IMO, this is the most intriguing bit of commentary in their ACV Update announcement

*And I forgive the company for the basic grammar mistake*

I actually find this 'customer advocacy' or network effect (if you could call it that) aspect to be intriguing moving forward for the company in what was the most fascinating bit of news flow from the company that came out in the March quarter. Increasing of storm intensity/frequency is beneficial to Pointerra.

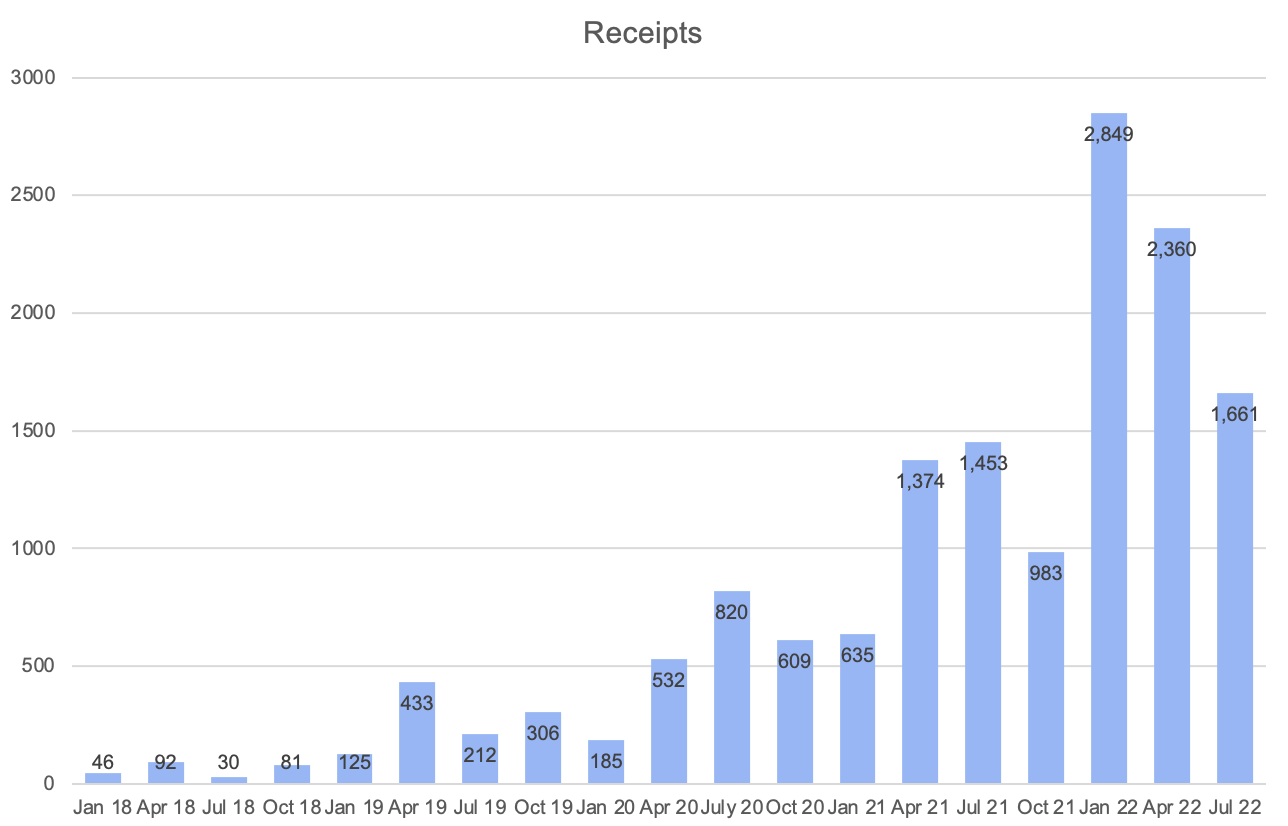

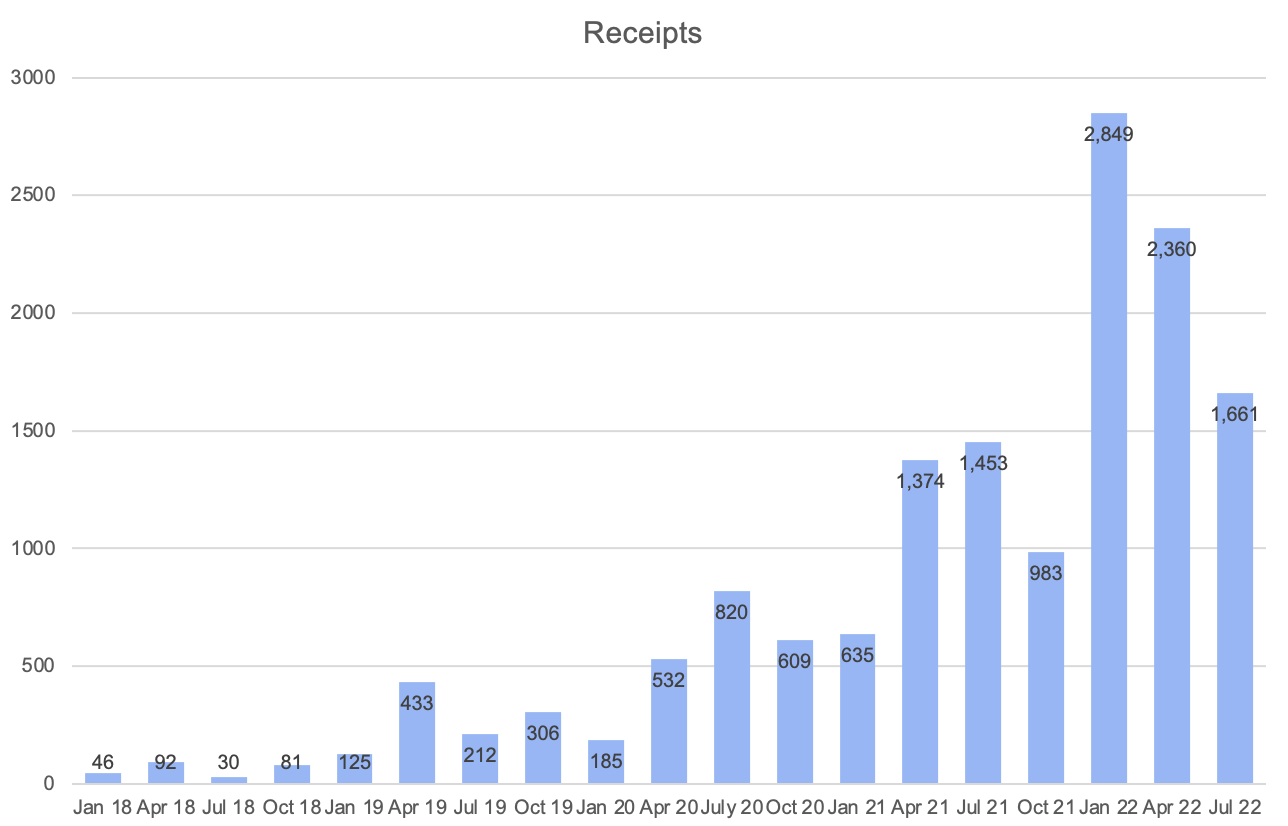

Now onto cash receipts history since this seems to be a major sore spot for some holders:

The long-term trend in receipts is obvious and we can't look at one or even two quarters in isolation. If we look at the FULL picture there is a sound argument that we should FULLY expect to see cash receipts increase signifcantly in the September and/or December quarter. Possibly as high as $5m but $4-4.5m more likely.

I also would not be surpised to see ACV reach $25m by June 2023. And if the company does not overly increase costs I expect the company to be consistently cash flow positive on a quarterly basis.