The Investor Presentation that Laserbond released to the market today gives some more detail to the problems in the Products segment.

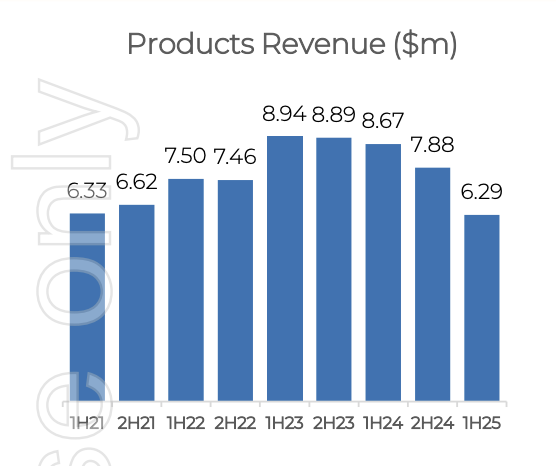

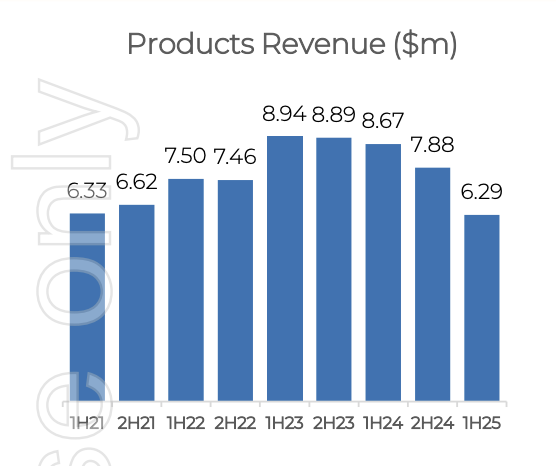

evenue is expected to remain stable "as a minimum" for the next two halves.The Products division revenue has declined 27.5% on pcp.

evenue is expected to remain stable "as a minimum" for the next two halves.The Products division revenue has declined 27.5% on pcp.

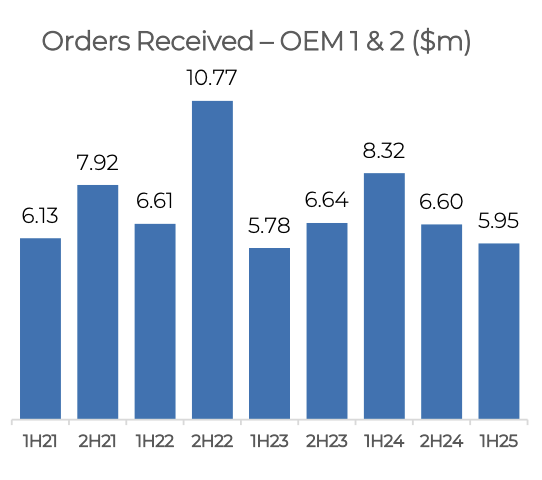

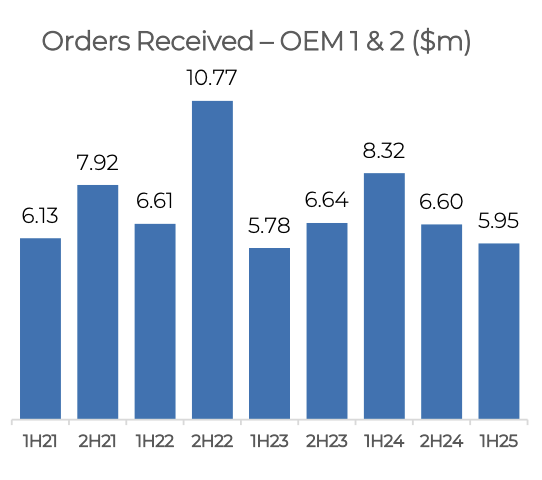

The OEM's are reporting impacts from "competitive pressures" and they are implementing strategies to "expand market share". This customer concentration risk which has been previously identified by management is confirmed by LBL's Orders Received graph.

From the about graph the majority of their Products division revenue is coming from two OEM's.

In the FY24 Annual report management stated in regard to decline in Products division revenue that was driven by lower demand from a large OEM , "The Board and management have strategies to diversify revenues so that they are not critically impacted by key customer dependencies. These strategies include developing a wider base of ‘tenant’ customers to dilute the risk and business development plans to target new customers in new markets."

Well fast forward to the current half and there is no evidence that management are fixing this problem. They have stated in this Investor presentation that Product revenue is expected to "remain stable as a minimum" for the next two halves. They are not expecting new OEM's to grow the Products revenue in the next 12 months.

The Laserbond share price has righfully fallen a long way. I now am uncertain of managements ability to execute on their stated strategy.

LBL has guided for FY25 revenue of $43-$46m and net profit before tax of $4.1-$4.7m (NPAT about $2.87-$3.29m assuming 30% tax rate). Taking the bottom end of this they are of a P/S of 1 and P/E of 14.9 looking forward.

How much rope do you give management to turn this around and at what point does this become thesis creep?

Laserbond are a profitable, dividend paying company with some defensive qualities and are relatively cheap however management need to start rebuilding trust with their shareholder base. The best way to do this is forward momentum of the business.

Held IRL (and just holding!)

evenue is expected to remain stable "as a minimum" for the next two halves.The Products division revenue has declined 27.5% on pcp.

evenue is expected to remain stable "as a minimum" for the next two halves.The Products division revenue has declined 27.5% on pcp.