Good call @edgescape - backed up by the following AFR articles I reckon:

23-Feb-2024: Good luck catching up to Nvidia (afr.com)

22-Feb-2024: NVDA: Chipmaker Nvidia soars after ‘insane’ Q4 earnings, artificial intelligence bulls cheer (afr.com)

22 Feb-2024: Before the Bell: Nvidia outlook fuels fresh AI-inspired rally (afr.com) (updated today)

22-Feb-2024: Nvidia and the trouble with bubbles (afr.com)

22-Feb-2024: Nvidia CEO Jensen Huang says global demand is surging for AI as revenue triples and shares jump (afr.com)

23-Feb-2024: Nvidia share price: How Australian investors can play the Nvidia AI boom on the ASX (afr.com)

Excerpt:

Picking local winners

This market power will extend to AI in time – even if they’re not monetising AI yet, these giants have the scale and earnings to invest in the technology now in a way that will allow them to set prices, protect margins and market share, and dictate competition in the future. The expense of AI development is such that size matters.

ASX investors have long recognised the advantaged position of big players in our relatively small markets; it’s not for nothing that five companies – BHP, Commonwealth Bank, CSL, NAB, and Westpac - account for 33 per cent of the ASX 200.

But when it comes to picking local winners from AI, it makes sense to look towards the largest 15 or so companies – the five firms above plus ANZ, Wesfarmers, Macquarie Group, Woodside, Goodman Group, Fortescue Rio Tinto and Telstra, Transurban and Woolworths – as having the most potential.

Some are already in the race. Telstra, for example, has already made clear its ambitions to both deploy AI and provide the infrastructure that will enable its adoption across the local economy, while Goodman has an ambitious data centre push underway.

But if we think more broadly three of the key ingredients that are likely to drive AI gains – massive data sets, deep pockets to invest in AI development, and what Boston Consulting Group’s local tech guru Patrick Forth has called an existing level of digital maturity – then it becomes clearer that big banks, big retailers and big miners like those listed above have the most to gain from early AI adoption.

Not only can they unlock early gains in what Forth has previously explained are four key areas – using analytics to optimise operations; personalisation; automation; and predictive operations and maintenance – but they have an opportunity to create an even bigger gap between themselves and smaller rivals that do not have the ability to invest in AI. Potentially, AI investment in the next few years could set up an advantage for the next decade.

Of course, we’re very early in this AI revolution, and the winners and losers are far from clear. Investors will need to look closely at how individual companies adopt AI – and then try and sort the big talk from the actual results. The advantage of first movers is also not guaranteed. There may be a lot of money wasted on failed AI experiments, and innovation can change market dynamics quickly; Nvidia looks bulletproof right now, but strong demand will eventually incentivise supply.

That’s a question for tomorrow. For now, bigger appears to be better when it comes to AI.

--- end of excerpt ---

Chanticleer podcast: Woolworths’ week from hell, Qantas’ ‘helpful’ profit drop & Nvidia AI fever grips markets (afr.com) [23-Feb-2024]

Ex-Bingo CEO Daniel Tartak sentenced | Playing the Nvidia-fuelled Al boom | Sydney’s $65m house sale (afr.com) [23-Feb-2024]

Excerpt:

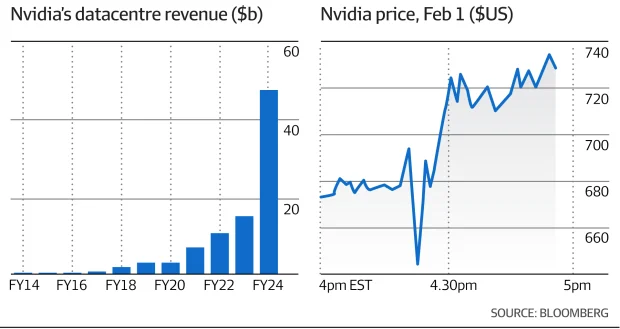

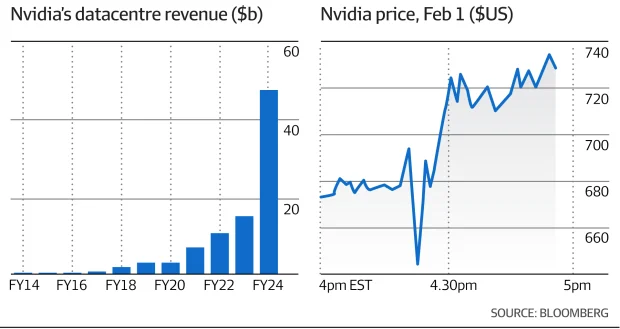

Wall Street strategists break down Nvidia’s surge Nvidia is on track to see its market valuation leap more than $300b, and it’s fuelling renewed exuberance for equities overall.

Matter of opinion

As Nvidia explodes, this may be the way to play AI on the ASX The ASX has few direct links to the AI boom, but investors should think about which local stocks are best placed to lead the race to adoption.

--- end of excerpt ---