Others have commented on today's news. I'll not repeat their content, buy add my assessment and decision.

The improvement in cashflow is good; however, $3.3m is still lower than two quarters ago. In a firm that needs to be growing strongly to justify its (albeit beaten down) valuation, it is hardly a need for celebration. I’m with @Noddy74 – I don’t share the market’s enthusiasm today. Perhaps the SP reaction was relief that the cash result wasn’t worse?

Cash receipts of $3.3m mean that the free cash surplus is likely to be thin, although it is good to hear that Ian believes this will be sustained going forward (although he now also has some new senior hires to pay.)

However, I’m still bothered by the unwillingness to give an ACV update. That means that without the contract renewal agreed, it looks bad. And as I’ve said before, I don’t trust management who only report discretionary metrics when they make them look good. The last entry in my spreadsheet was $20.1m in Oct-2022 up from $18.2m in Jun-22. So we are coming up to the anniversary and it sounds like the dial might not have moved much. Moreover, the result appears to be very dependent on a single customer. In the absence of newsflow of other large contracts, that sounds like an ongoing concentration risk.

Again, as @Noddy74 writes, if this product is so mission critical, why is the renegotiation of the contract taking so long?

I am pleased the CFO role has finally been filled. However, the musical chairs on the "Chief Growth Officers" roles - not one role but two (in a company that makes total annual revenues of the order of only $10m) continues to signal that things are not working to Ian's satisfaction on the customer wins front.

For me, It is time to look at the thesis. I originally held 3DP for three reasons:

• Leading tech platform for spatial data management with a large range of applications in multiple verticals

• Strong ACV and revenue growth

• Close to the inflection point, with potentially strong economics emerging

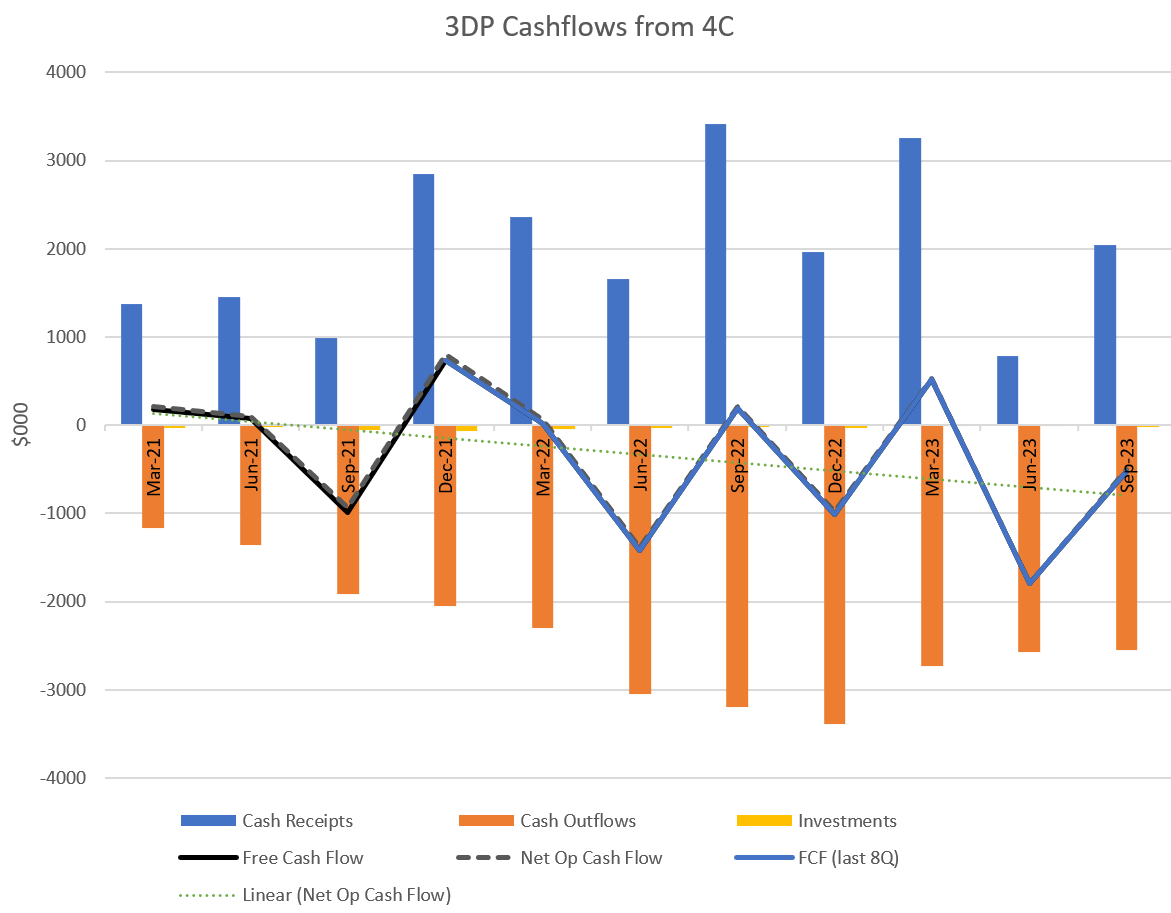

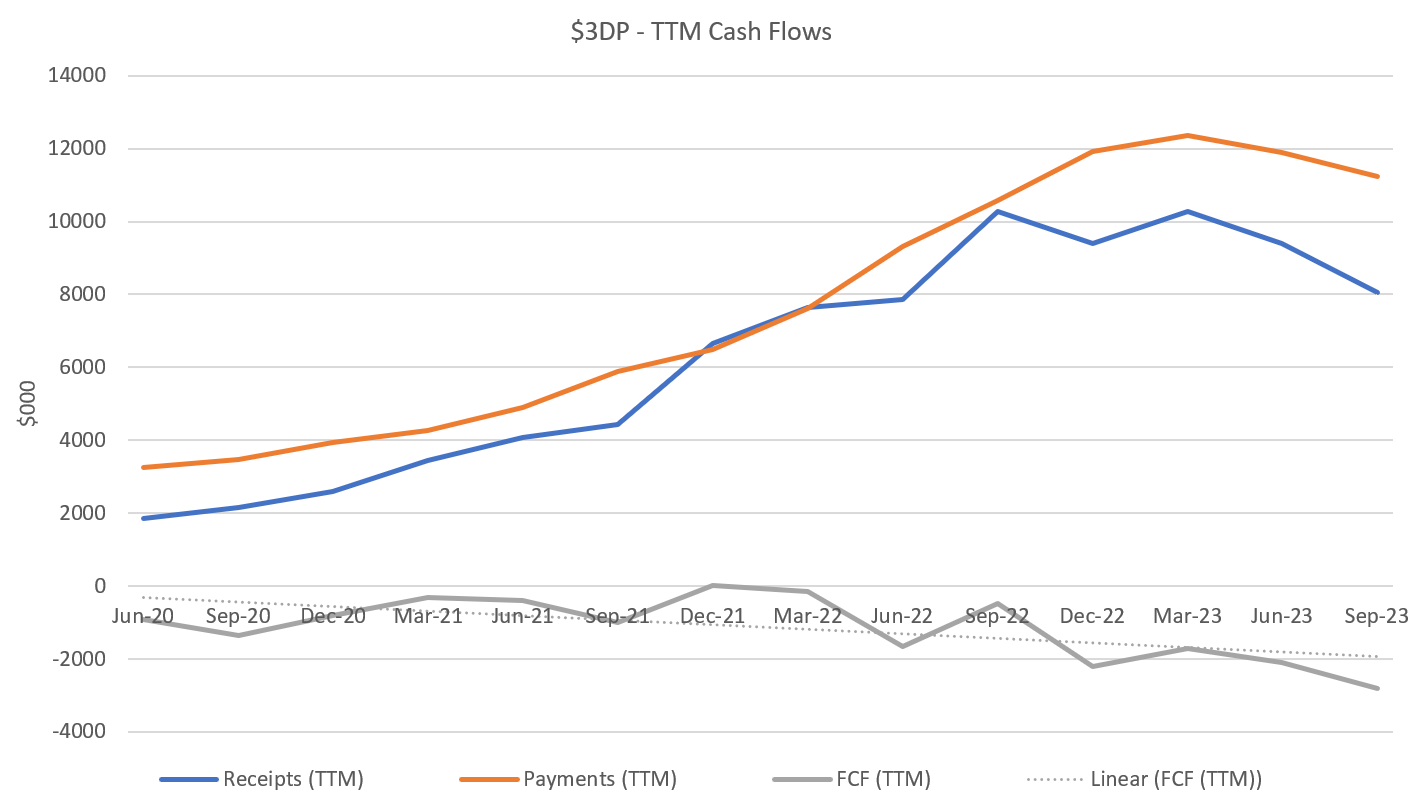

Looking back over the last 8Qs (and I appreciate I should wait for the 4C to fully update this straw, and therefore may prove to be premature):

• Cost growth has generally been ahead of or at least in step with growth in receipts

• We are still hovering around the inflection point. We first saw positive free cash flow in Sep. 2019. and have flirted with it on 3-4 occasions over the last 3.5 years

• ACV growth is now a question-mark

• Cash reserves are low

• Newsflow on new contracts / new customers has not been strong

Importantly, as @Noddy’s analysis shows, the operating economics are becoming a question-mark too, with the gap between ACV growth and growth in receipts expanding. What’s going on here? Are customers taking longer to use the product than anticipated? Is there drag in deploying it/customising it in each application?

I appreciate that it can take a long time to deliver “overnight success”. However, I’ve decided to move to the sideline with $3DP until the proposition becomes clearer. I recognise that in so doing I am crystallising a loss and if I buy back in in future, that I’ll give up the ground between maybe $0.105 (my sale price) and $0.20 or something similar.

However, for me, in these higher risk small caps that are yet to become cash generative, the thesis requires strong revenue growth above cost growth. Taking the high risk of a cash burning proposition relies on the momentum of the top line growth and the emerging economics, and all that entails in terms of positive revenue retention and new customer wins. I’ve now gone 5 or 6 Q’s where I haven’t been convinced that $3DP is delivering this. The ACV reporting holdout is the final straw.

I have divested my position in $3DP (IRL and SM).

Disc: No longer held