali reduced his stake in Nick Scali to 13.63% after selling half of what he held to Chinese supplier, Jason Furniture (KUKA) @ $7.00/share, for a total of $77.2 million. See here: Scali sells half stake in $77 million deal (insideretail.com.au) [27-March-2018]

In September of the following year (2019), KUKA sold their 11 million NCK shares at $6.85/share ($75m) through broker UBS, so slightly less than what they paid for them. See here: Nick Scali's largest shareholder sells stake for $75m (afr.com) [3-Sep-2019]

Anthony Scali held 7.95% of NCK prior to this current CR, worth around $103 million, and he has purchased an additional $4m worth of NCK @ $13.25 as part of this CR, so he still has significant skin in the game, despite taking profits along the journey.

He's no dummy this fella.