I really don't intend to come across as gushing fan-boy when I speak to some of these management teams...But sometimes our guests say all the right things.

I think Laserbond is very interesting at this juncture, and can see why a lot of people like it.

Personally, I really like CEOs with an engineering background. They may not have the polish of a career executive, but they tend to have a relentless focus on the product and are usually pretty straight shooters when it comes to investor communication. And with Wayne, you also have someone who has immense experience and a huge alignment to shareholders.

Despite being a $100m listed company, it very much has a family business vibe, and Wayne really managed to underscore the kind of things you tend to get with those operations -- a longer term focus and an adversity to undue risk.

As was made clear during the chat, the Technology division is the one to watch. Licensing the tech and supplying the equipment and consumables seems like a great way to scale into other markets in a way that is very capital efficient. Plus, you have to love the 'razor & blade' model, with them taking a 15% clip on all consumables.

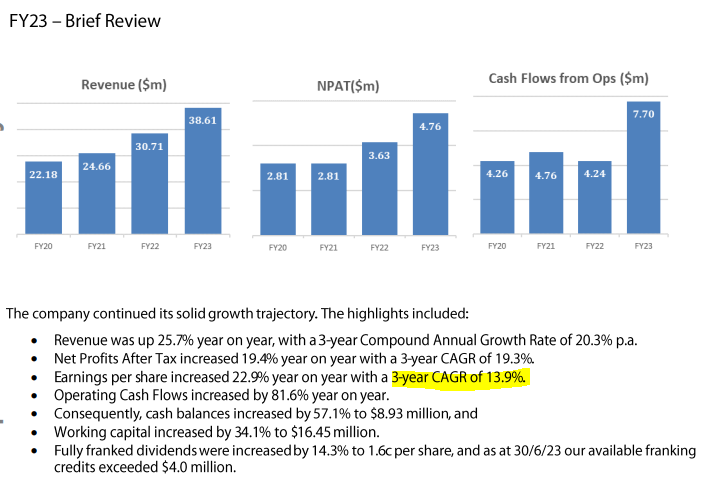

The target of $60m in revenue by FY25 -- which Matt and Wayne were careful to stress is NOT a forecast -- represents a double from current levels. Moreover, Matt said he thought *NET* margins could expand to as much as 20%. That gives you an EPS of 11cps, compared to 3.5cps in FY22. In that context, the current PE of 25 does not seem excessive -- although, as always, only on the proviso they get close to this target.

As I mentioned in the chat, I personally don't get too hung up on the specifics of these targets, but if it's directionally accurate then there's likely a good degree of upside for shareholders from the current level.

One of the more important structural/macro trends I continue to think is important in the coming decade or so is the domestic capex boom we will see as a result of a reduced dependence of China and Government stimulus (pretty much the thesis people like Russel Napier are pushing). If there's any legitimacy to that, it seems it'd be a good tailwind for a business like Laserbond.

Another factor that is a positive for me is that more than a few smart investors I know really like the company -- including Wini (who has held on Strawman since 2018) and Steve McCarthy from DMX. Not to outsource any thinking or responsibility, but that is something i tend to notice. I'm more than happy to ride coat tails!

Shares are pretty thinly traded, but for a long term hold I think it looks very interesting and plan to add a small position.

Oh, and I definitely plan to take up Wayne on his offer and arrange a site visit. Once I have details i'll share them here.