I totally agree with you on this @CanadianAussie - and it's why, as an AVA shareholder, I had resisted the urge to add anything to this forum. I just feel that we often seem to want microcaps to act as professionally as large caps in relation to investor relations and company announcements, and it's just not a realistic expectation. They haven't got the people in place to do that - oftentimes they are relying on their company secretary to make these announcements - which are authorised by the Board or senior management but may not always contain as much detail as we would like, because in some incidences the people briefing the person putting the announcement together doesn't yet have all of the relevant details. They are caught between a rock and a hard place because if they wait until they have a better worded and more thorough announcement they will often get put in a trading pause and receive a please explain ("speeding ticket") by the ASX in relation to trading movement, or else they will get a please explain AFTER their announcement - as was the case here - requesting further details and also asking all of those questions in relation to when they first became aware of the market sensitive news and why they didn't act sooner to ensure a fully informed market, etc.

In my experience, companies are always better off calling for a trading halt in these sort of situations and then taking their time to prepare a thorough first announcement that contains everything that they know that the ASX may ask them about if the do NOT disclose it in their first announcement. The risk is always that people speculate about things like capital raisings or losing large contracts and all the negative possibilities, and also that people will complain after the announcement that is was not worthy of a trading halt, but without the trading halt they end up looking unprofessional or negligent.

The main issue seems to be that microcaps often do not have the money to pay for full-time investor relations people and so forth, as larger companies do, so these jobs are being done by people who have other primary roles in the company. In AVA's case, they use the services of Citadel-MAGNUS (https://citadelmagnus.com/) as their investor relations and corporate communications services provider, hence the announcements coming from Alexandra Abeyratne at Citadel-MAGNUS rather than from AVA directly, and the contact person being Alexandra at CM, not anybody at AVA (for further enquiries).

Alexandra Abeyratne is the first face you'll see here: Citadel Magnus - Meet our Team - but they have a LOT of people working for them, and they work for a lot of companies - and in these situations they can only work with the info that they have been given. It's not ideal but it is what it is. With the benefit of hindsight a trading halt should have been called BEFORE the first announcement and then the first announcement could have been one that did NOT trigger an ASX Query Letter (aka "Please Explain" letter) that has now been served on AVA by the ASX - and they won't get to trade again until the questions in that letter have all been answered to the satisfaction of the ASX. I do see this a LOT with smaller companies, and it just comes back to lack of experience in running a public company and dealing with the ASX, OR not having the people whose sole job it is to handle that. In this case AVA have relied on an outside specialist company for this, but have clearly not provided them with enough info. You could also argue that Citadel-MAGNUS should have the requisite experience to have foreseen what has happened and to have refused to release the first announcement until there was sufficent information supplied to them to word an announcement that would NOT have resulted in the ASX Query. But on the flip-side of that, the ASX only tends to act on these matters when there is a substantial share price reaction, which triggers their attention, and perhaps Citadel-MAGNUS did not expect such a share price reaction to what they released on behalf of AVA.

We're all experts with the benefit of hindsight.

That's Neville Joyce, AVA's CFO (Chief Financial Officer) - he also holds the role of AVA's Company Secretary. Because they're small and don't feel they can justify having a separate role for a Company Secretary. AVA's website says that Neville is a highly experienced financial and commercial executive with proven expertise across multiple sectors including energy, mining, technology and manufacturing. With extensive experience in leadership, management and strategic financial analysis, Neville has held senior finance positions at Origin and Energy Australia including roles as Chief Financial Officer and Divisional Head of Finance. Prior to joining Ava Group, Neville was Group Chief Financial Officer at Redflex Holdings Ltd from 2017 to 2021. Neville is a CPA and holds a Bachelor of Business, and is based in Melbourne.

He's a finance professional based in Melbourne, not an investor relations specialist. They use Citadel-MAGNUS for investor relations and their offices are in Sydney and Perth. AVA's head office is in Mulgrave, in a light industrial area in Melbourne's south eastern suburbs:

That was taken by Google over 3 years ago, so they might look a little different now, but my point is that this is a technology company that seems more focussed on innovation and staying at the forefront of their industry, and increasing their sales and revenue clearly (selling their products), but they may need to bolster their marketing department, and once they can justify it, add a dedicated investor relations person to their staff.

In the meantime, I think we just have to accept that investor relations may continue to be less than ideal for a little while yet.

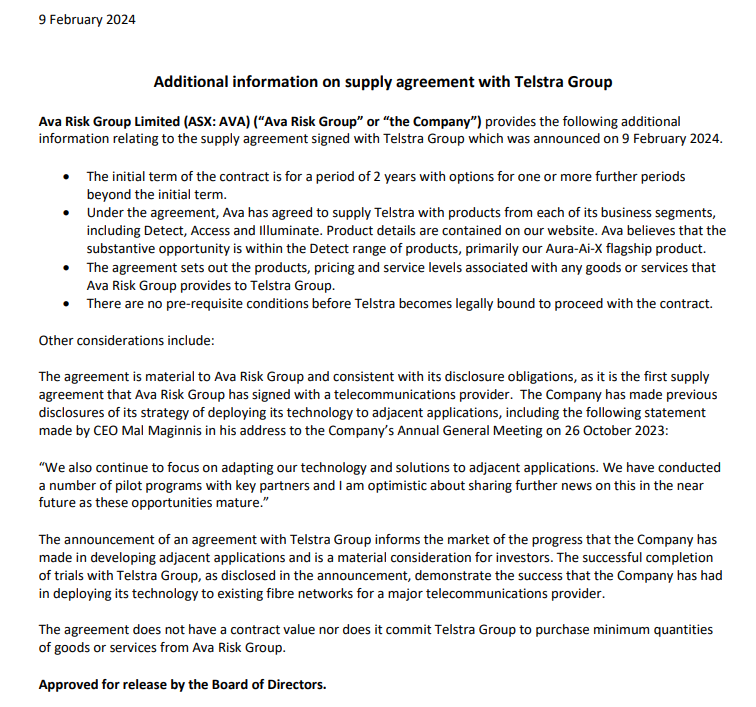

Additional: In relation to how "market sensitive" this contract or framework agreement is, AVA management feel it is material, and I agree with them, but just how material it is could be hard to quantify in terms of putting any hard numbers to it that Telstra is happy to agree to being published. And that's what the ASX clearly want right now - hard numbers, and if there are no hard numbers, WHY did AVA consider the announcement material in terms of the value of AVA? I think it's about progress and potential and what MIGHT come out of this agreement rather than saying we are going to earn X dollars over Y years directly from this. Difficult position for AVA to be in now because they're dealing with the Gorilla of the Telco sector here in Oz who has just agreed to use some of AVA's tech within their networks, and AVA don't want to say anything that Telstra aren't entirely happy with. But the ASX is asking AVA to be very specific about the likely impact of this agreement with Telstra. Difficult.