I have read and been thinking about the Culper research short report targeted at Arcadia and indirectly Neuren. Of the short reports that I have previously seen I consider this to be one of the lower quality attacks. It is very opportunistic timing 10 days before ARCADIA release their quarter numbers. Neuren's SP has also doubled recently so people are more likely to sell to lock in a gain, so this could be an attempt to establish a long position in Neu but thats neither here nor there. I did invest more in Neu yesterday after the trading halt as I am comfortable with the data that I have seen and I think Jon Pilcher is an honest CEO and I would be surprised if they were flogging a dodgy drug.

The short report is very heavy on emotive wording, lacks verifiable information and generally uses strawman (not the good platform type) arguments to support its points. It uses a nice trick of generating authority by attributing quotes to authority sources (Dr's, or de-identified facebook patient quotes etc) that are unidentifiable so their validity can not be verified. The disclaimer at the front of the report is also worth a read too and basically tells you that they will make stuff up.

The four main arguments of the short report are:

1: The treatment (Trofinitide) is ineffective, poorly tolerated and is causing significant adverse events

2: Patients are either not continuing its use or can't get insurance re-embursement so patient numbers have peaked

3: Insiders at ACADIA are leaving

4: Gene therapy treatments will become available and take the market

These arguments taken at face value and read in the emotive language of the report are pretty concerning. It also plays nicely into the the recency bias --> where the most recent piece of information we have is given more weight than older information. The trick here is that the brain isn't very good at separating real from fake information.

The 1st argument that the treatment is ineffective has some merit to it as we have known from the development trials that not all Rhetts patients would benefit from or tolerate the drug. Notice the link they provide goes to the prescribing medicine information rather than the peer reviewed study data which breaks these adverse events down.

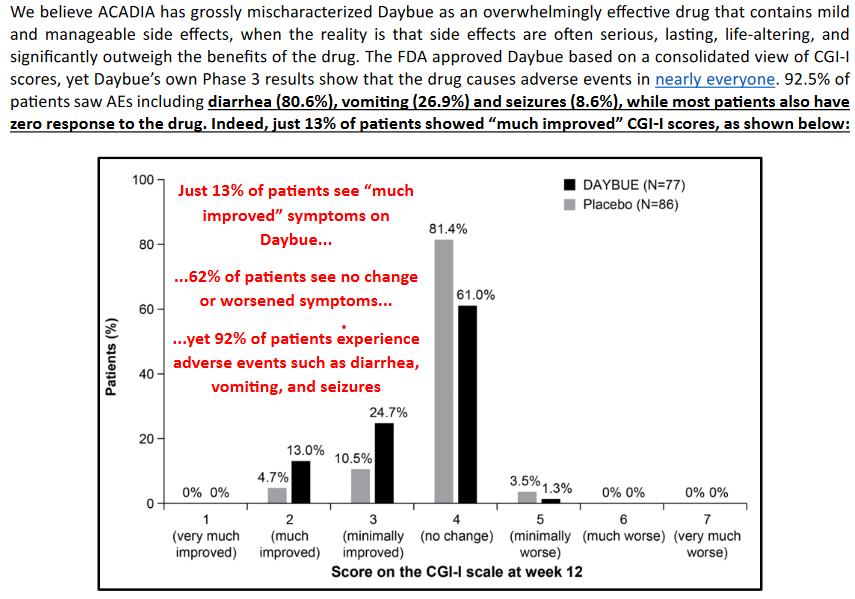

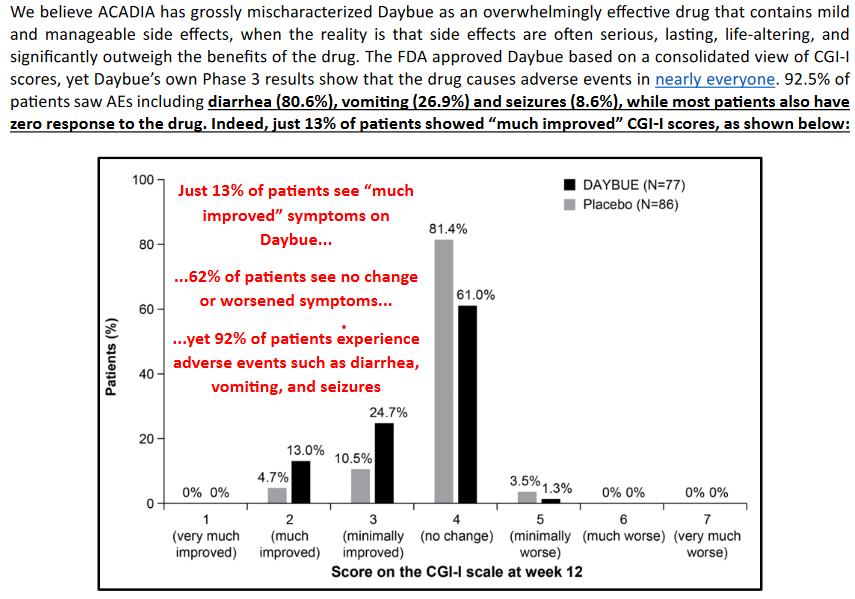

Culpers wording:

This information while true is misleading as this data is from the intial 12-week double blind trial. Nothing like quoted percentages in red ink to cause panic. The design of the study with good descriptions of the response metrics and the actual results is worth reading. Importantly an adverse effect in itself does not necessarily mean much. As part of these studies everything is reported and can be unrelated to the drug itself. In the Lavender study 2% (n=2) of placebo patients had adverse effects leading to drug withdrawal vs 17.2% (n=16) in the trofinitide group. Diarrhea and vomiting were the main adverse impacts and table 2 breaks down the severity of these effects with most being mild to moderate. Its worth pointing out that since this trial Acadia have developed treatment plans to manage these effects and there is good information about how they are doing this. Despite this diarrhea is still the main adverse event. ARCADIA are still fine tuning patient management of this event, and it is a valid risk that the severity of these issue limit the long term use or total dose rate. But for now this information is not conclusive.

Importantly, and what the Culper research failed to mention is that this initial 12-week Lavender trial transistioned into a 40 week open label trial called Lilac 1, where any patients who wished to continue the treatment could, as well as any patients on the placebo could start on trofinitide. 90% of the patients on Trofinitide in the Lavender trial continued using it. After the 52 weeks (Lavender + Lillac-1 time) only 54% (84/154) patients continued on trofinitide, with the majority dropping out due to adverse events (probably diarrhea), and 3% discontinued due to lack of efficacy.

77 of these patients then transistioned into Lillac 2 whose aim was long term safety and efficacy data. It ran for 32 months. 79% (n=60) of patients completed the study. In this study a further 3.9% (n=3) discontinued due to lack of efficacy and their were 5 deaths but these were due to causes unrelated to Trofinitide. Some patients have now been on the drug for 2.5 years. So this gives a reasonable amount of confidence that trofinitide is relatively safe and patients do see a benefit from using it. Diarrhea is still an issue as the main adverse event. This data was presented in December 2023 and a short video update was also provided by Dr Ponni Subblan - Acadia chief medical officer. The efficacy data over this period is consistent with the Lavender study, with most patients having minimally improved CGI-I scores. I am taking the Dr's interpretation on the CGI-I and the RSBQ scores and believe the benefits that they have published in peer reviewed journals. I think that the continued use of Trofinitide by patients and the willingness to tolerate the diarrhea will probably come down to the perceived improvement from the carer. So I think the best way to read this is to watch the ACADIA quarterly numbers.

From the data above I cant see how a "wall of discontinuation is about to hit ACADIA". Likewise, the argument Culper make that ARCADIA are misrepresenting the true discontinuation rate also doesn't make much sense to me. I don't think it matters if the patients tell their Dr that they are stopping or not as the uptake/discontinuation rate will be monitored through sales of Trofinitide, which ARCADIA would have as an early read and I can't see why ARCADIA would inflate this. Given they have guided for sales of between $80-87M, anything below this will be a concern and anything below the $66M they achieved last quarter would be an immediate sell and would validate Culpers patient discontinuation argument.

The insiders leaving ARCADIA argument doesn't really hold much weight - 3 senior people are leaving Doug Williamson Executive Vice President, Head of R&D (Jan 2023 - transition out currently) and Katie Bishop, Chief Scientific Officer (Jan 2021-Dec 2023). Arcadia has >500 employees, so we would expect some turnover and without anything but circumstantial conjecture I can't really see this claim being anything but a misdirection to make the situation seem dire. Especially since one of the recent hires is Kimberly Manhard as a Senior Vice President , Global Strategic Planning and Execution. Seems to me if the internal data on Trofinitide was dodgy you wouldn't be continuing to develop a global rollout strategy. Instead you would have raised capital after the last quarters numbers and projections before the "theoretical 6 month wall of discontinuations" hit you.

The gene therapy argument is not new and it is a genuine risk, but I don't think it will be a deal breaker for Trofinitide. If patients gain a benefit from Trofinitide then they will keep using it, likewise I am expecting that Arcadia are continually improving the management of diarrhea symptoms to make it more tolerable. The benefits and tolerability will determine whether ARCADIA's guidance is correct. Trofinitide has a significant first treatment advantage, currently there are no other FDA approved treatments. The gene thereapy enrollment trial they highlight is a phase 1 trial, so a long way to go before it is ready for the market. Gene therapy has been discussed on Strawman previously and it could be something great, but it is still a long way off so I don't really think at this stage it is a viable threat to Trofinitide.

I am also more comfortable buying into Neuren on this weakness due to the valuation being modest - although this is based on the trofinitide rollout continuing, and the recent positive readout from their NNZ-2591 phase 2 trial for Phelan-McDermid syndrome in December. I had previously prescribed this drug no value but after the phase 2 result I think this is now worth owning an option on it being successful.

That was a long winded way for me to say I think the Culper research was scaremongering.