Pinned straw:

Thanks for posting the Straw @TomS, ripper job to provide an overview on headline numbers, especially considering Laserbond have been busy this morning with 5 announcements, 3 of which being price sensitive - so I am sure the forum is and will work through these. I reckon this one is going to generate some discussion.

I held a similar view regarding LBL and Wayne Hooper prior to today's announcement, but my patience has worn thin and unfortunately, run out.

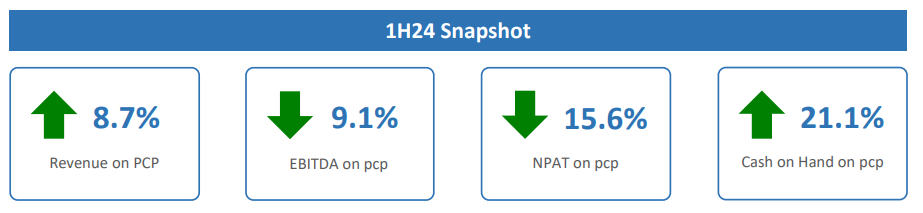

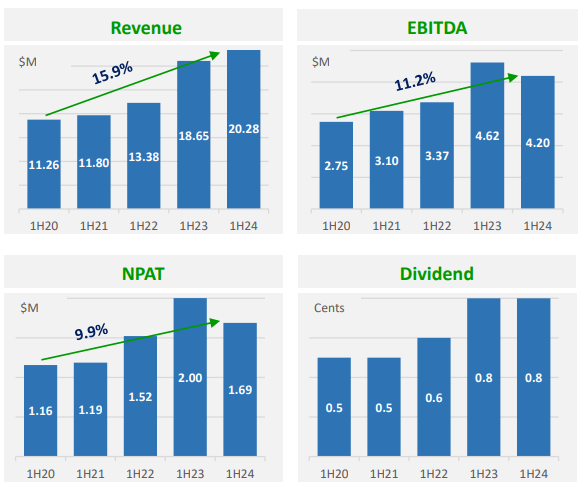

The retrace in NPAT and subsequently EPS is a kicker in today's market; especially considering the association with LBL being a 'growth-based small cap at a reasonable price'.

The announcement of the Acquisition of Gateway Group, which @BoredSaint has just posted about here is a little odd and bizarre. Now I've been wanting LBL to expand out West for some time now (I'm a WA fella myself who works in the mining industry) given the lucrative WA market. It makes sense. However, what isn't so clear to me is what exactly LBL have paid for Gateway Group. Now I am no market analyst wizard myself but I am unable to understand exactly what they have coughed up for the acquisition. As a shareholder, I'd not only like to know this, but I'd like it to be made pretty clear too

In not clearly advising this to shareholders - I see that as strike one.

I swing and miss all the time, but there's a few other things that got my goat - (1), as noted above, the retrace in NPAT and EPS is not what we want to be seeing in today's market, yes revenue is growing, but that won't mean much to shareholders if your EPS is going in the other direction. (2), I am quite confident that supplier and procurement issues have been flagged in the past as an issue for the business - I get that this is the game they're playing in, but, 'once bitten twice shy for me.' (3) The dividend payout remaining consistent HoH is where I think the Board is simply trying to please shareholders here as oppose to keeping some of this as cash on hand to fund these future growth opportunities, especially considering two headline numbers have gone backwards. (4) The technology segment is minimal, lumpy, not growing, and no longer being pursued as a key driver of growth.

LBL was one of my lower conviction stocks, so with the above and this in mind, all this amounts to strikes two and three. So for now I am out (Sold), and happy to sit on the sidelines and watch.

@TomS I'm not sure it was an overeaction given the relatively weak numbers. In my opinion these results were below par relative to what they historically have delivered. Profit down expenses up is a hard sell, regardless of the reasons. EPS down 16%.

I am not a shareholder of LBL but have looked at it several times, but I am anchored to what I could have bought it for!

The two main questions I have is 1) around the technology services, it has become a little bit of overpromise and under deliver on these deals. The licence deals were meant to lead to high margin low capex revenue streams, but they seem continually be delayed. The commentary seems to be shifting expectations away from further offshore technology sales, in preference to internal demands. This section makes me think the future of the technology division might be more constrained.

"At present, LaserBond’s range of technologies available for licensing has covered a diversity of applications, which are often further developed to bespoke designs to meet specific customer requirements. In future, beyond the current period of high internal demand, we intend to offer a smaller range of standardised LaserBond cladding cells that can be produced cost- effectively with short lead times as other surface engineering services businesses seek to expand into the laser technology space"

The second question I have is around access to skilled labour it seems like they find it difficult to get enough skilled staff to run their operations at full capacity. 1/3 of the increased costs was on recruiting skilled workers. While on the surface the WA expansion looks like a good fit, I imagine the skilled worker problem will be exacerbated in WA. Veem have had a similar problem with this in the past and I would think the pool of workers would be the same.

The potential expansion into the US is similar to above could be a great decision but Aus companies expanding overseas hasn't always worked out so well. Does increase the execution risk a bit.

Not to say that they aren't a good company I'm just not very excited about the current result