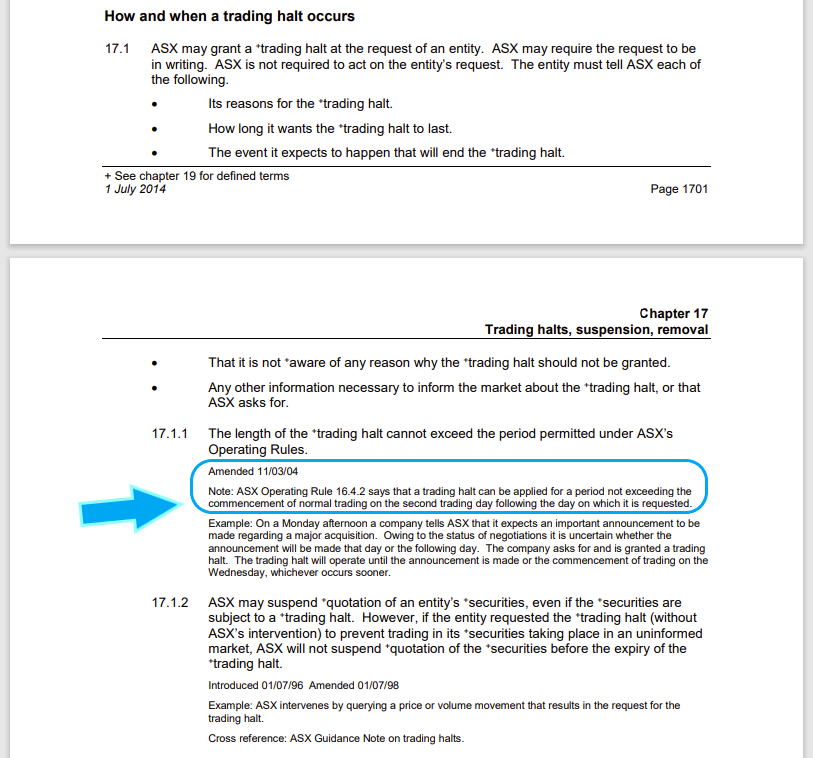

I won't disagree with any of that - because I have a low opinion of 3DP's management also, and I won't invest in them, but just to clarify: Trading Halts have short time frames, as explained in the ASX-Listing-Rules-Chapter17.pdf - at 17.1 on pages 1701 and 1702, as shown below:

The example that the ASX give there directly below the rule that I've highlighted in blue is EXACTLY what happened here in Pointerra's case - except that the reason for the trading halt was an announcement regarding the award of a material contract rather than a major acquisition (a major acquisition being the reason used in the example above); Pointerra requested a trading halt on Monday afternoon, so they had to either make the announcement that lifted the trading halt on Monday afternoon or Tuesday, but by the commencement of normal trading on Wednesday morning at the very latest OR instead request a trading suspension because they need more time, and a trading suspension can continue indefinitely as long as they continue to pay their listing fees and do not break any of the other listing rules. If they do NOT request a trading suspension before the trading halt is due to expire (commencement of trading Wednesday in this case, and in the example given by the ASX above), then the ASX will AUTOMATICALLY roll them into a trading suspension. They ALWAYS do, at the START of the SECOND trading day after a trading halt has been called for if the company doesn't do anything, because a trading halt can not exceed one full trading day after it has been called for, and that full trading day was Tuesday.

So it's not so much that the ASX was all over them, it's just the way trading halts work. They are very short term, and if the company needs longer than the full day after the trading halt is called for, then a trading suspension is their only option. You can keep extending a trading suspension indefinitely, but not a trading halt.

To clarify further, with regard to the ASX's wording in today's announcement (on Wednesday):

It sounds like the ASX is saying that they wrote to or emailed Pointerra on Tuesday (27th Feb) requesting specified information, and they MAY have done that, however as I understand it, the listing rules REQUIRE 3DP to provide that information (details) about the "material contract award" on Tuesday, or before the opening of trading on Wednesday at the latest, because the impending disclosure of the details of the "material contract award" was the very reason that 3DP gave for their trading halt request on Monday afternoon, so the wording in the ASX's announcement on Wednesday (reproduced above) is that 3DP have failed to comply with that "requirement", not failed to comply with that "request", so I'm fairly sure this was automatic, based on the listing rules, rather than being the result of 3DP failing to respond to a "please explain" letter from the ASX. At this point at least.

That's trading halts. Now to trading suspensions - which 3DP are now in - If a company calls for a trading suspension then it has to give an expected timeframe, which can be days, weeks or months, but when the ASX move a company into a trading suspension either automatically (as in this case) or because they have issues with some aspect of a company's announcement(s) or behaviour and they have issued the company with a "please explain" letter and are awaiting a response from the company (likely NOT the case here, yet, but it could be the case if 3DP's first announcement - which we are still waiting for - is deficient in the view of the ASX), the ASX do not give any timeframe because the ball is in the company's court, and the ASX has no idea how long the company are going to take, and don't much care, as long as they aren't trading. In these cases it's all about market participants being able to trade in a fully informed market, so while a company is suspended from trading there are no concerns about that, because no trading is taking place. The ASX is prepared to give companies as long as they wish to take in these cases, because as long as they're not trading, there isn't much for the ASX to worry about in terms of that company.

In summary:

- Trading Halts - can only last until the opening of the SECOND trading day after the trading halt is called for, no longer. It can be shorter, but not longer. Can not be extended.

- Trading Suspensions - can last indefinitely. No time limits.

There is one further step, which is called "Removal from the official list", otherwise known as delisting, and it's usually permanent. It occurs when a company is taken over by another company or when a company doesn't pay their annual ASX listing fees within the required timeframe, or for other various reasons. A company going into voluntary administration doesn't mean they will get delisted immediately; there is a process when companies go broke, and it takes time, but a company in that situation would be suspended during that period before eventually being delisted. 3DP is not in that situation at this point in time.

So for all intents and purposes a trading halt and a trading suspension really aren't any different from each other, other than one has a short timeframe and the other doesn't have any limits in regards to time (except when a company is subsequently delisted - which is not applicable in this case at this point in time).