Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Down to the wire for 3DP 4c traditionally never a good thing. Still here because there is no point in selling! Av price 20c. IO how are those receipts and all that potential coming?

Someone made a good point IKE had a great qrtr people are spending in the sector maybe just not with Pointerra?

Sep 25

Previous Forecast vs Actuals

Updated Valuation

Updated Forecast

Sep 24

- Bear - 15% Annual Growth Rate

- Base - 25% Annual Growth Rate

- Bull - 50% then 35% Annual Growth Rate

15% Discount Rate

Q4 - New quarter. Same story.

The Good (*Once again these are based of statements with no backing of data)

- Amazon have recommenced their long delayed yard mapping project. There may not be a lot of revenue that comes out of this in the end, but it's a solid logo to have when promoting your product.

- Storm response module now live with Entergy with expected subscription to start in Q1FY26. Once again not likely a significant value item by itself, but it may start to be a contributor to the unknown ARR figure.

- Three new mining sites added in conjunction with GridVision. The partnership commenced in H2FY24 and now looks to be gaining some momentum.

- Renewals with Australian Transport authorities at higher rates and increasing numbers should lead to increased revenue off the same cost base.

The Not So Good (*Based on the facts)

- Cash receipts did not rebound to Q2 levels as stated in the Q3. Only $1.6m in cash received which is less than the long term quarterly average since CY22. This resulted in a cash out flows of ~$1m and cash balance decrease to $1.9m. Once again less than two quarters of runway left. There hasn't been too much of a change in operating expenses so if additional revenue can be captured and realised there is an opportunity for operating leverage.

- Appear to have missed out on the contract with Australian utilities that were tendered on a while back.

Watch Status

- Decrease in sentiment. Pointerra has for the last several quarters been on the verge of what looked like it could be a turn around in the business. At this point until there can be some consistency in the financials and some improved reporting metrics it could all still be a big fluffy sales pitch.

Valuation Status

- Valuation updated. Due to tracking in line between previous Base / Bull cases. Small increase in base case numbers. Small increase in likelihood of Bull Case.

What To Watch

Some progress made on a few items.

- New Q4FY25

- Digital Surveyor to launch in Q1FY26

- General watch - Grids IV Updates

- GeoPanel Opportunities with Leidos Australia

- Previous Quarter

- Cash receipts expected at Q2 levels. ~$4m❌$1.6.m. Forecasting much bigger numbers again

- Contract Updates? Entergy Resilience Program / Enel Columbia /? Updates? Progress?❌No Updates

- Paid storm response assessment for new utility customer to be carried out in Q4✅ Completed with Entergy. Annual subscription transition expected in Q1FY26

- WA miner hazard management pilot to commence.✅ Commenced. Completion expected in Nov / Q2FY26

- Multi year contract extension with East coast road/rail customers expected in Q4✅ Contracts renewed at increased ARR

- Older

- Teamed up with two utilities for JARVIS. Expected selection in Q4❌ Submission completed, selection now expected early FY2026

- Engaging with European rail operator ❌ No Update

- Oil and Gas exploration implementation to be completed in Q3. ❌ Ongoing. Nearing completion

- Indonesian national mapping program. No time frame provided.Q2FY25❌ No Update

- Commercial agreements being finalised with global engineering software provided for integration of Pointerras pole loading and analysis. Q1FY25 ❌ No Update

Late Q3 review. Is Pointerra an opportunity for EOFY selling and a potential positive swing in Q4 and full year results?

The Good

- DoE Hurricane R&D program to start in Q4.This isn’t a significant amount and the payment schedule is unknown, but having ~$3m AUD in contracted work progressing assists in cash flows. The Q3 results highlighted that there is still a reliance on these government programs.

- Ongoing platform development and expanded regional hosting.

The Not So Good

- The roller coaster continues with a pretty poor quarter for cashflow following a solid Q2. Management has tried to put a positive spin on this by highlighting the YTD positive number of $0.1m and $4.5m of receivables but the result shows how lumpy the cashflow still is. With only $3m in the bank it’s still not a comfortable position.

- LAST CHANCE Alert - It is called out that Q4 receivables are expected to rebound to Q2 levels. This is a very different statement from the previous program delays. I would hope that with the history of disappointments and misses a statement like this wouldn’t be issued lightly. If they were to match Q2, it would put 3DP into a position for a positive cashflow year and a solid foundation for FY26.

- Some progress looks to be made on announced historical programs, but the quarterly updates tend to say alot without saying much. @Strawman Is there an opportunity to line Ian up again so that we can try to tease out some more details here? I know Pointerra is out of favour with the community but the last meeting was back in 2023.

Watch Status

No Change. - Negative Cashflow offset by new contracts and forecast.

Valuation Status

Review at Full Year - Half Year Position - Revenue - $6.9m EBITDA - $690,000 - Tracking toward previous bull case.

Sep 24 Valuation

What To Watch

- New Q3FY25

- Cash receipts expected at Q2 levels. ~$4m

- Contract Updates? Entergy Resilience Program / Enel Columbia /? Updates? Progress?

- Paid storm response assessment for new utility customer to be carried out in Q4

- WA miner hazard management pilot to commence.

- Multi year contract extension with East coast road/rail customers expected in Q4

- Post Quarter - Contract negotiations for GRIDS IV expected to take several months. First contract opportunities ~ Q3FY26?

- Previous Quarter

- Working with multiple energy utilities on upcoming DoE funding applications for digital twin development. ✅Teamed up with two utilities for JARVIS. Expected selection in Q4

- Engaging with European rail operator ❌ No Update

- US GRIDS IV program to be announced in March 25. ❌✅ Announced after end of quarter. One of eight consortia selected for the panel. Teamed up with Leidos. A positive signal for Pointerra's technology

https://www.leidos.com/company/who-we-are

- Oil and Gas exploration implementation to be completed in Q3. ???? Ongoing

- Indonesian national mapping program. No time frame provided.????Ongoing

- Older

- US electric utility vegetation management solution. Extended to Aus & NZ. Expected awards in FY25 - Q1FY25 ✅ Contract with Davey Resource Group. Estimated revenues of over $500m

- Commercial agreements being finalised with global engineering software provided for integration of Pointerras pole loading and analysis. Q1FY25 ❌ No Update

- Submission of pricing to two Australian electric utilities Q4FY24 ❌ No Update

- New sectors with global sporting companies - Q4FY24❌ No Update

- Rollout of Mill Module across 8 sites over the next 12 months - Q3FY24 ❌ No Update - 12 months old. To be removed

- Global rollout of Master Model with a global mining customer after completion of trials. Q3FY24 ❌ No Update - 12 months old. To be removed

- Final negotiations with global Miner for hazard management platform. Initial demonstration to be completed Q3FY25 ✅Paid pilot implementation underway.

- Pre-implementation review with an Oil and Gas operator for exploration activities. Contract award expected in FY25. ❌ No Update - 12 months old. To be removed

TA isn't the best tool to call on for volatile and speculative microcaps that are prone to wild swings.

Today's breakaway follow through was roundly rejected, but the price held a level that is close to the "twin peaks" of July/August last year, so that bodes well. Let's see if the market can build on that to the bullish side in the coming weeks.

A strong update, and the market has reacted accordingly, sending shares soaring nearly 50% on high volumes.

Hopefully it can kick on from here for long-suffering holders.

Just had a look through the 3DP AGM notice and saw resolution 8 on p21 for 12m Options granted to Lynx for Corporate Advisory Services...

https://www.marketindex.com.au/asx/3dp/announcements/notice-of-annual-general-meetingproxy-form-6A1234217

AGM is 5pm Fri 29th Nov - the last possible moment (and no virtual option for those without easy access to Subiaco), but that shouldn't surprise, the best ones always go last ...

This resolution is to place with Lynx 1.5% of Share on Issue. Exercisable at $0.06, so effectively raising $720,000 (and then spending it straight away) if the price gets there (20% uplift from here).

It's a lot of capital to be paying away for 12 months of advisory services (that's already started), so what do shareholders get for it?

"The advisory covers investor awareness, investor engagement, introductions, strategic capital advice and other general advice."

"The Company agreed to reimburse Lynx for all reasonable out-of pocket expenses incurred in connection with provision of services under the Mandate, with approval of the Company required for any single expense in excess of $500."

My thoughts

This seems a little desperate to me.

They must fear another damaging cap raise around the corner - App 4C due out tomorrow, after close most likely.

So they just paid 1.5% of the company to (among other things) get connected to cap markets players for a potential equity raise - which will then pay Lynx a further 6% of any such raise.

So 3DP is aware of the potential need to raise capital and this will cost 6% + 10%? of any amount raised. They're effectively taking about 85c in the $ of any Cap Raise on this basis.

Didn't they get a vulture capitalist on their board who should be across this sort of thing - or are these his cronies?

A reminder of the importance of management in smaller companies...

Disc: No longer held

No sales/profit result detail and usual wall of text presentation slides and excuses of customer receipt delays preventing operating cash flow positive – note to management, if it happens 10 times in a row, expect and plan for it!

· $2.66m in receipts (Vs Q3 $0.77m)

· -$0.18m operating CF, cash receipts delayed a positive Qtr which was the same comment as last quarter.

· Raised $2m from share issue in the quarter

· $2.7m closing cash for the quarter

· Work is “commencing” on the $2.5m US DOE grid resilience program.

Still not sure why I am holding this.

Disc: I own RL, had the sense to dump from SM

3DP on Ausbiz - Watch here

Ian Olson, CEO of Pointerra (ASX: 3DP), illuminates the company's approach to supporting US energy utility sector. Pointerra has been steadily focussed on this sector since 2018, offering innovative solutions to utility companies struggling with the sheer scale of infrastructure investing. Ian says the US government's major investments in infrastructure have necessitated innovative solutions like those of Pointerra, offering digital twin data-enabled risk assessments and helping companies direct capital in a smarter way.

The key objective for Pointerra is recurring revenue. Although currently they hold less than ten contracts in the US, many of these are with large scale utilities, leading to large revenues and opportunities. Pointerra's target is approximately five million IRR from each of the top 50 US utilities, a figure that translates into a significant sum in Australian dollars. Despite the long lead times associated with these contracts, Olson maintains that the return on investment is worth it.

Olson further expounds on Pointerra's business model of targeting various sectors like mining, oil and gas, and civil infrastructure. He focuses on the importance of innovation in a world where there are material and labour shortages, reinforcing Pointerra's key role in driving critical changes. Also, he notes the prominence of AI in Pointerra's operations, helping to create smarter analytics and predictive models, ultimately optimising customers' capital expenditure.

Despite a dip in the share price, with a return to profitability and increased revenue diversity, Olson remains confident in the future success of Pointerra.

Well I almost fell off my chair- look who is bringing some revenue in before June 2025!

All that bike riding paid off - a little 1.6 mill.pdf

PVL.asx announced today a strategy update.

It seems they as PE, bought into 3DP recently on 05/06/24 for $198k for 6m shares at 3.3c as part of the recent institutional placement. I use PVL as an avenue into PE ownership...but I am also still a bag-hodler for 3DP.asx. Oh the irony of owning PE but owning a public company?

Looking at the strategy update, I suspect they are planning on flipping the shares and not holding long term.

I’m sorry for those that still hold shares but when the company is involved in Court proceedings to set aside a statutory demand it is usually not a good sign.

POINTERRA LIMITED -v- HERE EUROPE B.V. [2024] WASC 212

http://www.austlii.edu.au/cgi-bin/viewdoc/au/cases/wa/WASC/2024/212.html

The expected cap raise has arrived. I hope they have lined up an investor as current shareholders are unlikely to cough up much if anything given the last dismal capital raise. So which type of new bike will Ian purchase. Colour me cynical. Not one word on new contract not a peep.

Oh boy, 16 pages of high gloss....

Was it @Wini that coined the law (sorry if it was someone else) regarding the number of pretty pictures stabled to the front of the 4C's inverse relationship to the result contained within the 4C?

The headline number of customer receipts is down to $0.77M (from Q2 $1.33M). To be fair, the shiny picture that highlights $1.04M has been received in this April (2024) alone is a solid data point...

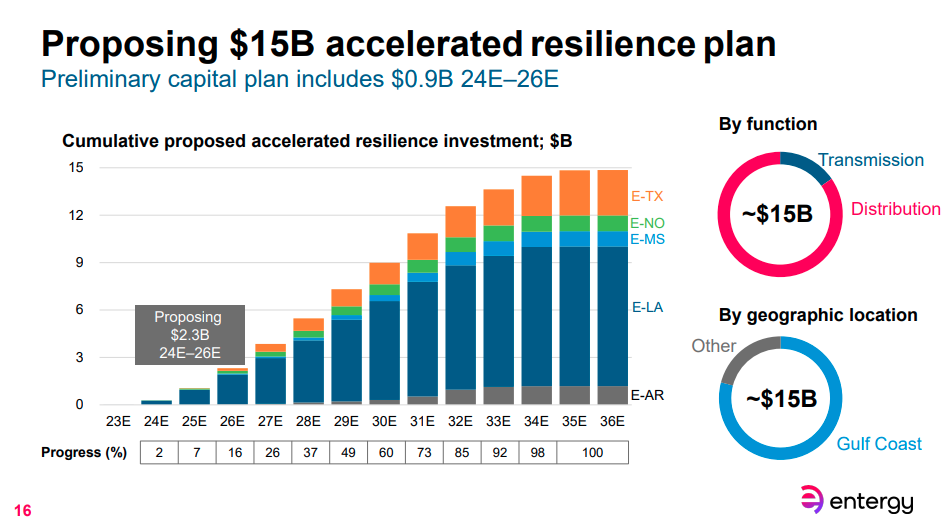

From a recent Entergy pres:

So the "material contract" was a bit of a whimper, but hey, atleast it wasn't bad news...

The Good

- Partnerships with data capture hardware providers will help reach wider markets and use cases. These companies do tend to have their own software solutions though.

https://www.teledyneoptech.com/En/Home/

- Currently pending contract announcement

The Not So Good

- Customer receipts of $1.33m. Cash receipts are now trending down over the long term.

- With operational cash outflows of $1.45m the company's cash balance is now at $1.5m. (plus addition of $1.04m placement). This leaves room for just over a quarter at the current cash burn rate. The directors believe that the cash will be coming, and its been repeated for the last several quarters.

- It is now coming down to do or die for Pointerra in this regard. Looking at the expenses, it doesn’t look like there are many areas where spending could be stopped easily, unless they look at cuts to the staff situation.

There are also reportedly $1.5m in deferred payments due in H2, which could help the situation.

- Based on all the positive developments in the slide deck, one would think that the company is kicking goals. Alot of the statements sound good, but it is hard to quantify anything from the updates, and historically they have not translated to revenue growth.

- It already has been discussed heavily here, but failing to meet ASX requirements for trading halt / suspension highlights some of the issues which have been ongoing for some time.

Watch Status

Deteriorating

Valuation Status

Increase likelihood of bear case

*FY24 Annualised numbers

What To Watch

- Grid reliance programs are set to restart in CY24.

- Engaged in discussions with several new U.S energy companies for support climate change response initiatives. First round of federal funding announced, second round is open

https://www.energy.gov/gdo/grid-resilience-and-innovation-partnerships-grip-program-projects

- Negotiating with global engineering company (Jacobs?) delivering a digital twin. If successful this will provide a good case study on application of the portfolio.

- Further deals with Enel across operating regions outside of Columbia (Carried Over)

- Amazon start up delayed from December to Q4FY24.

- Updates to the start of the Entergy program

- Use of the pointerra platform by Gridvision

- Results from pipeline inspection trials - 500km gas pipeline - Working with several partners, this could be the start of a new growth vertical.

- Digital Twin integration from construction with an Australian Oil and Gas company. It would be good to get more detail on how they are executing on this.

- Next generation point cloud data format now completed testing and rollout during Q3.

- Cash flow + and EBITDA + still reported as attainable in FY24.

With the release of the H1 Results after the close on Friday, I did a 'snapshot' analysis on those metrics (see my previous post) which displays progress (or lack thereof) during the period, this intended to highlight the strength of 'carry' into the second Half. The NAV plunging to more than - AUD 3m (Balance Sheet Insolvency) coupled with the Auditors Report coverage on the Company's ability to continue to operate as a Going Concern constitute a sobering thought which cannot be dismissed. The Deferred Revenue and Receivables numbers as at 31 Dec hardly inspire and the AUD 2 m shortfall when comparing Receivables and Payables number all suggests the squeeze is set to continue. The AUD 100k decline in Payables is not material.

I have subsequently gone through the narrative + numbers in more detail and can comment as follows :

- My comment on the Company returning to Positive Operating Cash Flow in H2 was incorrect. Whilst this is certainly implied, the Company said..." H2 FY24 offers the opportunity to showcase the capability with a view to the delivery of a POSITIVE H2 EARNINGS result for the Company." This becomes a message on the Income Statement Revenue) opposed to the Balance sheet (Cash). Also a huge uptick in terms of aspiration.

- The narrative clearly states that the program delays are resolved and the Utility spend is coming back. This coincides with the fact in the USA, the financial year runs January to December. So Utilities are cashed up interms of Budgetry spend. Tax credits will be flowing towards Utilities from the Fed's Infrastructure USD 1.25 TRILLION Infrastructure Resiliency & new Climate Change intergrations. Remember Data Capture & Analytics will feature as a 'front end' activity in any plan in support of prioritizing work.

- Right now, the ASX have suspended Pointerra regarding an announcement on a 'Material Contract Award'. Amazon roll-out is planned for Q4 FY 24.

- Then, the Company have advised that during the Half Year, spend by existing Customers grew across Pointerra's target market sectors with the award of multiple new contracts with Existing and New Customers. So, do we have a new pipiline of growth across the non Utiliy verticals.

- Building on the above, they report that the Company continues to EXECUTE on it's Strategy in both Mining and Oil & Gas Sectors, focusing on the use of Pointerra3D to support Capex, Operations & Maintenance with an Australian Miner. Implies awarded work in progress IMO.

If we go back to the key message in the H1 Financials. " The Recorded Revenue & Customer Receipts were well below Company expectations due to previously communicated program delays with KEY US Energy Utility Companies, which impacted the Company's Invoicing and Cash collection, ALL OF WHICH are expected to resolve during H2 FY24.

In closing we have felt the pain of the pause in buying by the US Utities. If they are back, Revenues will ramp USD 10m / year based on FY 22 numbers, Then add the Entergy deal conservatively worth USD 7 m a year PLUS

- PLUS Amazon

- PLUS further participation in Fed's USD 1.25 TRILLION Infrastructure Resilliency Program

- PLUS growth ex numerous new Partnerships

- PLUS new momentum in other verticals

- PLUS new geographies

Having done the Research on the process being adopted by Utilities to embrace the ginormous USA Infrastructure andClimate Change agenda + validating that the 'Pause' is real, I am staying the course on this one. Can reassess with the ASXapproval 'material contract' announcement, hopefully this week, the Q3 4c (end April), the Q4 4c (end July), the FY 2024 Financials and if all fails, a Banya Software takeover offer where Ian & Team remain involved in the Business and we shareholders get offered x cents per share.

RobW

Despite still being in an ASX Suspension Period pending resolve on an issue over an announcement regarding a 'Material' Contract, the Company released their Half Year results after the market closed.

Herewith a copy of my Hot Copper post which provides some early observations.....

The Half Year Financials were never going to be pretty. The Company is essentially in what they call Balance Sheet Insolvency. Whilst this is different to trading Insolvent (where you cannot TIMEOUSLY fulfil your obligations in terms of Liabilities),the underlying comparisons over the last 6 months do not point to an improving situation.

Negative NAV ...extends from AUD 1.581m to AUD 3.207m

Receivables... down from AUD 2.723m to AUD 0.606m (compared to Trade&Payables of AUD2.518m)

Deferred Revenue ...down from AUD 2.712m to AUD 2.270m. Note : A portion of this may be for Advanced Payments and therefore not Accessable.

And finally, the only 'small' positive

Trade & Other Payables .... down (less than previous) from AUD 2.615m to AUD 2.518m

Lots to digest in the report, but the above IMO points to the urgent need for a capital injection. CR, loan or if Directors stump up. Debtor Factoring... not much to work with.

The Company talk of a cash flow positive H2. Had they used the ' Changes since 31 Dec. comment section' to provide some numbers on Cash Receipts during Jan & Feb or booked Revenue since 1 Jan, may have supported their stated confidence on a rebound. But not to be, Just the confirmation of the AUD 1m placement to an original Founder. Helps but not enough to fix the above.

Next 4 months crucial IMO.

Rokewa

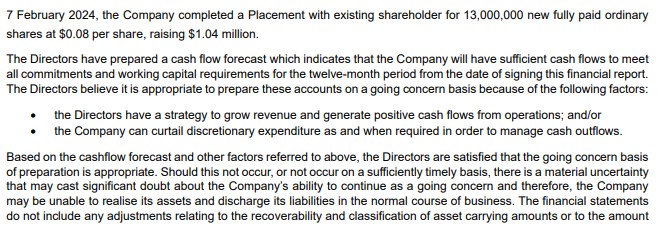

ASX have suspended Pointerra for not responding regarding details / content of 'a material contract award' announcement which justified their trading halt on the 26th. Announcement was not forthcoming this am and the ASX challenge was yesterday (27th). Welcome the fact that the ASX are all over this. Time for Ian to realise Pointerra is a listed Company and non compliance has consequences. Recent placement of 13 m shares at 8 cents (90% premium to the market price ??)

All said, the probability of Pointerra delisting and going the Banya Software route is up a notch.

Let's see how things unfold. H1 FY 24 results due by COB Thursday.

RobW

Any Ideas?

Partnership with Emesent confirmed by Emesent. This is good news, they have a good grip on Autonomous flight lidar solutions and are quite large in the mining industry around the world.

Emesent are also out of Brisbane a good Australian success story.

Pointerra have updated the market this morning after appointing a strategic reseller for the Middle East region -- specifically to 'resell and implement the Pointerra 3D Digital Twin Platform".

With an initial term of 2 years, the agreement does not contain any minimum sales or revenue targets. It currently isn't material and it is not possible to currently quantify any revenue impact for the company. The update is more noise and unnecessary of a release to the market.

My take: this is likely another classic 'must be seen to be doing something' announcement to the market before releasing another set of subpar results.

Disc: NOT HELD

Ian Olsen has been interviewed by RAAS https://www.raasgroup.com/

One of their services is to "We work with small and micro-cap companies to raise their profile and generate market interest."

I wonder why share price is important? Interesting given recent board to change to include guy from Banyan software.

Anyway, my points from the interview.

Not much different here to the recent Strawman interview.

https://www.pointerra.com/investors/presentations/

- Ian said FY 23 was unacceptable result

- planning to be EBITDA and cash flow positive this FY

- Got caught on wrong side of big utility program pauses and had also increased costs with new exec hires

- Calendar 24/25 in US will significant

- He says he is being told to worry about whether they have enough capacity for future years but the utility programs are huge and need to happen. The programs are multi-year and unprecedented in how much data is to be created

- Expects FY H2 to start to see this revenue come through

- He defends the lack of ARR figure by saying the he want the utilities revenue to be baked in and not program related like it is currently. He is thinking the ARR figure will be available Q3 rather than before Xmas

- They have a Tier 1 global mining customer who is deploying them across more than 40 sites in more than 12 countries. Looks like more than $1m/year. Takes a while to roll out but no timeframe provided.

- Amazon digital twin work is supposed to be a 700 site rollout and > $1M ARR

- Work has restarted planning for rollout. No timeframe for when.

- Work was paused when Amazon went through a restructure

So the revenue can has been kicked down the road to Q3.

Is he just trying to keep the ship afloat or will we look back at current share price and think it a bargain?

Easy to look past the recently announced Board Changes as all in the course of business. Someone stands down and someone new (with perfect skill set) steps up.AGM on the 22 November 2023.

Worth checking out the Banyan Software website. You will quickly realise that the newly appointed Non Exec Director may have a different agenda. Whether Ian has initiated this is anybody's guess, but on the back of a challenging year (program delays), the inability to land the FULL cap raise, the fall-out in terms of investor sentiment and the share price, and then comments like 90 days comes around too quickly (ASX reporting), just maybe they are seeing this as a pathway to de-list / go Private.

Herewith Banya Software's Xmas message end CY22....

Looking forward to an exciting 2023!

We're excited to have grown to 25 businesses and over 1000 employees across North America, the UK and Europe, and Australia. And, we're proud to continue to be 100% referenceable by all the owners who have chosen us as the next permanent home for their business. There's significant capital behind us and we expect to be very active across Australia and New Zealand in the year ahead.

My money is on a much bigger agenda here.

RobW

So back to close to 2019 share price levels. All these apparent contracts not converting- SP in free fall. Looks like the market is very clear about 3DPs performance. AGM will likely be a bloodbath.

Curious as to what others thought of the meeting today.

On one hand, I can totally take Ian at face value:

The company was growing rapidly, funded by extremely supportive capital markets and they had a monster opportunity ahead of them... and then, with the big deals concentrated in a specific geography/sector, their giant US counterparties pulled back on all CAPEX as they got whacked with higher rates and constrained by capped pricing.

So 3DP went from (arguably realistically) expecting $3-4m in quarterly cash flows, to finding that they didn't even have enough to fund costs and ongoing development. In short, the world changed on them before they could hit sustainable profitability and are now faced with the challenge of funding operations and growth, but with an ever shrinking balance sheet.

Importantly, according to Ian, these projects have not gone away, they were suspended instead of cancelled, and are expected to resume in the coming months. To such an extent that Ian seems to think they can deliver CF and EBITDA +'ve results for FY24.

If true, shares are probably extremely cheap. We'll see a confluence of revenue booked in one of these quarters which will prompt a material re-rate as the growth narrative is once again seen as realistic.

On the other hand...

Regardless of the external operating environment, the company has scored some big home goals in over-promising, cancelling a core reported metric and poorly executing a capital raise. Rightly or wrongly, that's done a lot to undermine trust. And trust is everything here.

Ian talks a good game, but until we see evidence of a turnaround, it's easy to take the assertions as wishful thinking. Even if the general nature of the situation is as Ian describes, there's still the potential for big clients to delay further, or renegotiate better terms. And there's not much spare cash left at this stage either..

I'd really like to give the company the benefit of the doubt, but cannot in good conscience add to my (now relatively tiny) position until we see more clarity and progress in the reported financials.

As expected.... sigh. Another underwhelming quarter, referencing project delays and promises that additional contracts are coming.

Fundamentally, my investment here looks to have been a bad one. @mikebrisy's recent analysis paints the perfect picture -- this is not mission critical software as my investment thesis initially suggested. They are struggling to win contracts, are no longer growing sufficiently and perhaps most importantly I no longer believe management are competent enough to take the business forward.

Last year in general was a shocker -- cash receipts collected went backwards considerably, while costs widened. This is continued evidence of more of the same. Perhaps what grinds my gears the most is management suggesting they had the capital required to operate sustainably, before eventually succumbing to what was a much-needed raise at dilutive levels. Their strategy has not been effective to date and I wouldn't be surprised if we hear the dreaded 'strategic review' in a year or two.

Stepping backwards, I think they have spread themselves too thin. This is a good case that demonstrates you should target certain industries/thematics and not try and be a 'jack of all trades' across the board. This approach is difficult when you are cash flow negative, particularly in the current environment where funding is increasingly difficult to obtain. I also don't think we can make a case that Pointerra are genuine market leaders, and their balance sheet and growth (or lack of) supports this.

More than anything else, my decision to sell at these levels boils down to the fact that this just doesn't appear to be a high-quality business like I once thought, and there are much better opportunities elsewhere.

Disc: sold

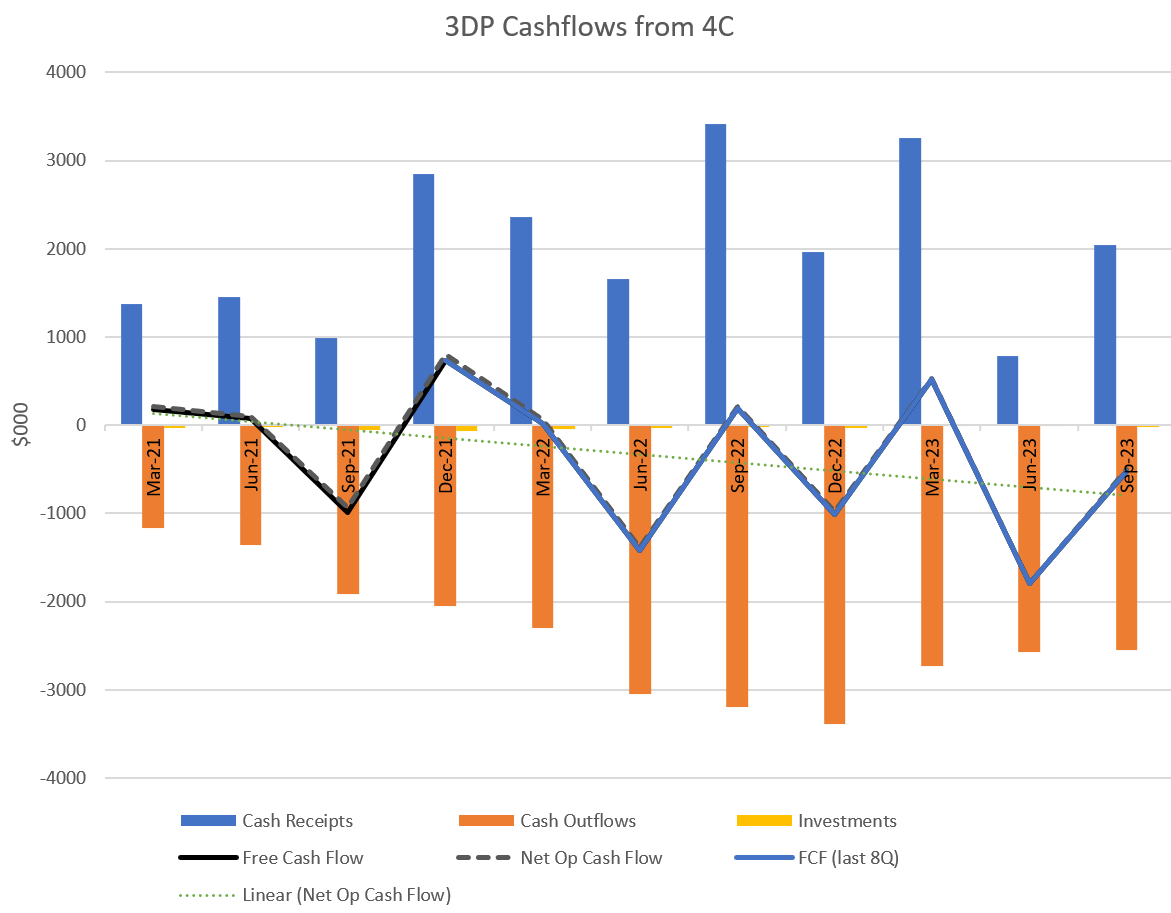

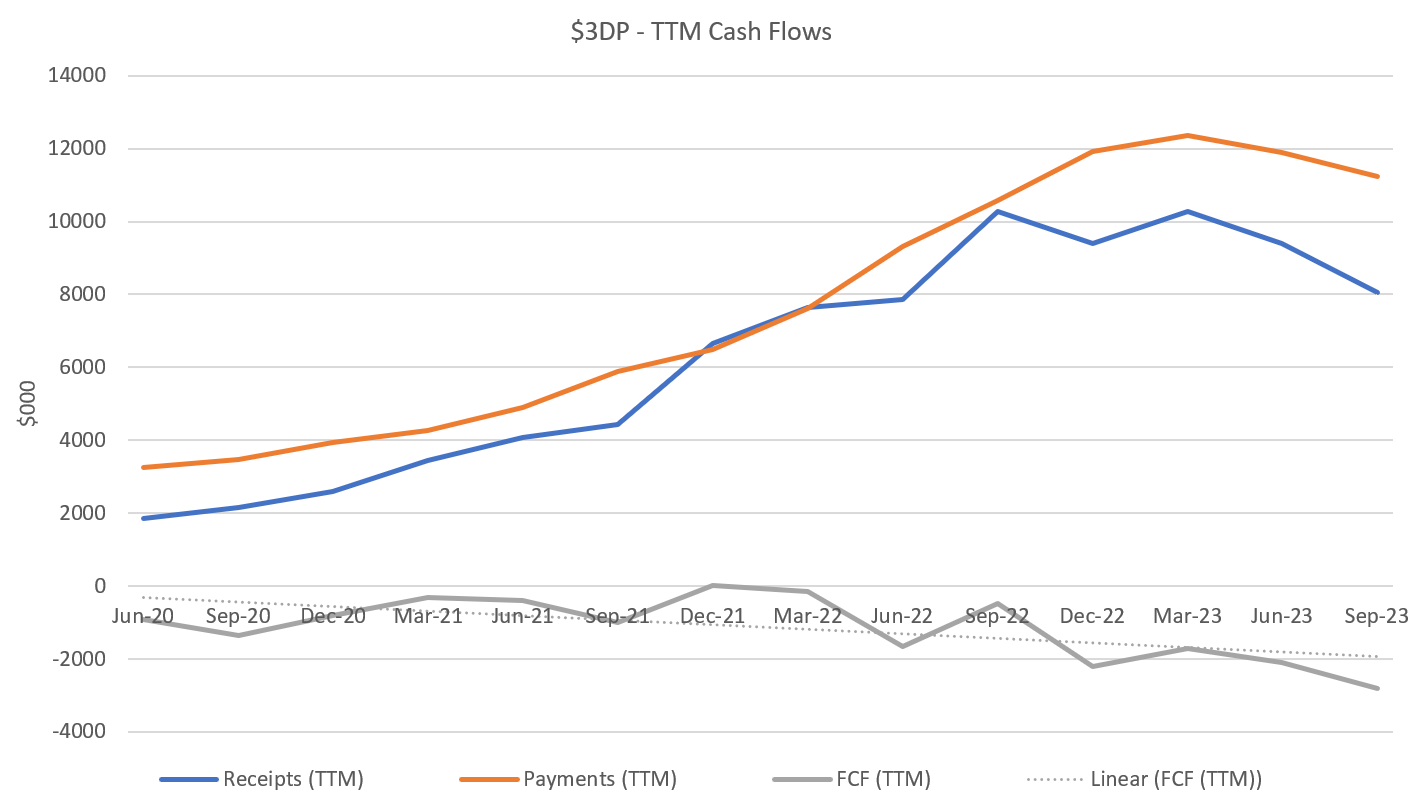

Others here are following $3DP more closely than I am, so I will hold back on the broader commentary.

However, I have just updated my trend charts on CF.

Figure 1 - Quarterly Cash Flows

The faint dotted green line is the trend on FCF over 8Q.

Just to highlight that the trends are fundamental, I have plotted the data in a rolling Trailing 12-Month format (TTM):

Figure 2; Cash Flow Trends TTM

This visualisation shows the same trends but takes out some of the noise.

My Key Takeaways

The business has declining receipts. But it can't control costs well enough. The gap between the receipts and costs trajectory is widening.

Absent a breakthrough, this is in danger of entering a death spiral. Not only does it lack scale, but its not even showing a trajectory to ever reach scale.

Not investible from my perspective.

Hopefully this provides some fodder for questions to Ian later today around sustainability of the business. (I'll have to catch up with the recording later, as I have other commitments today and can't attend.)

Disc: No longer held in RL and SM

An encouraging update, although quite vague from a financial standpoint.

New commercial agreements announced, one with an initial US$312k pa subscription, and all with expansion potential.

New Business Development hires to shorten sales cycles and land 7-figure contracts, and Amazon digital twin program for its distribution centres due to restart in December.

Will look to get some more detail when we speak with Ian tomorrow.

Well, this latest raise was an underwhelming affair.

Arguably, it all started on July 28 with a bullish announcement that Pointerra's utility partners were selected for a US$15b grid resilience CAPEX program. The detail was vague, but hinted at a significant revenue opportunity, and shares duly rose -- in fact, they more than doubled at one point (briefly).

A few days later the company's 4th quarter announcement showed a disappointing cash inflow, but this was explained as a timing issue with much of the shortfall received in July. The company said it "continues to self-fund organic growth". The ACV metric was again notably absent.

Two weeks later, Pointerra revealed it had raised $2m via an institutional placement at 12c per share (a 13% discount to the recent volume weighted trading price, but a 25% premium to where shares were at prior to July 28). Veritas, the lead manager for the raise, was paid $120k, or 6% of the total raised.

Shareholders were offered the same deal to raise a further $1.5m, but by this stage shares had returned to sub-10c, meaning any uptake would be at a 20%-odd premium to what you could get on market. Unsurprisingly, very few shareholders took up the offer, which raised just $195k, or 13% of the targeted total. Frankly, it's amazing they raised anything!

All told, the capital raised cost 6% in fees and a 2.8% dilution to existing shareholders. And all for a relative pittance in cash -- an amount that would have barely covered the FY23 cash burn.

I've lined up a meeting with Ian for the 31st of this month, but I assume the rationale will be they just needed a bit to help accelerate some growth and will be self-funded from here ("cross my heart and hope to die, stick a needle in my eye")

To be fair, they are dealing with big customers and project delays aren't uncommon for large CAPEX programs. They are a tiny company desperately trying to scale while continuing to invest in their product and resourcing. So maybe what we're dealing with here, and in other outcomes that fell short of expectations, is just a bit of over-exuberance from management, but which they genuinely feel is well founded.

But the fact is that they have damaged their reputation -- and that will take a long time to rebuild.

The lesson here for management is that it's usually best to under-promise and over-deliver. When you make bold claims you really just create a rod for your back, imo.

The market mood has really shifted for the better with Pointerra of late -- and not without some justification. But the latest 4C is somewhat lacking in my opinion.

Operating cash flow was significantly negative for the quarter (down $1.8m) with just $800k in customer cash receipts. That compares to cash receipts of $3.25m in prior quarter. This was apparently due to invoicing delays, and in July $1.8m has since been collected.

So hopefully just a timing issue, and the company says "the core business operation continues to self-fund organic growth across the business in Australia and the US."

Let's hope so -- there's less than $1.5m left in the bank.

The ACV chart -- long highlighted by the business -- was again absent. I think that's very poor form to simply abandon this metric.

Lots of fluff in the announcement and very little detail.

Others have commented on today's news. I'll not repeat their content, buy add my assessment and decision.

The improvement in cashflow is good; however, $3.3m is still lower than two quarters ago. In a firm that needs to be growing strongly to justify its (albeit beaten down) valuation, it is hardly a need for celebration. I’m with @Noddy74 – I don’t share the market’s enthusiasm today. Perhaps the SP reaction was relief that the cash result wasn’t worse?

Cash receipts of $3.3m mean that the free cash surplus is likely to be thin, although it is good to hear that Ian believes this will be sustained going forward (although he now also has some new senior hires to pay.)

However, I’m still bothered by the unwillingness to give an ACV update. That means that without the contract renewal agreed, it looks bad. And as I’ve said before, I don’t trust management who only report discretionary metrics when they make them look good. The last entry in my spreadsheet was $20.1m in Oct-2022 up from $18.2m in Jun-22. So we are coming up to the anniversary and it sounds like the dial might not have moved much. Moreover, the result appears to be very dependent on a single customer. In the absence of newsflow of other large contracts, that sounds like an ongoing concentration risk.

Again, as @Noddy74 writes, if this product is so mission critical, why is the renegotiation of the contract taking so long?

I am pleased the CFO role has finally been filled. However, the musical chairs on the "Chief Growth Officers" roles - not one role but two (in a company that makes total annual revenues of the order of only $10m) continues to signal that things are not working to Ian's satisfaction on the customer wins front.

For me, It is time to look at the thesis. I originally held 3DP for three reasons:

• Leading tech platform for spatial data management with a large range of applications in multiple verticals

• Strong ACV and revenue growth

• Close to the inflection point, with potentially strong economics emerging

Looking back over the last 8Qs (and I appreciate I should wait for the 4C to fully update this straw, and therefore may prove to be premature):

• Cost growth has generally been ahead of or at least in step with growth in receipts

• We are still hovering around the inflection point. We first saw positive free cash flow in Sep. 2019. and have flirted with it on 3-4 occasions over the last 3.5 years

• ACV growth is now a question-mark

• Cash reserves are low

• Newsflow on new contracts / new customers has not been strong

Importantly, as @Noddy’s analysis shows, the operating economics are becoming a question-mark too, with the gap between ACV growth and growth in receipts expanding. What’s going on here? Are customers taking longer to use the product than anticipated? Is there drag in deploying it/customising it in each application?

I appreciate that it can take a long time to deliver “overnight success”. However, I’ve decided to move to the sideline with $3DP until the proposition becomes clearer. I recognise that in so doing I am crystallising a loss and if I buy back in in future, that I’ll give up the ground between maybe $0.105 (my sale price) and $0.20 or something similar.

However, for me, in these higher risk small caps that are yet to become cash generative, the thesis requires strong revenue growth above cost growth. Taking the high risk of a cash burning proposition relies on the momentum of the top line growth and the emerging economics, and all that entails in terms of positive revenue retention and new customer wins. I’ve now gone 5 or 6 Q’s where I haven’t been convinced that $3DP is delivering this. The ACV reporting holdout is the final straw.

I have divested my position in $3DP (IRL and SM).

Disc: No longer held

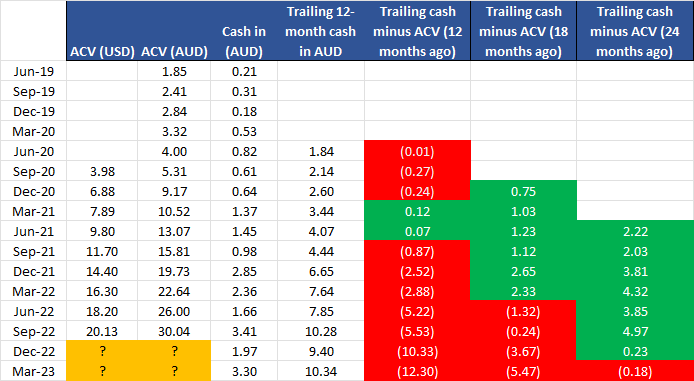

The market seems to be a lot more excited about Pointerra's trading update than I am. The ACV update is not really an update at all except to say that previously flagged renewal negotiations are still ongoing. It seems like all will be revealed at an update on 28 April 2023. Hopefully that is the case.

They report a 'rebound' in cash receipts. It is true that at $3.3m it's the second highest quarter they've had for receipts. The problem is that cash in is not keeping pace with previously reported trailing ACV - not even nearly. If you track trailing 12-month cash in, it used to trail reported ACV from about 12 months prior. Not great but if you knew that was what to expect you could probably live with it. In late 2021 that started to slip and it was taking up to 18 months to convert ACV to cash. In today's update an 18-month trail seems like the good old days as trailing 12-month cash receipts doesn't even keep pace with the ACV from two years ago!

They describe their suite as a must-have platform. As difficult as it might be to deal with some of their US customers, I can't get my head around why they'd not pay for mission critical software nor take so long to renew.

[Not held]

Executive Appointments

In order to strengthen the important revenue generating business development teams in the Australian and US operations, the Company has identified 2 experienced executives to fill the roles of Chief Growth Officer (US Operations) and Chief Growth Officer (Australian Operations). Pointerra has also appointed a CFO to strengthen financial reporting and management at the Company.

Joe Gerczak commenced with the Company as Chief Growth Officer (US Operations) in early April 2023 and arrives at Pointerra following the sale of his previous venture, Smartronix to a US private equity investor.

Bevan Slattery has left the building.

Just lodged a "Ceasing to be a substantial holder" notice on the ASX.

Took 11.5m 3DP shares out this month at around the $0.11 mark.

So that will have been behind a lot of the selling.

He would have to be across the ACV numbers and other behind the scenes details.

So that may be behind his selling.

He's also just parachuted into the MP1 CEO hot seat after Vincent English left it still warm for him last week.

So that could also be a factor, we may never know.

Maybe Strawman can get him on the red phone - I assume he has a direct line to the higher ups for big issues like this?

1/3/23 Half year results release notes

· Disappoint market with sales flat PCP and down 40% on previous half explained as invoice timing for large customers (pcp case repeated has some credibility).

· ACV figures withheld pending confirmation has impacted investor confidence.

· Cash outflow (0.95m) well below loss (3.1m) due to improvement in AR balance, with expectations that sales expected for H1 will fall into H2 much like prior year…

· Expecting positive CF in the next 2 quarters, but cap raise possible/likely if that doesn’t work out.

· 90% GM is maintained pointing to good operating leverage potential still in play.

· Interesting to see share based payments as negative, reflecting resignation of entitled staff and hence forfeit of rights leading to a write back of the expense. Does this indicate staff moral or other issues? Note that 7m loan shares to KMP remain outstanding, no options or other rights to directors or KMP, so relatively clean/light SBC.

· Expense increase Vs PCP is mostly US operations segment +2.3m Vs Australia +0.7m which aligns with sales growth opportunity.

· Working capital deficiency (-372k) change from 30 Jun 22 (+3.1m) is almost totally explained by 3m reduction in AR balance over the period which also shows why Operating CF was significantly better than the P&L result for the half. The 30 Jun 22 AR balance was a blow out on historical averages so seems to be the main cause of the distortion. Not an issue.

Conclusion: Result could reflect the bumpy effect of a transition to large US customers for sales growth or be a red flag on execution and growth rates going forward. Will wait for more information on release of ACV to assess level of transparency of management and future growth expectations.

Valuation Range: $0.10 to $0.24 (based on 30% Vs 80% FY23 Sales growth, then 17% CAGR to 2030)

Disc: Own RL + SM

I can't value the business until I get some confidence in the ACV numbers............I'll just use an EV/s of 4.4.

Gulp...the DCF wasn't kind to Pointerra, but I think this was a useful exercise because it highlights the risks at play here. On one hand, you have a high margin potential business; one that will likely have no issues scaling due to the nature of its software. On the other hand, the business continues to have issues taking receipts from customers and there are some orange flags around staffing (mainly culture) and increasing costs.

H1 results won't be pretty reading -- admin expenses are higher than ever, while manufacturing and operating costs spiked in Q2 and are currently on track to be double that of last year. I am not seeing the evidence of operating leverage that I want to see.

Analysis of Pointerra's historical cash flow statements makes for tough reading:

Prior to FY22, the proceeding years suggested we might actually be seeing a business starting to scale.... until it didn't. FY22 bucked the trend; costs increased far quicker than cash intake. What we know about FY23 thus far suggests this trend has continued:

My DCF reflects this. I (generously) projected 200k FCF this year, before projecting 1m FCF in FY24, 2.5m in FY25 and 4m in FY26. With a discount rate of 8.4%, I reach a CV of 61m. Divide this by shares outstanding (677m) and I reach a valuation of 0.10c. This valuation isn't kind to the business, but I want to point out if anything it is probably a little aggressive -- I don't think the business will achieve cash flow positive this FY and we need to see significant improvement to the financials in the coming years. I also haven't accounted for dilution, Pointerra is running on the smell of an oily rag at the moment and a raise might be just around the corner. On a P/S ratio of 12x, an argument can be made that Pointerra is currently expensive. And on that note, things could still get much worse for shareholders. Unfortunately, that includes me, but only for the time being -- a few more underwhelming reporting periods and I will be cutting my losses.

$3DP issued its 2Q FY23 4C report today as well as an incomplete Enterprise Sales update.

Their Report Highlights:

• Multiple new material contracts awarded

• Quarterly cash receipts Q2 FY23 A$1.9 million

• Cash outflow from operations A$0.9 million

• Program delays by some US customers impacted invoicing in Q2

• Invoicing and cashflow expected to rebound in Q3 and Q4 FY23

• Core business operations continue self-funding organic growth

My takeaways

By any measure, a softer quarter. What makes is problematic is less the lower receipts compared with 1Q, but the PCP comparison - a higher cost base and materially lower receipts.

The premise of recurring revenue is that it recurs. So while there may be q-on-q lumpiness due toi the impact of payment phasing of material contracts, a growth SaaS company should show consistent annual growth - otherwise it is no growing!

See my usual CF trend analysis, (reduced to focus on the trend of the last 8Qs). OpCF is a negative trend indicating that 3DP has some way to go to achieve sufficient scale that operating leverage shows through.

3DP remains squarely in the position of being yet to demonstrate that it is a sustainable business. There are references to expectations of stronger receipts in Q3 and Q4. Unless we see these materialise, then a capital raise will certainly be required.

I continue to hold, but these are not the results that will lead to me increase my RL position.

Additionally, there was a rather odd Enterprsie Sales update with a promise of the ACV update in February. Traditionally, the Enterprise Sales and ACV update has followed the 4C. The fact that $3DP cannot enter a $ACV number today can only mean that they don't like the number.

Expect an adverse SP reaction today.

Disc: Held in RL and SM

Pricing in some significant growth in coming years, the value range for me would be 30c - 40c by my numbers. For me current price (23c) is still factoring in growth but closer to 10%. Definitely more potential upside here.

Pointerra Historical Capital Raises - $11.15 raised since IPO market cap today $135.6m at $0.20

· July 2020 Bevan Slattery Placement/Invests $2.5m at $0.05 per share

· November 2019 Raises $2.5m at $0.05 per share

· November 2018 Raises $1.15m at $0.042 per share

· April 2016 Raised $5m at $0.03 per share Backdoor IPO

Acquisitions

· April 2021 - Airovant $1m Ordinary shares (2,583,092 Shares) in 3DP – US drone-based digital asset management business. https://www.asx.com.au/asxpdf/20210430/pdf/44w0qhn24wwmqc.pdf

Inside Ownership Ordinary Shares % 3DP Issued Net Value at $0.20

Bevan Slattery 45,140,940 6.66% $9.1m

(Capital B Asset Management)

Ian Olson (CEO) 42,814,889 6.32% $8.6m

Neville Bassett 4,732,266 0.69% $946K

Paul Farrell 3,000,000 0.44% $600K

Total 95,688,095 14.12% $19.12m

Here's the 2022 AGM from Pointerra, that was held yesterday (23/11/22).

Would have loved to have been there if i was in WA. One of the great things about small cap AGMs is that you pretty much have the entire board and management to yourself.

Case in point, Ian said that for this year Pointerra team members outnumbered Shareholders!

Anyway. Nothing really new here, but always good to hear a sermon from Ian.

Some great commentary already. Similar to others, I think this is a cracker of an update. In terms of my investment thesis -- consistent growth over a long period of time without investing huge sums of money to chase said growth -- everything appears in order here. And similar to you @mikebrisy, my confidence continues to grow, as Pointerra does the same.

@PinchOfSalt touched on the currency conversion tailwinds at play here. We obviously saw yesterday's 4C update provided in AUD, but when you consider ACV being reported in USD -- totalling more than $US20m -- extrapolate these payments out over the next year or two and you have some serious cash being added to Pointerra's pockets.

But there is another key bull case argument, which has already been touched on by @mikebrisy, that deserves further highlighting: net revenue retention (NRR). A NRR of 172% YoY is insane. The investment case becomes a different proposition when customers are not only using Pointerra's software, but slowly expanding their offering over a timeframe -- whatever this may be. Your target audience expands from not only new customers, but those already using Pointerra's platform.

To digress slightly, from all accounts, Pointerra have really hit the ground running with their recent work with FPL during Hurricane Ian. I am going to go out on a limb here and say this is one of the deals we will look back on in five years time and remark how it was company changing. Not only is the market a significant one for 3DP to enter -- think about the countries, towns and municipalities that are impacted by serious weather events, the list is exhaustive and only continues to grow -- but they are starting to enter 'mission critical' status when you are helping agencies respond to natural disasters. The capability of Pointerra3D to ingest data in real time shouldn't be underestimated. Ian mentioned in the recent chat with us that other agencies, similar to FPL, are starting to reach out and ask how 3DP can assist them. I am not surprised. That is powerful 'word of mouth' marketing that doesn't cost Pointerra a cent. But you are also starting to interact with reputable clients that have extensive budgets and a duty of care to the societies they service. Anyone here that has worked in crisis environments -- whether they be emergency response or coordination of resources -- understands the importance of mission critical software. When it genuinely helps the response to life threatening events, it becomes worth its weight in gold.

The main risk here for Pointerra -- who are still relatively small and struggle to attract high-quality sales staff -- is that they spread themselves too thin across multiple verticals/industries. It isn't uncommon to see a strategy like this overwhelm a business and ultimately backfire. With that in mind, their growth since FY20 has been nothing short of remarkable.

All in all, I am really happy with their progress and remain a happy shareholder. I am still looking to add to my holding around the 20c level and they are high up my list to increase my exposure to.

(As some have speculated ... it was just number 2 on Ian's priority list. Ongoing good progress.)

Net revenue retention is key - existing customers are increasing their use.

Enterprise Sales & ACV Update Highlights:

• Growth in US energy utility sector and expansion across AEC, Transport & Mining sectors drives US$1.9 million uplift in ACV

• ACV now totals US$20.1 million (31 October 2022)

• YoY ACV Growth = 72%, YoY Net Revenue Retention = 172%

Agree with @PinchOfSalt. It is frustrating when firms change reporting of regular metrics. It tends to only mean one thing.

Looking back over history, $3DP has been reliable in issuing 4C and ACV Update reports within minutes of each other. However, there is earlier precedent for holding back and issuing later in November 2020.

So, what might be going on? A few ideas. First, there's the obvious - new ACV was poor. Second - there's a new contract imminent and Ian wants to hold off a few days,

We know by his own admission Ian is stretched at the moment without a CFO. So with today the last day to get the 4C out, perhaps he simply prioritised that, and the ACV report is to follow as there is no required timeframe.

Ian doesn't strike me as someone who would withhold a regular report, just because of an inconvenient quarter. On the contrary, given the strong 4C there is every reason to have issued it today. So my money is on 1) prioritising the 4C or 2) an imminent new contract to be included (still, its bad practice to do that.)

Let's see.

Adding to @PinchOfSalt 's straw I include my usual 4C trend analysis.

Good receipts last Q. Lumpy nature of receipts is not a surprise given impact of a small number of larger enterprise contracts and track record. Last Q we get the kicker from FPL emergency response, which will not be recurring.

What is recurring are the payments, so SP progression will need to see receipts becoming smoother over time.

Hats off to Ian however, over the long run $3DP is continuing to develop product and customer engagement across multiple verticals while maintaining a low operating and free cash flow burn - some Qs positive some negative, but the long run average c -$200k.

The question from my perspective is whether they achieve a breakthrough in one of the long sales cycle segments, like defence.

Disc: Held in RL (1.2%) and SM (9%)

Ok so a fairly long post but some rough notes from the excellent meeting with Ian. It's not a comprehensive list so check out the meeting if you have the time.

- In 2020 discussions with Bevan Slattery considered expanding the business model into data capture, not just storage and analysis, but instead, continue to maintain focus on core business where margins are higher and cross border sales are easier. Now data capture companies look to be coming to 3DP to host and manage datasets proactively rather than on demand.

- Reduction in bitcoin mining operations has reduced the competition and demand on server computation resources.

- Breaking into the AEC market has been hard as currently digital engineering teams are wedded to the way things have always been done.

- Jacobs the biggest AEC customer “will be a seven figure ARR contract ‘pretty soon’ and probably beyond that.”

- Entered the utilities market by chance. Now the opportunity is quite large. In the US there are 200 listed utility companies and circa 2500 state / county owned utilities.

- The use of 3d data in America compared to Australia is ~100x

- PGE spends $35m per annum on lidar and imagery to be able to understand what's happening across the network, previously taking months or up to a year to get the data. 3DP allows that workflow to be reduced significantly.

- Sales team working through utilities one by one. By Ian's language it sounded like sometimes these can be hard sells. As evidence of use cases from existing contracts grows this helps to build the sale case. A lot of the utility companies are collaborative and FPL is a big advocate for 3DP, but still need to cross the hurdle of changing the mindsets of how it’s always been done.

- Ian made the comment that some of the customers believe that 3DP may become a FERC (Federal Energy Regulatory Commission) standard. https://www.ferc.gov/electric

- On growth of sales vs managing cash flow Ian stated that there is a lot of interest from institutional investors to raise funds to accelerate growth as they have now demonstrated the market and the capital light business model. “What we want to do is become a globally relevant, extremely high growth, high margin subscription business” and sales require cash.

- Some frustration at the Airovant team leaving but pointed to an example of an opportunity they brought in - Working with Amazon on the automation of their fleets of driverless trucks around distribution centres by hosting digital twins.

- During the storm response to Hurricane Ian they met or exceeded all KPIs on the contract which has helped cement trust in the company. Confident that this will lead to being formally added to the storm response solution. Other utilities in adjacent states to Florida have started reaching out.

- Looking to try to get into real time autonomous data analytics space. Collision avoidance, threat detection etc. See opportunities in analysing the data and selling the outcomes.

- Restart of trade shows means that they can get in front of customers to educate about 3DPs capabilities.

- Considers traditional workflow their largest competitor.

- Other competitors are focused on one sector, whereas pointerras point of difference is the breadth of use, strength of analytics and business model.

- Getting good people is an ongoing challenge

- The $50m ACV target is still considered achievable. Eg. FPL $6-7m per annum fully deployed across the whole enterprise. Enough deals in the pipeline to reach if they secure them

- ACV vs Revenue. Contract from utility example - win contract, value enters ACV, takes time to get existing and new data to be given to 3DP, time to embed solution into workflow, then can start invoicing.

- Don’t charge implementation fees, only the subscription fees.

- Churn at the smaller end contracts $500-$1000/month customers but not with larger contracts

- Team in Glasgow talking to Network Rail using Sydney Trains as an example.

- Every Tier 1 miner as a customer - but only at a mine site level. Ian considers this a potential high growth area in the next 12 months.

- Ian states the Defence sector as the one that excites him the most given the opportunities. But it still needs more work.

- Partnership with pointfuse to provide AEC solutions. https://pointfuse.com/

- Recurring theme of struggling with securing good sales team members

- Expects costs to grow by around 50% in around FY23

Epic speed round from Ian. Loved it.

So I was reading on Hot Copper and...

Impressive Release regarding FPL Storm Response

Within 24 hours of post-storm data acquisition, Pointerra3D change detection analytics of the impacted network across large areas had been cross referenced with weather, imagery, and other supplementary data sources to support accelerated assessment and decision making by FPL storm response teams. Key statistics of the storm response effort included:

• 6 missions flown by FPL aerial LiDAR contractors

• 15Tb of data ingested and analysed by Pointerra3D

• 1,500 AWS cloud machines running in parallel over 5 days

• 18,500 poles modelled

• 1,100 poles identified as requiring remediation and/or replacement

With an interview scheduled with Ian Olson later today, thought I would share my updated trajectory analysis which depicts 'healthy' progress across the business.

The disconnect between ACV ( converted to AUD) and Revenue & Receipts continues to get a lot of air time on various media platforms. In trying to rationalize this, a lot of the discussion centres around billing and payment terms and the Company's messaging that due to different payment cycles, they expect this divide to close. Scrutiny of their Avg Debtor days does not point to anything untoward.

My take, which is different, is that we have a Company which is in pursuit of rapid scaling but subject to some interim delays (post contract award) associated with strategically driven customization. Pointerra started with an innovative core capability. They then enhanced the power of analytics, and continue to do so, and more recently they expanded the value proposition to include answers.

Rapid Scaling ( Market Penetration) & Customization would normally sit on opposing ends of the spectrum (as a contradiction) in any Sales strategy. But in Pointerra's case, the economic dividend comes from reaching that point where the cases and 'fruits' of customization can simply be replicated for new custom. Best example of this would be, following Hurricane Ian, is the tailored solution (the capability) installed at Florida, Power and Light ready for use by any other Utility Company in the USA. "Answers" inside of 48 hours !!

Not suggesting that there are not other contributing factors to the ACV / Revenue divide, but believe that the above plays a material part. @Strawman, maybe you can tease out what really sits behind the disconnect. They repeat the same point each quarter about different payment cycles and it's not gaining any credibility. Should point out that with the recent AUD weakness vs the USD, the currency converted Annual Contract Value, using the last declaration (31 July) now sits at AUD 30m. FY 2022 Sales Revenue AUD 10m.

Getting back to the trajectory analysis, the slide which depicts Revenue per Employee highlights what I regard as a current 'pain point'. Througout the last year we have heard about new hires, the additional resourcing through the Airovant acquisition and yet the the number of full-time employees remains the same at 31. Does this point to employee initiated churn or the fact that the Company is having difficulty finding the right quality of employee (Company initiated churn). I refer you to Ian's comment in the Annual Report under 'Outlook for FY2023'

" Success will likely result if we are able to focus on the biggest drag on growth – identifying, onboarding, nurturing and retaining exceptional people.

The absolute irony of scaling a cloud platform business is a magnified reliance on the need for exceptional people to conceive, build and sell digital twin solutions to our customers and prospects across the Company’s key target market sectors."

Note : All numbers used in the trajectory analysis exclude once off type items of spend plus items such as share based payments etc. Reason for excluding R& D Income and Spend in the one graph is that it provides me with a different and valuable perspective on Financial progress. The Slide which tracks R&D Grants is earmarked for Vertical (x6) Analysis or hopefully Cohort Analysis if and when the Company report these numbers.

Pointerra achieved revenue of $6.6M, at a ($0.7M) loss in the second half of 2022.

Pointerra invoiced $4.2 million in the final quarter. I suspect a fair chunk of this was invoiced in late June, with deferred revenue at $1.45 M (down from $1.8 M on Dec 31).

With the AUD vs USD down about 10% since the beginning of the financial year, Pointerra will benefit from exchange rate tailwinds, with a fair hunk of costs in AUD.

Assuming ACV leads revenue by 5 quarters, Pointerra revenue should be around $7.5 m AUD this half year, which should tip Pointerra into profitability, noting gross margins are running above 80%.

DISC - HELD.

Latest report is up.

Nothing unexpected - growth good very small EBITDA loss. On track for a big year FY23 if can sustain current growth.

The pace of ACV growth remains attractive, with Pointerra adding US$1.9m during the quarter -- pretty much bang on what they've done for the past couple years. That's am 86% uplift over the past year.

If they can retain this pace, they are well on their way to my target of $50m in FY25 sales.

@Noddy74 however makes an excellent point -- the cash receipts just aren't matching up with the reported ACV. For example, at the start of FY22 they had an ACV of A$13m (at the the then FX rate of 73c). Yet over the year they have collected only A$7.8m. Add current cash receivables of A$2.5m and you still fall short by around A$3m or so.

The company did say:

Elsewhere, Pointerra reiterated:

All of which explains things, to some extent. Perhaps an ARR figure would be better given this phenomenon, but either way these aren't precisely defined metrics and there's a lot of room for discretion.

I don't think anything dodgy is going on, other than the company wanting to present the most favourable metric. At least they have been consistent in the metrics they present. But perhaps I do need to be more cautious in equating ACV to revenue. The good thing is that the 'vector' of sales growth has the right direction and magnitude.

The cash situation is starting to get a little tight. Notwithstanding the variability they mention, the company has around 2-3 quarters left before they run out of cash at the current burn rate. And it's worth noting that R&D and staff costs have all accelerated, and the company said it expects to make additional hires. Plus there's this:

The company reckons the organic growth component can be internally funded, but did say that any acquisitions would be funded by scrip (adding dilution to existing holders). Of course, we should expect increasing staff costs as the company scales, and the real question is not the quantum spent but the return on this investment. Additionally, we should also want to see some operating leverage emerge, whereby revenue growth outpaces the associated cost growth.

I'll let members read the 4C and ACV update themselves, but on balance it's good to see sustained ACV momentum, increased spend from existing customers & increasing inbound enquiries.

The opportunity is there, it's all about execution and effective capital management.

*updating* I'm going to stick with a AUD$50m sales target for FY25. That's an average pace of about 25%pa growth from the current level of ACV. The market opportunity is much larger than this, of course, but scaling the business to that level in the coming years -- especially with difficulties in attracting good devs and sales people -- wont be straightforward. Nevertheless, if they achieve this milestone in the coming years and continue to sustain a high pace of growth, a FY25 price target of 70c isn't hard to conceive. Assuming 720m in shares by then, that'd be 'only' a P/S ~10, or a PE of ~50 (assuming attractive SaaS margins). That's still cheap for a business that would have achieved 10x it's top line in 5 years and be on pace for $100m sales in the medium term. Discounting back by 10%pa gives a current valuation of 52c. Alternatively, perhaps 3DP 'only' achieves 15% compound revenue growth (using current ACV as the baseline) through to FY25, hitting just $38m in sales. We could probably assume something like $4m in NPAT at that point. And at 5x sales, or a PE of roughly 50, the share price would be 26c three years from now. Or 20c when discounted back by 10%pa.

Not great given the current price, but there's some decent asymmetry in these two (admittedly rough) forecasts. On balance, i'm quite optimistic about Pointerra's prospects and think they have the making of a $1b company. But i do need to balance that against the risk of poor execution and slower than expected growth. For now, i'm going with the more bullish assumption. Yes, it's a high pace of growth but it's off a low base, and they have good traction and increasing penetration with good reference clients. Remember too that ACV growth is tracking at about US$8m pa.

Let's stay with a 50c fair value -- but acknowledge the true value likely lies 20-30% either side of that.

Jayze87

The R & D Rebate for FY22 should alone take care of that. The question is whether we will be materially EBITDA positive. NPAT positive ??? Be very close IMO.

Whatever the case, strong momentum going into FY23 and believe we will have a stellar year. A 'tipping point' that is sustainable looms.

RobW

An interview with Ian Olson from today.

Ignore the idiot at the start (me, not Claude!), but interesting to hear Ian say that the $50m revenue target could be hit a year earlier than I mentioned.

YouTube clip here

Valuation maintained based on March 2022 Quarter Activities and Cash Flow Report

Highlights:

• Landmark quarter – concurrently scaling US utility sector deployment across 4 key customers and growing ACV

• Q3 cash receipts A$2.4 million (71% YOY growth v Q3 FY21)

• YTD FYY22 cash receipts A$6.2 million (138% YOY growth v FY21)

• Consecutive cash flow positive quarter from operations (A$0.1 million)

• Business is self-funding organic growth

• Pointerra3D Analytics & Answers driving growth in ACV spend

• New customers added + existing customers grow ACV spend across all market sectors

The quarter was highlighted by step-change adoption in the scale of Pointerra3D platform deployment by US utility customers FPL, PG&E, Entergy & Eversource and reflects the continued development and adoption of the higher-value elements of the Pointerra3D solution portfolio - Analytics and Answers.

Thanks @Glutenfree for bringing this recent use case of Pointerra to light. https://youtu.be/jB5EjtTCk38

Diospatial combination of multiple mapping modalities into one digital twin using Pointerra technology is pretty darn cool. You can really get a sense of how 3DPs capability to power and deliver these 3D models can change the way industries function or meta worlds can be powered (maybe ;)

The Good:

Revenue up 104% and ACV up 47% compared to H1FY21 demonstrate that for now Pointerra is maintaining the high growth rate that is expected by the market. The company is also growing across all sectors, not just reliant a few large clients.

Cash flow positive operations in Q2, however I see this staying reasonably flat or even going back into the negative as the company starts to expand internationally. It looks as though management is timing international expansion as cash is set to become available and the product is proven, rather than putting their hand out to investors which is a positive for me at the moment. I think it was on a Baby Giants podcast where this was discussed for another company (forget which one) where they took too long to grow due to funding their own expansion and were overtaken by their competitors, and that is a risk here particularly in the competitive growing sector that they are playing in. Something to watch.

Announced that reporting metrics will be expanded in the future rather than just ACV, which will provide greater insight into segments, customer value and business operations.

The Bad:

Revenue and cash receipts are still lagging contract signings by a long way, so if the company needs to scale quickly to maintain further growth, this may have to be assisted by external funding. Previously Ian has mentioned in the past that they want to be selective with their growth, so this may not be an issue, but one to watch.

What To Watch / Targets:

Opening of office in the US is a big step for the company in being able to provide a more active sales and service to the US customer base, which is currently Pointerra's largest market.

Expanding global operations into the UK, Europe and Middle East. This is also another big step for the company as currently revenue only comes from Australia and the US according the H1 segments breakdown. Having broader exposure to other markets and companies will not only provide a wider market for sales but also provide more insight into a wider range of customer requirements. If implemented correctly this can only help to continue to refine and expand on their data analytics services improving the product overall.

On the lookout for potential acquisitions. I think there could be value here particularly in developing the analytics features but wary of growth by rollups. With only $5m in cash, anything substantial will need a capital raise or issuing of shares as flagged by in the ACV update. So far 3DP haven't ventured to far down this path.

One of the risks of small caps and inflation is the cost of debt going up with the interest rate, and this debt forcing them to capital raise or loan even more money! (or go bust)

Does 3DP have debt? According to the latest 4C, it has no debt.

This is a good sign, and ticks off a a reason to invest or stay invested. It means inflation will impact 3DP's supply chain and the sell prices of its own products, but not the debt, because there is none - one less worry to worry about!

It could also mean its at a bargain price right now, as the market sells off on debt fears related to inflation.

A good result from Pointerra today in regard to its Dec 2021 Cash Flow Report.

Hoping to get a good read on ACV in the coming weeks.

Pointerra has just shy of $5m in cash in the bank. Although CF positive in the latest quarter, increasing headcount and development expenses, coupled with the lumpy nature of customer receipts, means a further capital raise is a real possibility (although that's not a terrible thing if they can use that to underpin accelerated ACV growth).

To get a better sense of the cash flow picture, I've plotted out the results since the Dec18 quarter. Overall, an encouraging picture.

December 2021 Quarter Activities and Cash Flow Report

Highlights:

- Record quarterly cash receipts from customers A$2.85m, up from 0.98m.

- Cash flow positive quarter from operations A$0.80m.

- Material contracts (between A$4.33 million and A$6.60 million) in the US energy utilities sector, in addition to new customers added

- New customers added in the AEC, Survey and Mapping, Transport and Mining, Oil and Gas sectors.

Perhaps predictably, Q2 was a great quarter for 3DP. The biggest criticism in 3DP’s journey – in my opinion – has been the delay in which it receives cash receipts. Well, they have delivered a record quarter in terms of cash receipts received and announced material wins in the US energy utilities sector (as announced 14 Dec 2021). They are trending in the right direction and its clear there remains serious demand for their services – which is benefiting their cash flow.

We also received an update re: 3DP’s ongoing collaboration with the Defence and Intelligence sector:

‘Subsequent partnerships with these agencies to lodge joint applications for rapid funding rounds via the US Federal Government’s Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs also progressed during the quarter.’

Sounds promising. They are clearly looking to generate short-term funding to create a pathway to larger, more significant contracts/utilisation of 3DP’s platform. Government discussions are never easy – they are long, with various levels of red tape to overcome – but once an agency adopts a platform, subsequent contracts are sticky, valuable and worth their weight in gold. This won’t happen overnight, but I have no reason to doubt 3DP in executing. This sector in particular is where I think the magic will happen for 3DP - and is the reason I am invested in the company. That said, the positive inroads 3DP continues to make in other sectors provides additional substance and support to my investment thesis.

DISC: HELD

My view on Pointerra following the recent ACV announcement. I believe the announcement is a game-changer for the following three reasons:

- ETR is the one big material announcement we all have been waiting for since the PG&N and EverSource negotiations. Its show how large individual contract could get. Granted, not all of the current contract amount is going towards ACV, the expectation is the ACV contribution from ETR will be even larger when the service is rolled out to all business units. I am expecting similar large contract awards from other utilities in the future. The recent devastation caused by hurricanes and tornadoes will only speed up the intake.

- The speed at which ETR was onboarded is noteworthy. This is a reflection of the readiness of our product to meet the requirements of the utility sector. This has been a relatively long process. But with their experiences from PG&E and EverSource, the company is in a much better space to land material contracts in a short period of time.

- The comments in the outlook section suggest that the company is relatively happy with their position in the utility sector and now are focussing on other sectors, which the company believes to be equally big. Biden’s infrastructure bill is only going to provide further impetus to all these other sectors to take up services like what Pointerra has to offer.

So Pointerra is just playing with us now! New tonight to the website.