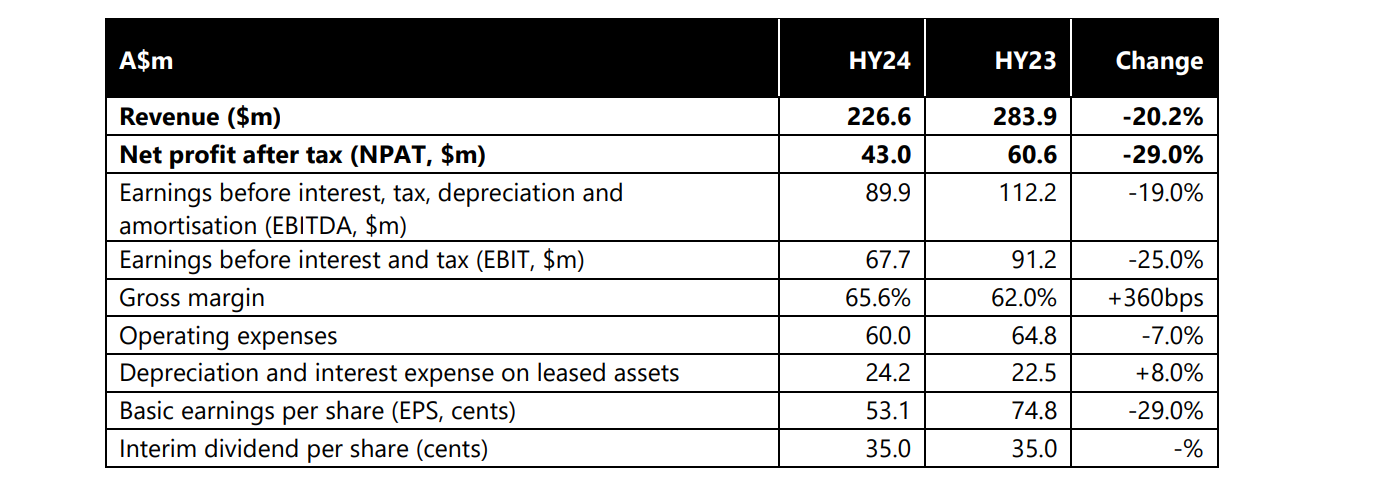

$NCK announced their 1H FY25 results this morning.

ASX Announcement

Their Highlights

ANZ Group

- Revenue $222.5m, gross profit margin 64.4%.

- Underlying profit after tax $36.0m versus October 2024 AGM guidance $30-33m.

- Statutory profit after tax $34.1m.

UK

- Revenue $28.6m, gross profit margin 45.1%

- Underlying loss after tax $2.8m.

- Application of AASB16 to the acquired UK property leases increased the UK loss after tax by $1.2m for the period. The adoption of AASB16 has no cash impact.

- Statutory loss after tax $4.1m.

Group Balance Sheet

- Cash and bank deposits $87.6m at 31 December 2024.

- Interim dividend 30 cents per share fully franked.

Other Significant Points from the Presentation

As expected, the 1H ANZ sales were subdued, with the suply chain problems communicated earlier further eating into %GM. ANZ revenue was down on pcp, although undeyling profit came in well ahead of guidance.

UK is now into the transition, with the Fabb range being run down, and some sales disruption due to the conversion of stores from Fabb to Nick Scale.

The UK Nick Scali website is up and running (view it here: https://www.nickscali.co.uk/ )

Integration is proceeding, with $KCK processes and systems implemented, and $2m run rate of costs taken out.

UK performance was also ahead of guidance.

UK is still running the old distribution centre, which is on 3-month notice, pending identification of the new operation.

Despite the transition, the UK operation is already seeing an improved %GM off the old range, and $NCK are guiding to a %GM of 57%-59% for the NickScali range and stores. Bearing in mind Australia achieves 64%-65%, this is an encouraging start, as the %GM should increase over time as the store network grows and the business benefits from scale and supplt chain benefits.

Positively, there are early indications of a good product-market fit. The rebranded $NCK stores were the 3 top performing stores in January 2025 for written sales orders, only one of which had been in the Fabb top 5.

The target is to complete 8 further re-branded stores to Nick Scale by EOFY, with ongoing sales disruption due to store conversions.

Importantly, $NCK are already evaluating potential new store locations in the UK.

Outlook

There were a few questions on the surprising soft start to the year, with written sales orders down 8.5% in January 2025, although Anthony cautioned against reading much into this, pointing out that the sale week of the January Sale in Feruary was up 5%.

My Assessment

FY25 and 1H FY26 represent an important period of transition, during a time of sluggish sales in ANZ.

The early signs of a positive start to the UK are there, although there will be a drag on performance as the Fabb brand is transitioned out and stores closed for the $NCK uplift. There is also a change yet to come around identifying and implementing a new distribution centre, which brings some transition risk, and certainly some addition cost.

I retreated to the sidelines on the SP recovery before Xmas (considering the tranisition risks in the UK coming at the time of a slower ANZ period, added to news of supply chain problems). As it turns out, it would have done me no harm to have held on but that said, I don't see positive performance catalysts in 2H FY25.

This morning's SP response (SP up to $18.00 at time of writing!) indicates that the market is looking through the sluggish current period, and seeing the potential for what the UK can achieve for SP. That was always the risk of selling on relative strength ahead of the result. Never mind.

The $NCK SP tends to be reasonably volatile, and I'll be happy to get back onboard around $15.00-$15,50, should I be presented the opportunity. Otherwise, it is not a stock I have to own, so patience and discipline are required! I think FY26 and FY27 could be transformational, as UK starts to drive the group result, and monetary easing contributes to a better retail environment, so if I can get back on in the next 6-9 months at a reasonable price, then I will.

Overall, Anthony and team are doing a good job (and I am looking forward to my new armchair arriving in April .... I did my bit to help January written orders!)

Disc: Not Held