Some good commentary on 3DP already. I remain a holder, but this is no longer a buy for me. I want to see the business start to execute. Like many others, there are some real question marks about their ability to do this. @slymeat, I hear that view mate, but conversely there are early signs that 3DP are struggling at a) effectively selling their offering, and b) collecting fu***ing cash! The pipeline is one thing, but on the other hand, there is also an opportunity slipping away from them here that wont be there forever.

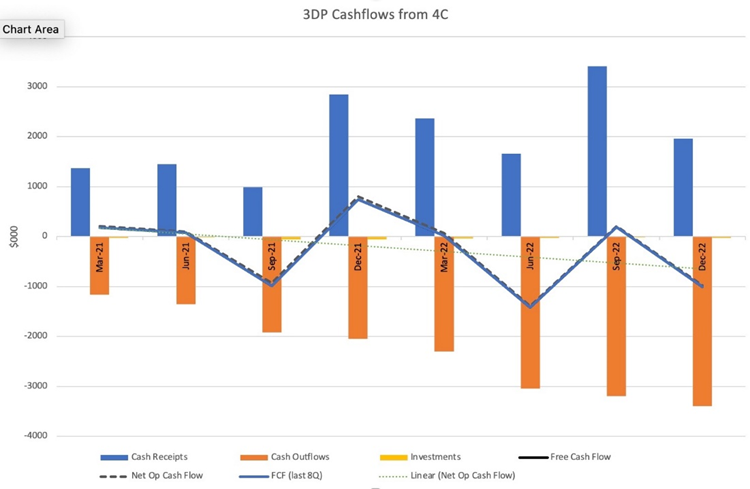

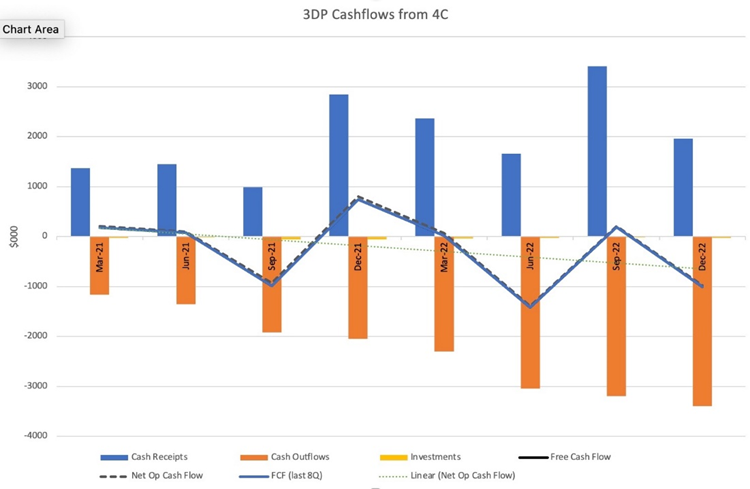

I want to highlight @mikebrisy's cash flow analysis chart from yesterday:

This encapsulates the real concern around 3DP at the moment. Their so-called 80-90%+ super high margins become a myth when they cannot demonstrate cost control while slowly increasing their revenues over time. Costs have been increasing QoQ for 24 months now. This is not reflective of the business I initially found interesting when I invested in 3DP. The thing is, if I was to sit down and study 3DP today for the first time, noting their cash flow performances over the last 12-24 months, I wouldn’t invest. Costs over the last three quarters in particular are rising, while cash intake is lumpy and underwhelming. Re: the ACV issue, I am less critical of than others – I get that customer invoicing can be a nightmare, particularly with larger customers – but I wont die on my sword. They need to start producing material cash, but they also need to get their expenses in line; they are getting out of hand, with little gain.

They have presented ACV to the market – in conjunction with the quarterly report or very close to it – for as long as I can remember. This month, as @mikebrisy notes, they have delayed its release due to not liking the number. I am not interested in a spoon-fed figure when they think it looks more attractive. It defeats the purpose of the report. I am also not supportive of a management team that think this way and it is bloody short-sighted. Orange flag number 1.

Perhaps we are starting to see orange flags becoming more evident, or maybe for whatever reason I am only starting to notice them. In addition to above, the staffing side of things looks to be a real concern. Correct me if I am wrong, but they acquired Airovant in 2021 – primarily to acquire the SME of the Airovant staff – but before we knew it 3/4 of the Airovant staff churned and were effectively lost within 12 months. Not a great sign, even in a tight employment market. Orange flag number 2.

@nnyck777, I missed the loss of the defence recruit – where was this recorded? If this is the case, another orange flag! That is more SME that the business is struggling to keep.

Not only do Pointerra appear to be struggling to hire the right staff, they are also having issues keeping them. This potentially points to some internal culture issues at play.

I will be very interested in the next few quarters and how the cashflow analysis looks. If costs continue to rise while the business struggles to bring in cash, I am out.