Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

$2.5m PBT through first four months of FY26. With a seasonally stronger 2H, addition of minority investment earnings from Gateway and $2.3m Technology licensing deal with Komatsu I think LBL is on track for $6-7m NPAT in FY26.

It will take LBL another result or two to earn it's market premium multiple, so 15x the midpoint is close enough to 80c.

Unfortunately I wasn't able to attend LBL's AGM on Thursday, but reading new CEO Rob Freeman's address I was impressed by the clarity of the strategy he was outlining. He spoke about the company's strengths, the challenges they need to overcome and the constant drive to solve customer problems.

Pleasingly the first four months of FY26 continue the turnaround seen in 2H25. Through to October, LBL reported revenues of $15.9m and PBT of $2.5m. LBL was also able to disclose the name of the OEM customer they signed a $2.3m Technology licensing deal with in September as Komatsu, and said they expect this first deal will be the "first of multiple" with two additional OEM's in "advanced stages of negotiation". After some trial and error it appears as if LBL has finally got their Technology segment go-to market correct.

It looks like the positive 2nd half 2025 has continued into 2026 with this in todays AGM update-

Trading update

Our FY26 results to date reflect the strong momentum from the second half of FY25, with a robust order book extending into calendar 2026. The July to October period delivered revenues of $15.9 million and an NPBT (prior to our share of Gateway's profits) of $2.5 million.

So in the first 3 months of 2026 they have already achieved 70% of the 2nd half 2025 revenues and 90% of the NPAT.

The wording did imply that coming into the xmas period this rate will slow due to timing effects. Overall a pretty good indication that last years grow spend was a temporary hiccup rather than a structural change to lower profitability.

This AGM was in person only, if anyone attended can you give an indication of what the vibe was and your impression of the new CEO

I want to ask what might seem like a dumb question about Laserbond, but I’ve been wondering about it for a while. If you take parts out and apply a coating, doesn’t it void any warranty of the entire piece of machinery?

My initial thoughts on Laserbond's latest results are quite positive, although the market seems unmoved. I guess much of it was expected.

At first glance the headline figures show only modest revenue growth and a small dip in operating profit, but this was a story of two halves (as the company was at pains to point out). The first half was weighed down by OEM demand issues and higher operating costs from strategic investment, but in the second half those investments seemed to start paying off --productivity improved, and OEM ordering patterns normalised. As a result profitability rebounded strongly.

On a full year basis revenue was up 3.6% to $43.5m while EBITDA slipped 4.7% to $9.0m and NPAT rose 10.4% to $3.8m (lower pre-tax profit plus a one-off downward adjustment to prior year provisions and other deductible items brought the tax bill down a fair bit).

But looking at the second half alone, we saw revenue up 7% from the pcp, and npat up 55% -- back to the record levels seen in FY23. If you annualise the second half (just by way of comparison) you get a PE of about 12x, compared to 17x if you just take the FY numbers as stated..

So while the shares dont look especially cheap on trailing numbers, the valuation is more reasonable if the second half performance proves sustainable. The services division continues to grow strongly, the products division bounced back in the second half and the technology division delivered its first modular laser cladding cell at Gateway. These are all encouraging signs that the strategic investments are bearing fruit.

My position on LaserBond remains the same. It is a solid business that has had its share of short term challenges and setbacks, but the core earnings power and long term prospects are intact. It may not be a flashy business, but it is resilient, and in 10 years it is likely to be larger and earning more than it does today. A normalised view of earnings provides comfort on valuation, especially given the strong second-half rebound. The company has no traditional bank debt, holds a healthy cash buffer, remains cash generative, and continues to support a tidy fully franked dividend.

What do others think? I'm probably being too positive.

I put together my thoughts around Laserbond for A Rich life

https://arichlife.com.au/is-the-laserbond-asx-lbl-share-price-too-low/

TLDR: Service division growing - Product revenue shrinking. Repeated missteps have caused the market to lose confidence. Holding on to US expansion may be a pivot towards gaining more profitability and winning back the market's trust - this could be an inflection point. ( Check out the Strawman interview - Management knows and acknowledges that they have to win back investors' trust)

$LBL announce they are putting US expansion plans on hold given the current uncertainty.

(I think this explains Trumps overnight response. Joking, not joking. Maybe it’s dawning on him that uncertainty will get in the way of him Making America Great Again if CEOs, not countries, won’t invest!)

The Investor Presentation that Laserbond released to the market today gives some more detail to the problems in the Products segment.

evenue is expected to remain stable "as a minimum" for the next two halves.The Products division revenue has declined 27.5% on pcp.

evenue is expected to remain stable "as a minimum" for the next two halves.The Products division revenue has declined 27.5% on pcp.

The OEM's are reporting impacts from "competitive pressures" and they are implementing strategies to "expand market share". This customer concentration risk which has been previously identified by management is confirmed by LBL's Orders Received graph.

From the about graph the majority of their Products division revenue is coming from two OEM's.

In the FY24 Annual report management stated in regard to decline in Products division revenue that was driven by lower demand from a large OEM , "The Board and management have strategies to diversify revenues so that they are not critically impacted by key customer dependencies. These strategies include developing a wider base of ‘tenant’ customers to dilute the risk and business development plans to target new customers in new markets."

Well fast forward to the current half and there is no evidence that management are fixing this problem. They have stated in this Investor presentation that Product revenue is expected to "remain stable as a minimum" for the next two halves. They are not expecting new OEM's to grow the Products revenue in the next 12 months.

The Laserbond share price has righfully fallen a long way. I now am uncertain of managements ability to execute on their stated strategy.

LBL has guided for FY25 revenue of $43-$46m and net profit before tax of $4.1-$4.7m (NPAT about $2.87-$3.29m assuming 30% tax rate). Taking the bottom end of this they are of a P/S of 1 and P/E of 14.9 looking forward.

How much rope do you give management to turn this around and at what point does this become thesis creep?

Laserbond are a profitable, dividend paying company with some defensive qualities and are relatively cheap however management need to start rebuilding trust with their shareholder base. The best way to do this is forward momentum of the business.

Held IRL (and just holding!)

LBL seems undervalued under moderate growth assumptions but requires strong execution to justify higher valuations. Based on my DCF, with a current share price of $0.42, the fair is $0.7 (quartiles $0.5 and 1.0) under base-case assumptions, suggesting around 66% (19-138%) upside.

Recent financials support this mixed outlook. Revenue remained flat in H1 FY25, and EBITDA declined 21.7% YoY, reflecting cost pressures and weaker OEM demand. However, H2 FY25 guidance suggests a recovery and LBL’s expansion plans could drive future growth.

My calculation of valuation metrics are:

- P/E of 12.3x, EV/EBITDA of 5.42x, and P/S of 1.03x suggest reasonable pricing.

- Free Cash Flow growth ranged from 5.2% to 17.9% across growth scenarios (4-19%) I ran.

- LBL’s WACC (9.3%) aligns with industry norms, but ROIC (8.1%-15.2%) must improve for long-term value creation.

Given execution risks, reliance on key OEMs, and mixed recent results, LBL presents a value opportunity but requires operational improvements. Therefore, entry at $0.42 might make sense...although some confirmation of revenue and margin recovery in H2 FY25 would be good.

Ugly. Still digesting completely but while the headline reads investment year, it isn't the extra costs that hurt too much, it's been the collapse of Products revenues. Here is the timeline from 1H24 when weakness first showed up:

Supply issue, but sorted in November so big backlog to eat into 2H24:

Supply issue sorted but then OEM customer upgraded their ERP software which messed up ordering patters. Sorted in June though so 1H25 will see recovery:

"Actually we have NFI why the OEM customer isn't ordering"

More work to be done, but when the last 18 months are outlined like this it doesn't paint a rosy picture!

A question for those more knowledgeable than I:

Is LBL a proxy for commodity prices?

Are we likely to see an upward movement is SP when commodities rebound?

Insider purchases from two directors. Not big amounts ($22k in all), but good to see, and hope it continues!

I'm a bit short on time today but read through the LBL results briefly. This is from their presentation:

Another interesting segment was from their commentary on the Gateway Acquisition:

Given that there was no further mention of their target of hitting $60m revenue, I think it can be assumed that this won't be hit due to the fact that they are unable to including the revenue from Gateway.

As a result the long term thesis is breaking but I will take a few days to fully digest the results before deciding on what to do next.

Disc: Held IRL and on Strawman.

It’s not a huge purchase but there is generally only one reason for directors to buy shares in a business. On the 26th and 27th February 2024, Non-executive Director Ian Neal bought 25,000 Laserbond shares at $0.75 per share, total value $18,750. Ian is paid a total of $60,000 per year for his role on the board.

Laserbond has updated the market with further details about the gateway purchase -

The reason details were lacking in today’s announcements regarding the purchase of Gateway are now apparent. Laserbond have just released an ASX update.

It looks like a great fit for Laserbond providing a base to further expand the business in WA through increased efficiencies and possible synergies with the hard- chrome plating part of the Gateway’s business. Gateway has some large mining services clients that should help to boost Laserbond’s revenues. While it will add to the capex and dilute shareholdings initially, this looks like a good long-term investment for Laserbond. I like the deal!

About Gateway

Established in 2010 to offer a more affordable and customised approach than original equipment manufacturers, Gateway has quickly established itself as a reliable machinery parts supplier.

Our purpose built workshop in Perth (Western Australia) allows us to provide flexibility in our services and allows our customers an involved and specific approach to their machine and maintenance requirements.

Services

Held IRL

Just as I was shutting down for the weekend, this came through.

Consideration is 4.5 x Gateways's FY23 EBITDA of $5.6m

So, 40% = $10.0 m

Paid as:

a) $4,894,433 cash

b) $5,974,729 in LBL shares based on a VWAP of $0.85444 per share.

$LBL has the right to acquire up to 51% in total.

Further shares to 100% at Gateway's shareholder's discretion.

Consideration for additional shares up to 4.5 x EBITDA up to a max. of 3 years average EBITDA. Method of cash and / or scrip to be decided at the time.

I'll not repeat any of the results and commentary today on $LBL, as I think everything is well-captured.

While also irritated at the clarity of the deal communication, we are learning time and again, that our small cap management team's and Boards simply need to develop their investor communication capabilities. While it is something to bear in mind from a governance and risk perspective, if I trust in the integrity of management, I'll cut them some slack.

I was also not unduly disappointed with the operating performance. Gross profit and %GM continue to progress.

The expense increase lacks explanation: $5.04 to $6.60m! But perhaps they felt it goes without saying given the things they are doing as part of the strategy. It is one to watch, and if expenses continue to expand in an outsized fashion, then that will be a flag for me. A more sophisticated management team would have provided more detail here.

The continued slow progress on the technology division is disappointing. However, this is a relatively new area for them, and I'd rather they continue to innovate subject to exercising capital discipline. The commentary indicates that they are managing this and adapting as they go. It will take time to get the business model and the execution around it right. It remains core to the thesis.

I am glad they are expanding the business to WA and I'm not too fussed about the $60m target, or how they get there.

So, while today had more bad news than good, that's the time to buy if the thesis is intact. For me the thesis is intact, so I increased my small RL holding by 25% at $0.75, and will put a corresponding SM order in now.

Disc: Held in RL (2%) and SM

Update 23/02/2024

Updating based on 1H FY24 results.

Management have reiterated that their FY25 revenue target of $60m will be met, albeit with an acquisition.

The acquisition makes the numbers a little messy as its hard to tell exactly how much contribution it will have to the bottom line but margins for the half disappointed so I will have to revise down some margin expectations at FY25.

Some revision of assumptions:

- FY25 revenue of $60m

- 10% net margins (decreased from previous expectations) = $6m NPAT

- SOI likely to increase given their scrip consideration for acquisition. Assuming it rises to around 115m SOI

At 20x PE for FY25 gives share price of around $1.04. Discounting this back gives a valuation of $0.90.

Disc: Held IRL and on Strawman

Update 21/08/2023

Update based on FY23 results:

- Revenue = $38.61m

- NPAT = $4.76m

- Net margins = 12.3%

Management once again reiterated their revenue target for FY25 for $60m. Now only 2 FY's away so discounting back 2 years gives us a valuation of $1.08.

Overall track record of the business in achieving targets has been questionable however. As shown in the current report which once again delayed any revenue from the technologies division. Although they did say this was timing related and that it should be recognised in the next report. Time will tell I guess.

I think the current share price ($0.84) assumes that revenue in FY25 will be around $46.5m on a 12% net margin. So if the next few reports show that they are getting close to the revenue target, we could see a decent re-rate.

Disc: Held IRL and on Strawman

Original Valuation

Very brief look at the company.

Management are guiding for $60m revenue by FY25.

Assuming they hit that target and at net margins of 12% gives NPAT of $7.2m.

At a PE of 20x in FY25 would give a share price of $1.31

Discounting this back 3 years at 10% pa gives valuation of $0.99.

Disc: Have taken a small position IRL to continue to monitor, have placed a buy order on SM to reflect this.

Laserbond announced that has made an acquisition of Gateway Group in order to expand their business into WA.

The details of the acquisition are not very clear...

- LBL will acquire an initial 40% equity interest in Gateway Group which will reach a minimum of 51% in 3 years from settlement date

- This will be paid in part cash and part scrip

- LBL is valuing Gateway at 4.5x EBITDA although this is the "enterprise value"

- Gateway had EBITDA of $5.6m

- The cash component will be funded from current cash reserves and will leave the business with $4.8m remaining

- LBL had cash reserves of $10.2m as at 31 Dec 2023

So based on what they've provided, the cash component of the transaction will be around $5.4m with the remaining in scrip. I'm hoping management give some further clarification as to the exact details of the transaction given that this is their way of achieving their guidance of achieving $60m in revenue by FY25.

Full announcement here.

Disc: Held IRL and on Strawman.

Share price decline on some higher-than-average volume isn't great in the lead up to the results - may be nothing.

DOES ANYONE KNOW WHAT THIS IS REGARDING?

Dear Shareholders

Market Clarification

Investors may have read an online post today presenting misleading information about the

company and its performance and asserting personal opinions about the current

management and board.

LaserBond rejects these unfounded and disingenuous allegations. The individual responsible

for circulating this information has, during the course of 2023, made numerous attempts to

return to LaserBond in a non-executive or executive role, all of which have been unsuccessful

for several reasons. The Board does not believe their return is in the company's and its

shareholders' best interests.

If anyone would like further information, please email [email protected]

providing your name and contact number, and the Chairman, CEO and/or CFO will be in

contact directly:

Approved for lodgement by the Board of LaserBond.

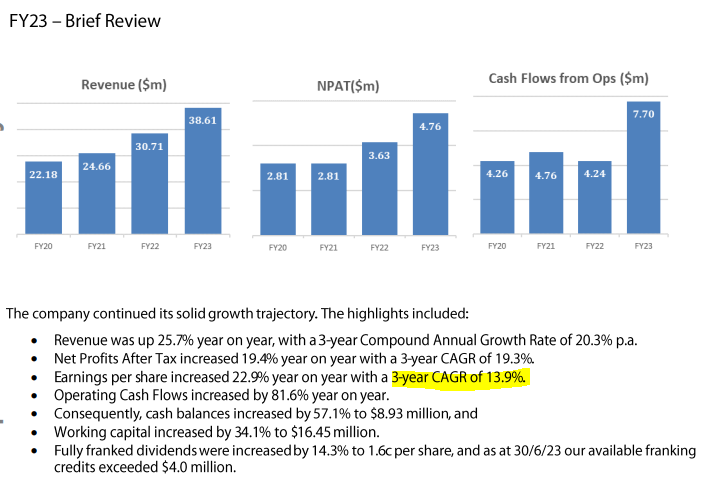

Wayne Cooper spoke at the AGM today -- I didn't attend, but in the release to the ASX there was an update on the revenue growth so far for FY24.

Before that, it's worth highlighting (as Wayne did) the last 3 year's worth of growth:

So far in FY24, the company has seen revenue increase by 12.6% above the same period last year. (he actually makes the comparison to FY22 but I assume that's a typo)

At any rate, in his words, the company is "well positioned and primed to continue its strong growth". He once again emphasised the investment made in people, skills and equipment.

Importantly, Wayne reiterated the FY25 revenue target of $60m. Obviously, that's great to hear. But it will require an acceleration of the average growth achieved in recent years, and a doubling of the growth seen in the first quarter.

I've lined up a meeting with Wayne for November 21 to see if we can't get a better grip on the reasons behind this expectation. But if they get anywhere near that target, and more or less maintain margins, the current PE of 20 seems rather tame.

Disc. Held

Not covered with glory here. below is my LBL dividend statement! how did this happen? i had a bushranger (low) bid in for a lot more stock, in the end of year volatility i got hit for 76 shares and then i hoped it would pull back and complete the trade or something, no luck, dumb move. should have raised and closed. now my trade has expired! at least its franked! lol

@Wini very interested in your view on $LBL.

It was on my shortlist of "companies I would like to increase if it hits certain criteria". It did. So I added on SM and RL. Unfortunately, I didn't see if there was an investor call today and, in any event, I was spread too thinly and missed it if there was.

Keen to hear what any other StrawPeople observed.

Revenue up 7% on prior half. H2 revenue of $19.9 M. ($38.6 M for FY2023).

Gross margins 54% (53% prior half).

NPAT: $4.76 M

Diluted EPS: 4.34 cents per share for FY 2023.

Final divvy: 0.8 cents per share

Outlook: Laserbond maintain FY2025 $60 million revenue target remains on track.

$2.5M id licencing fees that were guided to be earned in FY2023, have been delayed and will be recognised in FY2024. Flagged recent sales wins in India and another large offshore OEM manufacturer expected to see revenue recognition in FY2024.

DISC: HELD

Big(ish) drop on high volume leading into the results - usually not a great sign.

Interested to see if there is anything to it.

$LBL posted their results today.

After a rollercoaster week of results, I'll post their entire results summary because it is so well written and shows a really well-managed founder-led company. (My thanks for @Wini for putting me on to them).

My Takeaway: Great results on every dimension: both segments, financials, cash, dividend, outlook.

Held: RL (1.2%) SM (2.9%)

I really don't intend to come across as gushing fan-boy when I speak to some of these management teams...But sometimes our guests say all the right things.

I think Laserbond is very interesting at this juncture, and can see why a lot of people like it.

Personally, I really like CEOs with an engineering background. They may not have the polish of a career executive, but they tend to have a relentless focus on the product and are usually pretty straight shooters when it comes to investor communication. And with Wayne, you also have someone who has immense experience and a huge alignment to shareholders.

Despite being a $100m listed company, it very much has a family business vibe, and Wayne really managed to underscore the kind of things you tend to get with those operations -- a longer term focus and an adversity to undue risk.

As was made clear during the chat, the Technology division is the one to watch. Licensing the tech and supplying the equipment and consumables seems like a great way to scale into other markets in a way that is very capital efficient. Plus, you have to love the 'razor & blade' model, with them taking a 15% clip on all consumables.

The target of $60m in revenue by FY25 -- which Matt and Wayne were careful to stress is NOT a forecast -- represents a double from current levels. Moreover, Matt said he thought *NET* margins could expand to as much as 20%. That gives you an EPS of 11cps, compared to 3.5cps in FY22. In that context, the current PE of 25 does not seem excessive -- although, as always, only on the proviso they get close to this target.

As I mentioned in the chat, I personally don't get too hung up on the specifics of these targets, but if it's directionally accurate then there's likely a good degree of upside for shareholders from the current level.

One of the more important structural/macro trends I continue to think is important in the coming decade or so is the domestic capex boom we will see as a result of a reduced dependence of China and Government stimulus (pretty much the thesis people like Russel Napier are pushing). If there's any legitimacy to that, it seems it'd be a good tailwind for a business like Laserbond.

Another factor that is a positive for me is that more than a few smart investors I know really like the company -- including Wini (who has held on Strawman since 2018) and Steve McCarthy from DMX. Not to outsource any thinking or responsibility, but that is something i tend to notice. I'm more than happy to ride coat tails!

Shares are pretty thinly traded, but for a long term hold I think it looks very interesting and plan to add a small position.

Oh, and I definitely plan to take up Wayne on his offer and arrange a site visit. Once I have details i'll share them here.

Ahead of our meeting with Wayne Hooper CEO of $LBL later this month, I recently came across Owen Rask’s (aka @Owen ) interview and site visit. It’s a really good discussion of the history of the company, the family-owner-manager mindset, economic drivers, customers, and the technology licensing strategy.

Thoroughly recommend to those interested.

edited to add the link: https://youtu.be/geRLAorTM5E

Disc: Held in RL and SM. (Small position)

- Owen Rask talking to Wayne hooper from laserbond. Fascinating listen

https://podcasts.apple.com/au/podcast/australian-investors-podcast/id1414707038?i=1000583913077

LaserBond Limited (ASX: LBL) is pleased to announce a 28.1% increase in profit after tax to $1.52 million from 1.19 million in the previous corresponding period. The revenue performance was also strong with a 13.4% increase to $13.4 million from $11.8 million in 1H21. These results were achieved with the ongoing backdrop of Covid, which prevented sales teams from travelling and resulted in delayed customer maintenance schedules for repair of worn componentry.

Chief Executive Officer, Wayne Hooper, said, “We always believed we had a strong business, but the past two years have proved just how secure and durable the foundations of LaserBond are. We have weathered the substantial disruption precipitated by the pandemic and been tested well beyond any expectation for an extended period of time, and we have produced the sorts of earnings increases that are commendable in a normal trading environment.”

During the half, the business also retained its focus on growth with negotiations and an $11,127 million capital raising resulting in the acquisition of QSP Engineering in January this year to continue expanding its geographic footprint, build capacity and operate closer to customer sites down the east coast of Australia. Investment in innovation also continued with a number of projects underway to further develop and test proprietary products and technologies and preserve LaserBond’s market leading position in advanced surface engineering. LaserBond’s excellent health and safety record also remains intact, with no major incidents between 1 July and 31 December.

Strategy and Outlook

LaserBond has also sustained its focus on growth over the past two years, as well as balancing the demands and challenges of the changed trading environment. On 1 February this year, the acquisition of a Queensland presence for the business was settled for $9 million, consistent with the strategic objective to secure sites closer to customers while building capacity across the business divisions. QSP Engineering is a specialist surface engineering business with a full suite of thermal spraying equipment laser systems that LaserBond can immediately upgrade with LaserBond IP and technology. The operations are expected to contribute revenue in the vicinity of $2 - $2.5 million between 1 February and 30 June 2022.

LaserBond has a strong track record for integrating bolt-on acquisitions to augment capacity and expand its geographic footprint in Australia. In FY 21, the Victorian operations were acquired, and while the LaserBond® cladding cell that was planned for installation soon after the acquisition in 1H20 could not proceed due to the restrictions, it is now operational and expected to add capacity and thus revenue in 2H22.

LaserBond remains strong, committed and on the cusp of realising some material gains from a decades-long innovation program. It has a rock-solid operating platform with a blue-chip client base in essential services sectors, a suite of proprietary products and technologies that are more effective and cost-efficient than the alternatives, and sizeable markets for these products and technologies in North America, Asia and in Australia.

At our Annual General Meeting last November, we revised our long-term revenue target of $40 million by the end of financial year 2022 to approximately $35 million based on the impact of Covid on our operations. Having extended our strategic plan to 2025 year-end, we expect to be able to achieve a revenue target in excess of $60 million. This target, however, is underpinned by a number of assumptions, including the presumption that the constraints to our business and our customers’ operations will have eased to the point that normal economic conditions can prevail.

Mr Hooper also said, “Over the last five full years, we have invested almost $3 million in our targeted research and development program, working closely with customers to identify solutions to problems and expanding those solutions to our broader customer base. And over that time, we have gained a significant market lead in our areas of expertise, developing products and technologies that are well ahead of the competition. As restrictions around the globe ease, we are in a position to profit from our R&D investment by selling these products and technologies into specific, valuable markets both here in Australia and offshore.”

Disc: Held

LaserBond Limited is pleased to offer you the opportunity to subscribe for fully paid ordinary shares in the Company (New Shares) under a Share Purchase Plan (SPP).

Under the SPP, Eligible Shareholders have the opportunity to subscribe for up to $30,000 of New Shares at an issue price of $0.87 per New Share (Issue Price). The Issue Price represents a 5.4% discount to the closing price of Shares on 14 December 2021 and a 7.7% discount to the volume weighted average market price of Shares over the last five days on which sales of Shares were recorded on the Australian Securities Exchange (ASX) immediately prior to the Company undertaking its recent placement.

To view the Share Purchase Plan Offer Booklet, please click here

Not a lot of detail as to what the funds will be used for - in the SPP booklet it just says "The Board presently intends that the funds raised from the SPP will be applied towards working capital"

13-Sep-2021: CCZ Equities Research report: LaserBond (LBL): Laser focused on global growth opportunities

Analyst: Thomas Chapman, email: [email protected], Ph: 61 2 9238 8222

Company Overview

LaserBond (LBL) is an Australian heavy industrial surface engineering company that specialises in the advanced cladding of worn machine components using their proprietary laser technology. Founded in 1992, LBL’s technological leadership hasfostered engrained relationships with global blue-chip clients and is now well poised for accelerated US & European market growth.

Proprietary technology pivotal to LBL’s sustainable growth

LBL’s technology has been proven over 30 years to restore worn component surfaces to last 5-10x longer at <2x the cost of new parts. Key catalysts ahead are (1) accelerating the licensing of this technology to global OEMs, and (2) increasing sales of LBL branded high wear-resistant products, e.g. steel mill rolls. We are forecasting +14.6% sales and +34.8% EPS CAGR over the next 4 years.

Strong ROFE accretion ahead, and turbo-charged with an acquisition

With a new VIC cladding cell just installed and 2-3 tech sales expected for FY22, LBL looks fully invested and poised for strong top-line growth which we expect to drive ROFE accretion from 14.9% FY21 to 29.7% FY25. LBL is also seeking an acquisition (2H-FY22+ guidance), and if history is a guide, its balance sheet could fund +17.5% FY21 pro-forma EPS accretion via a <2x EBITDA transaction.

Key markets are increasingly ripe for disruption

Rising cost and ESG concerns are driving heavy industries to adopt sustainable solutions to their machinery wear & tear problem (~3.5%+ of GDP and ~3.0% of energy consumption globally). While LBL is in a microcosm here due to size, sector focus and geographic reach, a generational opportunity is emerging for LBL to outperform the +6.5% 5yr laser cladding global sector CAGR.

Valuation summary

We have valued LBL using a mix of DCF and peer EV/EBITDA methods. Our analysis suggests an interim fair valuation of $1.10-$1.20 per share. Given our baseline forecasts do not factor in any acquisitions, there is clear valuation upside risk should LBL deliver on an accretive 2H-FY22 acquisition.

Company Details

- Stock Code: LBL

- Last Close: 79.0cps (84 cps on 17-Sep-2021)

- Market Cap: $75.9m (now $81.6m on 17-Sep-2021)

- Enterprise Value: $75.2m

- Shares on Issue: 96.1m

- Sector: Capital Goods

- Index: None

Top 5 Shareholders

- Wayne Hooper 11.52%

- Diane Hooper 10.17%

- Rex Hooper 7.17%

- Lillian Hooper 5.79%

- Lornat Pty Ltd. 5.15%

--- end of excerpt - click on link at the top for the full CCZ report on LBL ---

Disclosure: I do not hold LBL shares, but I do like the company and I'm happy that they have paid off big time for @Wini and others who jumped onboard early on.

Other companies that the ASX sent out free broker reports on today included Cogstate, Silex Systems, Calix, Predictive Discovery, Playside Studios and Toys"R"Us, and @laoshi has posted links to all of those reports here.

24-Feb-2021: CCZ Equities Research: Laserbond (LBL): Stronger second half expected, Products division performing well

Analyst: Daniel Ireland, [email protected], +61 2 9238 8239

Stronger second half expected, Products division performing well

- Recommendation: BUY

- Target Price: 83cps (previous 108cps)

- Market Capitalization: $54m

- Index: None

- Share Price: 56cps (26-Feb-2021: 59.5cps)

- Sector: Industrials

- First half update: LBL declared 1H21 revenue and EBITDA of $11.8 M and $3.1M respectively (vs $11.3M and $2.7M pcp up +4.8% and +13.4%). The result was lower than expectations, largely due to COVID-19 restrictions causing delays in interstate transportation of parts to LBL’s facilities in NSW, SA and Victoria. Most notably, LBL’s softer services revenue that experienced delayed sales from new customers and reduced maintenance servicing for large mining and manufacturing businesses. However, the company is expecting a stronger second-half contribution from the services division (46% of group revenues 1H21) with the company declaring a ‘record volume of open quotes for active opportunities that currently exceeds $10M, with much of this work expected to proceed’.

- Services softer, Product sales strong: LBL displayed strong product sales during the first half ($6.3M up from $4.36M, +45% vs pcp), due to a product reconfiguration from a material OEM customer, combined with strong general demand. Management also highlighted several new products will add to the current sales momentum, including NanoClad© and EClad© which are close to commercialisation and promise to disrupt significant addressable markets. With lockdowns interrupting business conditions in 1H21, United Surfacing Technologies (UST), which was acquired in June 20, is expected to rebound in the second half, regaining the lost momentum caused by lockdowns in Victoria.

- Technology Division: LBL have ‘two promising local opportunities and one international opportunity under negotiation’, and we expect more opportunities will open as border restrictions ease. This will enable LBL’s sales force to meet customers face to face, further increasing tech sales and licensing revenues. The company noted that a technology sale in the US was imminent, subject to final testing, however we have not included these in our numbers given the uncertainty in timing (tech sales have traditionally added between $1.2M-$1.7M revenue for a core laser cladding cell, $200K in licensing revenue and $1M in consumables pa).

- Valuation: We reduced our valuation to $0.83 per share (previously $1.08) taking into account a weaker services contribution. We have reduced our estimates for FY21 Revenue to $27M and NPAT to $3.3M (CCZ prior forecast Rev $32.3M and NPAT $4.2M) excluding technology sales in the second half in our assumptions. We have also reduced the company’s Fy22 $40M revenue target and only included organic revenue growth as it remains unclear as to the timing of an acquisition which is required to reach the company’s stated target.

--- click on the link at the top for the full CCZ report on LBL ---

11-Nov-2020: CCZ Equities Research: Laserbond Limited (LBL): Australian industrial company going global

Analyst: Daniel Ireland, [email protected], +61 2 9238 8239

- Initiating Coverage - Laserbond (LBL): LBL’s products and services reduce the maintenance costs for critical machinery, with maintenance largely determined by corrosion and abrasion as key determinants in the useful life of machinery parts. The process known as laser cladding, enables parts and machinery to be protected from harsh conditions thus improving wear life. These services/products maintain mission critical parts used in manufacturing and minerals extraction, with life improvements ranging between 2x-20x a standard part. The cost to buy and maintain such machinery is a considerable cost, whilst downtime experienced during replacement compounds this expense. LBL’s laser cladded products and services protect machinery from this wear.

- Significant Industry Potential: Abrasion wear is estimated to cost up to 4% of GDP, with estimates of circa $30B pa across Australian industry alone. Industry research have found that even a modest improvement in wear life of critical components is crucial to improve the efficiency of capital-intensive industries. The applications for LBL’s technology are far reaching, across multiple industries and applications, with many avenues yet to be explored. LBL’s products have proven to significantly increase wear life, offering a cost-effective alternative to discarding parts once worn.

- High Barriers to Entry and Strong Growth: LBL’s heat diffusion process reduces the temperature required when laser cladding, resulting in a harder and longer lasting surface finish compared to traditional cladding methods. The company’s IP, a ‘methodology around surface application’ has been built over two decades of experience. Combination of expanding sales in the US and imminent R&D technology commercialisation could see LBL increase sales 2x within 5-7 years.

- Significant profit growth forecast in Fy21: Strong organic revenue for Services and Products (CCZ forecasts 11% & 20% vs ˜10% & 20% from LBL) in Fy21, combined with the 12-month integration of United Surface Technologies will accelerate revenue growth (CCZ forecast $32.3M Fy21, up 45% on Fy20). CCZ estimates the company will execute 1 Technology sale per annum (vs ˜LBL 1 in Fy21 & 2 thereafter), aided by the recurring support and services.

--- click on the link at the top for the full CCZ report on LBL ---