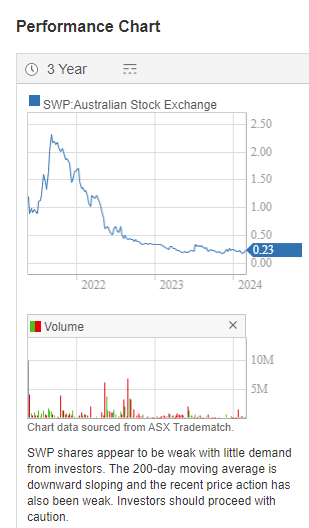

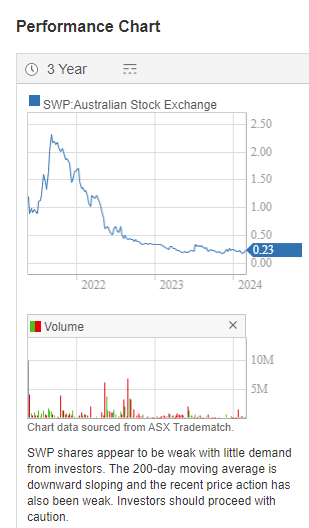

This is a company I review every 6 months and I can't understand why the market hates it so much - because I think they ARE making solid progress - although they didn't turn into the type of fast-growing Telco roll-up (growth via acquisition) story that some may have been hoping for, considering the pedigree of their Board and Management. Last night I used a graph of AVA over the past 3 years to underline that the market is not convinced they are growing and executing well with their business model and strategy. Well, Swoop (SWP), which I DO continue to hold, looks a LOT worse than AVA in terms of their share price graph, so share price movements can contain some information, but, in my opinion, not all information. The market has bid Swoop up +7.14% today so far, as I type this (or +1.5 cps from 21 to 22.5 cps) but they've come down a LONG way over the past couple of years:

They have made some business decisions that the market hasn't been keen on, like pursuing regional broadband internet connectivity programs using both fixed and wireless models - see here: Vic govt taps Swoop for regional fixed wireless rollout - Telco - CRN Australia

Plain text: https://www.crn.com.au/news/vic-govt-taps-swoop-for-regional-fixed-wireless-rollout-603489

And here: Victorian Government partners with Swoop for the Connecting Victoria program (telconews.com.au)

Plain text: https://telconews.com.au/story/victorian-government-partners-with-swoop-for-the-connecting-victoria-program

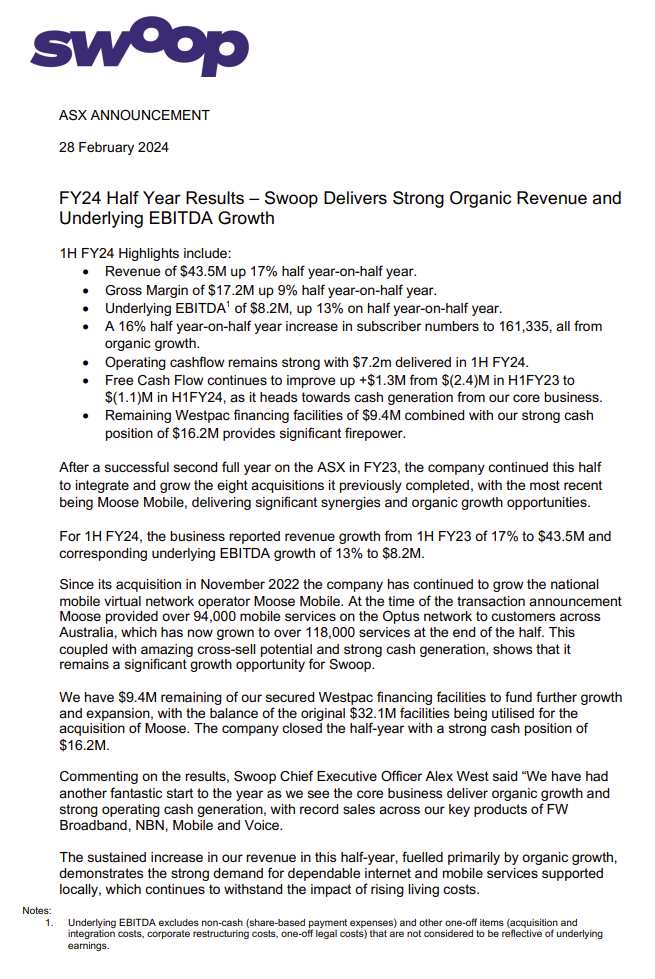

Here's Swoop's Report Today: Swoop-H1FY24-Results-Announcement.PDF

And their Presentation: Swoop H1FY24 Investor Briefing

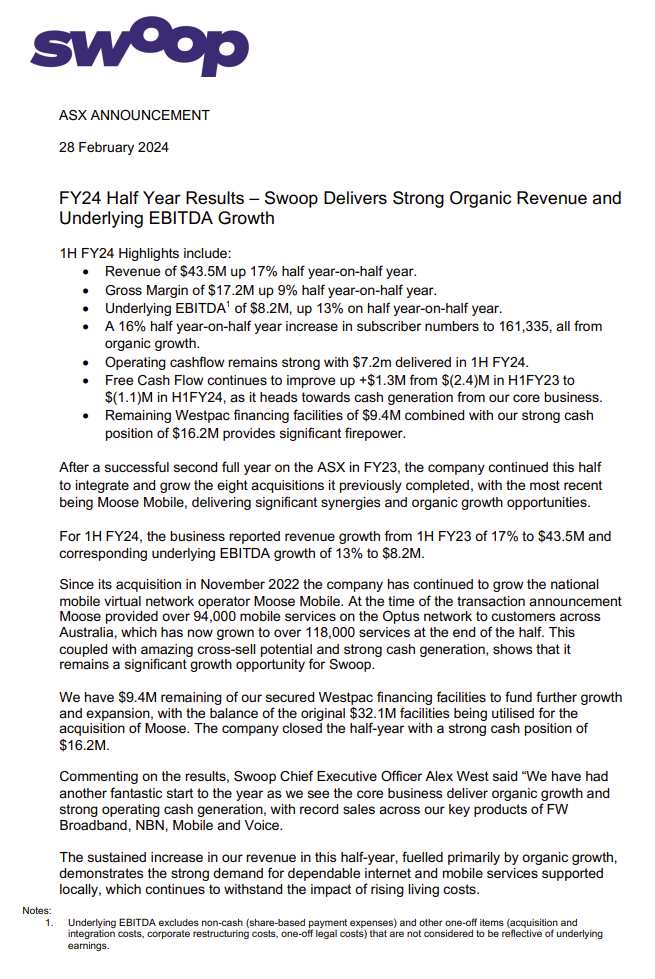

And here's the first page of that Results Announcement:

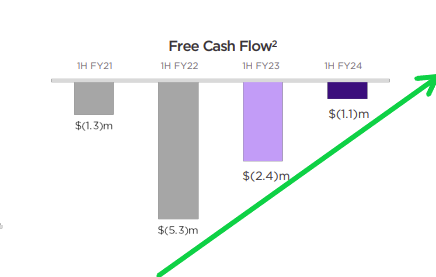

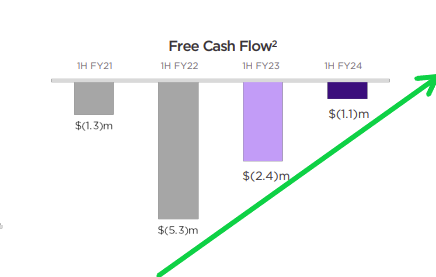

Not quite free cashflow positive, but the trajectory is good:

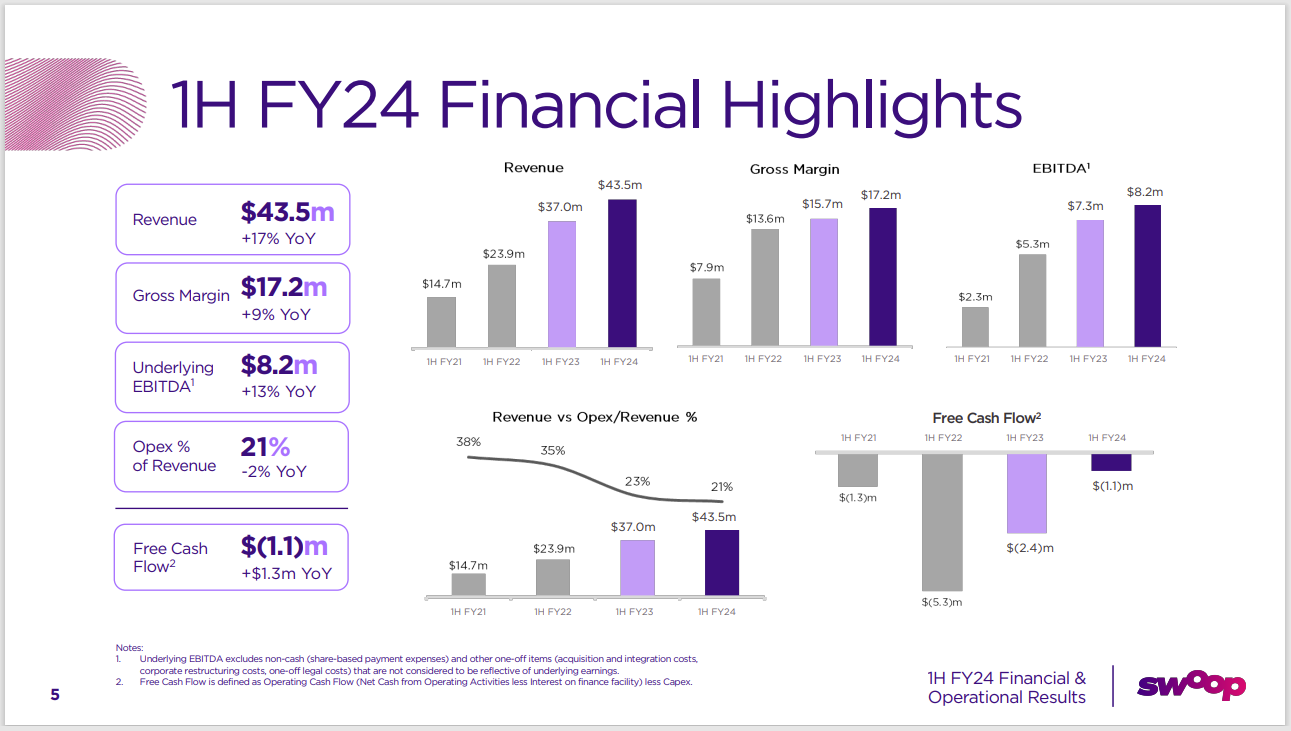

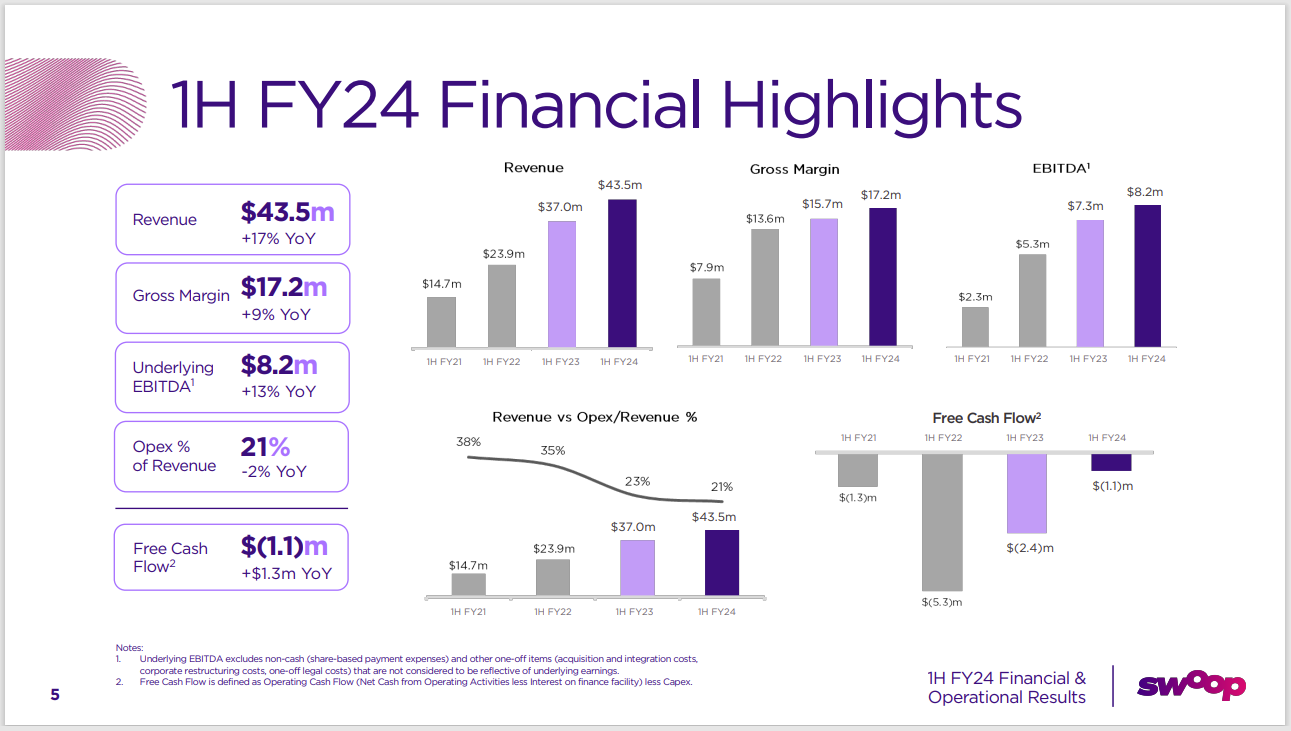

Also, both revenue and gross margins are improving and costs in terms of Opex/Revenue (%) is decreasing, so their core business is scaling OK. I could be wrong to keep Swoop and sell AVA - time will tell. Swoop look like they are making solid progress and my review today has resulted in me deciding to continue to hold them.

They have high management and board ownership, - with a few of them being substantial shareholders - and Andrew and Nicola Forrest's Tattarang is a cornerstone investor as well, and Tattarang remain invested in Swoop.