The market seems to be a lot more excited about Pointerra's trading update than I am. The ACV update is not really an update at all except to say that previously flagged renewal negotiations are still ongoing. It seems like all will be revealed at an update on 28 April 2023. Hopefully that is the case.

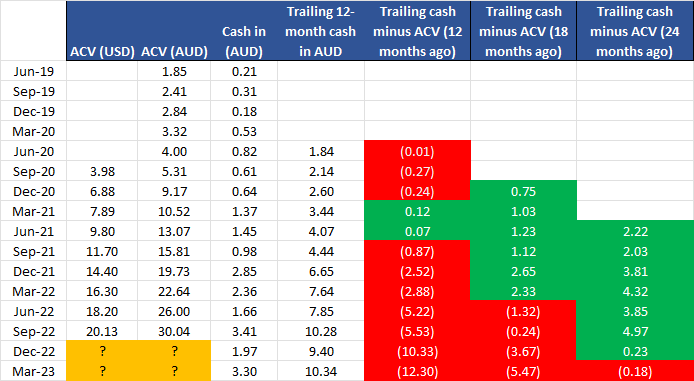

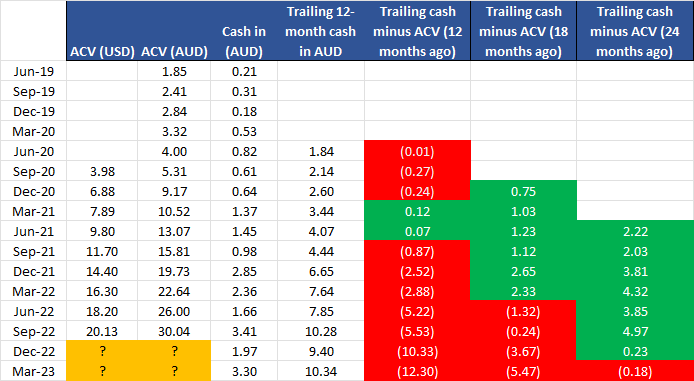

They report a 'rebound' in cash receipts. It is true that at $3.3m it's the second highest quarter they've had for receipts. The problem is that cash in is not keeping pace with previously reported trailing ACV - not even nearly. If you track trailing 12-month cash in, it used to trail reported ACV from about 12 months prior. Not great but if you knew that was what to expect you could probably live with it. In late 2021 that started to slip and it was taking up to 18 months to convert ACV to cash. In today's update an 18-month trail seems like the good old days as trailing 12-month cash receipts doesn't even keep pace with the ACV from two years ago!

They describe their suite as a must-have platform. As difficult as it might be to deal with some of their US customers, I can't get my head around why they'd not pay for mission critical software nor take so long to renew.

[Not held]