On the 23rd January 2024 QANTM Intellectual Property Limited (QIP) updated FY24 earnings guidance compared to the analyst estimate.

The update was provided on that basis that market conditions, industry conditions, the US$ to AU$ exchange rate and the regulatory environment do not materially change.

For the full financial year 2024, QANTM expects Earnings Per Share (reported) to be between 20% and 25% higher than the analyst estimate of 8.1 cents per share.

For the full financial year 2024, QANTM expects underlying EBITDA (post AASB 16) to be between 8% and 10% higher than the analyst estimate of $31 million.

The increase in expected earnings is mainly driven by:

1. improved financial disciplines, focused on more effective cost management and the reduction of debtor days;

2. the implementation of strategic initiatives starting to deliver increased benefits;

3. stronger than expected performance by Davies Collison Cave and FPA Patent Attorneys, in particular by Davies Collison Cave Law in the provision of intellectual property litigation services over an extended period; and

4. stronger than expected foreign exchange tailwinds.

Caution should be exercised in relation to any prior corresponding period comparison given it was a softer period during which QANTM made major investments across technology, people, processes and clients.

The key assumption that patent and trademark filing activities globally remain consistent with current trends continues to apply.

QANTM’s earnings announcement will be released on 22 February 2024 with full details to be provided at that time.

My Comments

I added QANTM to our IRL portfolio a few months ago based on its growing SaaS business (Sortify.tm) which I believe has the potential to be a global disrupter in trade mark protection. Sortify.tm’s mission is “making trade mark protection available to anyone”. Currently QANTM is only a small holding in our portfolio (1%) due to it’s low liquidity making it difficult to acquire (and perhaps difficult to sell, if needed!).

“Sortify.tm Attorney is the world’s only AI-based Software-as-a-Service (SaaS) suite of trademark classification and productivity tools, built by trademark attorneys for attorneys.

The intelligence of Sortify.tm’s software allows trademark lawyers and their teams to carry out everyday tasks smarter and faster across all stages of the trademark process - pre-filing, filing, examination and registration.” (From the Sortify.tm website: https://www.sortify.tm/)

QANTM acquired Sortify.tm in September 2021 for $11 million, with an upfront payment of $8 million and deferred payment of $3 million in two annual instalments (https://www.lawyersweekly.com.au/newlaw/32362-qantm-acquires-sortify-tm-for-11m)

Sortify was founded in New Zealand as a traditional trademark practice and evolved into a legal tech company providing technology solutions to brand owners, IP practitioners, and public and private sector entities.

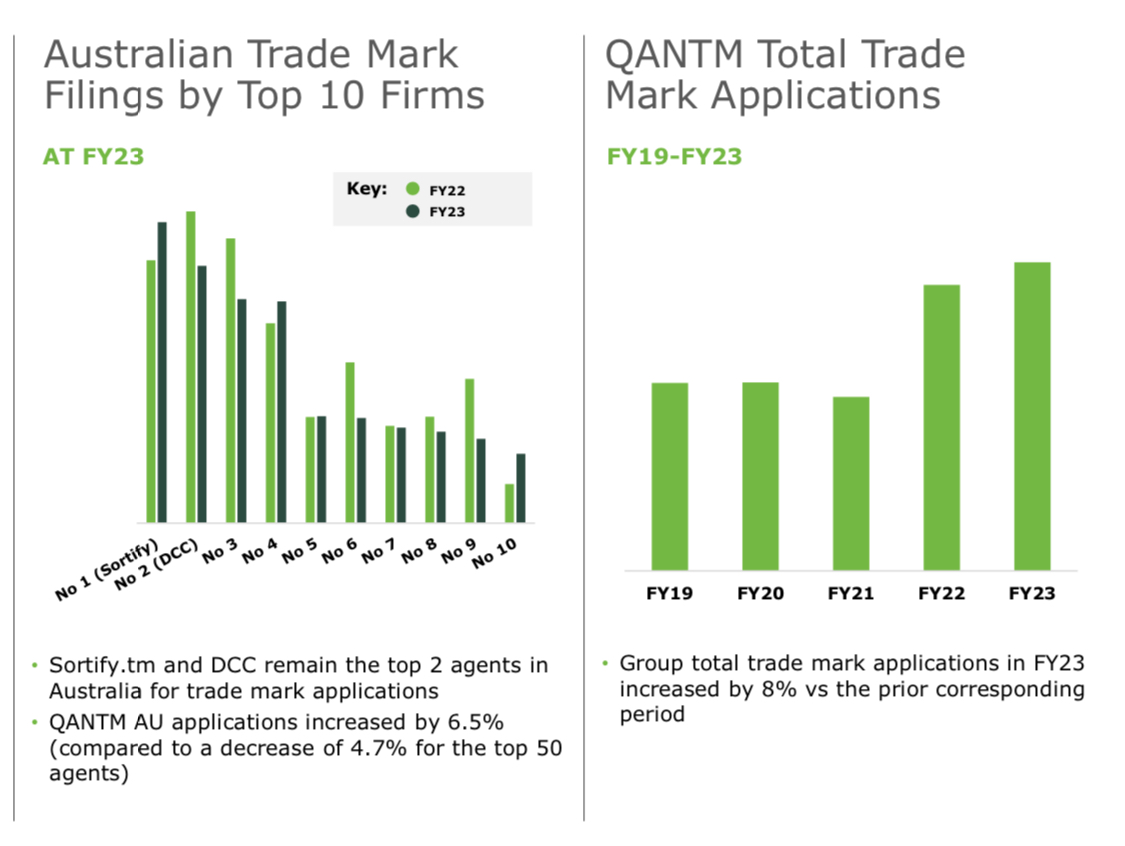

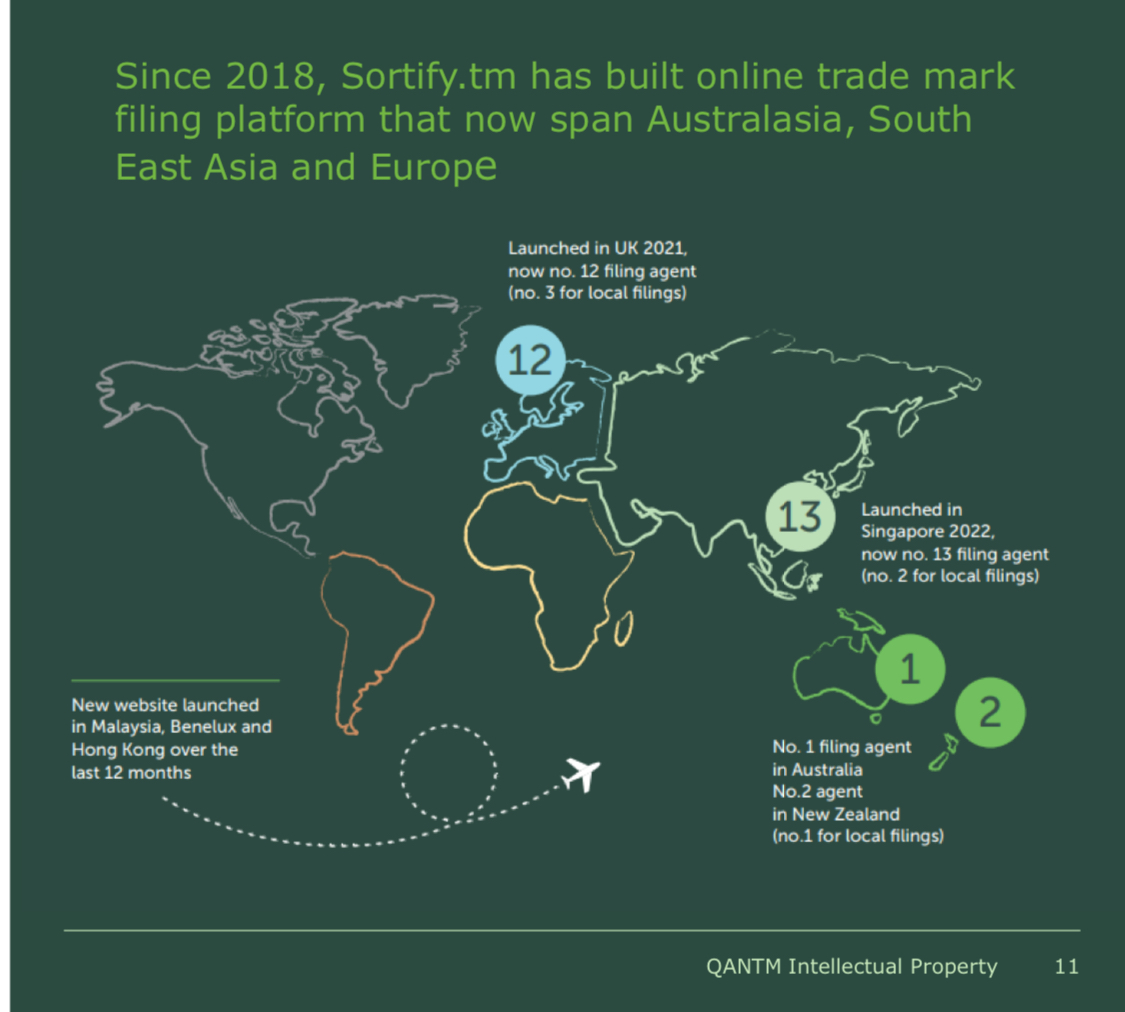

During FY23 Sortify.tm achieved record volumes in its main markets as the No 1 filer of trade marks in Australia, No 2 in NZ, and it is approaching the top 10 in the UK which is a very large market.

Source: Investor Briefing, 31 October 2023 (https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02733184-3A629660)

Sortify platforms have been established in Singapore, Malaysia and Hong Kong with promising early traction. Asian countries filed 67.6% of global patent applications in 2021 (largest patent market globally).

QANTM intends leveraging the Sortify.tm automation expertise into its DCC and FPA platforms.

QANTM is also looking for opportunities to further expand into Asia (eg. Thailand, Indonesia and India).

The analyst providing guidance for QANTM on Simply Wall Street (I believe it’s Bell Potter) is forecasting 25% annual earnings growth over the next few years.

I think this business is interesting and is worth some further investigation. As I research further into QANTM and Sortify.tm I hope to add further straws.

Held (1%)

About QANTM Intellectual Property

QANTM Intellectual Property Limited (QANTM, ASX: QIP) is the owner of a group of leading intellectual property (IP) services businesses operating in Australia, New Zealand, Singapore, Malaysia and Hong Kong under key brands Davies Collison Cave, DCC Advanz Malaysia, Davies Collison Cave Law, FPA Patent Attorneys, and Sortify.tm Ltd (including Sortify’s brands – DIY Trademarks, Trademarks Online and Trademark Planet). With more than 150 highly qualified professionals, the businesses within the QANTM Group have a strong track record in providing a comprehensive suite of services across the IP value chain to a broad range of Australian and international clients, ranging from start-up technology businesses to Fortune 500 multinationals, public research institutions and universities.