Pinned straw:

A good part of today's results were known, following the company's Q2 update less than a month ago.

The best parts being strong sales order growth of $12m in Q2. (And I guess the company reckons this is a pace they can maintain given they thought to annualise this in today's preso..) This has been underpinned by some large value contract wins, and there's a healthy sales back log to give some confidence in a decent second half.

The recent Telstra deal was highlighted, and although it was a botched announcement, it's clearly a deal with some interesting potential (albeit one that the company isn't able to quantify).

Still, the detect segment saw a decline in revenue of 8%, following a weak first quarter. As AVA said at the time, that was mainly due to some timing issues with bigger contracts in Q1, and we did see a very strong Q2 in this segment, but overall it was a weaker half compared to the pcp. AVA reiterated it expects a strong second half here. I hope so.

Part of the issue with AVA in recent periods is that one segment seems to always zig when another zags. And it was the Access segment that did all the heavy lifting this half, and that was largely an stocking event associated with the distribution deal with dormakaba.

But Detect is the biggest segment and that meant total EBITDA dipped back below neutral and continued R&D and inventory expansion saw a $1.8m drop in cash -- there's now only $1.8m in cash left. They said the cost base will stabilise at the current level, but the risks of a capital raise are perhaps higher than I first expected.

The biggest new news for me was a revised 'outlook' scenario, which they have now aligned with financial years.

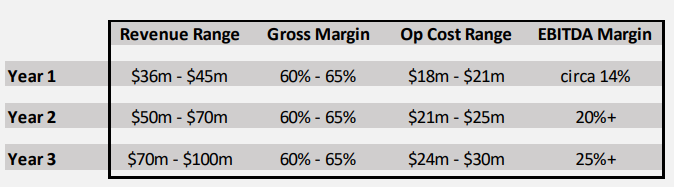

Before it was this:

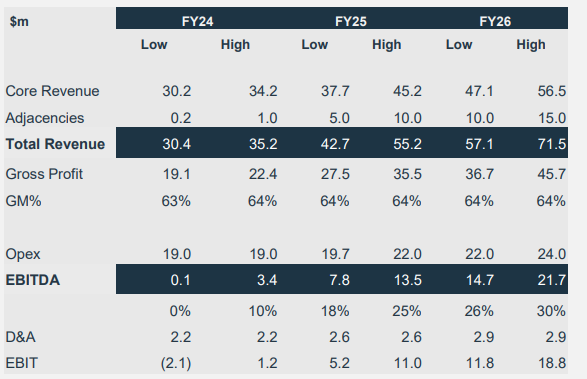

Now it is this:

So essentially the same, but clearly the real expansion in operating margins is not expected to start showing up until FY25.

Using the mid-points above, you get only a 5% EBITDA margin for FY24, and basically nothing at the lower end. Yes, things start to look very good after that, but they're basically saying to not expect much this FY. Beyond that, you just need faith these targets are somewhat reasonable.

Maybe they are, and I'm sure they're put forward in good faith, but until we see good evidence in the financials there's a good amount of faith that is required.

Later in the deck they again reiterate the target for $70-100m in revenue over the next 3 calendar years, with minimal cost increases. And given what they have above for FY26 ($57 -- 71m), and with a good chunk labelled as 'adjacencies' (ie. currently untapped applications of their products), I'm a bit nervous there's a fair amount of "hopium" in managements outlook.

Maybe they're right to be optimistic, and there really is good growth in sales orders, but we're yet to see this translate into anything exciting in the statutory numbers.

There is potential for some acquisitions to help the company reach it's goals, and that can be good cover for a capital raise, but this type of growth isn't always accretive to shareholders and has all kinds of risks. I don't think their GJD purchase is doing much for them yet.

There's clearly some big potential for AVA, and I know that building the foundations for growth always take longer than you think to build, and for that to deliver accelerating sales traction, but this one really is testing my patience. Especially with some recent communication blunders.

Hopefully we can get a better picture of things when we speak with the CEO next month.

Hackofalltrades

I noticed a bunch of people sold today - I'd be curious to know the thinking behind it.

topowl

Only 1.4mill traded today…

not that high…

won’t take much to get the price back up for what it’s worth.

#brightside

mikebrisy

@Strawman on cash, according to the financial report the breakdown is:

- Cash at bank and on hand $1.723m

- S/T deposits $0.055m

- Bank overdrafts ($1.482)m

- Cash and Cash Equiv, $0.296m

In addition they have $1.097m undrawn facility.

I think I heard Mal say that they are expecting this to improve in Q3, but they are running things close. Cash burn in the half was $3.556m, even if investment in tech, was a touch above the norm.

I would have thought more cash (whether through equity or debt) would be prudent, particularly given that Mal is still pushing to increase the backlog.

Disc: Not held

Strawman

Yeah they're cutting it close alright. Wont be surprised at all if there is a raise; if they do, i hope it's at least off strong results..

This is definitely taking longer to play out than I would have hoped. I was early on enamoured with the tech and the wide potential use cases over some big industries, and took some comfort in the ROI they achieved with their now divested Services business. The potential scalability and resultant economics were a factor too.

To be fair, the new CEO has only been in place for a little over a year, and the (reasonably big) changes he's enacted will take time to play out. The product offering does seem to have been refined, they're winning bigger customers, and costs are (apparently) unlikely to rise in the near term.

So i'm not ready to raise the white flag just yet. Especially when there's a case for value to be made even if they fall short of their targets.

Nevertheless, we still need to see reasonable sales growth -- ideally across all segments together -- and if we don't see evidence of that over the course of 2024, I'll consider the thesis busted.

mikebrisy

I ripped off the band-aid both with $AVA and $ALC today (SM and RL).

On $AVA, I've been looking at it ever since the divestment of the services business and been in and out a few times on SM and held for a while in RL. I was underwhelmed today by the financial performance as well as with the presentation discussion. It is not that there is anything fundamentally wrong or concerning, its just that my conviction is not growing. (No doubt time will prove me wrong.)

In the case of $ALC, I should have been patient and waited, but my position was small (as I have progressively offloaded over the last year or so) and with no news flow, I'm not sure what the FY result and narrative is going to look like. Again, conviction is gone.

Offloading both has allowed me to get a starter position in $IPG (RL and SM). I'll write up on this in due course, but the result today was OK. Recently, the market had run up to $5.30 as it has become a bit of a small cap fundies favourite. I missed the chance to get onboard last year at $3.80, and spent the last few months considering it expensive at $4.80, only to see it sail out of reach. Even though I hope to build a bigger position at a lower price, and have possibly paid more than I should, today I got the opportunity to get some at $4.80 and decided to strike and now have at least scratched the itch with a 1% position (RL).

wtsimis

Listening to Mal on the call and reading through the numbers Mal has spent time getting the business to be better commercially and paid higher in terms of employee costs to do so.

The employee costs year on year are up 29.17% when revenue is up 4.4% over same period.

H1 2023 - $4,765m v H1 2024 $6,156m.

This investment appears to be paying dividend if we take the sales order for H1 which is up 37%. This was called out as a issue in terms of sales cycles (reminds me of Alcidion) .This will drop to revenue in H2.

This will need to be repeated QonQ and Half on Half in order for the increased investment in commercial acumen to be justified.

Unfortunately this lag is putting pressure on the balance sheet and puts into question the capital allocation decision in which $437k dividend was paid in late 2023.

The outlook beyond 6month looks promising but RESULTS need to come and the MATERIAL nature of the telstra agreement will need to kick in.

Mal and the team need to run the business and the SP will follow . It feels this has not been the case to date.

Hold for me and will only look to add if market offers price below 15c or below 40m MC.

Disc: Top 6 position in RL and on SM

Bear77

Yes, I can certainly understand that @mikebrisy as I also sold my AVA as soon as I read their report - I slept in (late night) so got on the computer and read it mid-morning, then got a bee's whisker over 17.5 cps (sold a few at 18c and the rest at 17.5c), which crystalised a real-money loss, but I rolled that money into 32,000 XRF shares in that real-money portfolio (at $1.105 to $1.11, average price paid was $1.107358 today), although part of the funds for that buy also came from another sell today, of Aussie Broadband (ABB) at $4.615 (average price received), because I am not a fan of SLC and I think it's a big acquisition to launch without a presentation just one week after the SYM acquisition "Scheme" became legally effective on 19th Feb. I don't mind acquisitions when they make clear sense, but the details around the rationale behind this one in the two page announcement from ABB today left me unconvinced.

Around 18 months between the OTW acquisition being finalised and the Symbio acquisition being announced is plenty of time to fully integrate another company into your own and work out whether you are getting the expected synergies etc., but not one week. Orange flag for me, and with the sharp SP increase since the ABB H1 report, that was enough for me to sell all of my ABB - which I did not hold here on SM unfortunately - they've performed very nicely for me IRL. But I'm out for now - I may get back in when I'm more comfortable with the strategy and the execution.

But back to AVA. The company's revenue is just too lumpy and unpredictable and they are still not profitable and the margins were heading in the wrong direction as well. M/cap of around $51m. XRF is bigger at $151m, but have a look at these apples:

I sold out of Envirosuite (EVS) at between 9.2 and 9.3 cps back in July 2023 (7 months ago) and they're now trading at 5.9 cps and still making excuses for lack of profitability. AVA look like another one that's going to perennially disappoint, at least for a year or three, or not, we shall see. My thoughts are that they've exhausted my patience (EVS, and now AVA) and that my IT for them is busted, in that they haven't achieved what I expected them to within a reasonable timeframe. If I keep accepting their excuses I reckon that's "thesis creep", so I'm out, and I reserve the right to re-enter one or both at a later date when I consider them to be substantially derisked compared to where they sit today. I'm far happier to have that AVA money (and some of the ABB money as well) in XRF at this point.

[I have never held ALC thankfully].

[P.S. AVA closed today at 16.5 cps, so that's what I got for my AVA here on SM, despite selling in real life for just over 17.5 cps this morning, as explained above. I note there is more than twice the volume on the sell/offer side than there is on the buy/bid side - overnight - just 447,340 shares on the bid side vs 1,107,536 shares on the offer side - and while I understand that those numbers can mean very little as many market participants do not leave their orders in overnight, and many traders operate mostly or exclusively during the opening and/or closing market SPAs, I still reckon there are more people trying to exit AVA at this point in time than there are people who think they are a bargain at these levels - based on both the price action and the deteriorating fundamentals.]

edgescape

Haven't had time to digest IPD groups result so looking forward to your thoughts @mikebrisy

Was a big hit yesterday as I am heavily overweight in this vs everything else after taking the recent raise but not phased by this due to their guidance

Apologies for going off topic. Not good that Ava update with the cash position so perhaps a wise decision I got out a while back.

mikebrisy

@edgescape $IPG result was decent enough, even if a minor miss I think (but I think that's often the time to buy, as SP and consensus and delta's to both is pure noise). Although one analyst (one of the mid-ranking one, I can't see who) has upgraded FY24 EPS estimate on the result, and downgraded FY25 and FY26.

The consensus number is dragged up by Bell Potter who have a PT of $5.90 on it. Will be interesting to see their write-up on the result too.

I've only taken 25% of my intended stake in RL, as I am concerned not to overpay, but equally don't want to be left stranded. So, I am just going to average into it over time. There's enough SP volatility in it that I should be OK. (My SM order didn't go through because my SM $AVA sale didn't clear. So, I'll have to fixed that today.)

I'll probably get to a write-up back end of the week. Today I am focused on $PNV, tomorrow $NEU, and during both I am chewing over $ABB.

It's a busy week - but I know I'll soon look back and miss the data deluge of reporting season!

Strawman

I hear you re thesis creep @Bear77

I'm a pro at turning a growth thesis into a value thesis... EVS and AVA being prime examples.

The hardest part for me is trying to distinguish between a business that will forever be a "gunna" company (always promising big things down the track, but never getting any real earnings momentum), and a business that has simply suffered some set-backs, but still has the potential for material earnings growth and showing at least incremental progress.

On one hand, you could wait until the proof is in the pudding, and buy only after you see a few good periods of strong earnings growth. It's definitely a lower risk proposition, but you will almost certainly pay a higher price (and hence have lower future returns).

EG. back in 2016 Xero was bleeding cash, and shares were down 65% from their all time high. It would be a couple years before scale advantages started to unfold, and 4 years before they turned a profit. Had you waited until then, you'd be buying at over 4x the 2016 price. It would have still given a decent return, mind you, especially on a risk-adjusted basis, but not the 500% gain those who bought in 2016 received.

That's not to suggest you ignore the financials of a business, but you have to try and imagine what they could be if a few key assumptions play out (mainly sales and operating efficiency). Not what they have been so far.

To be clear, I think past financials are a really good indicator of the future (you can put a lot more faith in a company that has consistently delivered good results then one that has yet to demonstrate its viability), but that's far from any guarantee. Right up until 2021 Appen had an incredible track record of strong and profitable growth -- until it didn't.

The investors who spotted companies like XRF, Laserbond and Austco early (h/t @Wini), a few years back when earnings were flailing, have done very well. There's always some degree of luck, but those who saw the opportunity early had to look past recent reported results and instead try and figure the ROI on allocated capital (all these companies had been making sizeable CAPEX spends, which dampened the financials but built the foundation for subsequent growth).

That's super hard, and you can only give a company so much rope in trying to deliver on expectations. But business is hard, and even the best companies suffer all kinds of set-backs, so I probably tend to be overly generous in giving things time to play out.

Still, i'm mindful of a couple of truisms:

- With small caps, it's very often a case of gradually then suddenly. Shares can go nowhere for 3 years and then 5x in the next. ie. you can be too early and still achieve an excellent average annual return over the fullness of time.

- You only need a few big winners to underpin an excellent total portfolio return, even if a good number of individual investments don't work out. And the biggest winners are those that you find early (and manage to hold on to).

Anyway, none of this is to rationalise things with AVA. Things are not unfolding as I would have hoped, and i'll be out soon myself if things don't improve. But it's worth pointing out that this is normal, and to be expected across a portfolio of small cap, early-stage companies.

Not that my scorecard is anything to brag about (i'm only ranked #42 on the all-time leaderboard...), but I'll point to it given the sizeable positions it held in things like AVA, EVS (and plenty of other tragedies besides!)

Clearly, the last two years have not been great, but progress in investing is never a straight line. And it's a reminder to me that portfolio composition and structure is way more important than any one individual position.

Anyway, i'll stop rationalising now :)

topowl

If 14.1% pa is your low-tide mark after a couple down years....you're doing very well.

Wini

@Strawman I don't know AVA too well, I have owned in the past but haven't kept up too closely with it since. From reading the Straws on this report I do agree it could fall into the XRF/LBL/AHC bucket.

On those businesses, I agree they are three good examples of entering into good businesses at a cyclical downturn in earnings. However, as I have discussed in the past (I think we covered this in a meeting a while back), rather than looking to time a macro or industry cycle I think it's best to invest through a company's investment cycle. In all three of those examples you are correct that earnings fell or plateaued for a period of time, but only because management was investing behind a business that was actually still growing quite strongly. XRF was expanding into Europe with a greenfield office in Germany that bore operating losses for many years and masked the strength of the underlying Consumables segment. LBL had skilled labour shortages (unfortunately a common theme as highlighted by @Seymourbutts) which saw gross margins fall to 47-48% for a couple of periods before recovering. AHC invested very heavily in their product set to bring it up to the standard of tier one competitors and try and win larger and higher margin contracts, with profits muted (though the growing order book a testament to their good work).

But anyway sorry for backslapping myself and blabbering on, I think the main point of this is to agree with you that looking for good businesses that are going through some earnings weakness can be extremely lucrative, but I think the key is ensuring the earnings weakness doesn't stem from poor operational performance that requires a turnaround, but rather a solid and growing core business being masked by investment in other growth areas.

Bear77

@Hackofalltrades - I personally think AVA management are doing some good things, but they are making some mistakes, such as the recent dividend and the recent announcement regarding the Telstra framework agreement which lacked the necessary detail to avoid a "please explain" letter from the ASX. I won't comment on previous AVA management - beyond saying I'm not a fan of Scott Basham. I think they lack the experience needed to successfully run an ASX-listed company, as shown by those two mistakes I mentioned, and some others. I also think they are overpromising or guiding for stuff they are then unable to deliver. They undoubtedly have some decent gear to sell, and I like the machine learning side of the business in relation to nuisance alarms etc, which I previously thought could give them a real competitive advantage, however, from what I've seen, they are not getting enough traction quickly enough to propel the business forward at a good clip. That might come later, but in the meantime, how many capital raises will there be before they can become profitable and stay profitable, and actually grow those profits at a decent clip?

As @Wini says, "...the key is ensuring the earnings weakness doesn't stem from poor operational performance that requires a turnaround, but rather a solid and growing core business being masked by investment in other growth areas."

I'm leaning towards poor operational performance that requires a turnaround myself. I could be wrong. Obviously. We all have to make up our own mind about whether it's worth hanging in there with these sort of companies that take longer to come good than we had hoped. Wini has done very well by investing in the ones that have a solid and growing core business where business performance is masked by investment in growth, but as he says, he doesn't know AVA too well, and isn't invested in it clearly (because if he was invested in it, he WOULD know it well). I personally prefer to set some limits for traction, and AVA has exceeded their limit in my view - for me anyway. So I'm out.

Bear77

I can't help with names, but I know they have plenty of competition @Hackofalltrades , and my understanding was that it was/is mostly from much larger companies, so one of the benefits of choosing AVA to secure your site was that they would customise solutions to suit you, something that some of the larger companies don't bother with as they don't need to - they can just sell off-the-shelf solutions and leave it up to installation contractors or other people to mix, match and/or modify components to suit their client's needs - and AVA were small enough to provide more personalised service, however they did sell off their services division in 2021 for $63 million (AVA Risk Group (ASX:AVA) to sell off services arm for $63.1m | The Market Online), which incidentally is more than AVA's entire market capitalisation now, and I held them back then, before that sale, but sold out over concerns around that and also around the revenue cliff that the completion of the very lucrative IMOD contract might result in, but then I bought back in (at around 23 cps) in mid-September 2022 after watching Andrew's meeting with Rob Broomfield here on Strawman - but I had been following them since 2020 and expecting them to become profitable in 2023, but here we are - and their graph suggests that they've been in decline since late 2020:

Those last 3 years don't paint a pretty picture - it certainly doesn't look like a great little company with a good business model and capbale management who are executing well. Their share price is now fairly close to where they were five years ago, with a couple of dividends along the way, one of those being a big one - 13 cents/share (unfranked) in March 2022 to distribute some of the proceeds of that services division sale to their shareholders. When I bought back in (in September 2022) I thought they had been oversold, but I reckon now I was wrong about that at the time.

The past 3 years (2021 to 2023) is the graph of a company that continues to overpromise and underdeliver, and to underwhelm the market. I kept reviewing them every 6 months saying: They just need more time - but lately I'm saying: Just how much more money do I want to lose with this company?

So from where they were back in 2020, I think they should have been consistently profitable by 2023 at the latest. They've had some headwinds. All businesses do. Covid was a reasonable excuse when you can't get around the world and demo your products to potential distributors and customers because travel is shut down and people are in lockdown everywhere, but that was back in 2020 and AVA actually powered through 2020 - and that was reflected in a rising share price - as shown on that graph, then they sold off their services division, which was - I believe - a lot to do with large incentive payments that the then AVA Board and Management stood to receive at the time if the sale went through, and they had that massive IMOD (Indian Ministry of Defence) contract which we all knew had a finite end and if they couldn't find any similar contracts to replace it there would be big hit to revenue.

They haven't found anything that even comes close to that IMOD contract - it was a wonderful contract, very profitable, but it didn't last forever. So plenty of potential, but not much in terms of runs on the board in the past couple of years, so I've sold out to redeploy that capital into a company that IS growing (XRF). I've learned to keep unprofitable companies on a reasonably short leash - so if they miss their own guidance on multiple occasions, it's usually time to move on, or if their margins are heading in the wrong direction, as AVA's were in their recent half year report.

I review my investment thesis for each company I hold at least every 6 months after they report, and also when I become aware of news that may well impact the investment thesis inbetween reports, and if they haven't met or exceeded my expectations I will usually re-evaluate the investment case and see if there is still more clear upside than there is obvious downside risk. In AVA's case the downside risk is that they are still burning cash rather than making money, so they will have to raise capital if they can't turn that around real quick, and a capital raise for a company that is already down - as they are - is going to be at a significantly lower price than where they are trading, unless they can pump the share price first with some positive news. So that means shareholders can either pour more good money after bad, or get diluted even further - so their shares are worth even less.

Every "miss" is a black mark, such as guidance that is not achieved, and they have too many black marks for me, so that's what I mean in terms of traction limit - I've given them more than two years and they haven't made any significant progress in terms of sales traction, just the southeast progress of their share price.

My thoughts are that if they do indeed have a great business and capable management, I should have seen a lot more traction by now that would have resulted in profitability and earnings growth. While I did sell all of my (real money) AVA promptly on the morning they reported (Monday of this week) as soon as I read the report - and lodged a sell order here on SM as well - I now realise that I've lost more money than I needed to by holding on to them for as long as I have.